REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

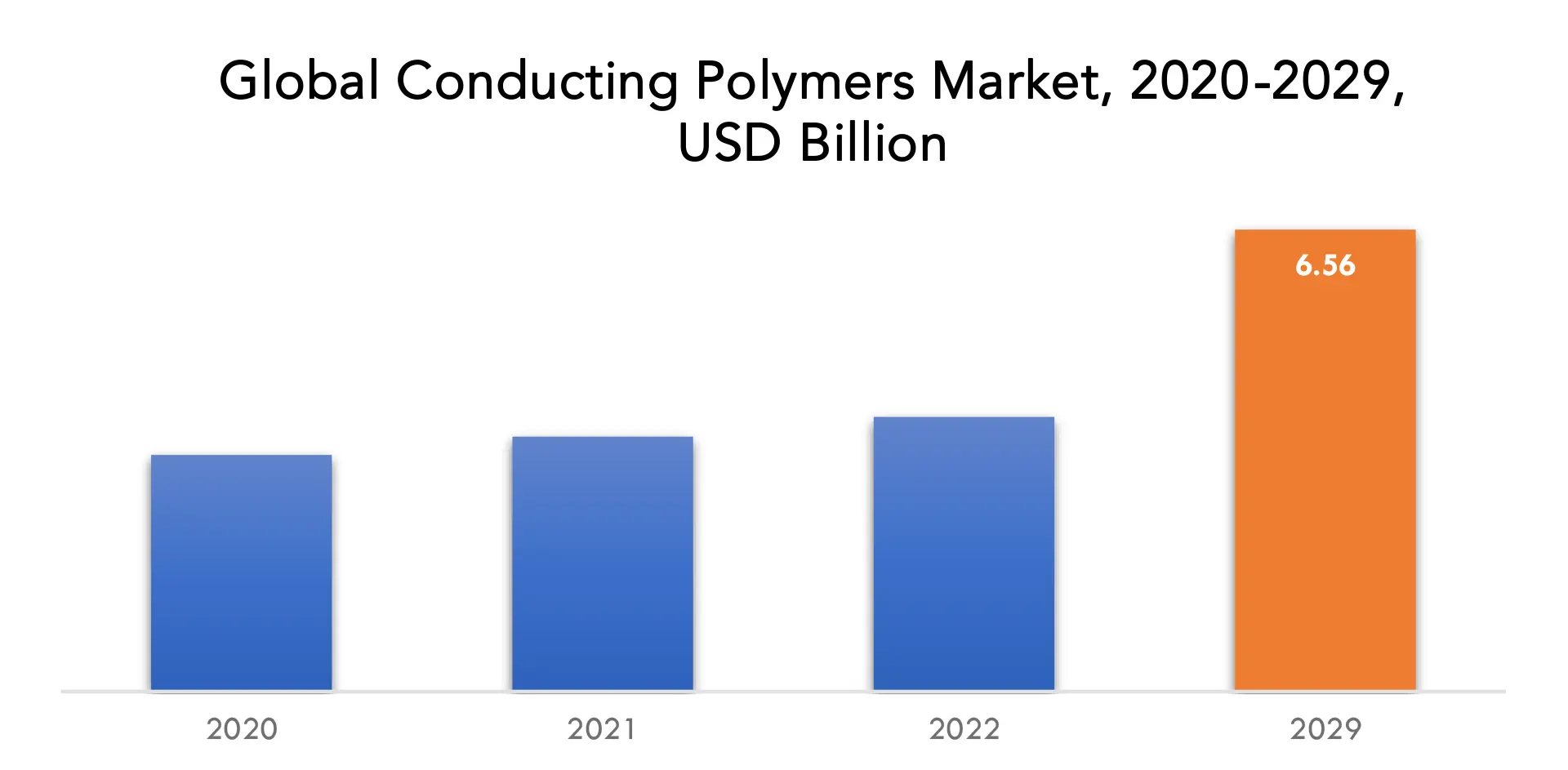

| USD 6.56 billion by 2029 | 7.7% | North America |

| By Conduction Mechanism | by Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Conducting Polymers Market Overview

The conducting polymers market is expected to grow at 7.7% CAGR from 2022 to 2029. It is expected to reach above USD 6.56 billion by 2029 from USD 3.36 billion in 2020.

