REPORT OUTLOOK

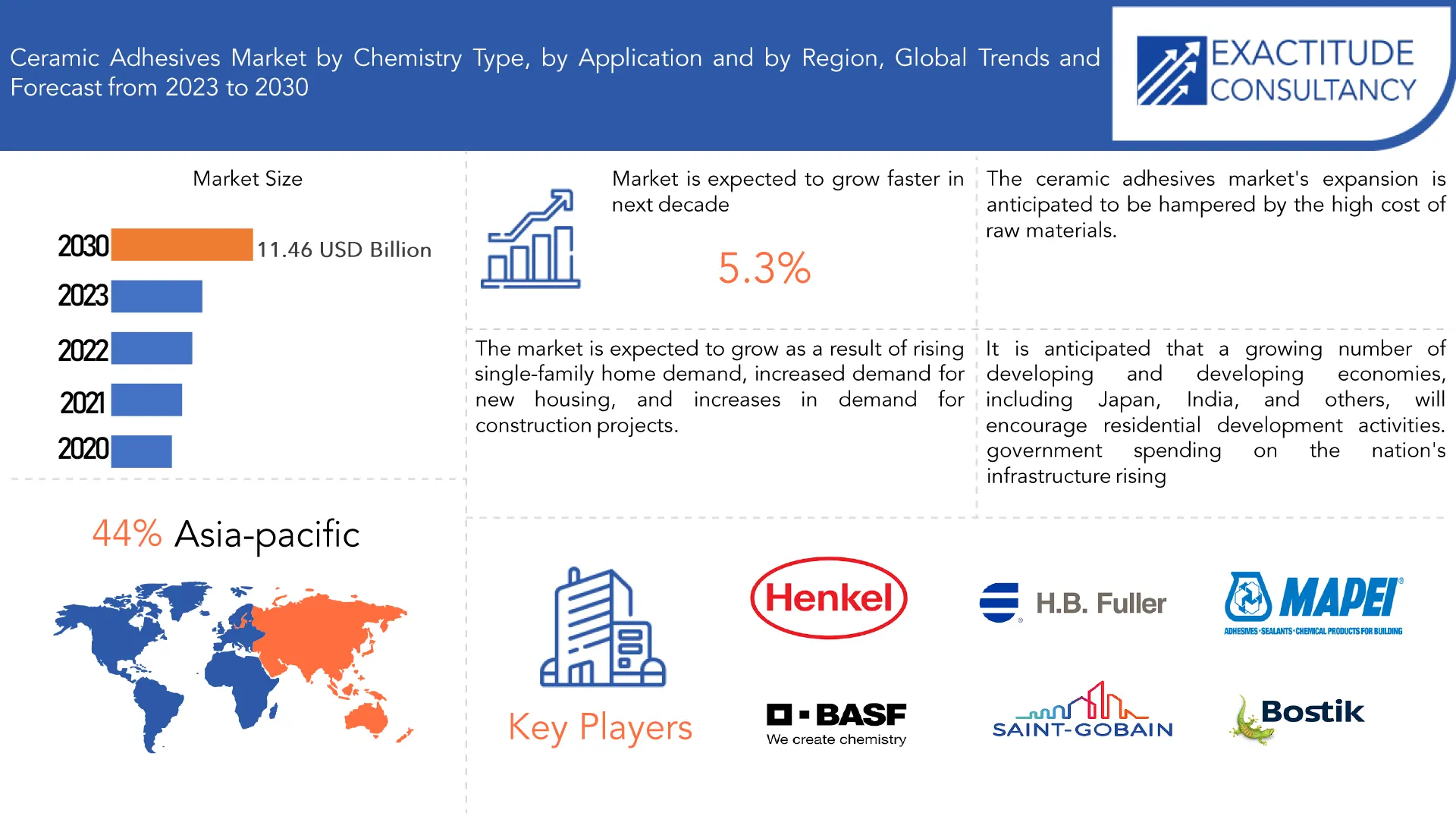

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 11.46 billion by 2030 | 5.3% | Asia Pacific |

| Market by Chemistry Type | Market by Application | Market by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Ceramic Adhesives Market Overview

