REPORT OUTLOOK

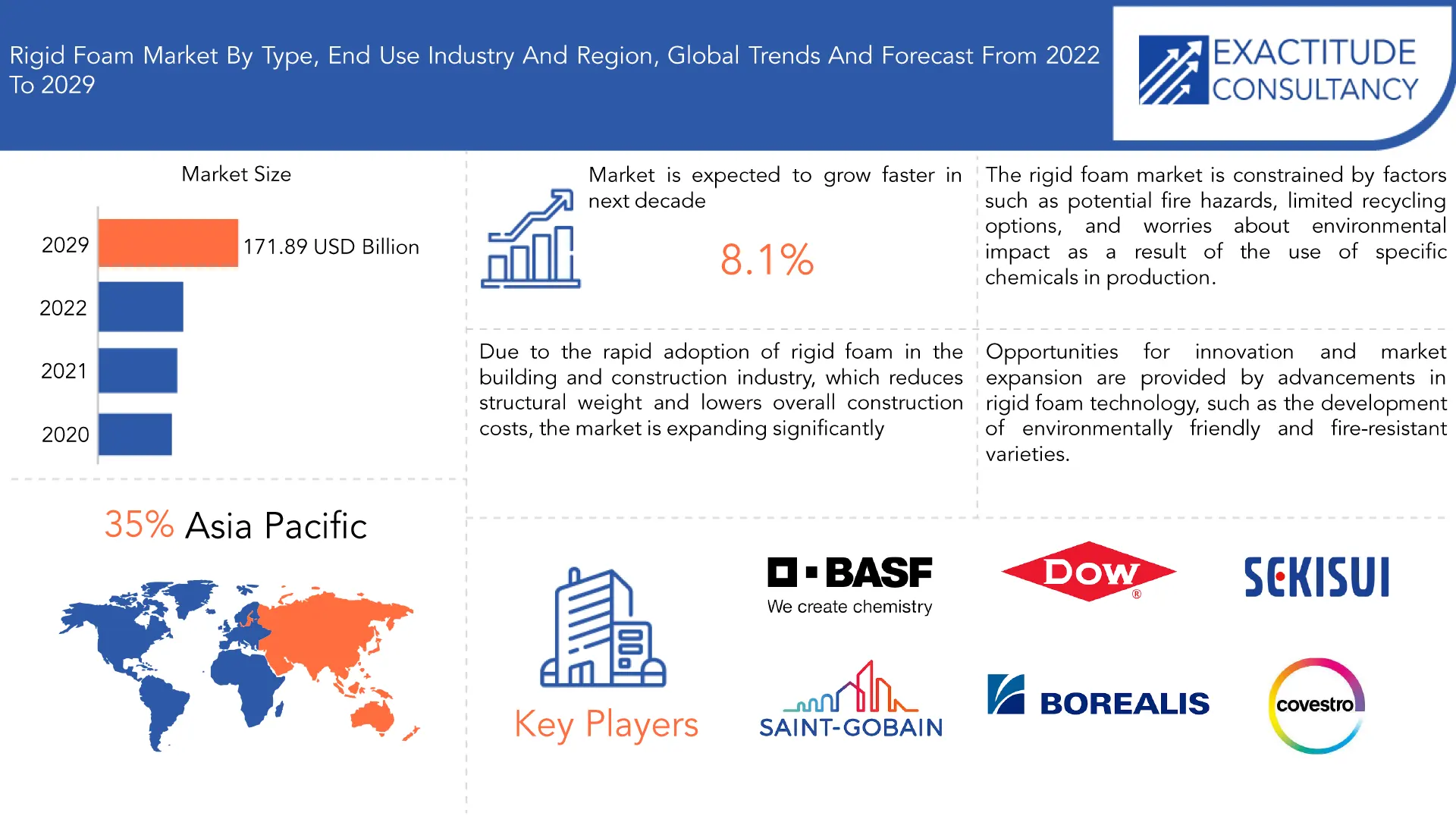

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 171.89 billion by 2029 | at 8.1% CAGR | Asia Pacific |

| By Type | By End Use | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Rigid Foam Market Overview

The rigid foam market is expected to grow at 8.1% CAGR from 2022 to 2029. It is expected to reach above USD 171.89 billion by 2029 from USD 85.58 billion in 2020.