Conducting polymers are a type of organic material with distinct electrical and optical properties. In contrast to traditional polymers, which are typically insulators, conducting polymers can conduct electricity. The presence of conjugated pi-electron systems within their molecular structures causes this conductivity. These polymers have a variety of interesting properties, such as tunable conductivity, flexibility, and processability, making them appealing for a variety of applications. The ability of conducting polymers to undergo reversible doping and de-doping processes, where charge carriers can be introduced or removed, resulting in changes in electrical conductivity, is one of their primary advantages. This feature enables them to modulate their electrical properties, making them suitable for organic electronics, sensors, batteries, and electrochromic devices.

Conducting polymers can be created using a variety of techniques, including chemical oxidation and electrochemical polymerization. The choice of monomers and synthesis conditions can influence the properties of the resulting polymer, allowing it to be tailored to specific application requirements in terms of conductivity, stability, and other properties. Significant research and development in the field of conducting polymers has occurred in recent years, with the goal of improving their performance, stability, and scalability. Advances in materials science, polymer chemistry, and nanotechnology have broadened the potential applications of conducting polymers, which now include everything from flexible and wearable electronics to energy storage and bioelectronics.

Rising awareness of the importance of shielding sensitive electronic devices medium from electrostatic discharge (ESD), radio frequency interference (RFI), and electromagnetic interference (EMI) as the market for sensitive electronic devices grows is expected to have a positive impact on market growth. Buyers are expected to purchase conductive plastics such as ABS and PPS in place of traditional metals and ceramics as the importance of electronics devices with reduced sound levels grows as a result of stringent noise pollution regulations. The growing importance of ionic polymers in the electronics industry due to their excellent dimensional stability and good conducting characteristics is expected to drive the growth of the conductive polymers market.

The readily available substitute materials, combined with low thermal conductivity compared to other alternatives, are expected to limit market growth in the forecast years. Furthermore, the high cost of conductive materials due to fluctuations in raw material costs is expected to stymie market growth in the forecast period.

Rising demand from emerging economies such as China, Japan, India, and South Korea is expected to keep market opportunities favorable. This trend is expected to be aided by increased product launches from market leaders such as Samsung and LG, including smartphones. For example, in July 2018, the Indian government announced the launch of the “Digital India Campaign,” which aims to increase internet connectivity and domestic production output in digital electronics. Furthermore, this initiative will boost the production of electronic goods such as smartphones, web cameras, and tablets. Such initiatives are expected to generate profitable opportunities for the global conductive polymers market to thrive.

The novel coronavirus emergency had a negative impact on the growth of the global conductive polymer market in 2020. This is due to the shutdown of various end-use industrial activities such as automotive and consumer electronics. For example, COVID-19 has had a significant impact on the automotive sector due to disruptions in the manufacturing of automobile parts as well as stopped activities in assembly plants, putting additional strain on global supply chains. These factors have an adverse effect on the global conductive polymer market. During this period of crisis, leading manufacturers are employing a variety of strategies, such as product launches and the introduction of new technology, to strengthen their position in the global market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Value (Kilotons) |

| Segmentation | By Conduction Mechanism, By Application, By Region |

| By Conduction Mechanism

|

|

| By Application

|

|

| By Region

|

|

Conducting Polymers Market Segment Analysis

The conducting polymers market is segmented based on conduction mechanism, application and region. Based on conduction mechanism market is segmented into Conducting Polymer Composites and Inherently Conductive Polymers (ICPs). By application market is segmented into anti-static packaging & coating, capacitors, actuators & sensors, batteries, solar cells, electroluminescence, printed circuit board, others. Conducting polymer composites is further sub-segmented into ABS, polycarbonates, PVC, PP, nylon, others. ICPs is further sub-segmented into polyaniline (PANI), polypyrrole (PPy), polyphenylene vinylenes (PPV), PEDOT, Others.

During the forecast period a, the polypyrrole (PPY) conductive polymer market is expected to grow at a rapid pace. This anticipated growth in the conductive polymer market is primarily due to increased utilization of Polypyrrole materials due to excellent shielding properties, resulting in increased use of PPY in electronic device packaging. Furthermore, like semiconductors and metals, PPY is a thermally and mechanically stable material with excellent electrical conductivity properties. Due to their stable properties, PPY materials have found widespread use in the production of LEDs, panel displays, and a variety of other applications. These factors are expected to boost market growth during the review period.