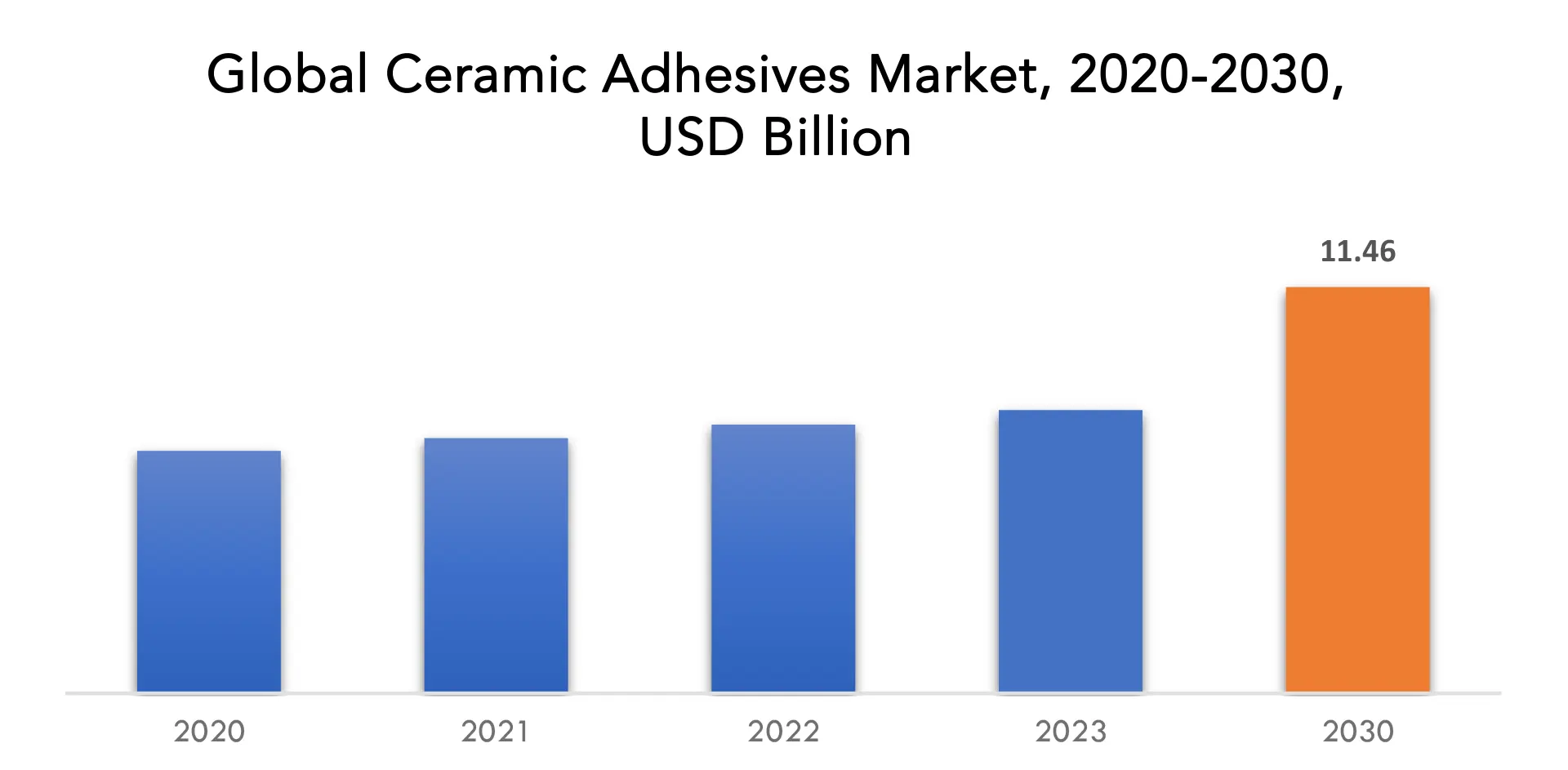

The Ceramic Adhesives Market is expected to grow at 5.3% CAGR from 2023 to 2030. It is expected to reach above USD 11.46 billion by 2030 from USD 6.84 billion in 2020.

