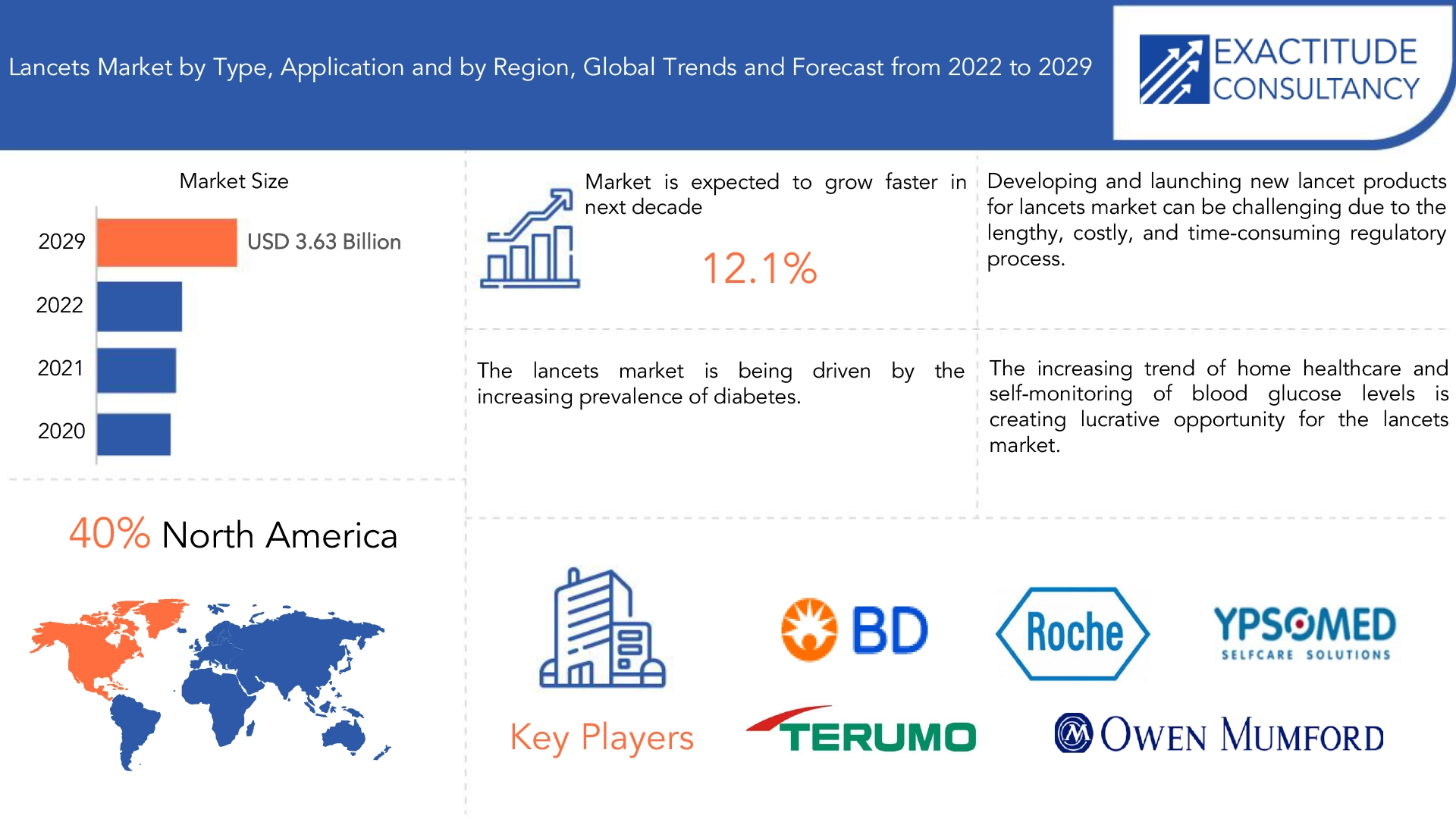

REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.63 billion by 2029 | 12.1 % | North America |

| by Type | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Lancets Market Overview

