REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 4.41 billion by 2029 | at 5.7 % CAGR | Asia Pacific |

| By Resin Type | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

Flock Adhesives Market Overview

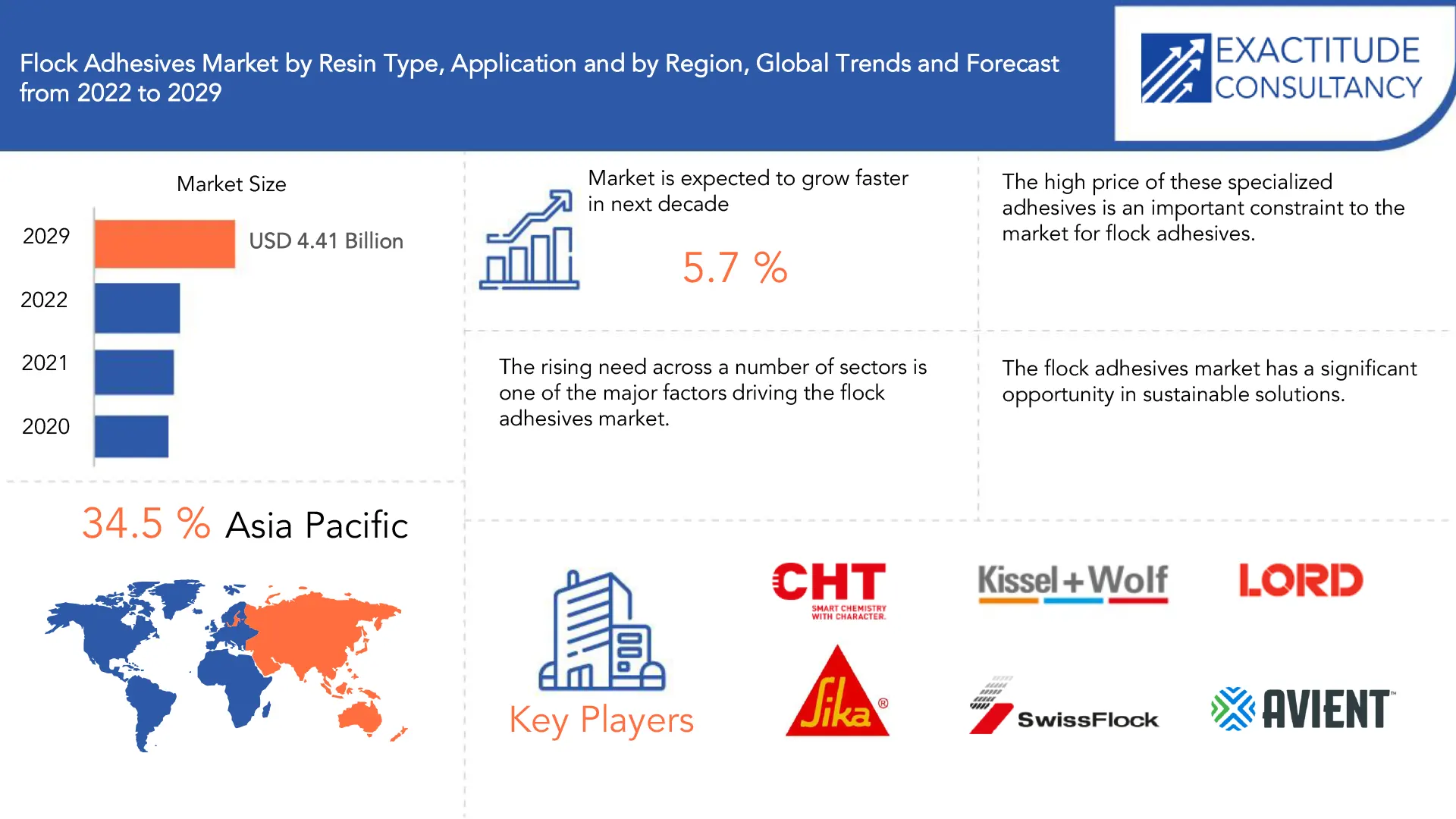

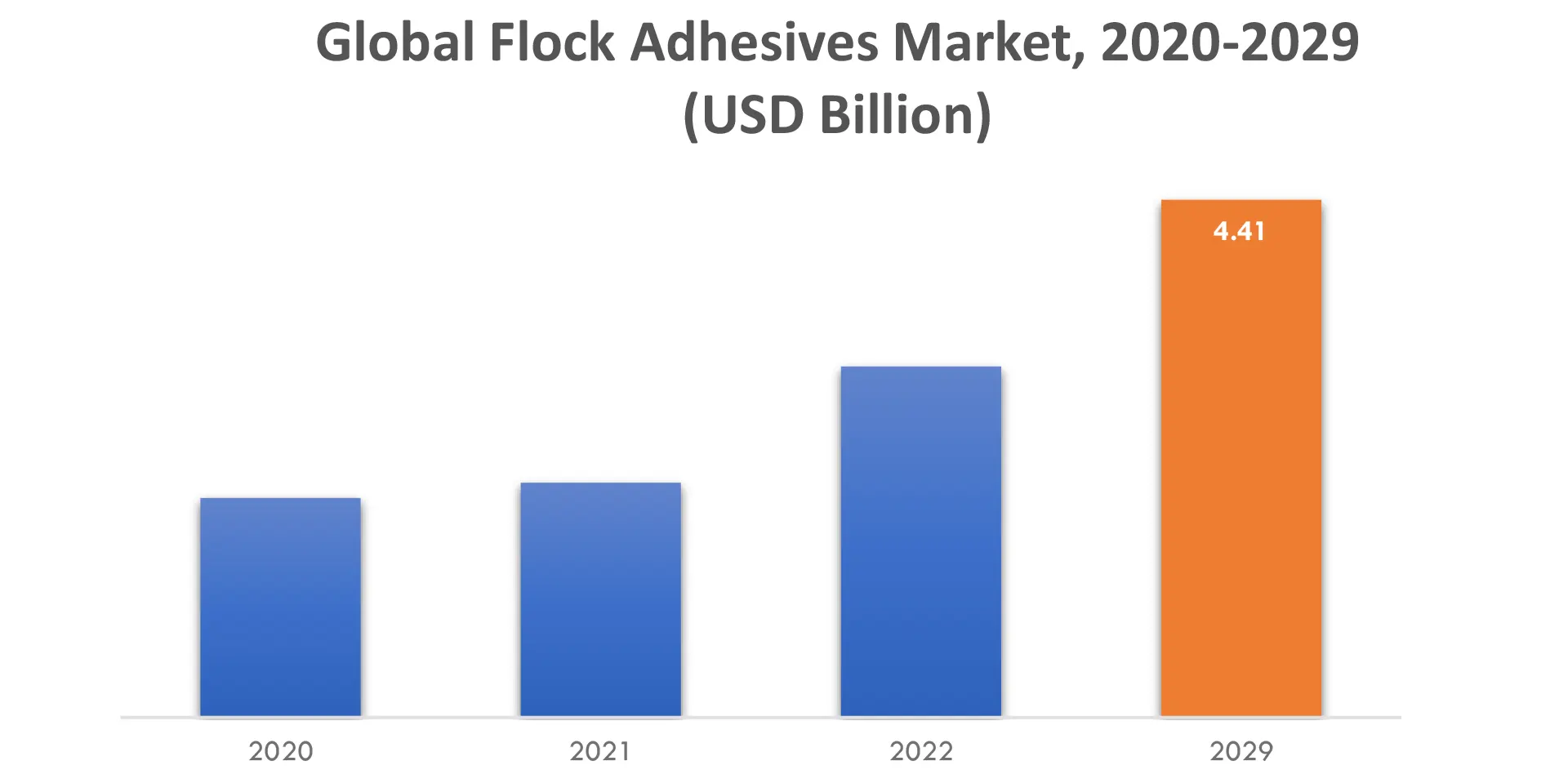

The flock adhesives market is expected to grow at 5.7 % CAGR from 2022 to 2029. It is expected to reach above USD 4.41 billion by 2029 from USD 1.87 billion in 2020.

