REPORT OUTLOOK

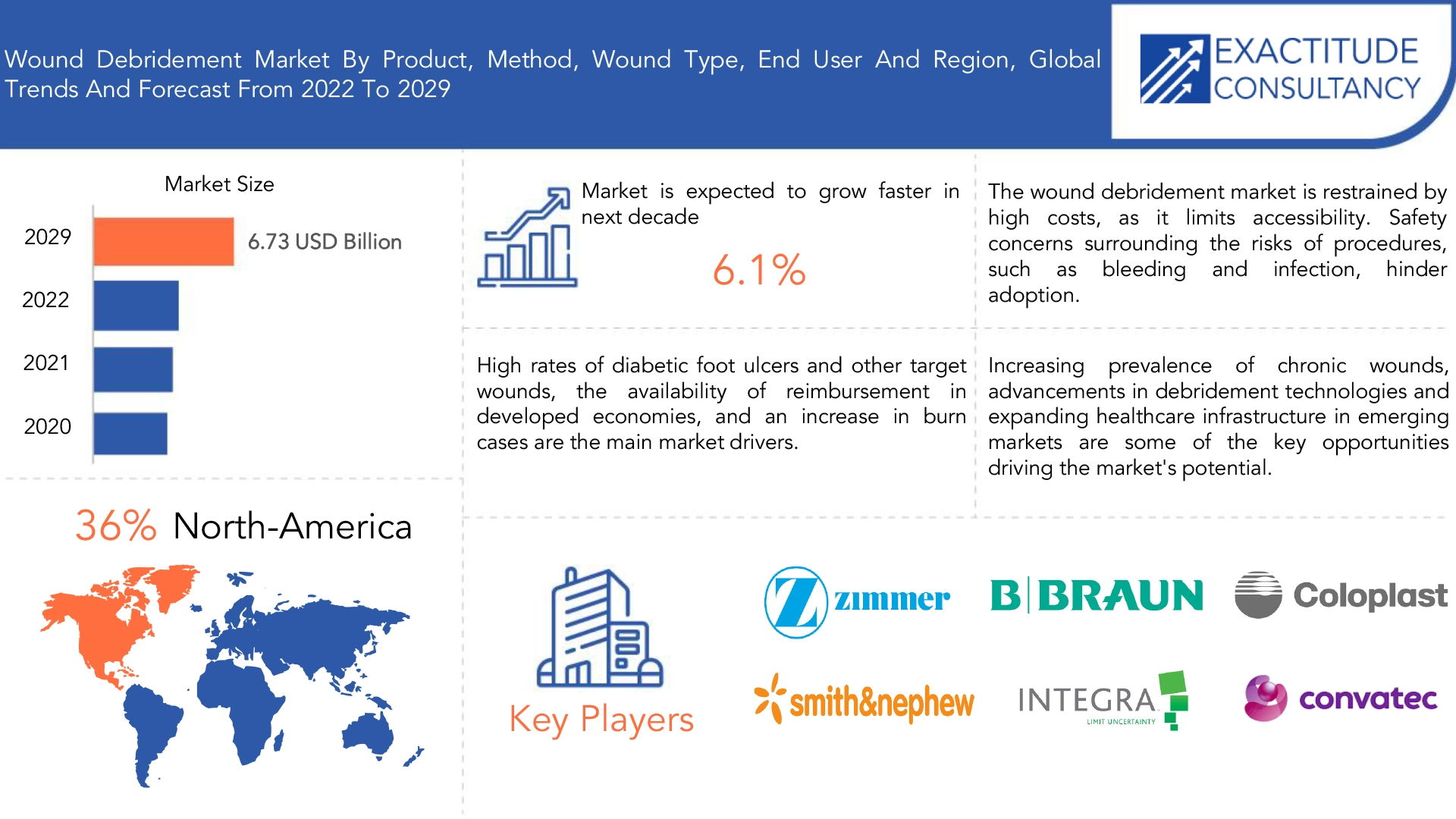

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 6.73 billion by 2029 | 6.1% | North America |

| by Product | by End User | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Wound Debridement Market Overview

