REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.90 billion by 2029 | 7.5% CAGR | North America |

| By Contact Position | By Type | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Reed Sensor Market Overview

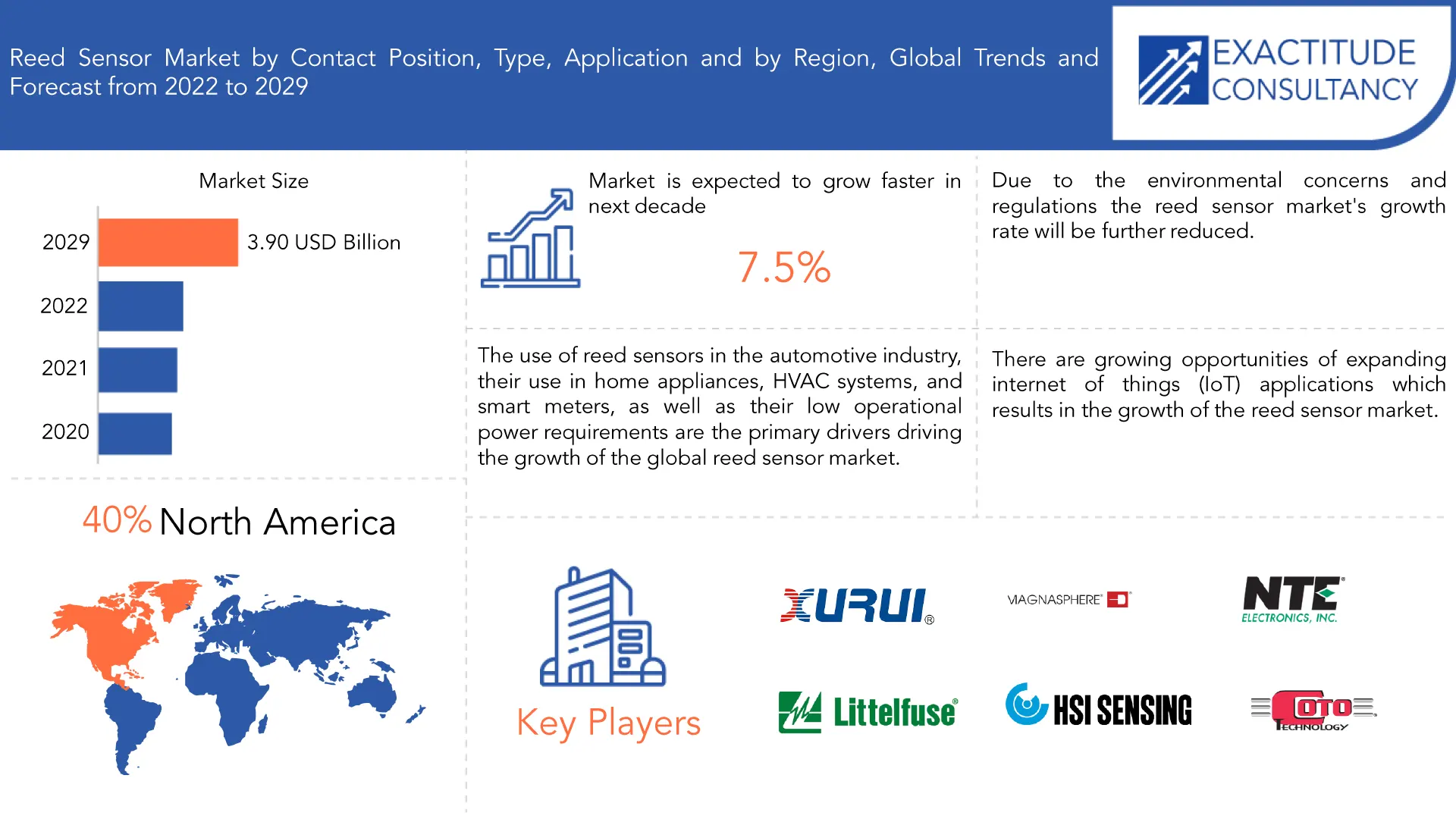

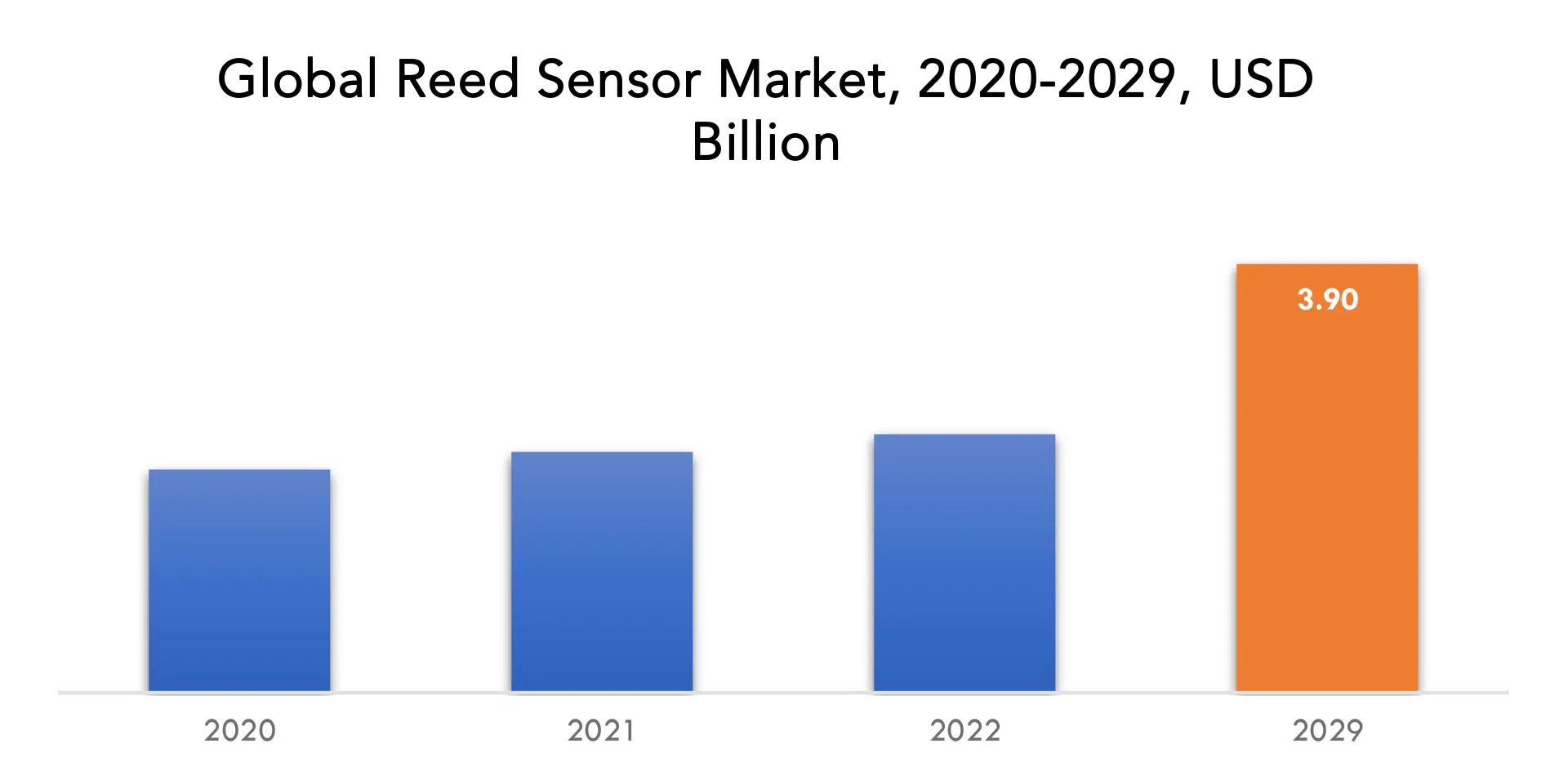

Reed sensor market is expected to grow at 7.5% CAGR from 2022 to 2029. It was valued 2.03 billion at 2020. It is expected to reach above USD 3.90 billion by 2029.

