REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

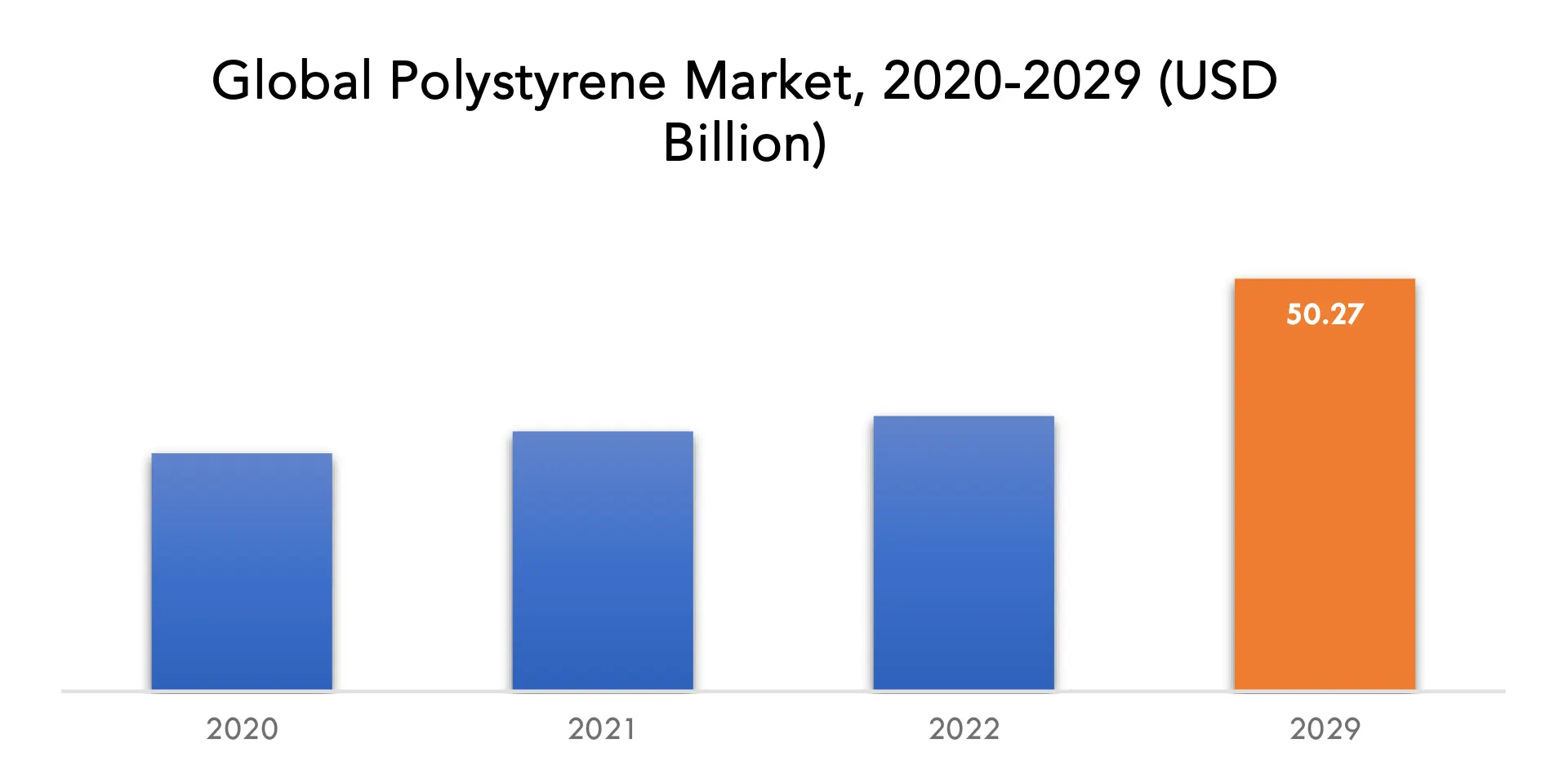

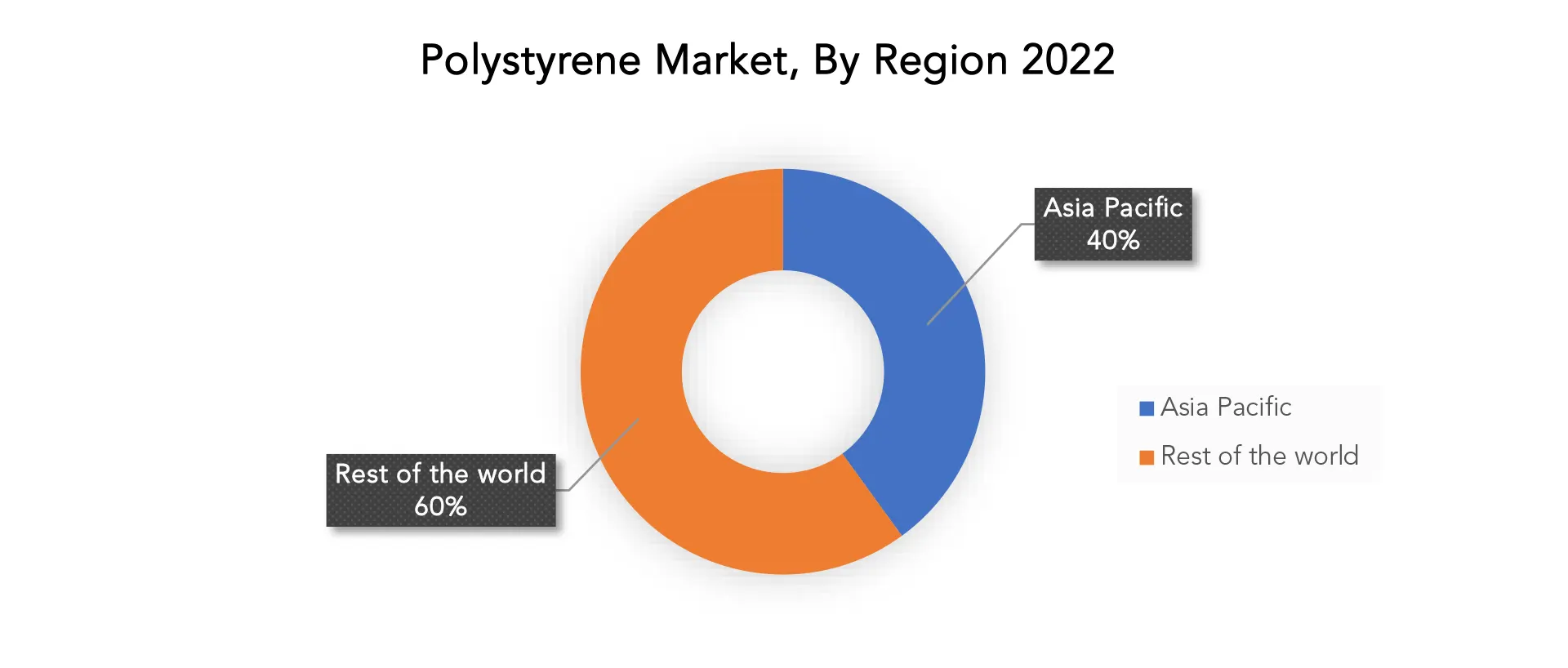

| USD 50.27 billion by 2029 | 5.95 % | Asia Pacific |

| by Type | By End User | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Polystyrene Market Overview

The polystyrene market is expected to grow at 5.95 % CAGR from 2022 to 2029. It is expected to reach above USD 50.27 billion by 2029 from USD 29 billion in 2020.

