REPORT OUTLOOK

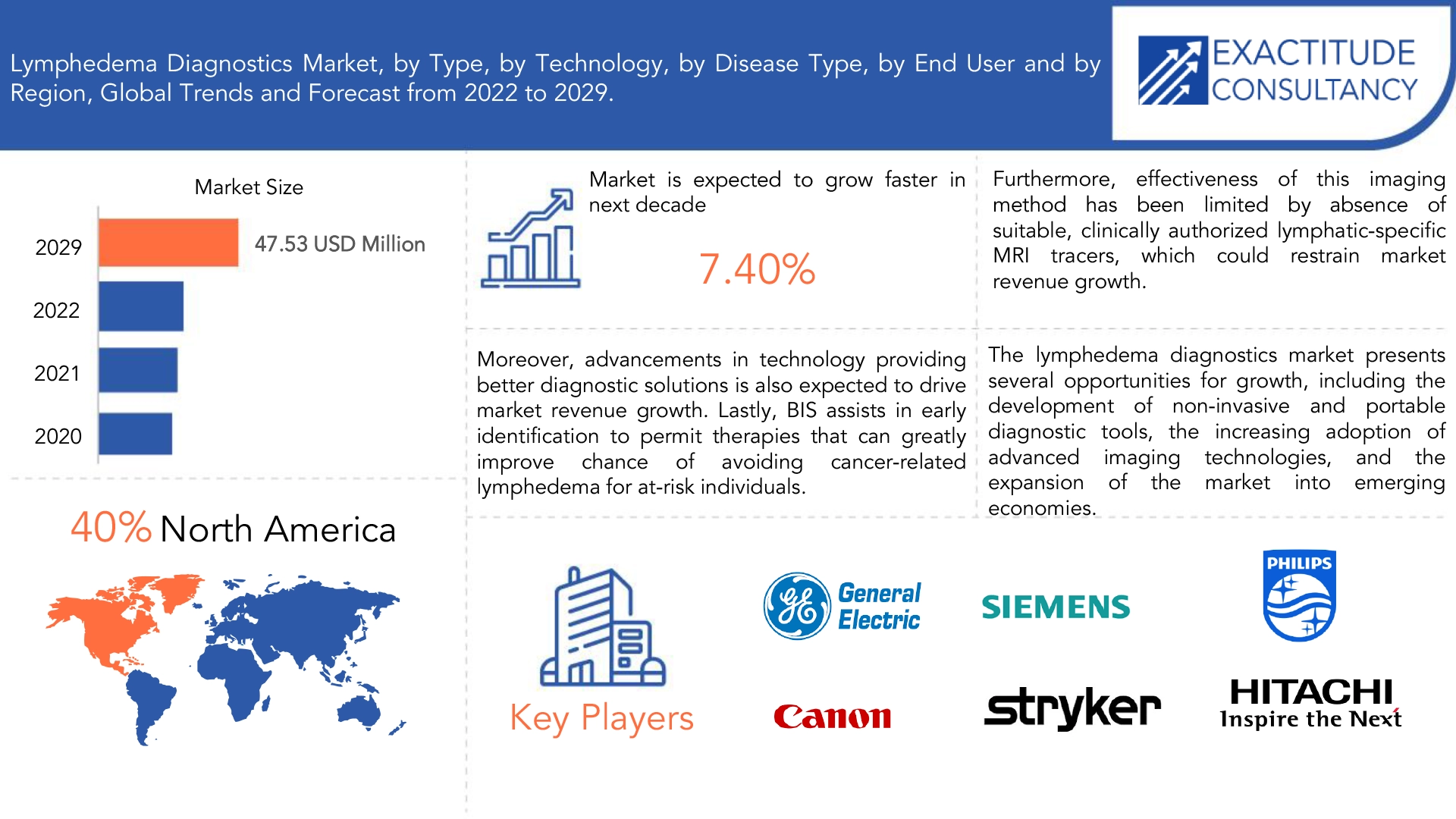

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 47.53 million by 2029 | 7.40 % | North America |

| by Type | By Technology | by End User | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Lymphedema Diagnostics Market Overview

