REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

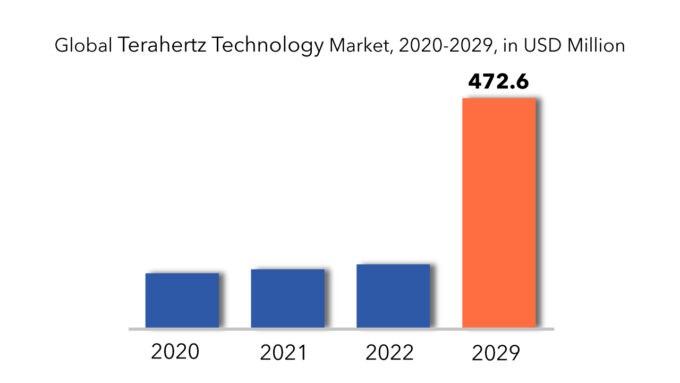

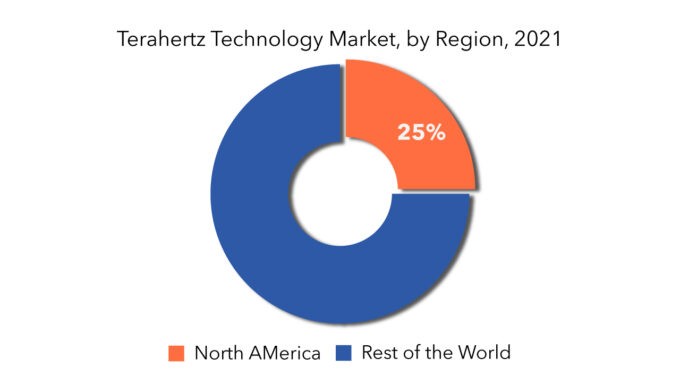

| USD 472.6 billion | 32.8% | North America |

| By Type | By Application |

|---|---|

|

|

SCOPE OF THE REPORT

Terahertz Technology Market Overview

The global terahertz technology market size is expected to grow at 32.8% CAGR from 2020 to 2029. It is expected to reach above USD 472.6 billion by 2029 from USD 112.2 Million in 2020.

The realm of Terahertz technology is rapidly evolving, presenting a spectrum of potential applications from passenger screening in airports to facilitating large-scale digital data transfers. The integration of terahertz systems within the semiconductor industry stands as a pivotal factor fueling the advancement of this technology sector.

Terahertz-based innovations are progressively penetrating commercial markets across diverse industries such as security, non-destructive testing, automotive, and telecommunications, thereby opening up avenues for market expansion. Notably, researchers have developed a Terahertz transmitter capable of transmitting digital data at speeds surpassing those offered by fifth-generation mobile networks (5G) by tenfold, heralding the terahertz band as a novel and abundant frequency resource poised to propel future ultrahigh-speed wireless communications, thereby catalyzing market growth.

The evolution towards 5G and the anticipated advent of 6G networks necessitate the utilization of high-bandwidth fiber optic cables integrated with optical transceivers to ensure the secure and reliable transfer of data. Consequently, the burgeoning optical communication infrastructure in low and middle-income countries is anticipated to underpin the future expansion of the optical communication and networking equipment market.

Manufacturers of optical transceivers are directing their focus towards research and development efforts aimed at catering to diverse applications including metro networks, data center interconnects, and long-haul applications, necessitating compatibility with intricate networks. Market leaders such as Fujitsu Optical Components (Japan) and Broadcom (US) are driving advancements with their offerings of compact, low-power-consuming transceivers. This trend is poised to fuel the market growth of small and compact optical modules, facilitating extensive data connectivity at high speeds. Consequently, the strategic emphasis on cost leadership and continuous innovation towards smaller, energy-efficient modules, alongside expedited deployment in data communication and telecommunication applications, and adherence to established standards (IEEE), present notable growth opportunities for optical transceivers within the optical communication and networking equipment market.