The flexible synthetic polymer polystyrene has been used into numerous aspects of our daily life. It is a well-liked option for a variety of applications due to its lightweight and insulating qualities. Polystyrene is undeniably present, whether it be in insulation panels, throwaway food containers, or packaging materials. Expanded polystyrene (EPS) is one of the most widely used types of polystyrene. It is frequently utilised in the building sector as insulation. Excellent thermal insulation is provided by EPS foam boards and panels, which lowers energy use and helps to maintain cosy indoor temperatures.

Additionally, often used in the packaging business is polystyrene foam. It is the best option for cushioning and shock-absorbing fragile products during transit. Polystyrene packing makes guarantee that goods reach their destinations undamaged, whether they are electronics or fragile glassware. Polystyrene foam is frequently used in the foodservice industry for disposable cups, plates, trays and takeaway containers. While its light weight makes for simple transport, its insulating qualities assist keep beverages warm or cold.

The polystyrene market is strongly influenced by consumer electronics. Due to its light weight, moldability, and electrical insulating qualities, polystyrene is an excellent material to employ when creating components for consumer electronics. Polystyrene is commonly used in a variety of items, including televisions, computer monitors, and audio systems. The market for polystyrene in this industry is expanding due to ongoing technological improvements and rising consumer demand for electronics. Polystyrene is a desirable material for making casings, housings, and packaging components since it can satisfy the particular specifications of consumer electronics makers.

The expanding environmental issues related to the production, use, and disposal of polystyrene are one of the major factors limiting the market for this material. As polystyrene is not biodegradable, it can linger in the environment for a long time and cause trash and pollution. Concerns regarding polystyrene’s environmental impact have been raised due to the buildup of the material in landfills and its effects on marine habitats. Regulations, restrictions, and consumer tastes have changed to favour eco-friendly materials as a result of growing awareness of plastic pollution and the need for sustainable alternatives. The polystyrene industry must address sustainability difficulties and create more ecologically friendly solutions as a result of these environmental concerns.

The market for polystyrene has a significant opportunity due to industrial uses. Due to its adaptability and qualities including insulation, durability, and low weight, polystyrene can be used in a variety of industrial settings. Polystyrene is utilised in exterior, interior, and instrument panel portions of automobiles, which helps to lighten the car and improve fuel economy. Polystyrene is used in the electrical and electronics industry to create parts including insulating boards, packaging materials, and protective casings. Polystyrene is also used in the pharmaceutical business for lab equipment and packaging. The expansion of these sectors, particularly in developing economies, offers the polystyrene market the chance to offer specialized services.

The covid-19 pandemic affected the polystyrene market in both positive and negative ways. On the one hand, the market for polystyrene profited from the rise in demand for packaging materials, particularly in the food and healthcare industries. During the pandemic, the use of polystyrene foam for food containers and medical supplies increased. On the other hand, the pandemic shattered worldwide supply systems, creating a lack of raw materials and logistical difficulties that had an impact on the manufacture and distribution of polystyrene goods. The market for polystyrene also faced difficulties as a result of the trend towards sustainability and the growing focus on minimising single-use plastics. Overall, due to shifting market dynamics, the pandemic had a mixed effect on the polystyrene market, presenting both opportunities and difficulties.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By type, by Form, by end user |

| By Type

|

|

| By Form |

|

| By End user |

|

| By Region |

|

Polystyrene Market Segment Analysis

The polystyrenes market is segmented based on type, form and end user.

High Impact Polystyrene (HIPS) currently has the largest market share among the types of polystyrene. High Impact Polystyrene (HIPS) is a modified form of polystyrene that offers improved impact resistance. It is commonly used in applications where toughness and durability are required, such as refrigerator liners, automotive components, and household appliances.

The packaging, building, and insulation industries all use polystyrene foams extensively. They are popular due to their light weight, superior thermal insulation, and affordable price. A significant market share is also held by polystyrene films and sheets. They are frequently employed in fields including graphic arts, throwaway tableware, and food packaging. Transparency, impact resistance, and moisture barrier qualities of polystyrene films and sheets make them appropriate for a variety of applications.

