REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

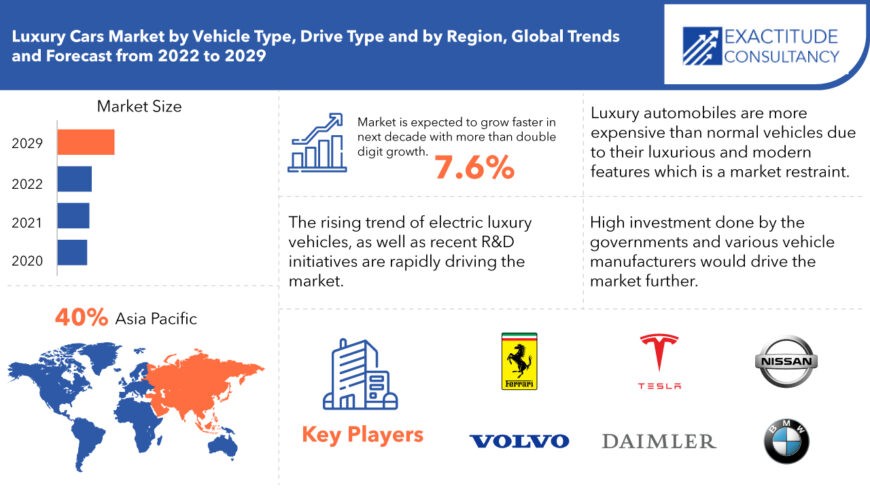

| USD 812.6 billion | 7.6% | Asia Pacific |

| by Vehicle Type | by Drive Type | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Luxury Cars Market Overview

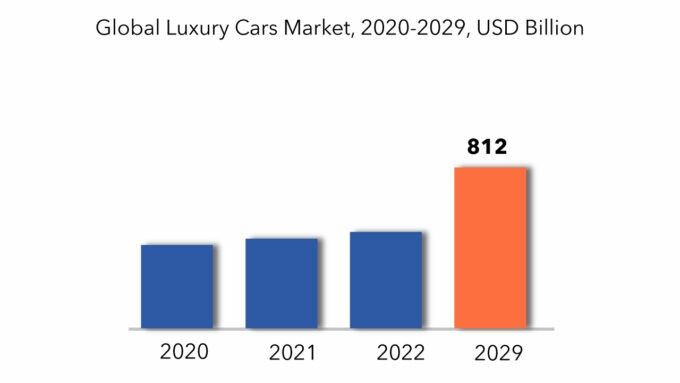

The global luxury car market size was USD 420.31 billion in 2020 and is projected to reach USD 812.6 billion by 2029, exhibiting a CAGR of 7.6% during the forecast period.

Luxury automobiles represent vehicles characterized by a prioritization of advanced technological features, exceptional performance capabilities, and the utilization of high-grade materials aimed at enhancing passenger and driver comfort. These vehicles are meticulously engineered to deliver a premium driving experience, featuring state-of-the-art amenities to cater to the demands for opulence and comfort prevalent among affluent consumers. Distinguished by their refined and stylish exteriors, as well as sumptuously appointed interiors adorned with premium materials such as supple leather and exquisite wood trim, luxury cars epitomize sophistication and elegance.

A prevailing trend in the luxury automotive sector involves manufacturers directing their attention towards electric and hybrid technologies to meet the escalating consumer preference for environmentally sustainable transportation options, thereby stimulating market growth. However, the presence of potent, large-sized engines in luxury vehicles often translates to higher fuel consumption, posing a constraint on market expansion. Nonetheless, ongoing advancements in automotive technology aimed at enhancing fuel efficiency and connectivity solutions are anticipated to drive market growth throughout the projected period.

The increasing popularity of electric vehicles, bolstered by proactive launches and strategic initiatives by key market players, is expected to further augment demand within the luxury car segment in the forecast period. Additionally, the market is being bolstered by the emergence of new contenders in the electric luxury vehicle sector in India. Notably, Jaguar has entered the Indian electric vehicle arena with its inaugural all-electric offering, the I-PACE, while Audi has made its foray into the Indian electric vehicle market with the introduction of the Audi e-tron and e-tron Sportback models, both available in the 55 Quattro variant, alongside the standard e-tron offered in a lower-specification 50 Quattro trim as well.

