Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

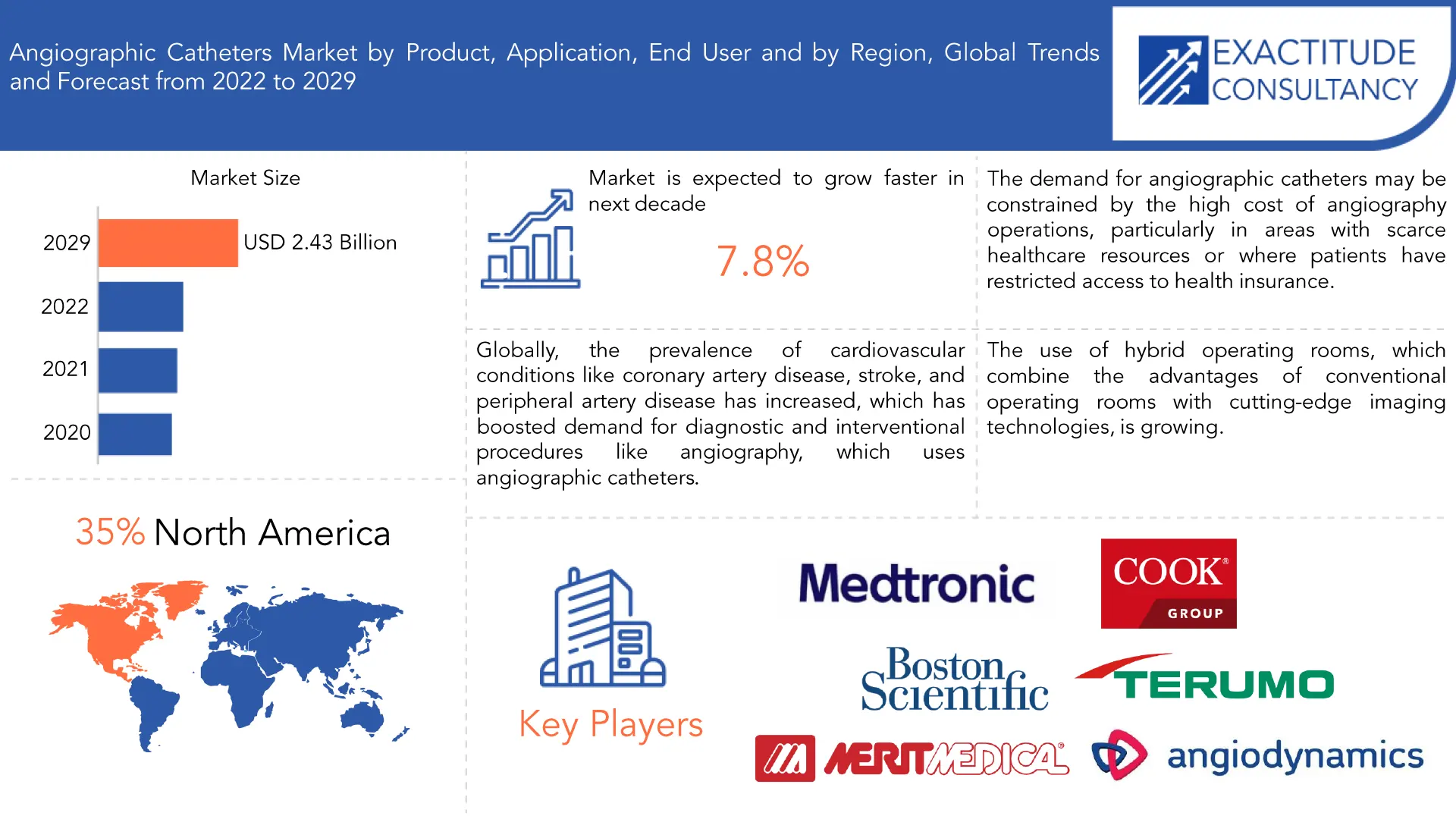

| USD 2.43 Billion By 2029 | 7.8% | North America |

| By Product | By Application | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Angiographic Catheters Market Overview

