Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 149.8 Billion By 2030 | 7.0% | North American |

| By Material | By Packaging Format | By End Use |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Biodegradable Packaging Market Overview

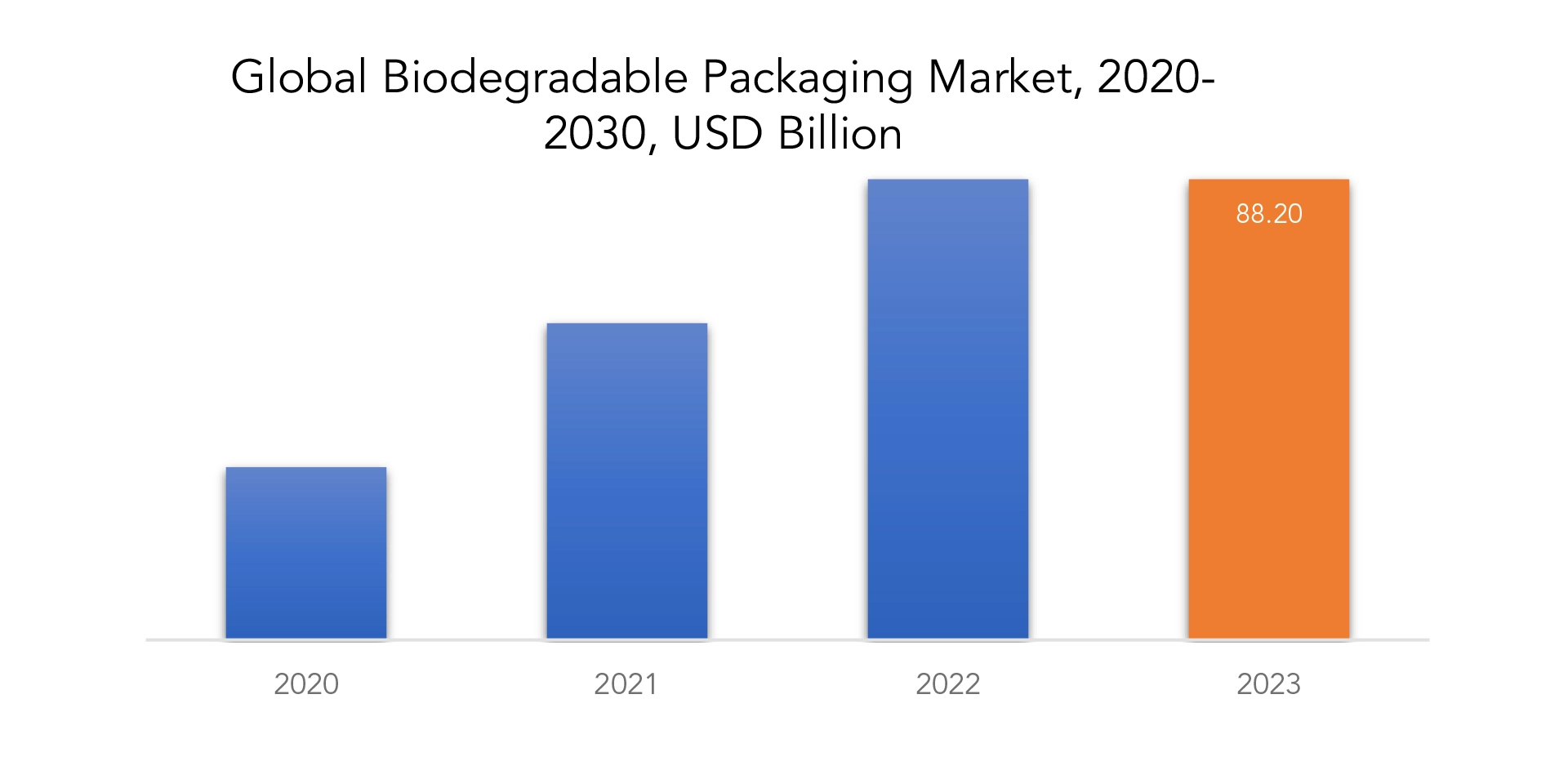

The global biodegradable packaging market is anticipated to grow from USD 88.2 Billion in 2023 to USD 149.8 Billion by 2030, at a CAGR of 7.0% during the forecast period.