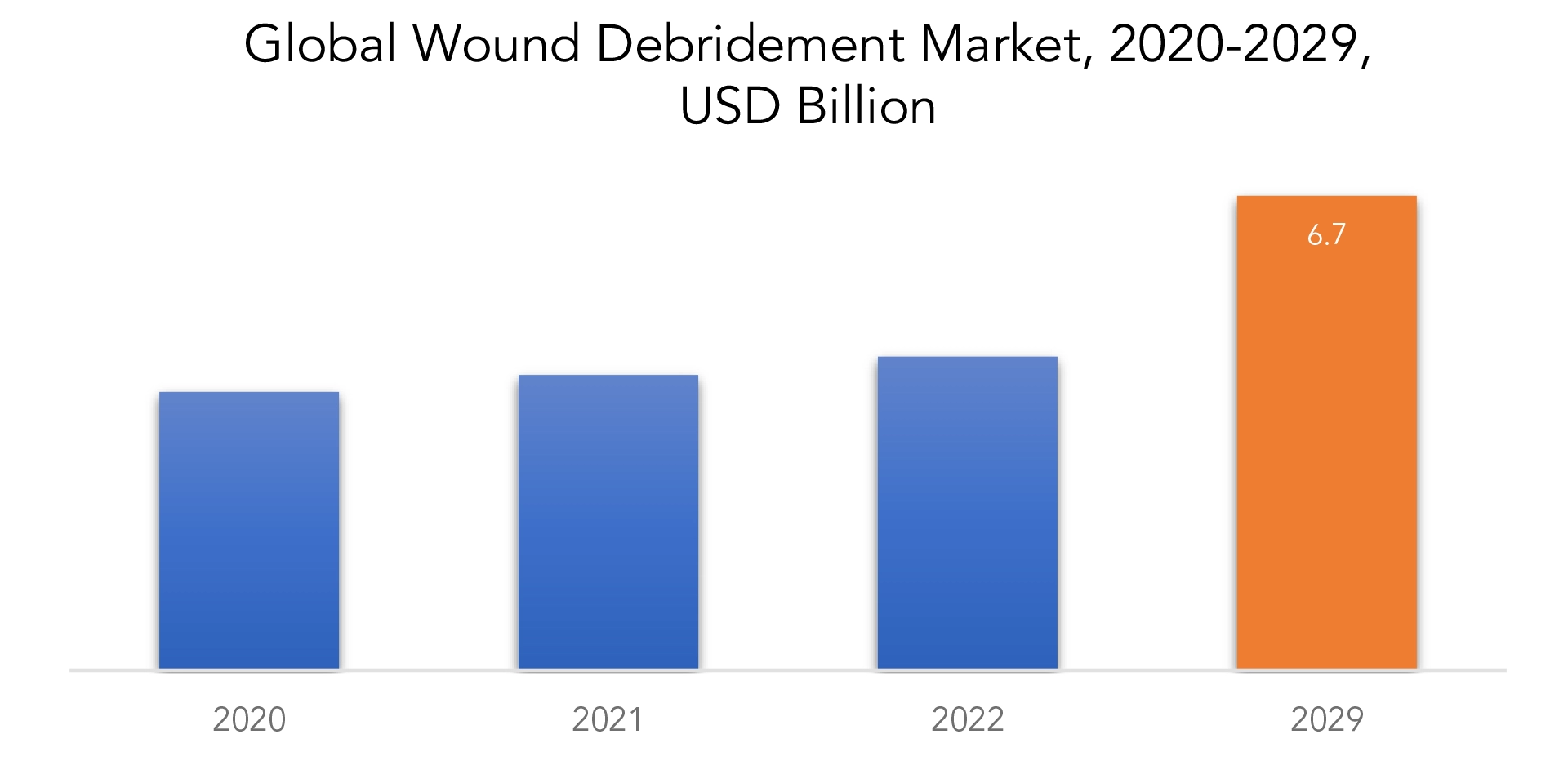

The wound debridement market is expected to grow at 6.1% CAGR from 2022 to 2029. It is expected to reach above USD 6.73 billion by 2029 from USD 3.95 billion in 2020.

