REPORT OUTLOOK

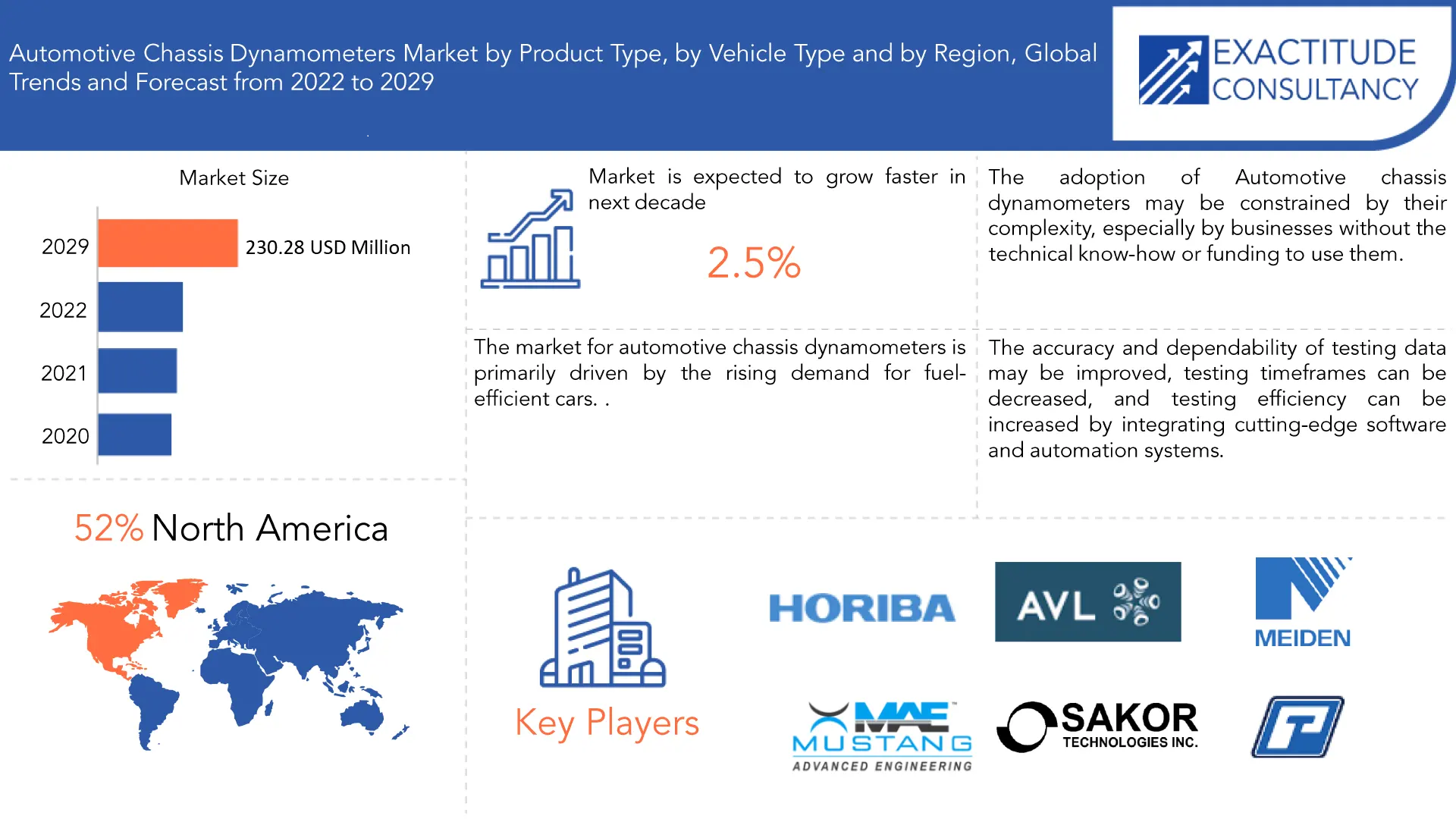

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 230.28 Million By 2029 | 2.5% | North America |

| By Product Type | By Vehicle Type | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Automotive Chassis Dynamometers Market Overview

