REPORT OUTLOOK

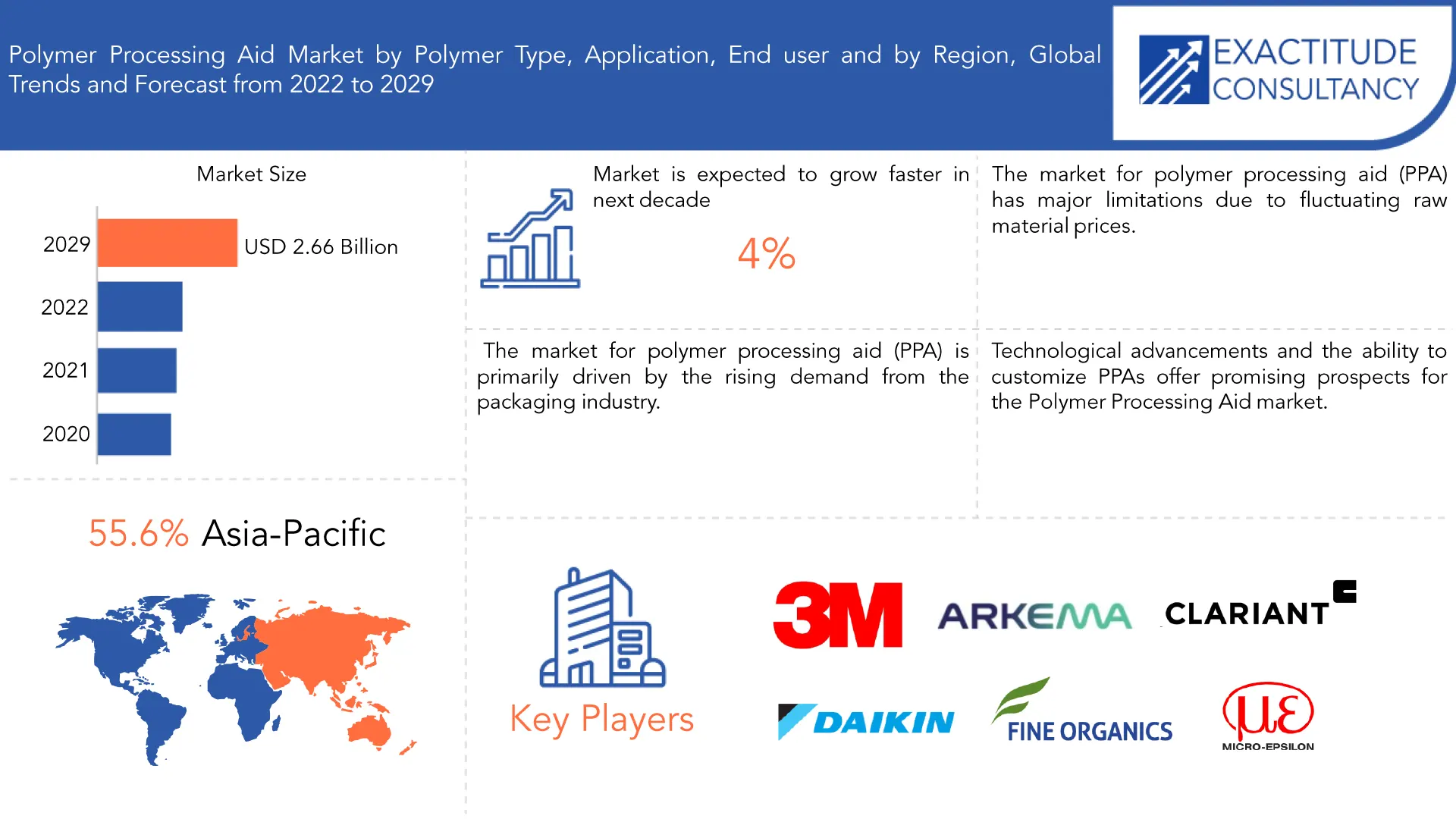

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2.66 billion by 2029 | 4 % | Asia-Pacific |

| by Type | by Application | by End User | by Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Polymer Processing Aid Market Overview

