REPORT OUTLOOK

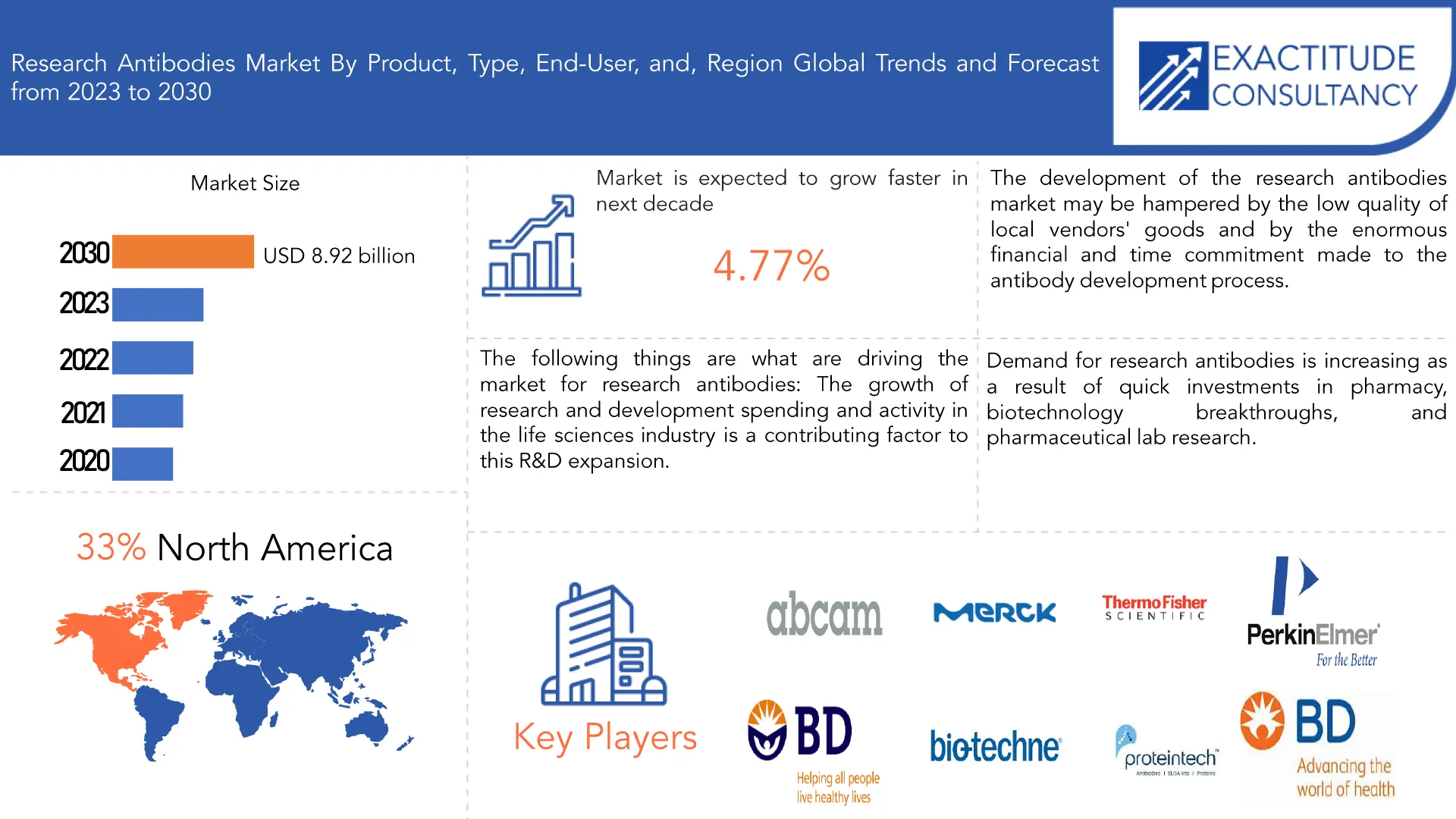

| Market Size | CAGR | Dominating Region |

|---|---|---|

| 8.92 billion by 2030 | CAGR of 4.77% | North America |

| by Product | by Type | by End-User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Research Antibodies Market Overview:

