REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 343.81 billion by 2030 | 7.39% | Asia Pacific |

| by Service | by Research | by End User | by Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Market Overview

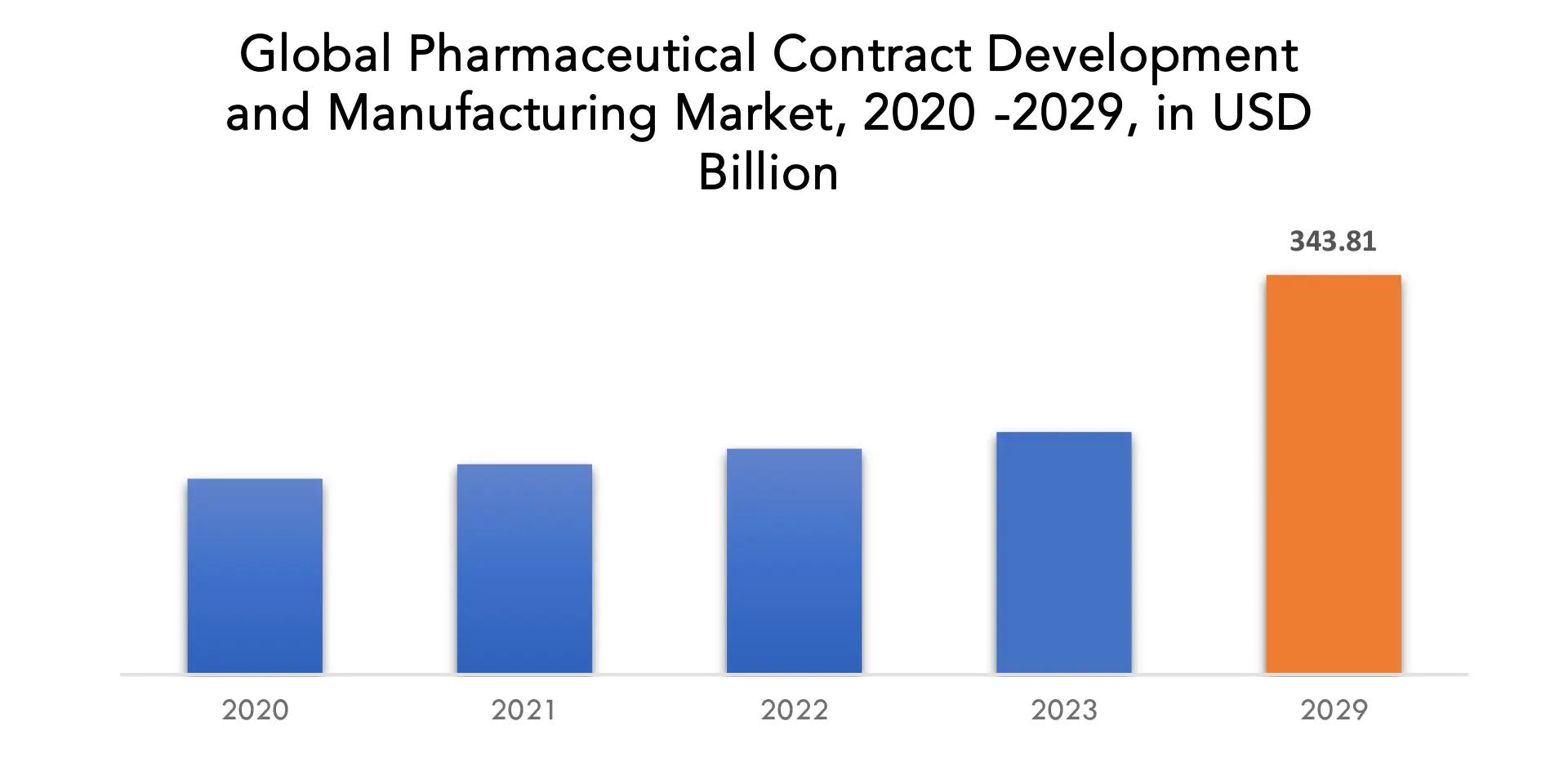

The global pharmaceutical contract development and manufacturing market size was valued at USD 208.72 billion in 2023, and projected to reach USD 343.81 billion by 2030, with a CAGR of 7.39% from 2023 to 2030.