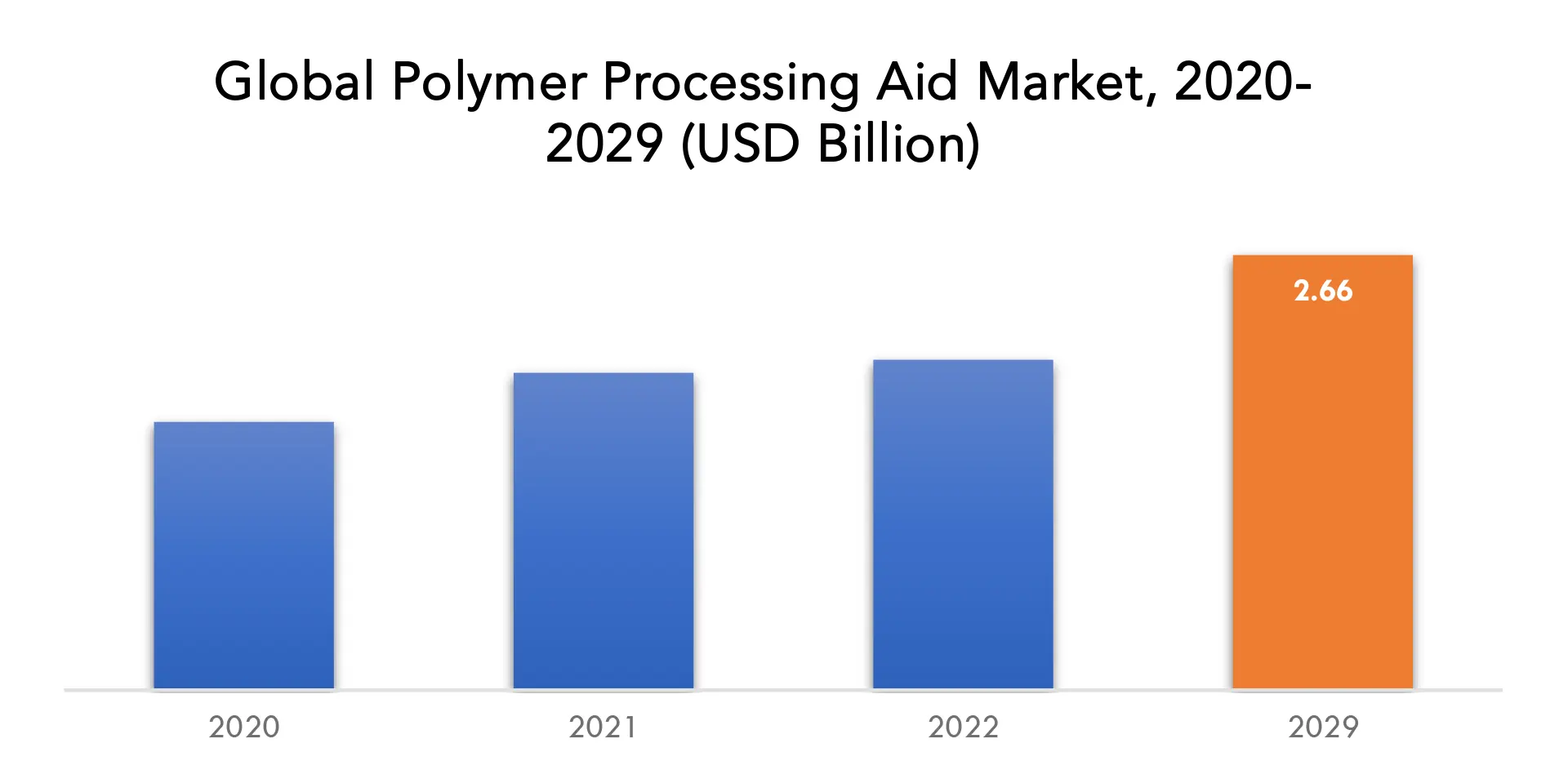

The polymer processing aid market is expected to grow at 4 % CAGR from 2022 to 2029. It is expected to reach above USD 2.66 billion by 2029 from USD 1.64 billion in 2020.