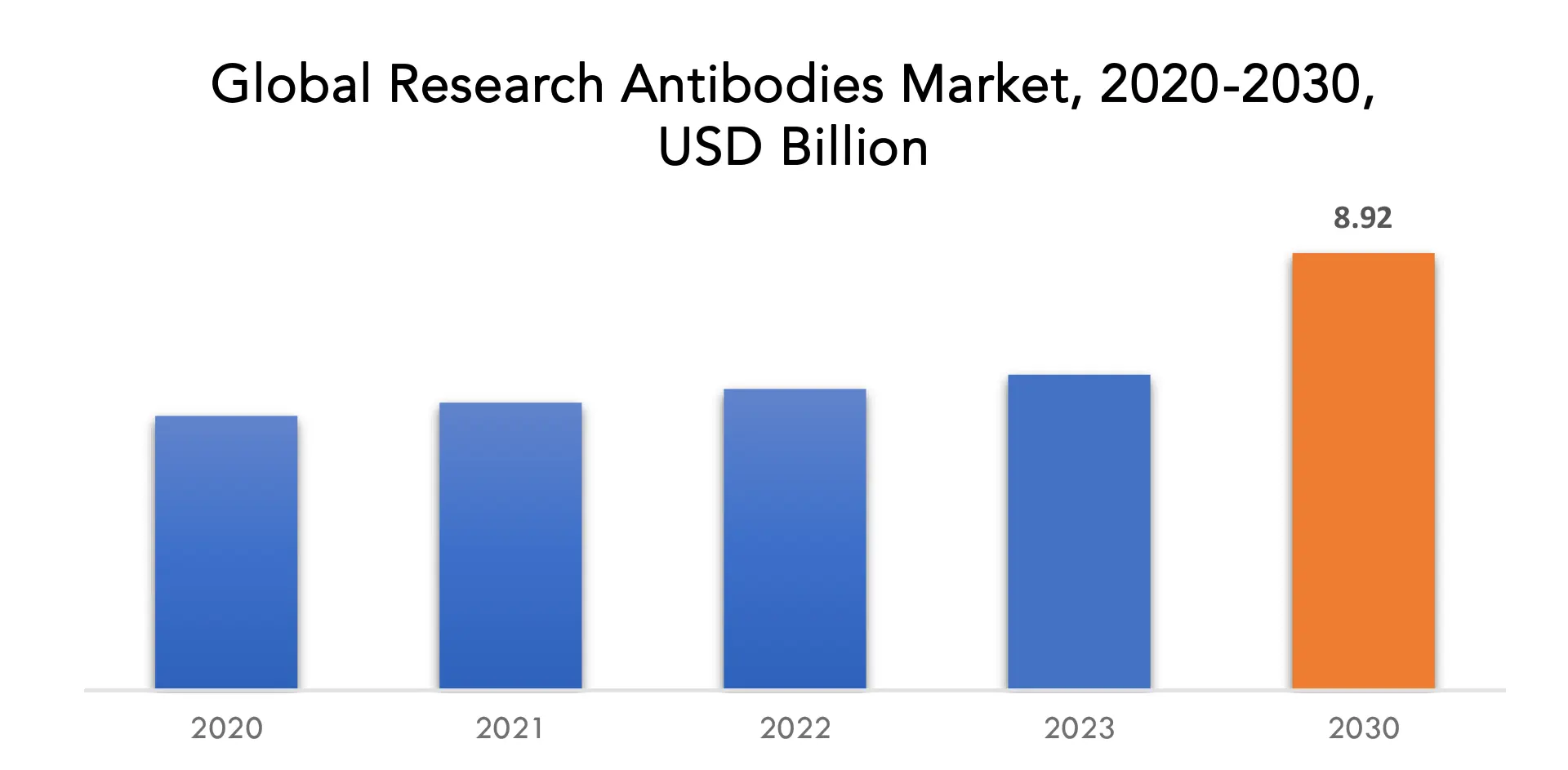

The global research antibodies market was valued at 6.44 billion in 2023 and is projected to reach 8.92 billion by 2030, growing at a CAGR of 4.77% from 2023 to 2030.

