REPORT OUTLOOK

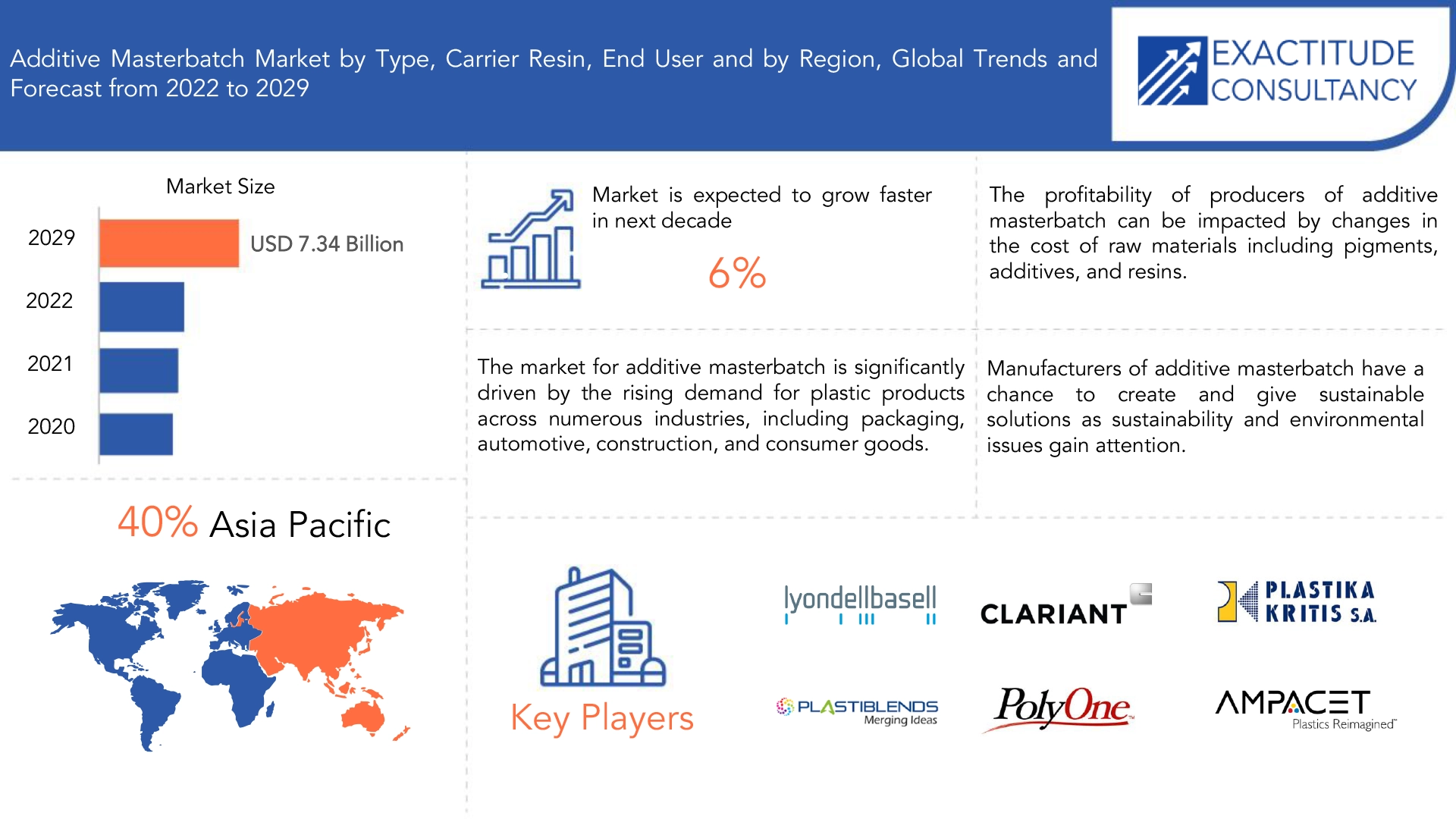

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 7.34 Billion By 2029 | 6% | Asia-Pacific |

| By Type | By Carrier Resin | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Additive Masterbatch Market Overview

