REPORT OUTLOOK

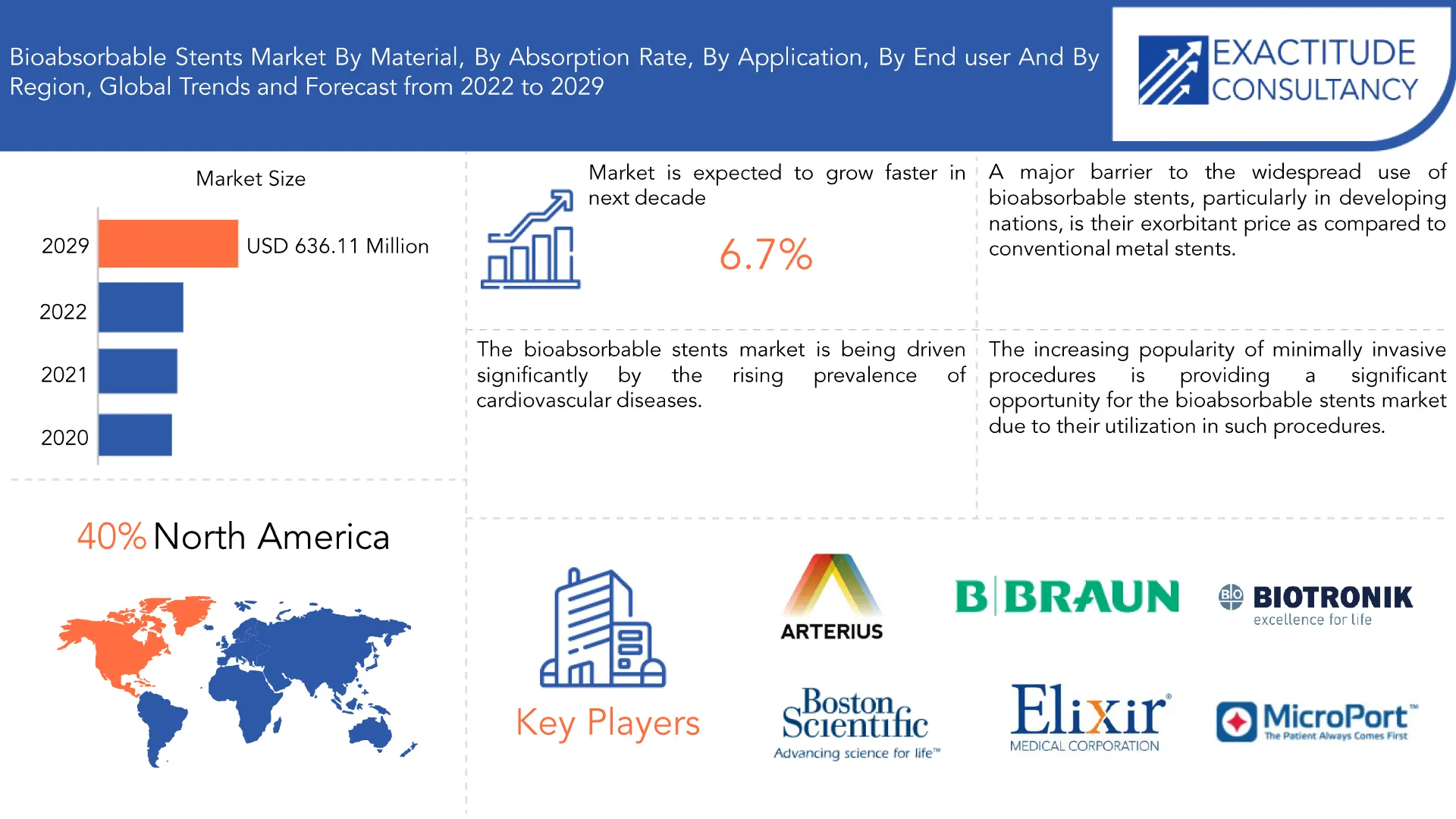

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 636.11 Million by 2029 | 6.7% | North America |

| By Material | By Absorption Rate | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Bioabsorbable Stents Market Overview

