REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

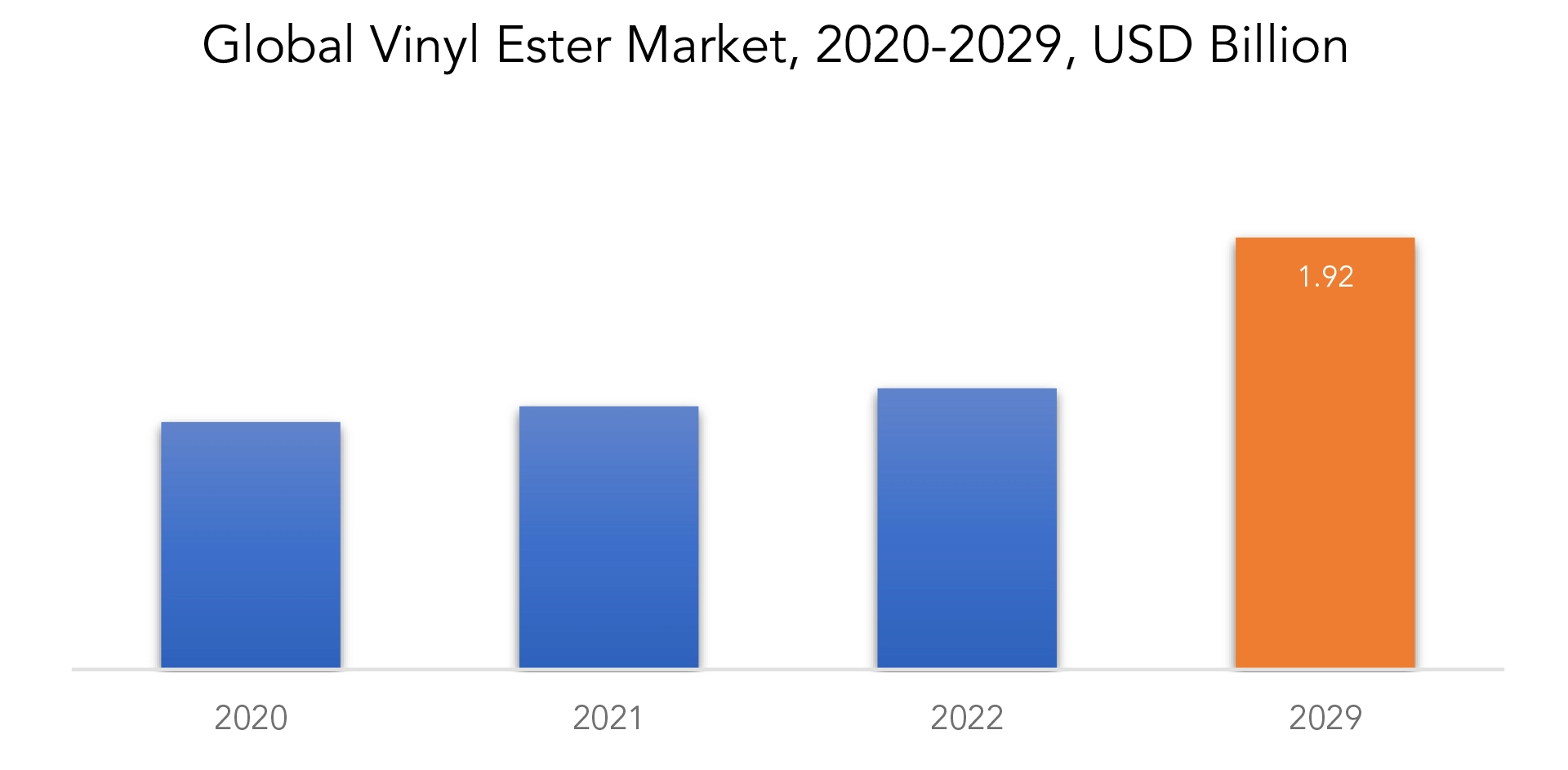

| USD 1.92 billion by 2029 | at 6.4 % CAGR | Asia Pacific |

| by Type | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Vinyl Ester Market Overview

The vinyl ester market is expected to grow at 6.4 % CAGR from 2022 to 2029. It is expected to reach above USD 1.92 billion by 2029 from USD 1.1 billion in 2020.

