REPORT OUTLOOK

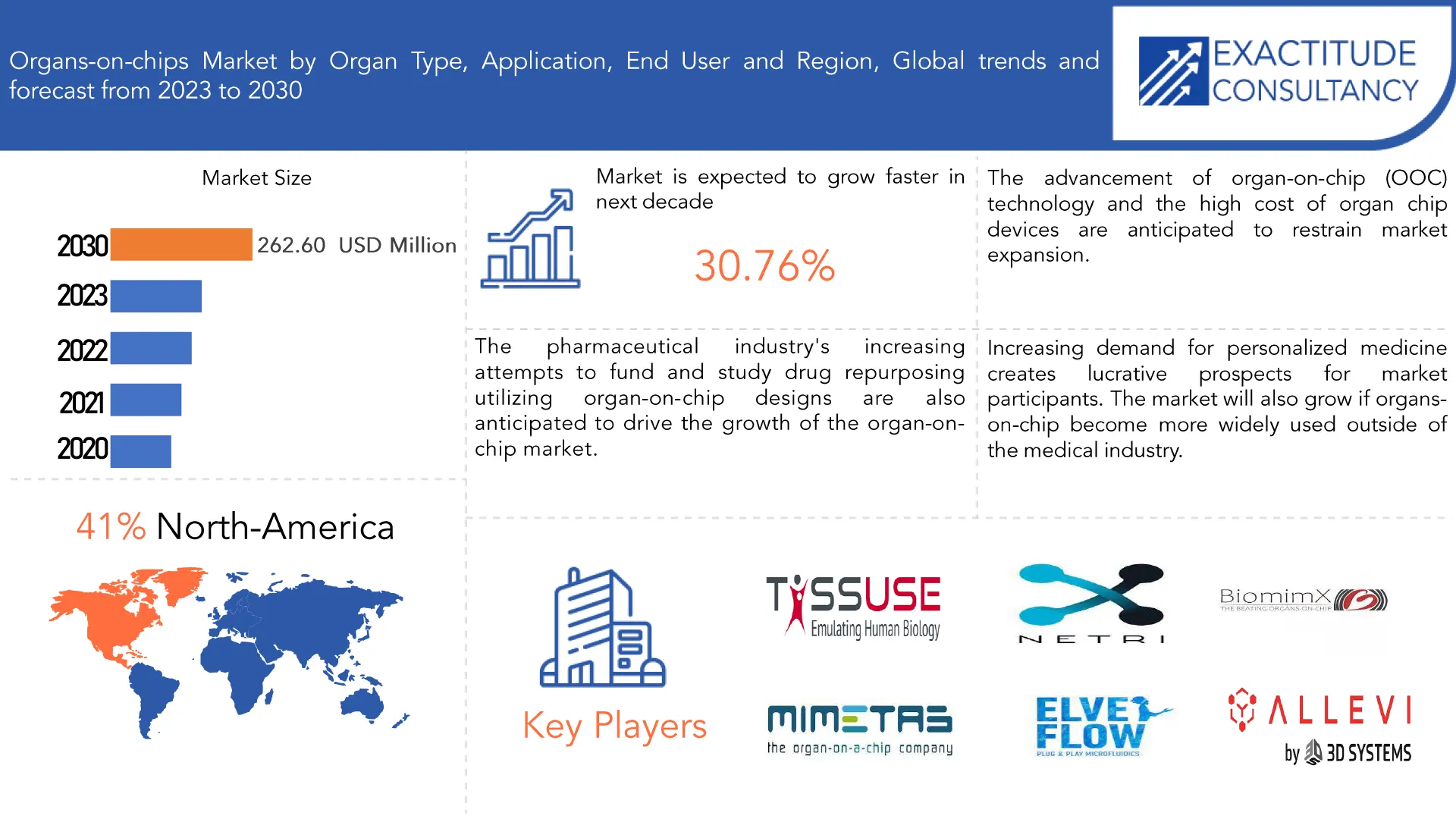

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 262.6 Million by 2030 | 30.76% | North America |

| by Organ Type | by Application | by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Organs on Chips Market Overview