Antibodies, which are proteins, are made by the immune system in response to the introduction of a foreign substance (also known as an antigen). Antibodies have a wide range of uses, including in basic science, medicine, and diagnostics. Antibodies are used by the immune system as a line of defense against pathogens, allergies, and illnesses. The body naturally produces these proteins. It is occasionally used to treat diseases like cancer, heart disease, rheumatoid arthritis, and others with monoclonal antibodies developed in labs.

The main factors driving the market for research antibodies are increased funding for proteomics research and drug discovery, rising rates of cancer and other chronic diseases with rising healthcare costs, a growing population, increasing urbanization, and industrialization, as well as various government agencies supporting this R&D growth by funding it and easing regulatory burdens.

These antibodies are being utilized by researchers to identify and find particular protein biomarkers, which are employed in the early detection and diagnosis of diseases. Researchers believe that this discovery could reduce the requirement for frequent booster vaccines while simultaneously boosting the immune systems of groups that are more susceptible to disease. Research and innovation depend on collaboration between academic institutions and the R&D departments of businesses. These partnerships guarantee the movement of information and technology from the academic world to the business world and vice versa. The number of such collaborations has greatly increased as a result of the escalating economic volatility and the quickening pace of technological change. Market participants are concentrating on working with academic institutions to raise awareness of new analytical technologies among students and researchers due to the numerous applications of research-specific antibodies and reagents.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Product, Type, End-User, and Region. |

| By Product

|

|

| By Type

|

|

| By End-User

|

|

| By Region

|

|

Research Antibodies Market Segment Analysis:

Based on product, type, end-user, and region, the global market for research antibodies is divided into these categories.