An additive called polymer processing assistance (PPA) is used in the production and processing of polymer materials, including plastics. It is a kind of chemical component added to the polymer formulation to increase processability and boost final product performance. When using different processing methods like extrusion, injection moulding, blow moulding, and film blowing, PPAs function by lowering friction and improving the flow characteristics of the polymer melt.

A polymer processing aid’s primary purpose is to make the polymer more processable by lowering melt viscosity, raising melt strength, and preventing melt fracture. PPAs provide smoother and more effective processing by reducing viscosity, which reduces energy consumption, boosts productivity, and improves the dimensional stability of the finished product. Additionally, they aid in reducing surface flaws like flow lines, streaks, and surface roughness.

PPAs can be adjusted to specific processing conditions and polymer types and are normally introduced in modest quantities to the polymer formulation. Fatty acid esters, metal stearates, acrylic polymers, and fluoropolymers are examples of PPAs that are often utilised. Based on their compatibility with the polymer matrix and the required processing enhancements, these additives are carefully chosen.

The market for polymer processing aid (PPA) is primarily driven by the rising demand from the packaging industry. Industries like food and beverage, medicines, cosmetics, and consumer products all depend heavily on packaging. The demand for effective polymer processing rises along with the demand for high-quality, aesthetically pleasing, and practical packaging materials. PPAs increase flow characteristics, decrease flaws, and improve the overall quality of packaging materials in addition to improving the processability of polymers.

The market for polymer processing aid (PPA) has major limitations due to fluctuating raw material prices. PPAs can be produced at a lower cost if raw materials’ costs are stable or fluctuate since they are made from a variety of sources, including petroleum-based goods. PPAs may become less commercially viable for end customers as a result of abrupt price rises that can raise production expenses. This may have an impact on PPA uptake and demand, particularly in price-sensitive businesses. To maintain competitive pricing and guarantee the profitability of their goods on the market, PPA manufacturers must carefully manage and reduce the risks connected with fluctuations in the price of raw materials.

Technological advancements and the ability to customize PPAs offer promising prospects for the polymer processing aid market. Ongoing research and development efforts are fueling the creation of novel PPA formulations that deliver improved performance attributes. Customizing PPAs to align with the unique demands of various polymers and processing techniques empowers manufacturers to provide bespoke solutions to their customers. This tailored approach entails optimizing the rheological characteristics, ensuring compatibility with specific polymers, and refining processing conditions. By embracing technological innovations and offering personalized PPA solutions, market players can differentiate themselves, address evolving customer needs, and gain a competitive advantage in the industry.

The worldwide pandemic slowed down various end-user industries, including the automobile, building, and packaging sectors, as well as supply chains and manufacturing activities. As a result, there was a brief fall in the market for polymer materials and PPAs. The availability of raw supplies was also impacted, and PPA distribution was hampered, by lockdown procedures and travel restrictions. However, the market is recoverin as economies gradually improve and enterprises are restarting their activities. In the years after the pandemic, there are chances for market expansion due to the rising demand for environmentally friendly packaging options and the recovery of the automobile and construction industries.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Polymer Type, by application, by end user |

| By Polymer Type |

|

| By Application

|

|

| By End User

|

|

| By Region

|

|

Polymer Processing Aid Market Segment Analysis

The polymer processing aids market is segmented based on polymer type, application and end user.