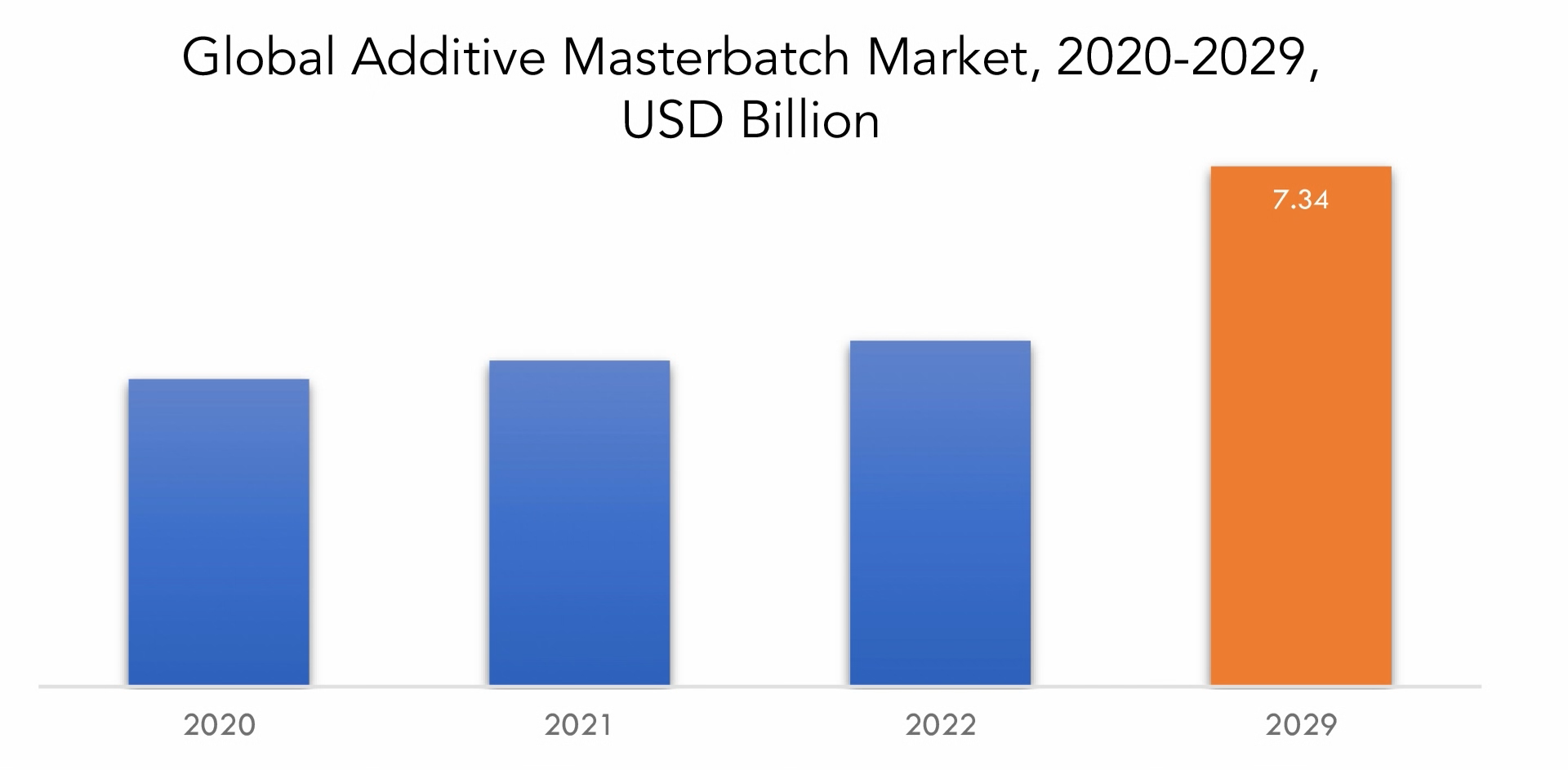

The Additive Masterbatch Market Is Expected to Grow At 6% CAGR From 2021 To 2029. It Is Expected to Reach Above USD 7.34 Billion By 2029 From USD 4.34 Billion In 2020.

A masterbatch is a concentrated mixture of additives and pigments that is formed during a heat-producing process, cooled, and then shaped into granular pieces. When making plastic, the processor can colour the raw polymer thanks to masterbatch. On the basis of industry standards and specifications, additive masterbatch is used in the production of packaging.

