REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

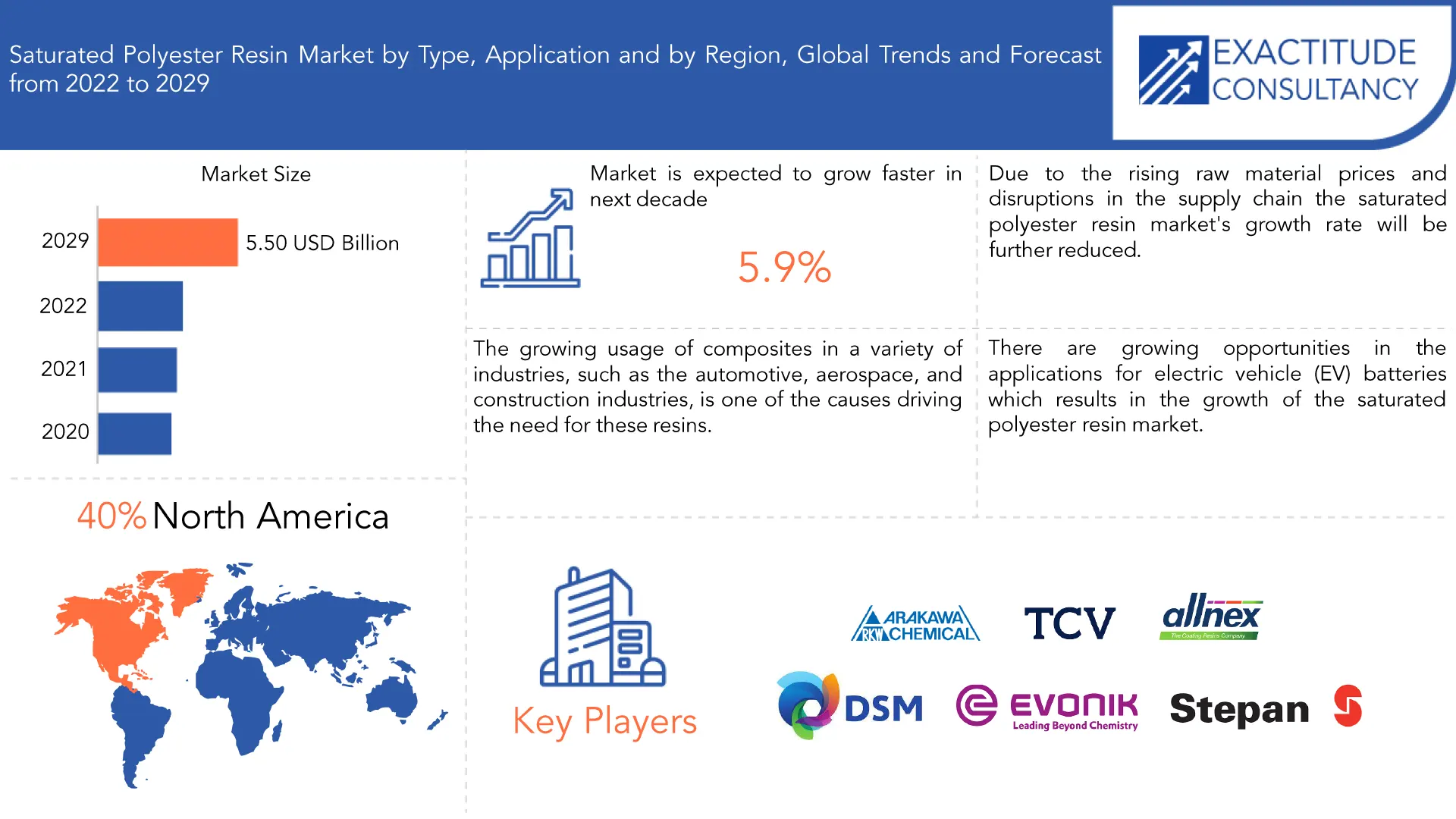

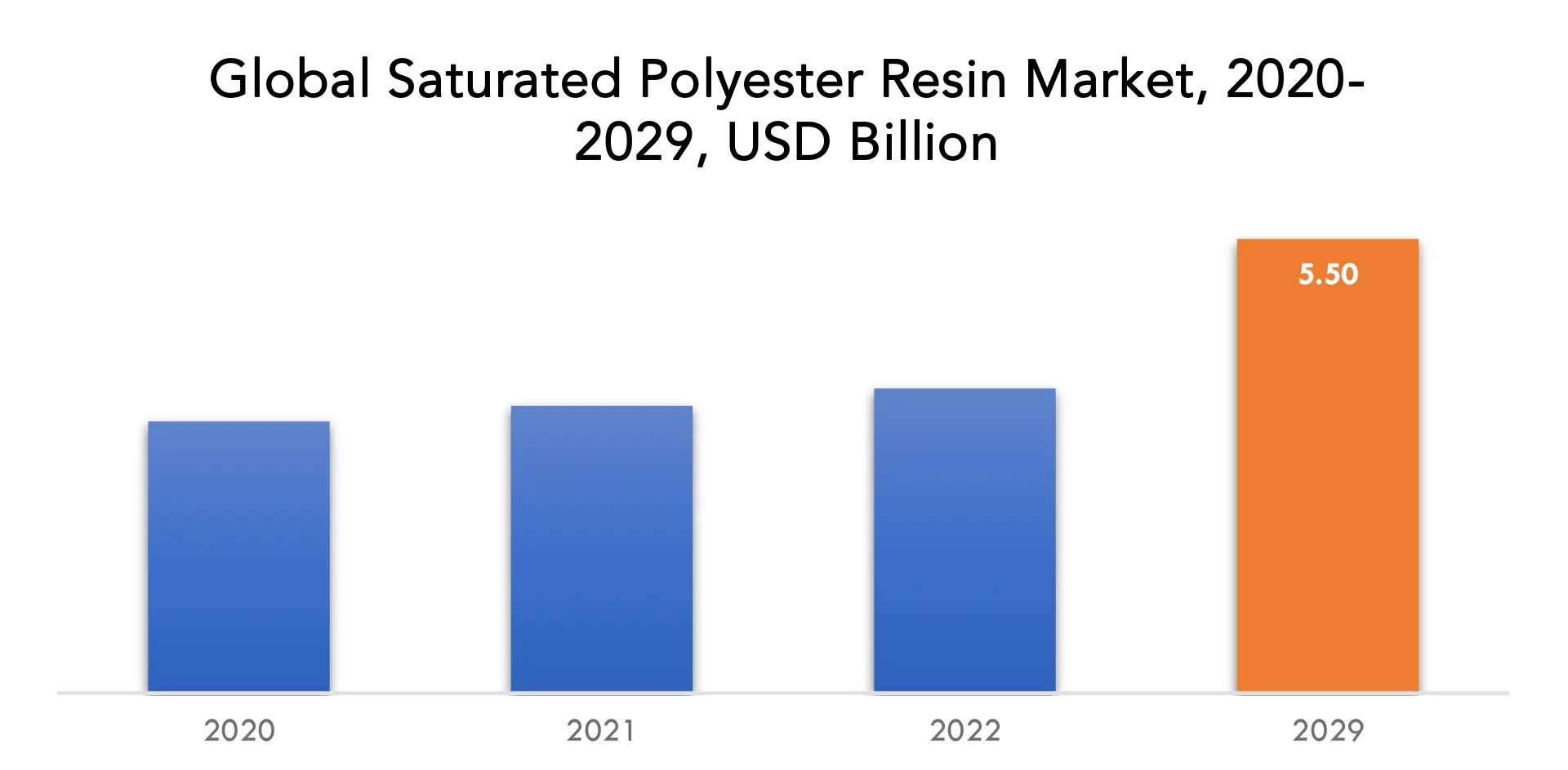

| USD 5.50 billion by 2029 | at 5.9% CAGR | North America |

| by Type | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Saturated Polyester Resin Market Overview

Saturated polyester resin market is expected to grow at 5.9% CAGR from 2022 to 2029. It was valued nearly 3.29 billion at 2020. It is expected to reach above USD 5.50 billion by 2029. The growing usage of composites in a variety of industries, such as the automotive, aerospace, and construction industries, is one of the causes driving the need for these resins. The highly sought-after electrical insulation, varnishes, and adhesives all use saturated polyester resins.

The industry that produces, distributes, and uses saturated polyester resins is referred to as the saturated polyester resin market. A form of thermosetting resin known as saturated polyester resins is frequently used in a variety of products, such as coatings, adhesives, composites, and fibers. These resins are produced through the reaction of glycols or other polyols with saturated dibasic acids, such as phthalic acid or ethylene glycol. High mechanical strength, strong chemical resistance, exceptional thermal stability, and minimal shrinkage while curing are just a few of the desirable qualities that saturated polyester resins have to offer. Due to these qualities, they are useful for a variety of applications in the automotive, building, electrical and electronics, and packaging industries.

