REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

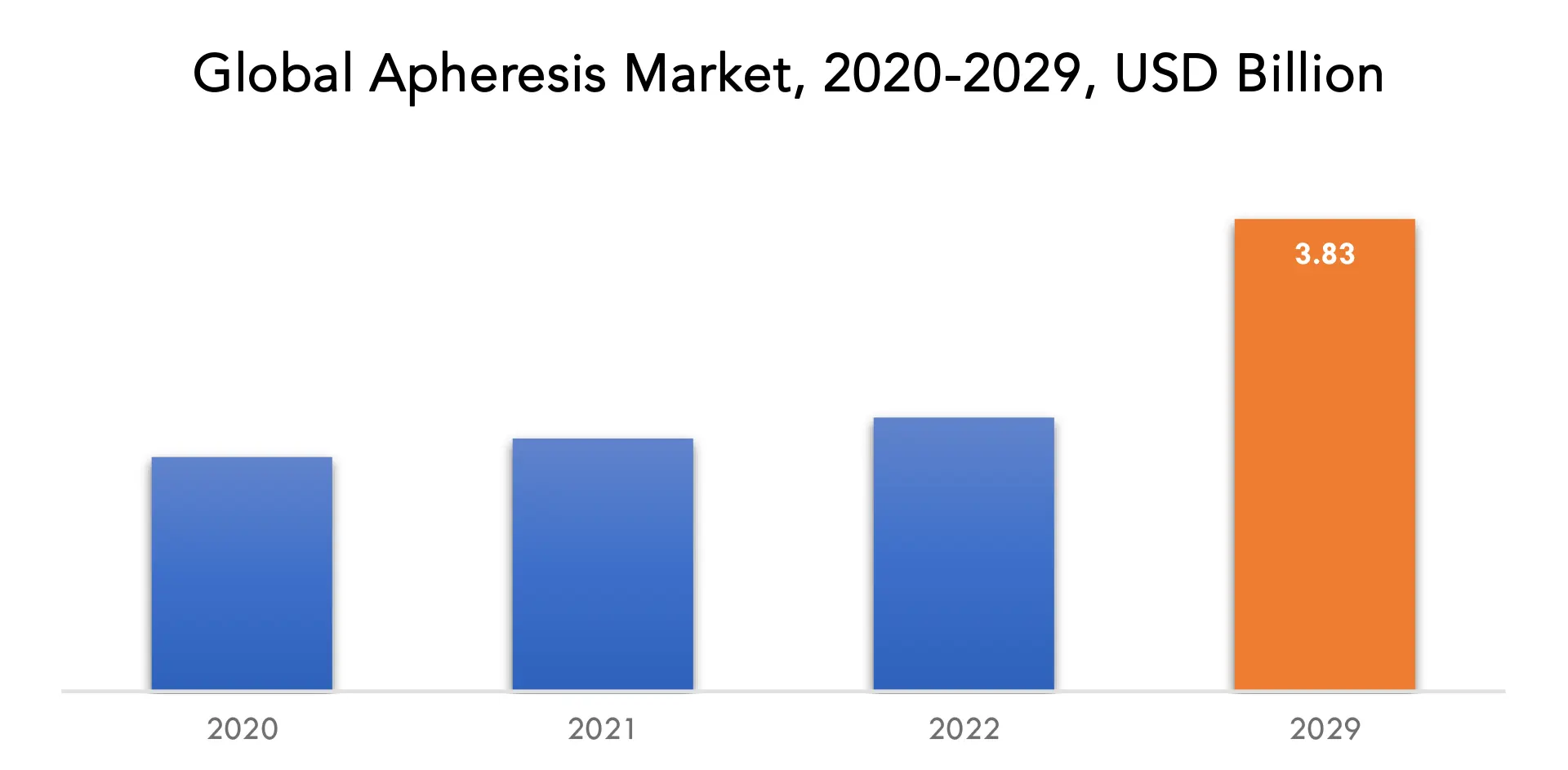

| USD 3.83 billion by 2029 | 8.10 % | North America |

| by Product | By Method | by End User | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Apheresis Market Overview

The apheresis market is expected to grow at 8.10 % CAGR from 2022 to 2029. It is expected to reach above USD 3.83 billion by 2029 from USD 1.9 billion in 2020.