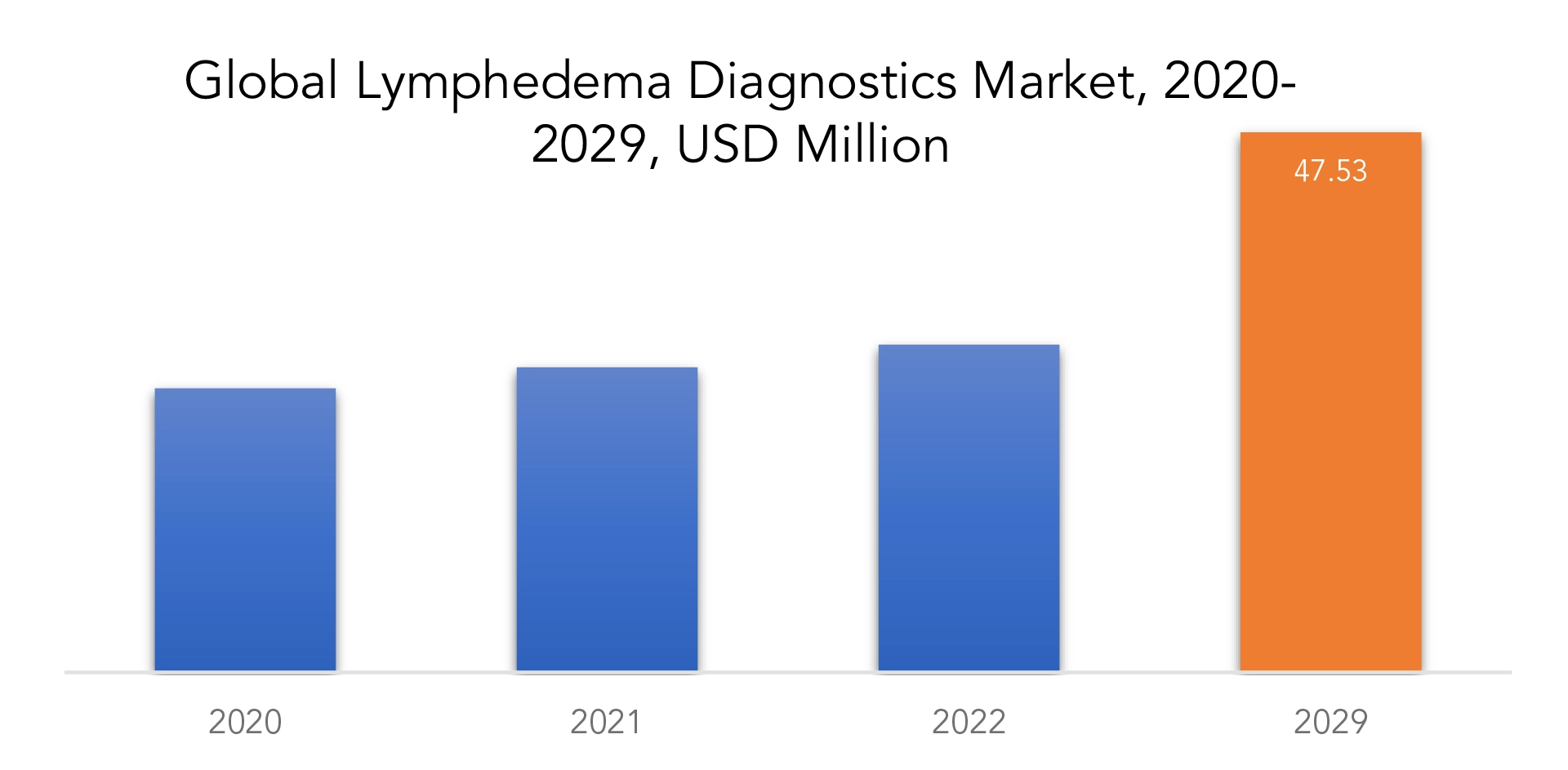

The lymphedema diagnostics market is expected to grow at 7.40 % CAGR from 2022 to 2029. It is expected to reach above USD 47.53 million by 2029 from USD 25 million in 2020.

A chronic illness known as lymphedema causes tissues to bulge as extra fluid builds up inside of them. Lymphatic blockage, which typically affects the arms and legs, is another name for lymphedema. Some people even endure chest, head, and vaginal swelling.

Additionally, it is anticipated that enhanced diagnostic solutions offered by technological improvements will fuel market revenue growth. For instance, tracking and treating lymphedema in the future will be made possible using Bio impedance Spectroscopy (BIS), which is scalable and simple to incorporate into workflows. Doctors and therapists may spend more time on patients due to BIS, which can be administered by licensed clinical staff and does away with the need for an examining room. Finally, BIS supports early detection to enable therapy that can significantly increase the likelihood of preventing cancer-related lymphedema for at-risk persons.

