REPORT OUTLOOK

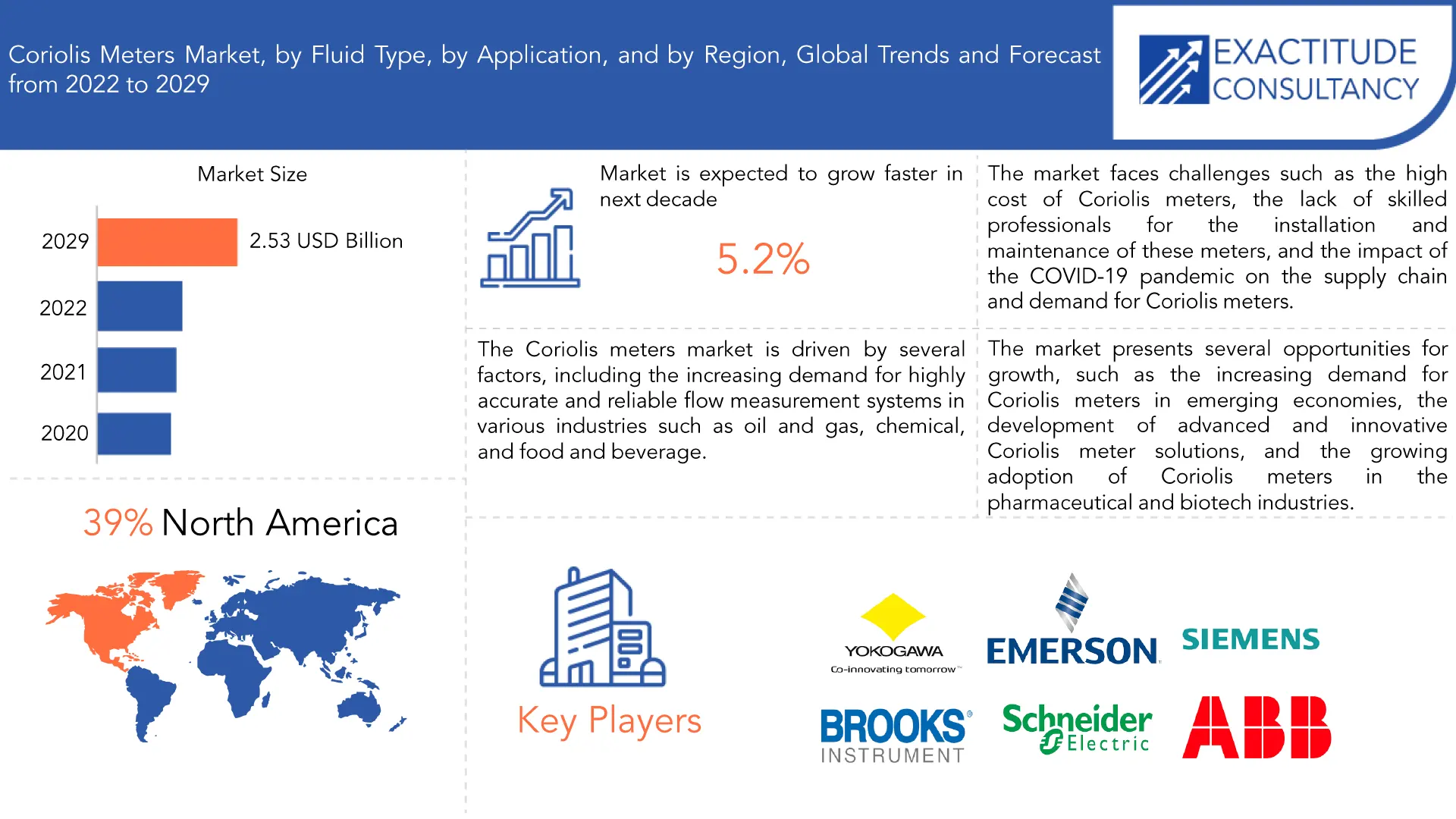

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2.53 billion by 2029 | 5.2% | North America |

| By Fluid Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Coriolis Meters Market Overview

