REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2.82 billion by 2030 | 6.30% | North America |

| by Type | by Technology | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Elemental Analysis Market Overview

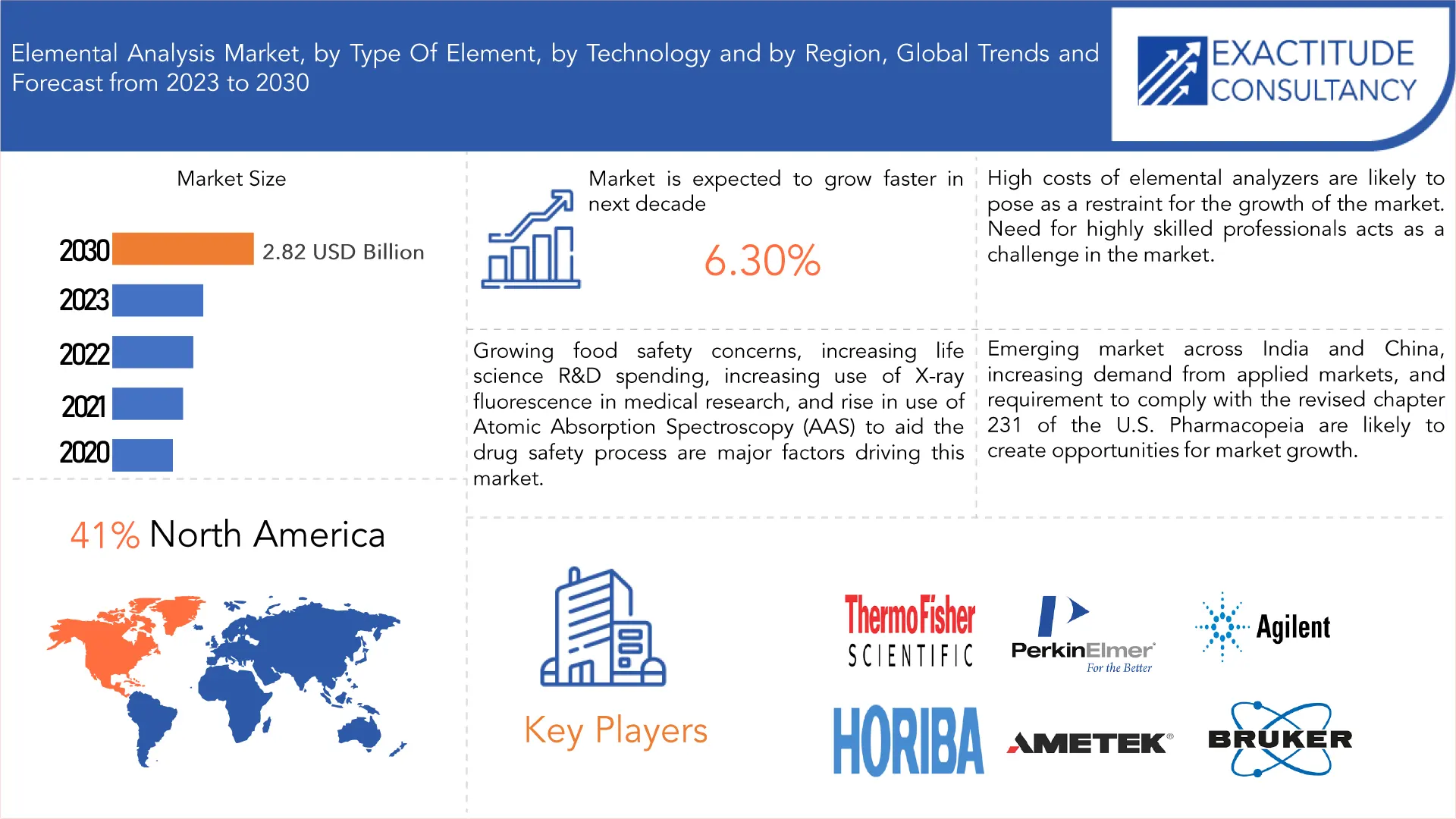

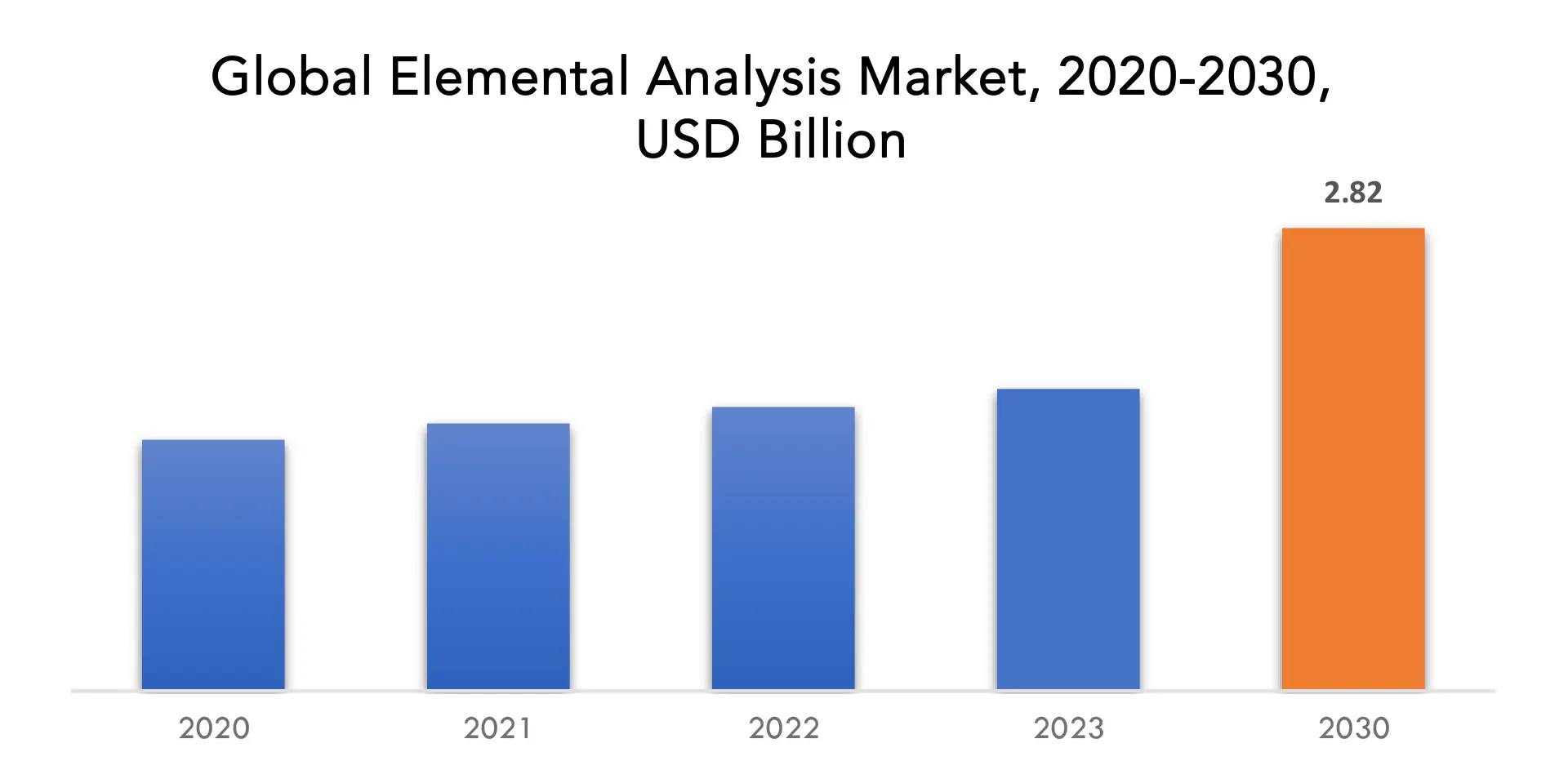

The elemental analysis market is expected to grow at 6.30% CAGR from 2023 to 2030. It is expected to reach above USD 2.82 billion by 2030 from USD 1.84 billion in 2023.