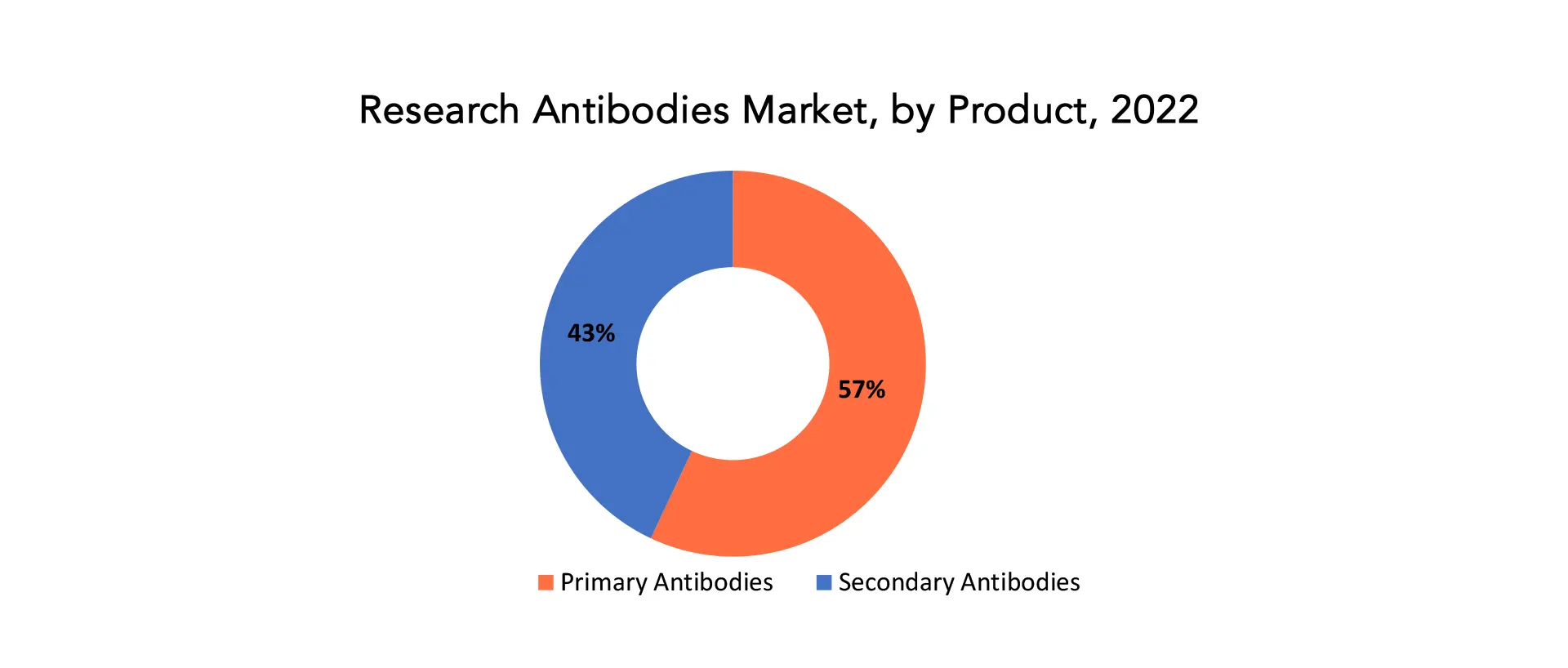

Antibodies are categorized into Primary Antibodies and Secondary Antibodies based on product research. A primary antibody is used to research the absorption, distribution, metabolism, and excretion (ADME) of medicinal medicines as well as the multi-drug resistance (MDR) of disorders such as cancer, diabetes, Parkinson’s disease, and Alzheimer’s disease. In 2022, the primary antibodies market had the most revenue share (74.46%), and it is expected to continue to grow at the fastest rate over the coming years. This can be linked to the growing accessibility of primary antibodies that use rabbits, mouse, goats, and other species as hosts, as well as the broad range of applications that can be made using such antibodies in the R&D sector.

Additionally, the market is expected to expand exponentially due to the widespread use of primary antibodies in routine laboratory operations including staining and imaging. While By conjugating with proteins, secondary antibodies increase the value of an antibody by providing signal detection and amplification. Immunolabeling is very effective with secondary antibodies. Primary antibodies, which are clinging to the target antigen(s) directly, bind to secondary antibodies. In immunolabeling, the Fab domain of the primary antibody attaches to an antigen and releases the secondary antibody’s Fc domain. The Fc domain of the primary antibody is then bound by the Fab domain of the secondary antibody. One type of secondary antibody can attach to numerous types of primary antibodies since the Fc domain is constant within the same animal class. By labeling only one kind of secondary antibody as opposed to several kinds of primary antibodies, the cost is decreased. Due to several secondary antibodies adhering to a primary antibody, secondary antibodies aid in increasing sensitivity and signal amplification. Immunization of a host animal with antibodies from a different species results in the production of secondary antibodies. Goat anti-rabbit IgG secondary antibodies will be produced after immunizing a goat with rabbit IgG. The primary antibody of interest’s isotype and the species in which it was generated should both be matched by the secondary antibody. For instance, the signal of rabbit IgG primary antibodies can be detected using a goat anti-rabbit IgG secondary antibody. The availability of ready-to-use conjugated antibodies, which can enhance product development efforts by assisting in the identification, grouping, and purification of selected antigens, is another factor contributing to the predicted rise in demand for secondary research antibodies. For instance, Thermo Fisher Scientific, Inc. sells fluorescent dye-conjugated secondary antibodies that facilitate protein identification in a range of applications, such as immunohistochemistry, western blotting, and fluorescent cell imaging, among others.