The packaging sector typically holds the largest market share for polystyrene based on end user. Due to its low cost, superior insulation capabilities, and lightweight nature, polystyrene is frequently utilised in packaging applications. It is frequently used to package products like foam trays, single-use cups and plates, protective packaging, and electrical insulation.

Polystyrene Market Players

The polystyrene market key players include Styrolution Group GMBH, Total Petrochemicals, BASF SE, Formosa Chemicals & Fiber Corporation, Kumho Petrochemicals Ltd., Chi Mei Corporation, SABIC, Trinseo, Videolar S/A, Cibapac, Polyoak Packaging Group, Arkema, Synthos.

Recent News:

April 19, 2023: INEOS Styrolution, the global leader in styrenics, has today announced that a range of styrenics based polymers are an effective and sustainable alternative for ceramics, compared to traditional resin-based applications. The styrenics based approach allows for recycling and there is no loss of the distinctive appearance of ceramics. In addition, energy consumption during production is significantly lower using a styrenics based solution than firing ceramics.

March 22, 2023: BASF introduced a new Ultramid Deep Gloss grade, optimized for highly glossy automotive interior parts, and applied for the first time to the garnish of Toyota‘s new Prius. The mold-in-color technology used to produce the new grade is more sustainable, as it improves the production efficiency of automotive parts since the solvent painting process is eliminated.

Polystyrene Market Regional Analysis

The polystyrenes market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The Asia Pacific polystyrene market is expected to grow significantly over the next years. The need for packaging, construction, and consumer goods is being driven by rising population, urbanisation, and rising disposable incomes in nations like China, India, and Southeast Asian countries, which is increasing polystyrene use. Market restrictions are a result of environmental issues and laws governing the treatment of plastic garbage. Opportunities can be found in the creation of bio-based and environmentally friendly substitutes, in the development of technology for recycling and waste disposal, and in the expanding need for lightweight and energy-efficient materials across a variety of industries. With these elements at play, the Asia Pacific polystyrene market is anticipated to experience rapid expansion in the years to come.

The packaging and construction industries’ demand drove a moderate growth in the European polystyrene market. Sustainable alternatives have become more popular as a result of environmental concerns that triggered examination and restrictions. Expanded polystyrene (EPS) recycling programmes designed to boost collection and recycling rates. The dynamics of the market were impacted by changes in the cost of raw materials like styrene monomer. The emphasis on product innovation and capacity expansion was shared by major players including BASF SE and INEOS Styrolution. Due to the market’s dynamic nature, industry publications and market studies should be read for the most recent information.

Key Market Segments: Polystyrene Market

Polystyrene Market By Type, 2020-2029, (USD Billion), (Kilotons)

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Expandable Polystyrene (EPS)

Polystyrene Market By Form, 2020-2029, (USD Billion), (Kilotons)

- Foams

- Films

- Sheets and Others

Polystyrene Market By End User, 2020-2029, (USD Billion), (Kilotons)

- Automotive

- Packaging

- Building and Construction

- Electrical and Electronics

- Consumer Goods

- Healthcare and Others

Polystyrene Market By Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Who Should Buy? Or Key stakeholders

- Polystyrene Suppliers

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Key Questions Answered: –

- What is the expected growth rate of the polystyrenes market over the next 7 years?

- Who are the major players in the polystyrenes market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the polystyrenes market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the polystyrenes market?

- What is the current and forecasted size and growth rate of the global polystyrenes market?

- What are the key drivers of growth in the polystyrenes market?

- What are the distribution channels and supply chain dynamics in the polystyrenes market?