The use of reed sensors in the automotive industry, their use in home appliances, HVAC systems, and smart meters, as well as their low operational power requirements and ability to operate in hostile environments, are the primary drivers driving the growth of the global reed sensor market.

The reed sensor market refers to the industry involved in the manufacturing, distribution, and sale of reed sensors. Reed sensors are electronic devices that utilize a reed switch and a magnet to detect and respond to changes in magnetic fields. They are commonly used for proximity sensing, position detection, and contactless switching applications. The market encompasses various sectors, including automotive, telecommunications, consumer electronics, industrial automation, healthcare, and more. Reed sensors are known for their reliability, compact size, and low power consumption, making them a popular choice in many industries. They offer advantages such as high sensitivity, fast response times, and resistance to vibration and shock. Their simple operating principle and versatility make them suitable for a wide range of applications, including door and window sensors, flow meters, security systems, and automotive sensors.

The reed sensor market is driven by several factors, including the increasing demand for automation and smart devices, advancements in sensor technology, and the growing adoption of Internet of Things (IoT) devices. Additionally, the automotive industry’s focus on safety and comfort features, as well as the rising need for energy-efficient solutions in various sectors, contribute to the market’s growth. The market is characterized by intense competition, with numerous players offering reed sensors with different specifications and features to cater to diverse customer requirements.

The reed sensor market is influenced by various dynamics that shape its growth and development. The increasing demand for automation and smart devices across industries is a key driving factor. Reed sensors play a crucial role in enabling automation and control systems by providing accurate and reliable proximity and position sensing capabilities. As industries continue to embrace automation for improved efficiency and productivity, the demand for reed sensors is expected to grow significantly. Advancements in sensor technology contribute to the dynamics of the Reed Sensor Market. Manufacturers are continuously innovating and improving reed sensor designs, enhancing their performance, sensitivity, and durability. Miniaturization and integration of reed sensors with other components have also been a focus, allowing for more compact and versatile applications. These technological advancements open up new possibilities and expand the potential applications of reed sensors, further fueling market growth.

The proliferation of Internet of Things (IoT) devices is driving the demand for reed sensors. IoT devices rely on sensors for data collection and monitoring, and reed sensors provide a reliable and cost-effective solution for various IoT applications. As IoT adoption continues to increase across industries, the demand for reed sensors as part of IoT-enabled systems is expected to rise. The ability of reed sensors to operate in harsh environments and their compatibility with wireless communication technologies make them suitable for IoT deployments in sectors such as smart homes, industrial automation, and healthcare. The reed sensor market is driven by the demand for automation, advancements in sensor technology, and the growth of IoT applications. These dynamics create a favorable environment for the market’s expansion, with continuous innovation and expanding application areas paving the way for future growth opportunities.

Reed Sensor Market Segment Analysis

By contact position the market is segmented into form A, form B, form C, others. Form A refers to a normally open (NO) configuration where the contacts are closed in the presence of a magnetic field. Form B represents a normally closed (NC) configuration where the contacts are open in the presence of a magnetic field. Form C, also known as a changeover or SPDT (Single Pole Double Throw), has a common contact and two switchable contacts, allowing for both NO and NC operations. These contact forms cater to different application requirements. Apart from these, there may be other specialized contact configurations available to meet specific needs in the market.

By type the market is segmented into dry reed sensor, mercury-wetted reed sensor. Dry reed sensors and mercury-wetted reed sensors are two common types of reed sensors in the market. Dry reed sensors utilize sealed reed switches without any additional substances, offering a cost-effective and environmentally-friendly solution. They are commonly used in various applications such as proximity sensing, security systems, and automotive applications. On the other hand, mercury-wetted reed sensors feature reed switches that are immersed in a mercury-filled environment. These sensors provide enhanced performance in terms of switching speed, reliability, and low contact resistance. They find applications in high-demanding industries like telecommunications, aerospace, and medical equipment where precise and high-speed switching is required.