In the market for polymer processing aids (PPA), polyethylene (PE) and polypropylene (PP) hold the highest market shares. In many different industries, including packaging, automotive, construction, and consumer goods, PE and PP are widely used. The market for PPAs in these polymer types is driven by the substantial demand for effective processing aids to improve the processability and quality of PE and PP products. While PVC, ABS, and Polycarbonate also have notable market shares, they are comparatively smaller than PE and PP.

Polymer processing aids (PPAs) usually hold a significant market share in the cast and blown film industries. The fabrication of plastic films used in a variety of packaging applications, such as bags, wraps, and flexible packaging, is known as blown film and cast film. To enhance film characteristics, decrease surface flaws, and improve processability, PPAs are widely employed in this application.

The polymer processing aid (PPA) market is predominantly driven by the packaging sector, which consistently holds the highest market share. This sector encompasses diverse segments like food and beverage packaging, pharmaceutical packaging, and consumer goods packaging, among others. PPAs are integral in optimizing the processability and performance of polymer materials utilized in packaging applications.

Polymer Processing Aid Market Players

The polymer processing aid market key players include 3M, Arkema, Clariant AG, Daikin America, Fine Organics, Micro-Epsilon, PolyOne Corporation, Tosaf Compounds Ltd., Wells Plastics Ltd., BP p.l.c, TotalEnergies, and Hanwha Group.

Recent News:

- May 30, 2022: Foster/Mednet, became new distributor for our High Performance Polymers for medical applications. Foster Corporation, Arkema’s primary High Performance Medical Polymers distributor globally and historical partner supported MedNet by supplying them with their extensive range of compounds based on Arkema’s specialty polyamides and will bring their in-depth technical knowledge of Arkema’s high performance polymers portfolio.

- July 20, 2021: Clariant expanded its contribution to sustainability with pigments certified OK compost INDUSTRIAL. o meets sustainability targets and fulfill commitments to the plastics circular economy; producers of plastic articles are increasingly using polymers that are compostable.

Polymer Processing Aid Market Regional Analysis

The polymer processing aids market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