Biodegradable packaging is a packaging material that can naturally decompose and break down into non-toxic components when they are visible to environmental conditions such as sunlight, moisture, and microbial activity. Unlike traditional plastic packaging, which can persist in the environment for hundreds of years, biodegradable packaging is designed to be more environmentally friendly and sustainable. Biodegradable packaging is generally thought to be made only from bio-based or plant-based materials, but that’s not true. Biodegradability depends on the molecular structure and strength of a material’s polymer chain, rather than its source. To biodegrade, the polymer structure (string of monomers) that make up the material must be able to disintegrate, or break down, into tiny pieces that can be safely digested by microorganisms. This means biodegradable packaging can be made from bio-based and fossil-based polymers.

Biodegradable packaging materials can be sourced from renewable resources and often require fewer fossil fuels in their Packaging Formation, contributing to resource conservation. Biodegradable packaging can be integrated into a circular economy model, where materials are designed to be reused, recycled, or composted, rather than disposed of as waste. This supports a more sustainable and regenerative approach to packaging. Non-biodegradable plastic waste poses a significant threat to wildlife that may ingest or become entangled in plastic debris. Biodegradable packaging is less likely to harm wildlife in this way. Many consumers are becoming more environmentally conscious and are seeking Packaging Formats with sustainable packaging. Biodegradable packaging can be a selling point for businesses looking to attract eco-friendly consumers.

Increasing awareness of the environmental impact of traditional non-biodegradable plastics has led to increased demand for more sustainable packaging solutions. Biodegradable packaging is seen as a way to reduce plastic pollution, which is a global concern. Many managements and regulatory bodies around the world have introduced measures to reduce plastic waste and encourage the use of biodegradable and compostable materials. These policies create incentives for businesses to adopt biodegradable packaging. Consumers are progressively looking for eco-friendly Packaging Formats and packaging.

The preference for biodegradable packaging is driven by a desire to make more environmentally responsible choices. Companies that offer such packaging can attract a rising segment of environmentally conscious consumers. Businesses are recognizing the importance of corporate social responsibility and sustainability. Using biodegradable packaging aligns with these principles, and companies are adopting such packaging to enhance their brand image and meet sustainability goals. Advances in material science and technology have led to the development of biodegradable materials that offer competitive performance and durability compared to traditional plastics. This has made biodegradable packaging more viable for a wide range of Packaging Formats.

Biodegradable packaging materials can be derived from renewable resources such as corn, sugarcane, and other plant-based sources, reducing the industry’s dependence on fossil fuels. The growth of industrial composting facilities and compost collection programs in various regions has created a more favorable environment for the disposal and decomposition of biodegradable packaging materials. As more businesses and industries adopt biodegradable packaging, economies of scale and increased Packaging Formation have made these materials more cost-competitive with traditional packaging materials, further driving market growth.

Biodegradable packaging is being used in a wider range of applications, including food packaging, personal care Packaging Formats, and even industrial and agricultural applications. This diversification of uses is contributing to market expansion. Improved investment in research and development of biodegradable packaging materials and technologies has accelerated innovation and improved the quality and availability of these materials in the market. As supply chains become more global, businesses are adapting to various regulations and consumer preferences in different regions. Biodegradable packaging offers a versatile solution that can meet a variety of international requirements. These are some factors that drives the market growth for the biodegradable packaging market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Kilotons) |

| Segmentation | By Material, By Packaging Format, By End Use and By Region |

| By Material |

|

| By Packaging Format |

|

| By End Use |

|

| By Region |

|

Biodegradable Packaging Market Segmentation Analysis

The global Biodegradable Packaging market is divided into 4 segments material., packaging format, end use and region. by material the market is bifurcated into Paper & Paperboard, Bio-plastic, Bagasse. By packaging format, the market is bifurcated into bottles & jars, boxes & cartons, cans, trays & clamshells, cups & bowls, pouches & bags, films & wraps, labels & tapes, others (stick pack, sachets, etc.); by end use the market is bifurcated into food & beverage, personal care & cosmetics, pharmaceuticals, homecare, other consumer goods and region.