Ceramic adhesives are used in large-scale vacuum, high-temperature, and cryogenic applications to bond and seal metals, ceramics, quartz, and glass. Due to their ability to withstand high temperatures, ceramic adhesives are frequently utilized. Epoxy and phenolic adhesives, for instance, can be utilized at temperatures as high as 150 °C. Several ceramics have been created that work at temperatures. These adhesives are based on inorganic binders such as metal phosphates and alkali silicates, along with powdered fillers like zirconium oxide, carbon, or aluminum oxide. Two-component methods are available for ceramic adhesives. They have an appearance like biological glue. In many different applications, including instrument binding and coil form coatings, electronics encapsulation, metal and ceramic coatings, and impregnation of electrical insulators, high-temperature ceramics that are resistant to molten metals, reducing atmospheres, and solvents are utilized.

The desire for high-performance, cost-effective, and environmentally friendly building goods is the main driver of market expansion for ceramic adhesives. Additionally, ceramic adhesive producers frequently work to offer their clients products that are both affordable and of the highest quality. The ceramic adhesive market is likewise primarily driven by it. Future expansion should also be fueled by escalating demand from the building industry, rising demand for new apartments, and an increase in the popularity of single-family homes.

Additionally, the market is anticipated to benefit from rising construction activity in a few industries, including transportation, schools, healthcare, offices, water supply, retail malls, hotels, and manufacturing facilities. The market’s overall expansion is constrained by a few specific restrictions and obstacles. The market expansion is constrained by unstable raw material prices and strict government regulations in developed nations. However, economic expansion, government expenditure increases on infrastructure development in emerging nations, and unrealized potential in these areas present intriguing growth prospects.

The ceramic adhesives market began to rebound as economies increasingly opened and construction activities picked up. Infrastructure improvements, government stimulus plans, and incentives for the building industry have all contributed to increased demand and the market’s revival. Due to the pandemic’s emphasis on hygiene and health, sanitary solutions have received more attention in a variety of settings, including hospitals, healthcare institutions, and public spaces. This could increase demand for ceramic adhesives with antibacterial features or surfaces that are simple to clean. The ceramic adhesives market began to rebound as economies increasingly opened and construction activities picked up. Infrastructure improvements, government stimulus plans, and incentives for the building industry have all contributed to increased demand and the market’s revival. Due to the pandemic’s emphasis on hygiene and health, sanitary solutions have received more attention in a variety of settings, including hospitals, healthcare institutions, and public spaces. This could increase demand for ceramic adhesives with antibacterial features or surfaces that are simple to clean.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Kilotons) |