The demand for high-performance coatings and composites, expanding construction activity, and the trend towards lightweight and fuel-efficient automobiles are some of the reasons driving the market for saturated polyester resins. Additionally, the development of custom resin grades for particular applications is made possible by technological developments in resin composition and production techniques. The highly competitive polyester resin market is essential for supplying adaptable and robust products that satisfy the performance standards of numerous industries. Manufacturers and suppliers concentrate on innovation and product development to suit client expectations and maintain market competitiveness as demand increases.

The expanding construction sector is what is driving the demand for saturated polyester resins. Due to their exceptional adhesion, toughness, and resistance to weathering and chemicals, these resins are extensively used in architectural coatings, floors, and adhesives for building applications. The market for saturated polyester resins is anticipated to rise significantly as building activities expand internationally, particularly in emerging nations. The dynamics of the saturated polyester resin market heavily depend on the automobile sector. In automotive coatings and composite applications, saturated polyester resins are used to improve aesthetics, offer corrosion protection, and increase fuel efficiency by lowering the weight of vehicle components. The automotive industry is expected to increase demand for saturated polyester resins due to rising demand for lightweight automobiles and strict emission requirements.

The dynamics of the saturated polyester resin industry are being impacted by concerns about sustainability and the environment. Growing consumer demand for environmentally friendly and long-lasting products has resulted in the creation of bio-based saturated polyester resins made from renewable resources. In response to consumer awareness of the need for ecologically friendly solutions and government policies supporting sustainability, the market is seeing a trend towards bio-based resins. The trends and patterns of the saturated polyester resin market are influenced by things like the expansion of the construction industry, demand from the automobile industry, and the growing emphasis on sustainability. Manufacturers and suppliers are expected to develop and produce cutting-edge goods that satisfy performance criteria and abide by environmental norms as industries continue to change.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion, Thousand Units) |

| Segmentation | By Type, By Application |

| By Type |

|

| By Application |

|

| By Region |

|

Saturated Polyester Resin Market Segment Analysis

By type the market is segmented into liquid saturated polyester resin, solid saturated polyester resin. One of the most useful materials available on the market for coatings, adhesives, and composite applications is liquid saturated polyester resin. It has great flow characteristics, is simple to handle, and is additive compatible. The effective wetting and coating characteristics of liquid resins allow for easy application and consistent film development. On the other hand, powder coatings frequently start with solid saturated polyester resin. When properly cured, it has great chemical resistance, excellent mechanical qualities, and good heat resistance. Solid resins serve as the building blocks for developing long-lasting and protective coatings that are frequently employed in sectors like the automobile, appliance, and general industrial applications.

By application the market is segmented into powder coatings, industrial paints, coil & can coatings, automotive paints, flexible packaging, 2k PU coatings. In the market, powder coatings are widely used as a long-lasting and environmentally friendly substitute for conventional liquid coatings. Industrial paints are crucial for safeguarding buildings and machinery in sectors including infrastructure, industry, and oil & gas. For the protection of metal coils and cans used in the packaging business, coil & can coatings were created. Automotive paints enhance the aesthetic of automobiles while shielding them from environmental elements including UV radiation, chemicals, and corrosion. They also serve a decorative and protective purpose. Coatings for flexible packaging are used to improve the functionality and aesthetics of flexible packaging materials. Two-component polyurethane coatings, often known as 2k PU coatings, are very durable, chemically resistant, and mechanically strong.

Saturated Polyester Resin Market Key Players

Saturated polyester resin market key players include Arakawa Chem, TCV, Allnex, DSM, Evonik, Hitachi Chem, Stepan, NIPPON GOHSEI, Hexion, Arkema, SK Chem, CSE Group.

March 02, 2023: TCV named a GrowthCap top growth equity firm.

September 22, 2022: allnex Launched CRYLCOAT® 2406-2: Versatile Polyester Resin for Outdoor Industrial Applications.

