REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

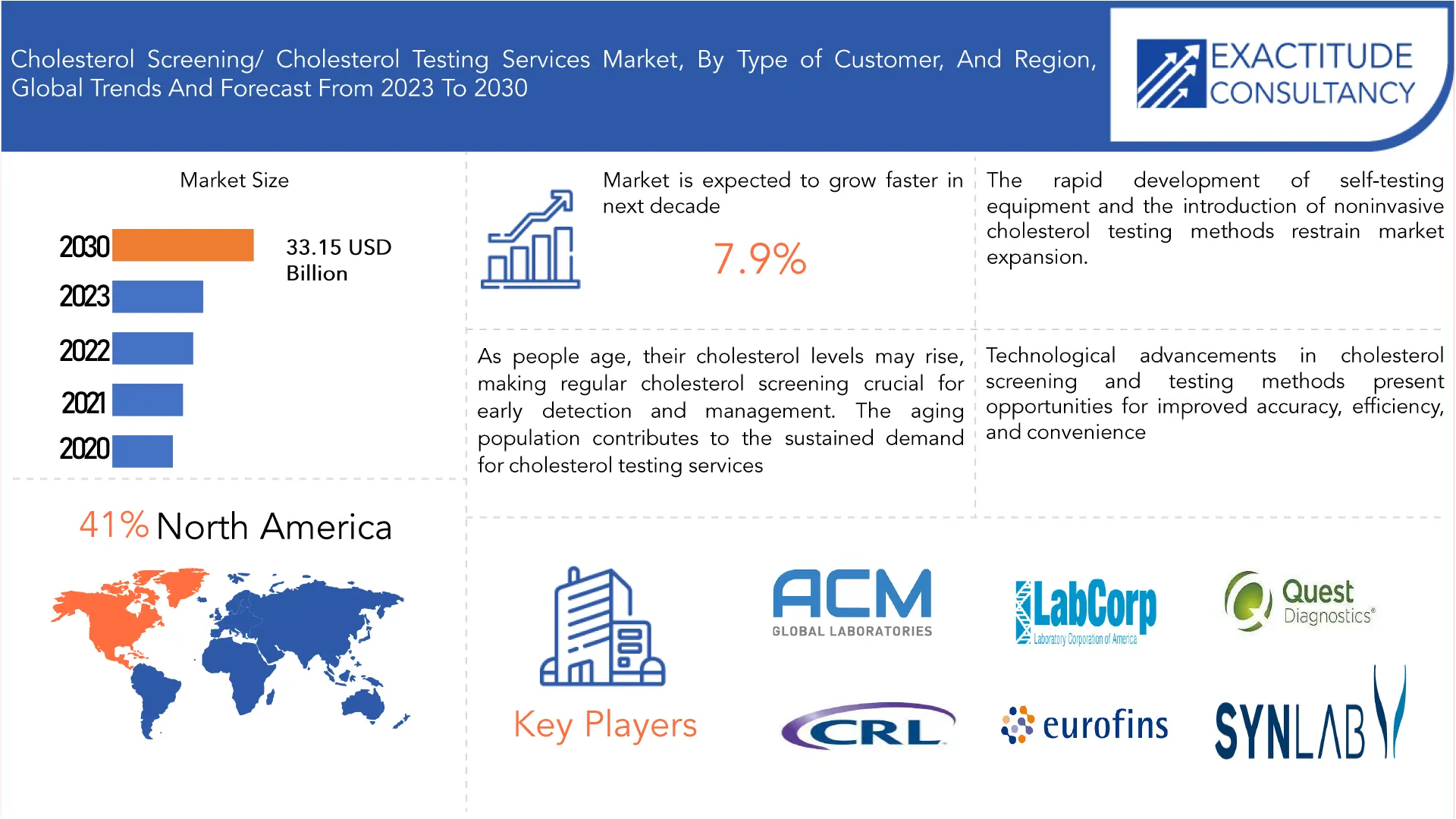

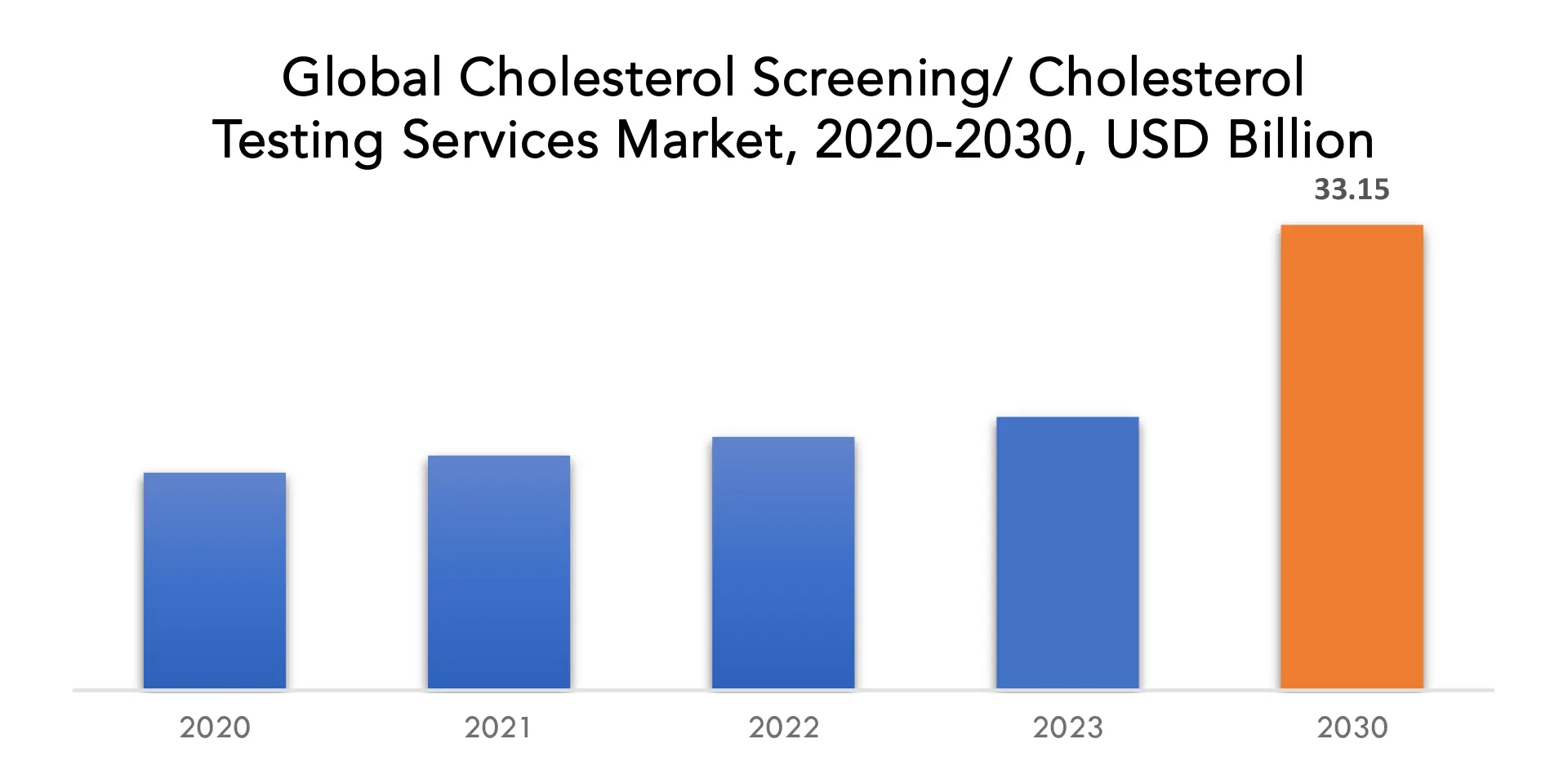

| USD 33.15 Billion by 2030 | 7.9% | Asia Pacific |

| by Type of Customer | by Region |

|---|---|

|

|

SCOPE OF THE REPORT

Cholesterol Screening/ Cholesterol Testing Services Market Overview

The cholesterol screening/ cholesterol testing services market is expected to grow at 7.9% CAGR from 2023 to 2030. It is expected to reach above USD 33.15 Billion by 2030 from USD 19.47 Billion in 2023.