Terahertz Technology Market Segment Analysis

The terahertz detectors sector dominated the worldwide terahertz technology market. Terahertz radiation is found in the electromagnetic spectrum between the microwave and far-infrared regions. These radiations can penetrate plastics, clothing, and wood; they are non-ionizing radiations, which means they are harmless for people and animals, unlike X-rays, which may be dangerous. Terahertz radiations are frequently used in full-body scanning devices used at airports and other public areas for security purposes, as well as in medical applications for early cancer cell detection.

Terahertz imaging by processing is widely used in the food business for detecting moisture, foreign bodies, testing, and quality control. It has been discovered to be a safe, quick, and non-destructive detection method in food goods. Terahertz incoherent imaging is widely employed in biological applications. The National Center for Biotechnology Information (NCBI) proposed phase less terahertz coded-aperture imaging (PTCAI) as an incoherent detection approach in January 2019. The suggested method records the echo signal intensity responses in biomedical imaging applications utilizing an incoherent detection array or a single incoherent detector.

Terahertz Technology Market Key Players

From large companies to small ones, many companies are actively working in the terahertz technology market. These key players include Acal BFi UK Ltd, Advanced Photonix Inc., Advantest Corporation, HÜBNER GmbH & Co. KG,Luna Innovations Inc., Menlo Systems GmbH, Microtech Instrument Inc., Terasense Group Inc., Teraview limited, Toptica Photonics AG, Das-Nano SLand others.

Companies are mainly terahertz technology they are competing closely with each other. Innovation is one of the most important key strategies as it has to be for any market. However, companies in the market have also opted and successfully driven inorganic growth strategies like mergers & acquisitions, and so on.

- July 2020 – Advantest Corporation started to sell its new TS9001 TDR System that is based on the company’s exclusive Terahertz technology to provide non-destructive, high-resolution circuit fault analysis in advanced semiconductor packages, like flip-chip BGAs, wafer-level packages, and 2.5D/3D ICs.

- January 2021 – TeraView secured development funding from the Sustainable Innovation Fund of approximately EUR 191 million with Innovate UK, a United Kingdom’s innovation agency. This funding is specifically targeted at TeraView’s cutting-edge technology for next-generation 6G network applications. TeraView will use its expertise and intellectual property to develop the building blocks of future 6G networks, which will use terahertz (THz) frequencies.

Who Should Buy? Or Key stakeholders

- Suppliers

- Manufacturing Companies

- End-user companies

- Research institutes

- Others

Key Takeaways:

- The global terahertz technology market size is expected to grow at 32.8% CAGR.

- The terahertz detectors sector dominated the worldwide terahertz technology market based on type.

- Its major share is occupied by North America.

- Medical and Healthcare dominated the global terahertz technology market based on application.

- The Terahertz technology market is witnessing growth driven by advancements in imaging and sensing applications across industries such as healthcare, security, and telecommunications.

Terahertz Technology Market Regional Analysis

The terahertz technology market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Its major share is occupied by Asia Pacific, North America, and Europe the region. North America shares 25% of the total market.

Key Market Segments: Terahertz Technology Market

Terahertz Technology Market By Type, 2020-2029, (USD Million)

- Terahertz Imaging

- Terahertz Spectroscopy

- Terahertz Communication Systems

Terahertz Technology Market By Application, 2020-2029, (USD Million)

- Medical And Healthcare

- Défense And Security

- Food And Agriculture

- Industrial

- Semiconductor

- Others

Terahertz Technology Market By Region, 2020-2029, (USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered.

Key Question Answered

- What are the growth opportunities related to the adoption of terahertz technology across major regions in the future?

- What are the new trends and advancements in the terahertz technology market?

- Which product categories are expected to have the highest growth rate in the terahertz technology market?

- Which are the key factors driving the terahertz technology market?