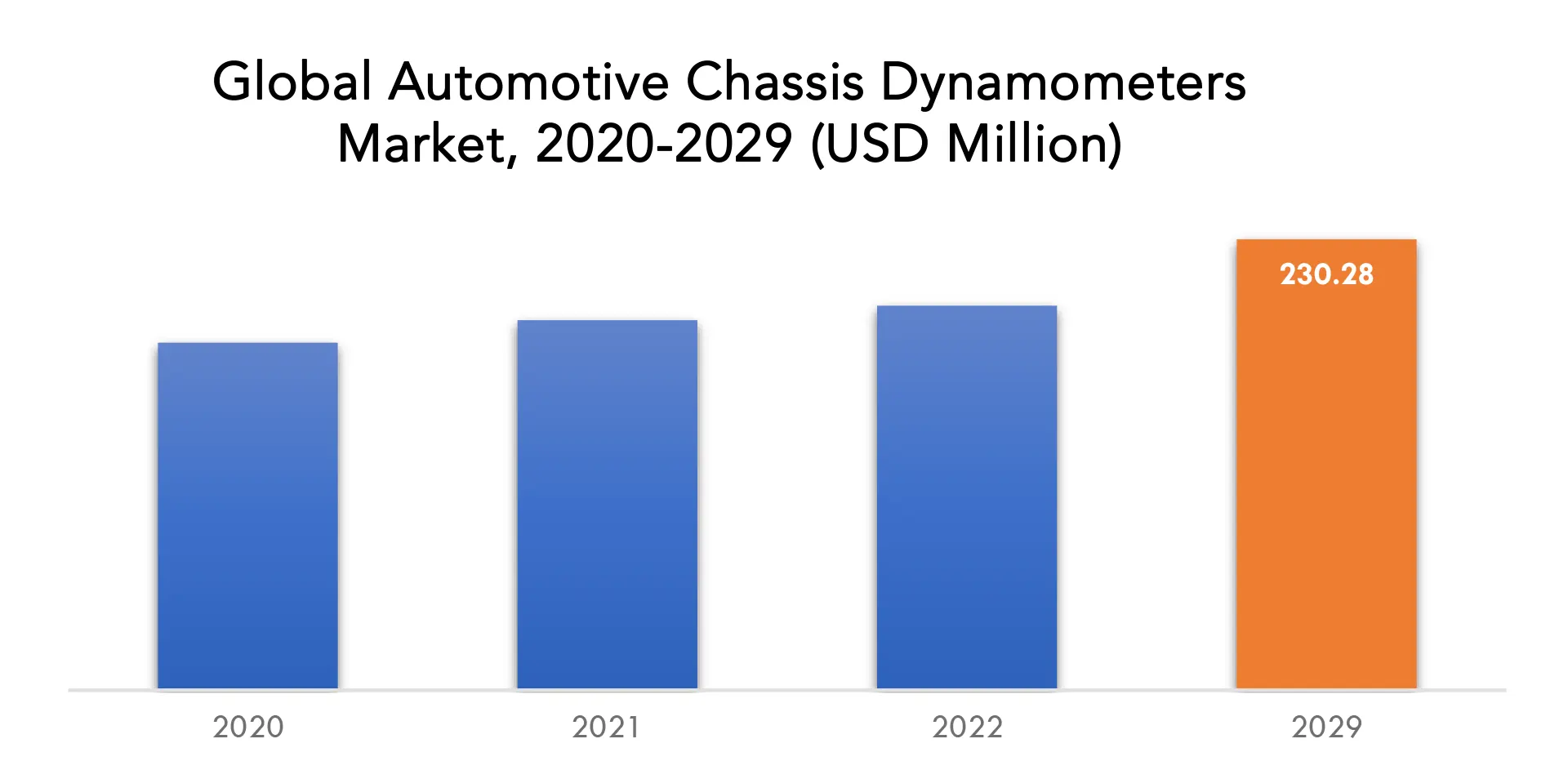

The Automotive Chassis Dynamometers Market Is Expected to Grow At 2.5% CAGR From 2022 To 2029. It Is Expected to Reach Above USD 230.28 Million By 2029 From USD 189 Million In 2021.