Pharmaceutical Contract Development and Manufacturing (CDMO) is the term used to describe the outsourcing of drug development and manufacturing tasks by pharmaceutical firms to specialized businesses. To carry a pharmaceutical product from idea to market, a pharmaceutical firm (the client) and a CDMO (the service provider) have formed a strategic collaboration. Among the many services provided by CDMOs are the creation of medication formulations, process optimization, analytical testing, production of clinical trial products, production at commercial scale, packaging, and distribution. They can manage different stages of medication research and manufacture since they have the know-how, facilities, and regulatory information needed.

Pharmaceutical CDMOs’ main objectives are to help their clients develop drugs faster, for less money, and to make the most of the CDMO’s resources and experience. Pharmaceutical businesses may concentrate on their core skills, such as research and marketing, by outsourcing these tasks while depending on the CDMO for effective and high-quality medication manufacture. Modern facilities and compliance with legal requirements, such as Good Manufacturing Practices (GMP), are provided by CDMOs to guarantee the safety, effectiveness, and caliber of the pharmaceutical items they manufacture. Through close collaboration with their clients, they offer technical know-how, process improvement, and regulatory assistance all throughout the drug development lifecycle.

Pharmaceutical operations are increasingly being outsourced, moving from low-value tasks like bottling to more valuable ones like designing and developing medical devices. This business is expanding as a result of an increase in patients having surgical procedures, advancements in illness detection and diagnosis in developing nations, and operational process outsourcing expertise. Pharmaceutical firms, like their peers in other industries, are increasingly focusing their resources on their core business operations while outsourcing particular duties to specialized businesses. Therefore, it is projected that throughout the course of the forecast period, increasing outsourcing levels by significant pharmaceutical businesses would profitably fuel the expansion of the pharmaceutical CMO market.

There are becoming to be less and fewer procedures that result in worthwhile outputs, despite the fact that R&D expenses are continually growing. Many companies have realized that using the pharmaceutical markets, which are still in the early phases of development, and moving this component of operations overseas are effective cost-cutting measures. Additionally, third-party logistic companies like DHL have expanded their service offerings to include contract packaging services. Additionally, as the turnaround time for formulations and technology continues to accelerate, CMOs will need to make increasingly substantial expenditures to increase their agility and ability to react swiftly to changes in the production setup. The growth of the worldwide pharmaceutical contract development and manufacturing organizations market may be constrained by several factors.

Cell and gene treatments are highly specialized and may be able to fill medical gaps in the treatment of a variety of illnesses. As a result of these medicines’ significant therapeutic potential, several pharmaceutical firms and investors have spent money in their development and commercialization. As of February 2020, the FDA had approved nine cell and gene treatments.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Service, By research Phase, By End User, By Region. |

| By Service

|

|

| By Research Phase |

|

| By End User

|

|

| By Region

|

|

Pharmaceutical Contract Development and Manufacturing Market Segment Analysis

The pharmaceutical manufacturing service, drug development service, and biologic manufacturing service are the three primary service categories that make up the market. The segment’s substantial share may be attributable to factors like the expanding biopharmaceuticals and pharmaceutical markets globally, as well as the increasing demand for biologics and biosimilars in the area. In 2022, pharmaceutical manufacturing services had the lion’s share of the market. In addition, major market companies are spending in medication research and discovery, which would probably accelerate the segment’s growth.