According to application, the conductive polymers market share from the solar cells segment is expected to grow at a rapid pace. This expansion can be attributed to rising public awareness of renewable energy sources and promising photovoltaic technology, specifically cells. Organic solar cells, perovskite solar cells, and dye-sensitized solar cells are expected to increase the use of conductive polymers in device components, and the structures of these solar cells, due to their diverse properties, are expected to favor segment expansion in the coming years.

Conducting Polymers Market Key Players

The conducting polymers market key players include 3M, Lubrizol, Covestro AG, Celanese Corporation, SABIC, Henkel AG, BASF SE, Syngenta AG, Bayer CropScience AG, Novozymes A/S, and others.

Recent Developments:

- 22 May 2023: BASF’s Coatings division has launched a crowdsourcing digital tool to streamline and enhance color formula search for customers of its two paint brands, NORBIN and Shancai.

- 22 March 2023: BASF introduced a new Ultramid Deep Gloss grade, optimized for highly glossy automotive interior parts, and applied for the first time to the garnish of Toyota‘s new Prius.

Conducting Polymers Market Regional Analysis

The conducting polymers market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia and Rest of Europe

- South America: includes Brazil, Argentina, Colombia and Rest of South America

- Middle East & Africa: includes UAE, South Africa, Saudi Arabia and Rest of MEA

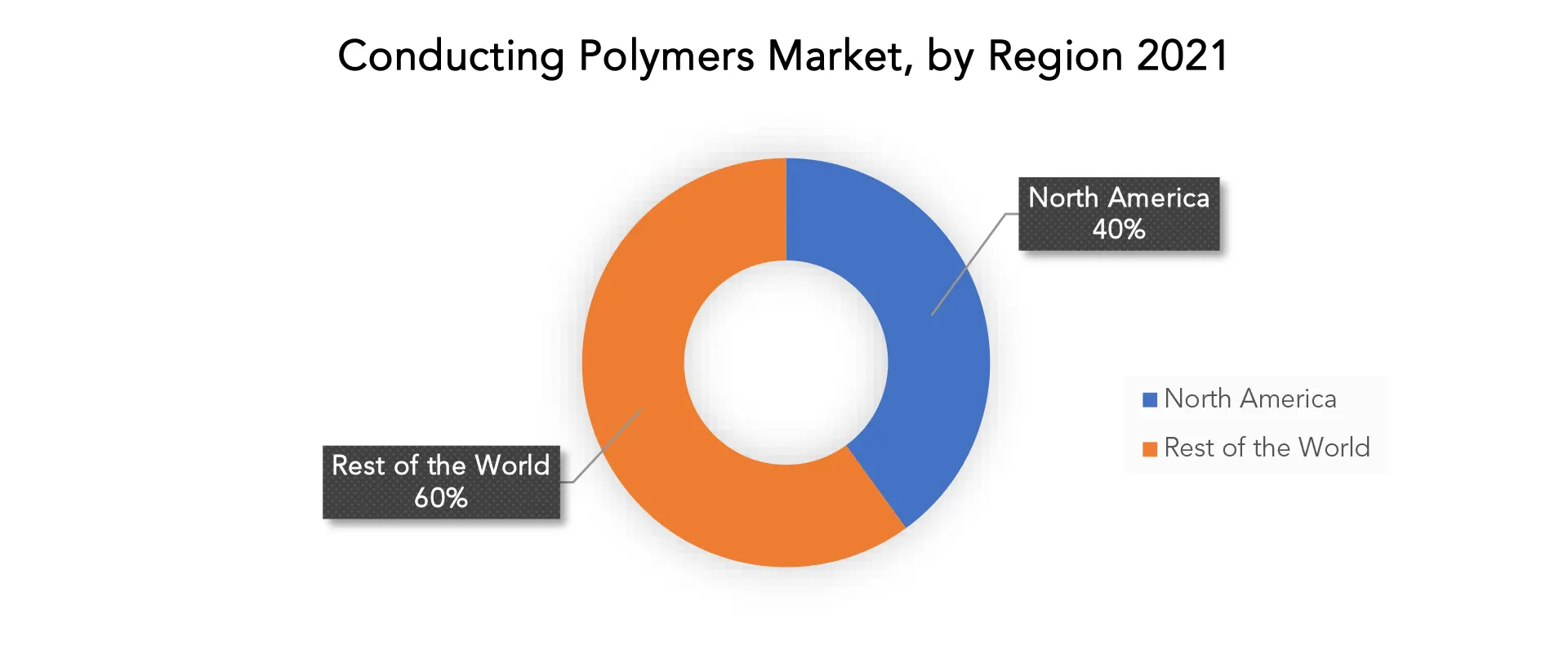

Over the forecast period, North America will see significant demand. The conductive polymers sector will continue to experience dynamic changes as a result of the impact of foreign players, which will drive the industry towards new product offerings. During the forecast period, North America is the most extensive market for conductive polymer products, accounting for more than 40% of the overall conductive polymer market share in 2021.

In terms of geographical segmentation, Europe is expected to be the second-largest market for conductive polymers. The use of sensors and batteries by end users in the automobile industry is expected to drive the growth of the region’s conductive polymers market. Conductive polymers play an important role in the production of both of these automotive electrical elements. Another key driving factor in Europe is the presence of major market players such as Bayer, Ormecon Chemie GmbH, and others. The growing demand for conductive polymers in applications such as capacitors, textiles, actuators, batteries, sensors, and solar cells is expected to drive significant growth in APAC over the next few years.

Key Market Segments: Conducting Polymers Market

Conducting Polymers Market By Conduction Mechanism, 2020-2029, (USD Billion, Kilotons)

- Conducting Polymer Composites

- ABS

- Polycarbonates

- PVC

- PP

- Nylon

- Others

- Inherently conductive polymers (ICPs)

- Polyaniline (PANI)

- Polypyrrole (PPy)

- Polyphenylene vinylenes (PPV)

- PEDOT

- Others

Conducting Polymers Market By Application, 2020-2029, (USD Billion, Kilotons)

- Anti-static packaging & coating

- Capacitors