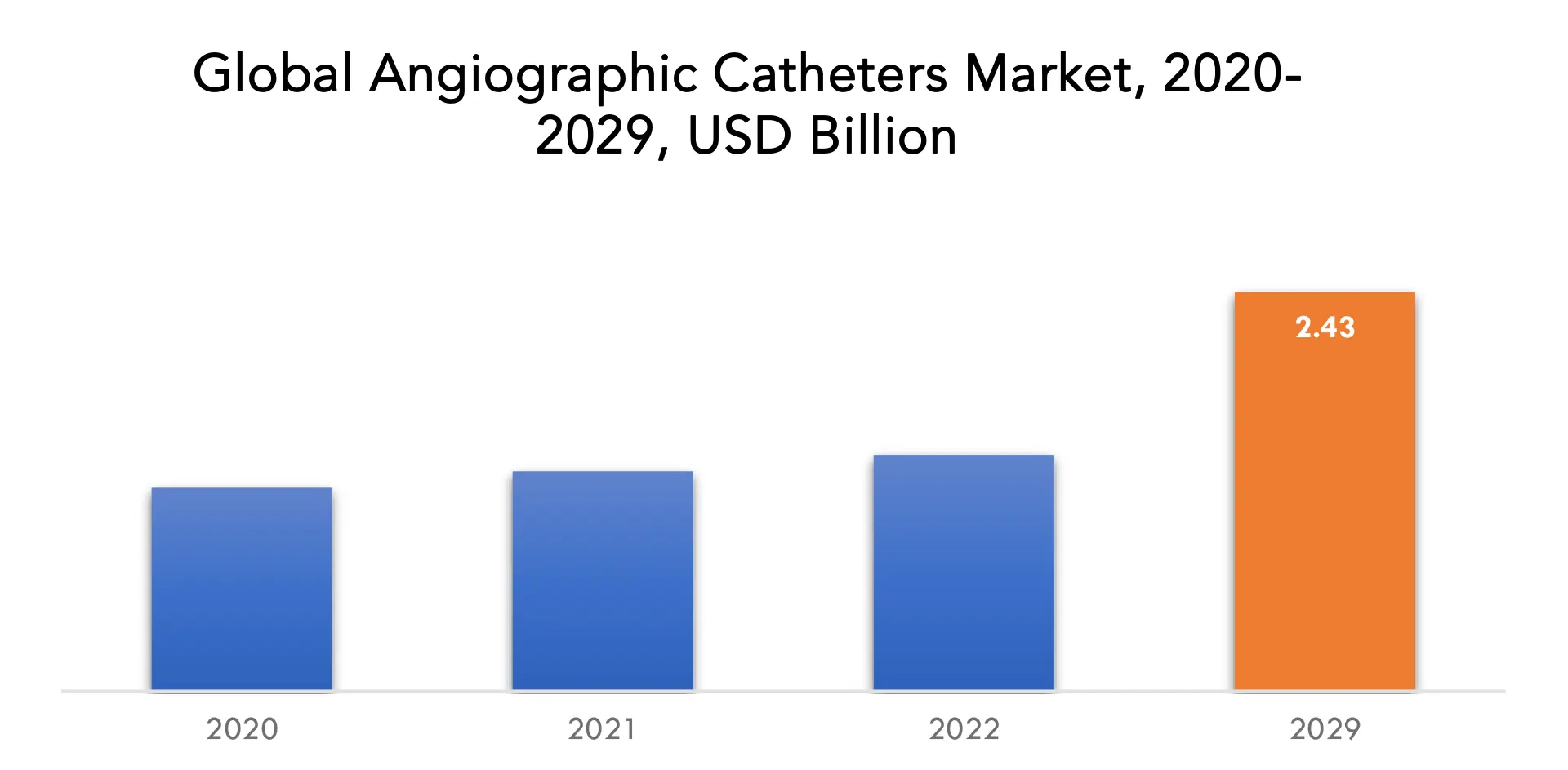

The angiographic catheters market is expected to grow at 7.8% CAGR from 2021 to 2029. It is expected to reach above USD 2.43 Billion by 2029 from USD 1.24 Billion in 2020.

A catheter is a tubular device that permits fluid to enter or exit a blood vessel or anatomical cavity. To view the circulatory system organs, a contrast agent is injected into the body using an angiographic catheter. These catheters could have been designed with ends that permitted selected localization from a distance. A diagnostic catheter that is also used for angiographic operations is known as an angiographic catheter. It distributes medicinal chemicals and radiopaque substances to specified areas of the circulatory system. The market for angiographic catheters will expand at a faster rate due to the increasing prevalence of cardiovascular illnesses. Likewise, the market for angiographic catheters is expanding as a result of sedentary lifestyles, hypertension, and obesity rates. The need for angiographic catheters will increase even more as domestic income levels rise. People can spend more on healthcare due to rising domestic income, and reimbursement policies make it simpler for patients to accept treatments.

