Report Outlook

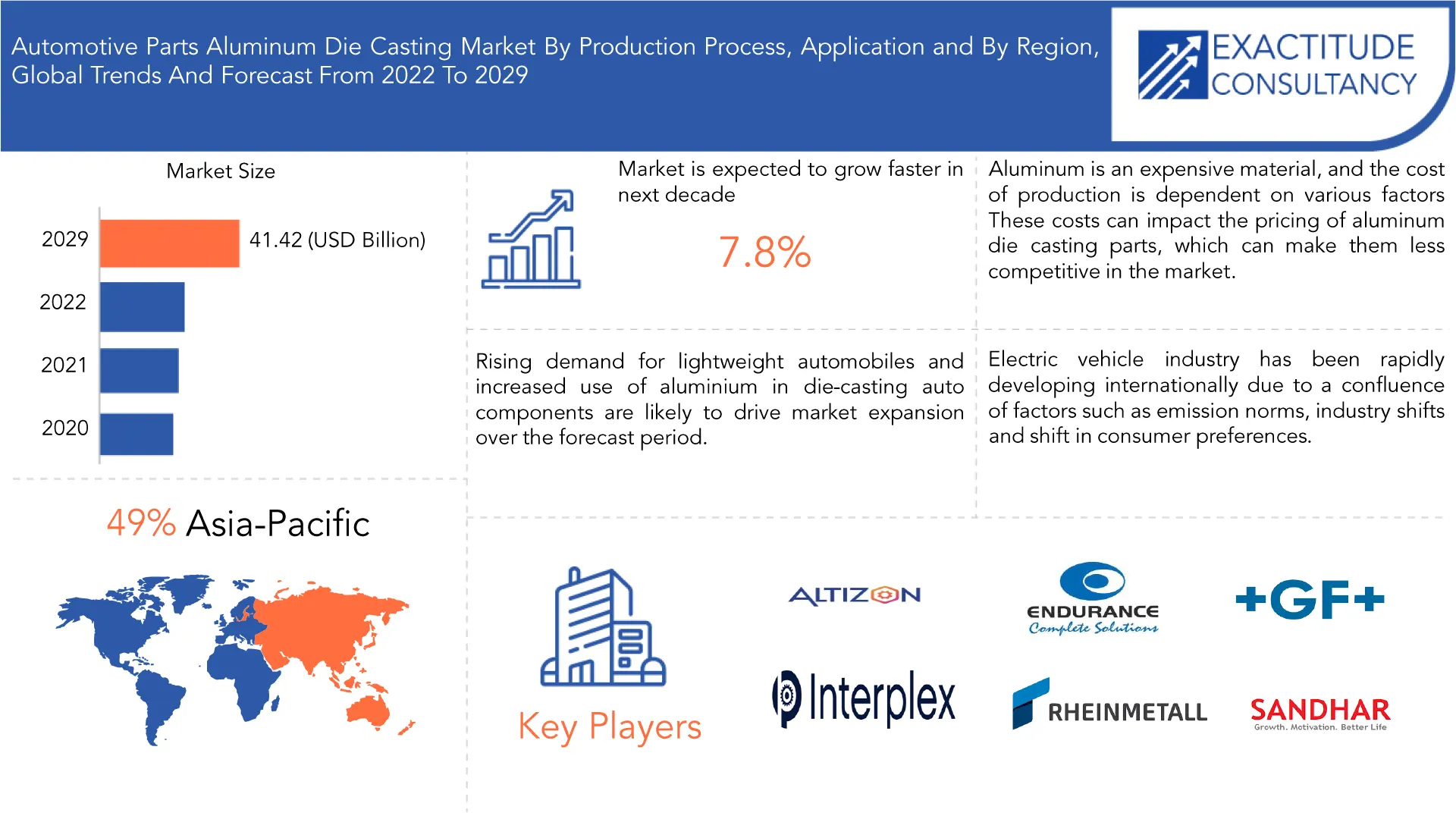

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 41.42 Billion By 2029 | 7.8% | Asia Pacific |

| By Production Process | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Automotive Parts Aluminum Die Casting Market Overview