| Segmentation | By Type, By Application, By Region |

| By Chemistry Type

|

|

| By Application

|

|

| By Region

|

|

Ceramic Adhesives Market Segment Analysis

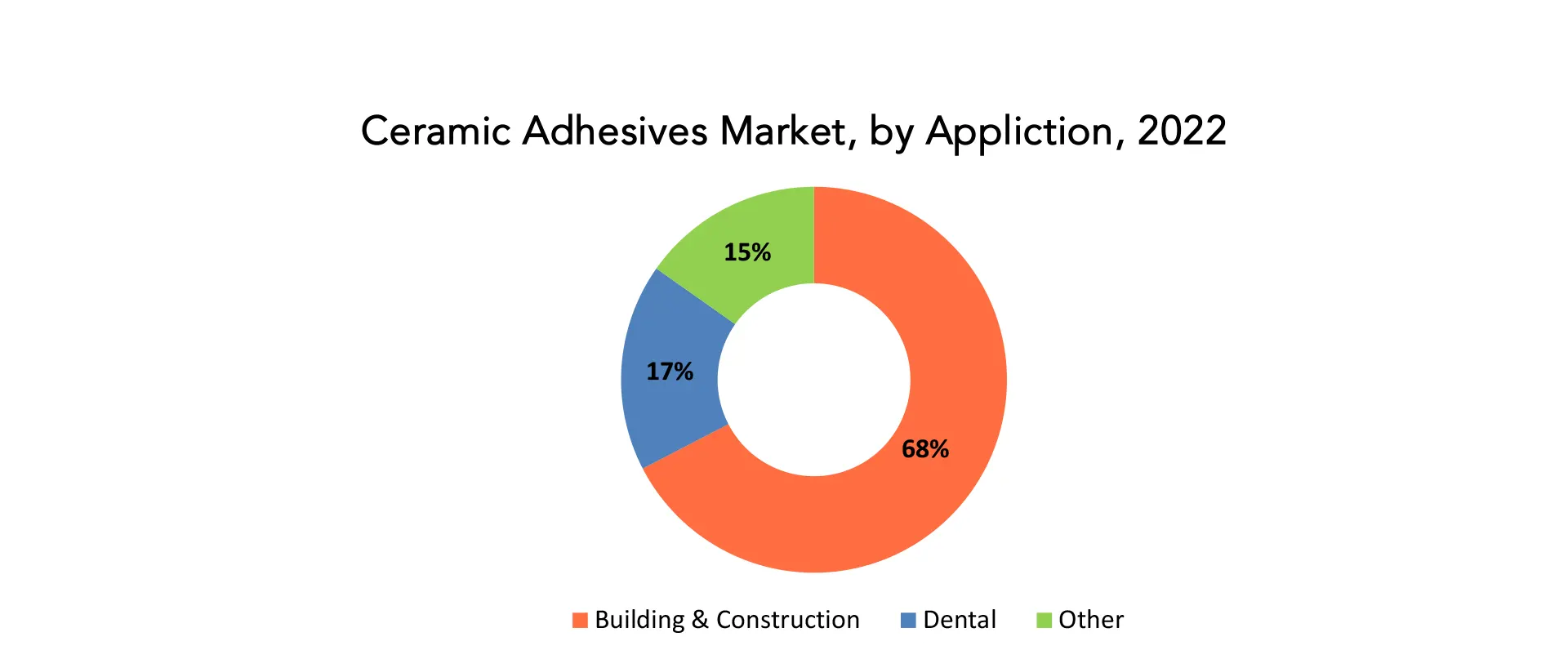

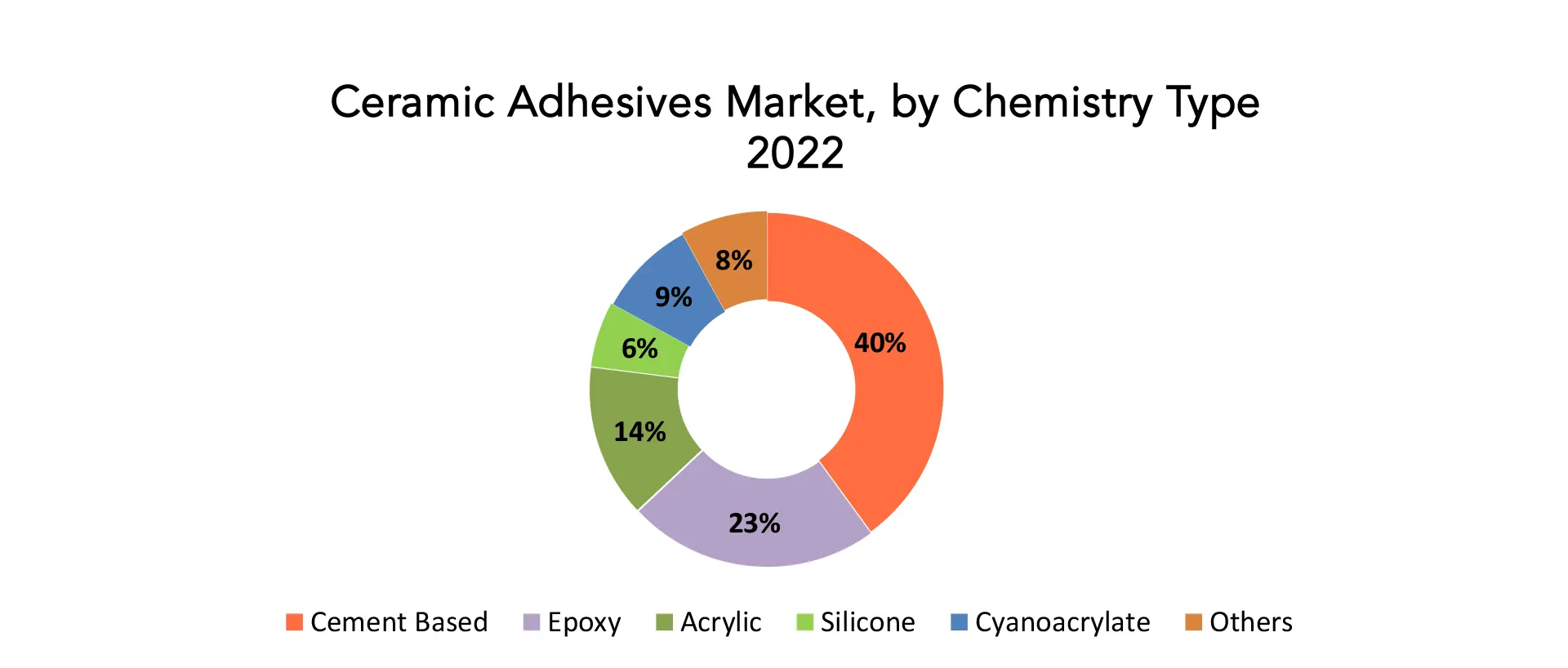

The ceramic adhesives market is segmented based on chemistry type, application, and region.

Based on chemistry type, a significant portion of the market was made up of cement-based. There are several brands of cement-based adhesives on the market that offer various compositions and variants. Cement-based adhesives are simple for builders and contractors to obtain, guaranteeing convenience and accessibility for construction projects. Concrete and cement boards are examples of common cementitious substrates in construction that cement-based adhesives are compatible with. By ensuring a solid contact between the adhesive and the substrate thanks to this compatibility, the ceramic tile installation will perform better overall and last longer. In general, cement-based ceramic adhesives are more economical than other varieties. Typical ceramic tile installations, deliver good performance, are easily accessible, and are reasonably priced. They are a well-liked option for both residential and commercial construction projects due to their cost.

Based on application, a significant portion of the market was made up of building & construction. Ceramic adhesives are typically used to attach tiles on surfaces such as floors, walls, and other parts of buildings. Ceramic tiles are widely used in the building sector due to their aesthetic appeal, robustness, and ease of maintenance. Ceramic adhesives guarantee stable and long-lasting installations by forming a solid bind between the tiles and the substrate. Infrastructure projects like bridges, tunnels, airports, and train stations also frequently use ceramic adhesives. Ceramic materials are frequently used for these projects, either as practical or architectural features. The bonding and fixing of these ceramic components in situ require the use of ceramic adhesives. The market for ceramic tiles and, by extension, ceramic adhesives is driven by the rising need