Rigid foam, also referred to as foam board or insulation board, is a strong, lightweight material that is frequently used for insulation in buildings and other applications. It is made from a variety of plastics, including polyisocyanurate (polyiso), expanded polystyrene (EPS), and extruded polystyrene (XPS). Plastic beads are expanded or extruded to create rigid foam, which has a cellular structure with closed or partially closed air pockets. Due to its excellent insulating qualities, which are provided by these air pockets, foam is a highly effective material for lowering heat transfer and enhancing energy efficiency in buildings. The material’s rigidity enables it to support structures and improve the rigidity and strength of walls, roofs, and other building elements. It can be easily installed, cut, and shaped, making it a flexible option for insulation in a variety of applications.

High thermal resistance, moisture resistance, and resistance to the growth of mould and mildew are just a few benefits of rigid foam. Additionally, it offers sound insulation, which helps to create a quieter environment inside. Rigid foam is also lightweight, which makes handling easier and lowers transportation expenses. But it’s crucial to remember that rigid foam can release poisonous gases if it catches fire, so installation and use should be done with the appropriate fire safety precautions. Additionally, the use of specific chemicals during the production of some rigid foam types may raise environmental issues. Overall, rigid foam is a valuable insulation material that enhances building energy efficiency while providing excellent thermal performance and structural support.

Due to the rapid adoption of rigid foam in the building and construction industry, which reduces structural weight and lowers overall construction costs, the market is expanding significantly. In addition, since the majority of energy is lost through walls, windows, and roofs, energy conservation is a major concern in today’s society. The demand for rigid foam is anticipated to increase across a variety of end-use industries, including packaging, automotive, and construction. Additionally, rigid foam is now used more frequently in a variety of applications due to its exceptional qualities, including higher chemical resistance, lightweight, light-density structure, and high insulation value.

The rigid foam market is constrained by factors such as potential fire hazards, limited recycling options, and worries about environmental impact as a result of the use of specific chemicals in production. Changing raw material prices can also have an impact on pricing stability. The use of specific kinds of rigid foam may also be restricted in some areas by strict building codes and regulations. These elements might make it difficult for rigid foam insulation to gain ground and become widely used.

Numerous growth and development opportunities are presented by the rigid foam market. Rigid foam is in demand as a high-quality insulation material as energy-efficient buildings are becoming more of a priority, and stricter building codes are also driving this demand. A sizable market for insulation products is provided by the expanding construction sector, particularly in emerging economies. Additionally, improvements in rigid foam technology, like the creation of environmentally friendly and fire-resistant varieties, offer chances for innovation and market growth. The range of applications, which now also includes the automotive and packaging sectors, expands the market prospects for rigid foam.

On the rigid foam market, the COVID-19 pandemic has had a conflicting effect. The market initially experienced disruptions as a result of supply chain problems, a decline in construction activity, and economic uncertainty worldwide. The demand for insulation materials decreased as a result of the suspension or delay of numerous construction projects. The market did, however, gradually rebound as economies started to recover and construction activities picked back up. The increased demand for rigid foam insulation is also a result of the pandemic’s increased focus on energy-efficient constructio

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Value (Kilotons) |

| Segmentation | By Type, By end use industry, By Region |

| By Type

|

|

| By End Use Industry

|

|

| By Region

|

|

Rigid Foam Market Segment Analysis

The rigid foam market is segmented based on type, end use industry and region. Based on type market is segmented into polyurethane (PU), polystyrene (PS), polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and others. By end use industry market is segmented into building & construction, appliances, packaging, automobile, and others.

The most popular kind of rigid foam, with the largest market share, is polyurethane foam. It is preferred over other varieties of rigid foam due to its superior insulation qualities, high strength-to-weight ratio, and simplicity of installation. The most widely used rigid foam is polystyrene, followed by polyethylene foam and phenolic foam. PVC foam, polypropylene foam, and polyisocyanurate foam are some additional rigid foam with a smaller market share.