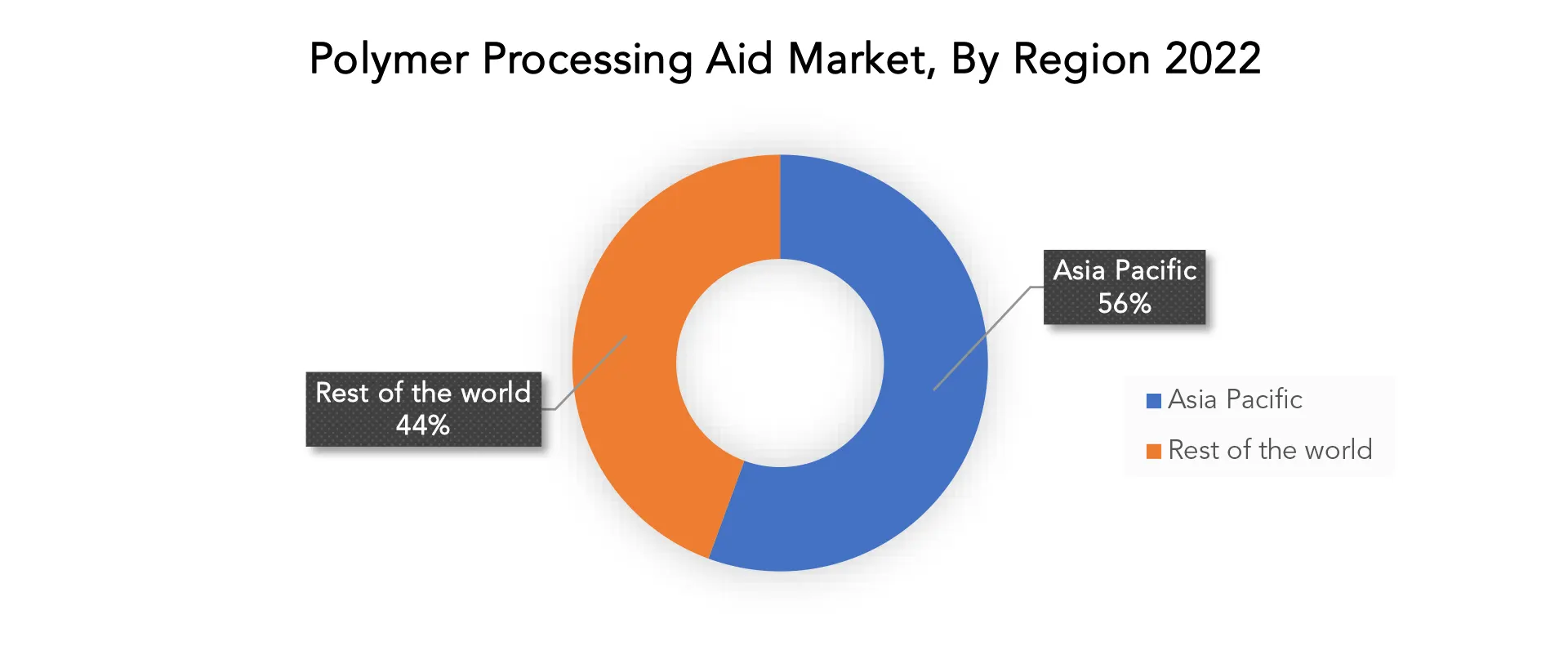

A major market for Polymer Processing Aid (PPA) is the Asia-Pacific region due to its growing manufacturing and industrial sectors. The market in this area is fueled by the rising need for construction materials, packaging, and consumer goods, all of which increase the demand for effective tools for polymer processing. The adoption of green PPAs is also influenced by the growing emphasis on sustainability and environmental standards. However, the market also encounters obstacles including varying raw material costs and a lack of knowledge about the advantages of PPAs. Despite these obstacles, the Asia Pacific PPA industry offers considerable prospects. Customized PPAs are now possible due to technological improvements, particularly in sectors like electronics and the automobile industry.

North America and South America are both major regions for the production and consumption of plastics, making the polymer processing aid market crucial for various industries, including packaging, automotive, construction, and consumer goods. The main producers of polymer processing aids in North America are the United States and Canada. Particularly in the United States, the plastics industry has flourished due to the country’s robust manufacturing sector and high consumer demand. The nation has a strong infrastructure for the manufacture and distribution of plastic products, as well as numerous significant manufacturers of polymer processing aids.

Key Market Segments: Polymer Processing Aid Market

Polymer Processing Aid Market by Polymer Type, 2020-2029, (USD Billion), (Kilotons)

- Polyethylene

- Polypropylene

- PVC, ABS and Polycarbonate

- Others

Polymer Processing Aid Market by Application, 2020-2029, (USD Billion), (Kilotons)

- Blown Film & Cast Film

- Wire & Cable

- Extrusion Blow Molding

- Fibers and Raffia

- Pipe and Tube

- Others

Polymer Processing Aid Market by End User, 2020-2029, (USD Billion), (Kilotons)

- Packaging

- Building and Construction

- Transportation

- Textiles

- IT and Telecommunication

- Others

Polymer Processing Aid Market by Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Who Should Buy? Or Key stakeholders

- Polymer Processing Aid Suppliers

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Key Questions Answered: –

- What is the expected growth rate of the polymer processing aids market over the next 7 years?

- Who are the major players in the polymer processing aids market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the polymer processing aids market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the polymer processing aids market?

- What is the current and forecasted size and growth rate of the global polymer processing aids market?

- What are the key drivers of growth in the polymer processing aids market?

- What are the distribution channels and supply chain dynamics in the polymer processing aids market?