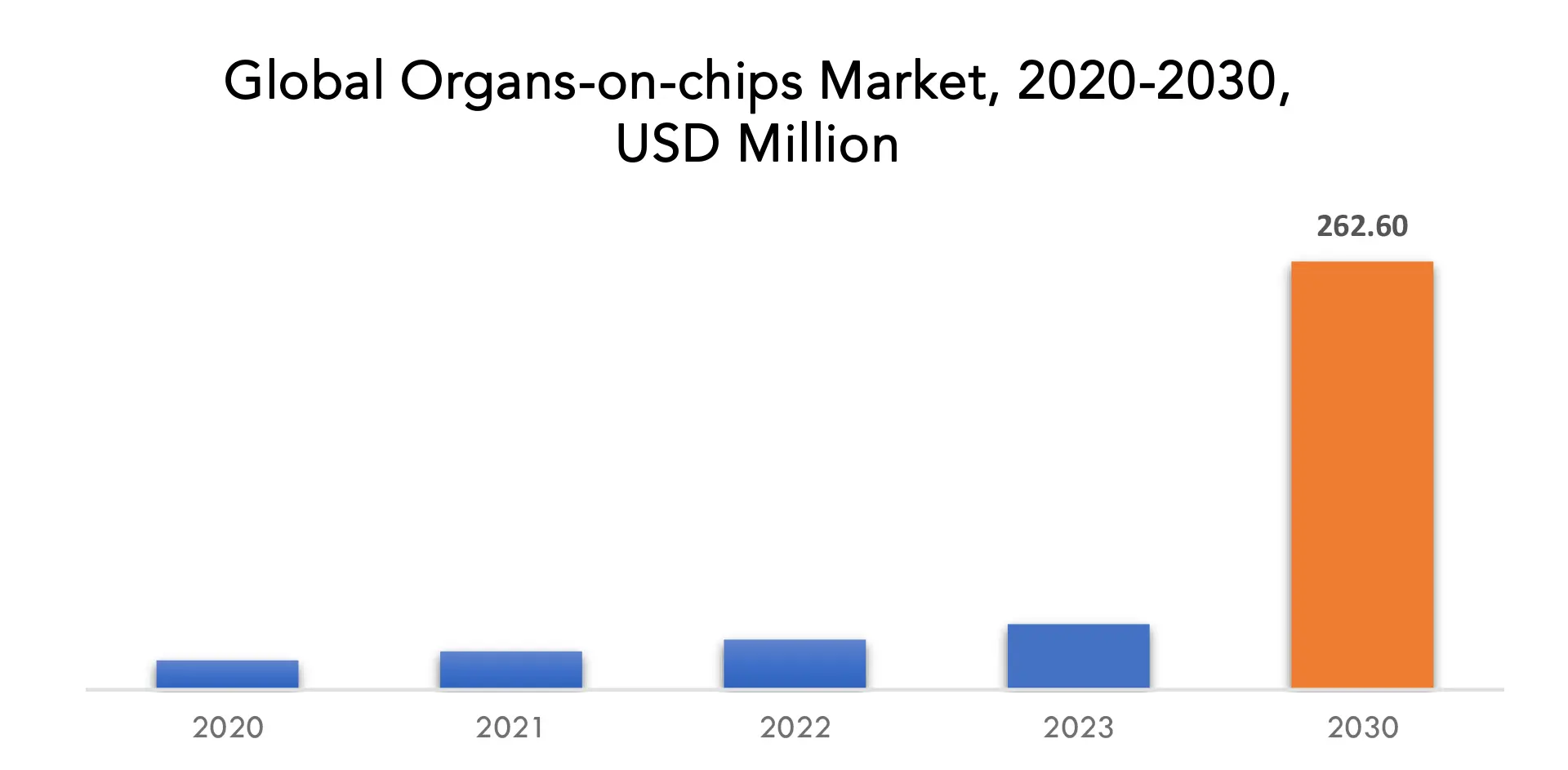

The organs-on-chips market is expected to grow at 30.76% CAGR from 2023 to 2030. It is expected to reach above USD 262.6 Million by 2030 from USD 40.18 million in 2023.

