Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

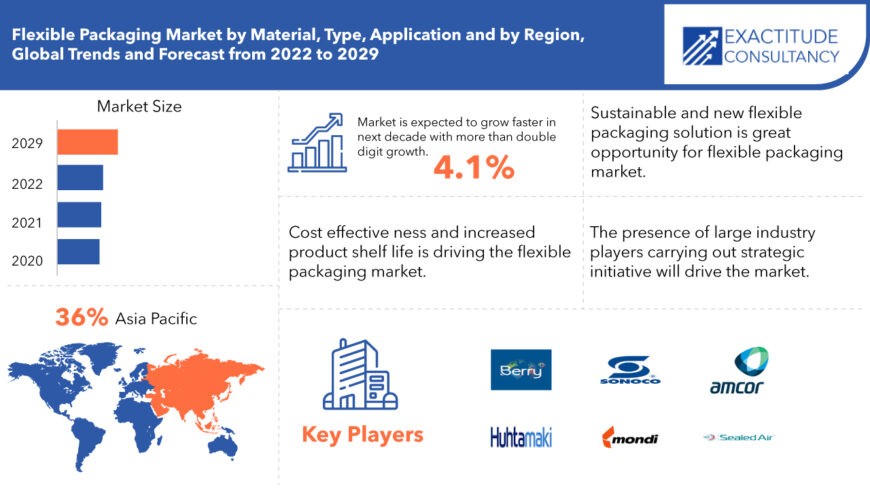

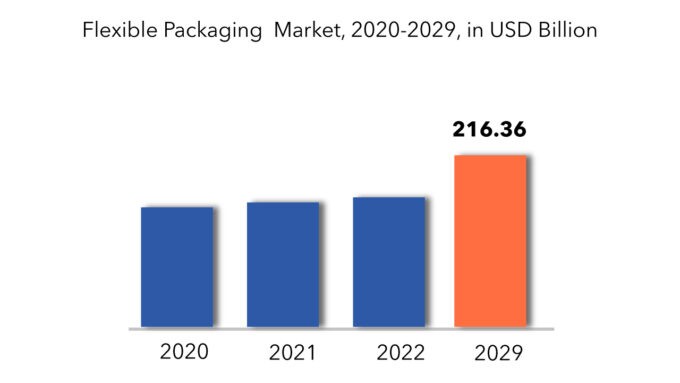

| USD 216.70 billion | 4.1% | Asia Pacific |

| By Material | By Type | By Printing Technology | By Application |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Flexible Packaging Market Overview

The global flexible packaging market is projected to reach USD 216.70 billion by 2029 from USD 216.4 billion in 2021, at a CAGR of 4.1% from 2022 to 2029.

The increasing utilization of flexible packaging products within the medical and pharmaceutical sectors is a driving force behind the heightened demand for these goods. Such products offer a range of benefits, including diverse container options, reduced requirement for raw materials, simplified disposal processes, and their lightweight nature, all of which are anticipated to amplify the demand for these products throughout the forecast period. Notably, the U.S. market is poised for significant growth during this period, primarily propelled by the increasing demand for packaging within the food and beverage as well as healthcare sectors.

This market’s momentum is sustained by the steady expansion of the healthcare, food and beverage, and personal care industries. Furthermore, lifestyle and demographic dynamics are foreseen to contribute to the surge in demand for cosmetic products. The broad application spectrum of flexible metal packaging products has prompted manufacturers of rigid metal packaging to transition towards flexible alternatives. This shift is prompted by the reduced energy consumption and notable decrease in waste production associated with flexible packaging.

Moreover, governmental agencies in the United States are investing in projects aimed at curbing carbon emissions and energy usage, thereby fostering a positive outlook for the market. Notably, in January 2022, the U.S. Department of Energy (DOE) announced a funding injection of USD 13.4 million to advance the production of plastic with minimized energy consumption and reduced carbon dioxide emissions. This funding targets the resolution of challenges associated with metal waste recycling. Given that flexible packaging necessitates fewer materials compared to rigid alternatives, it entails lower energy consumption during production and contributes to carbon emissions mitigation.

