REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 11.59 billion by 2029 | 8.0 % | North America |

| by Product | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Mass Spectrometry Market Overview

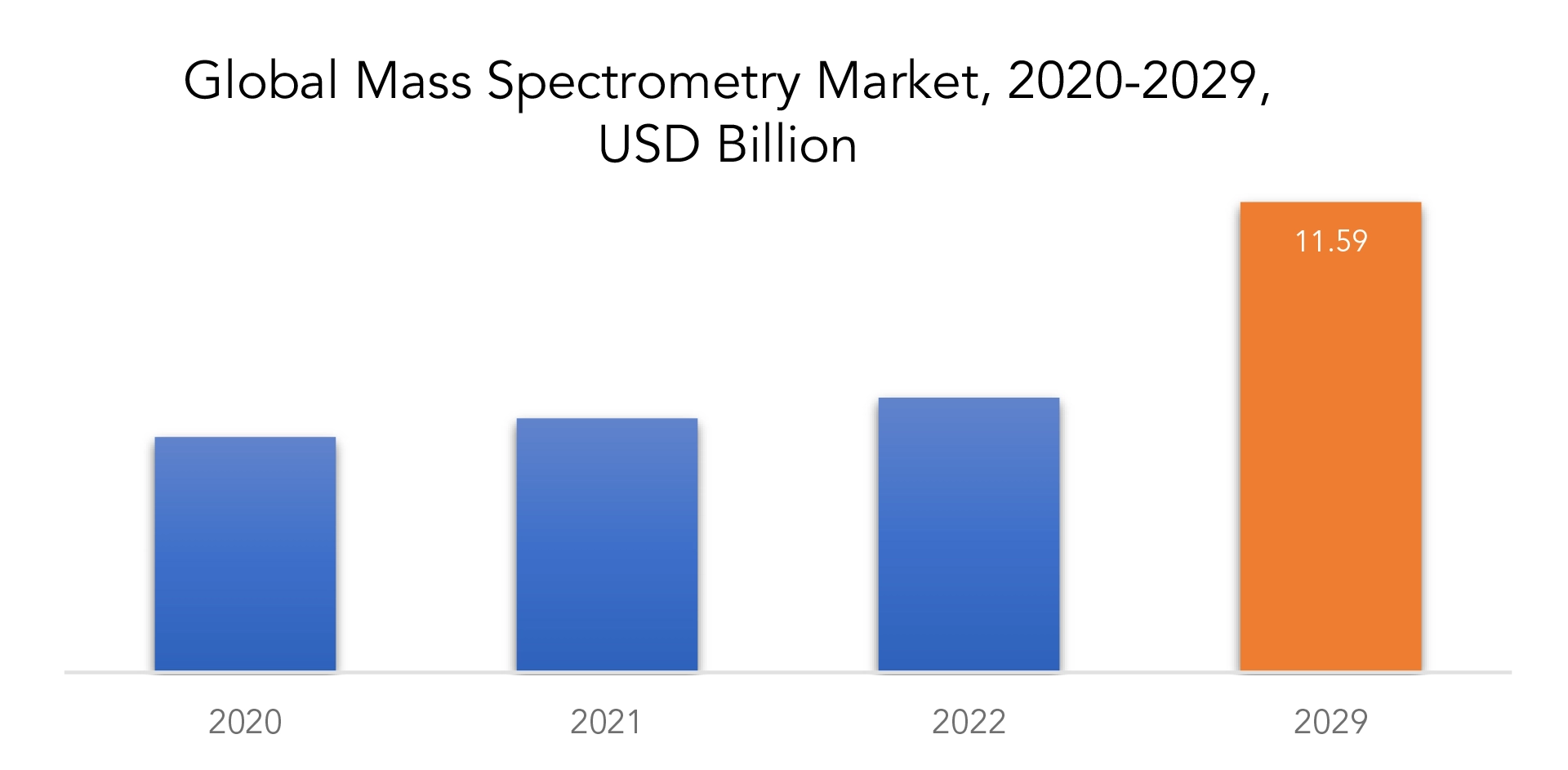

The mass spectrometry market is expected to grow at 8.0 % CAGR from 2022 to 2029. It is expected to reach above USD 11.59 billion by 2029 from USD 5.8 billion in 2020.