Based on material bio plastic segment dominating biodegradable packaging market. Bioplastics are often seen as a more maintainable alternative to traditional petroleum-based plastics. They are derived from renewable resources, such as corn, sugarcane, or starch, which makes them appealing to environmentally conscious consumers and businesses looking to reduce their carbon footprint. Bioplastics can be engineered to have specific properties, such as flexibility, strength, or barrier properties, making them suitable for different packaging needs. This versatility has contributed to their dominance in the market. Many governments and regions have introduced regulations and incentives to promote the use of bioplastics. These policies encourage businesses to adopt bioplastic packaging materials, further boosting their market dominance. Consumers are increasingly seeking eco-friendly alternatives, and they often favor Packaging Formats packaged in biodegradable materials, including bioplastics.

Businesses respond to this consumer demand by using bioplastic packaging. Bioplastics can be processed using existing plastic manufacturing equipment and supply chains. This compatibility simplifies the transition for businesses to adopt bioplastic packaging. Some bioplastics are compostable, meaning they can be processed in industrial composting facilities. This makes them a suitable choice for businesses aiming to meet composting and waste diversion goals. Bioplastics generally have a lower environmental impact compared to traditional plastics, especially in terms of greenhouse gas emissions during Packaging Formation.

As the bioplastic segment has grown, economies of scale and increased competition have driven down costs, making bioplastic packaging more cost-competitive with traditional plastics. Bioplastics are used in various applications beyond traditional packaging, including agricultural films, 3D printing, and medical devices, expanding their market reach. Many businesses view the use of bioplastics as part of their corporate social responsibility initiatives and sustainability goals, which has accelerated their adoption.

Based on end use food and beverage segment dominating in the biodegradable packaging market. Numerous governments and regulatory bodies around the world have imposed stricter regulations on the use of traditional plastic packaging due to its harmful environmental impact. Food and beverage Packaging Formats are highly regulated, and many countries have implemented policies that encourage or require eco-friendly packaging for these Packaging Formats. As a result, food and beverage companies are more likely to adopt biodegradable packaging solutions to comply with these regulations.

There is an increasing global awareness of environmental issues and a strong consumer demand for sustainable and eco-friendly Packaging Formats, including packaging. Food and beverage Packaging Formats have high visibility in the consumer market, and companies in this sector are often under pressure to adopt greener packaging options to meet consumer expectations. Biodegradable packaging can offer a solution for extending the shelf life and maintaining the freshness of food and beverage Packaging Formats. Packaging plays a crucial role in preserving the quality and safety of these Packaging Formats. Biodegradable packaging materials, such as compostable films, can be designed to provide the necessary barrier properties to protect food and beverages. Many food and beverage companies are leveraging their commitment to sustainability and environmental responsibility as a part of their brand identity.

Biodegradable packaging supports enhance their image as environmentally responsible brands, which can be a competitive advantage in the market and can attract environmentally-conscious consumers. The development of new and improved biodegradable packaging materials and technologies has made them more suitable for the specific requirements of the food and beverage industry. Advancements in bioplastics, edible packaging, and other innovative materials have expanded the possibilities for eco-friendly packaging solutions in this sector. Food and beverage packaging contribute significantly to plastic waste due to their high consumption. Biodegradable packaging helps reduce the amount of plastic waste in landfills and oceans, which is a pressing concern for many stakeholders.

Biodegradable packaging Market Trends

- Businesses were increasingly focusing on closing the loop and creating circular supply chains, which includes designing packaging for recyclability, reusability, or composability.

- Beyond bioplastics, there was an exploration of other sustainable materials like algae-based packaging, mushroom packaging, and plant-based materials, adding diversity to the market.

- More companies were providing clear and accurate information about their packaging materials, enabling consumers to make informed choices.

- Companies were collaborating with research institutions and other businesses to develop and promote sustainable packaging solutions. Such partnerships aimed to accelerate innovation and adoption.

- Brands were using their commitment to eco-friendly and biodegradable packaging as a competitive advantage and a marketing tool to attract environmentally conscious consumers.

- The food and beverage industry were a significant adopter of biodegradable packaging due to concerns about food safety and shelf life. Innovations in edible packaging were also emerging.

- Companies and organizations were investing in research and development to create more efficient and cost-effective biodegradable packaging materials.

Biodegradable packaging Market Competitive Landscape

The competitive landscape of the biodegradable packaging market is dynamic and continually evolving. Various companies and players are competing to meet the increasing demand for sustainable and eco-friendly packaging solutions. While the specific competitive dynamics may change over time

- NatureWorks LLC

- BASF SE

- Novamont S.p.A.