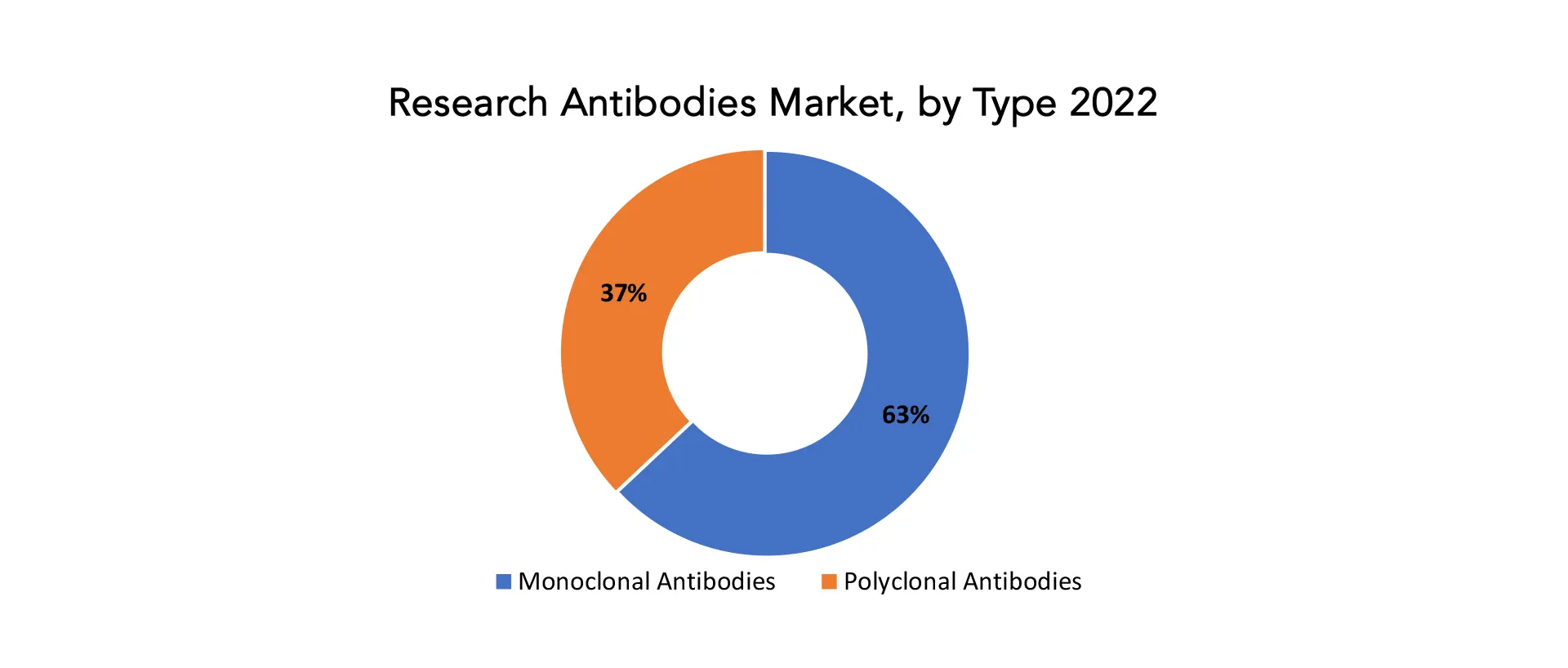

The two primary categories of research antibodies are monoclonal antibodies and polyclonal antibodies. Similar artificial antibodies called monoclonal antibodies imitate the functions of the human immune system. Many diseases, including some forms of cancer, are diagnosed and treated using monoclonal antibodies. They can be employed independently or to deliver medications, poisons, or radioactive materials right to cancer cells. Also, a variety of antibodies produced by several B cell lineages are combined to form polyclonal antibodies (PAbs). These antibodies are actually a group of immunoglobulin molecules that react to a particular antigen, with each molecule recognizing a separate antigen epitope.

Academic & Research Institutes, Contract Research Organizations, and Pharmaceutical & Biotechnology Companies are the end-users of the research antibodies market.