The need for plastic products has increased due to the growing urbanization, industrialization, and urbanization occurring throughout the world. This has significantly propelled the market and is a key factor driving the additive masterbatch market. Due to their extensive use and affordable availability, masterbatch-oriented products have attracted a sizable consumer base as a result of the industrial sectors’ rapid development. The main causes of the increase in solid waste are the expanding industrial production, the growing world population, and the usage of plastic in everyday products. Several nations’ governments have put tight rules into place to promote plastic recycling and reuse while reducing plastic waste. To make recycled plastic more usable, additive masterbatch is employed. The global market for additive masterbatch is expected to expand in revenue due to more stringent government regulations and plastic recycling.

The characteristics of plastic have improved thanks to additive masterbatch. The qualities of plastic, such as scratch resistance, chemical resistance, and water resistance, are being improved through additive masterbatch. The market for additive masterbatch is anticipated to increase as a result of rising consumer demand for durable plastics. For market participants in the global additive masterbatch, the consumption of plastics, particularly in the construction industry, represents a good market opportunity. The use of plastics and other derivatives of plastic, which pose a danger to the market, has been prohibited by the governments of the majority of the world’s nations, which has had an impact on the expansion of the additive masterbatch market value. The market for additive masterbatch is also constrained by the affordability of locally produced goods and their widespread adoption by many firms. And that will slow the market’s rate of expansion.

The various markets have been badly impacted by the COVID-19 pandemic. The manufacturing facility and the supply chain have both had a significant impact on market expansion. The market for additive masterbatch has grown more slowly since COVID-19’s appearance, but it is now steadily recovering thanks to the lifting of the lockdown. When the pandemic is finished, the additive masterbatch market will resume its pre-pandemic level of growth due to the abrupt growth in CAGR.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Kilotons) |

| Segmentation | By Type, By Carrier Resin, By End User, By Region |

| By Type |

|

| By Carrier Resin |

|

| By End User |

|

| By Region |

|

Additive Masterbatch Market Segment Analysis

The Additive Masterbatch Market is segmented based on type, carrier resin, end user and region.

Based on type, the market is segmented into antimicrobial, flame retardant and antioxidant, others. According to estimates, the antimicrobial additive masterbatch is the most prevalent and rapidly expanding type of masterbatch. Due to the rising demand for plastic products, antibacterial additive masterbatch is dominant. Utilizing an antimicrobial additive masterbatch, plastic items are shielded from microorganisms like yeast, bacteria, fungi, and algae. This kind of masterbatch is employed in a number of applications, including those for consumer goods, healthcare, and hygiene items.

Based on carrier resin, the market is segmented into polyethylene (PE), polystyrene (PS), polypropylene (PP), polyvinyl chloride (PVC), polyethylene terephthalate (PET), others. The greatest type of carrier resin, in terms of quantity, is polyethylene. This is since it has superior characteristics to other resins. Low density, great toughness, and moisture resistance are some of these characteristics. Due to their numerous uses in buckets, containers, pipes, toys, plastic bags, sheets, and wraps, LDPE and LLDPE are widely employed in the additive masterbatch industry. Due to their low tensile strength, LDPE and LLDPE are flexible materials that are typically utilised in shopping bags. Due to their many qualities, including ductility, tensile strength, resistance to water, flexibility, and stiffness, these varieties of polyethylene are frequently utilised as carrier resins in additive masterbatch. This makes polyethylene the material that is produced the most frequently in the world.

Based on end user, the market is segmented into packaging, building & construction, automotive, consumer goods, agriculture, electrical & electronics, others. Due to the widespread usage of additive masterbatches to improve the aesthetics, usability, and protection of plastic packaging materials, the packaging industry is a major sector.

Additive Masterbatch Market Players

The Additive Masterbatch Market Key players include Clariant AG, Schulman, Inc., PolyOne Corporation, Plastika Kritis S.A., Plastiblends India Limited, Dow, RTP Company, Ampacet Corporation, LyondellBasell Industries Holdings B.V., Tosaf Group, O’neil Color & Compounding, Astra Polymers, Prayag Polytech, Alok Masterbatch, Dainichiseika Color & Chemicals Mfg. Co., Ltd., Rajiv Plastic Industries, Meilian Chemical Co., Ltd.