It is believed that as people become older, chronic limb edoema will become more common. Over 5.4 out of 1,000 patients over the age of 65 are known to be affected by the prevalence, which is thought to be 1.3 per 100,000 people in the community. A severe issue affecting one in every five breast cancer patients, chronic arm edoema is also thought to occur in 22% of cases of breast cancer survivors every year. The market for lymphedema diagnostics is expanding as a result of the increased prevalence of cancer-associated lymphedema and the desire for its diagnosis.

Major challenges that may impede the growth of the market’s revenue include high costs for diagnostic equipment and inadequate reimbursements. For instance, women pay significant out-of-pocket costs for breast cancer and lymphedema. The high expense of the tools and the high degree of technical competence required to utilize them and interpret the results remain the main downsides of magnetic resonance imaging (MRI). The lack of adequate, clinically approved lymphatic-specific MRI tracers has also hindered the usefulness of this imaging technique, which may be a factor in the potential slow expansion of the industry.

The development of non-invasive and portable diagnostic instruments, the rising use of cutting-edge imaging technologies, and the market’s expansion into developing nations are just a few of the growth prospects presented by the lymphedema diagnostics market. The desire for focused therapies and personalized medicine is also rising, which offers a chance for the creation of diagnostic instruments that are more precise and effective. Additionally, partnerships between major market companies and research institutes are anticipated to spur innovation and broaden the industry.

On the market for lymphedema diagnoses, the COVID-19 epidemic has had a conflicting effect. One the one hand, the pandemic has reduced the need for elective operations, such as lymphedema diagnostics, which has hurt the industry. However, the epidemic has made it clear how crucial it is to get a diagnosis as soon as possible, which is what will likely increase demand for lymphedema diagnoses in the years to come. In addition, it is anticipated that the development of portable and non-invasive diagnostic instruments would expand their usage in telemedicine and remote monitoring applications both during and after the pandemic.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million). |

| Segmentation | By Type, By Technology, By Disease Type, End User, By Region. |

| By Type

|

|

| By Technology

|

|

| By Disease Type

|

|

| By End User |

|

| By Region

|

|

Lymphedema Diagnostics Market Segment Analysis

The lymphedema diagnostics market is segmented based on type, technology, disease type and end user.

It primarily results from gene defects that interfere with the lymphatic system’s development. Compared to secondary lymphedema, this form has a lower incidence. Damage to the lymphatic system leads to secondary lymphedema. Injury, infection, and cancer treatment are a few of the causes of lymphatic system damage. The type segment’s largest share belongs to this segment. The primary driver of segmental expansion is increasing incidence and prevalence of cases.

The market for lymphedema diagnostics has been divided into categories based on technology, including lymphoscintigraphy, computed tomography, ultrasound imaging, magnetic resonance imaging, and others. During the forecast period, it is anticipated that the lymphoscintigraphy segment will contribute the biggest revenue share. This is due to the potential for early disease identification and the ability of lymphoscintigraphy to identify molecular activity.

The market for lymphedema diagnostics has been divided into categories for cancer, cardiovascular disease (CVD), inflammatory disorders, and other diseases based on the kind of illness. During the projected period, it is anticipated that the cancer section will provide a sizably substantial portion of the total revenue. This is brought on by the rising incidence of cancer-related lymphedema.

Hospitals, diagnostic centers, and other entities make up the different end use segments of the lymphedema diagnostics market. During the projected period, the hospitals segment is anticipated to account for a sizably big revenue share. This is due to an increase in the number of people who seek out hospitals to do diagnostic procedures. By using specialized massage techniques and their understanding of the most recent treatment options, skilled physical therapists and lymphedema therapists can also assist patients in regaining balance and taking control of their lives.

Lymphedema Diagnostics Market Player

The lymphedema diagnostics market key players includes General Electric Company, Siemens AG, Koninklijke Philips N.V., Canon, Inc., Stryker Corporation, Hitachi, Ltd., Neusoft Corporation, Esaote SPA, Shimadzu Corporation, Mindray Medical International Limited.

Recent News:

16 February 2023: Siemens announced the launch of private industrial 5G user equipment, a critical component for the manufacturing industry in its digital transformation journey.