In order to promote healing, a vital step in wound management called wound debridement involves removing contaminated or devitalized tissue from a wound site. This procedure aids in removing potential infection sources, lowers bacterial loads, and promotes the development of healthy granulation tissue. Wound debridement can be done in a number of ways, both surgical and non-surgical methods being frequently used. During surgery, debridement removes necrotic or non-viable tissue by using sharp implements like scalpels or scissors. Although it calls for knowledge and anesthesia, this technique enables the precise removal of damaged tissue. Enzymatic debridement, which uses topical agents to dissolve dead tissue, and autolytic debridement, which relies on the body’s own mechanisms to gradually remove necrotic material, are two non-surgical treatment options.

Debridement of wounds should be done in a sterile setting by qualified medical personnel. Regular wound assessments are necessary to determine whether debridement is necessary and to determine the best method based on the wound’s characteristics. Debridement done correctly promotes the growth of healthy tissue for optimum healing, speeds up the healing of wounds, and lowers the risk of complications.

Non-healing acute and chronic wounds, including pressure ulcers, venous ulcers, and diabetic ulcers, are becoming more common. Additionally, there is an increase in the risk factors linked to obesity, alcohol use, and poor nutrition. There will be a sharp rise in the frequency of acute and venous wounds due to the ageing population. The ageing population will be the main driver of the demand for wound care services, which will then drive the demand for these products. One of the key factors driving the growth of the global wound debridement market is the rising incidence of both acute and chronic wounds. Pressure ulcers, venous ulcers, and diabetic ulcers are a few examples of the acute and chronic wounds that don’t heal. There is also a rise in the risk factors linked to obesity, alcohol use, and poor nutrition. Acute and venous wounds will occur more frequently as the population ages, which will have a significant impact. The ageing population will be primarily responsible for this, driving the demand for wound care services and products. One of the major factors that will propel the growth of the global wound debridement market is the increasing prevalence of both acute and chronic wounds.

Numerous factors limit the market for wound debridement. Debridement procedures are expensive and therefore out of reach for many patients, especially in settings with limited resources. Healthcare professionals and patients are reluctant to use aggressive debridement techniques due to safety concerns about potential risks like bleeding, infection, and damage to healthy tissue. Furthermore, underutilization or a delay in the implementation of these procedures is caused by a lack of knowledge and instruction regarding the significance and methods of wound debridement. It will take work to increase cost-effectiveness, strengthen safety precautions, and raise patient and healthcare community awareness and education in order to address these restraints.

The market for wound debridement offers potential for growth and development. One of the main factors boosting the market’s potential is the rising prevalence of chronic wounds, improvements in debridement technology, rising demand for minimally invasive procedures, and growing healthcare infrastructure in emerging markets.

The market for wound debridement has been significantly impacted by the COVID-19 pandemic. Wound debridement and other non-essential procedures have received less attention from healthcare providers as they concentrate on managing and treating COVID-19 patients. Restrictions and limitations have forced the postponement or cancellation of elective procedures, including debridement, at numerous healthcare facilities. Additionally, the financial strain caused by the pandemic has prevented healthcare systems from investing in and implementing advanced debridement technologies. The increased focus on infection control and wound care has created opportunities for the market, though, and has increased demand for debridement products and methods to prevent and treat wound complications in COVID-19 patients.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By product, by method, by wound type, by end user, by region |

| By Product

|

|

| By method |

|

| By wound type |

|

| By End User |

|

| By Region

|

|

Wound Debridement Market Segment Analysis

The wound debridement market is segmented based on product, method, wound type, end-user and region. By product the market is bifurcated into gels, ointments & creams, surgical devices, debridement pads, and others. By method market is bifurcated into autolytic, enzymatic, surgical, mechanical, and others. By wound type market is divided into diabetic foot ulcers, pressure ulcers, surgical & trauma wounds, burns, and others. By end user market is bifurcated into hospitals, clinics, and others.