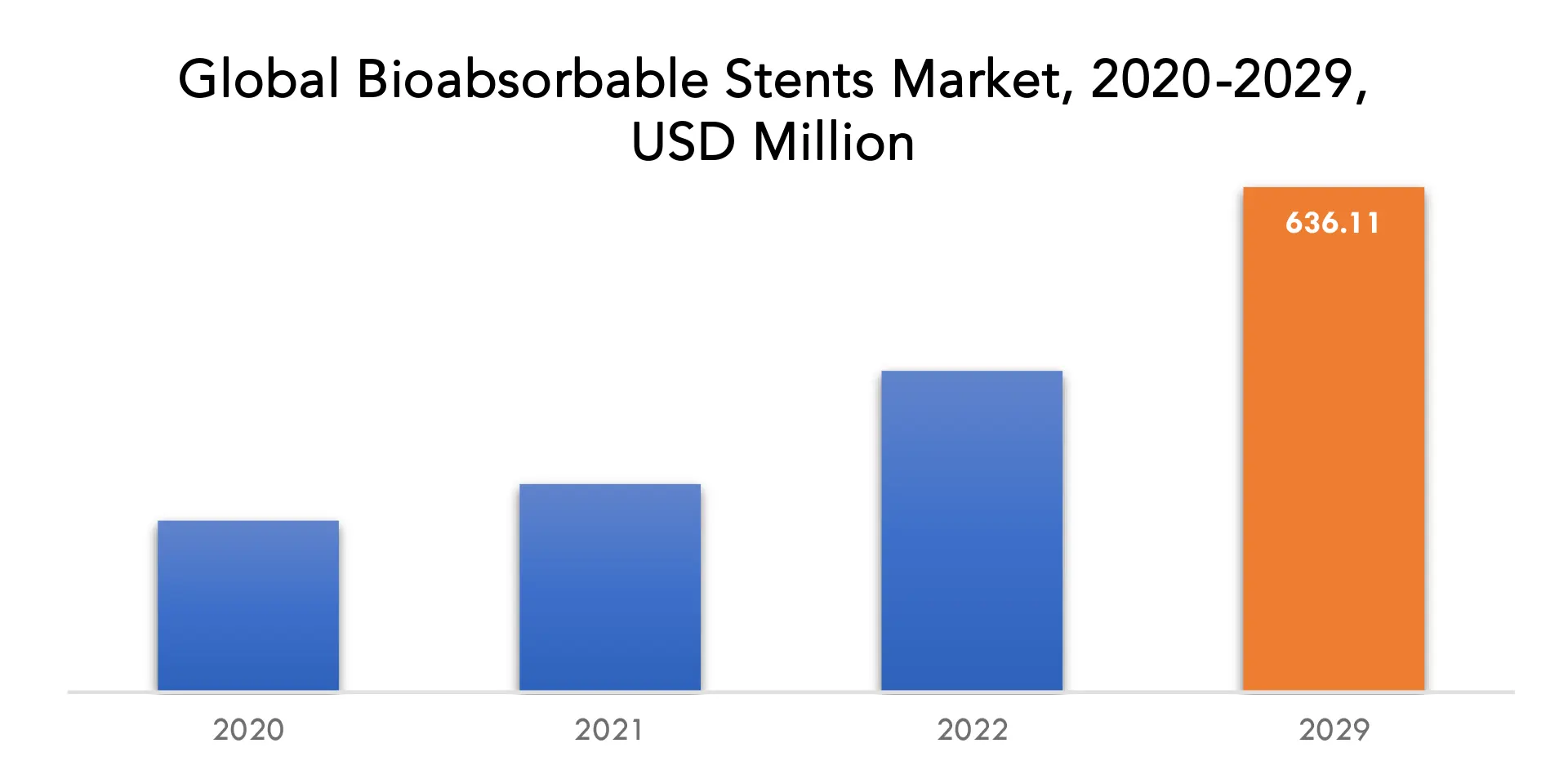

The bioabsorbable stents market is expected to grow at 6.7% CAGR from 2022 to 2029. It is expected to reach above USD 636.11 Million by 2029 from USD 262 Million in 2021.

Bioabsorbable stents, also known as biodegradable stents, are medical devices utilized for treating narrowed or blocked arteries resulting from plaque buildup. These stents are made of materials that are naturally absorbed by the body, eliminating the requirement for a permanent implant.