The analytical method of mass spectrometry can be used to locate and identify small amounts of a compound in a sample as well as traces of other substances at low concentrations. It enables specialists and academics to thoroughly catalogue complex materials in a single analysis. In this process, the sample is initially ionized by the loss of one electron. Using computerized measurements of the ions’ charge and mass, the ions are then split and classified.

The mass spectrometry market is driven by a number of reasons, including expanding R&D expenditures in the biotechnology and pharmaceutical sectors, rising demand for analytical methods in drug discovery and development, and technological developments in the sector. The increasing use of mass spectrometry in clinical diagnostics, food safety testing, and environmental testing is also anticipated to fuel market expansion. However, constraints like high instrument costs, a shortage of qualified specialists, and strict regulatory requirements are expected to make it difficult for some regions’ markets to expand.

Research and development (R&D) investments are rising in the pharmaceutical and biotechnology sectors. The fundamental reason for this is the requirement for quicker and more effective medication discovery and development processes. Due to it can detect and quantify compounds fast and precisely, mass spectrometry is being employed more frequently in R&D efforts in various sectors. Over the course of the forecast, this is anticipated to fuel the market.

One of the key barriers to market expansion is the high cost of premium goods. High-end mass spectrometry equipment are frequently very expensive, and many potential buyers may find these costs to be unaffordable. Consumable costs are also extremely substantial and include kits for sample preparation, for example. Another significant obstacle is the expense of acquiring and keeping on staff the qualified workers that are required to run and maintain these systems. These factors restrict the use of mass spectrometry systems and services, which restrains the market’s expansion.

The market is expanding as a result of developing nations’ increased usage of technology. The technology’s expanding use in areas such as clinical diagnostics, research and development, and drug discovery and development is fueling the market’s expansion. Additionally, the market is anticipated to have a lot of chances due to manufacturers’ increased focus on developing new products and technologies in emerging markets. Additionally, it is anticipated that the market would experience significant growth in the coming years as a result of industry participants’ growing investments in R&D projects and the expansion of their distribution networks in the area.

The COVID-19 epidemic has had a favourable effect on the global mass spectrometry market. Due to the COVID-19 driving market, there has been a significant demand from the biotechnology and pharmaceutical industries for numerous spectrometers. The National Centre for Disease Control (NCDC) and the Institute of Genomics and Integrative Biology (IGIB) in Delhi, India, used a mass spectrometer in 2020 to identify a novel coronavirus (COVID-19) with 95% sensitivity and 100% precision with regard to RT-PCR. A quick test for the COVID-19 virus was developed and released in April 2020 by UK diagnostics company MAP Sciences. Within 30 minutes, test results are supposed to be available thanks to this technology, which uses multiple spectrometry to find various proteins in COVID-19.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion). |

| Segmentation | By Product, By Technology, By Application, End User, By Region. |

| By Product

|

|

| By Technology

|

|

| By Application

|

|

| By End User |

|

| By Region

|

|

Mass Spectrometry Market Segment Analysis

The mass spectrometry market is segmented based on product, technology, application and end user.

In 2022, the instruments segment accounted for the majority of revenue at 77.39%. Within this segment, spectrometers have become increasingly popular in the biotechnology sector due to their versatility in various applications. Spectrometry workflows using mass spectrometry are especially gaining traction in clinical and preclinical testing for drug discovery, as well as biomedical research in the pharmaceutical industries.

Out of all the spectrometry technologies, quadrupole liquid chromatography-mass spectrometry had the highest share of 37.09% in 2022. This technology has experienced significant demand in recent years, mainly due to of its numerous advantages. For example, the triple quadrupole technology is a critical analytical technique in clinical research analysis and is capable of detecting trace levels of biomarkers in complex biological fluids.