All the cells in our body contain cholesterol, a waxy, fatty-like substance. If your blood cholesterol level is too high, it may join with other blood constituents to produce plaque, which adheres to the lining of your arteries. Another name for a comprehensive cholesterol test is a lipid panel or lipid profile. It can be used by your doctor to assess the levels of “good” and “bad” cholesterol as well as a form of fat called triglycerides in your blood. With the prevalence of cardiovascular diseases and obesity rising, the market for cholesterol testing services globally is anticipated to have considerable growth in the upcoming years. Aside from increasing knowledge and adoption of preventive healthcare, another factor that will boost the market is doctors’ preference for lab testing over self-testing. The government’s actions will also raise test quality. Furthermore, the prevalence of cardiovascular illnesses would rise due to the growing senior population worldwide.

Furthermore, increase in healthcare expenditure and rise in public awareness about the cardiovascular disease, its causes, treatment, and prevention also boost the growth of the market. The elevated levels of cholesterol create health threats such as sharp risk of stroke & heart diseases and account for many deaths. Cholesterol screening services allow early detection of the problems related to high cholesterol levels, avoiding complications, and increasing the survival chances of patients. On the other hand, the rapidly growing home/self-testing market and emergence of non-invasive cholesterol testing methods are expected to restrain the growth of this cholesterol testing services market to a certain extent.

Obesity is a condition linked to elevated cholesterol. The need for these tests will increase as the number of ailments linked to high cholesterol increases, which will propel the global market for laboratory cholesterol testing. Services for cholesterol lab testing help to diagnose problems early, prevent complications, and increase the odds of survival for patients. This is expected to lead to an increase in the demand for lab tests for cholesterol. The government agencies segment is predicted to grow significantly in the next years due to their increased focus on preventive treatment and early detection to avoid serious medical problems. To provide top-notch diagnostic testing services globally, the key market players team up with organizations affiliated with the federal, state, and local governments. Adults between the ages of 40 and 59 have the highest levels of total cholesterol. A sedentary lifestyle, which has been connected to the emergence of several illnesses, including obesity, diabetes, and heart disease, is mostly to blame for this.

The severe acute respiratory syndrome coronavirus is the culprit behind the current coronavirus disease-19 (COVID-19) epidemic. When infected with the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) that causes coronavirus illness-19, patients with cardiovascular disease (CVD), hypertension, and overweight/obesity typically have a more severe clinical course (COVID-19). This risk increases as your arteries narrow due to an accumulation of poor cholesterol. The type of plaque known as plaque prevents blood from reaching and leaving your heart and other organs. High cholesterol has been linked to a higher chance of contracting several ailments. There is even some evidence that some COVID-19 patients experience greater mortality as a result of having raised cholesterol levels. Following the COVID-19 pandemic, people are getting fatter and are more likely to acquire cardiovascular diseases.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Type of Customer, By Region |

| By Type of Customer |

|

| By Region

|

|

Cholesterol Screening/ Cholesterol Testing Services Market Segment Analysis

Cholesterol screening/ cholesterol testing services market is segmented based on type of customer, and region.