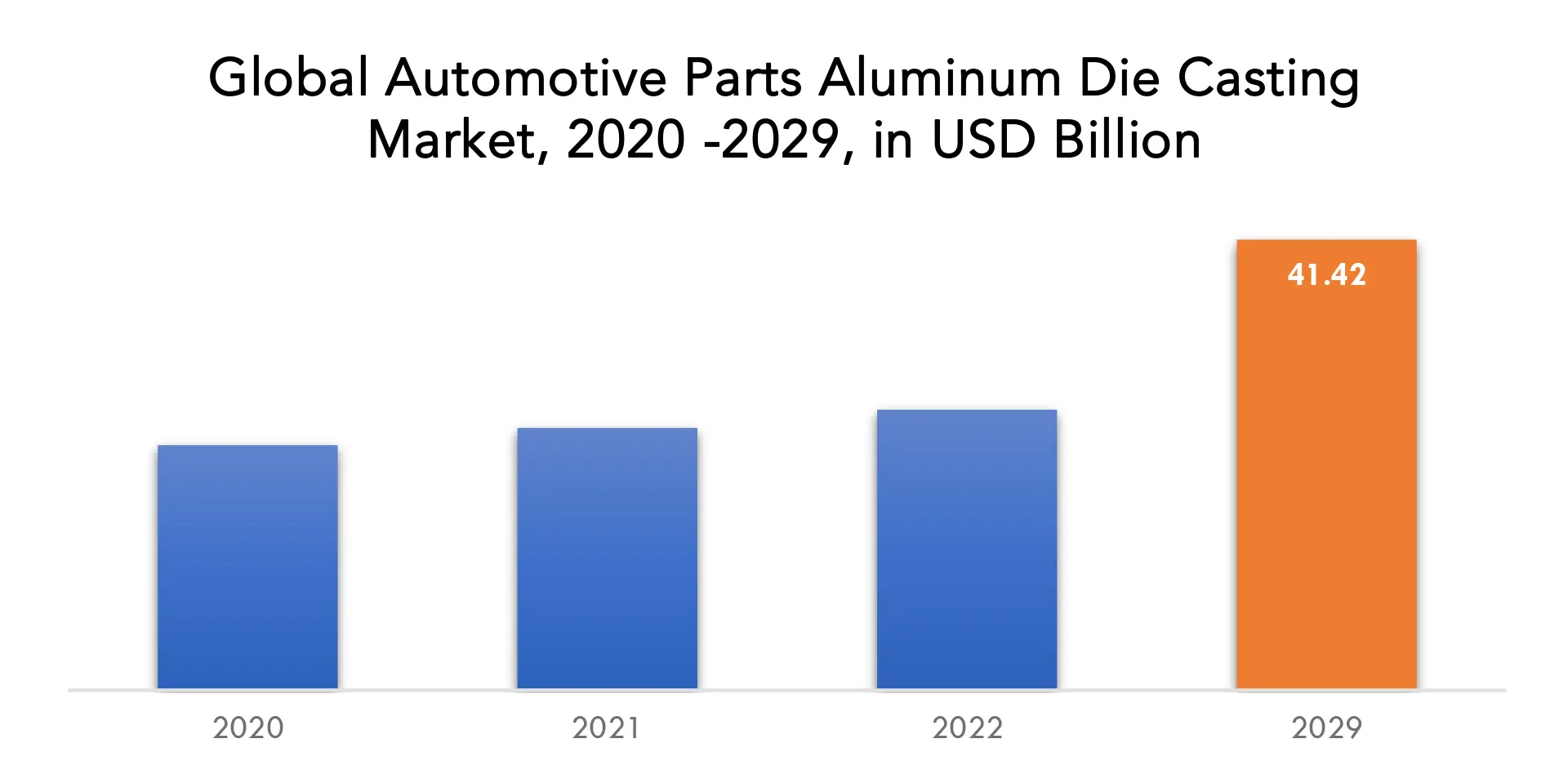

The global automotive parts aluminum die casting market is projected to reach USD 41.42 billion by 2029 from USD 22.53 billion in 2020, at a CAGR of 7.8 % from 2022 to 2029.

Automotive parts aluminum die casting is a manufacturing process used to produce complex parts made of aluminum for use in automobiles. The process involves injecting molten aluminum under high pressure into a steel mold or die, which is designed to give the part its shape and features. Aluminum die casting is a popular choice for automotive parts due to it offers a high degree of dimensional accuracy and repeatability, excellent surface finish, and the ability to produce complex shapes with tight tolerances. Additionally, aluminum is lightweight, strong, and has excellent thermal conductivity, making it ideal for automotive applications.