- Mondi Group

- Tetra Pak

- Amcor Limited

- Smurfit Kappa Group

- Huhtamaki Oyj

- Stora Enso

- Be Green Packaging

- International Paper

- Kruger Inc.

- Eco-Packaging Formats, Inc.

- Bemis Company, Inc.

- Green Packaging

- Vegware

- Biopac (UK) Ltd.

- Eco-Insulation

- Genpak

- EarthFirst Films (Novolex)

These are top 20 key players which play an important role in the biodegradable packaging market.

Biodegradable packaging Market Regional Analysis

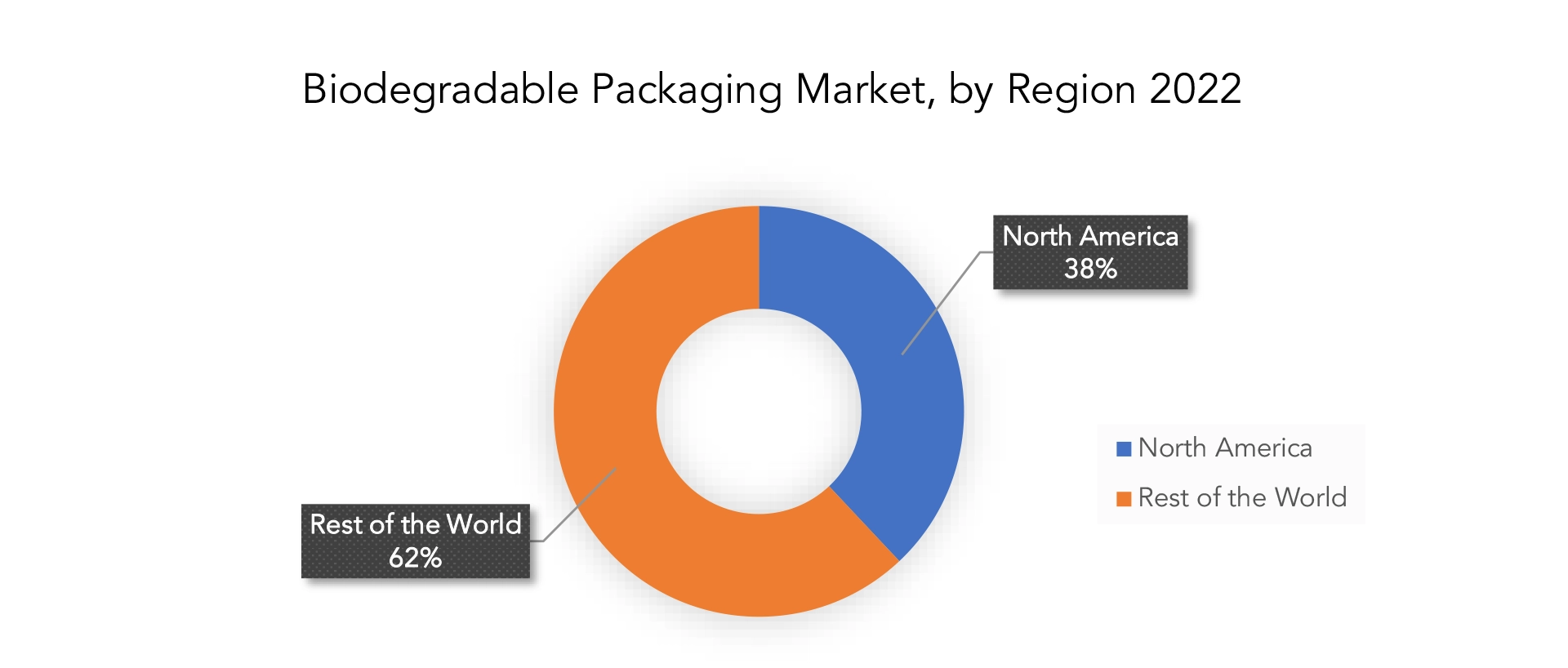

North America accounted for the largest market in the biodegradable packaging market. North america accounted for the 38 % market share of the global market value. North America has a strong and growing awareness of environmental issues, particularly plastic pollution and waste. Consumers in this region have been increasingly demanding eco-friendly and sustainable packaging solutions. This demand has driven the adoption of biodegradable packaging by businesses to meet consumer preferences.