Flock adhesives, also known as flocking adhesives, are essential to the flocking process. Using the flocking technique, you can add small fibres to a surface to give it a velvety or textured appearance. The flock fibres must successfully connect to the substrate for this procedure to be successful, which is made possible by flock adhesives. The substrate is ready for flocking by being cleaned, and occasionally primed or sanded to guarantee the best adhesion. Following that, the flock adhesive is applied to the prepared surface using a variety of techniques such as spraying, brushing, or dipping, making sure to establish a homogeneous layer.

The flock fibres are then added to the surface that has been coated with adhesive. The flock fibres are usually electrically charged and drawn to the adhesive using an electrostatic process. For the flock fibres and the substrate to be securely bonded, the formulation of the adhesive is essential. Following flocking, the adhesive needs to cure or dry. The precise technique relies on the formulation of the glue, with choices including air drying or using heat to quicken the procedure. Any extra flock fibres that did not stick to the adhesive are removed once the adhesive has set or dried by gently brushing them off or vacuuming them up.

The rising need across a number of sectors is one of the major factors driving the flock adhesives market. Flock adhesives are becoming more and more in demand in industries like packaging, furniture, automotive, textiles, and cosmetics. Flock adhesives are used in several sectors to provide their products the desired finishes, textures, and aesthetics. The need for flock adhesives is expanding along with the popularity of flocked surfaces because of its improved aesthetic appeal, soft touch, durability, and utility. The market for flock adhesives has been growing steadily as a result of this trend, which is being pushed by industries’ aim to provide consumers with distinctive and high-quality products.

The high price of these specialized adhesives is an important constraint to the market for flock adhesives. Flock adhesive manufacture frequently involves intricate formulations and procedures, which raises the cost of production in comparison to traditional adhesives.

lock adhesive usage may be constrained by cost, particularly in markets or uses where cost is an important factor. Flock adhesive demand could be affected if producers and end users choose more affordable substitutes. Continuous efforts to improve production procedures, investigate cost-effective formulations, and inform the market about the potential long-term advantages and value of flock adhesives are needed to mitigate this limitation.

The flock adhesives market has a significant opportunity in sustainable solutions. With the rising importance of environmental concerns, there is a growing demand for eco-friendly and sustainable products. Flock adhesive manufacturers can seize this opportunity by creating formulations that are devoid of harmful chemicals, exhibit lower VOC emissions, and demonstrate enhanced biodegradability. By promoting and offering sustainable flock adhesives, manufacturers can cater to the requirements of environmentally conscious industries and consumers. This not only aligns with the global sustainability agenda but also positions the flock adhesives market for long-term growth and a competitive edge in a dynamic market environment.

Initially due to pandemic the market faced a downturn due to disruptions in global supply chains, reduced industrial activities, and decreased consumer demand. Major consumers of flock adhesives, such as the automotive and textiles industries, were significantly affected. However, as the pandemic progressed, there was a rebound in certain industries like packaging, medical textiles, and home furnishings, leading to a gradual recovery in the flock adhesives market. The increased emphasis on hygiene and health-related applications, coupled with the resurgence of manufacturing activities, presented opportunities for flock adhesive manufacturers to adapt to evolving market demands.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion, Kilotons) |

| Segmentation | By Resin Type, By Application, By Region |

| By Resin Type |

|

| By Application |

|

| By Region |

|

Flock Adhesives Market Segment Analysis

The flock adhesives market is segmented based on resin type and application.