Based on type of customer, a significant portion of the market was made up of diagnostic centers. Providing patients with a variety of diagnostic tests, such as cholesterol screening, is a specialty of diagnostic centers. These institutions frequently contain cutting-edge laboratories, knowledgeable staff, and specialized tools to carry out various tests quickly and accurately. A few factors have contributed to the rise in popularity of diagnostic centers in recent years. In comparison to hospitals, they typically have lower wait periods and convenient access to diagnostic procedures. Additionally, diagnostic centers might offer specialized services that are just focused on diagnostic testing, enabling them to provide patients seeking cholesterol screening with a streamlined and effective experience. Hospitals and clinics, in addition to diagnostic facilities, are essential in the delivery of services for cholesterol screening and testing. To suit the needs of their patients, these healthcare facilities frequently have their own internal laboratories or may work with other diagnostic facilities.

Cholesterol Screening/ Cholesterol Testing Services Market Players

The cholesterol screening/ cholesterol testing services market key players include ACM Medical Laboratory, Clinical Reference Laboratory, Inc., Laboratory Corporation of America Holdings, Eurofins Scientific, Quest Diagnostics Incorporated, SYNLAB International GmbH, Fresenius Medical Care Holdings, Inc., Spectra Laboratories Inc., Unilabs, Bio-Reference Laboratories Inc.

Recent News:

- On June 2021, ACM Global Laboratories, Inc. is pleased to announced the rebranding of ABS Laboratories to ACM Bioanalytical Services. Founded over two decades ago by Drs. Colin Feyerabend and Mira Doig, ABS Laboratories was purchased by ACM Global Laboratories in 2018 as it expanded its central laboratory testing offerings for clinical trials to include bioanalytical services. ABS Laboratories, now ACM Bioanalytical Services, specialised in complex assay development and validation for the quantification of drugs, metabolites and biomarkers in biological samples used in pharmaceutical research and development.

- On February 2021, Clinical Reference Laboratory (CRL), one of the largest privately held clinical testing laboratories in the U.S., and Walgreens announced that the FDA-authorized CRL Rapid Response COVID-19 Saliva Test is available through Walgreens Find Care®, a digital health platform available on the Walgreens app and Walgreens.com. Sold under CRL’s HealthConfirm® brand, the COVID-19 Saliva Test is non-invasive and highly accurate, offered consumers the convenience of self-collecting the test right in their homes without supervision.

Who Should Buy? Or Key stakeholders

- Cholesterol Testing Service Providers

- Cholesterol Testing Kit Manufacturers

- Public and Private Physicians

- Healthcare Institutions (Medical Data Centres)

- Diagnostic & Clinical Laboratories

- Distributors and Suppliers of Cholesterol Testing Kits

- Health Insurance Companies/Payers

- Pharmaceutical Companies

- Employers/Organizations

- Market Research and Consulting Firms

Cholesterol Screening/ Cholesterol Testing Services Market Regional Analysis

The cholesterol screening/ cholesterol testing services market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