A resin known as vinyl ester is created by esterifying epoxy resin with monocarboxylic acid. The finished product is then dissolved in styrene or another solvent. Pipes and tanks, construction, transportation, and paint and coatings are just a few of the industries that use vinyl ester. It is a thermoset substance that is frequently used in place of polyester and epoxy. Increased strength and corrosion resistance are just two of the physical benefits of vinyl ester. Due to of this, it is a preferred substance among many others. It has a low viscosity and is not easily absorbed by water. Compared to other materials, it offers superior mechanical qualities and strength.

Due to growing environmental concerns, new legislation governing hazardous emissions, and rising demand for corrosion-resistant materials, the flue gas desulfurization (FGD) industry is seeing increased demand for installations. These factors are also driving the vinyl ester market. The ongoing demand for vinyl ester in the chemical and water and wastewater treatment end-use industries is another factor driving the vinyl ester market. However, the market for vinyl ester is being hampered by lower prices and easy access to replacements. Additionally, during the period of forecasting the global vinyl ester market, there will be opportunities due to the rise in wind turbine installations globally and subsequent growth in the usage of vinyl ester in public transit buses and trains.

The improved corrosion, high strength, and durability of vinyl ester, along with its rising demand from a variety of industries including construction, automotive, and chemical processing, are the market’s primary growth factors. Additional factors driving the market expansion for vinyl ester resins include expanding infrastructure development investments, the demand for lightweight materials, and increased environmental sustainability consciousness.

The presence of cheaper alternatives, like epoxy resins, which have similar qualities, is one of the market restrictions for vinyl ester. The high production and processing costs of vinyl ester resins relative to other resin types also present a barrier to market expansion. Further factors that may impede market growth include changes in the cost of raw materials, strict rules governing the use of specific chemicals, and a lack of end-user knowledge of the advantages of vinyl ester resins.

Numerous chances for expansion exist in the vinyl ester market. Vinyl ester resins have a promising market environment thanks to the rising need for corrosion-resistant materials in developing nations. Additionally, due to the outstanding mechanical qualities of vinyl ester resins, the expanding use of composite materials in sectors including wind energy, aircraft, and marine applications presents substantial prospects. Additionally, improvements in curing systems and fire retardancy in vinyl ester resin technology open up new business opportunities and applications.

Infectious disease COVID-19 was first discovered in Hubei province of Wuhan city in late December. SARS-CoV-2, a virus that causes the severe acute respiratory syndrome, is extremely contagious and spreads from person to person. Since the diseases initial outbreak in December 2019, it has spread to nearly 213 nations, prompting the World Health Organization to declare a public health emergency on March 11, 2020. International and local companies in the vinyl ester business have already cut output as a result of the COVID-19 pandemic’s interruption.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons). |

| Segmentation | By Type, By Application, By Region. |

| By Type

|

|

| By Application

|

|

| By Region

|

|

Vinyl ester Market Segment Analysis

The vinyl ester market is segmented based on type and application.

According to type, the vinyl ester market for Bisphenol A Diglycidyl Ether (DGEBA) is anticipated to be the largest type segment from 2020 to 2030. Due to of their ability to resist corrosion, bisphenol A vinyl ester resins are employed in a wide range of chemical applications and FGD processes. Vinyl ester resins are mostly used in the maritime sector as gel coats, barrier coats, and in the main composite body of ships.

In terms of application, the pipes and tanks sector held around 53.3% of the vinyl ester market share in 2020. In high-temperature formulations like chemical reactors and storage tanks, vinyl ester is employed. As topcoats for metal containers and electro-refining tanks, it is also utilized.

Vinyl Ester Market Player

The vinyl ester market key players includes AOC, LLC, Ashland Global Holdings Inc., DIC CORPORATION, INEOS, Interplastic Corporation, Polynt, Reinchhold LLC 2, SHOWA DENKO K.K., Sino Polymer Co., Ltd., Swancor.

10 December 2020: AOC announced it has completed the acquisition of the Unsaturated Polyester Resin (UPR) manufacturing operations in Ústí nad Labem (Czech Republic). This footprint extension will allow AOC to further improve service and logistics to its customers in Central/ Eastern Europe as well as in Germany, and will make new products (e.g. based on recycled PET) available for customers around Europe.

15 January 2020: AOC announced that per 3 march 2020, BÜFA composite systems, the German-based supplier of tailor-made unsaturated polyester resins and resin formulations, will acquire AOC (UK) Ltd. After completion of the acquisition, aoc (UK) Ltd. Will be trading under the name of BÜFA composites UK. AOC will remain the supplier of the resins portfolio.