Due to there is such a high demand for insulation materials in residential, commercial, and industrial buildings, the building and construction industry dominates the rigid foam market. In order to provide structural support, soundproofing, and thermal insulation, rigid foam is frequently used in construction and building applications. The demand for rigid foam in the construction industry is also being driven by rising awareness of energy efficiency and sustainable building techniques. The second-largest end-use market for rigid foam is the automotive sector, where it is employed for vibration dampening, soundproofing, and weight reduction. Rigid foam is frequently used in the packaging industry due to its superior insulating and safeguarding qualities. Appliances and other end-use industries with smaller market shares in the rigid foam market include marine and HVAC.

Rigid Foam Market Key Players

The rigid foam market key players include Saint-Gobain, Dow Chemical Corporation, BASF SE, Borealis AG, Sekisui Chemical Co.,Ltd, Covestro AG, Armacell International S.A., Huntsman International LLC, JSP, Zotefoams Plc and others.

Recent Developments:

- 22 May 2023: BASF’s Coatings division has launched a crowdsourcing digital tool to streamline and enhance color formula search for customers of its two paint brands, NORBIN and Shancai.

- 22 March 2023: BASF introduced a new Ultramid Deep Gloss grade, optimized for highly glossy automotive interior parts, and applied for the first time to the garnish of Toyota‘s new Prius.