Luxury Cars Market Segment Analysis

The luxury cars market is segmented on the basis of vehicle type, drive type and region. The market is divided into hatchbacks, sedans, and sport utility vehicles based on vehicle type. Due to large sales and manufacturing of luxury sedans, the sedan sector accounts for a significant portion of the global market. Over the forecast period, the sport utility vehicle segment is expected to grow at an exponential rate. The market is divided into two categories based on drive viz; ICE and electric. Due to increased demand and sales of these luxury vehicles around the world, the ICE sector has the greatest proportion of the global market. The electric category, on the other hand, is predicted to rise at a phenomenal rate in the market, owing to consumers’ growing preference for premium electric vehicles.

Luxury Cars Market Players

The key players dominating the market are AB Volvo, Aston Martin Lagonda Global Holding Plc, BMW AG, Daimler AG, Ferrari N.V., Nissan Motor Company Ltd., Tesla Inc, Toyota Motor Corporation and Volkswagen AG among others.

- AB Volvo is the parent company of the Volvo Group. The Volvo Group is a manufacturer of trucks, buses, construction equipment, diesel engines, and marine and industrial engines. The Volvo Group also provides solutions for financing and service.

- Aston Martin Lagonda designs, creates and exports cars which are sold in 55 countries around the world. Its sports cars are manufactured in Gaydon with its luxury DBX SUV range proudly manufactured in St Athan, Wales.

- Bayerische Motoren Werke AG, commonly known as Bavarian Motor Works, BMW or BMW AG, is a German automobile, motorcycle and engine manufacturing company founded in 1916.

Who Should Buy? Or Key Stakeholders

- Automobile Manufacturers

- Mechanical Industry

- Electric Industry

- Investors

- Manufacturing companies

- End user companies

Key Takeaways:

- The global luxury car market was exhibiting a CAGR of 7.6% during the forecast period.

- Due to large sales and manufacturing of luxury sedans, the sedan sector accounts for a significant portion of the global market.

- Due to increased demand and sales of these luxury vehicles around the world, the ICE sector has the greatest proportion of the global market.

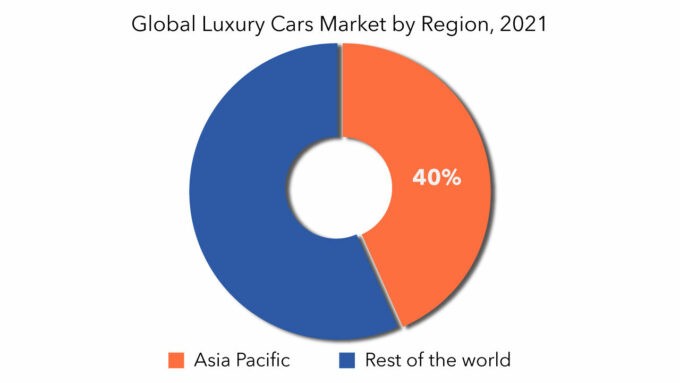

- Asia Pacific is the dominating the market and accounts for the largest share globally.

- The luxury car market continues to prioritize innovation, sustainability, and personalized experiences to cater to discerning consumers’ evolving preferences.

Luxury Cars Market Regional Analysis

The global luxury cars market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia Pacific is the dominating the market and accounts for the largest share globally. The presence of a number of large-scale companies in this area has had a considerable impact on regional market development. The ever-increasing population in countries like India and China has helped luxury car producers in Asia Pacific.

Key Market Segments: Luxury Cars Market

Luxury Cars Market by Vehicle Type, 2020-2029, (USD Million) (Thousand Units)

- Hatchback

- Sedan

- Sport Utility

- SUV

Luxury Cars Market by Drive Type, 2020-2029, (USD Million) (Thousand Units)

- Ice

- Electric

Luxury Cars Market by Region, 2020-2029, (USD Million) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered.

Key Question Answered

- What are the growth opportunities related to the adoption of luxury cars across major regions in the future?