- What are the technological advancements and innovations in the polystyrenes market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the polystyrenes market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the polystyrenes market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of polystyrenes in the market and what is the impact of raw material prices on the price trend?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL POLYSTYRENE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON POLYSTYRENE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL POLYSTYRENE MARKET OUTLOOK

- GLOBAL POLYSTYRENE MARKET BY TYPE, (USD BILLION, KILOTONS)

- GENERAL PURPOSE POLYSTYRENE (GPPS)

- HIGH IMPACT POLYSTYRENE (HIPS)

- EXPANDABLE POLYSTYRENE (EPS)

- EXPANDED POLYSTYRENE (EPS)

- EXTRUDED POLYSTYRENE (XPS)

- GLOBAL POLYSTYRENE MARKET BY FORM, (USD BILLION, KILOTONS)

- FOAMS

- FILMS

- SHEETS AND OTHERS

- GLOBAL POLYSTYRENE MARKET BY END USER, (USD BILLION, KILOTONS)

- AUTOMOTIVE

- PACKAGING

- BUILDING AND CONSTRUCTION

- ELECTRICAL AND ELECTRONICS

- CONSUMER GOODS

- HEALTHCARE AND OTHERS

- GLOBAL POLYSTYRENE MARKET BY REGION, (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- STYROLUTION GROUP GMBH

- TOTAL PETROCHEMICALS

- BASF SE

- FORMOSA CHEMICALS & FIBER CORPORATION

- KUMHO PETROCHEMICALS LTD.

- CHI MEI CORPORATION

- SABIC

- TRINSEO

- VIDEOLAR S/A

- CIBAPAC

- POLYOAK PACKAGING GROUP

- ARKEMA

- SYNTHOS*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 4 GLOBAL POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 5 GLOBAL POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 7 GLOBAL POLYSTYRENE MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL POLYSTYRENE MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 15 NORTH AMERICA POLYSTYRENE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA POLYSTYRENE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 17 US POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 US POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 US POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 20 US POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 21 US POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 22 US POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 23 CANADA POLYSTYRENE MARKET BY TYPE (BILLION), 2020-2029

TABLE 24 CANADA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 25 CANADA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 26 CANADA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 27 CANADA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 CANADA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 29 MEXICO POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 30 MEXICO POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 31 MEXICO POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 32 MEXICO POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 33 MEXICO POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 MEXICO POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 35 SOUTH AMERICA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 SOUTH AMERICA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 39 SOUTH AMERICA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 41 SOUTH AMERICA POLYSTYRENE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA POLYSTYRENE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 43 BRAZIL POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 BRAZIL POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 BRAZIL POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 46 BRAZIL POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 47 BRAZIL POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 48 BRAZIL POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 49 ARGENTINA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 50 ARGENTINA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 51 ARGENTINA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 52 ARGENTINA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 53 ARGENTINA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ARGENTINA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 55 COLOMBIA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 56 COLOMBIA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 57 COLOMBIA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 58 COLOMBIA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 59 COLOMBIA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 60 COLOMBIA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 67 ASIA-PACIFIC POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 69 ASIA-PACIFIC POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 71 ASIA-PACIFIC POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 73 ASIA-PACIFIC POLYSTYRENE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC POLYSTYRENE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 75 INDIA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 76 INDIA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 77 INDIA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 78 INDIA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 79 INDIA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 80 INDIA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 81 CHINA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 CHINA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 CHINA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 84 CHINA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 85 CHINA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 86 CHINA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 87 JAPAN POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 JAPAN POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 JAPAN POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 90 JAPAN POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 91 JAPAN POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 92 JAPAN POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 93 SOUTH KOREA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 95 SOUTH KOREA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 97 SOUTH KOREA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 99 AUSTRALIA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA FERTILIZER ADDITIVESBY TYPE (KILOTONS), 2020-2029

TABLE 101 AUSTRALIA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 103 AUSTRALIA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 105 SOUTH EAST ASIA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA FERTILIZER ADDITIVESBY TYPE (KILOTONS), 2020-2029