Who Should Buy? Or Key stakeholders

- Manufacturers

- Raw materials

- Distributors

- Research and development organizations

- Regulatory bodies

- Industry associations

- Investors

- Consumers

- Trade organizations

- Government agencies

- Others

Saturated Polyester Resin Market Regional Analysis

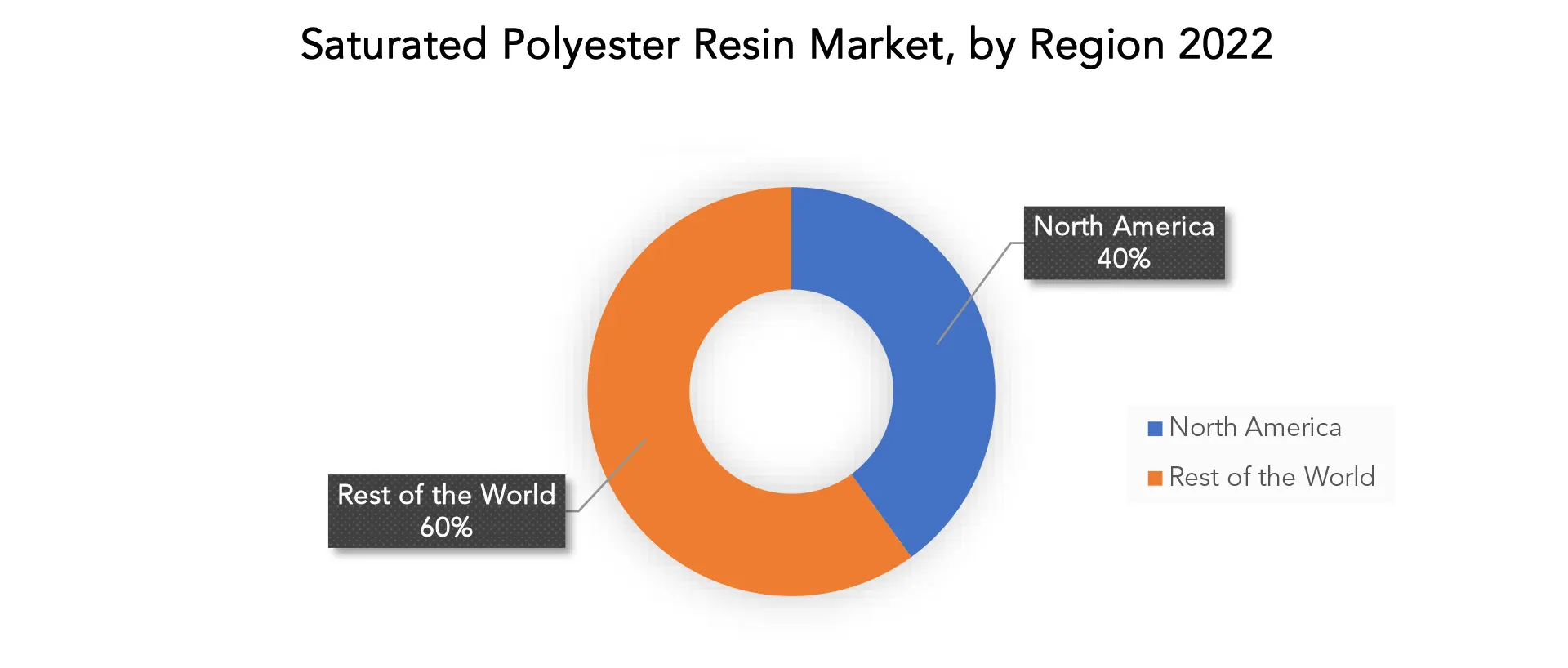

Saturated polyester resin market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The market for saturated polyester resin in North America has been expanding steadily in recent years. The region’s strong end-use sectors, such the automotive, construction, and packaging industries, along with its well-developed industrial infrastructure, have helped to expand the market. The requirement for high-performance materials, rising construction activity, and strict environmental restrictions have all contributed to the need for saturated polyester resins in applications like coatings, adhesives, and composites. The emphasis on sustainability and technological developments in resin formulation have further fueled industry expansion. In the upcoming years, it is anticipated that the North American saturated polyester resin market will continue to grow due to the region’s emphasis on innovation, product development, and growing end-use industries.

The saturated polyester resin market has seen substantial expansion in the Asia Pacific region. The need for a variety of applications, including coatings, adhesives, and fibers, has been driven by factors such increased industrialization, urbanization, and a rising middle-class population. The booming building industry in the area, especially in nations like China and India, has been a key factor in market expansion. Additionally, Asia Pacific’s automotive industry is expanding quickly thanks to increased disposable incomes and rising car output. The saturated polyester resin market has also been helped by the region’s emphasis on infrastructural development, technical developments, and helpful government measures. The market is anticipated to increase steadily in the near future due to the continuing economic expansion and industrial activities in Asia Pacific.