By application the market is segmented into telecommunication, automotive & transportation, safety & security, healthcare, construction, others. In the reed sensor market, the telecommunication sector relies on reed sensors for applications such as proximity detection in mobile devices and magnetic sensing in telecommunications infrastructure equipment. In automotive and transportation, reed sensors play a vital role in speed and position sensing, fuel level sensing, and seatbelt detection. The safety and security industry utilizes reed sensors in door/window sensors, alarm systems, and access control systems. In healthcare, reed sensors are used in medical devices, such as infusion pumps and patient monitoring systems. Reed sensors also find applications in construction for level sensing, proximity detection, and automation systems. Furthermore, reed sensors have diverse applications in industries like industrial automation, consumer electronics, and energy management systems.

Reed Sensor Market Key Players

Reed sensor market key players include Aleph America, Stg Germany GmbH, Zhejiang Xurui Electronic, Magnasphere, Nte Electronics, Littelfuse, HSI Sensing, Ryazan Metal Ceramics Instrumentation Plant JSC (RMCIP), PIC GmbH, Coto Technology, Pickering Electronics, Aleph America, and Zhejiang Xurui Electronic.

November 28, 2022: NTE Introduced Piezo Electric Buzzers.

June 08, 2023: Littelfuse Launched NEMA-style Surge Protective Device (SPDN) Series.