17 August 2021: Siemens Limited and Tata Power Delhi Distribution Limited (Tata Power-DDL) jointly announced the successful deployment of Smart Metering Technology for over 2,00,000 Smart Meters in North Delhi.

Lymphedema Diagnostics Market Regional Analysis

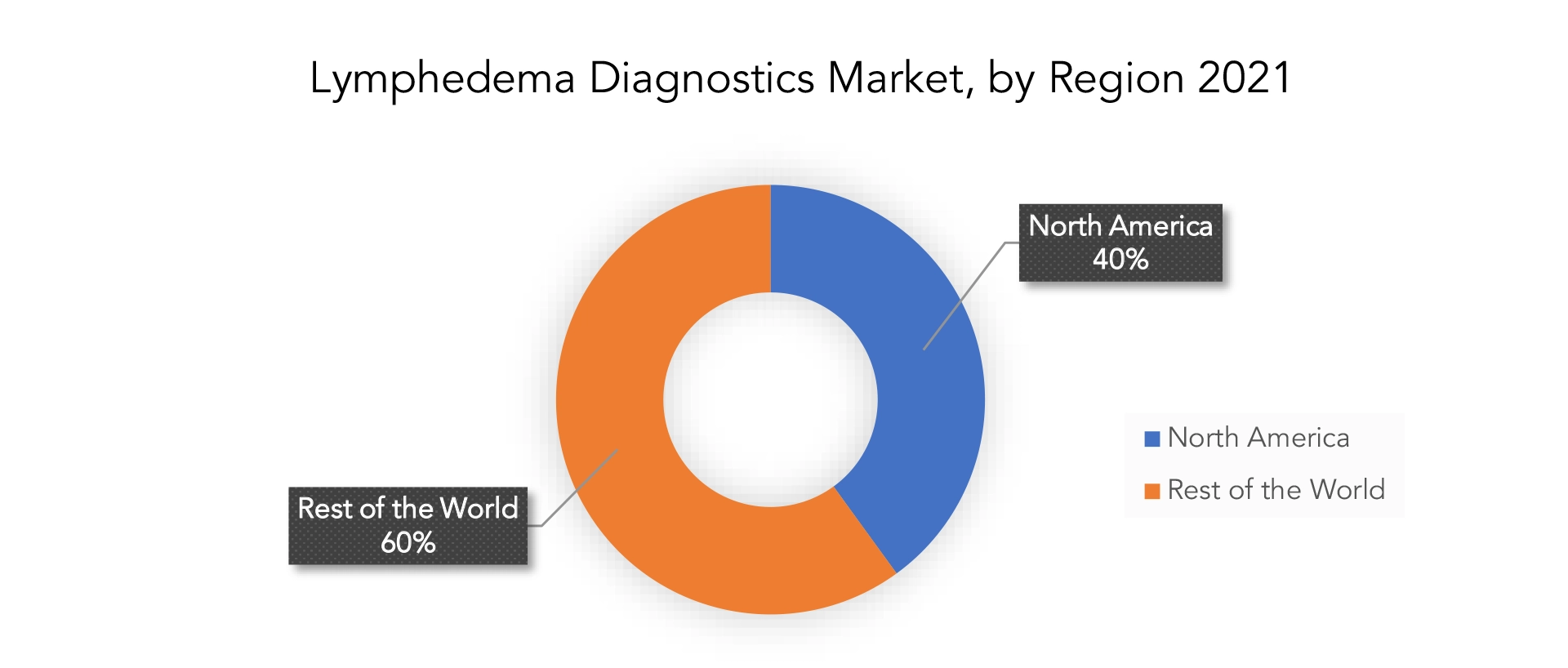

The lymphedema diagnostics market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

During the projected period, North America is anticipated to generate the greatest revenue share due to rising cancer-related lymphedema incidence. For instance, each year more than 1 million Americans suffer from lymphedema, a potentially serious illness. Other variables influencing revenue growth in this region include the expanding usage of technologically advanced diagnostic imaging technology and better insurance coverage policies.

Over the projection period, the Europe market is anticipated to see the quickest revenue growth. This is a result of increased funding and research and development (R&D) efforts to create novel technologies that enable early disease identification. As an illustration, the Lymphit project, which is supported by the European Union (EU), has developed a state-of-the-art microneedle-based technology for analysing the lymphatic system using a fluorescent dye to improve lymphedema detection at an early stage. Due to quantitative dye monitoring, which provides knowledge regarding the health of the lymphatic system, therapy may be initiated when the issue is treatable.