Research Antibodies Market Players:

The major players operating in the global Research Antibodies industry include the major market players are Abcam Plc., Merck KGaA, Thermo Fisher Scientific, Inc., Cell Signalling Technology, Inc., Santa Cruz Biotechnology Inc., PerkinElmer, Inc., Becton, Bio-Techne Corporation, Proteintech Group, Inc., Jackson ImmunoResearch Inc., Dickinson, and Company, Johnson & Johnson Services, Inc., Eli Lilly, and Company., Bio-Rad Laboratories, Inc., Rockland Immunochemicals, Inc., Novartis AG, and others

2 May 2023: Janssen Biotech, Inc., one of the Janssen Pharmaceutical Companies of Johnson & Johnson, has entered into a worldwide collaboration and license agreement with Cellular Biomedicine Group Inc.

24 April 2023: Johnson & Johnson Launched Kenvue Inc. IPO Roadshow.

Who Should Buy? Or Key stakeholders

- Manufacturing

- End-Use Industries

- BFSI

- Automotive

- Manufacturing & Construction

- Regulatory Authorities

- Research Organizations

- Information Technology

- Materials & Chemicals

Research Antibodies Market Regional Analysis:

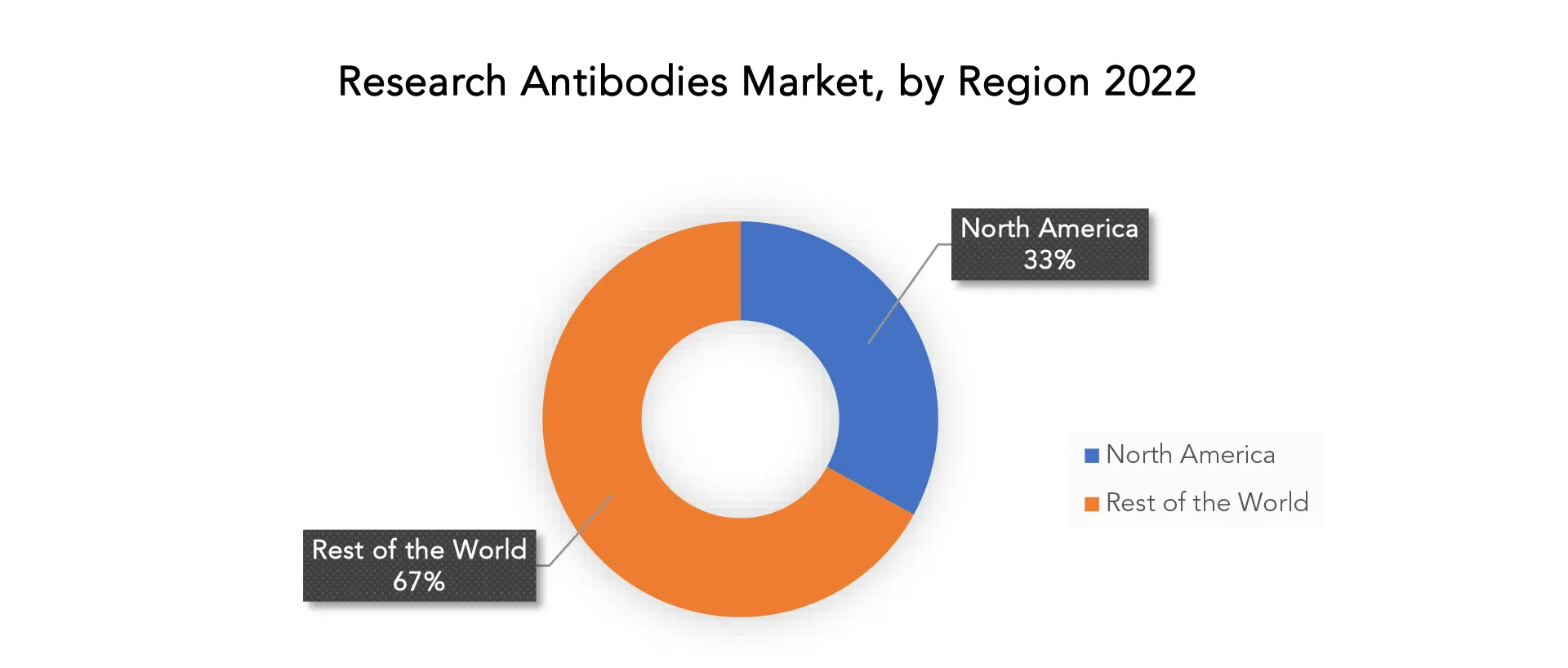

Geographically, the Research Antibodies market is segmented into North America, South America, Europe, APAC, and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