In 2022, the largest share of revenue in the market was held by the proteomics segment at 46.69%. Mass spectrometry-based proteomics research is a comprehensive technique used for quantitative protein profiling and investigating protein-protein interactions. The availability and advancement of quantitative proteomics workflows have expanded the range of applications for studying protein dynamics, structure, transformation, and function.

The pharmaceutical and biotechnology companies segment had the highest market share in 2022 at 43.98%, mainly due to the extensive adoption of mass spectrometry-based protein sequencing in drug discovery and development processes. The increasing demand for biomolecule analysis and drug component analysis is expected to drive the segment’s growth in the market.

Mass Spectrometry Market Key Player

The mass spectrometry market key players includes Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Danaher Corporation, Waters Corporation, BrU.K.er Corporation, Shimadzu Corporation, PerkinElmer, Inc., Rigaku Corporation, LECO Corporation, JEOL Ltd.

Recent News:

29 March 2023: Thermo Fisher Scientific, the world leader in serving science, and Arsenal Biosciences, Inc. (ArsenalBio), a clinical-stage cell therapy company engineering advanced chimeric antigen receptor (CAR)-T cell therapies for solid tumors, today announced an update to our strategic collaboration to further the development of manufacturing processes for new cancer treatments.

07 March 2023: Thermo Fisher Scientific was provided proteomics and biopharmaceutical research laboratories with a new line of low-flow HPLC columns that improve separation performance and stability of biologically complex samples.

Mass Spectrometry Market Regional Analysis

The mass spectrometry market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