- What are the technological advancements and innovations in the polymer processing aids market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the polymer processing aids market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the polymer processing aids market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of polymer processing aids in the market and what is the impact of raw material prices on the price trend?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL POLYMER PROCESSING AID MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON POLYMER PROCESSING AID MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL POLYMER PROCESSING AID MARKET OUTLOOK

- GLOBAL POLYMER PROCESSING AID MARKET BY POLYMER TYPE, (USD BILLION, KILOTONS)

- POLYETHYLENE

- POLYPROPYLENE

- PVC, ABS AND POLYCARBONATE

- OTHERS

- GLOBAL POLYMER PROCESSING AID MARKET BY APPLICATION, (USD BILLION, KILOTONS)

- BLOWN FILM & CAST FILM

- WIRE & CABLE

- EXTRUSION BLOW MOLDING

- FIBERS AND RAFFIA

- PIPE AND TUBE

- OTHERS

- GLOBAL POLYMER PROCESSING AID MARKET BY END USER, (USD BILLION, KILOTONS)

- PACKAGING

- BUILDING AND CONSTRUCTION

- TRANSPORTATION

- TEXTILES

- IT AND TELECOMMUNICATION

- OTHERS

- GLOBAL POLYMER PROCESSING AID MARKET BY REGION, (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- 3M

- ARKEMA

- CLARIANT AG

- DAIKIN AMERICA

- FINE ORGANICS

- MICRO-EPSILON

- POLYONE CORPORATION

- TOSAF COMPOUNDS LTD.

- WELLS PLASTICS LTD.

- BP P.L.C

- TOTALENERGIES

- HANWHA GROUP*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 7 GLOBAL POLYMER PROCESSING AID MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL POLYMER PROCESSING AID MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 15 NORTH AMERICA POLYMER PROCESSING AID MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA POLYMER PROCESSING AID MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 17 US POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 18 US POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 19 US POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 US POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 US POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 22 US POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 23 CANADA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (BILLION), 2020-2029

TABLE 24 CANADA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 25 CANADA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 26 CANADA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 27 CANADA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 CANADA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 29 MEXICO POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 30 MEXICO POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 31 MEXICO POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 MEXICO POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 33 MEXICO POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 MEXICO POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 35 SOUTH AMERICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 37 SOUTH AMERICA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 SOUTH AMERICA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 41 SOUTH AMERICA POLYMER PROCESSING AID MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA POLYMER PROCESSING AID MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 43 BRAZIL POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 44 BRAZIL POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 45 BRAZIL POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 BRAZIL POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 BRAZIL POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 48 BRAZIL POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 49 ARGENTINA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 50 ARGENTINA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 51 ARGENTINA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 52 ARGENTINA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 53 ARGENTINA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ARGENTINA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 55 COLOMBIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 56 COLOMBIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 57 COLOMBIA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 58 COLOMBIA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 59 COLOMBIA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 60 COLOMBIA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 67 ASIA-PACIFIC POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 69 ASIA-PACIFIC POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 71 ASIA-PACIFIC POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 73 ASIA-PACIFIC POLYMER PROCESSING AID MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC POLYMER PROCESSING AID MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 75 INDIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 76 INDIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 77 INDIA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 78 INDIA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 79 INDIA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 80 INDIA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 81 CHINA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 82 CHINA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 83 CHINA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 CHINA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 CHINA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 86 CHINA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 87 JAPAN POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 88 JAPAN POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 89 JAPAN POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 JAPAN POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 JAPAN POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 92 JAPAN POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 93 SOUTH KOREA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 95 SOUTH KOREA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 97 SOUTH KOREA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 99 AUSTRALIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA FERTILIZER ADDITIVESBY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 101 AUSTRALIA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 AUSTRALIA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 105 SOUTH EAST ASIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA FERTILIZER ADDITIVESBY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 107 SOUTH EAST ASIA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 109 SOUTH EAST ASIA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC FERTILIZER ADDITIVESBY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 117 EUROPE POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 118 EUROPE POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 119 EUROPE POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 120 EUROPE POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 121 EUROPE POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 122 EUROPE POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 123 EUROPE POLYMER PROCESSING AID MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE POLYMER PROCESSING AID MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 125 GERMANY POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 126 GERMANY POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 127 GERMANY POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 GERMANY POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 GERMANY POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 130 GERMANY POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 131 UK POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 132 UK POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 133 UK POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 134 UK POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 135 UK POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 136 UK POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 137 FRANCE POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 138 FRANCE POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 139 FRANCE POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 140 FRANCE POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 141 FRANCE POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 142 FRANCE POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 143 ITALY POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 144 ITALY POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 145 ITALY POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 146 ITALY POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 147 ITALY POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 148 ITALY POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 149 SPAIN POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 150 SPAIN POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 151 SPAIN POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 152 SPAIN POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 153 SPAIN POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 154 SPAIN POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 155 RUSSIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 156 RUSSIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 157 RUSSIA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 158 RUSSIA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 159 RUSSIA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 160 RUSSIA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 161 REST OF EUROPE POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 163 REST OF EUROPE POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 165 REST OF EUROPE POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 175 UAE POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 176 UAE POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 177 UAE POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 178 UAE POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 179 UAE POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 180 UAE POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 181 SAUDI ARABIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 183 SAUDI ARABIA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 185 SAUDI ARABIA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 187 SOUTH AFRICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 189 SOUTH AFRICA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 191 SOUTH AFRICA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY POLYMER TYPE (KILOTONS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY END USER (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA POLYMER PROCESSING AID MARKET BY END USER (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYMER PROCESSING AID BY POLYMER TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL POLYMER PROCESSING AID BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL POLYMER PROCESSING AID BY END USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL POLYMER PROCESSING AID BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL POLYMER PROCESSING AID MARKET BY REGION, USD BILLION, 2021