Automobile chassis dynamometers are devices used to test and assess a vehicle’s performance. They test a vehicle’s power, torque, and fuel efficiency using a set of rollers and measuring equipment to replicate various driving circumstances.

Automobile manufacturers, academic institutes, and testing facilities frequently employ chassis dynamometers to enhance the effectiveness and performance of their cars. They are also used to assess emissions and make sure that cars adhere to legal requirements.

Chassis dynamometers are available in two basic varieties which are hub-type and roller-type. Hub-type chassis dynamometers link to the dynamometer using the vehicle’s hubs, whereas roller-type chassis dynamometers use a set of rollers that the vehicle’s tyres rest on. Most types of automobiles can be tested on the more popular roller-type chassis dynamometers. In general, automotive chassis dynamometers are essential to the sector, assisting producers in creating more economical and environmentally friendly vehicles.

The market for automotive chassis dynamometers is primarily driven by the rising demand for fuel-efficient cars. Customers are looking for automobiles with lower fuel consumption and emissions due to increased fuel prices and growing environmental concerns. Automotive chassis dynamometers are vital for measuring and assessing a vehicle’s fuel efficiency. They enable automakers to optimize the design and functionality of their engines, transmissions, and other components to achieve maximum fuel efficiency by simulating various driving scenarios. Vehicle emissions are also assessed using chassis dynamometers to make sure they adhere to ever-stricter government standards. The demand for precise and dependable emissions testing tools, including chassis dynamometers, is growing as emissions regulations tighten.

Chassis dynamometers can be challenging to use, maintain, and repair as they call for specialized technical knowledge. The adoption of these tools may be constrained by their complexity, especially by businesses without the technical know-how or funding to use them. As sophisticated machinery, chassis dynamometers need operators with training in automotive engineering, instrumentation, and software development. To guarantee their accuracy and dependability, they also need routine calibration, maintenance, and repair. For some businesses, the requirement for highly specialized technical competence and the high expense of operator and technician training might be a major entrance hurdle.

The accuracy and dependability of testing data may be improved, testing timeframes can be decreased, and testing efficiency can be increased by integrating cutting-edge software and automation systems. By using cutting-edge software and automation systems, chassis dynamometer testing procedures can become more simplified and effective. The automotive chassis dynamometers industry may benefit from cloud-based platforms in a number of ways, including remote access, data administration, and analysis. Testing facilities may be able to manage their testing operations more effectively, store data securely, and communicate with clients and stakeholders by integrating with cloud-based platforms.

The pandemic caused a downturn in the world economy, which in turn affected the market for new cars and, consequently, for chassis dynamometers. Orders for chassis dynamometers were delayed and cancelled as a result of several automakers being forced to temporarily close their production plants. Travel restrictions and other physical barriers brought on by the pandemic made it difficult for businesses to test vehicles on-site. The need for chassis dynamometers was impacted by this shift towards remote testing and virtual testing. The development of electric and hybrid vehicles received more attention, which increased the need for testing and assessing these vehicles’ effectiveness. The market for chassis dynamometers was given the chance to create new testing methods to fulfil the demand.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million, Thousand Units) |

| Segmentation | By Product Type, By Vehicle Type |

| By Product Type |

|

| By Vehicle Type |

|

| By Region |

|

Automotive Chassis Dynamometers Market Segment Analysis

The automotive chassis dynamometers market is segmented based on product type and vehicle type.

Motorcycles and small passenger cars are often tested on single roller dynamometers. They have a straightforward construction that consists of a single roller coupled to a motor that exerts pressure to the wheels of the vehicle. As they are less expensive than multi-roller dynamometers, single roller dynamometers are a preferred option for smaller companies or those on a tight budget. Multi-roller dynamometers, on the other hand, are more complex and can be used for testing a wider range of vehicles, including heavy-duty trucks and buses.