for new homes and businesses as well as renovation and remodeling projects. Ceramic adhesives with better characteristics have been developed as a result of advancements in adhesive technology. These adhesives include advantages such as quicker cure times, stronger bonds, higher chemical resistance, and greater flexibility.

Ceramic Adhesives Market Players

The market research report covers the analysis of market players. Key companies profiled in the report include 3M, Henkel AG & Co. KGaA, BASF SE, H.B. Fuller Company, Saint-Gobain, MAPEI S.p.A., Bostik, Ardex Group, Terraco Holdings Ltd., Huntsman International LLC.

Recent Development:

-

On February 2023, the newest addition to the company’s line of adhesives is designed to stay in place for up to 28 days, 3M announced, doubling the two-week wear time that has long been the standard for stick-on medical devices. The manufacturing giant first began subverting that standard last spring, when it unveiled an adhesive tape that could be used for up to 21 days at a time.

-

On May 2023, Polytec PT, a company based in Germany, developed thermal interface materials for batteries and engineering adhesives for the electronics market. It delivered around €15 million in sales with one main production site in Karlsbad, Germany. Polytec PT developed a strong expertise in thermal interface materials which are key to enabling fast charging of the battery and efficient dissipation of the heat. Polytec PT has already built a solid position in this market.

Who Should Buy? Or Key stakeholders

- Manufacturers of Ceramic Adhesives and Their Raw Materials

- Raw Material Suppliers

- Manufacturers of Ceramic Adhesives Used in Various Application Industries

- Traders, Distributors, and Suppliers of Ceramic Adhesives

- Regional Ceramic Adhesives Manufacturers Associations and General Ceramic Adhesives Associations

- Non-Governmental Organizations, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Ceramic Adhesives Market Regional Analysis

The ceramic adhesives market by region includes North America, Asia-Pacific (APAC), Europe, South America, And Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