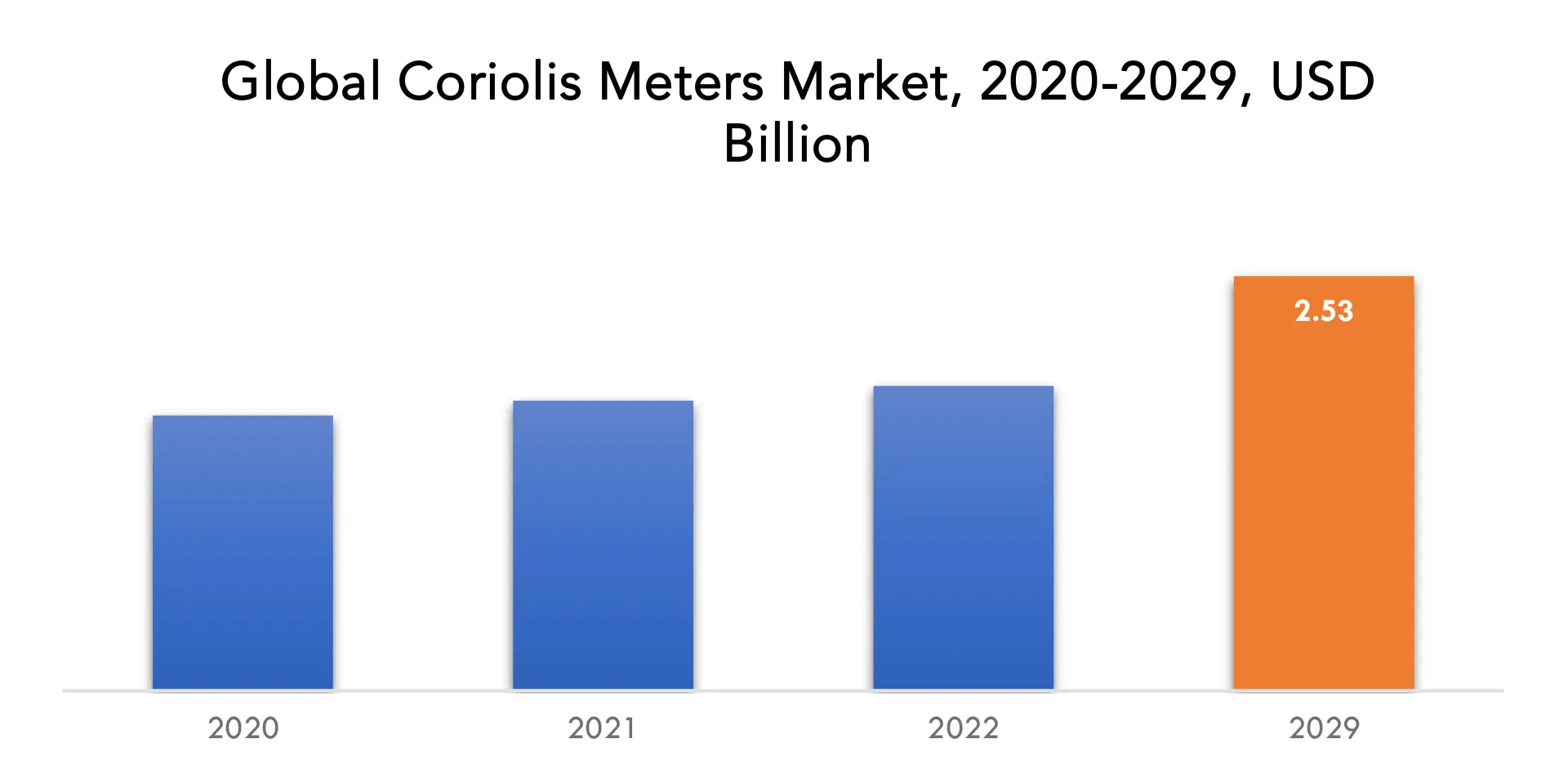

The coriolis meters market is expected to grow at 5.2% CAGR from 2022 to 2029. It is expected to reach above USD 2.53 billion by 2029 from USD 1.6 billion in 2020.

Water, acids, chemicals, caustic, and other liquids such as these are all measured in mass flow using coriolis meters. Straight coriolis mass flow meters and curved tube flow meters are the two types of coriolis meters that are distinguished by how they operate. High fluid velocities are produced by decreasing the cross-sectional area of the single-curved, thin-walled tube used in coriolis meters that is linked to the process pipe. Coriolis meters are utilized in a variety of applications, including concentration measurement, feed characterization, chemical additive metering, process assessment and optimization, and product quality control.