The most popular type of chassis dynamometers on the market are those used to test passenger cars. Compared to those used for heavy-duty vehicles like buses and trucks, these dynamometers are often smaller and less expensive. Additionally, they are more adaptable as they can be used to evaluate a range of passenger vehicles, such as sedans, SUVs, and sports cars.

Automotive Chassis Dynamometers Market Players

The Automotive Chassis Dynamometers Market key players include Horiba Ltd., AVL List GmbH, Meidensha Corporation, Mustang Advanced Engineering, SAKOR Technologies Inc., Power Test Inc., Sierra Instruments Inc., Rototest International AB, Maha Maschinenbau Haldenwang GmbH & Co. KG, Taylor Dyno.

Recent Developments:

March 3, 2023: MAE’s most recent e-mobility dyno was the installation at the University of Windsor in Ontario, Canada. The MAE-AWD-500-AC/EC-LEGACY-BG chassis dynamometer was a custom-built piece of testing equipment to meet the school’s requirements for research into electric vehicles, including BEV, PHEV, and FCEV.

August 10, 2022: Mustang Advanced Engineering (MAE), an American manufacturer of quality, industry-leading, testing equipment, dynamometers and related products, delivered a heavy-duty transmission dynamometer for testing of large truck transmissions for Edelbrock, an American manufacturer of specialty automotive, truck, and motorcycle parts, at their Cerritos, California R&D facility. The state-of-the-art test cell was designed by MAE to efficiently accommodate the need to test repaired and refurbished transmissions by way of CAN communication, while meeting all required codes for mechanical and electrical hook-ups as established by state and local regulations.