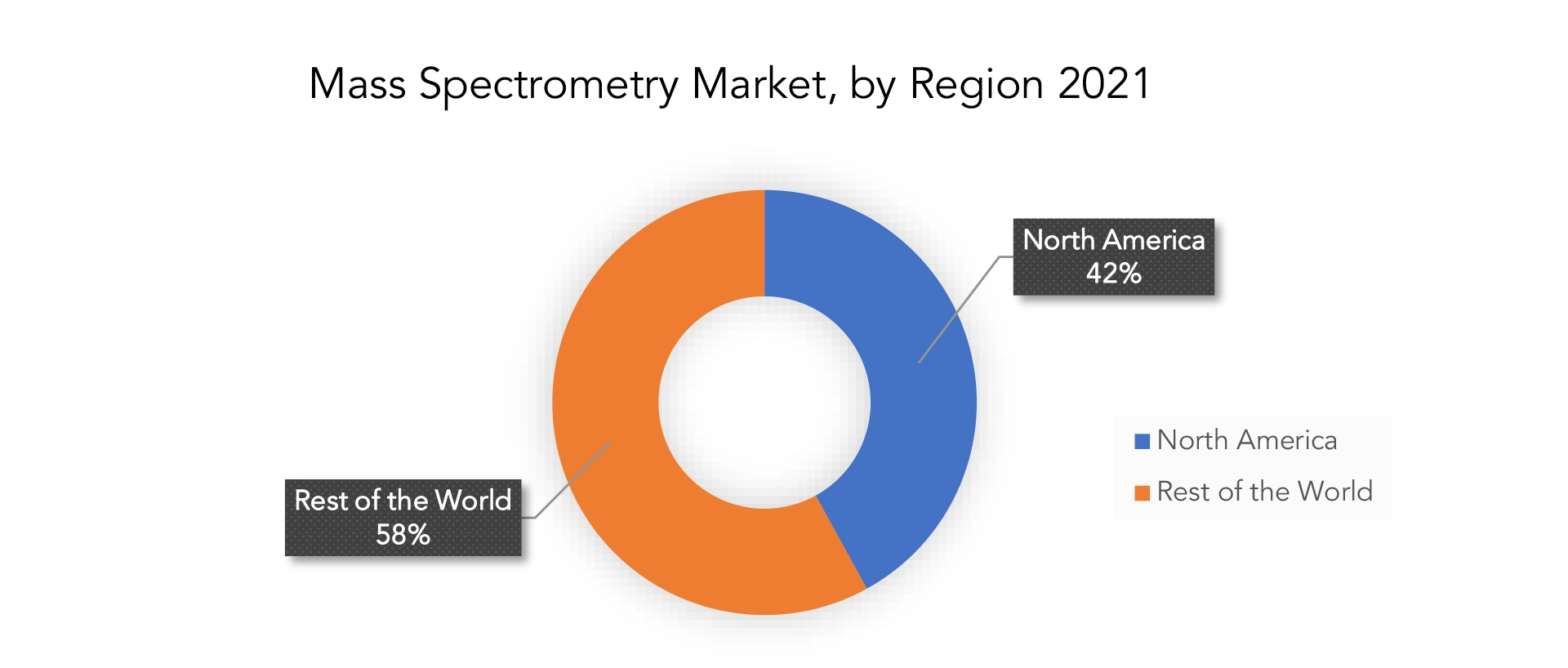

In 2022, North America held the highest market share of 41.94% owing to the region’s robust research and development activities and well-established healthcare infrastructure. Additionally, the increasing focus on disease prevention measures in the region has further driven the demand for mass spectrometry. The government funding in the region is also substantial, and initiatives such as UniProt, a free portal for obtaining protein sequencing and functional information, are supported by various government institutions like the National Eye Institute, National Heart, Lung, and National Human Genome Research Institute, which is expected to contribute to market growth.

Over the forecast period, the Asia Pacific region is projected to grow at the highest compound annual growth rate (CAGR) of 8.97% due to its large population and increasing focus on healthcare systems. The region’s growing attention towards proteomics and genomics research and initiatives taken by academic institutions for the development of protein-based therapeutics have presented significant growth opportunities for the market in the Asia Pacific region.

Key Market Segments: Mass Spectrometry Market

Mass Spectrometry Market by Product, 2020-2029, (USD Billion).

- Instruments

- Consumables & Services

Mass Spectrometry Market by Technology, 2020-2029, (USD Billion).

- Quadrupole Liquid Chromatography Mass Spectrometry

- Gas Chromatography Mass Spectrometry (GC-MS)

- Fourier Transform Mass Spectrometry (FT-MS)

- Time of Flight Mass Spectrometry (TOFMS)

- Matrix Assistant Laser Desorption/Ionization Time of Flight Mass Spectrometry (MALDI-TOF)

- Magnetic Sector Mass Spectrometry

- Others

Mass Spectrometry Market by Application, 2020-2029, (USD Billion).

- Proteomics

- Metabolomics

- Glycomics

- Others

Mass Spectrometry Market by End User, 2020-2029, (USD Billion).

- Government & Academic Institutions

- Pharmaceutical & Biotechnology Companies

- Others

Mass Spectrometry Market by Region, 2020-2029, (USD Billion).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Who Should Buy? Or Key Stakeholders

- Mass spectrometry instrument manufacturers

- Pharmaceutical and biotechnology companies

- Academic and research institutions

- Clinical diagnostic laboratories

- Government and regulatory bodies

- Distributors and suppliers

- Service providers

- Others

Key Question Answered

- What is the expected growth rate of the mass spectrometry market over the next 7 years?

- Who are the major players in the mass spectrometry market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such As Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the mass spectrometry market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the mass spectrometry market?

- What is the current and forecasted size and growth rate of the global mass spectrometry market?

- What are the key drivers of growth in the mass spectrometry market?

- What are the distribution channels and supply chain dynamics in the mass spectrometry market?

- What are the technological advancements and innovations in the mass spectrometry market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the mass spectrometry market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the mass spectrometry market?