TABLE 107 SOUTH EAST ASIA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 109 SOUTH EAST ASIA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC FERTILIZER ADDITIVESBY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 117 EUROPE POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 118 EUROPE POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 119 EUROPE POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 120 EUROPE POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 121 EUROPE POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 122 EUROPE POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 123 EUROPE POLYSTYRENE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE POLYSTYRENE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 125 GERMANY POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 GERMANY POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 GERMANY POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 128 GERMANY POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 129 GERMANY POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 130 GERMANY POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 131 UK POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 132 UK POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 133 UK POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 134 UK POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 135 UK POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 136 UK POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 137 FRANCE POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 138 FRANCE POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 139 FRANCE POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 140 FRANCE POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 141 FRANCE POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 142 FRANCE POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 143 ITALY POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 144 ITALY POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 145 ITALY POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 146 ITALY POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 147 ITALY POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 148 ITALY POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 149 SPAIN POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 150 SPAIN POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 151 SPAIN POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 152 SPAIN POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 153 SPAIN POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 154 SPAIN POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 155 RUSSIA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 156 RUSSIA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 157 RUSSIA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 158 RUSSIA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 159 RUSSIA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 160 RUSSIA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 161 REST OF EUROPE POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 163 REST OF EUROPE POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 165 REST OF EUROPE POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 175 UAE POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 176 UAE POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 177 UAE POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 178 UAE POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 179 UAE POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 180 UAE POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 181 SAUDI ARABIA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 183 SAUDI ARABIA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 185 SAUDI ARABIA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 187 SOUTH AFRICA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 189 SOUTH AFRICA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 191 SOUTH AFRICA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA POLYSTYRENE MARKET BY END USER (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYSTYRENE TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL POLYSTYRENE FORM, USD BILLION, 2020-2029

FIGURE 10 GLOBAL POLYSTYRENE END USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL POLYSTYRENE REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL POLYSTYRENE MARKET, BY REGION 2021, USD BILLION

FIGURE 14 GLOBAL POLYSTYRENE MARKET, BY FORM 2021, USD BILLION

FIGURE 15 GLOBAL POLYSTYRENE MARKET, BY TYPE 2021, USD BILLION

FIGURE 16 GLOBAL POLYSTYRENE MARKET, BY END USER 2021, USD BILLION

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 STYROLUTION GROUP GMBH: COMPANY SNAPSHOT

FIGURE 19 TOTAL PETROCHEMICALS: COMPANY SNAPSHOT

FIGURE 20 BASF SE: COMPANY SNAPSHOT

FIGURE 21 FORMOSA CHEMICALS & FIBER CORPORATION: COMPANY SNAPSHOT

FIGURE 22 KUMHO PETROCHEMICALS LTD.: COMPANY SNAPSHOT

FIGURE 23 CHI MEI CORPORATION: COMPANY SNAPSHOT

FIGURE 24 SABIC: COMPANY SNAPSHOT

FIGURE 25 TRINSEO: COMPANY SNAPSHOT

FIGURE 26 VIDEOLAR S/A: COMPANY SNAPSHOT

FIGURE 28 CIBAPAC: COMPANY SNAPSHOT

FIGURE 28 POLYOAK PACKAGING GROUP: COMPANY SNAPSHOT

FIGURE 28 ARKEMA: COMPANY SNAPSHOT

FIGURE 28 SYNTHOS: COMPANY SNAPSHOT

FAQ

The polystyrene market is expected to grow at 5.95 % CAGR from 2022 to 2029. It is expected to reach above USD 50.27 billion by 2029 from USD 29 billion in 2020.

Asia Pacific held more than 40 % of the Polystyrenes market revenue share in 2021 and will witness expansion in the forecast period.

The polystyrene market is strongly influenced by consumer electronics. Due to its light weight, moldability, and electrical insulating qualities, polystyrene is an excellent material to employ when creating components for consumer electronics.

The packaging sector typically holds the largest market share for polystyrene based on end user. Due to its low cost, superior insulation capabilities, and lightweight nature, polystyrene is frequently utilised in packaging applications

Asia pacific is the largest market for polysterene market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.