Bioabsorbable stents gradually dissolve and are replaced by new tissue as the artery heals, unlike conventional stents made of metal that remain in the body indefinitely. This restoration of normal blood flow reduces the risk of long-term complications like stent thrombosis.

Typically, bioabsorbable stents are produced from biocompatible and biodegradable materials like polylactic acid, polyglycolic acid, and other polymers. These materials are designed to provide temporary support to the artery during the healing process and then gradually degrade into harmless byproducts that are eliminated from the body.

However, there are also some drawbacks to bioabsorbable stents. They can be more expensive than traditional stents, and there are concerns about their long-term safety and effectiveness. Some studies have suggested that bioabsorbable stents may be associated with a higher risk of certain complications, such as the need for repeat procedures or heart attacks.

The bioabsorbable stents market is being driven significantly by the rising prevalence of cardiovascular diseases, including coronary artery disease, heart attacks, and strokes, which remain leading causes of death globally. Bioabsorbable stents are a reliable treatment option for cardiovascular diseases, restoring blood flow to the affected artery and reducing the risk of complications, including stent thrombosis. As the incidence of cardiovascular diseases continues to rise, there is a growing demand for effective treatments like bioabsorbable stents, which is fueling market growth. Additionally, bioabsorbable stents offer several benefits over traditional metal stents, including reduced risk of long-term complications, better long-term outcomes, and improved patient comfort.

A major barrier to the widespread use of bioabsorbable stents, particularly in developing nations, is their exorbitant price as compared to conventional metal stents. The intricacy of the manufacturing process and the usage of more expensive biodegradable materials than conventional ones are to blame for the price disparity. Another big hurdle to the commercialization for bioabsorbable stents is technical difficulties. Complex technological procedures are needed to produce bioabsorbable stents, which may restrict supply and impede market expansion. These obstacles include making sure the stent degrades at the right rate, maintaining the stent’s structural integrity during deployment, and achieving consistent mechanical qualities.

The increasing popularity of minimally invasive procedures is providing a significant opportunity for the bioabsorbable stents market due to their utilization in such procedures. Minimally invasive procedures offer several advantages over traditional open surgeries, including shorter hospital stays, faster recovery times, and a lower risk of complications. Bioabsorbable stents are especially well-suited for minimally invasive procedures since they can be inserted through a small incision and gradually dissolve over time, eliminating the need for a permanent implant. As a result, they are an appealing treatment option for patients who are not suitable candidates for conventional metal stents or who prefer a less invasive treatment approach.

On the one hand, as hospitals were concentrating on treating COVID-19 patients, the pandemic resulted in a decrease in elective treatments, particularly those requiring bioabsorbable stents. On the other side, due to the need to cut down on hospital stays and prevent virus exposure, the pandemic also resulted in a rise in demand for minimally invasive procedures, particularly those utilizing bioabsorbable stents. In addition, the pandemic raised attention on lowering healthcare expenses, which might enhance interest in bioabsorbable stents as a less expensive option to conventional metal stents.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million) ,(Thousand Units) |

| Segmentation | By Material, Absorption Rate, Application, End user |

| By Material |

|

| By Absorption Rate |

|

| By Application |

|

| By End user |

|

| By Region

|

|

Bioabsorbable Stents Market Segment Analysis

The bioabsorbable stents market is segmented based on material, absorption rate, application and end user.

Bioresorbable polymer-based stents have the largest market share for the bioabsorbable stents market based on material. These stents are made from biocompatible and biodegradable polymers such as polylactic acid and polyglycolic acid, and they gradually dissolve over time while being replaced by new tissue as the artery heals.

Based on the absorption rate, slow-absorption stents have a larger market share compared to fast-absorption stents in the bioabsorbable stents market. Slow-absorption stents are designed to dissolve more gradually over a period of months to years, while fast-absorption stents dissolve more rapidly over a period of weeks to months.

Based on application, coronary artery disease has the biggest market share for bioabsorbable stents. Blockages in the coronary arteries, which carry blood to the heart, are primarily treated with bioabsorbable stents. These obstructions may result in heart attacks, shortness of breath, and severe chest pain.