Many North American countries and states have implemented regulations and policies aimed at reducing plastic waste and encouraging the use of biodegradable and compostable packaging. These regulations create a favorable environment for biodegradable packaging manufacturers. North America is home to many innovative startups and established companies focused on developing and producing biodegradable packaging materials and Packaging Formats. The region has seen substantial investments in research and development to create more sustainable alternatives to traditional plastics.

The region’s influential retail and food service industries, including major fast-food chains and large grocery store chains, have shown a commitment to sustainable packaging. This has led to the adoption of biodegradable packaging solutions in their operations. Many North American consumer goods companies have been proactive in incorporating biodegradable packaging into their Packaging Format lines to appeal to environmentally conscious consumers. North America has access to a wide range of raw materials, including agricultural resources such as corn and sugarcane, which are commonly used in the Packaging Formation of biodegradable plastics and packaging materials. North America is home to numerous universities and research institutions with a focus on materials science and sustainability. These institutions contribute to the development of innovative biodegradable packaging solutions. Efforts to educate consumers about the benefits of biodegradable packaging and proper disposal methods have been significant in North America, creating a more informed and responsible consumer base.

Target Audience for Biodegradable Packaging Market

- Manufacturers of biodegradable packaging materials

- Packaging companies specializing in biodegradable solutions

- Retailers and food service chains

- Consumers

- Government and regulatory bodies

- Advocacy groups and NGOs

- Waste management and recycling facilities

- Research and development institutions

- Investors and financial institutions

- Trade associations

- Educational institutions

- Healthcare and pharmaceutical industry

- Agricultural sector

- Technology and innovation enthusiasts

Import & Export Data for Biodegradable Packaging Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on Packaging Formation and consumption volume of the Packaging Format. Understanding the import and export data is pivotal for any player in the Biodegradable packaging market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Biodegradable packaging Market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the biodegradable packaging. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Packaging Format breakdown: by segmenting data based on Biodegradable packaging –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences Packaging Format innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the Biodegradable Packaging Market Report

Biodegradable Packaging Market by Material, 2020-2030, USD Billion, (Kilotons)

- Paper & Paperboard

- Bio-plastic

- Polylactic Acid (PLA)

- Cellulose-based

- Starch-based

- Polybutylene succinate

- Others (Protein-based plastics etc.)

- Bagasse

Biodegradable Packaging Market by Packaging Format, 2020-2030, USD Billion, (Kilotons)

- Bottles & Jars

- Boxes & Cartons

- Cans

- Trays & Clamshells

- Cups & Bowls

- Pouches & Bags

- Films & Wraps

- Labels & Tapes

- Others (Stick pack, Sachets, etc.)

Biodegradable Packaging Market by End Use, 2020-2030, USD Billion, (Kilotons)

- Food & Beverage

- Personal Care & Cosmetics

- Pharmaceuticals

- Homecare

- Other Consumer Goods

Biodegradable Packaging Market by Region 2020-2030, USD Billion, (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the biodegradable packaging market over the next 7 years?

- Who are the major players in the biodegradable packaging market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and africa?

- How is the economic environment affecting the biodegradable packaging market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the biodegradable packaging market?

- What is the current and forecasted size and growth rate of the biodegradable packaging market?

- What are the key drivers of growth in the biodegradable packaging market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the biodegradable packaging market?

- What are the technological advancements and innovations in the biodegradable packaging market and their impact on packaging format development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the biodegradable packaging market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the biodegradable packaging market?

- What are the packaging format packaging formats and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- BIODEGRADABLE PACKAGING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BIODEGRADABLE PACKAGING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- BIODEGRADABLE PACKAGING MARKET OUTLOOK

- GLOBAL BIODEGRADABLE PACKAGING MARKET BY MATERIAL, 2020-2030, (USD BILLION) (KILOTONS)

- PAPER & PAPERBOARD

- BIO-PLASTIC

- POLYLACTIC ACID (PLA)

- CELLULOSE-BASED

- STARCH-BASED

- POLYBUTYLENE SUCCINATE

- OTHERS (PROTEIN-BASED PLASTICS ETC.)

- BAGASSE

- GLOBAL BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT, 2020-2030, (USD BILLION) (KILOTONS)

- BOTTLES & JARS

- BOXES & CARTONS

- CANS

- TRAYS & CLAMSHELLS

- CUPS & BOWLS

- POUCHES & BAGS

- FILMS & WRAPS

- LABELS & TAPES

- OTHERS (STICK PACK, SACHETS, ETC.)