A technique called elemental analysis is used to locate and count the elements in a sample. It can be used to determine the amounts of various elements present in a range of substances, including soils, plants, rocks, minerals, metals, and other things. Elemental analysis is a technique that can be used to study the composition of materials, assess their purity, and pinpoint trace components. Elements can be analyzed using a variety of methods, including atomic absorption spectrometry, X-ray fluorescence, and inductively coupled plasma mass spectrometry.

Major market drivers include new international GMP and GDP certification called “EXCiPACT” for pharmaceutical excipients in North America and Europe, rising food safety concerns, rising life science R&D spending, expanding use of X-ray fluorescence in medical research, and growing use of Atomic Absorption Spectroscopy (AAS) to support the drug safety process. Due to these developments, inductively coupled plasma spectrometry (ICP), inductively coupled plasma mass spectrometry (ICP-MS), and atomic absorption spectrometry (AAS) have all been developed. Additionally, prospects for market expansion are probably going to be brought about by the rising markets in China and India, the rise in application market demand, and the need to adhere to the updated Chapter 231 of the US Pharmacopoeia.

One of the key factors propelling the growth of the elemental analyzer market is the rising need for the analysis of solid materials’ elemental composition. Inorganic and organic compounds can be analyzed by elemental analyzers, and they can produce accurate results. Elemental analyzers are user-friendly since they can simultaneously determine Sulphur and Carbon. The need for elemental analyzers is rising as a result of the need to determine the elemental composition of materials in sectors such as the construction, mining, petrochemical, and pharmaceutical industries. But during the anticipated term, a shortage of skilled labor is anticipated to constrain the market. Since the workforce in many developing and undeveloped nations lack the technical expertise to operate modern equipment, elemental analysis is often conducted using older instruments. Consequently, many manufacturers in these nations run training programs. However, there is still a sizable gap between the demand and availability of workers who can operate devices for elemental analysis.

The growing need for elemental analysis in emerging industries like renewable energy, nanotechnology, and biotechnology is one of the major opportunities in the elemental analysis market. Market expansion is being driven by the demand for sophisticated elemental analysis techniques to assist R&D, quality control, and process optimization efforts. Additionally, the use of elemental analysis in mining, forensic sciences, and geological exploration offers strong commercial opportunities. Also, the COVID-19 epidemic had a big effect on the market for elemental analysis. In the case of COVID-19 patients, the body contained abnormally high levels of trace elements, and the respiratory system was in danger of infection due to of the blood’s increased levels of heavy metals. For instance, according to the study report that was published by the American Journal of Analytical Chemistry in May 2021, the elemental analysis in COVID-19 patients was carried out using atomic absorption (AA) spectrophotometer. This analysis revealed that COVID-19 patients have abnormal levels of toxic elements (cadmium and nickel) compared to essential trace metals (zinc, iron, and copper) in the biological samples.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Type Of Element, By Technology, By Region. |

| By Type Of Element

|

|

| By Technology

|

|

| By Region

|

|

Elemental Analysis Market Segment Analysis

The elemental analysis market is segmented based on the type of element and technology.