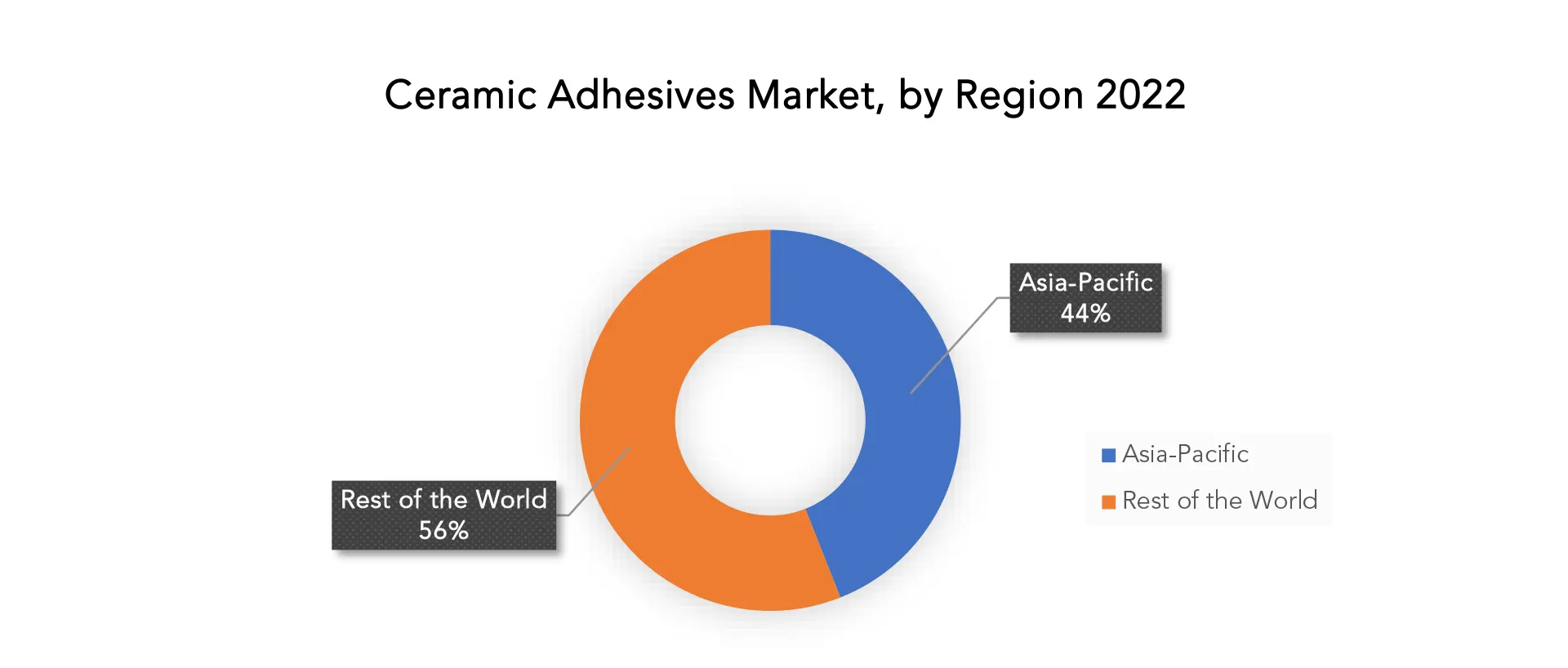

In terms of value and volume, the ceramic adhesives market in Asia Pacific is anticipated to grow at the fastest rate. Manufacturers of ceramic adhesives are concentrating on the Asia Pacific market since it has the largest building industry in the world, which accounts for 44% of global construction investment. Due to the ongoing migration of several firms’ ceramic adhesive production facilities to China, the market for ceramic adhesives is anticipated to grow significantly over the course of the projected period. In addition, countries like India, Thailand, and Indonesia have boosted their investments in the building and construction sector.

The tight enforcement of several environmental regulations in North America and Europe banning the use or production of ceramic adhesives may strangle the market for these products. To ensure safety and minimize health concerns associated with VOC emissions from chemical compounds used to generate ceramic adhesives, the world’s manufacturers of ceramic adhesives focus on these issues. This affects the ability of North American and European producers of ceramic adhesives to produce their products.