Artificial organs that mimic human organs are known as “organs-on-chip.” It is a multichannel 3D micro-fluidic cell culture apparatus that stimulates the functions, processes, and physiologic reactions of organs. The invention of a new model of in vitro multicellular human organisms is the consequence of the integration of labs-on-chips (LOCs) and cell biology, which enables researchers to study human physiology in an organ-specific environment. The lung, gut, brain, liver, and heart are just a few of the organs that this chip creates a small channel for blood and air passage in. These devices are built on a microchip with constantly perfused chambers filled with living cells and organized to stimulate physiology at the level of the tissues and organs. The technology known as “organ-on-chip” uses silicone to grow internal organs.

Tissue engineering and microfluidics are combined to create an innovative technology called organ-on-chip. These technologies are anticipated to offer efficient solutions to persistent problems in the development of new medications and the treatment of certain diseases. It has a significant impact on drug development studies, which benefits the organ-on-chip market. The demand for lung-based organ culture and kidney applications, as well as an increase in the demand for drug screening, are what are driving the global market for organs on chips. The organ-on-chip market is anticipated to experience significant growth in the coming years due to the rise in research activities using organ-on-chip devices as an alternative to animal testing for the discovery of new drugs.

In addition, the healthcare sector’s spike in demand for organ-on-chip devices is anticipated to drive growth in the global organ-on-chip market. One use for organ-on-chip technology in the medical field is the real-time imaging, in vitro biochemical analysis, and genetic and metabolic activities of living cells in a functional tissue. Growth in the organ-on-chip market is being fueled by improvements in cell biology, microfabrication, and microfluidics, which have increased the acceptance of organ-on-chips. The demand for lung- and kidney-based organ culture devices as well as an increase in the demand for organ-on-chips in drug screening are anticipated to drive the market for these products. Additionally, it is anticipated that the lack of donor organs and the availability of functional organs created in a lab will be a huge advantage in meeting the expanding need for organ transplantation.

Overall, the market for organs on chips is expected to benefit from the COVID-19 outbreak. In order to increase the hospital capacity for patients diagnosed with COVID-19, a sizable number of clinics and hospitals around the world underwent restructuring. Due to the quick increase of COVID-19 patients, non-essential procedures may have fallen behind. Production and delivery of supplies for healthcare were halted as a result of the lockdown. But during the COVID-19 pandemic, organ-on-chip technology emerged as a viable tool for the creation of medications and vaccines that were being investigated and put through clinical trials for the infection. As a result, during the pandemic, it had a very favorable effect.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million) |