Apheresis is the process of drawing blood from a donor, removing one or more blood components like platelets, white blood cells, or plasma, and then transfusing the remaining blood back into the donor at any point during the procedure. Whole blood from a patient or donor is changed during apheresis inside of a device that is essentially built as a centrifuge, where the components of whole blood are separated. The remaining parts are then re-transfused back into the donor after one of the separated segments is removed.

The market for apheresis is primarily driven by the rising prevalence of chronic diseases, the rise in the number of injury cases, the rising demand from biopharmaceutical companies for source plasma, the rising demand for blood components and the rise in concerns about the safety of blood, the rise in the number of complex surgical procedures, and the favourable reimbursement for apheresis procedures. However, it is anticipated that the high cost of apheresis devices, therapeutic apheresis procedures, and installation of apheresis devices through the rental model, as well as fewer blood donations using apheresis due to lack of awareness and the strict donor recruitment criteria, will somewhat restrain market growth in the upcoming years.

Increased global demand for blood components and a rise in government programmes to promote blood donation are the main factors behind the growth of the apheresis industry. Additionally, recently authorized apheresis therapeutic indications for autoimmune hemolytic anaemia, acute disseminated encephalomyelitis, and cardiac neonatal lupus support market expansion. NexSys PCS with persona technology, which tailors plasma collection based on a donor’s unique body composition, was approved by the FDA (Food and Drug Administration) in October 2020. It is manufactured by Haemoneticsis, a blood management product firm.

Despite the advent of new revenue streams for the apheresis sector, there are many obstacles in the way that could unintentionally limit growth prospects. The shortage of qualified specialists is a significant impediment to growth. A technology transformation of epochal proportions has just taken place, revolutionizing the healthcare sector and, consequently, its operations. The expense of acquiring knowledgeable resources rises as a result of the lack of knowledgeable operators, adding to the already high cost of apheresis processes.

Additionally, it is anticipated that the use of therapeutic apheresis in pediatric therapy would contribute to market expansion. It’s a difficult technological effort to give children therapeutic apheresis. The majority of apheresis therapies were created through research and clinical trials on adult patients. However, since diseases like leukaemia and autoimmune disorders are becoming more common in children, more work will need to be put into creating new apheresis therapy strategies that are especially suited for kids.

Additionally, the use of therapeutic apheresis in pediatric care is anticipated to support market expansion. Children’s therapeutic apheresis is a technologically difficult task. Studies and clinical trials on adult patients form the foundation for the majority of apheresis therapy. However, greater efforts should be made to create new apheresis therapy approaches specifically created for children as the prevalence of diseases including leukaemia and autoimmune disorders among children is rising.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion). |

| Segmentation | By Product, By Method, By Procedure, By Component, By End User, By Region. |

| By Product

|

Devices

Disposable & Reagents Software |

| By Method | Centrifugation

Membrane Separation Selective Absorption |

| By Procedure | Donor/Automated Apheresis

Therapeutic Apheresis |

| By Component

|

Plasma

Platelets Leukocytes Lymphocytes RBCs |

| By End User

|

Blood Centers

Hospitals Others |

| By Region

|

North America

Asia Pacific Europe South America Middle East Asia & Africa |

Apheresis Market Segment Analysis

The apheresis market is segmented based on product, method, procedure, component and end user.

Depending on the product, the disposable & reagent category accounted for the largest market share in 2021. This trend is anticipated to hold true throughout the projection period as a result of the significant developments being made in the creation of blood bags, tubing, and disposable kits. The same category, though, is anticipated to experience significant expansion throughout the course of the apheresis market estimate.

Due to the widespread use of centrifugation in the preparation of blood components like packed red blood cells (PRBCs) and fresh frozen plasma (FFP) in a single-step heavy spin, the centrifugation segment dominated the market size for apheresis as a method in 2021, and this trend is anticipated to continue during the forecast period.

A substantial portion of the worldwide apheresis market is held by blood centers, which support the expansion of the donor apheresis sector. As a result, the donor/automated segment led the apheresis market share by procedure in 2021, and this trend is anticipated to continue over the forecast period. Additionally, the industry has grown as a result of an increase in apheresis platelet and plasma contributions.