The government’s increasing efforts to raise public awareness will also have a significant impact on the market growth rate for angiographic catheters. The development of technology is another important aspect contributing to the expansion of the industry. Additionally, the market will develop as a result of an increase in the number of elderly people and their preference for minimally invasive procedures. The market for angiographic catheters will have slower growth due to rising tobacco, alcohol, and drug usage. The expansion of the angiographic catheter market will benefit from the increase in research and development activities. The majority of research and development efforts are focused on a method that pinpoints the exact location of bleeding and can be used for embolization or vasopressin therapy. In addition, the projected growth rate of the angiographic catheter market will be further accelerated by the acceleration of technical advancement in medical devices. With the use of more advanced technology, angiograms give a precise picture of the blood vessels, which has been shown to be advantageous for market expansion.

An allergic response to the unfamiliar substances or medications used during the procedure is one of the hazards associated with catheterization. The angiographic catheter market faces a significant challenge since there may be bleeding, infection, bruising, and blood clots in the capillaries at the catheter attachment site, which can result in a heart attack, stroke, or other serious illnesses. On the other hand, the high cost of angiographic procedures will restrain market expansion. The market for angiographic catheters will also face significant challenges from rigorous government regulations related to product approval. However, during the projection period of 2022–2029, the unusual nature of therapies and their limited availability would act as a restraint and further hamper the growth rate of the market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Million units) |

| Segmentation | By Product, By Application, By End User, By Region |

| By Product |

|

| By Application |

|

| By End user |

|

| By Region |

|

Angiographic Catheters Market Segment Analysis

The angiographic catheters market is segmented based on product, application, end user and region.

Based on product, the market is segmented into scoring balloon catheters, conventional catheters, drug eluting balloon catheters, cutting balloon catheters. Within the market for angiographic catheters, conventional catheters dominate the product category. Angiography, angioplasty, and embolization are just a few of the diagnostic and interventional techniques that frequently make use of these catheters. Conventional angiographic catheters are made up of a long, thin tube made of flexible plastic or rubber that is put into a blood artery and guided to the desired location using fluoroscopy or other imaging methods. The blood arteries can then be seen on X-ray images after the catheter is used to inject contrast material into the bloodstream.

Based on application, the market is segmented into coronary, endovascular, neurology, oncology. By 2029, the coronary market category is anticipated to hold a sizeable revenue share. Blood is given to the heart muscle by coronary arteries because, like all other bodily tissues, the heart muscle need oxygen-rich blood to function. Plasma that has lost oxygen must also be thrilled. During angiographic surgery, the coronary arteries encircle the heart. The neurology section, on the other hand, is anticipated to expand at a sizable CAGR throughout the projection period. A cerebral angiogram, also referred to as a brain angiography, is an examination that checks the brain’s blood vessels and blood flow for problems. These problems can occur in the neurological segment and include bleeding in the brain, a narrowing or blockage of a blood vessel, and bulging in a blood artery, including an aneurysm. In addition, employing X-rays, endovascular techniques aid in the visualization of blood arteries. This section also involves performing native anesthesia in the upper part of the thigh.

Based on end user, the market is segmented into hospital, clinics, ambulatory surgical centers. By 2029, the hospital sector is anticipated to command a sizable revenue portion of the market. A larger healthcare substructure, the availability of a competent workforce, and the cost of the materials used to make catheters are all contributing reasons to the expansion of this market. Another factor influencing the growth of this market is the escalation in an enduring puddle, which is due to a significant increase in the geriatric population suffering from lifestyle ailments like atherosclerosis and heart failure disease and is anticipated to increase hospital income production. But during the projection period, the ambulatory surgical segment is anticipated to expand at a substantial CAGR. Ambulatory surgical procedures include same-day surgical care, which includes defensive and diagnostic procedures with a focus on modern medical comforts. The ambulatory surgical procedure involves performing tonolectomies, hernia repairs, and cataract operations.

Angiographic Catheters Market Players

The angiographic catheters Market Key players include Medtronic, Boston Scientific Corporation, Terumo Medical Corporation, Cardinal Health, Merit Medical Systems, Inc., AngioDynamics, Inc., OSCOR Inc., B. Braun Melsungen AG, InSitu Technologies Inc., BVM Medical Limited, Precision Extrusion Inc., Cardiva, C.R. Brad Inc., Abbott Laboratories, Cook Group.