| Segmentation | By Organ Type, By Application, By End User, By Region |

|

By Organ Type

|

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

|

Organs on chips Market Segment Analysis

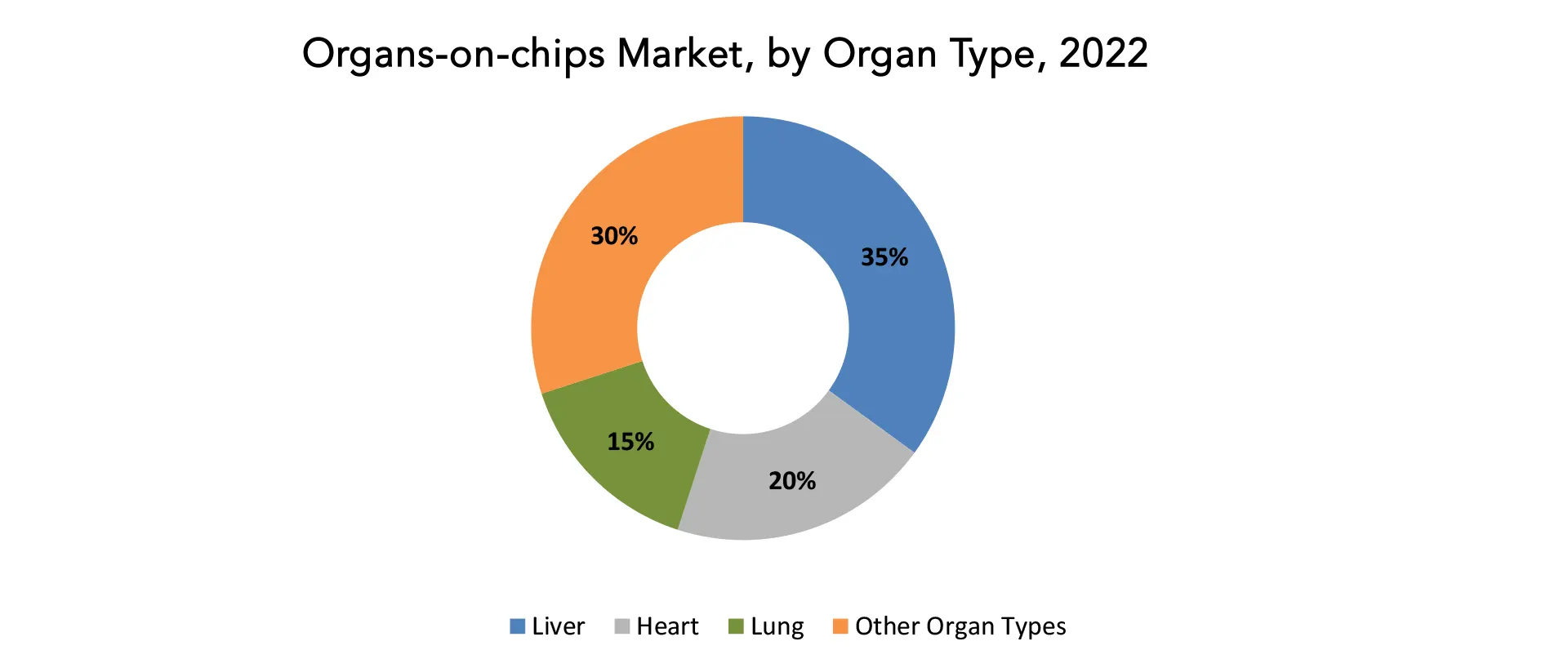

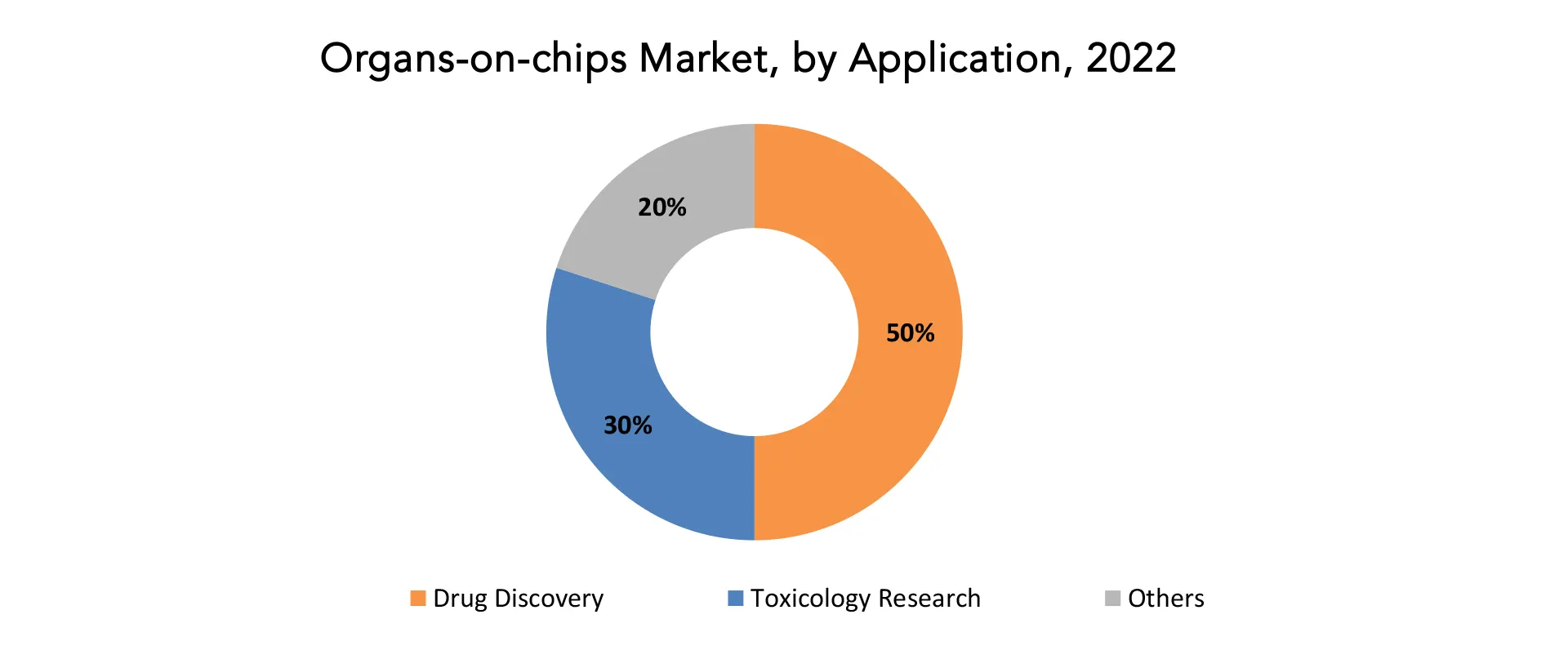

The organs on chips market is segmented based on organ type, application, end user, and region.

By organ type the market is segmented into liver, heart, lung, other organ types. A significant portion of the market made up of lung. Lung organ type segments are being created to enhance the physiological relevance of the existing in vitro alveolar-capillary interface models. The alveolar-capillary interface in the human body has specific structural, functional, and mechanical properties that can be accurately mimicked by a multifunctional microdevice of this kind. The market for “lungs on a chip” is anticipated to expand at the fastest CAGR. The need for efficient drug development for respiratory diseases such lung cancer, asthma, and chronic obstructive pulmonary disease (COPD) has led to an increase in the prevalence of these conditions.

By application the market is segmented into drug discovery, toxicology research, others. A significant portion of the market made up of drug discovery. Drug testing is primarily utilized for speedy evaluation of samples. To assess the impact of medications on the body, scientists and researchers use organ-on-chip culture systems. With this method, many body organs are also thoroughly tested for drug toxicity or efficacy. The potential of a specific medicine candidate as well as the likelihood of failure can be early identified by researchers using organs-on-chip technology. This component is helping this segment’s revenue to increase.