- Actuators & Sensors

- Batteries

- Solar cells

- Electroluminescence

- Printed circuit board

- Others

Conducting Polymers Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Who Should Buy? Or Key stakeholders

- Suppliers and Distributors

- Chemicals Industry

- Investors

- End user companies

- Research and development

- Regulatory Authorities

- Others

Key Question Answered

- What is the expected growth rate of the conducting polymers market over the next 7 years?

- Who are the major players in the conducting polymers market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and Africa?

- How is the economic environment affecting the conducting polymers market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the conducting polymers market?

- What is the current and forecasted size and growth rate of the global conducting polymers market?

- What are the key drivers of growth in the conducting polymers market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the conducting polymers market?

- What are the technological advancements and innovations in the conducting polymers market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the conducting polymers market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the conducting polymers market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of melamine formaldehyde in the market and what is the impact of raw material prices on the price trend?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CONDUCTING POLYMERS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CONDUCTING POLYMERS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CONDUCTING POLYMERS MARKET OUTLOOK

- GLOBAL CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION, KILOTONS)

- CONDUCTING POLYMER COMPOSITES

- ABS

- POLYCARBONATES

- PVC

- PP

- NYLON

- OTHERS

- INHERENTLY CONDUCTIVE POLYMERS (ICPS)

- POLYANILINE (PANI)

- POLYPYRROLE (PPY)

- POLYPHENYLENE VINYLENES (PPV)

- PEDOT

- OTHER

- CONDUCTING POLYMER COMPOSITES

- GLOBAL CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION, KILOTONS)

- ANTI-STATIC PACKAGING & COATING

- CAPACITORS

- ACTUATORS & SENSORS

- BATTERIES

- SOLAR CELLS

- ELECTROLUMINESCENCE

- PRINTED CIRCUIT BOARD

- OTHERS

- GLOBAL CONDUCTING POLYMERS MARKET BY REGION (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SOUTH AFRICA

- SAUDI ARABIA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- 3M

- LUBRIZOL

- COVESTRO AG

- CELANESE CORPORATION

- SABIC

- HENKEL AG

- BASF SE

- SYNGENTA AG

- BAYER CROPSCIENCE AG

- NOVOZYMES A/S*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 2 GLOBAL CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 3 GLOBAL CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL CONDUCTING POLYMERS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL CONDUCTING POLYMERS MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA CONDUCTING POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA CONDUCTING POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 14 US CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 15 US CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (BILLION), 2020-2029