- What are the service offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA TECHNOLOGYS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL MASS SPECTROMETRY MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON MASS SPECTROMETRY MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL MASS SPECTROMETRY MARKET OUTLOOK

- GLOBAL MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

- INSTRUMENTS

- CONSUMABLES & SERVICES

- GLOBAL MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION) , 2020-2029

- QUADRUPOLE LIQUID CHROMATOGRAPHY MASS SPECTROMETRY

- GAS CHROMATOGRAPHY MASS SPECTROMETRY (GC-MS)

- FOURIER TRANSFORM MASS SPECTROMETRY (FT-MS)

- TIME OF FLIGHT MASS SPECTROMETRY (TOFMS)

- MATRIX ASSISTANT LASER DESORPTION/IONIZATION TIME OF FLIGHT MASS SPECTROMETRY (MALDI-TOF)

- MAGNETIC SECTOR MASS SPECTROMETRY

- OTHERS

- GLOBAL MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION) , 2020-2029

- PROTEOMICS

- METABOLOMICS

- GLYCOMICS

- OTHERS

- GLOBAL MASS SPECTROMETRY MARKET BY END USER (USD MILLION) , 2020-2029

- GOVERNMENT & ACADEMIC INSTITUTIONS

- PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- OTHERS

- GLOBAL MASS SPECTROMETRY MARKET BY REGION (USD MILLION) , 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- THERMO FISHER SCIENTIFIC, INC.

- AGILENT TECHNOLOGIES, INC.

- DANAHER CORPORATION

- WATERS CORPORATION

- K.ER CORPORATION

- SHIMADZU CORPORATION

- PERKINELMER, INC.

- RIGAKU CORPORATION

- LECO CORPORATION

- JEOL LTD. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 2 GLOBAL MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 3 GLOBAL MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 4 GLOBAL MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 5 GLOBAL MASS SPECTROMETRY MARKET BY REGION (USD MILLION), 2020-2029

TABLE 6 NORTH AMERICA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 7 NORTH AMERICA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 8 NORTH AMERICA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 9 NORTH AMERICA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA MASS SPECTROMETRY MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 11 US MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 12 US MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 13 US MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 14 US MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 15 CANADA MASS SPECTROMETRY MARKET BY PRODUCT (MILLION), 2020-2029

TABLE 16 CANADA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 17 CANADA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 18 CANADA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 19 MEXICO MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 20 MEXICO MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 21 MEXICO MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 22 MEXICO MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 23 SOUTH AMERICA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 24 SOUTH AMERICA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 25 SOUTH AMERICA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 26 SOUTH AMERICA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 27 SOUTH AMERICA MASS SPECTROMETRY MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 28 BRAZIL MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 29 BRAZIL MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 30 BRAZIL MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 31 BRAZIL MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 32 ARGENTINA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 33 ARGENTINA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 34 ARGENTINA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 35 ARGENTINA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 36 COLOMBIA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 37 COLOMBIA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 38 COLOMBIA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 39 COLOMBIA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 40 REST OF SOUTH AMERICA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 41 REST OF SOUTH AMERICA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 42 REST OF SOUTH AMERICA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 43 REST OF SOUTH AMERICA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 44 ASIA-PACIFIC MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 45 ASIA-PACIFIC MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 46 ASIA-PACIFIC MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 47 ASIA-PACIFIC MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 48 ASIA-PACIFIC MASS SPECTROMETRY MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 49 INDIA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 50 INDIA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 51 INDIA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 52 INDIA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 53 CHINA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 54 CHINA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 55 CHINA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 56 CHINA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 57 JAPAN MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 58 JAPAN MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 59 JAPAN MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 60 JAPAN MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 61 SOUTH KOREA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 62 SOUTH KOREA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 63 SOUTH KOREA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 64 SOUTH KOREA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 65 AUSTRALIA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 66 AUSTRALIA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 67 AUSTRALIA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 68 AUSTRALIA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 69 SOUTH EAST ASIA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 70 SOUTH EAST ASIA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 71 SOUTH EAST ASIA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 72 SOUTH EAST ASIA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 73 REST OF ASIA PACIFIC MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 74 REST OF ASIA PACIFIC MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 75 REST OF ASIA PACIFIC MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 76 REST OF ASIA PACIFIC MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 77 EUROPE MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 78 EUROPE MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 79 EUROPE MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 80 EUROPE MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 81 EUROPE MASS SPECTROMETRY MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 82 GERMANY MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 83 GERMANY MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 84 GERMANY MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 85 GERMANY MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 86 UK MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 87 UK MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 88 UK MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 89 UK MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 90 FRANCE MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 91 FRANCE MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 92 FRANCE MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 93 FRANCE MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 94 ITALY MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 95 ITALY MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 96 ITALY MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 97 ITALY MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 98 SPAIN MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 99 SPAIN MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 100 SPAIN MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 101 SPAIN MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 102 RUSSIA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 103 RUSSIA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 104 RUSSIA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 105 RUSSIA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 106 REST OF EUROPE MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 107 REST OF EUROPE MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 108 REST OF EUROPE MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 109 REST OF EUROPE MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 110 MIDDLE EAST AND AFRICA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 111 MIDDLE EAST AND AFRICA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 112 MIDDLE EAST AND AFRICA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 113 MIDDLE EAST AND AFRICA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 114 MIDDLE EAST AND AFRICA MASS SPECTROMETRY MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 115 UAE MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 116 UAE MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 117 UAE MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 118 UAE MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 119 SAUDI ARABIA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 120 SAUDI ARABIA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 121 SAUDI ARABIA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 122 SAUDI ARABIA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 123 SOUTH AFRICA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 124 SOUTH AFRICA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 125 SOUTH AFRICA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 126 SOUTH AFRICA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