North America dominates the largest market for the research antibodies market. Due to the rising prevalence of cardiovascular and blood illnesses, North America is predicted to account for a sizeable portion of the global market for research antibodies. With a 33% revenue share, North America commanded the majority of the market in 2022. The growing focus on stem cells, biomedicine, and cancer research is a key factor in its sizable market share. The market is anticipated to rise as a result of the presence of major players like Thermo Fisher Scientific, Inc. and PerkinElmer, Inc., among others, as well as an increase in the number of biotechnology and biopharmaceutical companies in the area that concentrate on life sciences innovation. Also, due to the rising incidence of lung cancer in the United States, North America is anticipated to be the most attractive area in the global market for research antibodies. For instance, the Centres for Disease Control and Prevention state that there were 221,097 new cases of lung and bronchus cancer in 2019 and that 139,601 Americans lost their lives to the disease. So, research antibodies dominate the market in the North American region.

Key Market Segments: Research Antibodies Market

Research Antibodies Market by Product, 2020-2030, (USD Billion)

- Primary Antibodies

- Secondary Antibodies

Research Antibodies Market by Type, 2023-2030, (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

Research Antibodies Market by End-User, 2023-2030, (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

Research Antibodies Market by Region, 2023-2030, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered:

- What is the expected growth rate of the research antibodies market over the next 7 years?

- Who are the major players in the research antibodies market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the research antibodies market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the research antibodies market?

- What is the current and forecasted size and growth rate of the global research antibodies market?

- What are the key drivers of growth in the research antibodies market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the research antibodies market?

- What are the technological advancements and innovations in the research antibodies market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the research antibodies market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the research antibodies market?

- What are the services offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL RESEARCH ANTIBODIES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE RESEARCH ANTIBODIES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL RESEARCH ANTIBODIES MARKET OUTLOOK

- GLOBAL RESEARCH ANTIBODIES MARKET BY PRODUCT, 2020-2030, (USD BILLION)

- PRIMARY ANTIBODIES

- SECONDARY ANTIBODIES

- GLOBAL RESEARCH ANTIBODIES MARKET BY TYPE, 2020-2030, (USD BILLION)

- MONOCLONAL ANTIBODIES

- POLYCLONAL ANTIBODIES

- GLOBAL RESEARCH ANTIBODIES MARKET BY END-USER, 2020-2030, (USD BILLION)

- ACADEMIC & RESEARCH INSTITUTES

- CONTRACT RESEARCH ORGANIZATIONS

- PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- GLOBAL RESEARCH ANTIBODIES MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ABCAM PLC.

- MERCK KGAA

- THERMO FISHER SCIENTIFIC, INC.

- CELL SIGNALLING TECHNOLOGY, INC.

- SANTA CRUZ BIOTECHNOLOGY INC.

- PERKINELMER, INC.

- BECTON

- BIO-TECHNE CORPORATION

- PROTEINTECH GROUP, INC.

- JACKSON IMMUNORESEARCH INC.

- DICKINSON AND COMPANY

- JOHNSON & JOHNSON SERVICES, INC.

- ELI LILLY AND COMPANY.

- BIO-RAD LABORATORIES, INC.

- ROCKLAND IMMUNOCHEMICALS, INC.