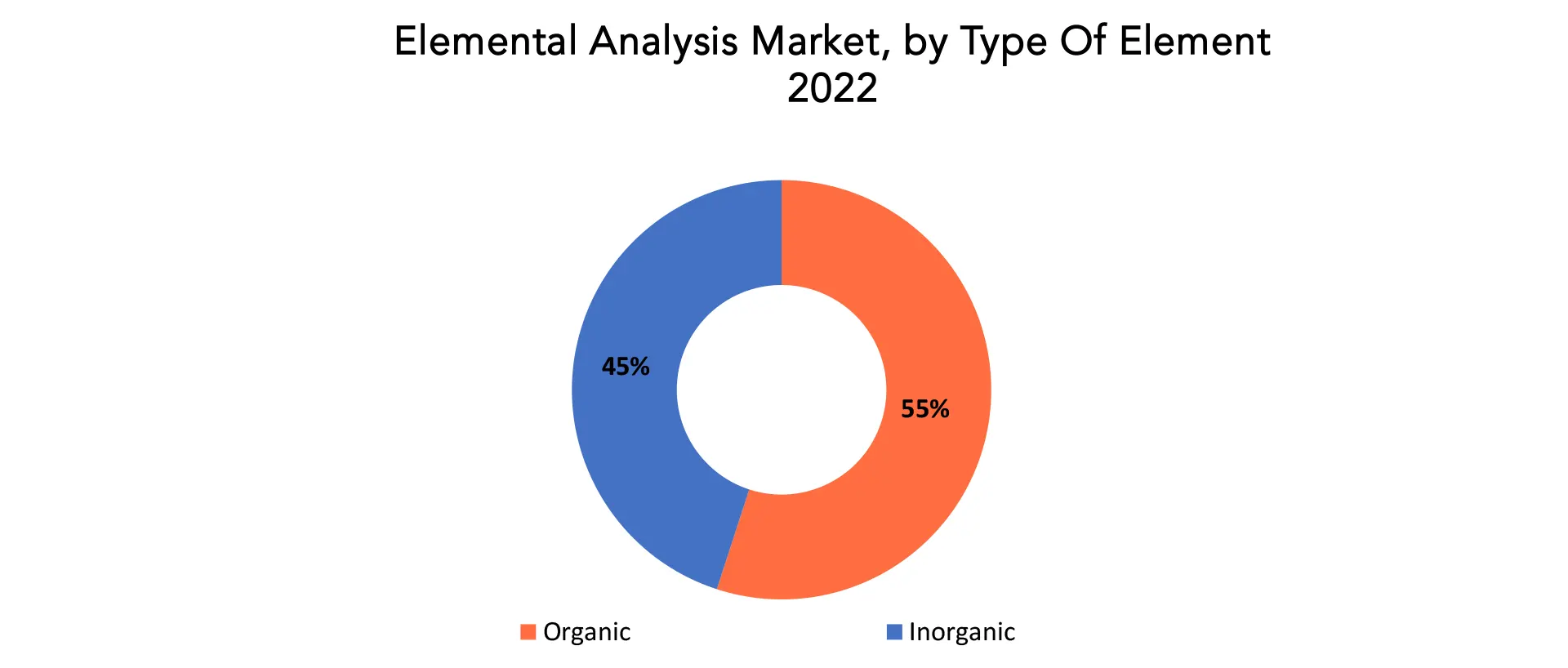

Organic, inorganic, and trace metal elements are only a few of the many elements that elemental analyzers can find. The quantitative and qualitative estimate of organic compounds, including carbon, hydrogen, nitrogen, and sulfur among others, is known as organic elemental analysis. Given that they are the most fundamental substances present in every sample, estimation of these substances in medications is uncommon.

Throughout the anticipated time, it’s estimated that the market for organic element estimation will continue to expand steadily. Numerous analytical techniques are used in inorganic elemental analysis to evaluate the inorganic and elemental composition of solids, liquids, aqueous solutions, chemical mixes, materials, or products. Cations, metals, anions, and inorganic salts are examples of inorganic components. They are also used to qualitatively and quantitatively estimate the presence of heavy metals and to look for catalyst traces in samples. Markets for organic and inorganic elements are divided based on the sorts of elements they contain. By type, inorganic elements had the biggest market share in 2020 and are projected to expand at the quickest rate throughout the projection period.