Since gels maintain a moist wound environment and have some advantages over other products, such as no inflammation, less bleeding, filling the dead space, and removal of necrotic tissues safely and without causing infection, they are predicted to dominate the wound debridement market.

The segment of the global wound debridement market with the largest share was enzymatic debridement products based on method. This is primarily attributable to elements like their excellent debriding performance and substantial market penetration.

In 2021, the segment for diabetic foot ulcers is anticipated to hold the largest market share. This dominance is attributable to an increase in diabetic patients, a number of foot deformities, and trauma. For instance, the International Diabetes Federation estimates that the number of diabetics in South East Asia alone is 90 million. In the Western Pacific, this figure increases to 206 million. In light of this and the risk of developing diabetic foot ulcers, it is anticipated that the diabetic foot ulcers market will grow significantly over the course of the forecast period.

The hospitals sector generated the largest amount of market revenue in 2021, and it is anticipated that it will continue to hold the top spot throughout the forecast period. This is attributed to an increase in cases of pressure ulcers, surgical & trauma wounds, diabetic foot ulcers, and surgical wound cases due to an increase in hospital surgeries.

Wound Debridement Market Key Players

The wound debridement market key players include Zimmer Biomet Holdings Inc, Smith & Nephew, B. Braun Melsungen AG, Coloplast A/S, ConvaTec Group, Paul Hartmann, Mölnlycke Health Care, Lohmann & Rauscher, Medline Industries, Integra Lifesciences, and Others.

Recent Developments:

16 May, 2023: Smith+Nephew (LSE:SN, NYSE:SNN), the global medical technology company, introduces two key products that close the feedback loop for its robotics and digital surgery portfolio – Personalized Planning powered by AI and RI.INSIGHTS Data Visualization Platform..

20 September, 2022: Smith+Nephew (LSE:SN, NYSE:SNN), the global medical technology business, today announces the launch of its OR3O Dual Mobility System for use in primary and revision hip arthroplasty in Japan.