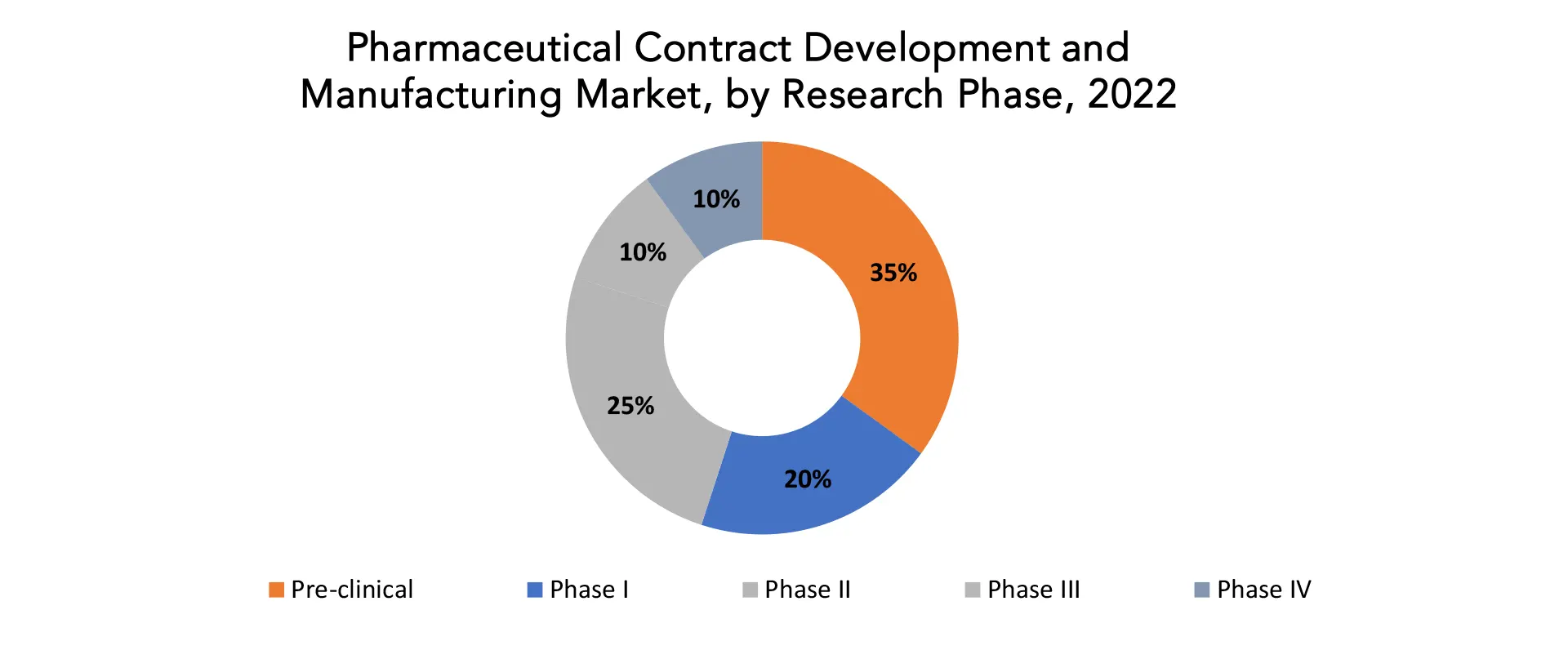

The phase III sector, which currently has the largest market share, is anticipated to expand at a CAGR of 9.33% during the course of the projection. The most extensive long-term safety information is provided through phase III trials, which are randomized controlled multicenter investigations. Phase III studies, which more closely resemble real-world clinical practice than phase I or II trials, examine a novel drug’s effectiveness and safety for 6–12 months in a large patient population (a few hundred or more). Since it would not be morally acceptable to subject patients to several months of placebo therapy, these studies are often done on an outpatient basis with no in-house days and an active comparator.