Recent Developments:

13 March, 2023: LyondellBasell announced the decision to acquire Mepol Group.

30 September, 2022: LyondellBasell announced the acquisition of Colortech da Amazonia, a manufacturer of color concentrates, additive masterbatch and mineral-filled compounds.

Who Should Buy? Or Key Stakeholders

- Additive Masterbatch Manufacturers

- Additive Masterbatch Suppliers

- Additive Masterbatch Traders & Distributors

- Raw Materials Suppliers

- Service Providers

- Government & Regional Agencies

- Research Organizations

- Investors

- Regulatory Authorities

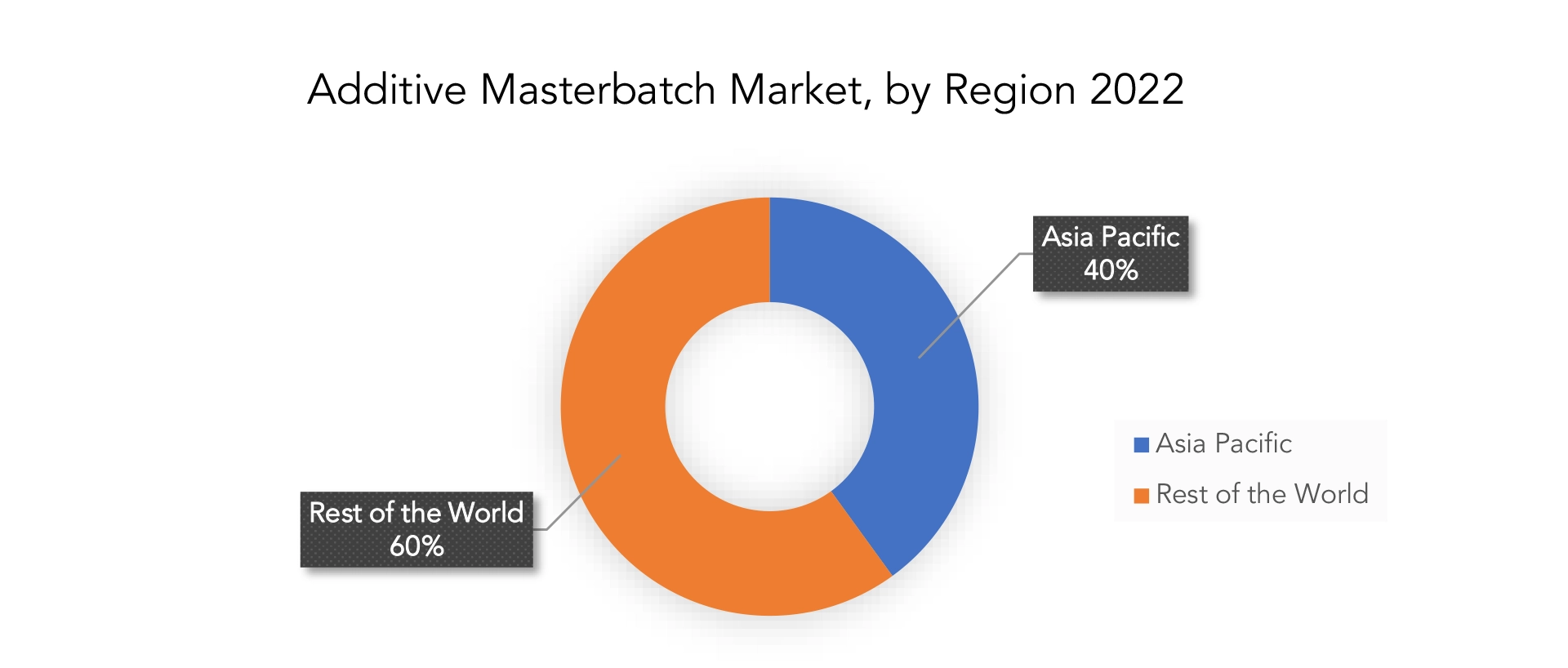

Additive Masterbatch Market Regional Analysis

The Additive Masterbatch Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The region with the largest market share for additive masterbatch in 2021 was Asia-Pacific. Particularly in nations like China, India, and Southeast Asian countries, the Asia-Pacific region has experienced tremendous industrialization. The growing consumption of plastic goods as a result of this industrial expansion has boosted the demand for additive masterbatches. Construction, packaging, automotive, consumer products, and other industries all have significant manufacturing bases in the region. These sectors use additive masterbatches extensively to improve the qualities of plastic products. The need for additive masterbatches used in building materials including pipes, profiles, and sheets has surged as a result of the significant growth the Asia-Pacific construction industry has been experiencing. Due to shifting consumer habits, an increase in e-commerce, and rising urbanisation, the packaging business in the Asia-Pacific region has been growing quickly.

