REPORT OUTLOOK

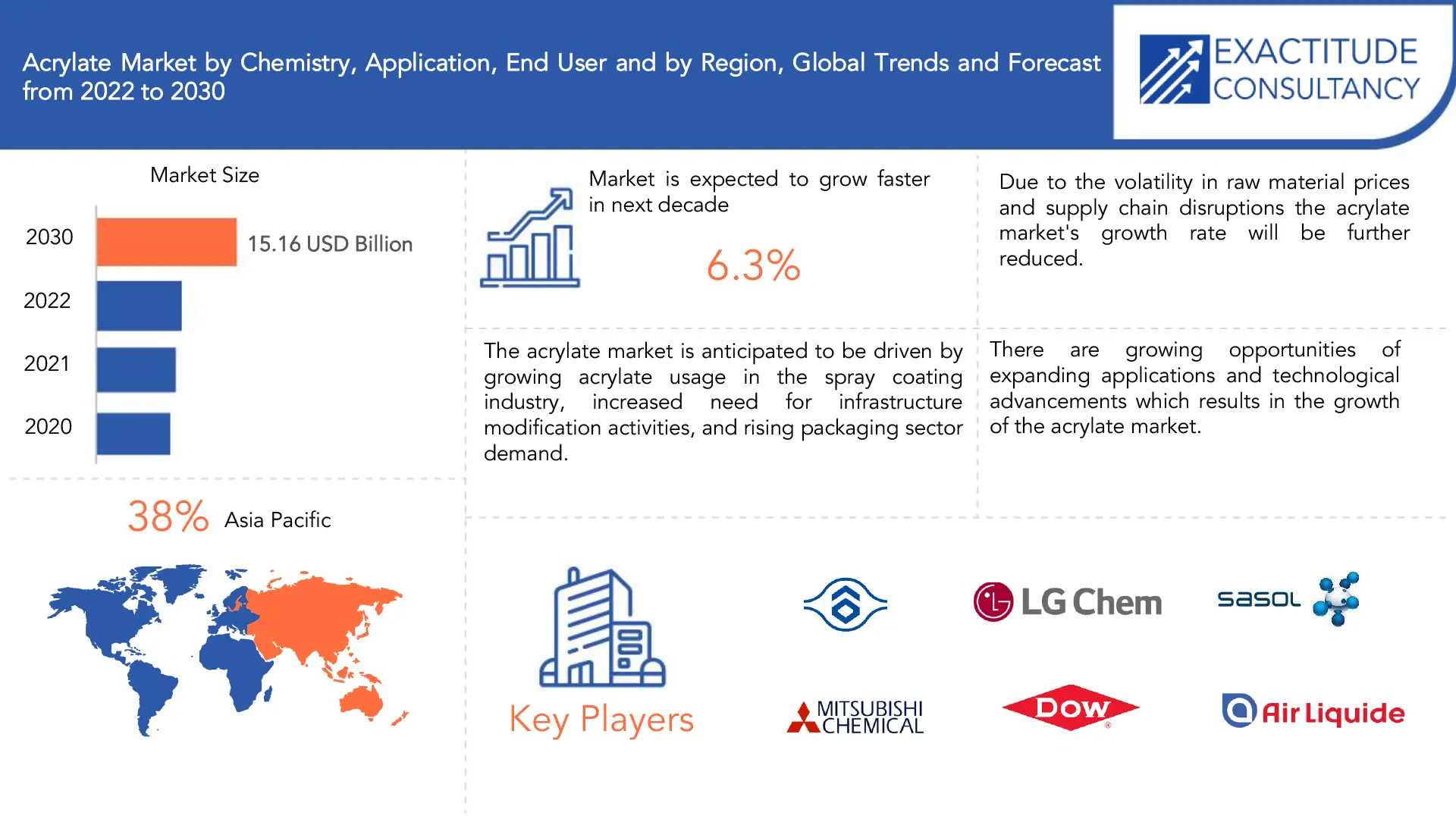

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 15.16 billion by 2029 | 6.3% | Asia Pacific |

| By Chemistry | By Application | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Acrylate Market Overview