There are various advantages to using aluminium die casting in the automobile sector. One of the key advantages is the ability to manufacture lightweight components. Aluminum is much lighter than other materials utilized in the automobile industry, such as steel or iron. Aluminum components in vehicles can assist to reduce vehicle weight, which can enhance fuel efficiency, handling, and performance. The adaptability of aluminium die casting for automobile parts is another benefit. The procedure enables the fabrication of complicated forms and features with tight tolerances, which can be difficult to create with conventional methods of manufacture. While this adaptability, automakers can create parts that are more efficient, durable, and visually beautiful.

The desire for lightweight and fuel-efficient automobiles is a major market driver. To fulfil tight pollution requirements and decrease operating costs, the automobile industry is under growing pressure to reduce vehicle weight and increase fuel economy. As aluminium die casting is a lightweight method of creating car parts, it is an appealing alternative for automakers wanting to increase fuel efficiency and decrease emissions.

The increasing adoption of electric vehicles is also driving growth in the market. Electric vehicles require lightweight components to maximize their range, and aluminum die casting is a cost-effective solution for producing such components. In addition, electric vehicles typically have higher torque, which puts more strain on the vehicle components. Aluminum die casting parts offer excellent durability and can withstand the high loads associated with electric vehicles.

Environmental problems are another key impediment to the sector. Aluminum die casting parts take a large amount of energy to manufacture, which can contribute to carbon emissions and global warming. Furthermore, the manufacturing process might create hazardous waste, which can endanger the environment if not adequately controlled. Manufacturers must invest in sustainable production processes to lessen their environmental effect as environmental rules become more rigorous.

The growing demand for lightweight and fuel-efficient automobiles is one of the market’s significant opportunities. To fulfil tight pollution requirements and decrease operating costs, the automobile industry is under growing pressure to reduce vehicle weight and increase fuel economy. While aluminium die casting is a lightweight method of creating car parts, it is an appealing alternative for automakers wanting to increase fuel efficiency and decrease emissions.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Production Process, By Application, By Region. |

| By Production Process |

|

| By Application |

|

| By Region |

|

Automotive Parts Aluminum Die Casting Market Segment Analysis

The global automotive parts aluminum die casting market is segmented by production process, application, and region.

Based on production process, the automotive parts aluminum die casting market is classified into pressure die casting, vacuum die casting, squeeze die casting, gravity die casting. The pressure die casting category had the biggest market share and is expected to increase at an 8.2% CAGR during the projected period. Aluminum has long been the metal of choice for pressure die casting. Hybrid and electric car technologies are becoming more popular in the automobile industry. Transmission, power train components, and battery compartment housings are projected to rely heavily on pressure die casting. Except for eliminating flash around the edge and potentially drilling and tapping holes, most high-pressure die castings do not require machining.

The gravity die-casting component comes in second. Gravity die casting is a conventional die casting procedure. This die-casting method yields metal pieces that are precisely dimensioned, finely defined, and have a smooth or textured surface.

Based on application, the automotive parts aluminum die casting market is classified into body parts, engine parts, transmission parts, battery and related components, other application types. The body parts segment had the greatest market share and is expected to increase at a 7.8% CAGR during the projected period. Major automakers use best-in-class machinery to manufacture body pieces. Lightweight automobiles are in high demand. The country’s demand for lightweight but strong body assemblies expanded, increasing the market. Electric car manufacturers are obtaining the most important equipment on the market for their body parts. As the need for lightweight body parts grows, corporations are developing dedicated production units.

Automotive Parts Aluminum Die Casting Market Players

The global automotive parts aluminum die casting market key players include Altizon Inc., Endurance Technologies Ltd (CN), Georg Fischer Limited, Interplex Holdings Ltd, Koch Enterprises, Martinrea Honsel, Nemak, Pace Industries, Rheinmetall AG, Rockman Industries, Ryobi Die Casting Inc., Sandhar Technologies, Shiloh Industries Inc., Sipra Quality Die Casting, and TEKSID SpA.

Recent News:

- April 4,2023: Rheinmetall’s Materials and Trade business received three new orders for structural parts for electric cars. Each new incoming order represents another step forward in the Group’s transition away from internal combustion engines and towards future-proof, environmentally friendly forms of mobility.

- 30-Nov-2021: Altizon Inc. announced that it is collaborating with SCL to expand the use of its industry-leading Datonis Digital Factory in casting and machining cells across all SCL factories in India and North America.