Industry Development:

- 02 August, 2021: Boston Scientific announced that the US centers for Medicare & Medicaid Services (CMS) granted a New Technology NTAP for single-use duodenoscopes applicable to the EXALT Model D Single-Use Duodenoscope.

- 12 July, 2022: Braun launched Introcan Safety 2 IV Catheter with One-time Blood Control Designed to make IV access safer for Clinicians.

Who Should Buy? Or Key stakeholders

- Manufacturers and Suppliers of Angiographic Catheters

- Hospitals and Healthcare Providers

- Financial Institutes

- Government & Regional Agencies

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Angiographic Catheters Market Regional Analysis

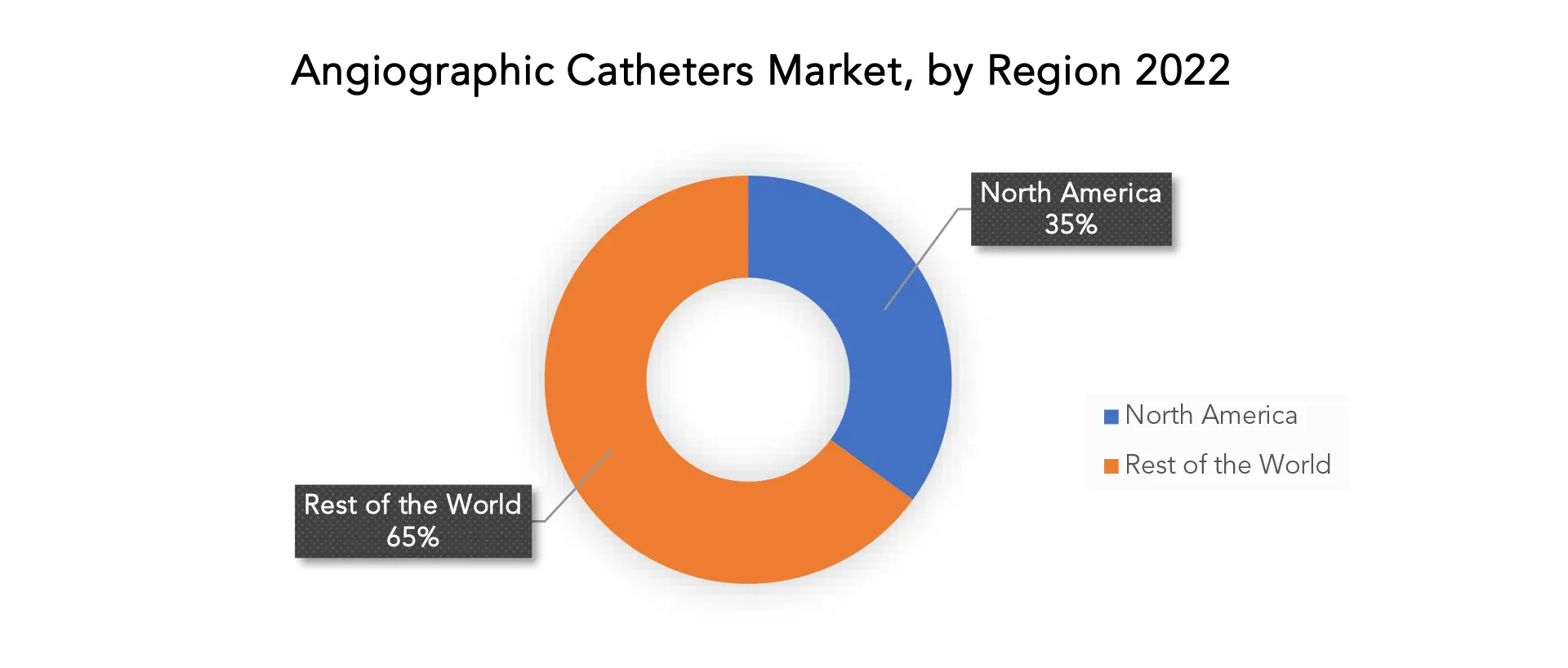

The angiographic catheters Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America dominated the angiographic catheters market in 2021. The area has a strong healthcare infrastructure, which consists of cutting-edge medical facilities, highly qualified healthcare workers, and substantial healthcare spending. Furthermore, the area has a sizable patient base with a high prevalence of chronic illnesses, including cardiovascular conditions, which call for angiography operations and associated equipment like angiographic catheters. Technology improvements that have increased the precision and security of angiography operations, such as the creation of novel imaging modalities and the use of sophisticated catheter materials, are another factor driving the market in North America. Additionally, the region offers a supportive regulatory framework that encourages innovation and financial investment in medical technology.