Based on end users, hospitals hold the greatest market share for bioabsorbable stents. This is as bioabsorbable stents are most commonly used in hospitals, which serve as the principal healthcare settings for the diagnosis and treatment of cardiovascular disorders. Hospitals also have specialized cardiac care departments that treat patients with advanced cardiovascular problems who need bioabsorbable stents and other cutting-edge therapies.

Bioabsorbable Stents Market Players

The bioabsorbable stents market key players include Arterius Limited, B. Braun Melsungen Ag, Biotronik Se & Co. Kg, Boston Scientific Corporation, Elixir Medical Corporation, Kyoto Medical Planning Co. Ltd, Microport Scientific Corporation, Abbott Laboratories, REVA Medical, Inc.

November 4, 2021: B. Braun and REVA Medical announced the strategic partnership for the distribution of Fantom Encore – a bioresorbable scaffold for coronary interventions, manufactured with REVA’s patented material Tyrocore. B. Braun started active distribution of the products in Germany and Switzerland in November 2021, with additional countries to follow soon.

April 24, 2023: Shanghai MicroPort Endovascular MedTech (Group) Co., Ltd. (Endovastec™) received registration approval from the Health Sciences Authority (HSA) of Singapore for its HerculesTM Thoracic Stent Graft with Low Profile Delivery System covered stent (hereafter referred to as “Hercules TM -LP Stent Graft”). This is the first product of MicroPort Endovastec to have been approved for market in Singapore.