Who Should Buy? Or Key stakeholders

- Suppliers and Distributors

- Chemicals Industry

- Investors

- End user companies

- Research and development

- Regulatory Authorities

- Others

Rigid Foam Market Regional Analysis

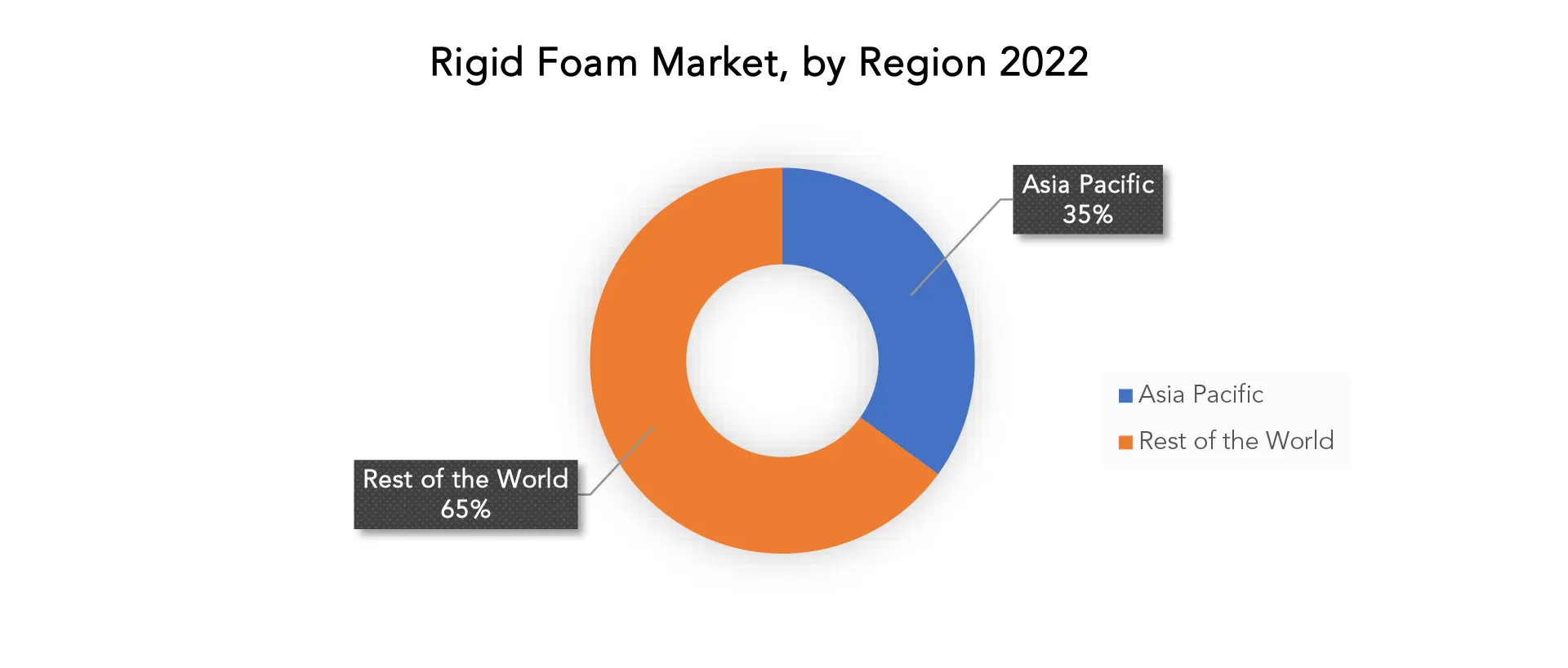

The rigid foam market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia and Rest of Europe

- South America: includes Brazil, Argentina, Colombia and Rest of South America

- Middle East & Africa: includes UAE, South Africa, Saudi Arabia and Rest of MEA

The largest market share is anticipated to come from Asia-Pacific during the forecast period. Numerous international players are setting up manufacturing bases in the Asia-Pacific region as a result of emerging markets like China, India, South Korea, and several Southeast Asian nations. Manufacturers are vying for customers in nations like China and India, where the demand for high-end, technologically advanced products is on the rise. The growth of the Asia-Pacific market for rigid foam is being driven by increased investments in the building and construction, appliance, and automobile end-use industries.

Due to the significant demand for insulation products in the construction, automotive, and packaging industries, North America has a sizable rigid foam market. The market in North America is also being driven by the rising awareness of energy efficiency and the demand for sustainable building practices. The United States and Canada are the region’s two biggest markets.

Due to the significant demand for insulation materials in the construction, automotive, and packaging industries, Europe is another significant market for rigid foam. The strict laws governing sustainable building methods and energy efficiency have an impact on the European market. The three biggest markets in the area are Germany, France, and the UK.

Key Market Segments: Rigid Foam Market

Rigid Foam Market By Type, 2020-2029, (USD Billion, Kilotons)

- Polyurethane (PU)

- Polystyrene (PS)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Others

Rigid Foam Market By End Use Industry, 2020-2029, (USD Billion, Kilotons)

- Building & Construction

- Appliances

- Packaging

- Automobile

- Others

Rigid Foam Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the rigid foam market over the next 7 years?

- Who are the major players in the rigid foam market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and Africa?

- How is the economic environment affecting the rigid foam market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the rigid foam market?

- What is the current and forecasted size and growth rate of the global rigid foam market?

- What are the key drivers of growth in the rigid foam market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the rigid foam market?

- What are the technological advancements and innovations in the rigid foam market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the rigid foam market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the rigid foam market?

- What are the product offerings and specifications of leading players in the market?

What is the pricing trend of rigid foam in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL RIGID FOAM MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON RIGID FOAM MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL RIGID FOAM MARKET OUTLOOK

- GLOBAL RIGID FOAM MARKET BY TYPE (USD BILLION, KILOTONS)

- POLYURETHANE (PU)

- POLYSTYRENE (PS)

- POLYETHYLENE (PE)

- POLYPROPYLENE (PP)

- POLYVINYL CHLORIDE (PVC)

- OTHERS

- GLOBAL RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION, KILOTONS)

- BUILDING & CONSTRUCTION

- APPLIANCES

- PACKAGING

- AUTOMOBILE

- OTHERS

- GLOBAL RIGID FOAM MARKET BY REGION (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SOUTH AFRICA

- SAUDI ARABIA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SAINT-GOBAIN

- DOW CHEMICAL CORPORATION

- BASF SE

- BOREALIS AG

- SEKISUI CHEMICAL CO.,LTD

- COVESTRO AG

- ARMACELL INTERNATIONAL S.A.