Who Should Buy? Or Key Stakeholders

- Automotive manufacturers

- Automotive parts suppliers

- Aftermarket parts and accessories companies

- Distributors and retailers

- Education & Research Institutes

- Research Professionals

- Emerging Companies

- Manufacturers

- Others

Automotive Parts Aluminum Die Casting Market Regional Analysis

The Automotive Parts Aluminum Die Casting market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia Pacific is expected to have the biggest market share during forecasted period. Major nations in the Asia-Pacific region, such as India, China, and Japan, are likely to contribute considerably to the market’s development throughout the forecast period. China is a large manufacturer of die casting parts, and the region’s increasing use of passenger automobiles is projected to have a positive influence on the industry. The Chinese economy is expanding, as is the disposable income of middle-class consumers. Furthermore, as the country’s desire for electric cars grows, so will the demand for aluminium die casted components in the future years.

North America is expected to have the greatest CAGR over the forecast period. North American countries contribute significantly to the automotive sector, with die-casting serving as a key support pillar for market expansion. The automotive sector is on the rise, and die casting manufacturers are making their mark. Automobile production has increased significantly in the United States, Canada, and Mexico.

Key Market Segments: Automotive Parts Aluminum Die Casting Market

Automotive Parts Aluminum Die Casting Market By Production Process, 2020-2029, (USD Billion) (Thousand Units)

- Pressure Die Casting

- Vacuum Die Casting

- Squeeze Die Casting

- Gravity Die Casting

Automotive Parts Aluminum Die Casting Market By Application, 2020-2029, (USD Billion) (Thousand Units)

- Body Parts

- Engine Parts

- Transmission Parts

- Battery And Related Components

- Other Application Types

Automotive Parts Aluminum Die Casting Market By Region, 2020-2029, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the automotive parts aluminum die casting market over the next 7 years?

- Who are the major players in the automotive parts aluminum die casting market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the automotive parts aluminum die casting market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the automotive parts aluminum die casting market?

- What is the current and forecasted size and growth rate of the global automotive parts aluminum die casting market?

- What are the key drivers of growth in the automotive parts aluminum die casting market?

- What are the distribution channels and supply chain dynamics in the automotive parts aluminum die casting market?

- What are the technological advancements and innovations in the automotive parts aluminum die casting market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the automotive parts aluminum die casting market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the automotive parts aluminum die casting market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of automotive parts aluminum die casting in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AUTOMOTIVE SAFETY DEVICE SALES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET OUTLOOK

- GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION, THOUSAND UNITS), 2020-2029

- ACTIVE SAFETY SYSTEM

- PASSIVE SAFETY SYSTEM

- GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION, THOUSAND UNITS),2020-2029

- HARDWARE

- SOFTWARE

- GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION, THOUSAND UNITS),2020-2029

- PASSENGER VEHICLE

- LIGHT TRUCK

- HEAVY TRUCK

- OTHERS

- GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY REGION (USD BILLION, THOUSAND UNITS),2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

-

- AUTOLIV

- JOYSON SAFETY SYSTEMS

- TOYODA GOSEI

- TRW AUTOMOTIVE

- CONTINENTAL

- DELPHI AUTOMOTIVE

- EAST JOY LONG MOTOR AIRBAG

- FLIR SYSTEMS

- HELLA KGAA HUECK

- WABCO VEHICLE CONTROL SYSTEM

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 4 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 6 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 17 US AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 US AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 US AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 20 US AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 21 US AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 22 US AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (BILLION), 2020-2029

TABLE 24 CANADA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 26 CANADA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 CANADA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 30 MEXICO AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 32 MEXICO AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 MEXICO AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 REST OF NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 REST OF NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 REST OF NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 38 REST OF NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 39 REST OF NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION N (USD BILLION), 2020-2029

TABLE 40 REST OF NORTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION N (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 43 SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 44 SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 45 SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 47 SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 48 SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 49 BRAZIL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 50 BRAZIL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 BRAZIL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 52 BRAZIL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 53 BRAZIL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 54 BRAZIL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 55 ARGENTINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 56 ARGENTINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 57 ARGENTINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 58 ARGENTINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 59 ARGENTINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 ARGENTINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 COLOMBIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 COLOMBIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 COLOMBIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 64 COLOMBIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 65 COLOMBIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 66 COLOMBIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 67 REST OF SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 68 REST OF SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 69 REST OF SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 70 REST OF SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 71 REST OF SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION N (USD BILLION), 2020-2029