To provide colour, protection, and functionality, additive masterbatches are widely employed in packaging materials, which helps the industry dominate the market. Due to cost benefits and market potential, several multinational corporations have moved their manufacturing operations to the Asia-Pacific region. This has increased the region’s demand for additive masterbatches. A sizable and quickly expanding customer base in Asia-Pacific fuels demand for a range of plastic items. The domination of the area has been aided by the use of additive masterbatches to improve the appearance and functionality of consumer goods.

Key Market Segments: Additive Masterbatch Market

Additive Masterbatch Market By Type, 2020-2029, (USD Billion, Kilotons)

- Antimicrobial

- Flame Retardant

- Antioxidant

- Others

Additive Masterbatch Market By Carrier Resin, 2020-2029, (USD Billion, Kilotons)

- Polyethylene (PE)

- Polystyrene (PS)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Others

Additive Masterbatch Market By End User, 2020-2029, (USD Billion, Kilotons)

- Packaging

- Building & Construction

- Automotive

- Consumer Goods

- Agriculture

- Electrical & Electronics

- Others

Additive Masterbatch Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new carrier resin

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the Additive Masterbatch Market over the next 7 years?

- Who are the major players in the Additive Masterbatch Market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the Additive Masterbatch Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Additive Masterbatch Market?

- What is the current and forecasted size and growth rate of the global Additive Masterbatch Market?

- What are the key drivers of growth in the Additive Masterbatch Market?

- Who are the major players in the market and what is their market share?

- What are the antioxidant and supply chain dynamics in the Additive Masterbatch Market?

- What are the technological advancements and innovations in the Additive Masterbatch Market and their impact on carrier resin development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Additive Masterbatch Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Additive Masterbatch Market?

- What are the product offering and specifications of leading players in the market?

- What is the pricing trend of additive masterbatch in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ADDITIVE MASTERBATCH MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ADDITIVE MASTERBATCH MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ADDITIVE MASTERBATCH MARKET OUTLOOK

- GLOBAL ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION, KILOTONS), 2020-2029

- ANTIMICROBIAL

- FLAME RETARDANT

- ANTIOXIDANT

- OTHERS

- GLOBAL ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION, KILOTONS), 2020-2029

- POLYETHYLENE (PE)

- POLYSTYRENE (PS)

- POLYPROPYLENE (PP)

- POLYVINYL CHLORIDE (PVC)

- POLYETHYLENE TEREPHTHALATE (PET)

- OTHERS

- GLOBAL ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION, KILOTONS), 2020-2029

- PACKAGING

- BUILDING & CONSTRUCTION

- AUTOMOTIVE

- CONSUMER GOODS

- AGRICULTURE

- ELECTRICAL & ELECTRONICS

- OTHERS

- GLOBAL ADDITIVE MASTERBATCH MARKET BY REGION (USD BILLION, KILOTONS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- CLARIANT AG

- SCHULMAN, INC.

- POLYONE CORPORATION

- PLASTIKA KRITIS S.A.

- PLASTIBLENDS INDIA LIMITED

- DOW

- RTP COMPANY

- AMPACET CORPORATION

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- TOSAF GROUP

- O’NEIL COLOR & COMPOUNDING

- ASTRA POLYMERS

- PRAYAG POLYTECH

- ALOK MASTERBATCH

- DAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.