- HUNTSMAN INTERNATIONAL LLC

- JSP

- ZOTEFOAMS PLC.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 4 GLOBAL RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 5 GLOBAL RIGID FOAM MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL RIGID FOAM MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA RIGID FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA RIGID FOAM MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 16 US RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 17 CANADA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 20 CANADA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 21 MEXICO RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 24 MEXICO RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 25 REST OF NORTH AMERICA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 REST OF NORTH AMERICA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 REST OF NORTH AMERICA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 28 REST OF NORTH AMERICA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 31 SOUTH AMERICA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 32 SOUTH AMERICA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 33 SOUTH AMERICA RIGID FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 34 SOUTH AMERICA RIGID FOAM MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 35 BRAZIL RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 BRAZIL RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 BRAZIL RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 38 BRAZIL RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 39 ARGENTINA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 ARGENTINA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 ARGENTINA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 42 ARGENTINA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 43 COLOMBIA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 COLOMBIA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 COLOMBIA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 46 COLOMBIA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 47 REST OF SOUTH AMERICA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 REST OF SOUTH AMERICA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 49 REST OF SOUTH AMERICA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 50 REST OF SOUTH AMERICA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 51 ASIA -PACIFIC RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 52 ASIA -PACIFIC RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 53 ASIA -PACIFIC RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 54 ASIA -PACIFIC RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 55 ASIA -PACIFIC RIGID FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 56 ASIA -PACIFIC RIGID FOAM MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 57 INDIA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 INDIA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 INDIA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 60 INDIA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 61 CHINA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 CHINA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 CHINA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 64 CHINA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 65 JAPAN RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 JAPAN RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 JAPAN RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 68 JAPAN RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 69 SOUTH KOREA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 SOUTH KOREA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 SOUTH KOREA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 72 SOUTH KOREA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 73 AUSTRALIA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 AUSTRALIA HYBRID APPLICATIONBY TYPES (KILOTONS), 2020-2029

TABLE 75 AUSTRALIA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 76 AUSTRALIA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC HYBRID APPLICATIONBY TYPES (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 81 EUROPE RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 84 EUROPE RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 85 EUROPE RIGID FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE RIGID FOAM MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 90 GERMANY RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 91 UK RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 UK RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 94 UK RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 95 FRANCE RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 98 FRANCE RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 99 ITALY RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 102 ITALY RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 103 SPAIN RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 106 SPAIN RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 107 RUSSIA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 110 RUSSIA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 UAE RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 124 UAE RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY END USE INDUSTRY (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA RIGID FOAM MARKET BY END USE INDUSTRY (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL RIGID FOAM MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL RIGID FOAM MARKET BY END USE INDUSTRY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL RIGID FOAM MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL RIGID FOAM MARKET BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL RIGID FOAM MARKET BY END USE INDUSTRY, USD BILLION, 2021

FIGURE 14 GLOBAL RIGID FOAM MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 SAINT-GOBAIN: COMPANY SNAPSHOT

FIGURE 17 DOW CHEMICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 18 BASF SE: COMPANY SNAPSHOT

FIGURE 19 BOREALIS AG.: COMPANY SNAPSHOT

FIGURE 20 SEKISUI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 21 COVESTRO AG: COMPANY SNAPSHOT

FIGURE 22 ARMACELL INTERNATIONAL S.A.: COMPANY SNAPSHOT

FIGURE 23 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

FIGURE 24 JSP: COMPANY SNAPSHOT

FIGURE 25 ZOTEFOAMS PLC: COMPANY SNAPSHOT

FAQ

The global rigid foam market size was valued at 85.58 billion in 2020.

The rigid foam market key players include Saint-Gobain, Dow Chemical Corporation, BASF SE, Borealis AG, Sekisui Chemical Co., Ltd, Covestro AG, Armacell International S.A., and Huntsman International LLC, JSP, Zotefoams Plc.

Asia-Pacific is the largest regional market for rigid foam market.

The rigid foam market is segmented into type, end use industry and region.

Growing demand for rigid foam in the building and construction industry is one of the factors that have contributed to favor the rigid foam market all over the globe.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.