Who Should Buy? Or Key stakeholders

- Manufacturers

- Distributors and suppliers

- End user

- System integrators

- Research and development teams

- Regulatory authorities

- Industry associations

- Consultants and analysts

- Investors and financial institutions

- Government agencies

- Others

Sensor Market Regional Analysis Reed

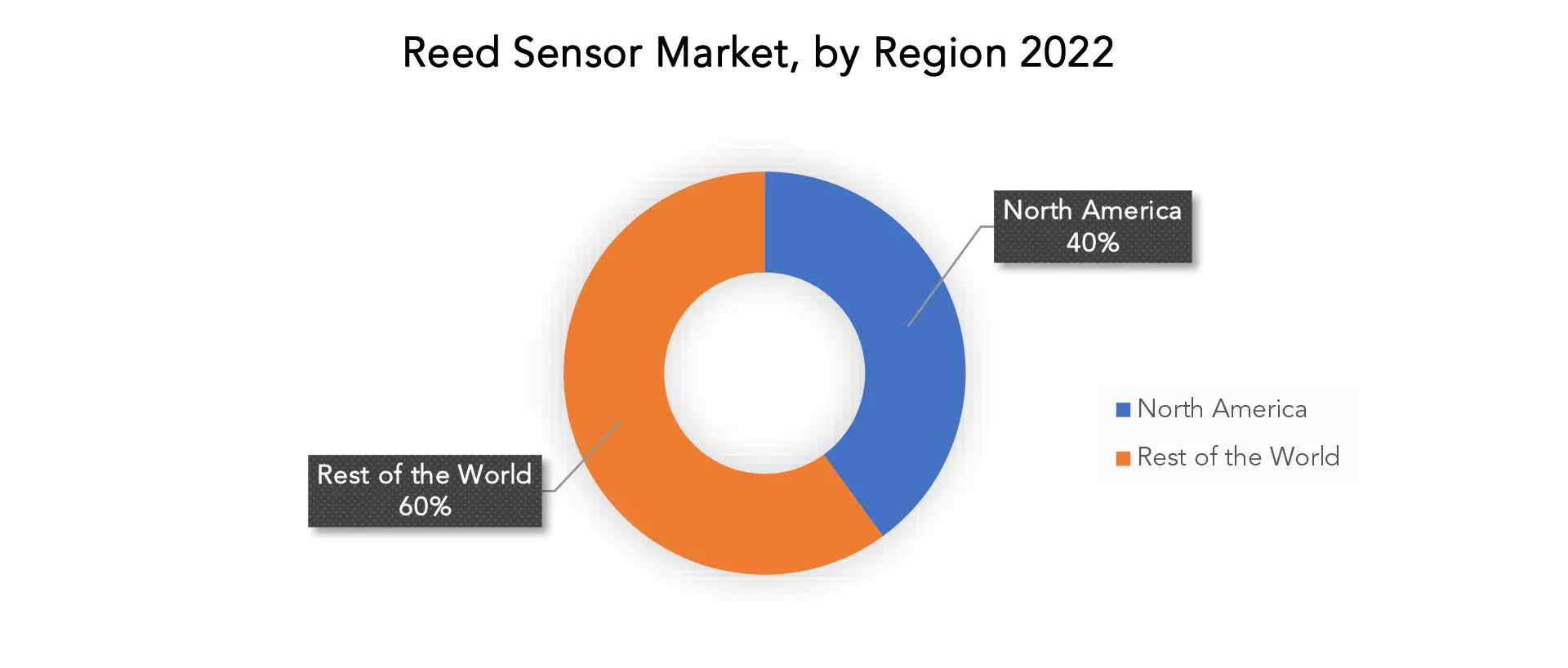

Reed sensor market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The North America reed sensor market has witnessed significant growth in recent years. Factors contributing to this growth include the region’s strong industrial base, technological advancements, and increasing demand for automation and IoT applications across various sectors. The automotive industry, in particular, has been a major driver, with the integration of reed sensors in vehicles for safety systems, position sensing, and fuel level detection. Additionally, the growing focus on renewable energy and smart grid infrastructure has created opportunities for reed sensors in the energy sector. The presence of key players and a favorable regulatory environment further support the market’s growth in North America.

Key Market Segments: Reed Sensor Market

Reed Sensor Market By Contact Position, 2020-2029, (USD Billion, Thousand Units)

- Form A

- Form B

- Form C

- Others

Reed Sensor Market By Type, 2020-2029, (USD Billion, Thousand Units)

- Dry Reed Sensor

- Mercury-Wetted Reed Sensor

Reed Sensor Market By Application, 2020-2029, (USD Billion, Thousand Units)

- Telecommunication

- Automotive & Transportation

- Safety & Security

- Healthcare

- Construction

- Others

Reed Sensor Market By Region, 2020-2029, (USD Billion, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new Type

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the reed sensor market over the next 7 years?

- Who are the major players in the reed sensor market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the reed sensor market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the reed sensor market?

- What is the current and forecasted size and growth rate of the global reed sensor market?

- What are the key drivers of growth in the reed sensor market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the reed sensor market?

- What are the technological advancements and innovations in the reed sensor market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the reed sensor market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the reed sensor market?

- What are the product voltage ratings and specifications of leading players in the market?

- What is the pricing trend of reed sensor market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL REED SENSOR MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON REED SENSOR MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL REED SENSOR MARKET OUTLOOK

- GLOBAL REED SENSOR MARKET BY CONTACT POSITION (USD BILLION, THOUSAND UNITS), 2020-2029

- FORM A

- FORM B

- FORM C

- OTHERS

- GLOBAL REED SENSOR MARKET BY TYPE (USD BILLION, THOUSAND UNITS), 2020-2029

- DRY REED SENSOR

- MERCURY-WETTED REED SENSOR

- GLOBAL REED SENSOR MARKET BY APPLICATION (USD BILLION, THOUSAND UNITS), 2020-2029

- TELECOMMUNICATION

- AUTOMOTIVE & TRANSPORTATION

- SAFETY & SECURITY

- HEALTHCARE

- CONSTRUCTION

- OTHERS

- GLOBAL REED SENSOR MARKET BY REGION (USD BILLION, THOUSAND UNITS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ALEPH AMERICA

- STG GERMANY GMBH

- ZHEJIANG XURUI ELECTRONIC

- MAGNASPHERE

- NTE ELECTRONICS

- LITTELFUSE

- HSI SENSING

- RYAZAN METAL CERAMICS INSTRUMENTATION PLANT JSC (RMCIP)