Wound Debridement Market Regional Analysis

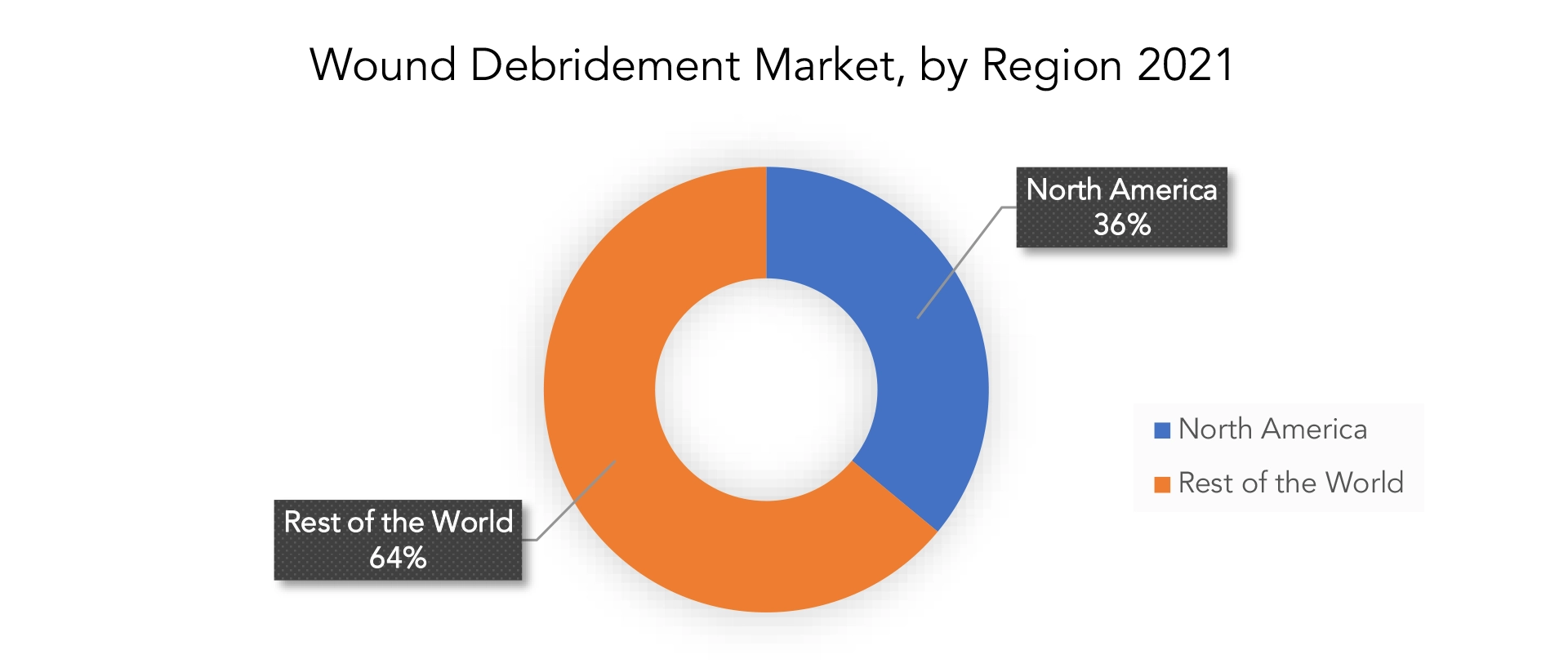

The wound debridement market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Spain, and Rest of Europe

- South America: includes Brazil, and Rest of South America

- Middle East & Africa: includes UAE, Saudi Arabia, Israel, and Rest of MEA

Throughout the forecast period, North America will continue to hold the largest market share. One of the main causes of the high growth of the wound debridement market size in the region is the high demand for superior medical technologies, increased adoption of technologically advanced wound debridement devices, advanced healthcare infrastructure, strong market presence of leading vendors, and increasing focus on wound care. Additionally, it is anticipated that the market will grow during the forecast period due to improvements in the healthcare infrastructure.

Due to an increase in cases of burns and trauma as well as a continually growing healthcare infrastructure, the presence of untapped resources, economic development, and an increase in the prevalence of chronic diseases, particularly diabetes, the wound debridement market in emerging countries in Asia-Pacific is predicted to grow at a significant rate during the forecast period.

Key Market Segments: Wound Debridement Market

Wound Debridement Market by Product, 2020-2029, (USD Billion)

- Gels

- Ointments & Creams

- Surgical Devices

- Debridement Pads

- Others

Wound Debridement Market by Method, 2020-2029, (USD Billion)

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

Wound Debridement Market by Wound Type, 2020-2029, (USD Billion)

- Diabetic Foot Ulcers

- Pressure Ulcers

- Surgical & Trauma Wounds

- Burns

- Others

Wound Debridement Market by End User, 2020-2029, (USD Billion)

- Hospitals

- Clinics

- Others

Wound Debridement Market by Region, 2020-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Who Should Buy? Or Key stakeholders

- Healthcare Industry

- Investors

- End user companies

- Research Organizations

- Government Organizations

- Others

Key Question Answered

• What is the expected growth rate of the wound debridement market over the next 7 years?

• Who are the major players in the wound debridement market and what is their market share?

• What are the end-user industries driving demand for market and what is their outlook?

• What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and Africa?

• How is the economic environment affecting the wound debridement market, including factors such as interest rates, inflation, and exchange rates?

• What is the expected impact of government policies and regulations on the wound debridement market?