Flexible Packaging Market Segment Analysis

The Food industry had the highest CAGR by End Use Industry in the forecast period.

The food industry’s market for flexible packaging is driven by the growing emphasis on hygiene and sustainability, increasing urbanization, shifting lifestyles, and high disposable income. Customers desire their food items to be clean, secure, and visually attractive. Food service packaging manufacturers have a robust ecosystem. They continually create new solutions to enhance consumer satisfaction, with a dedicated research and development facility using cutting-edge technologies to conduct various research tests. Nevertheless, because of the other positive characteristics of flexible packaging, like superior barrier qualities, it can be manufactured using less resources, enhances the longevity of products, and more, drawing in consumers primarily from the food sector.

During the forecast period, the Pouches segment had the highest Compound Annual Growth Rate (CAGR) based on Packaging Type.

Pouches are compact containers made of two flexible side flat sheets sealed along the edges to create a compartment, with volume determined by the walls’ positioning. There are primarily two kinds of pouches: stand-up pouches (SUPs) and flat or pillow pouches. Standard stand-up pouches and retort stand-up pouches are the two types of stand-up pouches.

Pouches are perfect for packaging bulk coffee and foods like dried or smoked meats. They are simple to use, can be heat sealed, and come in convenient packaging with various sizes and formats.

Flexible Packaging Market Players

The major players operating in the global flexible packaging industry include Sealed Air Corporation, Amcor, Berry Global Inc., Mondi, Sonoco, Huhtamaki, Coveris, Transcontinental Inc., Clondalkin Group. New strategies such as product launches and enhancements, partnerships, collaborations, and strategic acquisitions were adopted by market players to strengthen their product portfolios and maintain a competitive position in the flexible packaging market.

Recent Development:

March 21, 2024: Amcor (NYSE:AMCR, ASX:AMC), a global leader in developing and producing responsible packaging solutions, is the proud recipient of eight Flexible Packaging Achievement Awards for innovative and sustainable contributions to the industry.

3 July, 2024: Mondi, a global leader in sustainable packaging and paper, is launching the latest addition to its popular portfolio of sustainable pre-made plastic bags – FlexiBag Reinforced: a range of innovative mono-PE-based, recyclable packaging solutions with improved mechanical properties.

Who Should Buy? Or Key Stakeholders

- Food and beverages Companies

- Healthcare industries.

- Personal care user.

- Others

Flexible Packaging Market Regional Analysis

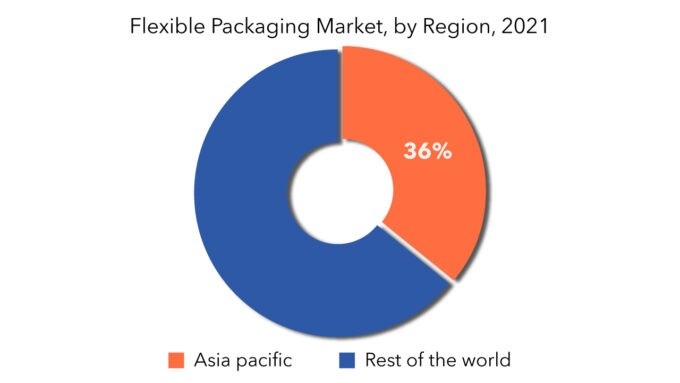

Geographically, the flexible packaging market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia Pacific region dominate the flexible packaging market. The market’s expansion is fueled by rising disposable income and growing demand for flexible packaging solutions. Apart from that, the region’s growth is expected to be aided by improved internet access and shifting consumer preferences. During the forecast period, the region is expected to grow faster in coming years, with countries like China, India, and Japan leading the way. China is a major contributor to the regional market’s expansion. Increased production, exports and imports, and consumption of products such as food and beverages, as well as medicines, are all benefits of the improving Chinese economy. Furthermore, the country’s economic structure has shifted from a production-based approach to a consumption-based approach

Key Market Segments: Flexible Packaging Market

Flexible Packaging Market by Material, 2020-2029, (USD Billion) (Kilotons)