- NOVARTIS AG

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 2 GLOBAL RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL RESEARCH ANTIBODIES MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA RESEARCH ANTIBODIES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 10 US RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 11 US RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 12 CANADA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 13 CANADA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 14 CANADA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 15 MEXICO RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 16 MEXICO RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 17 MEXICO RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA RESEARCH ANTIBODIES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 23 BRAZIL RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 24 BRAZIL RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 25 ARGENTINA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 26 ARGENTINA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 28 COLOMBIA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 29 COLOMBIA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC RESEARCH ANTIBODIES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 39 INDIA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 INDIA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 41 CHINA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 42 CHINA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 43 CHINA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 44 JAPAN RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 45 JAPAN RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 46 JAPAN RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 59 EUROPE RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 60 EUROPE RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 61 EUROPE RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 62 EUROPE RESEARCH ANTIBODIES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 64 GERMANY RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 65 GERMANY RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 66 UK RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 67 UK RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 68 UK RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 69 FRANCE RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 70 FRANCE RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 71 FRANCE RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 72 ITALY RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 73 ITALY RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 74 ITALY RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 75 SPAIN RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 76 SPAIN RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 77 SPAIN RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 78 RUSSIA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 79 RUSSIA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 80 RUSSIA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA RESEARCH ANTIBODIES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 89 UAE RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 90 UAE RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA RESEARCH ANTIBODIES MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA RESEARCH ANTIBODIES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA RESEARCH ANTIBODIES MARKET BY END-USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL RESEARCH ANTIBODIES MARKET BY PRODUCT, USD BILLION, 2020-2030

FIGURE 9 GLOBAL RESEARCH ANTIBODIES MARKET BY TYPE, USD BILLION, 2020-2030

FIGURE 10 GLOBAL RESEARCH ANTIBODIES MARKET BY END-USER, USD BILLION, 2020-2030

FIGURE 11 GLOBAL RESEARCH ANTIBODIES MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL RESEARCH ANTIBODIES MARKET BY PRODUCT, USD BILLION, 2022

FIGURE 14 GLOBAL RESEARCH ANTIBODIES MARKET BY TYPE, USD BILLION, 2022

FIGURE 15 GLOBAL RESEARCH ANTIBODIES MARKET BY END-USER, USD BILLION, 2022

FIGURE 16 GLOBAL RESEARCH ANTIBODIES MARKET BY REGION, USD BILLION 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ABCAM PLC.: COMPANY SNAPSHOT

FIGURE 19 MERCK KGAA: COMPANY SNAPSHOT

FIGURE 20 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT

FIGURE 21 CELL SIGNALLING TECHNOLOGY, INC.: COMPANY SNAPSHOT

FIGURE 22 SANTA CRUZ BIOTECHNOLOGY INC.: COMPANY SNAPSHOT

FIGURE 23 PERKINELMER, INC.: COMPANY SNAPSHOT

FIGURE 24 BECTON: COMPANY SNAPSHOT

FIGURE 25 BIO-TECHNE CORPORATION: COMPANY SNAPSHOT

FIGURE 26 PROTEINTECH GROUP, INC.: COMPANY SNAPSHOT

FIGURE 27 JACKSON IMMUNORESEARCH INC.: COMPANY SNAPSHOT

FIGURE 28 DICKINSON AND COMPANY: COMPANY SNAPSHOT

FIGURE 29 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT

FIGURE 30 ELI LILLY AND COMPANY: COMPANY SNAPSHOT

FIGURE 31 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

FIGURE 32 ROCKLAND IMMUNOCHEMICALS, INC.: COMPANY SNAPSHOT

FIGURE 33 NOVARTIS AG: COMPANY SNAPSHOT

FAQ

The global research antibodies market was valued at 6.44 billion in 2023 and is projected to reach 8.92 billion by 2030, growing at a CAGR of 4.77% from 2023 to 2030.

Based on product, type, end-user, and region the research antibodies market reports divisions are broken down.

The Global research antibodies market registered a CAGR of 4.77% from 2023 to 2030. The industry segment was the highest revenue contributor to the market.

North America is anticipated to be the most attractive area in the global market for research antibodies. For instance, the Centres for Disease Control and Prevention state that there were 221,097 new cases of lung and bronchus cancer in 2019 and that 139,601 Americans lost their lives to the disease.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.