By end user the market is segmented into pharmaceutical and biotechnology companies, academic and research institutes, other. A significant portion of the market made up of pharmaceutical and biotechnology companies. The market is primarily driven by pharmaceutical and biotechnology companies. This method has great promise for the pharmaceutical and biotech sectors in terms of forecasting adverse effects and the commercial success of medications and biological products. In order to evaluate novel therapies and pharmaceuticals and ensure the safety of novel treatments, where OoC plays a significant role, a complete biological data set may be developed thanks to the increased drug approval failure rates. Many pharmaceutical and biotechnology companies are using this method to hasten the discovery and development of innovative medicines. One of the key factors propelling the market’s growth is the increasing use of Organ-on-Chip technology by businesses for medication development.

Organs on Chips Market Key Players

The organs on chips market key players include TissUse GmbH, Allevi Inc., MIMETAS BV, Netri, BiomimX SRL, Elveflow, Altis Biosystems, Nortis Inc., InSphero, Emulate Inc.

Industry Developments:

- On November 2022, TissUse received fund from the Bill & Melinda Gates Foundation to developed a human preclinical lung-liver-lymph node co-culture on a HUMIMIC Chip infectable with Mycobacterium tuberculosis. This collaboration contributed to the development of Tuberculosis vaccine candidates and treatment modalities.

- On November 2022, The FDA Modernization Act 2.0 aim, in short, to update the U.S. Federal Food, Drug, and Cosmetic Act of 1938 by removing the requirement for animal testing before new pharmaceutical products reached the market. In essence, this law from the 1930s state that all new drugs and cosmetics must be tested on animals before moving on to clinical trials and being approved for human use.