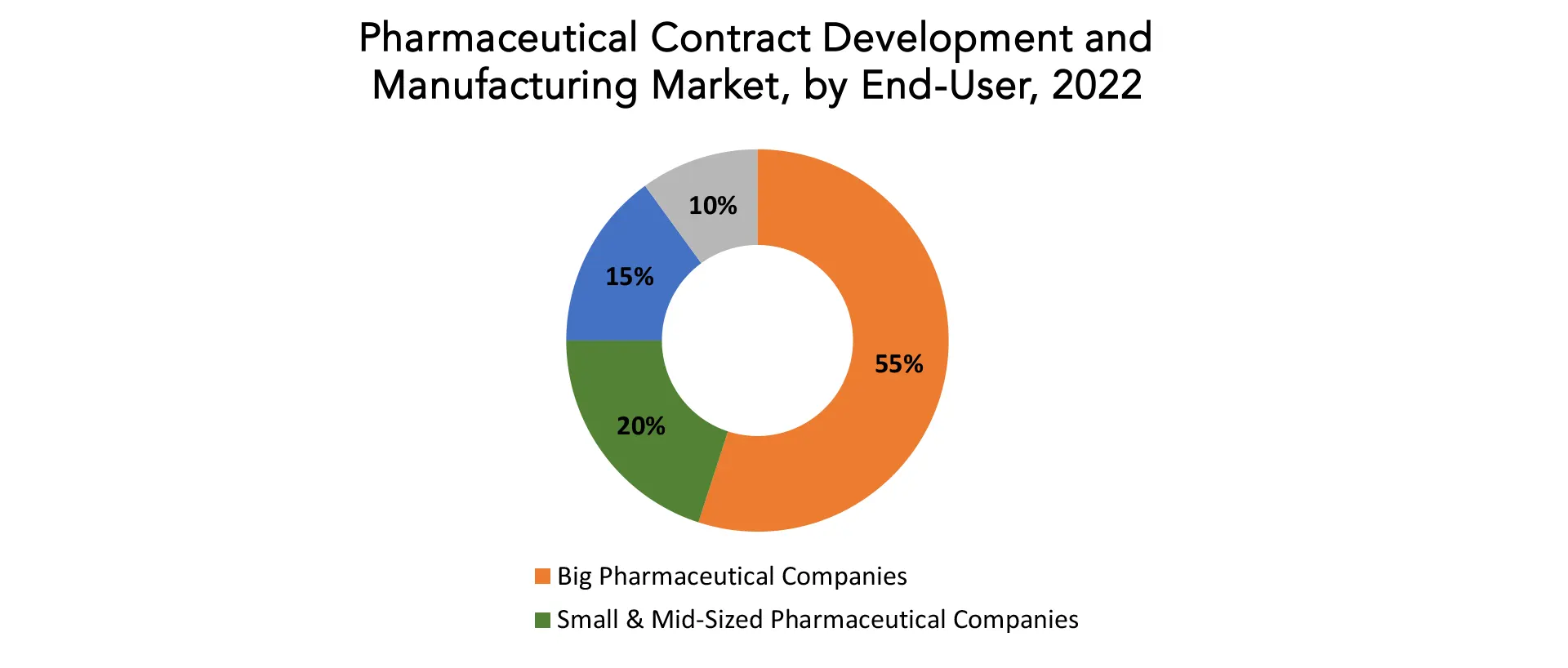

Big pharmaceutical firms, small and mid-sized pharmaceutical businesses, generic pharmaceutical companies, and other end users (academic institutes, small CDMOs, and CROs) are the different end user categories for the market. During the projected period, the major pharmaceutical firm’s category is anticipated to have the greatest CAGR. A few of the key factors projected to propel market expansion include growing investment in the development of cell and gene therapies, an increase in the number of biologics now undergoing pipeline investigations, and the rising need for targeted pharmacological treatments.