Who Should Buy? Or Key stakeholders

- Bioabsorbable Stents Market Suppliers

- Raw Materials Manufacturers

- Healthcare organizations

- Research Organizations

- Investors

- Regulatory Authorities

Bioabsorbable Stents Market Regional Analysis

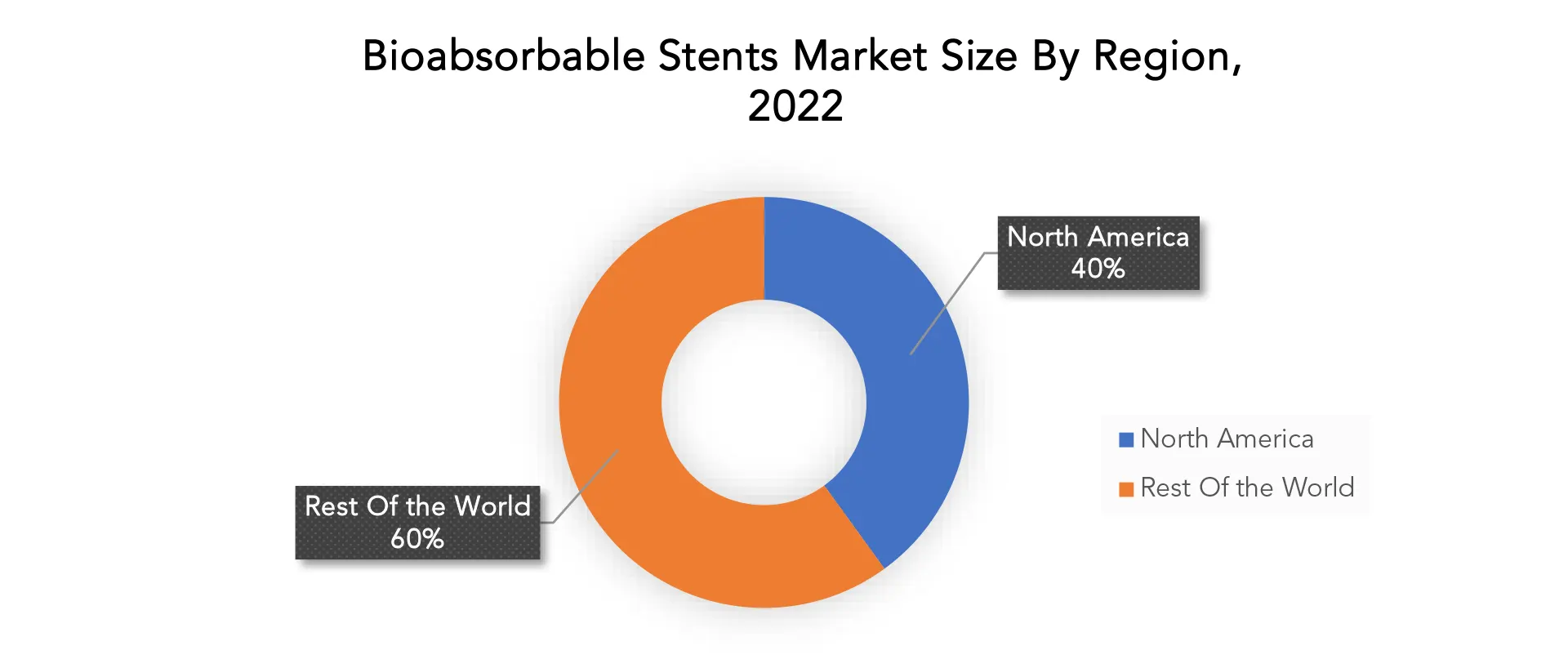

The bioabsorbable stents market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

In the upcoming years, the market for bioabsorbable stents in North America is anticipated to expand significantly. The increased incidence of cardiovascular disorders, such as coronary artery disease and peripheral artery disease, in this region is one of the major factors causing this growth. The market for these devices is anticipated to rise as bioabsorbable stents are a successful therapeutic option for many illnesses.The rising popularity of minimally invasive procedures is another factor fueling the rise of the North American market for bioabsorbable stents. Since they can be inserted through a small incision and gradually disappear over time, bioabsorbable stents are especially well-suited for minimally invasive procedures. This eliminates the need for a permanent implant.

In Europe, the bioabsorbable stents market has been driven by the increasing incidence of cardiovascular diseases, a growing aging population, and the development of innovative products by key players in the market. Similarly, in South America, the bioabsorbable stents market is also growing rapidly, driven by factors such as the increasing prevalence of cardiovascular diseases, improving healthcare infrastructure, and rising disposable incomes.

Key Market Segments: Bioabsorbable Stents Market

Bioabsorbable Stents Market By Material, 2020-2029, (USD Million),(Thousand Units)

- Bioresorbable polymer based stents

- Bioresorbable metallic stents

Bioabsorbable Stents Market By Absorption Rate, 2020-2029, (USD Million) ,(Thousand Units)

- Slow-absorption stents

- Fast-absorption stents

Bioabsorbable Stents Market By Application, 2020-2029, (USD Million) ,(Thousand Units)

- Coronary artery diseases

- Peripheral artery diseases

Bioabsorbable Stents Market By End User , 2020-2029, (USD Million) ,(Thousand Units)

- Hospitals

- Cardiac Centers

Bioabsorbable Stents Market By Region, 2020-2029, (USD Million) ,(Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered

- What is the expected growth rate of the bioabsorbable stents market over the next 7 years?

- Who are the major players in the bioabsorbable stents market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the bioabsorbable stents market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the bioabsorbable stents market?

- What is the current and forecasted size and growth rate of the global bioabsorbable stents market?

- What are the key drivers of growth in the bioabsorbable stents market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the bioabsorbable stents market?

- What are the technological advancements and innovations in the bioabsorbable stents market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the bioabsorbable stents market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the bioabsorbable stents market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of high temperature elastomers in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA ABSORPTION RATES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL BIOABSORBABLE STENTS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BIOABSORBABLE STENTS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL BIOABSORBABLE STENTS MARKET OUTLOOK

- GLOBAL BIOABSORBABLE STENTS MARKET BY MATERIAL, (USD MILLION) (THOUSAND UNITS) 2020-2029,

- BIORESORBABLE POLYMER BASED STENTS

- BIORESORBABLE METALLIC STENTS

- GLOBAL BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE,2020-2029, (USD MILLION) (THOUSAND UNITS) 2020-2029,

- SLOW-ABSORPTION STENTS

- FAST-ABSORPTION STENTS

- GLOBAL BIOABSORBABLE STENTS MARKET BY APPLICATION, 2020-2029,(USD MILLION) (THOUSAND UNITS) ,2020-2029

- CORONARY ARTERY DISEASES

- PERIPHERAL ARTERY DISEASES

- GLOBAL BIOABSORBABLE STENTS MARKET BY END USER, 2020-2029, (USD MILLION) (THOUSAND UNITS) ,2020-2029

- HOSPITALS

- CARDIAC CENTERS

- GLOBAL BIOABSORBABLE STENTS MARKET BY REGION , 2020-2029 ,(USD MILLION) (THOUSAND UNITS) ,2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ARTERIUS LIMITED