Who Should Buy? Or Key Stakeholders

- Healthcare Industry

- Hospitals and Clinics

- Scientific Research and Development

- Investors

- End User Companies

- Government and Regulatory Authorities

- Others

Organs on Chips Market Regional Analysis

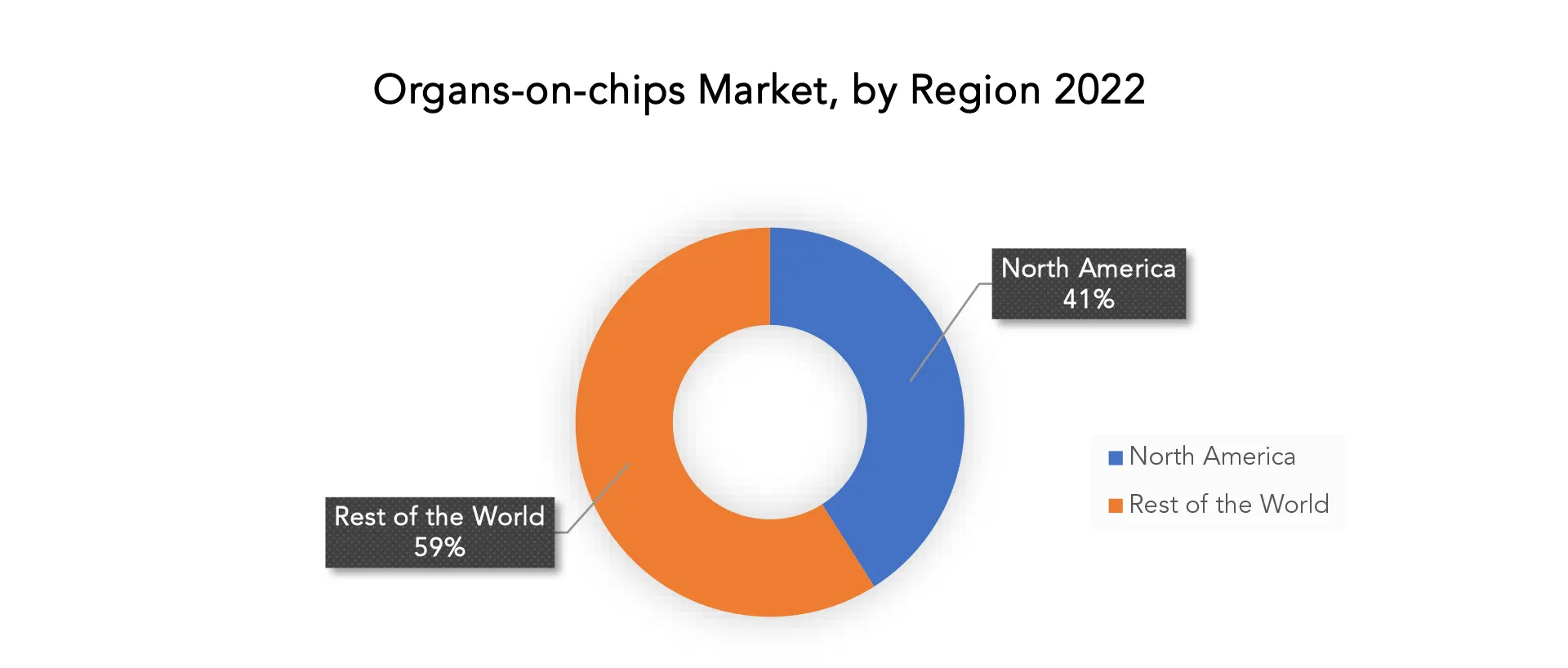

The organs on chips market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico, and Rest of North America

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes UAE, South Africa, Saudi Arabia, and Rest of MEA

In 2022, North America had a market share of more than 41%, The rising healthcare applications and cutting-edge technical breakthroughs in the region are mostly to blame for the huge expansion of the North American organs-on-chips market. The region’s economic development is further facilitated by the presence of top-tier experts and researchers.