Target Audience for Ceramic Adhesives Market

- Construction Companies

- Architects and Designers

- Ceramic Tile Manufacturers

- Adhesive Manufacturers and Suppliers

- Industrial and Commercial Facility Managers

- Research and Development Teams

- DIY Enthusiasts and Retailers

- Environmental and Sustainability Experts

Key Market Segments: Ceramic Adhesives Market

Ceramic Adhesives Market by Chemistry Type, 2020-2030, (USD Billion), (Kilotons)

- Cement Based

- Epoxy

- Acrylic

- Silicone

- Cyanoacrylate

- Others

Ceramic Adhesives Market by Application, 2020-2030, (USD Billion), (Kilotons)

- Building & Construction

- Dental

- Other

Ceramic Adhesives Market by Region, 2020-2030, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the expected growth rate of the ceramic adhesives market over the next 7 years?

- Who are the major players in the ceramic adhesives market and what is their market share?

- What are the end-user industries driving the market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the ceramic adhesives market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the ceramic adhesives market?

- What is the current and forecasted size and growth rate of the global ceramic adhesives market?

- What are the key drivers of growth in the ceramic adhesives market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the ceramic adhesives market?

- What are the technological advancements and innovations in the ceramic adhesives market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the ceramic adhesives market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the ceramic adhesives market?

- What are the products offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives

- Increasing sales and Market share

- Developing new Type

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CERAMIC ADHESIVES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CERAMIC ADHESIVES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CERAMIC ADHESIVES MARKET OUTLOOK

- GLOBAL CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE, 2020-2030, (USD BILLION), (KILOTONS)

- CEMENT BASED

- EPOXY

- ACRYLIC

- SILICONE

- CYANOACRYLATE

- OTHERS

- GLOBAL CERAMIC ADHESIVES MARKET BY APPLICATION, 2020-2030, (USD BILLION), (KILOTONS)

- BUILDING & CONSTRUCTION

- DENTAL

- OTHER

- GLOBAL CERAMIC ADHESIVES MARKET BY REGION, 2020-2030, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- 3M

- HENKEL AG & CO. KGAA

- BASF SE

- B. FULLER COMPANY

- SAINT-GOBAIN

- MAPEI S.P.A.

- BOSTIK

- ARDEX GROUP

- TERRACO HOLDINGS LTD.

- HUNTSMAN INTERNATIONAL LLC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 2 GLOBAL CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 3 GLOBAL CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 4 GLOBAL CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 5 GLOBAL CERAMIC ADHESIVES MARKET BY REGION (USD BILLION), 2020-2030

TABLE 6 GLOBAL CERAMIC ADHESIVES MARKET BY REGION (KILOTONS), 2020-2030

TABLE 7 NORTH AMERICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 8 NORTH AMERICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 9 NORTH AMERICA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 10 NORTH AMERICA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 11 NORTH AMERICA CERAMIC ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 12 NORTH AMERICA CERAMIC ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2030

TABLE 13 US CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 14 US CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 15 US CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 16 US CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 17 CANADA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 18 CANADA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 19 CANADA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 20 CANADA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 21 MEXICO CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 22 MEXICO CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 23 MEXICO CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 24 MEXICO CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 25 SOUTH AMERICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 26 SOUTH AMERICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 27 SOUTH AMERICA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 28 SOUTH AMERICA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 29 SOUTH AMERICA CERAMIC ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 30 SOUTH AMERICA CERAMIC ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2030

TABLE 31 BRAZIL CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 32 BRAZIL CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 33 BRAZIL CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 34 BRAZIL CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 35 ARGENTINA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 36 ARGENTINA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 37 ARGENTINA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 38 ARGENTINA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 39 COLOMBIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 40 COLOMBIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 41 COLOMBIA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 42 COLOMBIA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 43 REST OF SOUTH AMERICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 44 REST OF SOUTH AMERICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 45 REST OF SOUTH AMERICA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 46 REST OF SOUTH AMERICA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 47 ASIA-PACIFIC CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 48 ASIA-PACIFIC CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 49 ASIA-PACIFIC CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 50 ASIA-PACIFIC CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 51 ASIA-PACIFIC CERAMIC ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 52 ASIA-PACIFIC CERAMIC ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2030