- BRAUN MELSUNGEN AG

- BIOTRONIK SE & CO. KG

- BOSTON SCIENTIFIC CORPORATION

- ELIXIR MEDICAL CORPORATION

- KYOTO MEDICAL PLANNING CO. LTD

- MICROPORT SCIENTIFIC CORPORATION]

- ABBOTT LABORATORIES

- REVA MEDICAL, INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BIOABSORBABLE STENTS MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 2 GLOBAL BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 4 GLOBAL BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 6 GLOBAL BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 8 GLOBAL BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 9 GLOBAL BIOABSORBABLE STENTS MARKET BY REGION (USD MILLION) 2020-2029

TABLE 10 GLOBAL BIOABSORBABLE STENTS MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 12 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 14 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 16 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 17 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 18 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 19 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 20 NORTH AMERICA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 21 US BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 22 US BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 23 US BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 24 US BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 25 US BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 26 US BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 27 US BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 28 US BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 29 CANADA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 30 CANADA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 31 CANADA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 32 CANADA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 33 CANADA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 34 CANADA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 35 CANADA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 36 CANADA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 37 MEXICO BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 38 MEXICO BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 39 MEXICO BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 40 MEXICO BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 41 MEXICO BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 42 MEXICO BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 MEXICO BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 44 MEXICO BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 45 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 46 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 48 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 50 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 51 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 52 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 53 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 54 SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 55 BRAZIL BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 56 BRAZIL BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 57 BRAZIL BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 58 BRAZIL BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 59 BRAZIL BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 60 BRAZIL BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 61 BRAZIL BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 62 BRAZIL BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 63 ARGENTINA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 64 ARGENTINA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 65 ARGENTINA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 66 ARGENTINA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 67 ARGENTINA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 68 ARGENTINA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 69 ARGENTINA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 70 ARGENTINA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 71 COLOMBIA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 72 COLOMBIA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 73 COLOMBIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 74 COLOMBIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 75 COLOMBIA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 76 COLOMBIA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 77 COLOMBIA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 78 COLOMBIA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 87 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 88 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 89 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 90 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 91 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 92 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 93 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 94 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 96 ASIA-PACIFIC BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 97 INDIA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 98 INDIA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 99 INDIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 100 INDIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 101 INDIA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 102 INDIA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 INDIA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 104 INDIA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 105 CHINA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 106 CHINA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 107 CHINA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 108 CHINA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 109 CHINA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 110 CHINA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 111 CHINA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 112 CHINA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 113 JAPAN BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 114 JAPAN BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 115 JAPAN BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 116 JAPAN BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 117 JAPAN BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 118 JAPAN BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 119 JAPAN BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 120 JAPAN BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 121 SOUTH KOREA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 122 SOUTH KOREA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 123 SOUTH KOREA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 124 SOUTH KOREA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH KOREA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 126 SOUTH KOREA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH KOREA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 128 SOUTH KOREA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 129 AUSTRALIA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 130 AUSTRALIA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 131 AUSTRALIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 132 AUSTRALIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 133 AUSTRALIA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 134 AUSTRALIA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 135 AUSTRALIA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 136 AUSTRALIA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 137 SOUTH-EAST ASIA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 139 SOUTH-EAST ASIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 141 SOUTH-EAST ASIA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 143 SOUTH-EAST ASIA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 153 EUROPE BIOABSORBABLE STENTS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 154 EUROPE BIOABSORBABLE STENTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 155 EUROPE BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 156 EUROPE BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 157 EUROPE BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 158 EUROPE BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 159 EUROPE BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 160 EUROPE BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 161 EUROPE BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 162 EUROPE BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 163 GERMANY BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 164 GERMANY BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 165 GERMANY BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 166 GERMANY BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 167 GERMANY BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 168 GERMANY BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 169 GERMANY BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 170 GERMANY BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 171 UK BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 172 UK BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 173 UK BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 174 UK BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 175 UK BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 176 UK BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 177 UK BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 178 UK BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 179 FRANCE BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 180 FRANCE BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 181 FRANCE BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 182 FRANCE BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 183 FRANCE BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 184 FRANCE BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 185 FRANCE BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 186 FRANCE BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 187 ITALY BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 188 ITALY BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 189 ITALY BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 190 ITALY BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 191 ITALY BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 192 ITALY BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 193 ITALY BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 194 ITALY BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 195 SPAIN BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 196 SPAIN BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 197 SPAIN BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 198 SPAIN BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 199 SPAIN BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 200 SPAIN BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 201 SPAIN BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 202 SPAIN BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 203 RUSSIA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 204 RUSSIA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 205 RUSSIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 206 RUSSIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 207 RUSSIA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 208 RUSSIA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 209 RUSSIA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 210 RUSSIA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 211 REST OF EUROPE BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 212 REST OF EUROPE BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 213 REST OF EUROPE BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 214 REST OF EUROPE BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 215 REST OF EUROPE BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 216 REST OF EUROPE BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 217 REST OF EUROPE BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 218 REST OF EUROPE BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 229 UAE BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 230 UAE BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 231 UAE BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 232 UAE BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 233 UAE BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 234 UAE BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 235 UAE BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 236 UAE BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 237 SAUDI ARABIA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 238 SAUDI ARABIA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 239 SAUDI ARABIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 240 SAUDI ARABIA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 241 SAUDI ARABIA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 242 SAUDI ARABIA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 243 SAUDI ARABIA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 244 SAUDI ARABIA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 245 SOUTH AFRICA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 246 SOUTH AFRICA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 247 SOUTH AFRICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 248 SOUTH AFRICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 249 SOUTH AFRICA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 250 SOUTH AFRICA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 251 SOUTH AFRICA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 252 SOUTH AFRICA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY MATERIAL(USD MILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY MATERIAL(THOUSAND UNITS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(USD MILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE(THOUSAND UNITS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY END USER(USD MILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA BIOABSORBABLE STENTS MARKET BY END USER(THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIOABSORBABLE STENTS MARKET BY MATERIAL, USD MILLION, 2020-2029