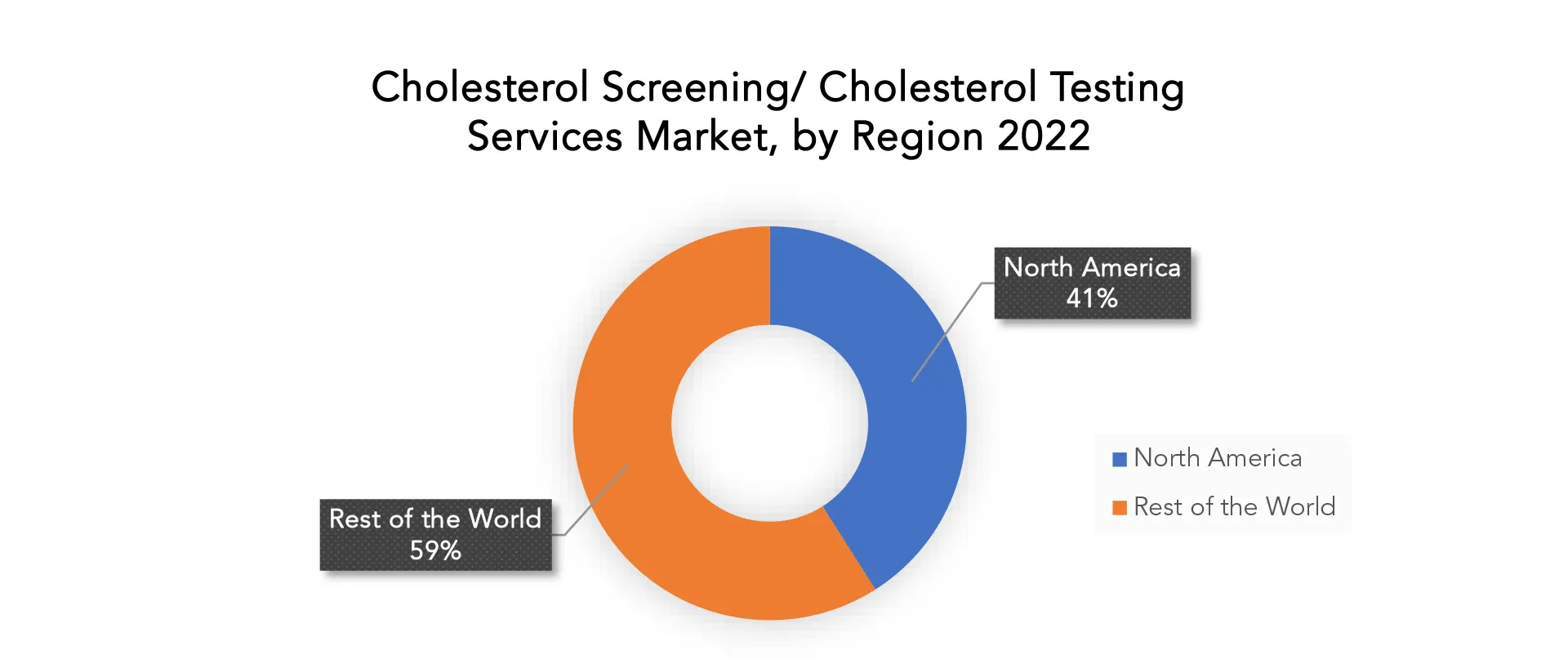

In terms of revenue, North America holds a significant portion of the worldwide market and is expected to continue to dominate during the forecast period. The growing senior population, which has increased the base of patients who can be served, is one of the main causes of this high percentage in North America. This modification is anticipated to increase awareness of preventative strategies like clinical diagnostics, particularly cholesterol screenings, to lower the occurrence of unpleasant events brought on by illnesses like stroke, diabetes, and cardiovascular disease. The U.S. is a significant market in North America for companies that offer cholesterol testing services.

Key Market Segments: Cholesterol Screening/ Cholesterol Testing Services Market

Cholesterol Screening/ Cholesterol Testing Services Market by Type of Customer, 2020-2030, (USD Billion)

- Physicians/Providers and Hospitals

- Government Agencies

- Diagnostic centers

- Patients

- Others

Cholesterol Screening/ Cholesterol Testing Services Market by Region, 2020-2030, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the cholesterol screening/ cholesterol testing services market over the next 7 years?

- Who are the major players in the cholesterol screening/ cholesterol testing services market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the cholesterol screening/ cholesterol testing services market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the cholesterol screening/ cholesterol testing services market?

- What is the current and forecasted size and growth rate of the global cholesterol screening/ cholesterol testing services market?

- What are the key drivers of growth in the cholesterol screening/ cholesterol testing services market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the cholesterol screening/ cholesterol testing services market?

- What are the technological advancements and innovations in the cholesterol screening/ cholesterol testing services market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the cholesterol screening/ cholesterol testing services market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the cholesterol screening/ cholesterol testing services market?

- What are the services offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA END-USERS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET OUTLOOK

- GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER OF CUSTOMER, (USD BILLION), 2020-2030

- PHYSICIANS/PROVIDERS AND HOSPITALS

- GOVERNMENT AGENCIES

- DIAGNOSTIC CENTERS

- PATIENTS

- OTHERS

- GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY REGION, (USD BILLION), 2020-2030

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ACM MEDICAL LABORATORY

- CLINICAL REFERENCE LABORATORY, INC.