Pharmaceutical Contract Development and Manufacturing Market Players

The global market is fragmented in nature with the presence of various key players such as Lonza Group, Thermo Fisher Scientific Inc., Catalent, Recipharm Ab, ABBVIE, Siegfried Holding Ag, Evonik Industries, Patheon Inc, Boehringer Ingelheim, Piramal Pharma Limited, Fujifilm Healthcare, Asymchem Laboratories (Tianjin) Co., Ltd. ,Wuxi Apptec along with medium and small-scale regional players operating in different parts of the world. Major companies in the market compete in terms of application development capability, product launches, and development of new technologies for product formulation.

May 2, 2023 – The US Food and Drug Administration (FDA) approved GenIbet Biopharmaceuticals, a subsidiary of the international contract development and manufacturing organisation (CDMO) Recipharm, to manufacture VOWST, a novel orally administered faecal microbiota product for the prevention of Clostridioides difficile recurrent infection (CDI) in adults after antibacterial treatment for recurrent CDI.

April 25, 2023 – At its location in Evionnaz, Switzerland, Siegfried, a renowned international Contract Development and Manufacturing Organisation (CDMO) with its headquarters in Zofingen, officially opened its new worldwide Research and Development (R&D) Centre for Drug Substances.

Who Should Buy? Or Key Stakeholders

- Service Providers/ Buyers

- Industry Investors/Investment Bankers

- Education & Research Institutes

- Research Professionals

- Emerging Companies

- Manufacturers

Pharmaceutical Contract Development and Manufacturing Market Regional Analysis

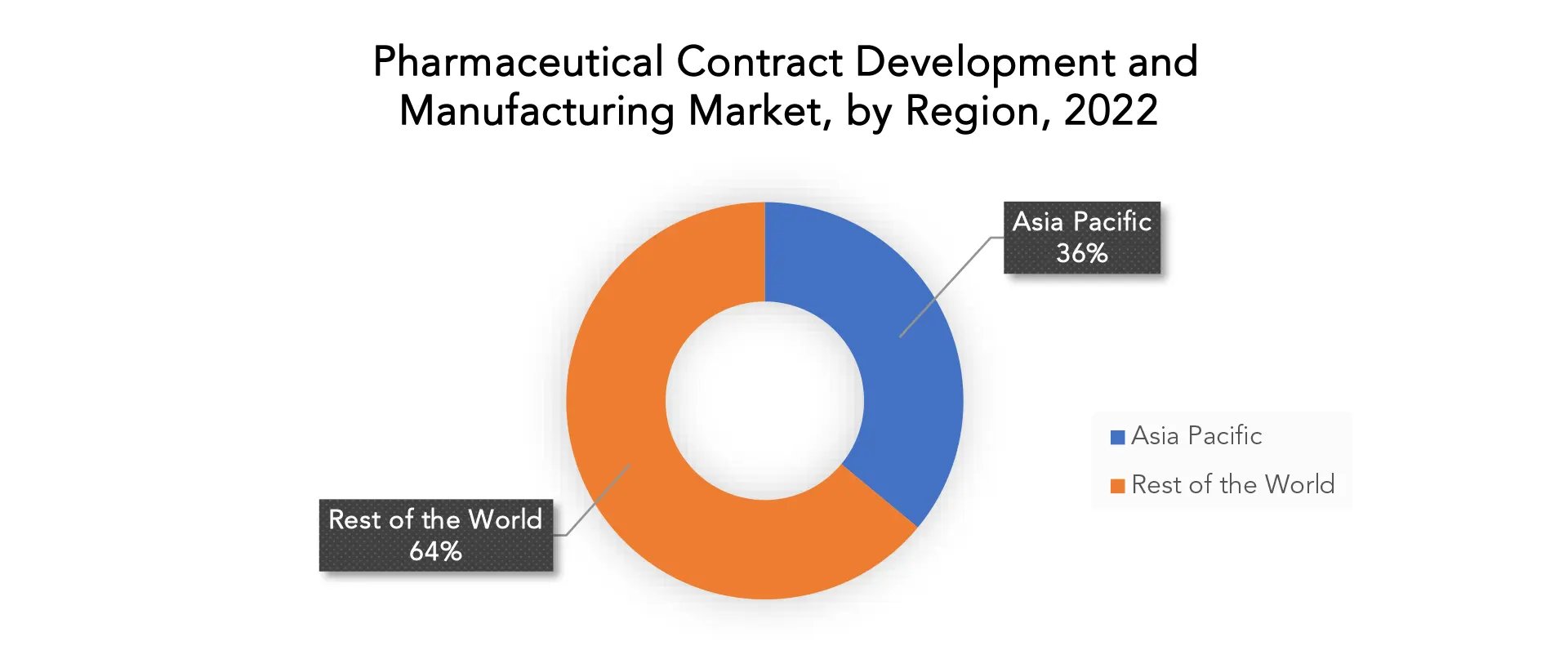

Geographically, the pharmaceutical contract development and manufacturing market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

In the worldwide pharmaceutical contract development and manufacturing organization (CDMO) market, Asia Pacific had a bigger revenue share of 36% and a significant CAGR. The rise in chronic and lifestyle illnesses, the availability of clinical trial expertise, and the outsourcing of research operations are all factors contributing to this region’s growth. Other elements contributing to market expansion include expanding supportive government efforts and bettering healthcare infrastructure. The biggest drivers of the market expansion in the area are China and India. Due to expanding generic drug demand and increased biotechnology company research efforts, North America had a sizable market share over the predicted period.

Key Market Segments: Pharmaceutical Contract Development and Manufacturing Market

Pharmaceutical Contract Development and Manufacturing Market by Service, 2020-2030, (USD Billion)