- GLOBAL BIODEGRADABLE PACKAGING MARKET BY END-USE, 2020-2030, (USD BILLION) (KILOTONS)

- FOOD & BEVERAGE

- PERSONAL CARE & COSMETICS

- PHARMACEUTICALS

- HOMECARE

- OTHER CONSUMER GOODS

- GLOBAL BIODEGRADABLE PACKAGING MARKET BY REGION, 2020-2030, (USD BILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, COMPANIES OFFERED, RECENT DEVELOPMENTS)

- NATUREWORKS LLC

- BASF SE

- NOVAMONT S.P.A.

- MONDI GROUP

- TETRA PAK

- AMCOR LIMITED

- SMURFIT KAPPA GROUP

- HUHTAMAKI OYJ

- STORA ENSO

- BE GREEN PACKAGING

- INTERNATIONAL PAPER

- KRUGER INC.

- ECO-PACKAGING FORMATS, INC.

- BEMIS COMPANY, INC.

- GREEN PACKAGING

- VEGWARE

- BIOPAC (UK) LTD.

- ECO-INSULATION

- GENPAK

- EARTHFIRST FILMS (NOVOLEX)

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 2 GLOBAL BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 3 GLOBAL BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 4 GLOBAL BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 5 GLOBAL BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 6 GLOBAL BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 7 GLOBAL BIODEGRADABLE PACKAGING MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL BIODEGRADABLE PACKAGING MARKET BY REGION (KILOTONS) 2020-2030

TABLE 9 NORTH AMERICA BIODEGRADABLE PACKAGING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA BIODEGRADABLE PACKAGING MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 11 NORTH AMERICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 13 NORTH AMERICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 15 NORTH AMERICA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 17 US BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 18 US BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 19 US BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 20 US BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 21 US BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 22 US BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 23 CANADA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 24 CANADA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 25 CANADA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 26 CANADA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 27 CANADA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 28 CANADA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 29 MEXICO BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 30 MEXICO BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 31 MEXICO BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 32 MEXICO BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 33 MEXICO BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 34 MEXICO BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 35 SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 37 SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 39 SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 41 SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 43 BRAZIL BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 44 BRAZIL BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 45 BRAZIL BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 46 BRAZIL BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 47 BRAZIL BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 48 BRAZIL BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 49 ARGENTINA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 50 ARGENTINA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 51 ARGENTINA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 52 ARGENTINA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 53 ARGENTINA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 54 ARGENTINA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 55 COLOMBIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 56 COLOMBIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 57 COLOMBIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 58 COLOMBIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 59 COLOMBIA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 60 COLOMBIA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 67 ASIA-PACIFIC BIODEGRADABLE PACKAGING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC BIODEGRADABLE PACKAGING MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 69 ASIA-PACIFIC BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 71 ASIA-PACIFIC BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 73 ASIA-PACIFIC BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 75 INDIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 76 INDIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 77 INDIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 78 INDIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 79 INDIA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 80 INDIA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 81 CHINA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 82 CHINA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 83 CHINA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 84 CHINA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 85 CHINA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 86 CHINA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 87 JAPAN BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 88 JAPAN BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 89 JAPAN BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 90 JAPAN BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 91 JAPAN BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 92 JAPAN BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 93 SOUTH KOREA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 95 SOUTH KOREA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 97 SOUTH KOREA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 99 AUSTRALIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 101 AUSTRALIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 103 AUSTRALIA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 105 SOUTH-EAST ASIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 107 SOUTH-EAST ASIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 109 SOUTH-EAST ASIA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 117 EUROPE BIODEGRADABLE PACKAGING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE BIODEGRADABLE PACKAGING MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 119 EUROPE BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 120 EUROPE BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 121 EUROPE BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 122 EUROPE BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 123 EUROPE BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 124 EUROPE BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 125 GERMANY BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 126 GERMANY BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 127 GERMANY BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 128 GERMANY BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 129 GERMANY BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 130 GERMANY BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 131 UK BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 132 UK BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 133 UK BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 134 UK BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 135 UK BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 136 UK BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 137 FRANCE BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 138 FRANCE BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 139 FRANCE BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 140 FRANCE BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 141 FRANCE BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 142 FRANCE BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 143 ITALY BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 144 ITALY BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 145 ITALY BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 146 ITALY BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 147 ITALY BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 148 ITALY BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 149 SPAIN BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 150 SPAIN BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 151 SPAIN BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 152 SPAIN BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 153 SPAIN BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 154 SPAIN BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 155 RUSSIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 156 RUSSIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 157 RUSSIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 158 RUSSIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 159 RUSSIA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 160 RUSSIA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 161 REST OF EUROPE BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 163 REST OF EUROPE BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 165 REST OF EUROPE BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 175 UAE BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 176 UAE BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 177 UAE BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 178 UAE BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 179 UAE BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 180 UAE BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 181 SAUDI ARABIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 183 SAUDI ARABIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 185 SAUDI ARABIA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 187 SOUTH AFRICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 189 SOUTH AFRICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 191 SOUTH AFRICA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY MATERIAL (KILOTONS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT (KILOTONS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA BIODEGRADABLE PACKAGING MARKET BY END-USE (KILOTONS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIODEGRADABLE PACKAGING MARKET BY MATERIAL USD BILLION, 2020-2030