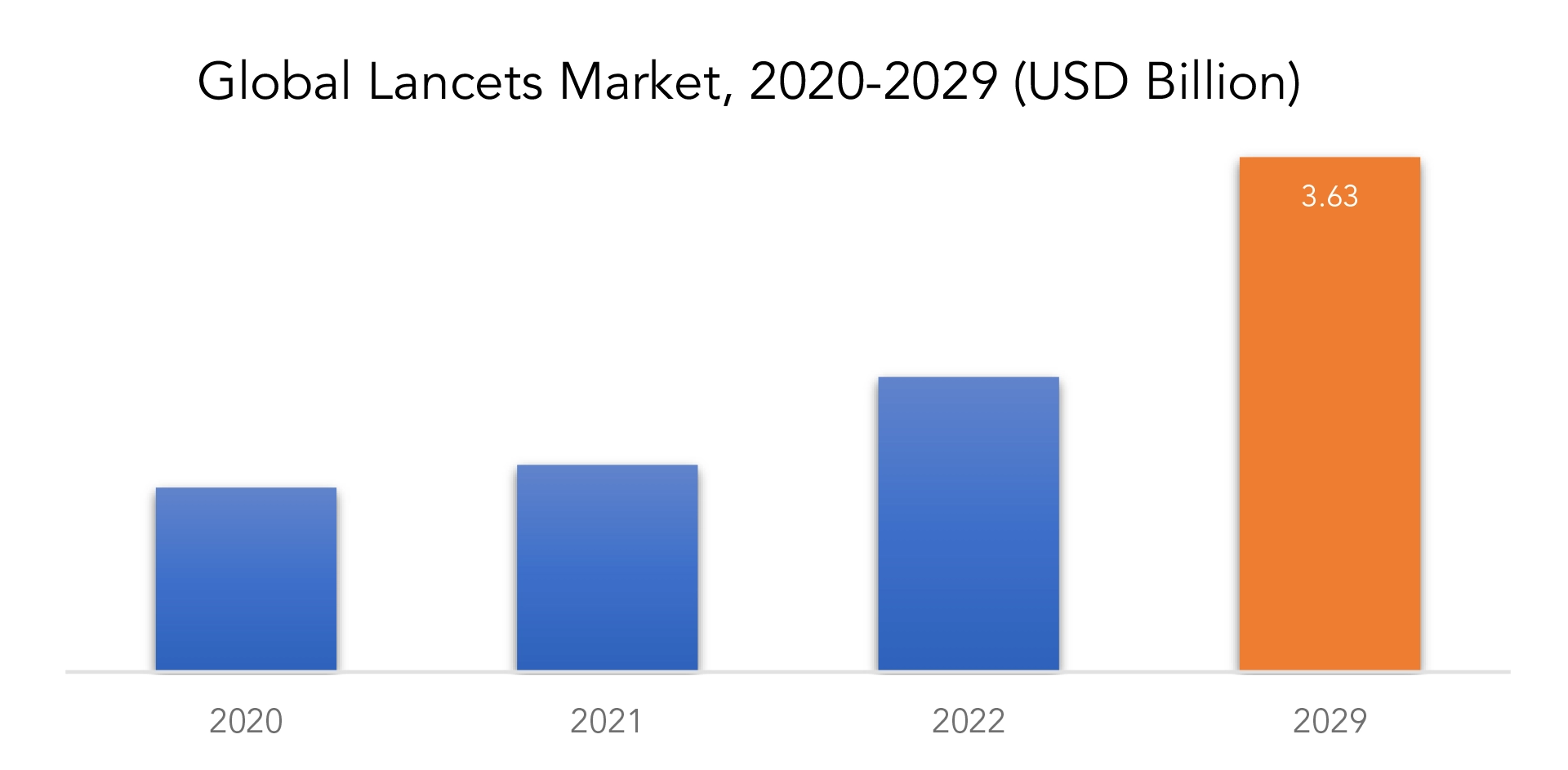

The lancets market is expected to grow at 12.1 % CAGR from 2022 to 2029. It is expected to reach above USD 3.63 billion by 2029 from USD 1.3 billion in 2020.

Lancets are disposable needles that are sharp and small in size, used to obtain a small blood sample by pricking the skin for glucose monitoring or other blood tests. Individuals with diabetes frequently use lancets to monitor their blood sugar levels regularly. Typically, lancets are comprised of a needle enclosed in a casing made of plastic or metal, designed to safeguard the user from accidental needle sticks and to ensure that the needle is properly placed for the skin prick. To activate the lancet, it is pressed against the skin, which releases the needle and punctures the skin. After use, the lancet is disposed of in a sharps container to prevent contamination and reduce the risk of infection.