Asia Pacific will have the angiographic catheters market’s fastest growth in 2021. In the Asia Pacific region, chronic disorders including cardiovascular diseases are becoming more common. The need for angiography procedures and associated equipment, such as angiographic catheters, is being driven by this. The area is making significant investments in the facilities for medical research, hospitals, and clinics. The need for medical devices like angiographic catheters is being driven by this investment. In order to increase access to care and patient outcomes, countries in the Asia-Pacific area are boosting their healthcare spending. As a result, there is an increase in investment in medical tools and supplies such angiographic catheters.

Key Market Segments: Angiographic Catheters Market

Angiographic Catheters Market By Product, 2020-2029, (USD Billion, Million Units)

- Scoring Balloon Catheters

- Conventional Catheters

- Drug Eluting Balloon Catheters

- Cutting Balloon Catheters

Angiographic Catheters Market By Application, 2020-2029, (USD Billion, Million Units)

- Coronary

- Endovascular

- Neurology

- Oncology

Angiographic Catheters Market By End User, 2020-2029, (USD Billion, Million Units)

- Hospital

- Clinics

- Ambulatory Surgical Centers

Angiographic Catheters Market By Region, 2020-2029, (USD Billion, Million units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Key Objectives:

- Increasing sales and market share

- Developing new application

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the angiographic catheters market over the next 7 years?

- Who are the major players in the angiographic catheters market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the angiographic catheters market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the angiographic catheters market?

- What is the current and forecasted size and growth rate of the global angiographic catheters market?

- What are the key drivers of growth in the angiographic catheters market?

- Who are the major players in the market and what is their market share?

- What are the end users and supply chain dynamics in the angiographic catheters market?

- What are the technological advancements and innovations in the angiographic catheters market and their impact on application development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the angiographic catheters market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the angiographic catheters market?

- What are the application product and specifications of leading players in the market?

- What is the pricing trend of angiographic catheters in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ANGIOGRAPHIC CATHETERS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ANGIOGRAPHIC CATHETERS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ANGIOGRAPHIC CATHETERS MARKET OUTLOOK

- GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION, MILLION UNITS), 2020-2029

- SCORING BALLOON CATHETERS

- CONVENTIONAL CATHETERS

- DRUG ELUTING BALLOON CATHETERS

- CUTTING BALLOON CATHETERS

- GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION, MILLION UNITS), 2020-2029

- CORONARY

- ENDOVASCULAR

- NEUROLOGY

- ONCOLOGY

- GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION, MILLION UNITS), 2020-2029

- AMBULATORY SURGICAL CENTERS

- HOSPITALS

- CLINICS

- GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY REGION (USD BILLION, MILLION UNITS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- MEDTRONIC

- BOSTON SCIENTIFIC CORPORATION

- TERUMO MEDICAL CORPORATION

- CARDINAL HEALTH

- MERIT MEDICAL SYSTEMS, INC.

- ANGIODYNAMICS, INC.

- OSCOR INC.

- BRAUN MELSUNGEN AG

- INSITU TECHNOLOGIES INC.

- BVM MEDICAL LIMITED

- PRECISION EXTRUSION INC.

- CARDIVA

- R. BRAD INC.

- ABBOTT LABORATORIES

- COOK GROUP

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 2 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 3 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 5 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 7 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY REGION (MILLION UNITS) 2020-2029

TABLE 9 NORTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (MILLION UNITS) 2020-2029

TABLE 11 NORTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 13 NORTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 15 NORTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 17 US ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 18 US ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 19 US ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 US ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 21 US ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 22 US ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 23 CANADA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 24 CANADA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 25 CANADA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 CANADA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 27 CANADA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 CANADA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 29 MEXICO ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 30 MEXICO ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 31 MEXICO ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 MEXICO ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 33 MEXICO ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 34 MEXICO ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 35 SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (MILLION UNITS) 2020-2029