Key Market Segments: Lymphedema Diagnostics Market

Lymphedema Diagnostics Market By Type, 2020-2029, (USD Million).

- Primary

- Secondary

Lymphedema Diagnostics Market By Technology, 2020-2029, (USD Million).

- Lymphoscintigraphy

- Magnetic Resonance Imaging

- Computed Tomography

- Ultrasound Imaging

- Others

Lymphedema Diagnostics Market By Disease Type, 2020-2029, (USD Million).

- Cancer

- Inflammatory Disease

- Cardiovascular Disease

- Others

Lymphedema Diagnostics Market By End User, 2020-2029, (USD Million).

- Hospitals

- Diagnostic Centers

- Others

Lymphedema Diagnostics Market By Region, 2020-2029, (USD Million).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Who Should Buy? Or Key Stakeholders

- Diagnostic tool manufacturers

- Healthcare providers

- Research institutions

- Regulatory authorities

- Patient advocacy groups

- Health insurance companies

- Distributors and suppliers

- Others

Key Question Answered

- What is the expected growth rate of the lymphedema diagnostics market over the next 7 years?

- Who are the major players in the lymphedema diagnostics market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such As Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the lymphedema diagnostics market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the lymphedema diagnostics market?

- What is the current and forecasted size and growth rate of the global lymphedema diagnostics market?

- What are the key drivers of growth in the lymphedema diagnostics market?

- What are the distribution channels and supply chain dynamics in the lymphedema diagnostics market?

- What are the technological advancements and innovations in the lymphedema diagnostics market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the lymphedema diagnostics market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the lymphedema diagnostics market?

- What are the service offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA TECHNOLOGYS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON LYMPHEDEMA DIAGNOSTICS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET OUTLOOK

- GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLION), 2020-2029

- PRIMARY

- SECONDARY

- GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLION) , 2020-2029

- LYMPHOSCINTIGRAPHY

- MAGNETIC RESONANCE IMAGING

- COMPUTED TOMOGRAPHY

- ULTRASOUND IMAGING

- OTHERS

- GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLION) , 2020-2029

- CANCER

- INFLAMMATORY DISEASE

- CARDIOVASCULAR DISEASE

- OTHERS

- GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLION) , 2020-2029

- HOSPITALS

- DIAGNOSTIC CENTERS

- OTHERS

- GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY REGION (USD MILLION) , 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- GENERAL ELECTRIC COMPANY

- SIEMENS AG

- KONINKLIJKE PHILIPS N.V.

- CANON, INC.

- STRYKER CORPORATION

- HITACHI, LTD.

- NEUSOFT CORPORATION

- ESAOTE SPA

- SHIMADZU CORPORATION

- MINDRAY MEDICAL INTERNATIONAL LIMITED*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 3 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 5 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 6 NORTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 7 NORTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 9 NORTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 10 NORTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 11 US LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 12 US LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 13 US LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 14 US LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 15 CANADA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (MILLIONS), 2020-2029