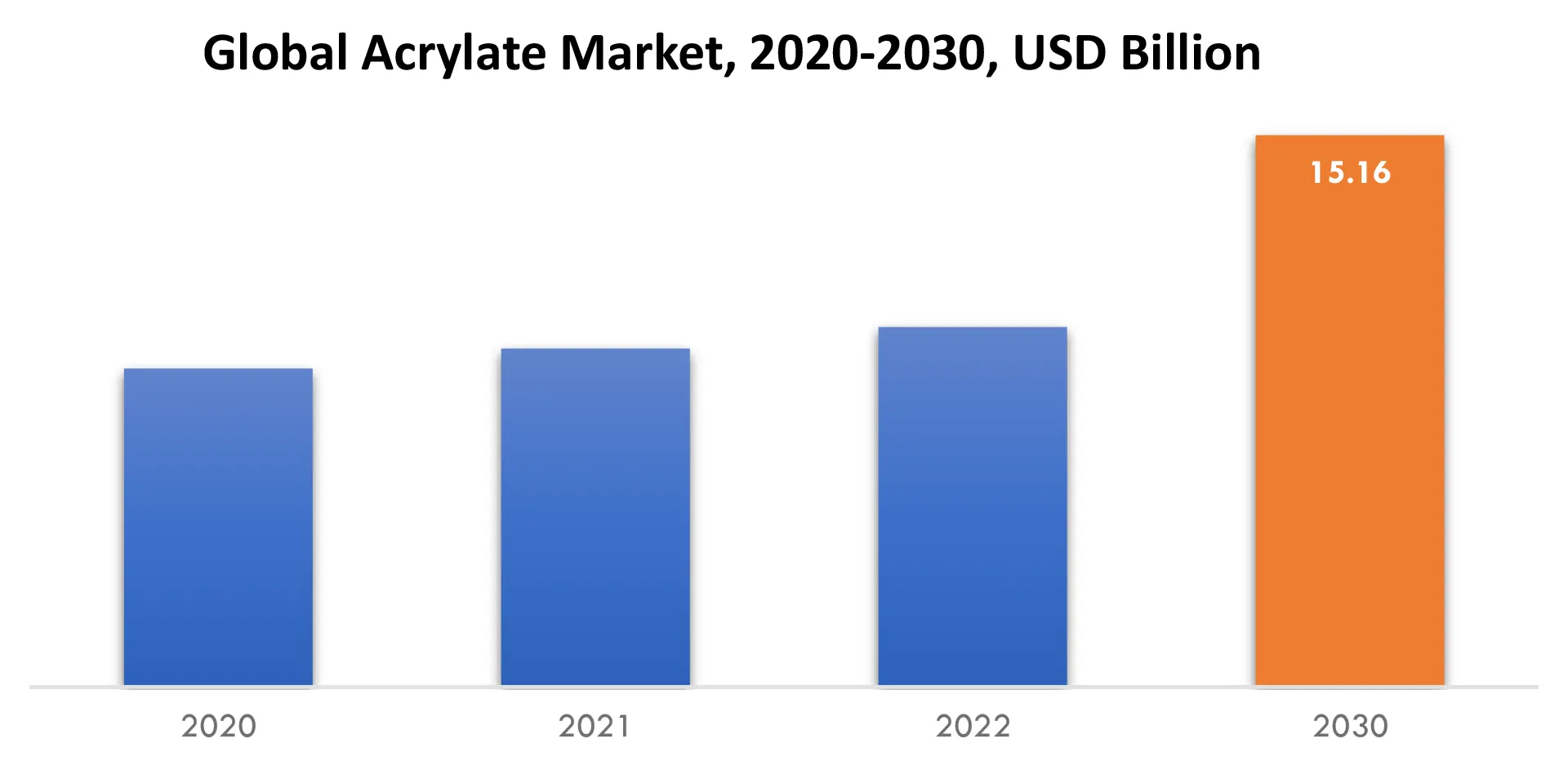

Acrylate market is expected to grow at 6.3% CAGR from 2022 to 2029. It was valued 8.75 billion at 2020. It is expected to reach above USD 15.16 billion by 2029.