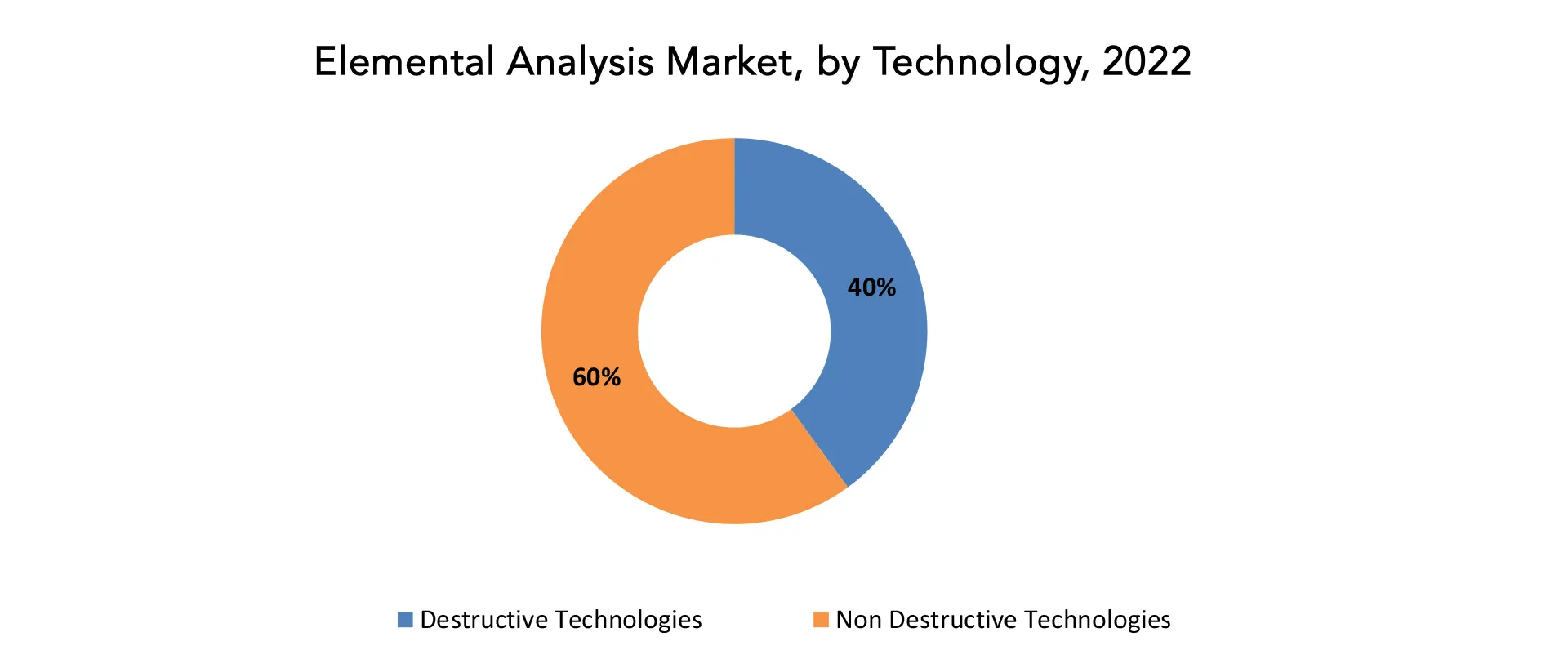

The market for elemental analysis can be divided into destructive and non-destructive technologies based on the type of technology being employed. In terms of technology, nondestructive technologies had the biggest proportion in 2022. Additionally, during the projected period, this sector is anticipated to increase at the fastest rate. The highest proportion of this segment is mostly attributable to the sample’s retention, high accuracy, and technological developments.

Elemental Analysis Market Player

The elemental analysis market key players include Thermo Fisher Scientific, Inc., Perkinelmer, Inc., Agilent Technologies, Inc., Bruker Corporation, Ametek, Inc., Horiba, Ltd, Rigaku Corporation, Shimadzu Corporation, Analytik Jena AG, Elementar Group.

Latest News:

March 29, 2023: Thermo Fisher Scientific, the world leader in serving science, and Arsenal Biosciences, Inc. (ArsenalBio), a clinical-stage cell therapy company engineering advanced chimeric antigen receptor (CAR)-T cell therapies for solid tumors, today announced an update to our strategic collaboration to further the development of manufacturing processes for new cancer treatments.