FIGURE 9 GLOBAL BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT, USD BILLION,

2020-2030

FIGURE 10 GLOBAL BIODEGRADABLE PACKAGING MARKET BY END-USE, USD BILLION, 2020-2030

FIGURE 11 GLOBAL BIODEGRADABLE PACKAGING MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL BIODEGRADABLE PACKAGING MARKET BY MATERIAL, USD BILLION 2022

FIGURE 14 GLOBAL BIODEGRADABLE PACKAGING MARKET BY PACKAGING FORMAT, USD BILLION 2022

FIGURE 15 GLOBAL BIODEGRADABLE PACKAGING MARKET BY END-USE, USD BILLION 2022

FIGURE 16 GLOBAL BIODEGRADABLE PACKAGING MARKET BY REGION, USD BILLION 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 NATUREWORKS LLC: COMPANY SNAPSHOT

FIGURE 19 BASF SE: COMPANY SNAPSHOT

FIGURE 20 NOVAMONT S.P.A. COMPANY SNAPSHOT

FIGURE 21 MONDI GROUP: COMPANY SNAPSHOT

FIGURE 22 TETRA PAK: COMPANY SNAPSHOT

FIGURE 23 AMCOR LIMITED: COMPANY SNAPSHOT

FIGURE 24 SMURFIT KAPPA GROUP: COMPANY SNAPSHOT

FIGURE 25 HUHTAMAKI OYJ: COMPANY SNAPSHOT

FIGURE 26 STORA ENSO: COMPANY SNAPSHOT

FIGURE 27 BE GREEN PACKAGING: COMPANY SNAPSHOT

FIGURE 28 INTERNATIONAL PAPER: COMPANY SNAPSHOT

FIGURE 29 KRUGER INC.: COMPANY SNAPSHOT

FIGURE 30 ECO-PACKAGING FORMATS, INC.: COMPANY SNAPSHOT

FIGURE 31 BEMIS COMPANY, INC.: COMPANY SNAPSHOT

FIGURE 32GREEN PACKAGING: COMPANY SNAPSHOT

FIGURE 33 VEGWARE: COMPANY SNAPSHOT

FIGURE 34 BIOPAC (UK) LTD.: COMPANY SNAPSHOT

FIGURE 35 ECO-INSULATION: COMPANY SNAPSHOT

FAQ

The global biodegradable packaging market is anticipated to grow from USD 88.2 Billion in 2023 to USD 149.8 Billion by 2030, at a CAGR of 7.0% during the forecast period.

North america accounted for the largest market in the biodegradable packaging market. North America accounted for the 38 % market share of the global market value.

NatureWorks LLC, BASF SE, Novamont S.p.A., Mondi Group, Tetra Pak, Amcor Limited, Smurfit Kappa Group, Huhtamaki Oyj, Stora Enso

Growing environmental awareness and concerns about plastic pollution have created a significant opportunity for biodegradable packaging. As consumers and businesses seek more sustainable alternatives to traditional plastics, the demand for eco-friendly packaging options continues to rise. Many governments worldwide are implementing regulations and policies aimed at reducing single-use plastics and encouraging the use of biodegradable materials. Businesses that invest in biodegradable packaging can benefit from regulatory support and incentives.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.