Additionally, the market is growing due to the notable presence of leading suppliers and manufacturers of organs on chips on a global scale. These factors will ultimately increase the demand for organ-on-chip goods in the local market. According to predictions, Asia-Pacific will gain market share. Due to increased disposable income among the public and favorable government funding for regenerative medicine research facilities, the market in the area will expand. Product innovation, cooperative relationships, and private-public strategic alliances will soon increase the market’s size.

Key Market Segments: Organs on Chips Market

Organs on chips Market by Organ Type, 2020-2030, (USD Million)

- Liver

- Heart

- Lung

- Other Organ Types

Organs on chips Market by Application, 2020-2030, (USD Million)

- Drug Discovery

- Toxicology Research

- Others

Organs on chips Market by End User, 2020-2030, (USD Million)

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Other

Organs on chips Market by Region, 2020-2030, (USD Million)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new Application

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the organs on chips market over the next 7 years?

- Who are the major players in the organs on chips market and what is their market share?

- What are the end user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the organs on chips market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the organs on chips market?

- What is the current and forecasted size and growth rate of the global organs on chips market?

- What are the key drivers of growth in the organs on chips market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the organs on chips market?

- What are the technological advancements and innovations in the organs on chips market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the organs on chips market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the organs on chips market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of organs on chips market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ORGANS ON CHIPS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ORGANS ON CHIPS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ORGANS ON CHIPS MARKET OUTLOOK

- GLOBAL ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

- LIVER

- HEART

- LUNG

- OTHER ORGAN TYPES

- GLOBAL ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

- DRUG DISCOVERY

- TOXICOLOGY RESEARCH

- OTHERS

- GLOBAL ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

- PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

- ACADEMIC AND RESEARCH INSTITUTES

- OTHER

- GLOBAL ORGANS ON CHIPS MARKET BY REGION (USD MILLION), 2020-2030

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- THERMO FISHER SCIENTIFIC

- MERCK KGAA

- LGC LIMITED

- MARAVAI LIFE SCIENCES

- ALNYLAM PHARMACEUTICALS, INC.

- BIOGEN INC.

- DANAHER CORPORATION

- EUROFINS SCIENTIFIC

- IONIS PHARMACEUTICALS, INC.

- KANEKA CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 2 GLOBAL ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 3 GLOBAL ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 4 GLOBAL ORGANS ON CHIPS MARKET BY REGION (USD MILLION), 2020-2030

TABLE 5 NORTH AMERICA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 6 NORTH AMERICA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 7 NORTH AMERICA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 8 NORTH AMERICA ORGANS ON CHIPS MARKET BY COUNTRY (USD MILLION), 2020-2030

TABLE 9 US ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 10 US ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 11 US ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 12 CANADA ORGANS ON CHIPS MARKET BY ORGAN TYPE (MILLION), 2020-2030

TABLE 13 CANADA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 14 CANADA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 15 MEXICO ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 16 MEXICO ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 17 MEXICO ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 18 REST OF NORTH AMERICA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 19 REST OF NORTH AMERICA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 20 REST OF NORTH AMERICA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 21 SOUTH AMERICA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 22 SOUTH AMERICA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 23 SOUTH AMERICA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 24 SOUTH AMERICA ORGANS ON CHIPS MARKET BY COUNTRY (USD MILLION), 2020-2030

TABLE 25 BRAZIL ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 26 BRAZIL ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 27 BRAZIL ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 28 ARGENTINA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 29 ARGENTINA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 30 ARGENTINA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 31 COLOMBIA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 32 COLOMBIA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 33 COLOMBIA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 34 REST OF SOUTH AMERICA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 35 REST OF SOUTH AMERICA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 36 REST OF SOUTH AMERICA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 37 ASIA-PACIFIC ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 38 ASIA-PACIFIC ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 39 ASIA-PACIFIC ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 40 ASIA-PACIFIC ORGANS ON CHIPS MARKET BY COUNTRY (USD MILLION), 2020-2030