March 7, 2023: Thermo Fisher Scientific was provided proteomics and biopharmaceutical research laboratories with a new line of low-flow HPLC columns that improve separation performance and stability of biologically complex samples.

Elemental Analysis Market Regional Analysis

The elemental analysis market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

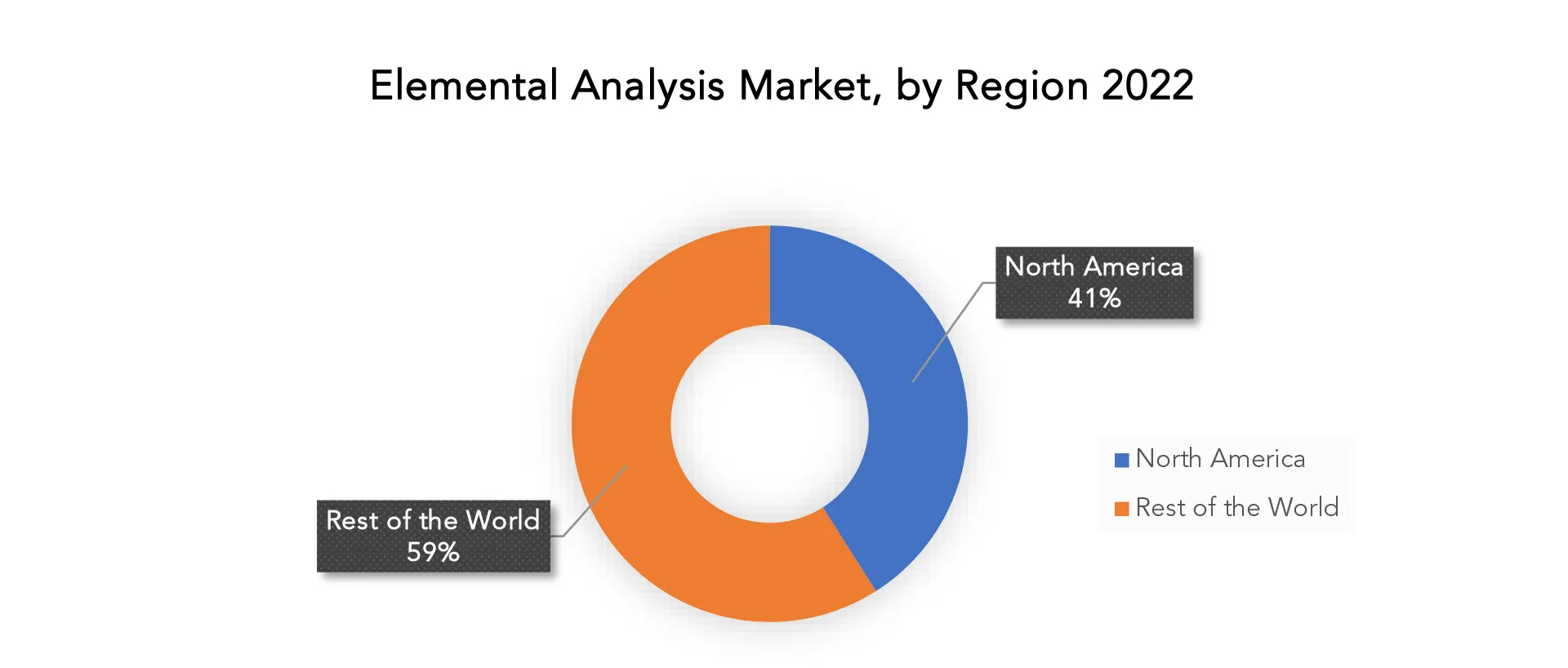

In 2023, North America held a 41% sales share, dominating the market. The USP guidelines and limits for elements in pharmaceutical compounds, the expansion of elemental analysis applications in healthcare, upcoming regulations requiring elemental analysis of finished medical products, and increased research into the creation of technologically advanced elemental analyzers are some of the major drivers of North America’s market share. While the CAGR for growth in Asia Pacific is anticipated to be the fastest during the forecast period. The market is anticipated to grow during the forecast period due to factors such as rising awareness about the safety of pharmaceuticals, an increase in conferences and meetings in Asia Pacific, and an increase in the interest of manufacturers of key elemental analysis products to establish subsidiaries in the region. As a result, North America dominates the elemental analysis market.