FIGURE 9 GLOBAL BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL BIOABSORBABLE STENTS MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL BIOABSORBABLE STENTS MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 12 GLOBAL BIOABSORBABLE STENTS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 GLOBAL BIOABSORBABLE STENTS MARKET BY MATERIAL, USD MILLION, 2021

FIGURE 14 GLOBAL BIOABSORBABLE STENTS MARKET BY ABSORPTION RATE, USD MILLION, 2021

FIGURE 15 GLOBAL BIOABSORBABLE STENTS MARKET BY APPLICATION, USD MILLION, 2021

FIGURE 16 GLOBAL BIOABSORBABLE STENTS MARKET BY END USER, USD MILLION, 2021

FIGURE 17 GLOBAL BIOABSORBABLE STENTS MARKET BY REGION, USD MILLION, 2021

FIGURE 18 PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 ARTERIUS LIMITED: COMPANY SNAPSHOT

FIGURE 21 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

FIGURE 22 BIOTRONIK SE & CO. KG: COMPANY SNAPSHOT

FIGURE 23 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

FIGURE 24 ELIXIR MEDICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 25 KYOTO MEDICAL PLANNING CO. LTD: COMPANY SNAPSHOT

FIGURE 26 MICROPORT SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

FIGURE 27 ABBOTT LABORATORIES: COMPANY SNAPSHOT

FIGURE 28 REVA MEDICAL, INC: COMPANY SNAPSHOT

FAQ

The bioabsorbable stents market is expected to grow at 6.7% CAGR from 2022 to 2029. It is expected to reach above USD 636.11 Million by 2029 from USD 262 Million in 2021.

North America held more than 40% of the Bioabsorbable Stents Market revenue share in 2021 and will witness expansion in the forecast period.

The bioabsorbable stents market is being driven significantly by the rising incidence of cardiovascular diseases, including coronary artery disease, heart attacks, and strokes, which remain leading causes of death globally.

Bioresorbable polymer-based stents have the largest market share for the bioabsorbable stents market based on material.

In the upcoming years, the market for bioabsorbable stents in North America is anticipated to expand significantly. The increased incidence of cardiovascular disorders, such as coronary artery disease and peripheral artery disease, in this region is one of the major factors causing this growth.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.