Due to its widespread application in the treatment of hematologic and neurological illnesses as well as renal and metabolic diseases, the plasma (plasmapheresis) segment dominated the market by component in 2021, and this trend is anticipated to persist over the forecast period. The platelet segment, however, is anticipated to experience significant increase over the course of the projection period due to the rising popularity of platelet apheresis operations worldwide.

Given that donor apheresis is a key component of the apheresis industry and that blood centers perform the majority of donor apheresis procedures globally, the blood centers segment dominated the market by end user in 2021, and this trend is anticipated to continue during the forecast period.

Apheresis Market Player

The apheresis market key players includes Kawasumi Laboratories, Asahi Kasei Medical, Kaneka Corporation, Cerus Corporation, Terumo BCT, B. Braun Melsungen AG, Haemonetics Corporation, Nikkiso, HemaCare Corporation, Fresenius Kabi.

19 April 2022: Asahi Kasei Medical had completed its acquisition of Bionova Scientific, LLC, a provider of contract process development services and GMP-compliant contract manufacturing services to biopharmaceutical companies as announced on April 19, 2022. The acquisition closed on May 31, 2022 (US Pacific time).

21 December 2021: ExThera Medical and Asahi Kasei Medical, a core operating company of the Asahi Kasei Group, have entered into an exclusive distribution agreement in Japan for ExThera’s Seraph® 100 Microbind® Affinity Blood Filter (Seraph 100). Per the agreement structure, ExThera Medical and Asahi Kasei Medical will collaborate to obtain regulatory approval of Seraph 100 for commercialization in Japan.