• What is the current and forecasted size and growth rate of the global wound debridement market?

• What are the key drivers of growth in the wound debridement market?

• Who are the major players in the market and what is their market share?

• What are the distribution channels and supply chain dynamics in the wound debridement market?

• What are the technological advancements and innovations in the wound debridement market and their impact on product development and growth?

• What are the regulatory considerations and their impact on the market?

• What are the challenges faced by players in the wound debridement market and how are they addressing these challenges?

• What are the opportunities for growth and expansion in the wound debridement market?

• What are the service offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL WOUND DEBRIDEMENT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON WOUND DEBRIDEMENT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL WOUND DEBRIDEMENT MARKET OUTLOOK

- GLOBAL WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION)

- GELS

- OINTMENTS & CREAMS

- SURGICAL DEVICES

- DEBRIDEMENT PADS

- OTHERS

- GLOBAL WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION)

- AUTOLYTIC

- ENZYMATIC

- SURGICAL

- MECHANICAL

- OTHERS

- GLOBAL WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION)

- DIABETIC FOOT ULCERS

- PRESSURE ULCERS

- SURGICAL & TRAUMA WOUNDS

- BURNS

- OTHERS

- GLOBAL WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION)

- HOSPITALS

- CLINICS

- OTHERS

- GLOBAL WOUND DEBRIDEMENT MARKET BY REGION (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- SPAIN

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- ISRAEL

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ZIMMER BIOMET HOLDINGS INC.

- SMITH & NEPHEW

- BRAUN MELSUNGEN AG

- COLOPLAST A/S

- CONVATEC GROUP

- PAUL HARTMANN

- MÖLNLYCKE HEALTH CARE

- LOHMANN & RAUSCHER

- MEDLINE INDUSTRIES

- INTEGRA LIFESCIENCES. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 2 GLOBAL WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 3 GLOBAL WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 4 GLOBAL WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 5 GLOBAL WOUND DEBRIDEMENT MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 NORTH AMERICA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 7 NORTH AMERICA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 9 NORTH AMERICA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA WOUND DEBRIDEMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 11 US WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 12 US WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 13 US WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 14 US WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 15 CANADA WOUND DEBRIDEMENT MARKET BY PRODUCT (BILLION), 2020-2029

TABLE 16 CANADA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 17 CANADA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 19 MEXICO WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 20 MEXICO WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 21 MEXICO WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 23 REST OF NORTH AMERICA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 24 REST OF NORTH AMERICA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 25 REST OF NORTH AMERICA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 26 REST OF NORTH AMERICA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 27 SOUTH AMERICA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 29 SOUTH AMERICA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 31 SOUTH AMERICA WOUND DEBRIDEMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 32 BRAZIL WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 33 BRAZIL WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 34 BRAZIL WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 35 BRAZIL WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 36 REST OF SOUTH AMERICA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 37 REST OF SOUTH AMERICA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 38 REST OF SOUTH AMERICA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 39 REST OF SOUTH AMERICA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 40 ASIA -PACIFIC WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 41 ASIA -PACIFIC WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 42 ASIA -PACIFIC WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 43 ASIA -PACIFIC WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 44 ASIA -PACIFIC WOUND DEBRIDEMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 45 INDIA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 46 INDIA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 47 INDIA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 48 INDIA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 49 CHINA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 50 CHINA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 51 CHINA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 52 CHINA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 53 JAPAN WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 54 JAPAN WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 55 JAPAN WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 56 JAPAN WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 57 SOUTH KOREA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 58 SOUTH KOREA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 59 SOUTH KOREA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 60 SOUTH KOREA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 61 REST OF ASIA PACIFIC WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 62 REST OF ASIA PACIFIC WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 63 REST OF ASIA PACIFIC WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 64 REST OF ASIA PACIFIC WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 65 EUROPE WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 66 EUROPE WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 67 EUROPE WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 68 EUROPE WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 69 EUROPE WOUND DEBRIDEMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 70 GERMANY WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 71 GERMANY WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 72 GERMANY WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 73 GERMANY WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 74 UK WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 75 UK WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 76 UK WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 77 UK WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 78 FRANCE WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 79 FRANCE WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 80 FRANCE WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 81 FRANCE WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 82 SPAIN WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 83 SPAIN WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 84 SPAIN WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 85 SPAIN WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 86 REST OF EUROPE WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 87 REST OF EUROPE WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 88 REST OF EUROPE WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 89 REST OF EUROPE WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 90 MIDDLE EAST AND AFRICA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 91 MIDDLE EAST AND AFRICA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 92 MIDDLE EAST AND AFRICA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 93 MIDDLE EAST AND AFRICA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 94 MIDDLE EAST AND AFRICA WOUND DEBRIDEMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 95 UAE WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 96 UAE WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 97 UAE WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 98 UAE WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 99 SAUDI ARABIA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 100 SAUDI ARABIA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 101 SAUDI ARABIA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 102 SAUDI ARABIA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 103 ISRAEL WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 104 ISRAEL WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 105 ISRAEL WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 106 ISRAEL WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