Who Should Buy? Or Key Stakeholders

- Automotive Chassis Dynamometers Market Suppliers

- Raw Materials Manufacturers

- Automotive manufacturers

- Automotive component suppliers

- Automotive testing and certification companies

- Government agencies and regulators

- Research institutions and universities

Automotive Chassis Dynamometers Market Regional Analysis

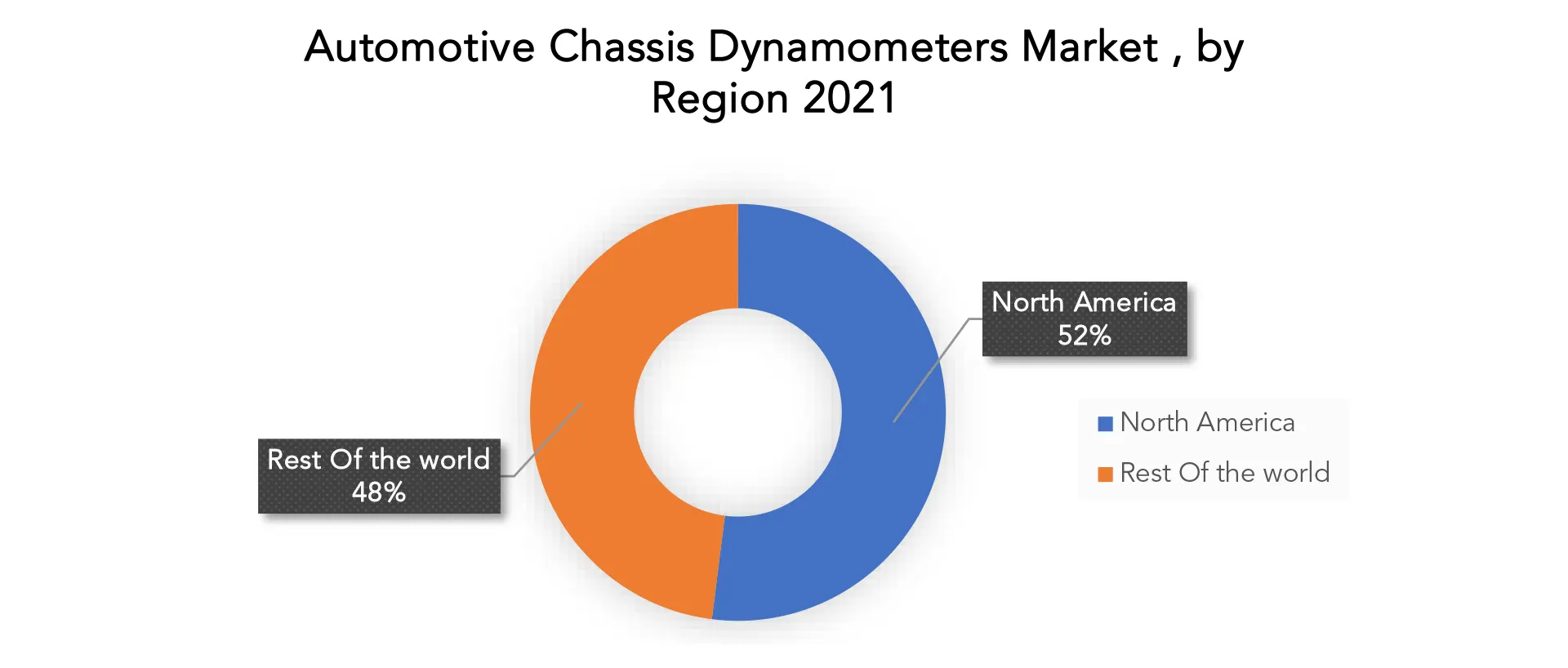

The automotive chassis dynamometers market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

A significant and quickly expanding region of the global market is the Asia Pacific automobile chassis dynamometers market. The region is home to a number of nations, including China, Japan, India, South Korea, and Australia. A number of factors, including the rising number of vehicles on the road, the rising need for fuel-efficient vehicles, and the rising acceptance of electric and hybrid vehicles, are driving the demand for chassis dynamometers in the Asia Pacific area. China dominates the Asia Pacific automotive chassis dynamometers industry and has the largest automotive market in the area. Additionally, the nation is the world’s leading producer and consumer of electric vehicles, which is increasing demand for specialised chassis dynamometers made for testing these vehicles.

Numerous factors, such as the rising demand for fuel-efficient vehicles, the requirement to adhere to higher emissions standards, and the increased emphasis on vehicle safety and performance, are driving the market for chassis dynamometers in North America. The United States is the largest market for automotive chassis dynamometers in North America, accounting for a significant share of the regional market. Canada has a large automotive industry, with several major manufacturers and suppliers operating in the country. Mexico is also an important market for the automotive industry, with several leading manufacturers establishing production facilities in the country to take advantage of lower labor costs.

Key Market Segments: Automotive Chassis Dynamometers Market

Automotive Chassis Dynamometers Market By Product Type, 2020-2029, (USD Million, Thousand Units)

- Single Roller

- Multi Roller

Automotive Chassis Dynamometers Market By Vehicle Type, 2020-2029, (USD Million, Thousand Units)

- Passenger Vehicle

- Commercial Vehicles

Automotive Chassis Dynamometers Market By Region, 2020-2029, (USD Million, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered

- What is the expected growth rate of the automotive chassis dynamometers market over the next 7 years?

- Who are the major players in the automotive chassis dynamometers market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the automotive chassis dynamometers market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the automotive chassis dynamometers market?

- What is the current and forecasted size and growth rate of the global automotive chassis dynamometers market?

- What are the key drivers of growth in the automotive chassis dynamometers market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the automotive chassis dynamometers market?

- What are the technological advancements and innovations in the automotive chassis dynamometers market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the automotive chassis dynamometers market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the automotive chassis dynamometers market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of automotive chassis dynamometers market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET OUTLOOK

- GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE,2020-2029, (USD MILLION, THOUSAND UNITS)

- SINGLE ROLLER

- MULTI ROLLER

- GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE ,2020-2029, (USD MILLION, THOUSAND UNITS)

- PASSENGER VEHICLE

- COMMERCIAL VEHICLES

- GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY REGION ,2020-2029, (USD MILLION, THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- HORIBA LTD.