For fluids with varying viscosity, compressibility, and density, coriolis meters are helpful. The steam-in-place (SIP), clean-in-place (CIP), and sterilizable service applications in personal care products are also appropriate for coriolis meters. The market for coriolis meters is expanding as a result of reasons such as the increasing need for energy on a global scale and the quickening pace of industrialization. Other factors anticipated to fuel growth of the global coriolis meters market over the forecast period include rising focus on natural and shale gas production, expanding exploration activities in deep waters, and rising demand from the oil and gas industry for calculating mass flow of liquids. But over the course of the forecast period, factors like high equipment maintenance costs and a lack of skilled labour are expected to restrain the growth of the global coriolis meters market.

Automation is a focus area for manufacturing plants as a way to cut down on waste, lead times, and unscheduled downtime. Growing industrialization, rising living standards around the world, and the large population base in the Asia Pacific area have all encouraged businesses to locate their facilities there. Coriolis meters are becoming more popular in the water and wastewater and oil and gas sectors. According to estimates, these important sectors’ turnaround and growing demand for high-performance Intelligent flow meters are contributing factors to the growth of the coriolis meters market. The two primary end-use industries for coriolis meters that are driving the global market are the oil and gas and water and wastewater sectors.

Numerous global industries have experienced significant disruption as a result of the COVID-19’s rapid spread. Oil & gas, the food & beverage industry, and others are some of the key coriolis meters end-users that were severely impacted by the epidemic. The value chain of the flowmeter market has been gradually impacted by the COVID-19 outbreak, according to the coriolis meters market Report. Industries like oil and gas, pulp and paper, chemicals, metals, and mining, as well as food and beverage production, have temporarily experienced a decrease in demand for their goods as a result of the global recession and customers’ reduced spending power. Due to the significant capacity expansions and the sluggish demand growth, the pandemic has had a significant influence on the market. The new coronavirus had an uneven impact on the market for coriolis meters along all value chains, with dramatic declines in Coriolis applications and strong demand for medical applications.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Fluid Type, By Application, By Region |

|

By Fluid Type

|

|

|

By Application

|

|

| By Region

|

|

Coriolis Meters Market Segment Analysis

Coriolis meters market is segmented based on fluid type, application, and region.

Based on fluid type, a significant portion of the market was made up of liquid. The measurement of different liquids, such as crude oil, refined petroleum products, chemicals, beverages, and other liquids, is included in the category for liquids. The liquid segment’s dominance in the market for coriolis meters is caused by a few variables. First off, liquids are more frequently employed than gases in a variety of industrial applications, including transportation, processing, and storage. Second, a vast range of viscosities, densities, and flow rates characterize liquids, and coriolis meters are well adapted to measure these characteristics precisely and consistently. Thirdly, accurate measurement is essential to ensuring efficient use and minimizing waste due to liquids are frequently more valuable than gases.

Based on application, a significant portion of the market was made up of oil and gas. For measuring the flow rates of crude oil, natural gas, and other petroleum products, coriolis meters are widely used in the oil and gas sector. They are utilized in the oil and gas industry’s upstream, midstream, and downstream processes, which include exploration, production, transportation, refining, and distribution. Coriolis meters are used in upstream operations to test wells and monitor the production of oil and gas. They are employed in midstream operations for pipeline monitoring and custody transfer measurement. Coriolis meters are utilized in the downstream operations for the blending, filling, and batching processes.

Coriolis Meters Market Players

The market research report covers the analysis of Market players. Key companies profiled in the report include Yokogawa Electric Corporation, Emerson, Siemens AG, ABB Ltd., Schneider Electric Co., Honeywell, Brooks Instruments, Tricor Coriolis Technology, Foxboro, Liquid Controls LLC.

- On January 2021, the water flow facility, which was commissioned has fully automated process control and data acquisition. Emerson meters offer additional information on flow conditions, which NEL have utilized within the new process control system. In total, fifteen of the Micro Motion ELITE Coriolis Peak Performance flow metersare used as reference meters to support testing lines varying in size from 0.25″ to 8″, flow rates of up to 550m3/h of oil or water and 358 MMscfd of gas, and pressures up to 140 bar.