- Paperboard

- Plastic

- Aluminum Foil

- PET Film

- Others

Flexible Packaging Market by Type, 2020-2029, (USD Billion) (Kilotons)

- Pouches

- Rollstock

- Bags

- Films & Wraps

- Others

Flexible Packaging Market By Printing Technology, 2020-2029, (USD Billion) (Kilotons)

- Rotogravure

- Flexography

- Digital Printing

- Others

Flexible Packaging Market by Application, 2020-2029, (USD Billion) (Kilotons)

- Food & Beverage

- Pharmaceutical & Healthcare

- Personal Care & Cosmetics

Flexible Packaging Market by Regions, 2020-2029, (USD Billion) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current scenario of the global flexible packaging market?

- What are the emerging technologies for the development of flexible packaging devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Flexible Packaging Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Flexible Packaging Market

- Global Flexible Packaging Market Outlook

- Global Flexible Packaging Market by Material, (USD Billion) (Kilo Tons)

- Polyethylene

- Polypropylene

- Polyamine

- Polyvinyl chloride

- Polystyrene

- Global Flexible Packaging Market by Type, (USD Billion) (Kilo Tons)

- Stand Pouches

- Flat Pouches

- Rollstocks

- Global Flexible Packaging Market by Application, (USD Billion) (Kilo Tons)

- Food & Beverage

- Healthcare

- Personal Care

- Global Flexible Packaging Market by Region, (USD Billion) (Kilo Tons)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, TYPEs Offered, Recent Developments)

- Sealed Air Corporation

- Amcor

- Berry Global Inc.

- Mondi

- Sonoco

- Huhtamaki

- Coveris

- Transcontinental Inc.,

- Clondalkin Group

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 2 GLOBAL FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 3 GLOBAL FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 4 GLOBAL FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 5 GLOBAL FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 6 GLOBAL FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 7 GLOBAL FLEXIBLE PACKAGING MARKET BY REGION (USD BILLIONS), 2020-2029

TABLE 8 GLOBAL FLEXIBLE PACKAGING MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA FLEXIBLE PACKAGING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 10 NORTH AMERICA FLEXIBLE PACKAGING MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 11 US FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 12 US FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 13 US FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 14 US FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 16 US FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA FLEXIBLE PACKAGING MARKET BY MATERIAL (CANADA BILLIONS), 2020-2029