Key Market Segments: Elemental Analysis Market

Elemental Analysis Market by Type of Element, 2020-2030, (USD Billion)

- Organic

- Inorganic

Elemental Analysis Market by Technology, 2020-2030, (USD Billion)

- Destructive Technologies

- Non Destructive Technologies

Elemental Analysis Market by Region, 2020-2030, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Who Should Buy? Or Key Stakeholders

- Elemental Analysis Equipment Manufacturers.

- Research Institutions and Laboratories

- Pharmaceutical and Biotechnology Companies

- Environmental Testing Agencies

- Petrochemical and Oil & Gas Companies

- Food and Beverage Industry

- Mining and Geological Exploration Companies

- Forensic Laboratories

- Regulatory Authorities

- Others

Key Question Answered

- What is the expected growth rate of the elemental analysis market over the next 7 years?

- Who are the major players in the elemental analysis market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the elemental analysis market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the elemental analysis market?

- What is the current and forecasted size and growth rate of the global elemental analysis market?

- What are the key drivers of growth in the elemental analysis market?

- What are the distribution channels and supply chain dynamics in the elemental analysis market?

- What are the technological advancements and innovations in the elemental analysis market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the elemental analysis market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the elemental analysis market?

- What are the service offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL VETERINARY IMAGING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ELEMENTAL ANALYSIS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL VETERINARY IMAGING MARKET OUTLOOK

- GLOBAL ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT, 2020-2030, (USD BILLION)

- ORGANIC

- INORGANIC

- GLOBAL ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY, 2020-2030, (USD BILLION)

- DESTRUCTIVE TECHNOLOGIES

- NON-DESTRUCTIVE TECHNOLOGIES

- GLOBAL ELEMENTAL ANALYSIS MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- THERMO FISHER SCIENTIFIC, INC.

- PERKINELMER, INC.

- AGILENT TECHNOLOGIES, INC.

- BRUKER CORPORATION

- AMETEK, INC.

- HORIBA, LTD

- RIGAKU CORPORATION

- SHIMADZU CORPORATION

- ANALYTIK JENA AG

- ELEMENTAR GROUP*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLION), 2020-2030

TABLE 2 GLOBAL ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 3 GLOBAL ELEMENTAL ANALYSIS MARKET BY REGION (USD BILLIONS), 2020-2030

TABLE 4 NORTH AMERICA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 5 NORTH AMERICA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 6 NORTH AMERICA ELEMENTAL ANALYSIS MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 7 US ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 8 US ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 9 CANADA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (BILLIONS), 2020-2030

TABLE 10 CANADA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 11 MEXICO ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 12 MEXICO ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 13 SOUTH AMERICA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 14 SOUTH AMERICA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 15 SOUTH AMERICA ELEMENTAL ANALYSIS MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 16 BRAZIL ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 17 BRAZIL ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 18 ARGENTINA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 19 ARGENTINA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 20 REST OF SOUTH AMERICA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 21 REST OF SOUTH AMERICA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 22 ASIA -PACIFIC ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 23 ASIA -PACIFIC ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 24 ASIA -PACIFIC ELEMENTAL ANALYSIS MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 25 INDIA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 26 INDIA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 27 CHINA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 28 CHINA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 29 JAPAN ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 30 JAPAN ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 31 SOUTH KOREA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 32 SOUTH KOREA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 33 AUSTRALIA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 34 AUSTRALIA HYBRID FUNCTIONBY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 35 AUSTRALIA ELEMENTAL ANALYSIS MARKET BY FUNCTION (USD BILLIONS), 2020-2030