Over the upcoming years, the acrylate market is anticipated to be driven by growing acrylate usage in the spray coating industry, increased need for infrastructure modification activities, and rising packaging sector demand.

The manufacturing, sale, and consumption of acrylate compounds are all part of the global sector known as the acrylate market. Due to their adaptable qualities, acrylates, a class of chemical compounds made from acrylic acid or its esters, are often employed in a variety of industries. These materials stand out for their outstanding adhesion, quick drying time, and resilience to ageing and the elements. The acrylate market includes several different uses, such as textiles, plastics, sealants, adhesives, coatings, and more.

Several reasons have contributed to the tremendous rise of the acrylate industry in recent years. The rising demand for sustainable and ecologically friendly goods is one of the main motivators. Since they emit less VOCs and have a smaller impact on the environment than solvent-based paints and adhesives, acrylics, especially water-based acrylics, have become more popular as alternatives. A further factor in the rise in acrylate-based product usage is the expansion of end-use industries like automotive, construction, and electronics.

Geographically speaking, the acrylate market is a worldwide one, with significant production and consumption centres situated in places like North America, Europe, Asia Pacific, and South America. The development of the acrylate sector is supported by the well-established infrastructure and robust manufacturing base in these areas. Additionally, new uses for acrylate compounds are being introduced thanks to technical developments and ongoing research and development efforts in the field of acrylate chemistry. Overall, as sectors look for high-performance materials with improved sustainability and functionality, the acrylate market is poised for further expansion.

During the next few years, the acrylate market is anticipated to be driven by growing acrylate usage in the spray coating industry and rising packaging sector demand. Moreover, the market was anticipated to grow in the upcoming years due to the growing demand for infrastructure alteration projects and rising disposable incomes. During the projected period, it is also anticipated that the rise of the automotive industry and increased demand for a water-based emulsion’s product will propel the market. Additionally, the industry is given a chance by the growing commercialization of bio-based acrylic acid. There are some limitations and difficulties that can impede market expansion. Acrylate-related risks to human health and the environment are anticipated to limit market growth.

The primary trend in the acrylic market is that consumers are increasingly favoring water-based (acrylic-based) emulsions over solutions with an oil base. The benefits of these goods, such as their quick drying times, color fastness, wear and water resistance, and environmental friendliness, are primarily responsible for this transition. Water-based paints also offer advantages for their use in interior and outdoor wall coverings since they are strong, stable in harsh environments, and free of volatile organic compounds (VOCs).

The participants in the acrylate market have a lot of opportunity to expand their product offerings and increase their market share by utilizing bio-based acrylates. The main cause of this is the allergic skin conditions linked to the principal acrylates, including butyl acrylate, 2-ethylhexyl acrylate, methyl acrylate, and ethyl acrylate. In the upcoming years, a lot of opportunities are anticipated due to the renewability and non-toxic character of bio-based versions.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion, Kilotons) |

| Segmentation | By Chemistry, By Application, By End User |

| By Chemistry |

|

| By Application | |

| By End User |

|

| By Region |

|

Acrylate Market Segment Analysis

By chemistry the market is segmented into butyl acrylate, ethyl acrylate, ethyl hexyl acrylate, methyl acrylate. Due to its outstanding adhesion and water resistance qualities, butyl acrylate is frequently used as a raw ingredient in the production of adhesives, sealants, coatings, and textiles. Since it is flexible and weatherproof, ethyl acrylate is used in the production of paints, varnishes, and emulsions. The manufacturing of plasticizers, adhesives, and coatings frequently uses ethyl hexyl acrylate as it offers great adherence and low-temperature flexibility. Due to its reactivity and compatibility with other monomers, methyl acrylate is used in the synthesis of polymers and copolymers for a variety of applications, including coatings, textiles, and adhesives. These acrylate substances support the broad range of goods offered on the market that serve various markets and purposes.