- PIC GMBH

- COTO TECHNOLOGY

- PICKERING ELECTRONICS

- ALEPH AMERICA

- ZHEJIANG XURUI ELECTRONIC *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 2 GLOBAL REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 4 GLOBAL REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 6 GLOBAL REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL REED SENSOR MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL REED SENSOR MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA REED SENSOR BY COUNTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA REED SENSOR BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA REED SENSOR MARKET BY APPLICATION INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 17 US REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 18 US REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 19 US REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 20 US REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 US REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 22 US REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 24 CANADA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 CANADA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 CANADA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 30 MEXICO REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 MEXICO REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 MEXICO REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA REED SENSOR MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA REED SENSOR MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 39 SOUTH AMERICA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 44 BRAZIL REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 45 BRAZIL REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 46 BRAZIL REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 BRAZIL REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 48 BRAZIL REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 50 ARGENTINA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 51 ARGENTINA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 52 ARGENTINA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 ARGENTINA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 54 ARGENTINA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 56 COLOMBIA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 57 COLOMBIA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 58 COLOMBIA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 59 COLOMBIA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 60 COLOMBIA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 61 COLOMBIA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 62 REST OF SOUTH AMERICA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 63 REST OF SOUTH AMERICA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 64 REST OF SOUTH AMERICA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 65 REST OF SOUTH AMERICA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 66 REST OF SOUTH AMERICA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 67 REST OF SOUTH AMERICA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 68 ASIA-PACIFIC REED SENSOR MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 69 ASIA-PACIFIC REED SENSOR MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 70 ASIA-PACIFIC REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 71 ASIA-PACIFIC REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 72 ASIA-PACIFIC REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 73 ASIA-PACIFIC REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 74 ASIA-PACIFIC REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 75 ASIA-PACIFIC REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 76 INDIA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 77 INDIA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 78 INDIA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 79 INDIA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 80 INDIA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 81 INDIA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 82 CHINA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 83 CHINA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 84 CHINA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 85 CHINA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 86 CHINA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 87 CHINA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 88 JAPAN REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 89 JAPAN REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 90 JAPAN REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 91 JAPAN REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 92 JAPAN REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 93 JAPAN REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 94 SOUTH KOREA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 95 SOUTH KOREA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 96 SOUTH KOREA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 97 SOUTH KOREA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 98 SOUTH KOREA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 99 SOUTH KOREA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 100 AUSTRALIA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 101 AUSTRALIA REED SENSOR BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 102 AUSTRALIA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 103 AUSTRALIA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 104 AUSTRALIA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 105 AUSTRALIA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 106 SOUTH EAST ASIA REED SENSOR MARKET BY CONTACT POSITION (USD MI LLION), 2020-2029