TABLE 41 INDIA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 42 INDIA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 43 INDIA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 44 CHINA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 45 CHINA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 46 CHINA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 47 JAPAN ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 48 JAPAN ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 49 JAPAN ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 50 SOUTH KOREA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 51 SOUTH KOREA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 52 SOUTH KOREA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 53 AUSTRALIA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 54 AUSTRALIA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 55 AUSTRALIA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 56 REST OF ASIA PACIFIC ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 57 REST OF ASIA PACIFIC ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 58 REST OF ASIA PACIFIC ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 59 EUROPE ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 60 EUROPE ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 61 EUROPE ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 62 EUROPE ORGANS ON CHIPS MARKET BY COUNTRY (USD MILLION), 2020-2030

TABLE 63 GERMANY ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 64 GERMANY ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 65 GERMANY ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 66 UK ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 67 UK ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 68 UK ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 69 FRANCE ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 70 FRANCE ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 71 FRANCE ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 72 ITALY ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 73 ITALY ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 74 ITALY ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 75 SPAIN ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 76 SPAIN ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 77 SPAIN ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 78 RUSSIA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 79 RUSSIA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 80 RUSSIA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 81 REST OF EUROPE ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 82 REST OF EUROPE ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 83 REST OF EUROPE ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA ORGANS ON CHIPS MARKET BY COUNTRY (USD MILLION), 2020-2030

TABLE 88 UAE ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 89 UAE ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 90 UAE ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 91 SAUDI ARABIA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 92 SAUDI ARABIA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 93 SAUDI ARABIA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 94 SOUTH AFRICA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 95 SOUTH AFRICA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 96 SOUTH AFRICA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA ORGANS ON CHIPS MARKET BY ORGAN TYPE (USD MILLION), 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA ORGANS ON CHIPS MARKET BY APPLICATION (USD MILLION), 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA ORGANS ON CHIPS MARKET BY END USER (USD MILLION), 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ORGANS ON CHIPS MARKET BY ORGAN TYPE, USD MILLION, 2020-2030

FIGURE 9 GLOBAL ORGANS ON CHIPS MARKET BY APPLICATION, USD MILLION, 2020-2030

FIGURE 10 GLOBAL ORGANS ON CHIPS MARKET BY END USER, USD MILLION, 2020-2030

FIGURE 11 GLOBAL ORGANS ON CHIPS MARKET BY REGION USD MILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 ORGANS ON CHIPS MARKET BY REGION, USD MILLION, 2022

FIGURE 14 ORGANS ON CHIPS MARKET BY ORGAN TYPE, USD MILLION, 2022

FIGURE 15 ORGANS ON CHIPS MARKET BY APPLICATION, USD MILLION, 2022

FIGURE 16 ORGANS ON CHIPS MARKET BY END USER, USD MILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 19 MERCK KGAA: COMPANY SNAPSHOT

FIGURE 20 LGC LIMITED: COMPANY SNAPSHOT

FIGURE 21 MARAVAI LIFE SCIENCES: COMPANY SNAPSHOT

FIGURE 22 ALNYLAM PHARMACEUTICALS, INC.: COMPANY SNAPSHOT

FIGURE 23 BIOGEN INC.: COMPANY SNAPSHOT

FIGURE 24 DANAHER CORPORATION: COMPANY SNAPSHOT

FIGURE 25 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 26 IONIS PHARMACEUTICALS, INC.: COMPANY SNAPSHOT

FIGURE 27 KANEKA CORPORATION: COMPANY SNAPSHOT

FAQ

The global organs-on-chips market revenue is projected to expand at a CAGR of 30.76% during the forecast period.

The global organs on chips market was valued at USD 40.18 Million in 2023

The organs on chips market key players include TissUse GmbH, Allevi Inc., MIMETAS BV, Netri, BiomimX SRL, Elveflow, Altis Biosystems, Nortis Inc., InSphero, Emulate Inc.

The rise in popularity of organs on chips due to their integration of microfluidics and tissue engineering. These technologies provide efficient solutions to persistent problems in the development of new medications and the treatment of certain diseases. The technique helps in research on drug development. Additionally, the market for organs on chips benefits from rising urbanization, lifestyle modifications, investments, and higher consumer expenditure.

The global organs on chips market is divided into organ type, application, end user, and region.

Due to the availability of a wide range of help provided by important industry pros and an increase in the toxicological examination of medications on the many types of organ cells, North America now holds a monopoly on the organ-on-chip market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.