Acrylics and polyurethane resins have been the dominant resin types in the flock adhesives market. Acrylic-based flock adhesives are widely used due to their excellent adhesion properties, versatility, and cost-effectiveness. Polyurethane-based flock adhesives offer superior flexibility, durability, and resistance to chemicals and abrasion.

The automotive and textiles industries have been the primary drivers of the flock adhesives market in terms of application. Automotive applications include flocking for interior components such as dashboards, door panels, and center consoles, while textiles applications include flocking for apparel, upholstery, and home furnishings.

Flock Adhesives Market Players

The flock adhesives market key players include CHT Germany GmbH, Kissel + Wolf, Lord Corporation, Sika Automotive, Swiss Flock, Stahl, Avient, Dow Chemical, H.B. Fuller Company, Nyatex Adhesive and Chemical Company.

Recent developments

January 23, 2023: Avient Corporation announced the expansion of its Gravi-Tech™ Density Modified Formulations portfolio to include more sustainable grades based on recycled and bio-based resin and/or filler, without sacrificing performance. First-generation Gravi-Tech Density Modified Formulations were developed to mimic the luxurious look, weight, and feel of die-cast or machined metals by using select metallic fillers and thermoplastic resin. These are a cost-effective alternative to metal, useful for applications in luxury packaging and consumer goods including caps and closures for cosmetics, bottle caps and boxes for spirits, and decorative knobs and grips for appliances, furniture, and automotive applications.

March 16, 2023: Stahl, a provider of coatings technologies headquartered in the Netherlands, completed the acquisition of ICP Industrial Solutions Group (ISG), a leader in high-performance coatings for packaging and labeling applications. The acquisition reinforces Stahl’s position as the global leader in the field of specialty coatings for flexible substrates.

Who Should Buy? Or Key stakeholders

- Flock Adhesives Suppliers

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Flock Adhesives Market Regional Analysis