TABLE 36 AUSTRALIA ELEMENTAL ANALYSIS MARKET BY ORGANIZATION SIZE (USD BILLION), 2020-2030

TABLE 37 REST OF ASIA PACIFIC ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 38 REST OF ASIA PACIFIC HYBRID FUNCTIONBY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 39 EUROPE ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 40 EUROPE ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 41 EUROPE ELEMENTAL ANALYSIS MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 42 GERMANY ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 43 GERMANY ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 44 UK ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 45 UK ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 46 FRANCE ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 47 FRANCE ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 48 ITALY ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 49 ITALY ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 50 SPAIN ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 51 SPAIN ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 52 REST OF EUROPE ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 53 REST OF EUROPE ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 54 MIDDLE EAST AND AFRICA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 55 MIDDLE EAST AND AFRICA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 56 MIDDLE EAST AND AFRICA ELEMENTAL ANALYSIS MARKET BY COUNTRY (USD BILLION), 2020-2030

TABLE 57 UAE ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 58 UAE ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 59 SOUTH AFRICA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 60 SOUTH AFRICA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

TABLE 61 REST OF MIDDLE EAST AND AFRICA ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT (USD BILLIONS), 2020-2030

TABLE 62 REST OF MIDDLE EAST AND AFRICA ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY (USD BILLION), 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT, USD BILLION, 2020-2030

FIGURE 9 GLOBAL ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY, USD BILLION, 2020-2030

FIGURE 10 GLOBAL ELEMENTAL ANALYSIS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ELEMENTAL ANALYSIS MARKET BY TYPE OF ELEMENT, USD BILLION, 2022

FIGURE 13 GLOBAL ELEMENTAL ANALYSIS MARKET BY TECHNOLOGY, USD BILLION, 2022

FIGURE 14 GLOBAL ELEMENTAL ANALYSIS MARKET BY REGION, USD BILLION, 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT

FIGURE 17 PERKINELMER, INC.: COMPANY SNAPSHOT

FIGURE 18 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 19 BRUKER CORPORATION: COMPANY SNAPSHOT

FIGURE 20 AMETEK, INC.: COMPANY SNAPSHOT

FIGURE 21 HORIBA, LTD: COMPANY SNAPSHOT

FIGURE 22 RIGAKU CORPORATION: COMPANY SNAPSHOT

FIGURE 23 SHIMADZU CORPORATION: COMPANY SNAPSHOT

FIGURE 24 ANALYTIK JENA AG: COMPANY SNAPSHOT

FIGURE 25 ELEMENTAR GROUP: COMPANY SNAPSHOT

FAQ

The elemental analysis market is expected to grow at 6.3 % CAGR from 2023 to 2030. It is expected to reach above USD 2.82 billion by 2030 from USD 1.84 billion in 2023.

North America held more than 41 % of the elemental analysis market revenue share in 2021 and will witness expansion in the forecast period.

Major market drivers include new international GMP and GDP certification called “EXCiPACT” for pharmaceutical excipients in North America and Europe, rising food safety concerns, rising life science R&D spending, expanding use of X-ray fluorescence in medical research, and growing use of Atomic Absorption Spectroscopy (AAS) to support the drug safety process. Due to these developments, inductively coupled plasma spectrometry (ICP), inductively coupled plasma mass spectrometry (ICP-MS), and atomic absorption spectrometry (AAS) have all been developed.

Organic, inorganic, and trace metal elements are only a few of the many elements that elemental analyzers can find. They are also used to qualitatively and quantitatively estimate the presence of heavy metals and to look for catalyst traces in samples. Markets for organic and inorganic elements are divided based on the sorts of elements they contain. By type, inorganic elements had the biggest market share in 2020 and are projected to expand at the quickest rate throughout the projection period.

In 2022 North America held a 41% sales share, dominating the market. The USP guidelines and limits for elements in pharmaceutical compounds, the expansion of elemental analysis applications in healthcare, upcoming regulations requiring elemental analysis of finished medical products, and increased research into the creation of technologically advanced elemental analyzers are some of the major drivers of North America’s market share.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.