By application the market is segmented into plastics, paints & coatings, adhesives & sealants, others. Plastics, including acrylic polymers, find extensive use in various industries such as automotive, packaging, electronics, and construction, benefiting from their excellent transparency, impact resistance, and weatherability. Paints and coatings rely on acrylates for their film-forming properties, providing durability, color retention, and resistance to chemicals and weathering. Adhesives and sealants benefit from acrylate compounds due to their fast-curing, high adhesion, and flexibility, serving industries such as construction, automotive, and electronics. Other applications encompass textiles, paper coatings, leather finishes, and emulsions, expanding the scope of the acrylate market and meeting diverse consumer demands.

By end user the market is segmented into packaging, building & construction, consumer goods, automotive, others. In packaging, acrylates are used for manufacturing films, coatings, and adhesives that enhance product protection, shelf life, and visual appeal. The building and construction sector relies on acrylates for applications such as sealants, waterproofing membranes, and adhesives, ensuring durability, weather resistance, and structural integrity. Acrylates find extensive use in consumer goods such as electronics, appliances, furniture, and household products, providing superior surface finishes, adhesion, and impact resistance. Automotive applications include coatings, adhesives, and sealants that enhance aesthetics, corrosion resistance, and overall performance. Additionally, acrylates serve in various other industries, including textiles, electronics, and medical devices, expanding the market’s versatility and growth potential.

Acrylate Market Key Players

Acrylate market key players include Formosa Petrochemical Corporation, LG Chem, SASOL Limited, Mitsubishi Chemical Corporation, The Dow Chemical Company, Air Liquide SA, BASF SE, Arkema, Evonik Industries, SIBUR, NIPPON SHOKUBAI CO. LTD.

Recent Development:

June 11, 2023: LG Chem collaborated with COSMAX to develop eco-friendly cosmetic containers.

June 09, 2023: Dow to launched automotive and upholstery leather finishing silicone free from BTEX*.