- RAJIV PLASTIC INDUSTRIES

- MEILIAN CHEMICAL CO., LTD.*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 4 GLOBAL ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 5 GLOBAL ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL ADDITIVE MASTERBATCH MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL ADDITIVE MASTERBATCH MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA ADDITIVE MASTERBATCH MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA ADDITIVE MASTERBATCH MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 17 US ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 US ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 19 US ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 20 US ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 21 US ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 22 US ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 23 CANADA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 26 CANADA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 27 CANADA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 CANADA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 29 MEXICO ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 32 MEXICO ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 33 MEXICO ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 34 MEXICO ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 43 BRAZIL ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 46 BRAZIL ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 47 BRAZIL ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 48 BRAZIL ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 49 ARGENTINA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 52 ARGENTINA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 53 ARGENTINA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 ARGENTINA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 55 COLOMBIA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 58 COLOMBIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 59 COLOMBIA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 60 COLOMBIA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC ADDITIVE MASTERBATCH MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC ADDITIVE MASTERBATCH MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 INDIA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 78 INDIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 79 INDIA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 INDIA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 CHINA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 84 CHINA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 85 CHINA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 CHINA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 JAPAN ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 90 JAPAN ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 91 JAPAN ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 92 JAPAN ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 117 EUROPE ADDITIVE MASTERBATCH MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE ADDITIVE MASTERBATCH MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 EUROPE ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 121 EUROPE ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 122 EUROPE ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 123 EUROPE ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 124 EUROPE ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 125 GERMANY ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 128 GERMANY ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 129 GERMANY ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 130 GERMANY ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 131 UK ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 UK ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 133 UK ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 134 UK ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 135 UK ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 UK ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 137 FRANCE ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 140 FRANCE ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 141 FRANCE ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 142 FRANCE ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 143 ITALY ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 146 ITALY ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 147 ITALY ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 148 ITALY ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 149 SPAIN ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 152 SPAIN ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 153 SPAIN ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 154 SPAIN ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 155 RUSSIA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 158 RUSSIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 159 RUSSIA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 160 RUSSIA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 175 UAE ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 176 UAE ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 177 UAE ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 178 UAE ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 179 UAE ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 180 UAE ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY END USER (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA ADDITIVE MASTERBATCH MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL ADDITIVE MASTERBATCH MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 6 GLOBAL ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN, USD BILLION, 2020-2029

FIGURE 7 GLOBAL ADDITIVE MASTERBATCH MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 8 GLOBAL ADDITIVE MASTERBATCH MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 9 PORTER’S FIVE FORCES MODEL

FIGURE 10 GLOBAL ADDITIVE MASTERBATCH MARKET BY TYPE, USD BILLION, 2021

FIGURE 11 GLOBAL ADDITIVE MASTERBATCH MARKET BY CARRIER RESIN, USD BILLION, 2021

FIGURE 12 GLOBAL ADDITIVE MASTERBATCH MARKET BY END USER, USD BILLION, 2021

FIGURE 13 GLOBAL ADDITIVE MASTERBATCH MARKET BY REGION, USD BILLION, 2021

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 CLARIANT AG: COMPANY SNAPSHOT

FIGURE 16 SCHULMAN, INC.: COMPANY SNAPSHOT

FIGURE 17 POLYONE CORPORATION: COMPANY SNAPSHOT

FIGURE 18 PLASTIKA KRITIS S.A.: COMPANY SNAPSHOT

FIGURE 19 PLASTIBLENDS INDIA LIMITED: COMPANY SNAPSHOT

FIGURE 20 DOW: COMPANY SNAPSHOT

FIGURE 21 RTP COMPANY: COMPANY SNAPSHOT

FIGURE 22 AMPACET CORPORATION: COMPANY SNAPSHOT

FIGURE 23 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY SNAPSHOT

FIGURE 24 TOSAF GROUP: COMPANY SNAPSHOT

FIGURE 25 O’NEIL COLOR & COMPOUNDING: COMPANY SNAPSHOT

FIGURE 26 ASTRA POLYMERS: COMPANY SNAPSHOT

FIGURE 27 PRAYAG POLYTECH: COMPANY SNAPSHOT

FIGURE 28 ALOK MASTERBATCH: COMPANY SNAPSHOT

FIGURE 29 DAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.: COMPANY SNAPSHOT

FIGURE 30 RAJIV PLASTIC INDUSTRIES: COMPANY SNAPSHOT

FIGURE 31 MEILIAN CHEMICAL CO., LTD.: COMPANY SNAPSHOT

FAQ

The Additive Masterbatch Market size had crossed USD 4.34 Billion in 2020 and will observe a CAGR of more than 6% up to 2029.

Rapid urbanization, changing call for consumer lifestyle, escalating health awareness between different categories of consumers, economic and geographic trends, and the development of material and packaging technology are primarily driving the growth of the market.

The region’s largest share is in Asia Pacific. Products manufactured in nations like India and China that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.