- On September 2022, Yokogawa Electric Corporation (TOKYO: 6841) announced the release of the OpreXTM Magnetic Flowmeter CA Series. This new product series succeeds the ADMAG CA Series and is being released as part of the OpreX Field Instruments family. The products in this new series are all capacitance-type magnetic flowmeters that can measure the flow of conductive fluids through a measurement tube without the fluids encountered the device’s electrodes.

Who Should Buy? Or Key Stakeholders

- Research and Development Institutes

- Regulatory Authorities

- Industrial

- Potential Investors

- End-use Industry

- Coriolis Meters Companies

- Academic Institutes

- Government Organizations

- Others

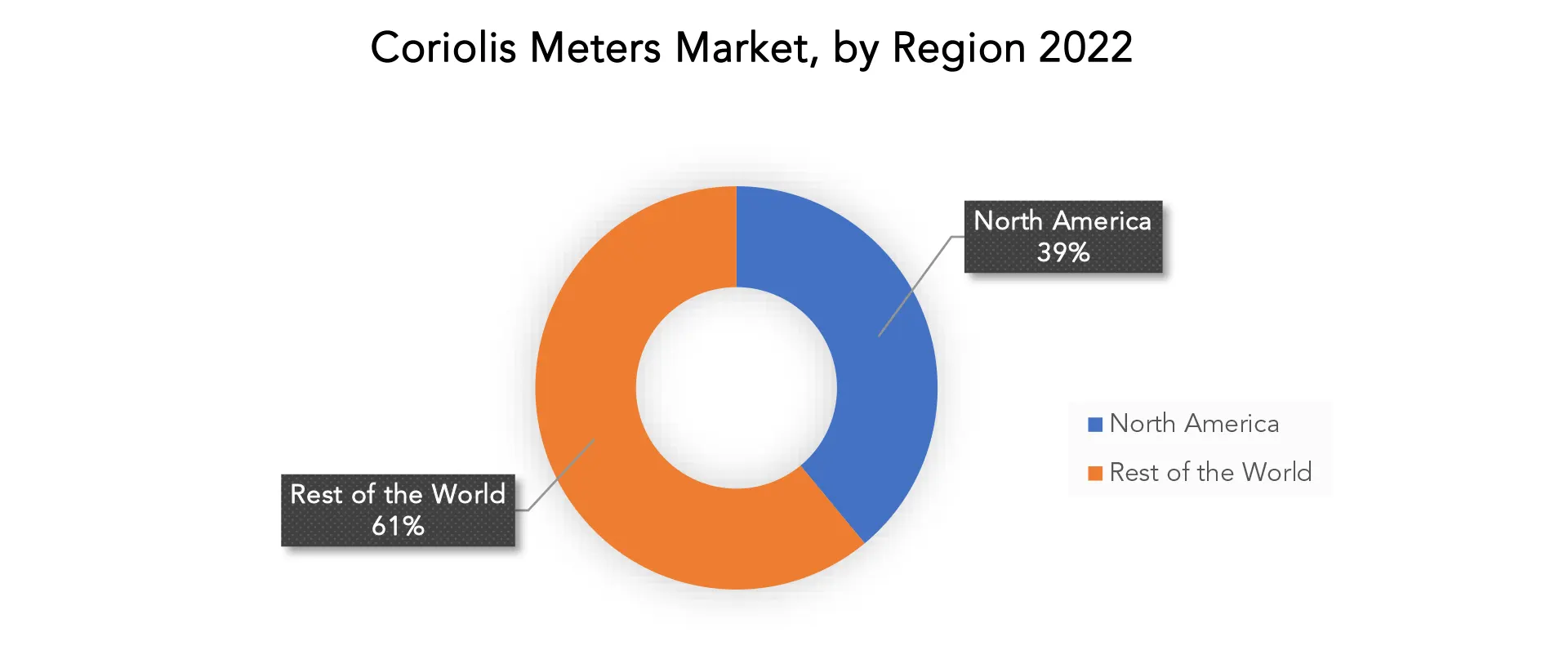

Coriolis Meters Market Regional Analysis

The coriolis meters market by region includes North America, Asia-Pacific (APAC), Europe, South America, And Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The greatest revenue share in 2021 over 39% was accounted for by North America. With a sizeable portion of the global market, North America is the region with the greatest market for coriolis meters. Due to the rising need for Coriolis meters in the oil and gas industry, the United States is the greatest contributor to the North American market. Reduced costs for renewable technology and worries about the environmental effects of traditional forms of energy have led to expansion in the renewable energy sector in recent decades. It is anticipated that the industry that produces renewable energy in North America will invest heavily in fresh projects. In the United States, diaphragm-positive displacement meters are frequently used to measure commercial and utility gas flow.