Who Should Buy? Or Key stakeholders

- Manufacturers and suppliers

- End user

- Research and development institutions

- Regulatory authorities

- Environmental organizations

- Trade associations

- Investors

- Consumers

- Trade partners and suppliers

- Government agencies

- Others

Acrylate Market Regional Analysis

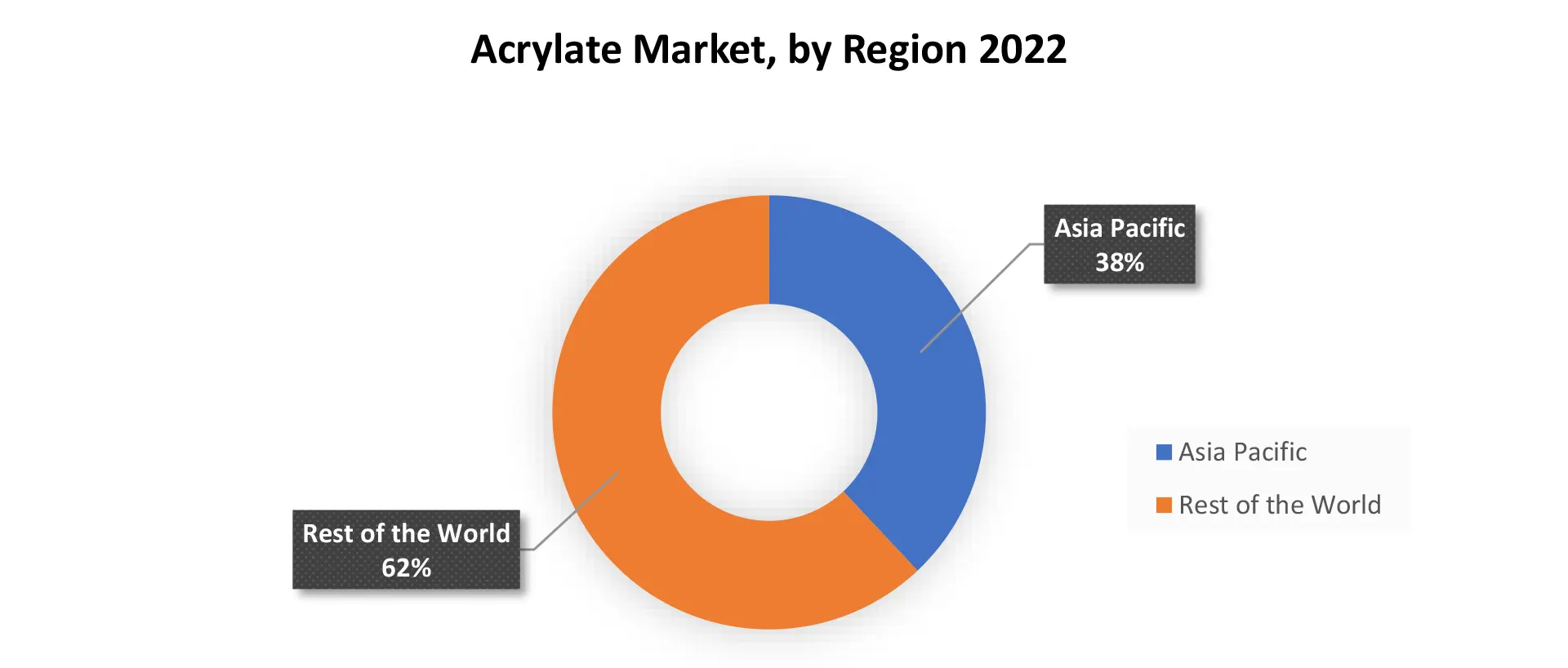

Acrylate market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The Asia Pacific acrylate market has experienced significant growth in recent years and is expected to continue its upward trajectory. The region’s expanding manufacturing sector, coupled with rising industrialization and urbanization, has fueled the demand for acrylate-based products across various industries such as packaging, construction, automotive, and consumer goods. Additionally, the growing population and rising disposable incomes in countries like China, India, and Southeast Asian nations have increased consumer spending, driving the demand for products that utilize acrylates. Furthermore, favorable government initiatives, investments in infrastructure development, and advancements in manufacturing technologies have contributed to the growth of the acrylate market in the Asia Pacific region.

Key Market Segments: Acrylate Market

Acrylate Market by Chemistry, 2020-2029, (USD Billion, Kilotons)

- Butyl Acrylate

- Ethyl Acrylate

- Ethyl Hexyl Acrylate

- Methyl Acrylate

Acrylate Market by Application, 2020-2029, (USD Billion, Kilotons)

- Plastics

- Paints & Coatings

- Adhesives & Sealants

- Others

Acrylate Market by End User, 2020-2029, (USD Billion, Kilotons)

- Packaging

- Building & Construction

- Consumer Goods

- Automotive

- Others

Acrylate Market by Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new Application

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the acrylate market over the next 7 years?

- Who are the major players in the acrylate market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the acrylate market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the acrylate market?

- What is the current and forecasted size and growth rate of the global acrylate market?

- What are the key drivers of growth in the acrylate market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the acrylate market?

- What are the technological advancements and innovations in the acrylate market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the acrylate market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the acrylate market?

- What are the product voltage ratings and specifications of leading players in the market?

- What is the pricing trend of acrylate market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ACRYLATE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ACRYLATE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ACRYLATE MARKET OUTLOOK

- GLOBAL ACRYLATE MARKET BY CHEMISTRY (USD BILLION, KILOTONS), 2020-2029

- BUTYL ACRYLATE

- ETHYL ACRYLATE

- ETHYL HEXYL ACYLATE

- METHYL ACRYLATE

- GLOBAL ACRYLATE MARKET BY APPLICATION (USD BILLION, KILOTONS), 2020-2029

- PLASTICS

- PAINTS & COATINGS

- ADHESIVES & SEALANTS

- OTHERS

- GLOBAL ACRYLATE MARKET BY END USER (USD BILLION, KILOTONS), 2020-2029

- PACKAGING

- BUILDING & CONSTRUCTION

- CONSUMER GOODS

- AUTOMOTIVE

- OTHERS

- GLOBAL ACRYLATE MARKET BY REGION (USD BILLION, KILOTONS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- FORMOSA PETROCHEMICAL CORPORATION