TABLE 53 INDIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 54 INDIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 55 INDIA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 56 INDIA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 57 CHINA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 58 CHINA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 59 CHINA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 60 CHINA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 61 JAPAN CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 62 JAPAN CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 63 JAPAN CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 64 JAPAN CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 65 SOUTH KOREA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 66 SOUTH KOREA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 67 SOUTH KOREA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 68 SOUTH KOREA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 69 AUSTRALIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 70 AUSTRALIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 71 AUSTRALIA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 72 AUSTRALIA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 73 SOUTH EAST ASIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 74 SOUTH EAST ASIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 75 SOUTH EAST ASIA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 76 SOUTH EAST ASIA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 77 REST OF ASIA PACIFIC CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 78 REST OF ASIA PACIFIC CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 79 REST OF ASIA PACIFIC CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 80 REST OF ASIA PACIFIC CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 81 EUROPE CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 82 EUROPE CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 83 EUROPE CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 84 EUROPE CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 85 EUROPE CERAMIC ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 86 EUROPE CERAMIC ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2030

TABLE 87 GERMANY CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 88 GERMANY CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 89 GERMANY CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 90 GERMANY CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 91 UK CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 92 UK CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 93 UK CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 94 UK CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 95 FRANCE CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 96 FRANCE CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 97 FRANCE CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 98 FRANCE CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 99 ITALY CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 100 ITALY CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 101 ITALY CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 102 ITALY CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 103 SPAIN CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 104 SPAIN CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 105 SPAIN CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 106 SPAIN CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 107 RUSSIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 108 RUSSIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 109 RUSSIA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 110 RUSSIA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 111 REST OF EUROPE CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 112 REST OF EUROPE CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 113 REST OF EUROPE CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 114 REST OF EUROPE CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2030

TABLE 121 UAE CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 122 UAE CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 123 UAE CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 124 UAE CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 125 SAUDI ARABIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 126 SAUDI ARABIA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 127 SAUDI ARABIA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 128 SAUDI ARABIA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 129 SOUTH AFRICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 130 SOUTH AFRICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 131 SOUTH AFRICA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 132 SOUTH AFRICA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (USD BILLION), 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE (KILOTONS), 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA CERAMIC ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE, USD BILLION, 2020-2030

FIGURE 9 GLOBAL CERAMIC ADHESIVES MARKET BY APPLICATION, USD BILLION, 2020-2030

FIGURE 10 GLOBAL CERAMIC ADHESIVES MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL CERAMIC ADHESIVES MARKET BY CHEMISTRY TYPE, USD BILLION, 2022

FIGURE 13 GLOBAL CERAMIC ADHESIVES MARKET BY APPLICATION, USD BILLION, 2022

FIGURE 14 GLOBAL CERAMIC ADHESIVES MARKET BY REGION, USD BILLION, 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 3M: COMPANY SNAPSHOT

FIGURE 16 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

FIGURE 17 BASF SE: COMPANY SNAPSHOT

FIGURE 18 H.B. FULLER COMPANY: COMPANY SNAPSHOT

FIGURE 19 SAINT-GOBAIN: COMPANY SNAPSHOT

FIGURE 20 MAPEI S.P.A.: COMPANY SNAPSHOT

FIGURE 21 BOSTIK: COMPANY SNAPSHOT

FIGURE 22 ARDEX GROUP: COMPANY SNAPSHOT

FIGURE 23 TERRACO HOLDINGS LTD.: COMPANY SNAPSHOT

FIGURE 24 HUNTSMAN INTERNATIONAL LLC.: COMPANY SNAPSHOT

FAQ

The ceramic adhesives market is expected to grow at 5.3% CAGR from 2022 to 2030. It is expected to reach above USD 10.89 billion by 2030 from USD 6.84 billion in 2020.

Asia Pacific held more than 44% of the ceramic adhesives market revenue share in 2022 and will witness expansion in the forecast period.

The growing demand for high-performance, economical, and environmentally friendly building products has caused the ceramic adhesives market to expand. A significant factor propelling the ceramic adhesives market is the continuous involvement of ceramic adhesive makers in offering consumers high-quality, affordable adhesive solutions. In addition, increased demand for new apartments, increased demand for single-family homes, and increased building demand are all anticipated to fuel future growth.

The market is anticipated to be dominated by Asia Pacific. Regional development will be encouraged by the growing government measures to boost the adoption of newer, better building technology.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.