Apheresis Market Regional Analysis

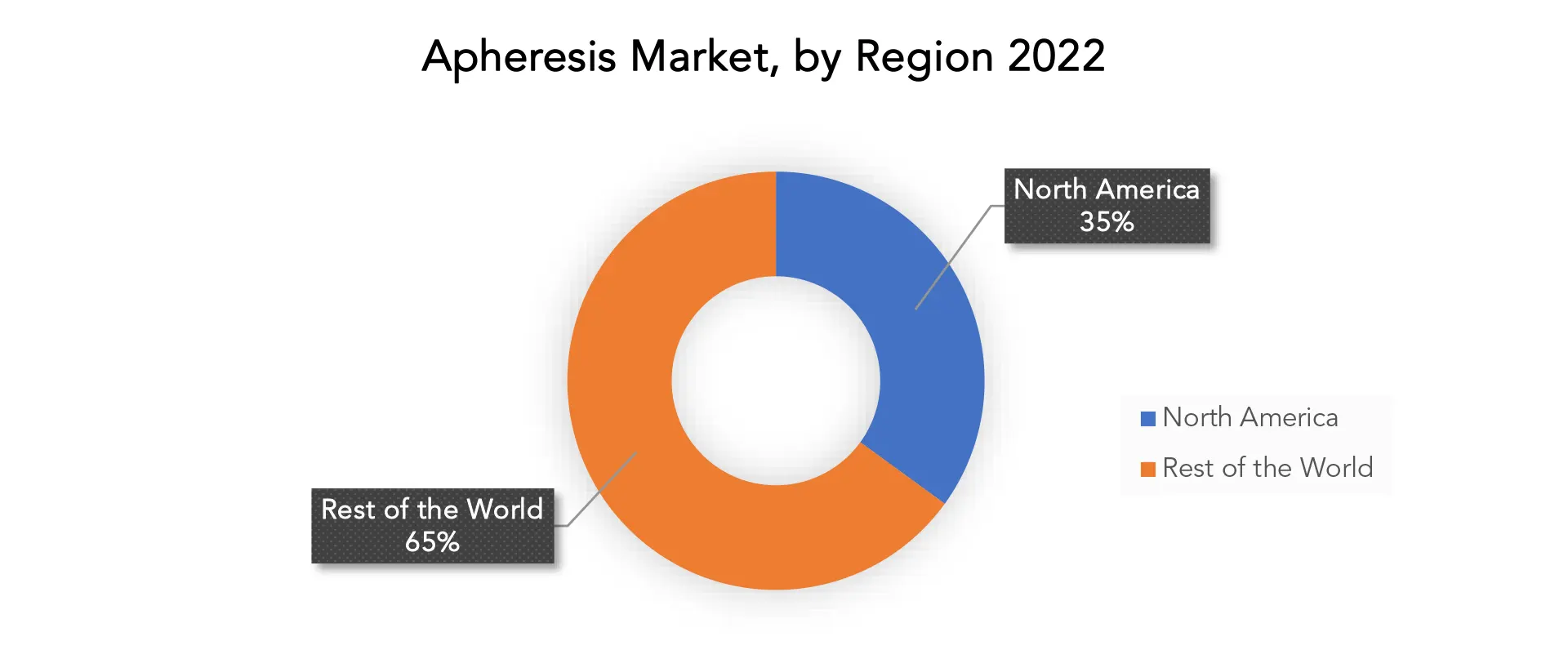

The apheresis market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

With a revenue share of 35.2% in the global market in 2022, North America topped the field and is predicted to keep doing so throughout the forecast period. The key drivers propelling the market in North America are the rising prevalence of blood-related ailments such kidney disease, metabolic disease, cancer, and neurological disorders, the rising number of donors, and the demand for blood components. Nearly 6.8 million Americans donate blood annually, according to The American National Red Cross. Furthermore, someone requires blood or platelets every two seconds. As a result, the market in the United States is being driven by an increase in both the number of donation camps and blood transfusions.

On the other hand, the Asia Pacific market is anticipated to see the greatest CAGR. One of the major factors contributing to this increase in revenue share is the rising prevalence of blood illnesses necessitating plasma and platelet transfusions in developing nations like China and India. Additionally, during the projection period, the industry is anticipated to benefit from an improved growth environment due to the region’s expanding healthcare practitioner population and improved healthcare infrastructure.

Key Market Segments: Apheresis Market

Apheresis Market By Product, 2020-2029, (USD Billion).

- Devices

- Disposable & Reagents

- Software

Apheresis Market By Method, 2020-2029, (USD Billion).

- Centrifugation

- Membrane Separation

- Selective Absorption

Apheresis Market By Procedure, 2020-2029, (USD Billion).

- Donor/Automated Apheresis

- Therapeutic Apheresis

Apheresis Market By Component, 2020-2029, (USD Billion).

- Plasma

- Platelets

- Leukocytes

- Lymphocytes

- RBCs

Apheresis Market By End User, 2020-2029, (USD Billion).

- Blood Centers

- Hospitals

- Others

Apheresis Market By Region, 2020-2029, (USD Billion).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Who Should Buy? Or Key Stakeholders

- Patients

- Healthcare Providers

- Apheresis Device Manufacturers

- Pharmaceutical Companies

- Blood Collection Centers

- Regulatory Authorities

- Research Institutions

- Insurance Companies and Payers

- Others

Key Question Answered

- What is the expected growth rate of the apheresis market over the next 7 years?

- Who are the major players in the apheresis market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such As Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the apheresis market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the apheresis market?

- What is the current and forecasted size and growth rate of the global apheresis market?

- What are the key drivers of growth in the apheresis market?

- What are the distribution channels and supply chain dynamics in the apheresis market?

- What are the technological advancements and innovations in the apheresis market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the apheresis market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the apheresis market?

- What are the services offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL APHERESIS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON APHERESIS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL APHERESIS MARKET OUTLOOK

- GLOBAL APHERESIS MARKET BY PRODUCT (USD BILLION), 2020-2029

- DEVICES

- DISPOSABLE & REAGENTS

- SOFTWARE

- GLOBAL APHERESIS MARKET BY METHOD (USD BILLION), 2020-2029

- CENTRIFUGATION

- MEMBRANE SEPARATION

- SELECTIVE ABSORPTION

- GLOBAL APHERESIS MARKET BY PROCEDURE (USD BILLION), 2020-2029

- DONOR/AUTOMATED APHERESIS

- THERAPEUTIC APHERESIS

- GLOBAL APHERESIS MARKET BY COMPONENT (USD BILLION), 2020-2029

- PLASMA

- PLATELETS

- LEUKOCYTES

- LYMPHOCYTES

- RBCS

- GLOBAL APHERESIS MARKET BY END USER (USD BILLION), 2020-2029

- BLOOD CENTERS

- HOSPITALS

- OTHERS

- GLOBAL APHERESIS MARKET BY REGION (USD BILLION), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- KAWASUMI LABORATORIES