- AVL LIST GMBH

- MEIDENSHA CORPORATION

- MUSTANG ADVANCED ENGINEERING

- SAKOR TECHNOLOGIES INC.

- POWER TEST INC.

- SIERRA INSTRUMENTS INC.

- ROTOTEST INTERNATIONAL AB

- MAHA MASCHINENBAU HALDENWANG GMBH & CO. KG

- TAYLOR DYNO. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 2 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 4 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY REGION (USD MILLION), 2020-2029

TABLE 6 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 8 NORTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 14 US AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 16 US AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 18 CANADA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 20 CANADA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 22 MEXICO AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 24 MEXICO AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 26 SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 28 SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 30 SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 32 BRAZIL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 34 BRAZIL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 36 ARGENTINA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 38 ARGENTINA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 40 COLOMBIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 42 COLOMBIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 48 ASIA-PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 50 ASIA-PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 52 ASIA-PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 54 INDIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 56 INDIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 58 CHINA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 60 CHINA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 62 JAPAN AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 64 JAPAN AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 66 SOUTH KOREA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 68 SOUTH KOREA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 70 AUSTRALIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 72 AUSTRALIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 82 EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 84 EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 86 EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 88 GERMANY AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 90 GERMANY AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 91 UK AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 92 UK AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 UK AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 94 UK AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 96 FRANCE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 98 FRANCE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 100 ITALY AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 102 ITALY AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 104 SPAIN AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 106 SPAIN AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 108 RUSSIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 110 RUSSIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 112 REST OF EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 114 REST OF EUROPE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 122 UAE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 124 UAE AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 126 SAUDI ARABIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 128 SAUDI ARABIA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 130 SOUTH AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 132 SOUTH AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (USD MILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (USD MILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY PRODUCT TYPE, USD MILLION, 2021

FIGURE 13 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY VEHICLE TYPE, USD MILLION, 2021

FIGURE 14 GLOBAL AUTOMOTIVE CHASSIS DYNAMOMETERS MARKET BY REGION, USD MILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 MAHA MASCHINENBAU HALDENWANG GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 17 TAYLOR DYNO.: COMPANY SNAPSHOT

FIGURE 18 HORIBA LTD: COMPANY SNAPSHOT

FIGURE 19 AVL LIST GMBH.: COMPANY SNAPSHOT

FIGURE 20 MEIDENSHA CORPORATION: COMPANY SNAPSHOT

FIGURE 21 MUSTANG ADVANCED ENGINEERING: COMPANY SNAPSHOT

FIGURE 22 SAKOR TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 23 POWER TEST INC.: COMPANY SNAPSHOT

FIGURE 24 ROTOTEST INTERNATIONAL AB: COMPANY SNAPSHOT

FIGURE 25 SIERRA INSTRUMENTS INC.: COMPANY SNAPSHOT

FAQ

The automotive chassis dynamometers market is expected to grow at 2.5 % CAGR from 2022 to 2029. It is expected to reach above USD 230.28 million by 2029 from USD 189 million in 2021.

Asia Pacific held more than 52 % of the automotive chassis dynamometers market revenue share in 2021 and will witness expansion in the forecast period.

The market for automotive chassis dynamometers is primarily driven by the rising demand for fuel-efficient cars. Customers are looking for automobiles with lower fuel consumption and emissions due to increased fuel prices and growing environmental concerns.

The most popular type of chassis dynamometers on the market are those used to test passenger cars. Compared to those used for heavy-duty vehicles like buses and trucks, these dynamometers are often smaller and less expensive. Additionally, they are more adaptable as they can be used to evaluate a range of passenger vehicles, such as sedans, SUVs, and sports cars.

A significant and quickly expanding region of the global market is the Asia Pacific automobile chassis dynamometers market. The region is home to a number of nations, including China, Japan, India, South Korea, and Australia. A number of factors, including the rising number of vehicles on the road, the rising need for fuel-efficient vehicles, and the rising acceptance of electric and hybrid vehicles, are driving the demand for chassis dynamometers in the Asia Pacific area.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.