Key Market Segments: Saturated Polyester Resin Market

Saturated Polyester Resin Market by Type, 2020-2029, (USD Billion, Thousand Units)

- Liquid Saturated Polyester Resin

- Solid Saturated Polyester Resin

Saturated Polyester Resin Market by Application, 2020-2029, (USD Billion, Thousand Units)

- Powder Coatings

- Industrial Paints

- Coil & Can Coatings

- Automotive Paints

- Flexible Packaging

- 2k PU Coatings

Saturated Polyester Resin Market by Region, 2020-2029, (USD Billion, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the saturated polyester resin market over the next 7 years?

- Who are the major players in the saturated polyester resin market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the saturated polyester resin market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the saturated polyester resin market?

- What is the current and forecasted size and growth rate of the global saturated polyester resin market?

- What are the key drivers of growth in the saturated polyester resin market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the saturated polyester resin market?

- What are the technological advancements and innovations in the saturated polyester resin market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the saturated polyester resin market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the saturated polyester resin market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of saturated polyester resin market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL SATURATED POLYESTER RESIN MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SATURATED POLYESTER RESIN MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL SATURATED POLYESTER RESIN MARKET OUTLOOK

- GLOBAL SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION, THOUSAND UNITS), 2020-2029

- LIQUID SATURATED POLYESTER RESIN

- SOLID SATURATED POLYESTER RESIN

- GLOBAL SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION, THOUSAND UNITS), 2020-2029

- POWDER COATINGS

- INDUSTRIAL PAINTS

- COIL & CAN COATINGS

- AUTOMOTIVE PAINTS

- FLEXIBLE PACKAGING

- 2K PU COATINGS

- GLOBAL SATURATED POLYESTER RESIN MARKET BY REGION (USD BILLION, THOUSAND UNITS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ARAKAWA CHEM

- TCV

- ALLNEX

- DSM

- EVONIK

- HITACHI CHEM

- STEPAN

- NIPPON GOHSEI

- HEXION

- ARKEMA

- SK CHEM

- CSE GROUP

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL SATURATED POLYESTER RESIN MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL SATURATED POLYESTER RESIN MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA SATURATED POLYESTER RESIN MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA SATURATED POLYESTER RESIN MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA SATURATED POLYESTER RESIN MARKET BY TYPE (BILLION), 2020-2029

TABLE 18 CANADA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC SATURATED POLYESTER RESIN MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC SATURATED POLYESTER RESIN MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE SATURATED POLYESTER RESIN MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE SATURATED POLYESTER RESIN MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 91 UK SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 UK SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA SATURATED POLYESTER RESIN MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SATURATED POLYESTER RESIN BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL SATURATED POLYESTER RESIN BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL SATURATED POLYESTER RESIN BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL SATURATED POLYESTER RESIN BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL SATURATED POLYESTER RESIN BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL SATURATED POLYESTER RESIN BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 ARAKAWA CHEM: COMPANY SNAPSHOT

FIGURE 17 TCV: COMPANY SNAPSHOT

FIGURE 18 ALLNEX: COMPANY SNAPSHOT

FIGURE 19 DSM: COMPANY SNAPSHOT

FIGURE 20 EVONIK: COMPANY SNAPSHOT

FIGURE 21 HITACHI CHEM: COMPANY SNAPSHOT

FIGURE 22 STEPAN: COMPANY SNAPSHOT

FIGURE 23 NIPPON GOHSEI: COMPANY SNAPSHOT

FIGURE 24 HEXION: COMPANY SNAPSHOT

FIGURE 25 ARKEMA: COMPANY SNAPSHOT

FIGURE 26 SK CHEM: COMPANY SNAPSHOT

FIGURE 27 CSE GROUP: COMPANY SNAPSHOT

FAQ

Saturated polyester resin market is expected to grow at 5.9 % CAGR from 2022 to 2029. it is expected to reach above USD 5.50 billion by 2029

North America held nearly 40% of saturated polyester resin market revenue share in 2021 and will witness expansion in the forecast period.

The growing usage of composites in a variety of industries, such as the automotive, aerospace, and construction industries, is one of the causes driving the need for these resins. The highly sought-after electrical insulation, varnishes, and adhesives all use saturated polyester resins.

powder coatings frequently start with solid saturated polyester resin. When properly cured, it has great chemical resistance, excellent mechanical qualities, and good heat resistance. Solid resins serve as the building blocks for developing long-lasting and protective coatings that are frequently employed in sectors like the automobile, appliance, and general industrial applications.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.