- ASAHI KASEI MEDICAL

- KANEKA CORPORATION

- CERUS CORPORATION

- TERUMO BCT

- BRAUN MELSUNGEN AG

- HAEMONETICS CORPORATION

- NIKKISO

- HEMACARE CORPORATION

- FRESENIUS KABI*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 2 GLOBAL APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 3 GLOBAL APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 4 GLOBAL APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 5 GLOBAL APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL APHERESIS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA APHERESIS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 9 NORTH AMERICA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 11 NORTH AMERICA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 13 US APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 14 US APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 15 US APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 16 US APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 17 US APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 18 CANADA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 19 CANADA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 20 CANADA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 21 CANADA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 22 CANADA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 23 MEXICO APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 24 MEXICO APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 25 MEXICO APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 26 MEXICO APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 27 MEXICO APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 SOUTH AMERICA APHERESIS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 29 SOUTH AMERICA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 30 SOUTH AMERICA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 31 SOUTH AMERICA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 32 SOUTH AMERICA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 33 SOUTH AMERICA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 34 BRAZIL APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 35 BRAZIL APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 36 BRAZIL APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 37 BRAZIL APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 38 BRAZIL APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 39 ARGENTINA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 40 ARGENTINA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 41 ARGENTINA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 42 ARGENTINA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 43 ARGENTINA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 44 COLOMBIA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 45 COLOMBIA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 46 COLOMBIA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 47 COLOMBIA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 48 COLOMBIA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 49 REST OF SOUTH AMERICA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 50 REST OF SOUTH AMERICA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 51 REST OF SOUTH AMERICA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 52 REST OF SOUTH AMERICA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 53 REST OF SOUTH AMERICA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 ASIA-PACIFIC APHERESIS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 55 ASIA-PACIFIC APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 56 ASIA-PACIFIC APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 57 ASIA-PACIFIC APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 58 ASIA-PACIFIC APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 59 ASIA-PACIFIC APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 60 INDIA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 61 INDIA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 62 INDIA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 63 INDIA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 64 INDIA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 65 CHINA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 66 CHINA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 67 CHINA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 68 CHINA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 69 CHINA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 70 JAPAN APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 71 JAPAN APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 72 JAPAN APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 73 JAPAN APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 74 JAPAN APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 75 SOUTH KOREA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 76 SOUTH KOREA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 77 SOUTH KOREA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 78 SOUTH KOREA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 79 SOUTH KOREA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 AUSTRALIA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 81 AUSTRALIA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 82 AUSTRALIA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 83 AUSTRALIA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 84 AUSTRALIA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 85 SOUTH-EAST ASIA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 86 SOUTH-EAST ASIA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 87 SOUTH-EAST ASIA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 88 SOUTH-EAST ASIA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 89 SOUTH-EAST ASIA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 90 REST OF ASIA PACIFIC APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 91 REST OF ASIA PACIFIC APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 92 REST OF ASIA PACIFIC APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 93 REST OF ASIA PACIFIC APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 94 REST OF ASIA PACIFIC APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 95 EUROPE APHERESIS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 96 EUROPE APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 97 EUROPE APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 98 EUROPE APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 99 EUROPE APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 100 EUROPE APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 101 GERMANY APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 102 GERMANY APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 103 GERMANY APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 104 GERMANY APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 105 GERMANY APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 106 UK APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 107 UK APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 108 UK APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 109 UK APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 110 UK APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 111 FRANCE APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 112 FRANCE APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 113 FRANCE APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 114 FRANCE APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 115 FRANCE APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 116 ITALY APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 117 ITALY APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 118 ITALY APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 119 ITALY APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 120 ITALY APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 121 SPAIN APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 122 SPAIN APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 123 SPAIN APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 124 SPAIN APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 125 SPAIN APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 126 RUSSIA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 127 RUSSIA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 128 RUSSIA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 129 RUSSIA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 130 RUSSIA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 131 REST OF EUROPE APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 132 REST OF EUROPE APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 133 REST OF EUROPE APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 134 REST OF EUROPE APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 135 REST OF EUROPE APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 MIDDLE EAST AND AFRICA APHERESIS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 137 MIDDLE EAST AND AFRICA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 138 MIDDLE EAST AND AFRICA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 139 MIDDLE EAST AND AFRICA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 140 MIDDLE EAST AND AFRICA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 141 MIDDLE EAST AND AFRICA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 142 UAE APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 143 UAE APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 144 UAE APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 145 UAE APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 146 UAE APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 147 SAUDI ARABIA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 148 SAUDI ARABIA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 149 SAUDI ARABIA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 150 SAUDI ARABIA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 151 SAUDI ARABIA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 152 SOUTH AFRICA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 153 SOUTH AFRICA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 154 SOUTH AFRICA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 155 SOUTH AFRICA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 156 SOUTH AFRICA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA APHERESIS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA APHERESIS MARKET BY METHOD (USD BILLION) 2020-2029