TABLE 18 CANADA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 19 CANADA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 20 CANADA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 21 CANADA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 22 CANADA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 23 MEXICO FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 24 MEXICO FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 25 MEXICO FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 26 MEXICO FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 MEXICO FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 28 MEXICO FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA FLEXIBLE PACKAGING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 30 SOUTH AMERICA FLEXIBLE PACKAGING MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 31 BRAZIL FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 32 BRAZIL FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 33 BRAZIL FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 34 BRAZIL FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 35 BRAZIL FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 36 BRAZIL FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 37 ARGENTINA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 38 ARGENTINA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 39 ARGENTINA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 40 ARGENTINA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 ARGENTINA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 42 ARGENTINA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 COLOMBIA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 44 COLOMBIA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 45 COLOMBIA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 46 COLOMBIA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 47 COLOMBIA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 48 COLOMBIA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 49 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 50 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 51 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 52 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 53 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 54 REST OF SOUTH AMERICA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 55 ASIA-PACIFIC FLEXIBLE PACKAGING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 56 ASIA-PACIFIC FLEXIBLE PACKAGING MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 57 INDIA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 58 INDIA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 59 INDIA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 60 INDIA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 61 INDIA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 62 INDIA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 63 CHINA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 64 CHINA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 65 CHINA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 66 CHINA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 CHINA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 68 CHINA DECISION SUPPORT SYSTEMS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 JAPAN FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 70 JAPAN FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 71 JAPAN FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 72 JAPAN FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 73 JAPAN FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 74 JAPAN FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 75 SOUTH KOREA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 76 SOUTH KOREA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 77 SOUTH KOREA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 78 SOUTH KOREA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 79 SOUTH KOREA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 80 SOUTH KOREA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 AUSTRALIA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 82 AUSTRALIA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 83 AUSTRALIA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 84 AUSTRALIA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 85 AUSTRALIA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 86 AUSTRALIA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 87 SOUTH EAST ASIA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 88 SOUTH EAST ASIA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 89 SOUTH EAST ASIA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 90 SOUTH EAST ASIA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 91 SOUTH EAST ASIA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 92 SOUTH EAST ASIA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 93 REST OF ASIA PACIFIC FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 94 REST OF ASIA PACIFIC FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 95 REST OF ASIA PACIFIC FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 96 REST OF ASIA PACIFIC FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 REST OF ASIA PACIFIC FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 98 REST OF ASIA PACIFIC FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 EUROPE FLEXIBLE PACKAGING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 100 EUROPE FLEXIBLE PACKAGING MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 101 GERMANY FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 102 GERMANY FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 103 GERMANY FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 104 GERMANY FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 GERMANY FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 106 GERMANY FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 UK FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 108 UK FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 109 UK FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 110 UK FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 111 UK FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 112 UK FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 113 FRANCE FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 114 FRANCE FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 115 FRANCE FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 116 FRANCE FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 FRANCE FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 118 FRANCE FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 ITALY FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 120 ITALY FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 121 ITALY FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 122 ITALY FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 ITALY FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 124 ITALY FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SPAIN FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 126 SPAIN FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 127 SPAIN FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 128 SPAIN FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 129 SPAIN FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 130 SPAIN FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 131 RUSSIA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 132 RUSSIA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 133 RUSSIA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 134 RUSSIA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 RUSSIA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 136 RUSSIA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 137 REST OF EUROPE FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 138 REST OF EUROPE FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 139 REST OF EUROPE FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 140 REST OF EUROPE FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 141 REST OF EUROPE FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 142 REST OF EUROPE FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 143 MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET BY COUNTRY (USD BILLIONS), 2020-2029

TABLE 144 MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 145 UAE FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 146 UAE FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 147 UAE FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 148 UAE FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 149 UAE FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 150 UAE FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 151 SAUDI ARABIA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 152 SAUDI ARABIA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 153 SAUDI ARABIA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 154 SAUDI ARABIA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 155 SAUDI ARABIA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 156 SAUDI ARABIA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 157 SOUTH AFRICA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 158 SOUTH AFRICA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 159 SOUTH AFRICA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 160 SOUTH AFRICA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 161 SOUTH AFRICA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 162 SOUTH AFRICA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 163 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET BY MATERIAL (USD BILLIONS), 2020-2029

TABLE 164 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 165 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET BY TYPE (USD BILLIONS), 2020-2029

TABLE 166 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 167 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET BY APPLICATION (USD BILLIONS), 2020-2029

TABLE 168 REST OF MIDDLE EAST AND AFRICA FLEXIBLE PACKAGING MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURE

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL FLEXIBLE PACKAGING MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL FLEXIBLE PACKAGING MARKET BY MATERIAL, USD BILLION, 2020-2029

FIGURE 10 GLOBAL FLEXIBLE PACKAGING MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL FLEXIBLE PACKAGING MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL FLEXIBLE PACKAGING MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 14 GLOBAL FLEXIBLE PACKAGING MARKET BY MATERIAL, USD BILLION, 2020-2029

FIGURE 15 GLOBAL FLEXIBLE PACKAGING MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 16 GLOBAL FLEXIBLE PACKAGING MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 17 FLEXIBLE PACKAGING MARKET BY REGION 2020

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 SEALED AIR CORPORATION: COMPANY SNAPSHOT

FIGURE 20 AMCOR: COMPANY SNAPSHOT

FIGURE 21 BERRY GLOBAL INC.: COMPANY SNAPSHOT

FIGURE 22 MONDI: COMPANY SNAPSHOT

FIGURE 23 SONOCO: COMPANY SNAPSHOT

FIGURE 24 HUHTAMAKI: COMPANY SNAPSHOT

FIGURE 25 COVERIS: COMPANY SNAPSHOT

FIGURE 26 TRANSCONTINENTAL INC: COMPANY SNAPSHOT

FIGURE 27 CLONDALKIN GROUP: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.