FIGURE 14 GLOBAL POLYMER PROCESSING AID MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL POLYMER PROCESSING AID MARKET BY POLYMER TYPE, USD BILLION, 2021

FIGURE 16 GLOBAL POLYMER PROCESSING AID MARKET BY END USER, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 3M: COMPANY SNAPSHOT

FIGURE 19 ARKEMA: COMPANY SNAPSHOT

FIGURE 20 CLARIANT AG: COMPANY SNAPSHOT

FIGURE 21 DAIKIN AMERICA COMPANY SNAPSHOT

FIGURE 22 FINE ORGANICS: COMPANY SNAPSHOT

FIGURE 23 MICRO-EPSILON: COMPANY SNAPSHOT

FIGURE 24 POLYONE CORPORATION: COMPANY SNAPSHOT

FIGURE 25 TOSAF COMPOUNDS LTD: COMPANY SNAPSHOT

FIGURE 26 WELLS PLASTICS LTD: COMPANY SNAPSHOT

FIGURE 28 BP P.L.C: COMPANY SNAPSHOT

FIGURE 28 TOTALENERGIES: COMPANY SNAPSHOT

FIGURE 28 HANWHA GROUP: COMPANY SNAPSHOT

FAQ

- The polymer processing aid market is expected to grow at 4 % CAGR from 2022 to 2029. It is expected to reach above USD 66 billion by 2029 from USD 1.64 billion in 2020.

Asia Pacific held more than 55 % of the Polymer Processing Aids market revenue share in 2021 and will witness expansion in the forecast period.

The growing need for high-quality plastic goods with improved performance traits, such as increased flow and decreased flaws, which can be attained through the use of processing aids, is one of the factors driving the market for polymer processing aids.

The polymer processing aid (PPA) market is predominantly driven by the packaging sector, which consistently holds the highest market share. This sector encompasses diverse segments like food and beverage packaging, pharmaceutical packaging, and consumer goods packaging, among others.

Asia Pacific is the largest regional market for polymer processing aid market

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.