Lancets are available in various sizes and gauges, and the selection of a lancet depends on the skin type, amount of blood needed, and the device used for blood sampling. Lancets can be used either with a handheld lancing device or an integrated lancet and blood glucose meter system.

The lancets market is being driven by the increasing prevalence of diabetes, which is a chronic disease that impairs the body’s ability to produce or use insulin, leading to high blood sugar levels. People with diabetes need to monitor their blood glucose levels frequently to manage their condition effectively. Lancets play a crucial role in obtaining blood samples for glucose monitoring and are commonly used by individuals with diabetes who need to monitor their blood sugar levels regularly. Consequently, the rising incidence of diabetes is expected to boost the demand for lancets. Regular monitoring of blood glucose levels is essential in preventing complications such as neuropathy, cardiovascular disease, and blindness, among others, in people with diabetes.

Developing and launching new lancet products can be challenging due to the lengthy, costly, and time-consuming regulatory process. To obtain regulatory approval, companies need to conduct rigorous testing and clinical trials that can take several years and require significant financial resources. Moreover, regulatory compliance can increase the manufacturing, marketing, and distribution costs of lancets, resulting in higher prices for end-users. This can hinder the adoption of lancets in low-income countries where healthcare resources are limited, and affordability is a significant concern.

The increasing trend of home healthcare and self-monitoring of blood glucose levels is creating lucrative opportunity for the lancets market. Portable blood glucose monitoring devices and lancets are increasingly available, enabling patients with diabetes to monitor their blood glucose levels conveniently without visiting a healthcare facility. This has led to improved patient compliance and better management of diabetes, reducing the risk of complications. As a result, the lancets market can benefit by developing lancets that are user-friendly, easy to use, and provide accurate results.

As hospitalizations due to covid-19 increased, there was a surge in demand for lancets in healthcare facilities to monitor the blood glucose levels of diabetic patients. However, the pandemic also caused supply chain disruptions and manufacturing delays, resulting in a shortage of lancets in some regions. The pandemic also accelerated the adoption of telemedicine and remote healthcare, leading to the development of innovative solutions for remote blood glucose monitoring using lancets, which opened up new opportunities for the lancets market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion, Thousand Units) |

| Segmentation | By Type, By Application, By Region |

| By Type |

|

| By Application |

|

| By Region |

|

Lancets Market Segment Analysis

The lancets market is segmented based on type, and application.

The lancets market is dominated by safety lancets, which have surpassed personal lancets in terms of market size and growth. This can be attributed to the rising demand for safety lancets, which provide various advantages over conventional personal lancets, such as reduced risk of needlestick injuries, ease of use, and compliance with safety regulations. Safety lancets are extensively used in hospitals, clinics, and other healthcare settings for blood sampling and medical procedures, further augmenting their market dominance.

The largest market share in the lancets market is held by glucose testing, which represents a significant portion of the overall demand for lancets. The high prevalence of diabetes worldwide and the increasing need for regular monitoring of blood glucose levels among diabetic patients are key drivers of this market segment. Hemoglobin testing is also a significant application area for lancets, particularly in the diagnosis and management of anemia and other blood-related disorders.

Lancets Market Players

The lancets market key players include Becton, Dickinson and Company, Roche Diagnostics, Ypsomed, Terumo Corporation, Owen Mumford, HTL-STREFA S.A, ARKRAY, B. Braun Melsungen, Sarstedt, and SteriLance Medical.

Industry Developments

February 22, 2023 : mylife Loop offered new remote monitoring feature for parents. mylife YpsoPump and mylife CamAPS FX is the only automated insulin delivery (AID) system that can be connected either to the Dexcom G6 sensor from Dexcom or to the FreeStyle Libre 3 sensor from Abbott.

April 11, 2023 : BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, launched a new, easy-to-use advanced ultrasound device with a specialized probe designed to provide clinicians with optimal IV placement.

Who Should Buy? Or Key stakeholders

- Lancets Suppliers

- Raw Materials Manufacturers

- Distributors and wholesalers

- Healthcare providers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Lancets Market Regional Analysis

The lancets market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The North America lancets market is expected to experience steady growth due to factors such as the high prevalence of diabetes, the increasing adoption of self-monitoring of blood glucose levels, and the availability of advanced healthcare infrastructure. The growing demand for safety lancets, which offer improved safety features and comply with stringent regulations, is expected to drive market growth. However, factors such as the high cost of lancets, strict regulatory guidelines, and the availability of alternative testing methods such as continuous glucose monitoring systems may hinder market growth.The covid-19 pandemic had an impact on the North America lancets market, with an increased demand for lancets due to the rising number of covid-19 patients with diabetes. The shift towards telemedicine and remote healthcare has also created new opportunities for the lancets market to develop innovative solutions for remote blood glucose monitoring.