Who Should Buy? Or Key Stakeholders

- Manufacturers, Dealers, and Suppliers of Vinyl Esters

- Government and Research Organizations

- Companies Operational in Material R&D

- Associations and Industrial Bodies

- Investment Banks

- Consulting Companies/Consultants in Chemical and Material Sectors

- Others

Vinyl Ester Market Regional Analysis

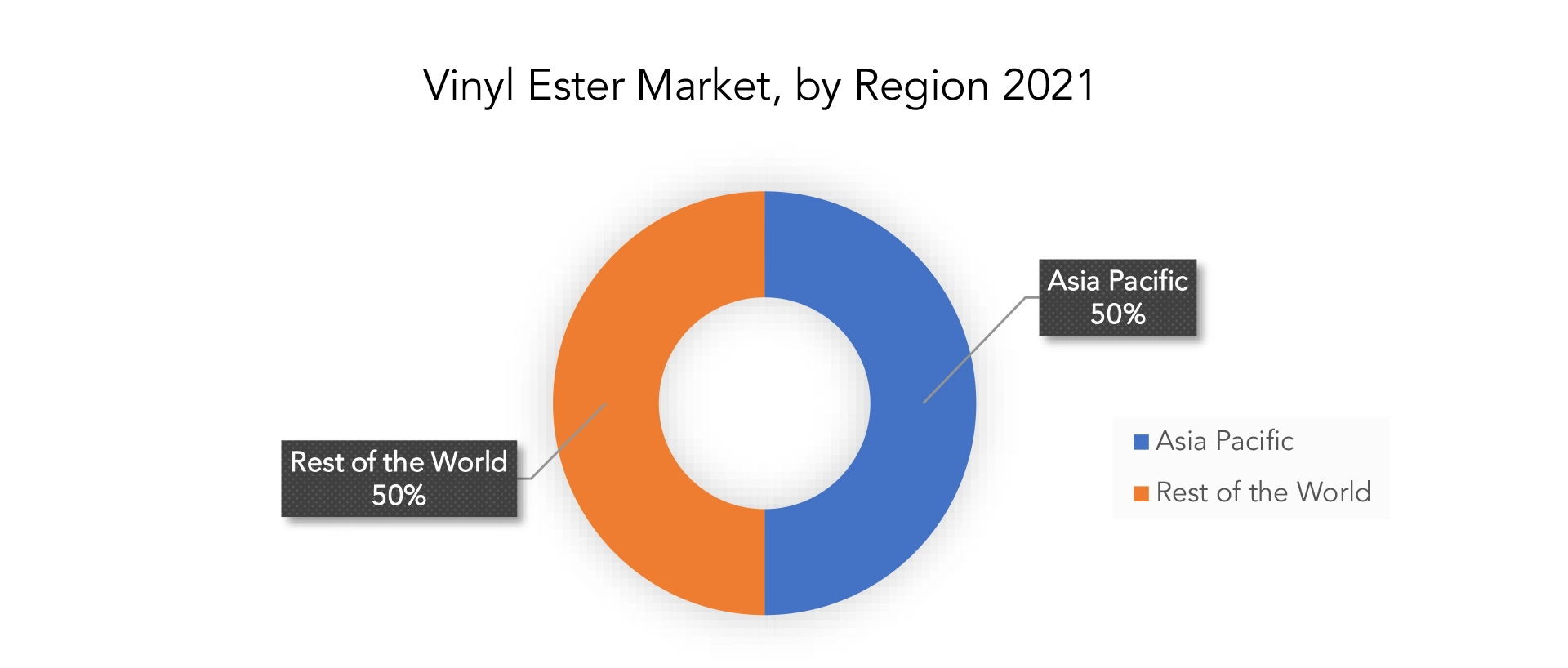

The vinyl ester market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Over the course of the prediction, the Asia-Pacific area is expected to overtake other markets as the main one. The primary drivers for the regional market growth include the developing construction sector, burgeoning demand for corrosion-resistant pipes & tanks, rising demand for raw materials, and vigorous urbanisation. The two countries in this region that are most prominently experiencing a substantial boom in the shipbuilding and marine industries are China and South Korea. As a result, the nations serve as the market’s primary growth drivers for vinyl ester resins in the Asia Pacific region.

Applications of vinyl ester in industry and wind energy are further market drivers in North America. Significant market shares are also held by the shipbuilding or marine sector. The European vinyl ester market is driven by Western European nations like France, Germany, the United Kingdom, Belgium, and Spain due to mature end-use markets. The vinyl esters market is quite minor in the Middle East and Africa and South America. Local vinyl ester markets in the Middle East are driven by the chemicals and petrochemicals sectors. South America’s market is led by Brazil and Mexico. The market has been impacted by the significant political and economic unrest in the area. Over the projected period, it is anticipated that demand for vinyl ester would rise due to the improvement in socioeconomic conditions.