Due to the existence of well-established end-user sectors and the rising demand for precise and trustworthy flow measurement, Europe is the second-largest market for coriolis meters. The main end-user of coriolis meters in Europe is the oil and gas sector, followed by the chemical and food and beverage sectors. Advanced flow measurement methods, such as coriolis meters, are becoming more popular in these industries due to the growing emphasis on lowering energy consumption and enhancing process efficiency.

Key Market Segments: Coriolis Meters Market

Coriolis Meters Market by Fluid Type, 2020-2029, (USD Billion), (Thousand Units)

- Liquid

- Gas

Coriolis Meters Market by Application, 2020-2029, (USD Billion), (Thousand Units)

- Oil and Gas

- Chemicals

- Food and Beverages

- Others

Coriolis Meters Market by Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and Market share

- Developing new Application

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the coriolis meters market over the next 7 years?

- Who are the major players in the coriolis meters market and what is their market share?

- What are the end-use industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the coriolis meters market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the coriolis meters market?

- What is the current and forecasted size and growth rate of the global coriolis meters market?

- What are the key drivers of growth in the coriolis meters market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the coriolis meters market?

- What are the technological advancements and innovations in the coriolis meters market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the coriolis meters market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the coriolis meters market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of coriolis meters market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CORIOLIS METERS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CORIOLIS METERS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CORIOLIS METERS MARKET OUTLOOK

- GLOBAL CORIOLIS METERS MARKET BY FLUID TYPE, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- LIQUID

- GAS

- GLOBAL CORIOLIS METERS MARKET BY APPLICATION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- OIL AND GAS

- CHEMICALS

- FOOD AND BEVERAGES

- OTHERS

- GLOBAL CORIOLIS METERS MARKET BY REGION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- YOKOGAWA ELECTRIC CORPORATION

- EMERSON

- SIEMENS AG

- ABB LTD.

- SCHNEIDER ELECTRIC CO.

- HONEYWELL

- BROOKS INSTRUMENTS

- TRICOR CORIOLIS TECHNOLOGY

- FOXBORO

- LIQUID CONTROLS LLC

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL CORIOLIS METERS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL CORIOLIS METERS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA CORIOLIS METERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA CORIOLIS METERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 14 US CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA CORIOLIS METERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA CORIOLIS METERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC CORIOLIS METERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC CORIOLIS METERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE CORIOLIS METERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE CORIOLIS METERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 91 UK CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 92 UK CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 UK CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 122 UAE CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY FLUID TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY FLUID TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA CORIOLIS METERS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CORIOLIS METERS MARKET BY FLUID TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CORIOLIS METERS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CORIOLIS METERS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL CORIOLIS METERS MARKET BY FLUID TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL CORIOLIS METERS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL CORIOLIS METERS MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 17 EMERSON: COMPANY SNAPSHOT

FIGURE 18 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 19 ABB LTD.: COMPANY SNAPSHOT

FIGURE 20 SCHNEIDER ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 21 HONEYWELL: COMPANY SNAPSHOT

FIGURE 22 BROOKS INSTRUMENTS: COMPANY SNAPSHOT

FIGURE 23 TRICOR CORIOLIS TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 24 FOXBORO: COMPANY SNAPSHOT

FIGURE 25 LIQUID CONTROLS LLC: COMPANY SNAPSHOT

FAQ

The coriolis meters market is expected to grow at 5.2% CAGR from 2022 to 2029. It is expected to reach above USD 2.53 billion by 2029 from USD 1.6 billion in 2020.

North America held more than 39% of the coriolis meters market revenue share in 2021 and will witness expansion in the forecast period.

Their expanding use in a number of industries, including gas and chemicals, can be attributed to their high demand. The demand for gas flow meters is rising as a result of the increased use of fuel in the industrial sector and in the production of electricity. Sales of gas flow meters are also increasing as a result of the global increase in demand for gas and oil.

In comparison to other regions, the market in North America is anticipated to represent the greatest share in terms of revenue. This might be linked to the region’s developing shale gas industry and the increased demand for novel technologies in the oil and gas sector.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.