TABLE 127 REST OF MIDDLE EAST AND AFRICA MASS SPECTROMETRY MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 128 REST OF MIDDLE EAST AND AFRICA MASS SPECTROMETRY MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA MASS SPECTROMETRY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 130 REST OF MIDDLE EAST AND AFRICA MASS SPECTROMETRY MARKET BY END USER (USD MILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL MASS SPECTROMETRY MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL MASS SPECTROMETRY MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 10 GLOBAL MASS SPECTROMETRY MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL MASS SPECTROMETRY MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 12 GLOBAL MASS SPECTROMETRY MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL MASS SPECTROMETRY MARKET BY PRODUCT, USD MILLION, 2021

FIGURE 15 GLOBAL MASS SPECTROMETRY MARKET BY TECHNOLOGY, USD MILLION, 2021

FIGURE 16 GLOBAL MASS SPECTROMETRY MARKET BY APPLICATION, USD MILLION, 2021

FIGURE 17 GLOBAL MASS SPECTROMETRY MARKET BY END USER, USD MILLION, 2021

FIGURE 18 GLOBAL MASS SPECTROMETRY MARKET BY REGION 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT

FIGURE 21 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 22 DANAHER CORPORATION: COMPANY SNAPSHOT

FIGURE 23 WATERS CORPORATION: COMPANY SNAPSHOT

FIGURE 24 BRU.K.ER CORPORATION: COMPANY SNAPSHOT

FIGURE 25 SHIMADZU CORPORATION: COMPANY SNAPSHOT

FIGURE 26 PERKINELMER, INC.: COMPANY SNAPSHOT

FIGURE 27 RIGAKU CORPORATION: COMPANY SNAPSHOT

FIGURE 28 LECO CORPORATION: COMPANY SNAPSHOT

FIGURE 29 JEOL LTD.: COMPANY SNAPSHOT

FAQ

The mass spectrometry market is expected to grow at 8.0 % CAGR from 2022 to 2029. It is expected to reach above USD 11.59 billion by 2029 from USD 5.8 billion in 2020.

North America held more than 42 % of the mass spectrometry market revenue share in 2021 and will witness expansion in the forecast period.

The mass spectrometry market is driven by a number of reasons, including expanding R&D expenditures in the biotechnology and pharmaceutical sectors, rising demand for analytical methods in drug discovery and development, and technological developments in the sector.

The proteomics segment held the largest revenue share of 46.69% in 2022. Mass spectrometry-based proteomics research is a comprehensive technique for quantitative profiling of proteins and studying protein-protein interactions.

North America is the largest regional market for mass spectrometry market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.