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- EUROFINS SCIENTIFIC

- QUEST DIAGNOSTICS INCORPORATED

- SYNLAB INTERNATIONAL GMBH

- FRESENIUS MEDICAL CARE HOLDINGS, INC.

- SPECTRA LABORATORIES INC.

- UNILABS

- BIO-REFERENCE LABORATORIES INC.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 2 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY REGION (USD BILLION) 2022-2030

TABLE 3 NORTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 4 NORTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 5 US CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 6 CANADA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 7 MEXICO CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 8 SOUTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 9 SOUTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 10 BRAZIL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 11 ARGENTINA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 12 COLOMBIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 13 REST OF SOUTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 14 ASIA-PACIFIC CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 15 ASIA-PACIFIC CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 16 INDIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 17 CHINA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 18 JAPAN CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 19 SOUTH KOREA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 20 AUSTRALIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 21 SOUTH-EAST ASIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 22 REST OF ASIA PACIFIC CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 23 EUROPE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 24 EUROPE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 25 GERMANY CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 26 UK CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 27 FRANCE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 28 ITALY CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 29 SPAIN CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 30 RUSSIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 31 REST OF EUROPE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 32 MIDDLE EAST AND AFRICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 33 MIDDLE EAST AND AFRICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 34 UAE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 35 SAUDI ARABIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 36 SOUTH AFRICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 37 REST OF MIDDLE EAST AND AFRICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER OF CUSTOMER, USD BILLION, 2020-2030

FIGURE 9 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 10 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER OF CUSTOMER, USD BILLION, 2022

FIGURE 11 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY REGION, USD BILLION, 2022

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 MARKET SHARE ANALYSIS

FIGURE 14 ACM MEDICAL LABORATORY: COMPANY SNAPSHOT

FIGURE 15 CLINICAL REFERENCE LABORATORY, INC.: COMPANY SNAPSHOT

FIGURE 16 LABORATORY CORPORATION OF AMERICA HOLDINGS: COMPANY SNAPSHOT

FIGURE 17 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 18 QUEST DIAGNOSTICS INCORPORATED: COMPANY SNAPSHOT

FIGURE 19 SYNLAB INTERNATIONAL GMBH: COMPANY SNAPSHOT

FIGURE 20 FRESENIUS MEDICAL CARE HOLDINGS, INC.: COMPANY SNAPSHOT

FIGURE 21 SPECTRA LABORATORIES INC.: COMPANY SNAPSHOT

FIGURE 22 UNILABS: COMPANY SNAPSHOT

FIGURE 23 BIO-REFERENCE LABORATORIES INC.: COMPANY SNAPSHOT

FAQ

The cholesterol screening/ cholesterol testing services market is expected to grow at 7.9% CAGR from 2023 to 2030. It is expected to reach above USD 33.15 Billion by 2030 from USD 19.47 Billion in 2023.

North America held more than 41% of the cholesterol screening/ cholesterol testing services market revenue share in 2022 and will witness expansion in the forecast period.

The primary driver accelerating the growth of the market for cholesterol testing is the decline in physical activity. Additionally, the market is being driven by the need for better cholesterol management and routine check-ups and screenings. The market for over-the-counter cholesterol test kits is also anticipated to increase as a result of rising electronics miniaturization, which is also projected to play a beneficial role in the creation of self-testing kits.

Cholesterol screening/ cholesterol testing services market has leading application in diagnostic centers industry.

In terms of market share and revenue, North America now rules the cholesterol testing market and will maintain this dominance during the projection period. This is a result of an increase in the number of elderly people, which has led to an increase in the number of cholesterol patients in this area. The focus will likely shift to clinical diagnostics, particularly cholesterol tests, in order to limit the bad events brought on by diseases like stroke, diabetes, and cardiovascular disease.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.