TABLE 37 SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 39 SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 41 SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 43 BRAZIL ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 44 BRAZIL ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 45 BRAZIL ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 BRAZIL ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 47 BRAZIL ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 48 BRAZIL ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 49 ARGENTINA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 50 ARGENTINA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 51 ARGENTINA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 ARGENTINA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 53 ARGENTINA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 ARGENTINA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 55 COLOMBIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 56 COLOMBIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 57 COLOMBIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 COLOMBIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 59 COLOMBIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 60 COLOMBIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 67 ASIA-PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (MILLION UNITS) 2020-2029

TABLE 69 ASIA-PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 71 ASIA-PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 73 ASIA-PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 75 INDIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 76 INDIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 77 INDIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 INDIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 79 INDIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 INDIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 81 CHINA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 82 CHINA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 83 CHINA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 CHINA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 85 CHINA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 CHINA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 87 JAPAN ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 88 JAPAN ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 89 JAPAN ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 JAPAN ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 91 JAPAN ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 92 JAPAN ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 93 SOUTH KOREA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 95 SOUTH KOREA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 97 SOUTH KOREA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 99 AUSTRALIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 101 AUSTRALIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 103 AUSTRALIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 105 SOUTH-EAST ASIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 107 SOUTH-EAST ASIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 109 SOUTH-EAST ASIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 117 EUROPE ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (MILLION UNITS) 2020-2029

TABLE 119 EUROPE ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 120 EUROPE ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 121 EUROPE ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 122 EUROPE ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 123 EUROPE ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 124 EUROPE ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 125 GERMANY ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 126 GERMANY ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 127 GERMANY ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 GERMANY ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 129 GERMANY ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 130 GERMANY ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 131 UK ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 132 UK ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 133 UK ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 UK ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 135 UK ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 UK ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 137 FRANCE ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 138 FRANCE ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 139 FRANCE ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 FRANCE ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 141 FRANCE ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 142 FRANCE ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 143 ITALY ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 144 ITALY ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 145 ITALY ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 146 ITALY ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 147 ITALY ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 148 ITALY ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 149 SPAIN ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 150 SPAIN ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 151 SPAIN ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 152 SPAIN ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 153 SPAIN ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 154 SPAIN ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 155 RUSSIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 156 RUSSIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 157 RUSSIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 RUSSIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 159 RUSSIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 160 RUSSIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 161 REST OF EUROPE ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 163 REST OF EUROPE ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 165 REST OF EUROPE ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY COUNTRY (MILLION UNITS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 175 UAE ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 176 UAE ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 177 UAE ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 UAE ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 179 UAE ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 180 UAE ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 181 SAUDI ARABIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 183 SAUDI ARABIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 185 SAUDI ARABIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 187 SOUTH AFRICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 189 SOUTH AFRICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 191 SOUTH AFRICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT (MILLION UNITS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION (MILLION UNITS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA ANGIOGRAPHIC CATHETERS MARKET BY END USER (MILLION UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 6 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 7 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 8 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 9 PORTER’S FIVE FORCES MODEL

FIGURE 10 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 11 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 12 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY END USER, USD BILLION, 2021

FIGURE 13 GLOBAL ANGIOGRAPHIC CATHETERS MARKET BY REGION, USD BILLION, 2021

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 MEDTRONIC: COMPANY SNAPSHOT

FIGURE 16 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

FIGURE 17 TERUMO MEDICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 18 CARDINAL HEALTH: COMPANY SNAPSHOT

FIGURE 19 MERIT MEDICAL SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 20 ANGIODYNAMICS, INC.: COMPANY SNAPSHOT

FIGURE 21 OSCOR INC.: COMPANY SNAPSHOT

FIGURE 22 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

FIGURE 23 INSITU TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 24 BVM MEDICAL LIMITED: COMPANY SNAPSHOT

FIGURE 25 PRECISION EXTRUSION INC.: COMPANY SNAPSHOT

FIGURE 26 CARDIVA: COMPANY SNAPSHOT

FIGURE 27 C.R. BRAD INC.: COMPANY SNAPSHOT

FIGURE 28 ABBOTT LABORATORIES: COMPANY SNAPSHOT

FIGURE 29 COOK GROUP: COMPANY SNAPSHOT

FAQ

The angiographic catheters market size had crossed USD 1.24 Billion in 2020 and will observe a CAGR of more than 7.8% up to 2029.

The technological innovation in the field of medical devices along with increasing investments in the healthcare sector are some of the factors that are driving the growth of the global angiographic catheters market.

The region’s largest share is in North America. Products manufactured in nations like US and Canada that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.