The lancet market in the Asia Pacific and South America regions is poised for substantial growth in the foreseeable future, driven by various factors. Among these factors, the escalating incidence of chronic diseases, including diabetes that necessitates regular blood glucose monitoring with lancets, stands out as a significant growth driver. With rapid urbanization and lifestyle changes prevalent in these regions, the prevalence of chronic diseases is expected to surge, spurring the demand for lancets. Another contributing factor is the rising adoption of self-monitoring devices and home healthcare, fueled by technological advancements and growing awareness about the advantages of early detection and prevention of chronic diseases.

Key Market Segments: Lancets Market

Lancets Market by Type, 2020-2029, (USD Billion, Thousand Units)

- Safety Lancets

- Personal Lancets

Lancets Market by Application, 2020-2029, (USD Billion, Thousand Units)

- Glucose Testing

- Hemoglobin Testing

- Coagulation Testing

- Other Applications

Lancets Market by Region, 2020-2029, (USD Billion, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered: –

- What is the expected growth rate of the lancets market over the next 5 years?

- Who are the major players in the Lancet market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the lancets market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the lancet market?

- What is the current and forecasted size and growth rate of the global lancets market?

- What are the key drivers of growth in the lancets market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the lancets market?

- What are the technological advancements and innovations in the lancets market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Lancet market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the lancets market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of lancets in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL LANCETS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON LANCETS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL LANCETS MARKET OUTLOOK

- GLOBAL LANCETS MARKET BY TYPE (USD BILLION, THOUSAND UNITS)

- SAFETY LANCETS

- PERSONAL LANCETS

- GLOBAL LANCETS MARKET BY APPLICATION (USD BILLION, THOUSAND UNITS)

- GLUCOSE TESTING

- HEMOGLOBIN TESTING

- COAGULATION TESTING

- OTHER APPLICATIONS

- GLOBAL LANCETS MARKET BY REGION (USD BILLION, THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BECTON, DICKINSON AND COMPANY

- ROCHE DIAGNOSTICS

- YPSOMED

- TERUMO CORPORATION

- OWEN MUMFORD

- HTL-STREFA S.A

- ARKRAY

- BRAUN MELSUNGEN

- SARSTEDT

- STERILANCE MEDICAL. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL LANCETS MARKET BY TYPE (USD BILLION ), 2020-2029

TABLE 2 GLOBAL LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL LANCETS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL LANCETS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA LANCETS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA LANCETS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA LANCETS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA LANCETS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC LANCETS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC LANCETS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE LANCETS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE LANCETS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 91 UK LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 UK LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA LANCETS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA LANCETS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA LANCETS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA LANCETS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA LANCETS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA LANCETS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LANCETS BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL LANCETS BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL LANCETS BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL LANCETS BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL LANCETS BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL LANCETS BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT

FIGURE 17 ROCHE DIAGNOSTICS : COMPANY SNAPSHOT

FIGURE 18 YPSOMED: COMPANY SNAPSHOT

FIGURE 19 TERUMO CORPORATION.: COMPANY SNAPSHOT

FIGURE 20 OWEN MUMFORD: COMPANY SNAPSHOT

FIGURE 21 HTL-STREFA S.A: COMPANY SNAPSHOT

FIGURE 22 ARKRAY: COMPANY SNAPSHOT

FIGURE 23 B. BRAUN MELSUNGEN.: COMPANY SNAPSHOT

FIGURE 24 SARSTEDT: COMPANY SNAPSHOT

FIGURE 25 STERILANCE MEDICAL: COMPANY SNAPSHOT

FAQ

The lancets market size was USD 1.46 Billion in the year 2021

North America held more than 40% of the Lancets market revenue share in 2021 and will witness expansion in the forecast period.

The lancets market is being driven by the increasing prevalence of diabetes, which is a chronic disease that impairs the body’s ability to produce or use insulin, leading to high blood sugar levels.

The largest market share in the lancets market is held by glucose testing, which represents a significant portion of the overall demand for lancets.

North America dominated the Lancets market in the year 2021.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.