TABLE 107 SOUTH EAST ASIA REED SENSOR BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 108 SOUTH EAST ASIA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 109 SOUTH EAST ASIA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 110 SOUTH EAST ASIA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 111 SOUTH EAST ASIA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 112 REST OF ASIA PACIFIC REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 113 REST OF ASIA PACIFIC REED SENSOR BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 114 REST OF ASIA PACIFIC REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 115 REST OF ASIA PACIFIC REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 116 REST OF ASIA PACIFIC REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 117 REST OF ASIA PACIFIC REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 118 EUROPE REED SENSOR MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 119 EUROPE REED SENSOR MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 120 EUROPE REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 121 EUROPE REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 122 EUROPE REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 123 EUROPE REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 124 EUROPE REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 125 EUROPE REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 126 GERMANY REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 127 GERMANY REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 128 GERMANY REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 129 GERMANY REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 130 GERMANY REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 131 GERMANY REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 132 UK REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 133 UK REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 134 UK REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 135 UK REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 136 UK REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 137 UK REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 138 FRANCE REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 139 FRANCE REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 140 FRANCE REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 141 FRANCE REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 142 FRANCE REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 143 FRANCE REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 144 ITALY REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 145 ITALY REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 146 ITALY REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 147 ITALY REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 148 ITALY REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 149 ITALY REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 150 SPAIN REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 151 SPAIN REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 152 SPAIN REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 153 SPAIN REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 154 SPAIN REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 155 SPAIN REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 156 RUSSIA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 157 RUSSIA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 158 RUSSIA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 159 RUSSIA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 160 RUSSIA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 161 RUSSIA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 162 REST OF EUROPE REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 163 REST OF EUROPE REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 164 REST OF EUROPE REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 165 REST OF EUROPE REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 166 REST OF EUROPE REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 167 REST OF EUROPE REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA REED SENSOR MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA REED SENSOR MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 175 MIDDLE EAST AND AFRICA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 176 UAE REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 177 UAE REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 178 UAE REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 179 UAE REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 180 UAE REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 181 UAE REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 182 SAUDI ARABIA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 183 SAUDI ARABIA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 184 SAUDI ARABIA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 185 SAUDI ARABIA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 186 SAUDI ARABIA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 187 SAUDI ARABIA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 188 SOUTH AFRICA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 189 SOUTH AFRICA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 190 SOUTH AFRICA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 191 SOUTH AFRICA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 192 SOUTH AFRICA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 193 SOUTH AFRICA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA REED SENSOR MARKET BY CONTACT POSITION (USD BILLION), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA REED SENSOR MARKET BY CONTACT POSITION (THOUSAND UNITS), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA REED SENSOR MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA REED SENSOR MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA REED SENSOR MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 199 REST OF MIDDLE EAST AND AFRICA REED SENSOR MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL REED SENSOR BY CONTACT POSITION, USD BILLION, 2020-2029

FIGURE 9 GLOBAL REED SENSOR BY TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL REED SENSOR BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL REED SENSOR BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL REED SENSOR MARKET BY CONTACT POSITION, USD BILLION, 2021

FIGURE 14 GLOBAL REED SENSOR MARKET BY TYPE, USD BILLION, 2021

FIGURE 15 GLOBAL REED SENSOR MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL REED SENSOR MARKET BY REGION, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ALEPH AMERICA: COMPANY SNAPSHOT

FIGURE 19 STG GERMANY GMBH: COMPANY SNAPSHOT

FIGURE 20 ZHEJIANG XURUI ELECTRONIC: COMPANY SNAPSHOT

FIGURE 21 MAGNASPHERE: COMPANY SNAPSHOT

FIGURE 22 NTE ELECTRONICS: COMPANY SNAPSHOT

FIGURE 23 LITTELFUSE: COMPANY SNAPSHOT

FIGURE 24 HSI SENSING: COMPANY SNAPSHOT

FIGURE 25 RYAZAN METAL CERAMICS INSTRUMENTATION PLANT JSC (RMCIP): COMPANY SNAPSHOT

FIGURE 26 COTO TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 27 PICKERING ELECTRONICS: COMPANY SNAPSHOT

FIGURE 28 ALEPH AMERICA: COMPANY SNAPSHOT

FIGURE 29 ZHEJIANG XURUI ELECTRONIC: COMPANY SNAPSHOT

FAQ

Reed sensor market is expected to grow at 7.5% CAGR from 2022 to 2029. it is expected to reach above USD 3.90 billion by 2029

North America held more than 40% of reed sensor market revenue share in 2021 and will witness expansion in the forecast period.

The use of reed sensors in the automotive industry, their use in home appliances, HVAC systems, and smart meters, as well as their low operational power requirements and ability to operate in hostile environments, are the primary drivers driving the growth of the global reed sensor market.

In the reed sensor market, the telecommunication sector relies on reed sensors for applications such as proximity detection in mobile devices and magnetic sensing in telecommunications infrastructure equipment. In automotive and transportation, reed sensors play a vital role in speed and position sensing, fuel level sensing, and seatbelt detection. The safety and security industry utilizes reed sensors in door/window sensors, alarm systems, and access control systems. In healthcare, reed sensors are used in medical devices, such as infusion pumps and patient monitoring systems. Reed sensors also find applications in construction for level sensing, proximity detection, and automation systems.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.