- Pharmaceutical Manufacturing Services

- Pharmaceutical API Manufacturing Services

- Pharmaceutical FDF Manufacturing Services

- Drug Development Services

- Biologic Manufacturing Services

- Biologic API Manufacturing Services

- Biologic FDF Manufacturing Services

Pharmaceutical Contract Development and Manufacturing Market by Research Phase, 2020-2030, (USD Billion)

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

Pharmaceutical Contract Development and Manufacturing Market by End User, 2020-2030, (USD Billion)

- Big Pharmaceutical Companies

- Small & Mid-Sized Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Other End Users (Academic Institutes, Small CDMOs, and CROs)

Pharmaceutical Contract Development and Manufacturing Market by Region, 2020-2030, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the pharmaceutical contract development and manufacturing market over the next 7 years?

- Who are the major players in the pharmaceutical contract development and manufacturing market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the pharmaceutical contract development and manufacturing market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on power system state estimator market?

- What is the current and forecasted size and growth rate of the global pharmaceutical contract development and manufacturing market?

- What are the key drivers of growth in the pharmaceutical contract development and manufacturing market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the pharmaceutical contract development and manufacturing market?

- What are the technological advancements and innovations in the pharmaceutical contract development and manufacturing market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the pharmaceutical contract development and manufacturing market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the pharmaceutical contract development and manufacturing market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON PHARMACEUTICAL CONTRACT DEVELOPMENT AND

- PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET OUTLOOK

MANUFACTURING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE, 2020-2030, (USD BILLION)

- PHARMACEUTICAL MANUFACTURING SERVICES

- PHARMACEUTICAL API MANUFACTURING SERVICES

- PHARMACEUTICAL FDF MANUFACTURING SERVICES

- DRUG DEVELOPMENT SERVICES

- BIOLOGIC MANUFACTURING SERVICES

- BIOLOGIC API MANUFACTURING SERVICES

- BIOLOGIC FDF MANUFACTURING SERVICES

- GLOBAL ASEPTIC SAMPLING MARKET BY RESEARCH PHASE, 2020-2030, (USD BILLION)

- PRE-CLINICAL

- PHASE I

- PHASE II

- PHASE III

- PHASE IV

- GLOBAL ASEPTIC SAMPLING MARKET BY END USER, 2020-2030, (USD BILLION)