- LG CHEM

- SASOL LIMITED

- MITSUBISHI CHEMICAL CORPORATION

- THE DOW CHEMICAL COMPANY

- AIR LIQUIDE SA

- BASF SE

- ARKEMA

- EVONIK INDUSTRIES

- SIBUR

- NIPPON SHOKUBAI CO. LTD. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 2 GLOBAL ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 3 GLOBAL ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 7 GLOBAL ACRYLATE MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL ACRYLATE MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA ACRYLATE BY COUNTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA ACRYLATE BY COUNTRY (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 15 NORTH AMERICA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA ACRYLATE MARKET BY END USER INDUSTRY (KILOTONS), 2020-2029

TABLE 17 US ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 18 US ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 19 US ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 US ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 US ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 22 US ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 23 CANADA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 24 CANADA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 25 CANADA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 26 CANADA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 27 CANADA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 CANADA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 29 MEXICO ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 30 MEXICO ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 31 MEXICO ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 MEXICO ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 33 MEXICO ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 MEXICO ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 35 SOUTH AMERICA ACRYLATE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA ACRYLATE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 37 SOUTH AMERICA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 39 SOUTH AMERICA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 41 SOUTH AMERICA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 43 BRAZIL ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 44 BRAZIL ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 45 BRAZIL ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 BRAZIL ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 BRAZIL ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 48 BRAZIL ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 49 ARGENTINA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 50 ARGENTINA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 51 ARGENTINA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 52 ARGENTINA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 53 ARGENTINA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ARGENTINA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 55 COLOMBIA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 56 COLOMBIA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 57 COLOMBIA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 58 COLOMBIA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 59 COLOMBIA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 60 COLOMBIA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 61 COLOMBIA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 62 REST OF SOUTH AMERICA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 63 REST OF SOUTH AMERICA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 64 REST OF SOUTH AMERICA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 65 REST OF SOUTH AMERICA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 66 REST OF SOUTH AMERICA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 67 REST OF SOUTH AMERICA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 68 ASIA-PACIFIC ACRYLATE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 69 ASIA-PACIFIC ACRYLATE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 70 ASIA-PACIFIC ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 71 ASIA-PACIFIC ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 72 ASIA-PACIFIC ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 73 ASIA-PACIFIC ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 74 ASIA-PACIFIC ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 75 ASIA-PACIFIC ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 76 INDIA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 77 INDIA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 78 INDIA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 79 INDIA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 80 INDIA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 81 INDIA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 82 CHINA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 83 CHINA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 84 CHINA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 85 CHINA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 86 CHINA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 87 CHINA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 88 JAPAN ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 89 JAPAN ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 90 JAPAN ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 91 JAPAN ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 92 JAPAN ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 93 JAPAN ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 94 SOUTH KOREA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 95 SOUTH KOREA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 96 SOUTH KOREA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 97 SOUTH KOREA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 98 SOUTH KOREA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 99 SOUTH KOREA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 100 AUSTRALIA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 101 AUSTRALIA ACRYLATE BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 102 AUSTRALIA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 103 AUSTRALIA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 104 AUSTRALIA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 105 AUSTRALIA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 106 SOUTH EAST ASIA ACRYLATE MARKET BY CHEMISTRY (USD MI LLION), 2020-2029