- What will the market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Terahertz Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Terahertz Market

- Global Terahertz Market Outlook

- Global Terahertz Market by Types, (USD Million)

- Terahertz imaging

- Terahertz spectroscopy

- Terahertz communication systems

- Global Terahertz Market by Application, (USD Million)

- Terahertz imaging

- Terahertz spectroscopy

- Terahertz communication systems

- Global Terahertz Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Acal BFi UK Ltd

- Advanced Photonix Inc

- Advantest Corporation

- HÜBNER GmbH & Co. KG

- Luna Innovations Inc

- Menlo Systems GmbH

- Microtech Instrument Inc

- Terasense Group Inc

- Teraview limited

- Toptica Photonics AG

- Das-Nano SL

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL TERAHERTZ MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 US TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 6 US TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 7 US TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 CANADA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 9 CANADA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 CANADA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 11 MEXICO TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 12 MEXICO TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 13 MEXICO TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 BRAZIL TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 15 BRAZIL TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 16 BRAZIL TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 17 ARGENTINA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 18 ARGENTINA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 COLOMBIA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 21 COLOMBIA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 23 REST OF SOUTH AMERICA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 24 REST OF SOUTH AMERICA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 INDIA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 27 INDIA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 28 INDIA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 29 CHINA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 30 CHINA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 31 CHINA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 JAPAN TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 33 JAPAN TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 JAPAN TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 35 SOUTH KOREA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 36 SOUTH KOREA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 37 SOUTH KOREA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 AUSTRALIA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 39 AUSTRALIA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 40 AUSTRALIA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 41 SOUTH-EAST ASIA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 42 SOUTH-EAST ASIA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 43 SOUTH-EAST ASIA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 REST OF ASIA PACIFIC TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 45 REST OF ASIA PACIFIC TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 REST OF ASIA PACIFIC TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 47 GERMANY TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 48 GERMANY TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 49 GERMANY TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 UK TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 51 UK TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 52 UK TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 53 FRANCE TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 54 FRANCE TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 55 FRANCE TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 ITALY TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 57 ITALY TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 ITALY TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 59 SPAIN TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 60 SPAIN TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 61 SPAIN TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 RUSSIA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 63 RUSSIA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 64 RUSSIA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 65 REST OF EUROPE TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 66 REST OF EUROPE TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 67 REST OF EUROPE TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 UAE TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 69 UAE TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 UAE TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 71 SAUDI ARABIA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 72 SAUDI ARABIA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 73 SAUDI ARABIA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH AFRICA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 75 SOUTH AFRICA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 76 SOUTH AFRICA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 77 REST OF MIDDLE EAST AND AFRICA TERAHERTZ MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 78 REST OF MIDDLE EAST AND AFRICA TERAHERTZ MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 79 REST OF MIDDLE EAST AND AFRICA TERAHERTZ MARKET BY END USER (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL TERAHERTZ MARKET BY TYPES, USD MILLION, 2019-2028

FIGURE 9 GLOBAL TERAHERTZ MARKET BY APPLICATION, USD MILLION, 2019-2028

FIGURE 10 GLOBAL TERAHERTZ MARKET BY REGION, USD MILLION, 2019-2028

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL TERAHERTZ MARKET BY TYPES, USD MILLION, 2019-2028

FIGURE 13 GLOBAL TERAHERTZ MARKET BY APPLICATION, USD MILLION, 2019-2028

FIGURE 14 GLOBAL TERAHERTZ MARKET BY REGION, USD MILLION, 2019-2028

FIGURE 15 TERAHERTZ MARKET BY REGION 2020

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 ACAL BFI UK LTD: COMPANY SNAPSHOT

FIGURE 18 ADVANCED PHOTONIX INC: COMPANY SNAPSHOT

FIGURE 19 ADVANTEST CORPORATION: COMPANY SNAPSHOT

FIGURE 20 HÜBNER GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 21 LUNA INNOVATIONS INC: COMPANY SNAPSHOT

FIGURE 22 MENLO SYSTEMS GMBH: COMPANY SNAPSHOT

FIGURE 23 MICROTECH INSTRUMENT INC: COMPANY SNAPSHOT

FIGURE 24 TERASENSE GROUP INC: COMPANY SNAPSHOT

FIGURE 25 TERAVIEW LIMITED: COMPANY SNAPSHOT

FIGURE 26 TOPTICA PHOTONICS AG: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.