- BIG PHARMACEUTICAL COMPANIES

- SMALL & MID-SIZED PHARMACEUTICAL COMPANIES

- GENERIC PHARMACEUTICAL COMPANIES

- OTHER END USERS (ACADEMIC INSTITUTES, SMALL CDMOS, AND CROS)

- GLOBAL ASEPTIC SAMPLING MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

9.1 LONZA GROUP

9.2 THERMO FISHER SCIENTIFIC INC.

9.3 CATALENT

9.4 RECIPHARM AB

9.5 ABBVIE

9.6 SIEGFRIED HOLDING AG

9.7 EVONIK INDUSTRIES

9.8 PATHEON INC

9.9 BOEHRINGER INGELHEIM

9.10 PIRAMAL PHARMA LIMITED

9.11 FUJIFILM HEALTHCARE

9.12 ASYMCHEM LABORATORIES (TIANJIN) CO., LTD.

9.13 WUXI APPTEC

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 2 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 3 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY REGIONS (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 10 US PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 11 US PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 12 CANADA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 13 CANADA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 14 CANADA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 15 MEXICO PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 16 MEXICO PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 17 MEXICO PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 23 BRAZIL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 24 BRAZIL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 25 ARGENTINA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 28 COLOMBIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 39 INDIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 40 INDIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 41 CHINA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 42 CHINA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 43 CHINA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 44 JAPAN PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 45 JAPAN PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 46 JAPAN PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 59 EUROPE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 60 EUROPE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 61 EUROPE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 62 EUROPE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 64 GERMANY PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 65 GERMANY PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 66 UK PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 67 UK PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 68 UK PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 69 FRANCE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 70 FRANCE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 71 FRANCE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 72 ITALY PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 73 ITALY PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 74 ITALY PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 75 SPAIN PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 76 SPAIN PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 77 SPAIN PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 78 RUSSIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 79 RUSSIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 80 RUSSIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 89 UAE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 90 UAE PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2020-2030

FIGURE 11 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY SERVICE (USD BILLION) 2022

FIGURE 14 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY RESEARCH PHASE (USD BILLION) 2022

FIGURE 15 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY END USER (USD BILLION) 2022

FIGURE 16 GLOBAL PHARMACEUTICAL CONTRACT DEVELOPMENT AND MANUFACTURING MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 LONZA GROUP: COMPANY SNAPSHOT

FIGURE 19 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

FIGURE 20 CATALENT: COMPANY SNAPSHOT

FIGURE 21 RECIPHARM AB: COMPANY SNAPSHOT

FIGURE 22 ABBVIE: COMPANY SNAPSHOT

FIGURE 23 SIEGFRIED HOLDING AG: COMPANY SNAPSHOT

FIGURE 24 EVONIK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 25 PATHEON INC: COMPANY SNAPSHOT

FIGURE 26 BOEHRINGER INGELHEIM: COMPANY SNAPSHOT

FIGURE 27 PIRAMAL PHARMA LIMITED: COMPANY SNAPSHOT

FIGURE 28 FUJIFILM HEALTHCARE: COMPANY SNAPSHOT

FIGURE 29 ASYMCHEM LABORATORIES (TIANJIN) CO., LTD.: COMPANY SNAPSHOT

FIGURE 30 WUXI APPTEC: COMPANY SNAPSHOT

FAQ

The pharmaceutical contract development and manufacturing market is expected to reach USD 267.02 billion by the end of 2023.

Rising demand for personalized medicine is a key trend gaining popularity.

The global pharmaceutical contract development and manufacturing market size was valued at USD 208.72 billion in 2023, and projected to reach USD 343.81 billion by 2030, with a CAGR of 7.39% from 2023 to 2030.

The Asia Pacific dominated the global industry in 2022 and accounted for the maximum share of more than 36% of the overall revenue.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.