TABLE 72 REST OF SOUTH AMERICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION N (THOUSAND UNITS), 2020-2029

TABLE 73 ASIA -PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 ASIA -PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 ASIA -PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 76 ASIA -PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 77 ASIA -PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 78 ASIA -PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 79 ASIA -PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 80 ASIA -PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 81 INDIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 INDIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 INDIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 84 INDIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 85 INDIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 86 INDIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 87 CHINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 CHINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 CHINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 90 CHINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 91 CHINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 92 CHINA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 93 JAPAN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 94 JAPAN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 95 JAPAN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 96 JAPAN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 97 JAPAN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 JAPAN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 99 SOUTH KOREA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 SOUTH KOREA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 SOUTH KOREA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 102 SOUTH KOREA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 103 SOUTH KOREA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 104 SOUTH KOREA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 105 AUSTRALIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 106 AUSTRALIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERINGBY TYPE (THOUSAND UNITS), 2020-2029

TABLE 107 AUSTRALIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 108 AUSTRALIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 109 AUSTRALIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 AUSTRALIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERINGBY TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 117 EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 118 EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 119 EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 120 EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 121 EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 122 EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 123 EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 125 GERMANY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 GERMANY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 GERMANY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 128 GERMANY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 129 GERMANY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 130 GERMANY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 131 UK AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 132 UK AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 133 UK AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 134 UK AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 135 UK AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 UK AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 137 FRANCE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 138 FRANCE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 139 FRANCE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 140 FRANCE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 141 FRANCE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 142 FRANCE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 143 ITALY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 144 ITALY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 145 ITALY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 146 ITALY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 147 ITALY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 148 ITALY AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 149 SPAIN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 150 SPAIN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 151 SPAIN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 152 SPAIN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 153 SPAIN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 154 SPAIN AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 155 RUSSIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 156 RUSSIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 157 RUSSIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 158 RUSSIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 159 RUSSIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 160 RUSSIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 161 REST OF EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 163 REST OF EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 165 REST OF EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION N (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION N (THOUSAND UNITS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 173 MIDDLE EAST ABD AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST ABD AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 175 UAE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 176 UAE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 177 UAE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 178 UAE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 179 UAE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 180 UAE AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 181 SAUDI ARABIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 183 SAUDI ARABIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 185 SAUDI ARABIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 187 SOUTH AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 189 SOUTH AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 191 SOUTH AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY RAW MATERIAL, USD BILLION, THOUSAND UNITS, 2020-2029

FIGURE 9 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY SOURCE, USD BILLION, THOUSAND UNITS, 2020-2029

FIGURE 10 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION, USD BILLION, THOUSAND UNITS, 2021

FIGURE 11 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY REGION, USD BILLION, THOUSAND UNITS, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY RAW MATERIAL, USD BILLION, THOUSAND UNITS, 2021

FIGURE 14 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY SOURCE, USD BILLION, THOUSAND UNITS, 2021

FIGURE 15 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY APPLICATION, USD BILLION, THOUSAND UNITS, 2021

FIGURE 16 GLOBAL AUTOMOTIVE SAFETY DEVICE SALES MARKET BY REGION, USD BILLION, THOUSAND UNITS, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 AUTOLIV.: COMPANY SNAPSHOT

FIGURE 19 JOYSON SAFETY SYSTEMS.: COMPANY SNAPSHOT

FIGURE 20 TOYODA GOSEI: COMPANY SNAPSHOT

FIGURE 21 CONTINENTAL: COMPANY SNAPSHOT

FIGURE 22 DELPHI AUTOMOTIVE: COMPANY SNAPSHOT

FIGURE 23 EAST JOY LONG MOTOR AIRBAG.: COMPANY SNAPSHOT

FIGURE 24 FLIR SYSTEMS: COMPANY SNAPSHOT

FIGURE 25 HELLA KGAA HUECK: COMPANY SNAPSHOT

FIGURE 26 WABCO VEHICLE CONTROL SYSTEM: COMPANY SNAPSHOT

FAQ

The global automotive parts aluminum die casting market is projected to reach USD 41.42 billion by 2029 from USD 22.53 billion in 2020, at a CAGR of 7.8 % from 2022 to 2029.

The growing adoption of electric vehicles, which require lightweight and high-performance parts. This is expected to drive the demand for aluminum die castings in the automotive industry.

The global Automotive parts aluminum die casting market registered a CAGR of 7.8 % from 2022 to 2029.

Asia-Pacific is expected to witness the fastest growth rate during the forecast period. In the Asia-Pacific region, major countries like India, China, and Japan are expected to contribute significantly to the development of the market over the forecast period.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.