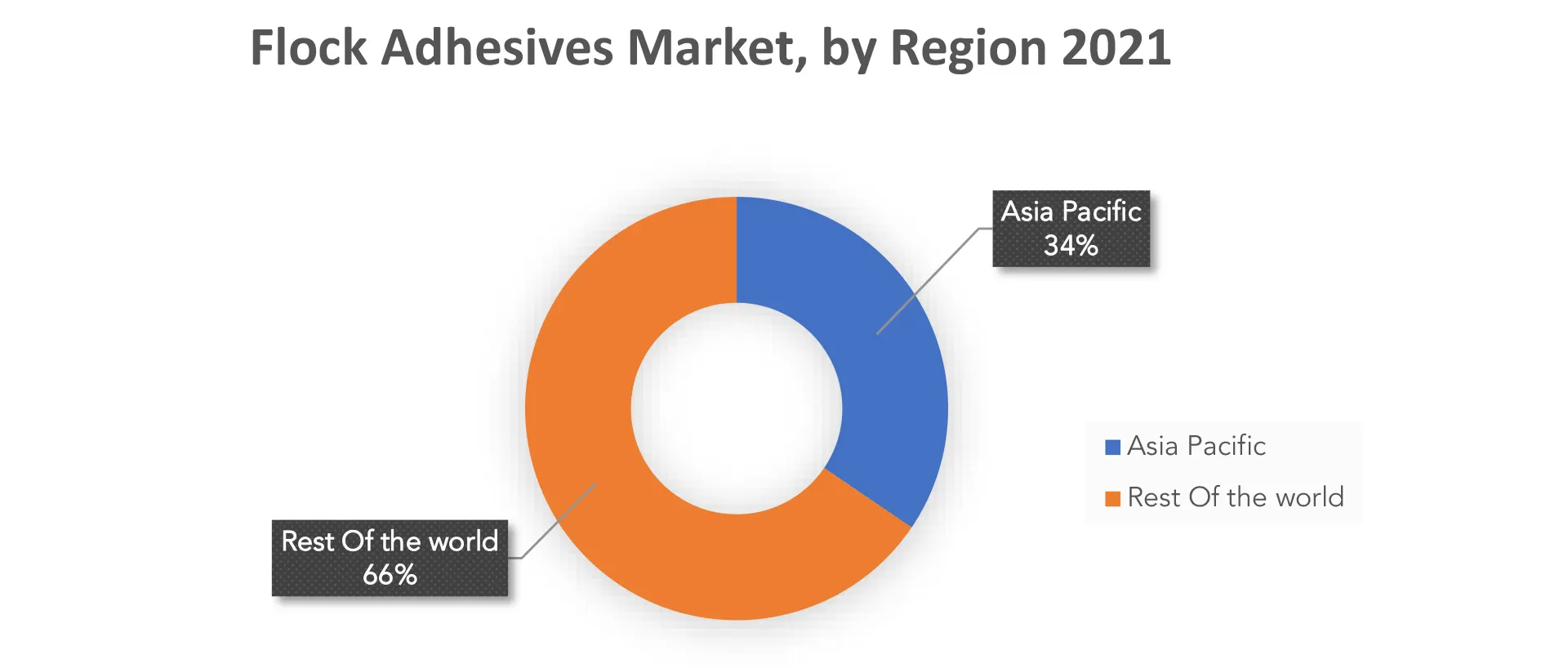

The flock adhesives market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The automotive and textile sectors’ increasing desire for improved aesthetics and superior bonding solutions is driving the market’s growth in Asia Pacific region. Flock adhesive use in the area is also being boosted by rising disposable money and shifting customer tastes towards opulent and personalized goods. Additionally, the increased interest in environmentally friendly and sustainable adhesives offers market participants a sizable opportunity. The Asia Pacific flock adhesives market is expected to increase significantly over the coming years as a result of technological developments and the appearance of novel flocking techniques. Manufacturers and suppliers have a huge opportunity to capitalize on the growing market demand.

The market for flock adhesives in Europe has steadily expanded due to a number of reasons. With flock adhesives used in interior components, the region’s robust automobile sector, particularly in Germany, France, and Italy, has been a major driver. Demand has also been boosted by the focus on luxury packaging and premium textiles. The high cost of flock adhesives and competition from other technologies are two limitations on the market, though. Despite these difficulties, there are always chances for improvement, especially in new applications and the creation of sustainable solutions. In Europe’s flock adhesives industry, the growing emphasis on eco-friendly goods and personalization presents opportunities for innovation and market expansion.

In North America, the flock adhesives market has been experiencing growth over the years. Factors such as increasing demand for flocked fabrics in the automotive and textile industries, rising consumer preferences for luxurious and aesthetically appealing products, and advancements in adhesive technologies have been driving the market. The automotive industry has been one of the major consumers of flock adhesives in North America. Flocked fabrics are used for various interior applications in automobiles, such as door panels, headliners, and instrument panels. The demand for premium and customized interiors has contributed to the growth of the flock adhesives market in this sector.

Key Market Segments: Flock Adhesives Market

Flock Adhesives Market by Resin Type, 2020-2029, (USD Billion, Kilotons)

- Acrylics

- Polyurethane

- Epoxy Resins

- Others

Flock Adhesives Market by Application, 2020-2029, (USD Billion, Kilotons)

- Automotive

- Textiles

- Paper And Packaging

- Others

- Medical

Flock Adhesives Market by Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the flock adhesives market over the next 7 years?

- Who are the major players in the flock adhesives market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the flock adhesives market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the flock adhesives market?

- What is the current and forecasted size and growth rate of the global flock adhesives market?

- What are the key drivers of growth in the flock adhesives market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the flock adhesives market?