TABLE 159 REST OF MIDDLE EAST AND AFRICA APHERESIS MARKET BY PROCEDURE (USD BILLION) 2020-2029

TABLE 160 REST OF MIDDLE EAST AND AFRICA APHERESIS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 161 REST OF MIDDLE EAST AND AFRICA APHERESIS MARKET BY END USER (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL APHERESIS MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 6 GLOBAL APHERESIS MARKET BY METHOD, USD BILLION, 2020-2029

FIGURE 7 GLOBAL APHERESIS MARKET BY PROCEDURE, USD BILLION, 2020-2029

FIGURE 8 GLOBAL APHERESIS MARKET BY COMPONENT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL APHERESIS MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 19 GLOBAL APHERESIS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL APHERESIS MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 13 GLOBAL APHERESIS MARKET BY METHOD, USD BILLION, 2021

FIGURE 14 GLOBAL APHERESIS MARKET BY PROCEDURE, USD BILLION, 2021

FIGURE 15 GLOBAL APHERESIS MARKET BY COMPONENT, USD BILLION, 2021

FIGURE 16 GLOBAL APHERESIS MARKET BY END USER, USD BILLION, 2021

FIGURE 17 GLOBAL APHERESIS MARKET BY REGION, USD BILLION, 2021

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 KAWASUMI LABORATORIES: COMPANY SNAPSHOT

FIGURE 20 ASAHI KASEI MEDICAL: COMPANY SNAPSHOT

FIGURE 21 KANEKA CORPORATION: COMPANY SNAPSHOT

FIGURE 22 CERUS CORPORATION: COMPANY SNAPSHOT

FIGURE 23 TERUMO BCT: COMPANY SNAPSHOT

FIGURE 24 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

FIGURE 25 HAEMONETICS CORPORATION: COMPANY SNAPSHOT

FIGURE 26 NIKKISO: COMPANY SNAPSHOT

FIGURE 27 HEMACARE CORPORATION: COMPANY SNAPSHOT

FIGURE 28 FRESENIUS KABI: COMPANY SNAPSHOT

FAQ

The apheresis market is expected to grow at 8.10 % CAGR from 2022 to 2029. It is expected to reach above USD 3.83 billion by 2029 from USD 1.9 billion in 2020.

North America held more than 35% of the apheresis market revenue share in 2021 and will witness expansion in the forecast period.

The market for apheresis is primarily driven by the rising prevalence of chronic diseases, the rise in the number of injury cases, the rising demand from biopharmaceutical companies for source plasma, the rising demand for blood components and the rise in concerns about the safety of blood, the rise in the number of complex surgical procedures, and the favourable reimbursement for apheresis procedures.

Due to its widespread application in the treatment of hematologic and neurological illnesses as well as renal and metabolic diseases, the plasma (plasmapheresis) segment dominated the market by component in 2021, and this trend is anticipated to persist over the forecast period.

With a revenue share of 35.2% in the global market in 2022, North America topped the field and is predicted to keep doing so throughout the forecast period. The key drivers propelling the market in North America are the rising prevalence of blood-related ailments such kidney disease, metabolic disease, cancer, and neurological disorders, the rising number of donors, and the demand for blood components.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.