TABLE 107 REST OF MIDDLE EAST AND AFRICA WOUND DEBRIDEMENT MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 108 REST OF MIDDLE EAST AND AFRICA WOUND DEBRIDEMENT MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 109 REST OF MIDDLE EAST AND AFRICA WOUND DEBRIDEMENT MARKET BY WOUND TYPE (USD BILLION), 2020-2029

TABLE 110 REST OF MIDDLE EAST AND AFRICA WOUND DEBRIDEMENT MARKET BY END USER (USD BILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL WOUND DEBRIDEMENT MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL WOUND DEBRIDEMENT MARKET BY METHOD, USD BILLION, 2020-2029

FIGURE 10 GLOBAL WOUND DEBRIDEMENT MARKET BY WOUND TYPE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL WOUND DEBRIDEMENT MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 12 GLOBAL WOUND DEBRIDEMENT MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 WOUND DEBRIDEMENT MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 15 WOUND DEBRIDEMENT MARKET BY METHOD, USD BILLION, 2021

FIGURE 16 WOUND DEBRIDEMENT MARKET BY WOUND TYPE, USD BILLION, 2021

FIGURE 17 WOUND DEBRIDEMENT MARKET BY END USER, USD BILLION, 2021

FIGURE 18 WOUND DEBRIDEMENT MARKET BY REGION, USD BILLION, 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 ZIMMER BIOMET HOLDINGS INC.: COMPANY SNAPSHOT

FIGURE 21 SMITH & NEPHEW: COMPANY SNAPSHOT

FIGURE 22 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

FIGURE 23 COLOPLAST A/S: COMPANY SNAPSHOT

FIGURE 24 CONVATEC GROUP: COMPANY SNAPSHOT

FIGURE 25 PAUL HARTMANN: COMPANY SNAPSHOT

FIGURE 26 MÖLNLYCKE HEALTH CARE: COMPANY SNAPSHOT

FIGURE 27 LOHMANN & RAUSCHER: COMPANY SNAPSHOT

FIGURE 28 MEDLINE INDUSTRIES.: COMPANY SNAPSHOT

FIGURE 29 INTEGRA LIFESCIENCES.: COMPANY SNAPSHOT

FAQ

The wound debridement market is studied from 2020 – 2029.

The wound debridement market is growing at a CAGR of 6.1% over the next 5 years.

Zimmer Biomet Holdings Inc., Smith & Nephew, B. Braun Melsungen AG, Coloplast A/S, ConvaTec Group, Paul Hartmann, Mölnlycke Health Care, Lohmann & Rauscher, Medline Industries, and Integra Lifesciences, are the major companies operating in wound debridement market.

Key factors that are driving the wound debridement market growth include a growing number of accidents and fire outbreaks are leading to rising in the cases of injuries.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.