- What are the technological advancements and innovations in the flock adhesives market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the flock adhesives market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the flock adhesives market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of flock adhesives in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL FLOCK ADHESIVESOUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON FLOCK ADHESIVESMARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL FLOCK ADHESIVESOUTLOOK

- GLOBAL FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION, KILOTONS)

- ACRYLICS

- POLYURETHANE

- EPOXY RESINS

- OTHERS

- GLOBAL FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION, KILOTONS)

- AUTOMOTIVE

- TEXTILES

- PAPER AND PACKAGING

- OTHERS

- MEDICAL

- GLOBAL FLOCK ADHESIVESMARKET BY REGION

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- CHT GERMANY GMBH

- KISSEL + WOLF

- LORD CORPORATION

- SIKA AUTOMOTIVE

- SWISS FLOCK

- STAHL

- AVIENT

- DOW CHEMICAL

- B. FULLER COMPANY

- NYATEX ADHESIVE A ND CHEMICAL COMPANY *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION ), 2020-2029

TABLE 2 GLOBAL FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS ), 2020-2029

TABLE 3 GLOBAL FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL FLOCK ADHESIVESMARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL FLOCK ADHESIVESMARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA FLOCK ADHESIVESMARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA FLOCK ADHESIVESMARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 14 US FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 15 US FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA FLOCK ADHESIVESMARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA FLOCK ADHESIVESMARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 31 BRAZIL FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 33 BRAZIL FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 ARGENTINA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 37 ARGENTINA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 COLOMBIA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 41 COLOMBIA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC FLOCK ADHESIVESMARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC FLOCK ADHESIVESMARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 55 INDIA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 CHINA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 59 CHINA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 JAPAN FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 63 JAPAN FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE FLOCK ADHESIVESMARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE FLOCK ADHESIVESMARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 92 UK FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 93 UK FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 122 UAE FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 123 UAE FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY RESIN TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA FLOCK ADHESIVESMARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL FLOCK ADHESIVESBY RESIN TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL FLOCK ADHESIVESBY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL FLOCK ADHESIVESBY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL FLOCK ADHESIVESBY RESIN TYPE, USD MILLION, 2021

FIGURE 13 GLOBAL FLOCK ADHESIVESBY APPLICATION, USD MILLION, 2021

FIGURE 14 GLOBAL FLOCK ADHESIVESBY REGION, USD MILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 CHT GERMANY GMBH: COMPANY SNAPSHOT

FIGURE 17 KISSEL + WOLF: COMPANY SNAPSHOT

FIGURE 18 LORD CORPORATION: COMPANY SNAPSHOT

FIGURE 19 SIKA AUTOMOTIVE: COMPANY SNAPSHOT

FIGURE 20 SWISS FLOCK.: COMPANY SNAPSHOT

FIGURE 21 STAHL: COMPANY SNAPSHOT

FIGURE 22 AVIENT.: COMPANY SNAPSHOT

FIGURE 23 DOW CHEMICAL: COMPANY SNAPSHOT

FIGURE 24 H.B. FULLER COMPANY: COMPANY SNAPSHOT

FIGURE 25 NYATEX ADHESIVE AND CHEMICAL COMPANY: COMPANY SNAPSHOT

FAQ

The flock adhesives market is expected to grow at 5.7 % CAGR from 2022 to 2029. It is expected to reach above USD 4.41 billion by 2029 from USD 1.87 billion in 2020.

Asia Pacific held more than 34.5% of the Flock Adhesives market revenue share in 2021 and will witness expansion in the forecast period.

The rising need across a number of sectors is one of the major factors driving the flock adhesives market. Flock adhesives are becoming more and more in demand in industries like packaging, furniture, automotive, textiles, and cosmetics.

The automotive and textiles industries have been the primary drivers of the flock adhesives market in terms of application. Automotive applications include flocking for interior components such as dashboards, door panels, and center consoles, while textiles applications include flocking for apparel, upholstery, and home furnishings.

The automotive and textile sectors’ increasing desire for improved aesthetics and superior bonding solutions is driving the market’s growth in Asia Pacific region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.