TABLE 16 CANADA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 17 CANADA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 18 CANADA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 19 MEXICO LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 20 MEXICO LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 21 MEXICO LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 22 MEXICO LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 23 SOUTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 24 SOUTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 25 SOUTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 26 SOUTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 27 SOUTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 28 BRAZIL LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 29 BRAZIL LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 30 BRAZIL LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 31 BRAZIL LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 32 ARGENTINA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 33 ARGENTINA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 34 ARGENTINA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 35 ARGENTINA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 36 COLOMBIA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 37 COLOMBIA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 38 COLOMBIA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 39 COLOMBIA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 40 REST OF SOUTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 41 REST OF SOUTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 42 REST OF SOUTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 44 ASIA-PACIFIC LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 45 ASIA-PACIFIC LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 46 ASIA-PACIFIC LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 47 ASIA-PACIFIC LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 48 ASIA-PACIFIC LYMPHEDEMA DIAGNOSTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 49 INDIA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 50 INDIA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 51 INDIA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 52 INDIA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 53 CHINA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 54 CHINA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 55 CHINA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 56 CHINA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 57 JAPAN LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 58 JAPAN LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 59 JAPAN LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 60 JAPAN LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 61 SOUTH KOREA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 62 SOUTH KOREA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 63 SOUTH KOREA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 64 SOUTH KOREA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 65 AUSTRALIA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 66 AUSTRALIA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 67 AUSTRALIA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 68 AUSTRALIA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 69 SOUTH EAST ASIA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 70 SOUTH EAST ASIA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 71 SOUTH EAST ASIA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 72 SOUTH EAST ASIA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 73 REST OF ASIA PACIFIC LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 74 REST OF ASIA PACIFIC LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 75 REST OF ASIA PACIFIC LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 76 REST OF ASIA PACIFIC LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 77 EUROPE LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 78 EUROPE LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 79 EUROPE LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 80 EUROPE LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 81 EUROPE LYMPHEDEMA DIAGNOSTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 82 GERMANY LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 83 GERMANY LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 84 GERMANY LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 85 GERMANY LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 86 UK LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 87 UK LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 88 UK LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 89 UK LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 90 FRANCE LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 91 FRANCE LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 92 FRANCE LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 93 FRANCE LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 94 ITALY LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 95 ITALY LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 96 ITALY LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 97 ITALY LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 98 SPAIN LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 99 SPAIN LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 100 SPAIN LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 101 SPAIN LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 102 RUSSIA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 103 RUSSIA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 104 RUSSIA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 105 RUSSIA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 106 REST OF EUROPE LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 107 REST OF EUROPE LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 108 REST OF EUROPE LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 109 REST OF EUROPE LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 110 MIDDLE EAST AND AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 111 MIDDLE EAST AND AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 112 MIDDLE EAST AND AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 113 MIDDLE EAST AND AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 114 MIDDLE EAST AND AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 115 UAE LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 116 UAE LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 117 UAE LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 118 UAE LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 119 SAUDI ARABIA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 120 SAUDI ARABIA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 121 SAUDI ARABIA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 122 SAUDI ARABIA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 123 SOUTH AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 124 SOUTH AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 125 SOUTH AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 126 SOUTH AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

TABLE 127 REST OF MIDDLE EAST AND AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 128 REST OF MIDDLE EAST AND AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE (USD MILLIONS), 2020-2029

TABLE 130 REST OF MIDDLE EAST AND AFRICA LYMPHEDEMA DIAGNOSTICS MARKET BY END USER (USD MILLIONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 10 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 12 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY TYPE, USD MILLION, 2021

FIGURE 15 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY TECHNOLOGY, USD MILLION, 2021

FIGURE 16 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY DISEASE TYPE, USD MILLION, 2021

FIGURE 17 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY END USER, USD MILLION, 2021

FIGURE 18 GLOBAL LYMPHEDEMA DIAGNOSTICS MARKET BY REGION 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

FIGURE 21 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 22 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

FIGURE 23 CANON, INC.: COMPANY SNAPSHOT

FIGURE 24 STRYKER CORPORATION: COMPANY SNAPSHOT

FIGURE 25 HITACHI, LTD.: COMPANY SNAPSHOT

FIGURE 26 NEUSOFT CORPORATION: COMPANY SNAPSHOT

FIGURE 27 ESAOTE SPA: COMPANY SNAPSHOT

FIGURE 28 SHIMADZU CORPORATION: COMPANY SNAPSHOT

FIGURE 29 MINDRAY MEDICAL INTERNATIONAL LIMITED: COMPANY SNAPSHOT

FAQ

The lymphedema diagnostics market is expected to grow at 7.40 % CAGR from 2022 to 2029. It is expected to reach above USD 47.53 million by 2029 from USD 25 million in 2020.

North America held more than 40 % of the lymphedema diagnostics market revenue share in 2021 and will witness expansion in the forecast period.

Additionally, it is anticipated that enhanced diagnostic solutions offered by technological improvements will fuel market revenue growth. For instance, tracking and treating lymphedema in the future will be made possible using Bio impedance Spectroscopy (BIS), which is scalable and simple to incorporate into workflows.

During the projected period, it is anticipated that the cancer section will provide a sizably substantial portion of the total revenue. This is brought on by the rising incidence of cancer-related lymphedema.

During the projected period, North America is anticipated to generate the greatest revenue share due to rising cancer-related lymphedema incidence. For instance, each year more than 1 million Americans suffer from lymphedema, a potentially serious illness. Other variables influencing revenue growth in this region include the expanding usage of technologically advanced diagnostic imaging technology and better insurance coverage policies.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.