TABLE 107 SOUTH EAST ASIA ACRYLATE BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 108 SOUTH EAST ASIA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 109 SOUTH EAST ASIA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 110 SOUTH EAST ASIA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 111 SOUTH EAST ASIA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 112 REST OF ASIA PACIFIC ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 113 REST OF ASIA PACIFIC ACRYLATE BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 114 REST OF ASIA PACIFIC ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 115 REST OF ASIA PACIFIC ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 116 REST OF ASIA PACIFIC ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 117 REST OF ASIA PACIFIC ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 118 EUROPE ACRYLATE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 119 EUROPE ACRYLATE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 120 EUROPE ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 121 EUROPE ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 122 EUROPE ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 123 EUROPE ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 124 EUROPE ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 125 EUROPE ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 126 GERMANY ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 127 GERMANY ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 128 GERMANY ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 129 GERMANY ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 130 GERMANY ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 131 GERMANY ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 132 UK ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 133 UK ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 134 UK ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 135 UK ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 136 UK ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 137 UK ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 138 FRANCE ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 139 FRANCE ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 140 FRANCE ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 141 FRANCE ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 142 FRANCE ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 143 FRANCE ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 144 ITALY ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 145 ITALY ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 146 ITALY ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 147 ITALY ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 148 ITALY ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 149 ITALY ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 150 SPAIN ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 151 SPAIN ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 152 SPAIN ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 153 SPAIN ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 154 SPAIN ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 155 SPAIN ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 156 RUSSIA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 157 RUSSIA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 158 RUSSIA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 159 RUSSIA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 160 RUSSIA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 161 RUSSIA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 162 REST OF EUROPE ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 163 REST OF EUROPE ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 164 REST OF EUROPE ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 165 REST OF EUROPE ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 166 REST OF EUROPE ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 167 REST OF EUROPE ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA ACRYLATE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA ACRYLATE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 175 MIDDLE EAST AND AFRICA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 176 UAE ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 177 UAE ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 178 UAE ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 179 UAE ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 180 UAE ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 181 UAE ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 182 SAUDI ARABIA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 183 SAUDI ARABIA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 184 SAUDI ARABIA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 185 SAUDI ARABIA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 186 SAUDI ARABIA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 187 SAUDI ARABIA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 188 SOUTH AFRICA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 189 SOUTH AFRICA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 190 SOUTH AFRICA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 191 SOUTH AFRICA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 192 SOUTH AFRICA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 193 SOUTH AFRICA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA ACRYLATE MARKET BY CHEMISTRY (USD BILLION), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA ACRYLATE MARKET BY CHEMISTRY (KILOTONS), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA ACRYLATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA ACRYLATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA ACRYLATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 199 REST OF MIDDLE EAST AND AFRICA ACRYLATE MARKET BY END USER (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ACRYLATE BY CHEMISTRY, USD BILLION, 2020-2029

FIGURE 9 GLOBAL ACRYLATE BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL ACRYLATE BY END USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL ACRYLATE BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ACRYLATE MARKET BY CHEMISTRY, USD BILLION, 2021

FIGURE 14 GLOBAL ACRYLATE MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL ACRYLATE MARKET BY END USER, USD BILLION, 2021

FIGURE 16 GLOBAL ACRYLATE MARKET BY REGION, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 FORMOSA PETROCHEMICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 19 LG CHEM: COMPANY SNAPSHOT

FIGURE 20 SASOL LIMITED: COMPANY SNAPSHOT

FIGURE 21 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 22 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 23 AIR LIQUIDE SA: COMPANY SNAPSHOT

FIGURE 24 BASF SE: COMPANY SNAPSHOT

FIGURE 25 ARKEMA: COMPANY SNAPSHOT

FIGURE 26 EVONIK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 27 SIBUR: COMPANY SNAPSHOT

FIGURE 28 NIPPON SHOKUBAI CO. LTD: COMPANY SNAPSHOT

FAQ

Acrylate market is expected to grow at 6.3% CAGR from 2022 to 2029. it is expected to reach above USD 15.16 billion by 2029

Asia Pacific held more than 38% of acrylate market revenue share in 2021 and will witness expansion in the forecast period.

Over the upcoming years, the acrylate market is anticipated to be driven by growing acrylate usage in the spray coating industry, increased need for infrastructure modification activities, and rising packaging sector demand.

In packaging, acrylates are used for manufacturing films, coatings, and adhesives that enhance product protection, shelf life, and visual appeal. The building and construction sector relies on acrylates for applications such as sealants, waterproofing membranes, and adhesives, ensuring durability, weather resistance, and structural integrity. Acrylates find extensive use in consumer goods such as electronics, appliances, furniture, and household products, providing superior surface finishes, adhesion, and impact resistance. Automotive applications include coatings, adhesives, and sealants that enhance aesthetics, corrosion resistance, and overall performance.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.