Key Market Segments: Vinyl Ester Market

Vinyl Ester Market by Type, 2020-2029, (USD Billion), (Kilotons).

- Bisphenol A Di glycidyl Ether (DGEBA)

- Epoxy Phenol Novolac (EPN)

- Brominated Fire Retardant

- Others

Vinyl Ester Market by Application, 2020-2029, (USD Billion), (Kilotons).

- Pipes & Tanks

- Paints & Coatings

- Transportation

- Pulp & Paper

- Others

Vinyl Ester Market by Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the vinyl ester market over the next 7 years?

- Who are the major players in the vinyl ester market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the vinyl ester market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the vinyl ester market?

- What is the current and forecasted size and growth rate of the global vinyl ester market?

- What are the key drivers of growth in the vinyl ester market?

- What are the distribution channels and supply chain dynamics in the vinyl ester market?

- What are the technological advancements and innovations in the vinyl ester market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the vinyl ester market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the vinyl ester market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of vinyl ester in the market and what is the impact of raw application prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL VINYL ESTER MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON VINYL ESTER MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL VINYL ESTER MARKET OUTLOOK

- GLOBAL VINYL ESTER MARKET BY TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- BISPHENOL A DIGLYCIDYL ETHER (DGEBA)

- EPOXY PHENOL NOVOLAC (EPN)

- BROMINATED FIRE RETARDANT

- OTHERS

- GLOBAL VINYL ESTER MARKET BY APPLICATION, 2020-2029, (USD BILLION), (KILOTONS)

- PIPES & TANKS

- PAINTS & COATINGS

- TRANSPORTATION

- PULP & PAPER

- OTHERS

- GLOBAL VINYL ESTER MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AOC, LLC

- ASHLAND GLOBAL HOLDINGS INC.

- DIC CORPORATION

- INEOS

- INTERPLASTIC CORPORATION

- POLYNT

- REINCHHOLD LLC 2

- SHOWA DENKO K.K.

- SINO POLYMER CO., LTD.

- SWANCOR

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL VINYL ESTER MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL VINYL ESTER MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA VINYL ESTER MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA VINYL ESTER MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA VINYL ESTER MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA VINYL ESTER MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 31 BRAZIL VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 33 BRAZIL VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 ARGENTINA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 ARGENTINA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 COLOMBIA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 COLOMBIA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC VINYL ESTER MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC VINYL ESTER MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 55 INDIA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 CHINA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 CHINA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 JAPAN VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 JAPAN VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE VINYL ESTER MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE VINYL ESTER MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 UK VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 UAE VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA VINYL ESTER MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL VINYL ESTER BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL VINYL ESTER BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL VINYL ESTER BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL VINYL ESTER BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL VINYL ESTER BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL VINYL ESTER BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AOC, LLC: COMPANY SNAPSHOT

FIGURE 17 ASHLAND GLOBAL HOLDINGS INC.: COMPANY SNAPSHOT

FIGURE 18 DIC CORPORATION: COMPANY SNAPSHOT

FIGURE 19 INEOS: COMPANY SNAPSHOT

FIGURE 20 INTERPLASTIC CORPORATION: COMPANY SNAPSHOT

FIGURE 21 POLYNT: COMPANY SNAPSHOT

FIGURE 22 REINCHHOLD LLC 2: COMPANY SNAPSHOT

FIGURE 23 SHOWA DENKO K.K.: COMPANY SNAPSHOT

FIGURE 24 SINO POLYMER CO., LTD.: COMPANY SNAPSHOT

FIGURE 25 SWANCOR: COMPANY SNAPSHOT

FAQ

The vinyl ester market is expected to grow at 6.4 % CAGR from 2022 to 2029. It is expected to reach above USD 1.92 billion by 2029 from USD 1.1 billion in 2020.

Asia Pacific held more than 50% of the vinyl ester market revenue share in 2021 and will witness expansion in the forecast period.

The improved corrosion resistance, high strength, and durability of vinyl ester, along with its rising demand from a variety of industries including construction, automotive, and chemical processing, are the market’s primary growth factors.

In terms of application, the pipes and tanks sector held around 53.3% of the vinyl ester market share in 2020. In high-temperature formulations like chemical reactors and storage tanks, vinyl ester is employed. As topcoats for metal containers and electro-refining tanks, it is also utilized.

Asia Pacific is the largest regional market for vinyl ester market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.