TABLE 18 CANADA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 19 CANADA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 22 MEXICO CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 23 MEXICO CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 REST OF NORTH AMERICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 26 REST OF NORTH AMERICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 27 REST OF NORTH AMERICA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 REST OF NORTH AMERICA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 31 SOUTH AMERICA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 SOUTH AMERICA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 33 SOUTH AMERICA CONDUCTING POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 34 SOUTH AMERICA CONDUCTING POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 35 BRAZIL CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 36 BRAZIL CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 37 BRAZIL CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 BRAZIL CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 ARGENTINA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 40 ARGENTINA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 41 ARGENTINA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 ARGENTINA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 COLOMBIA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 44 COLOMBIA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 45 COLOMBIA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 COLOMBIA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 REST OF SOUTH AMERICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 48 REST OF SOUTH AMERICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 49 REST OF SOUTH AMERICA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 REST OF SOUTH AMERICA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA -PACIFIC CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 52 ASIA -PACIFIC CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 53 ASIA -PACIFIC CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 54 ASIA -PACIFIC CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 55 ASIA -PACIFIC CONDUCTING POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 56 ASIA -PACIFIC CONDUCTING POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 57 INDIA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 58 INDIA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 59 INDIA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 INDIA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 CHINA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 62 CHINA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 63 CHINA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 CHINA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 JAPAN CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 66 JAPAN CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 67 JAPAN CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 JAPAN CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 SOUTH KOREA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 70 SOUTH KOREA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 71 SOUTH KOREA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 SOUTH KOREA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 AUSTRALIA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 74 AUSTRALIA HYBRID APPLICATIONBY CONDUCTION MECHANISMS (KILOTONS), 2020-2029

TABLE 75 AUSTRALIA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 AUSTRALIA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC HYBRID APPLICATIONBY CONDUCTION MECHANISMS (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 82 EUROPE CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 83 EUROPE CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE CONDUCTING POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE CONDUCTING POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 88 GERMANY CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 89 GERMANY CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 92 UK CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 93 UK CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 96 FRANCE CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 97 FRANCE CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 100 ITALY CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 101 ITALY CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 104 SPAIN CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 105 SPAIN CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 108 RUSSIA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 109 RUSSIA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 122 UAE CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 123 UAE CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA CONDUCTING POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CONDUCTING POLYMERS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CONDUCTING POLYMERS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL CONDUCTING POLYMERS MARKET BY CONDUCTION MECHANISM, USD BILLION, 2021

FIGURE 13 GLOBAL CONDUCTING POLYMERS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL CONDUCTING POLYMERS MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 3M: COMPANY SNAPSHOT

FIGURE 17 LUBRIZOL: COMPANY SNAPSHOT

FIGURE 18 COVESTRO AG: COMPANY SNAPSHOT

FIGURE 19 CELANESE CORPORATIONS: COMPANY SNAPSHOT

FIGURE 20 SABIC: COMPANY SNAPSHOT

FIGURE 21 HENKEL AG: COMPANY SNAPSHOT

FIGURE 22 BASF SE: COMPANY SNAPSHOT

FIGURE 23 SYNGENTA AG: COMPANY SNAPSHOT

FIGURE 24 BAYER CROPSCIENCE AG: COMPANY SNAPSHOT

FIGURE 25 NOVOZYMES A/S: COMPANY SNAPSHOT

FAQ

The global conducting polymers market size was valued at 3.36 billion in 2020.

The conducting polymers market key players 3M, Lubrizol, Covestro AG, Celanese Corporation, SABIC, Henkel AG, BASF SE, Syngenta AG, Bayer CropScience AG, Novozymes A/S.

North America is the largest regional market for conducting polymers market.

The conducting polymers market is segmented into conduction mechanism, application and region.

Growing demand for anti-static packaging and coating to package, store, and transport items with ESD sensitivity in order to protect the equipment from damage is the emerging trend in conductive polymer market. In addition, surge in demand for solar panels to use solar energy for residential purpose across the globe is likely to increase the demand for conductive polymers as conductive polymer is widely used in manufacturing of solar cells due to their easy fabrication process, low cost, and p-type semiconductor nature.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.