- What are the new trends and advancements in the luxury cars market?

- Which product categories are expected to have highest growth rate in the luxury cars market?

- Which are the key factors driving the luxury cars market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Luxury Cars Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Luxury Cars Market

- Global Luxury Cars Market Outlook

- Global Luxury Cars Market by Vehicle Type, (USD Million) (Thousand Units)

- Hatchback

- Sedan

- Sport Utility

- SUV

- Global Luxury Cars Market by Drive Type, (USD Million) (Thousand Units)

- ICE

- Electric

- Global Luxury Cars Market by Region, (USD Million) (Thousand Units)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- AB Volvo

- Aston Martin Lagonda Global Holding Plc

- BMW AG

- Daimler AG

- Ferrari N.V.

- Nissan Motor Company Ltd.

- Tesla Inc

- Toyota Motor Corporation

- Volkswagen AG

- Tata Motors Limited

- Others

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL LUXURY CARS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL LUXURY CARS MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 7 US LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 8 US LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 9 US LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 10 US LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 11 CANADA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 12 CANADA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 13 CANADA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 14 CANADA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 15 MEXICO LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 16 MEXICO LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 17 MEXICO LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 18 MEXICO LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 19 BRAZIL LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 21 BRAZIL LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 23 ARGENTINA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 25 ARGENTINA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 27 COLOMBIA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 29 COLOMBIA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 35 INDIA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 36 INDIA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 37 INDIA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 38 INDIA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 39 CHINA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 40 CHINA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 41 CHINA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 42 CHINA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 43 JAPAN LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 44 JAPAN LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 45 JAPAN LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 46 JAPAN LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH KOREA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH KOREA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 51 AUSTRALIA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 53 AUSTRALIA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 55 SOUTH-EAST ASIA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 SOUTH-EAST ASIA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 63 GERMANY LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 64 GERMANY LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 65 GERMANY LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 66 GERMANY LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 67 UK LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 68 UK LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 69 UK LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 70 UK LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 71 FRANCE LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 72 FRANCE LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 73 FRANCE LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 74 FRANCE LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 75 ITALY LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 76 ITALY LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 77 ITALY LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 78 ITALY LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 79 SPAIN LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 80 SPAIN LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 81 SPAIN LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 82 SPAIN LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 83 RUSSIA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 85 RUSSIA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 87 REST OF EUROPE LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 89 REST OF EUROPE LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 91 UAE LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 92 UAE LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 93 UAE LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 94 UAE LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 95 SAUDI ARABIA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 97 SAUDI ARABIA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 99 SOUTH AFRICA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 101 SOUTH AFRICA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA LUXURY CARS MARKET BY VEHICLE TYPE (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA LUXURY CARS MARKET BY VEHICLE TYPE (THOUSAND UNITS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA LUXURY CARS MARKET BY DRIVE TYPE (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA LUXURY CARS MARKET BY DRIVE TYPE (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LUXURY CARS MARKET BY VEHICLE TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL LUXURY CARS MARKET BY DRIVE TYPE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL LUXURY CARS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL LUXURY CARS MARKET BY VEHICLE TYPE 2020

FIGURE 13 GLOBAL LUXURY CARS MARKET BY DRIVE TYPE 2020

FIGURE 14 LUXURY CARS MARKET BY REGION 2020

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AB VOLVO: COMPANY SNAPSHOT

FIGURE 17 ASTON MARTIN LAGONDA GLOBAL HOLDING PLC: COMPANY SNAPSHOT

FIGURE 18 BMW AG: COMPANY SNAPSHOT

FIGURE 19 DAIMLER AG: COMPANY SNAPSHOT

FIGURE 20 FERRARI N.V.: COMPANY SNAPSHOT

FIGURE 21 NISSAN MOTOR COMPANY LTD.: COMPANY SNAPSHOT

FIGURE 22 TESLA INC: COMPANY SNAPSHOT

FIGURE 23 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

FIGURE 24 VOLKSWAGEN AG: COMPANY SNAPSHOT

FIGURE 25 TATA MOTORS LIMITED: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.