Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

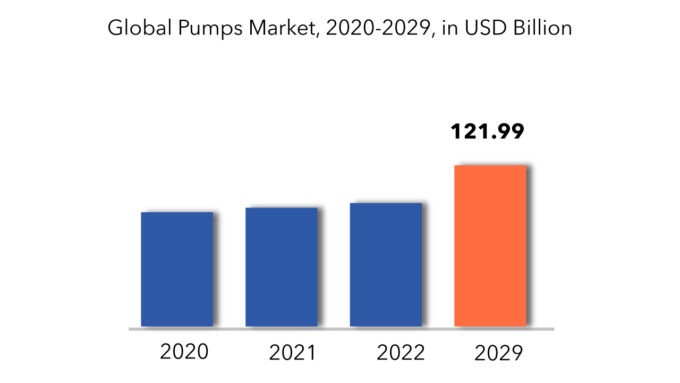

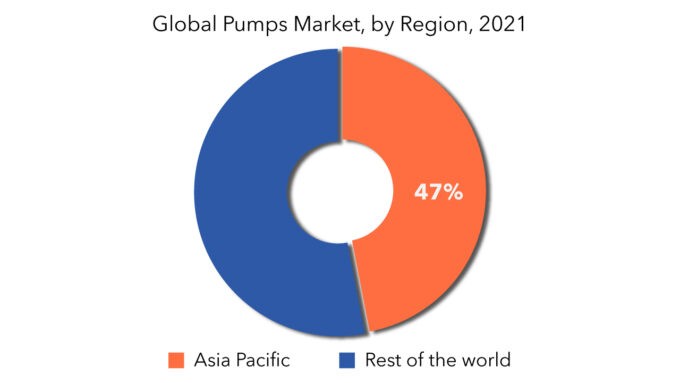

| USD 121.99 billion | 3.9% | Asia Pacific |

| By Product Type | By Application | By Regions |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Pumps Market Overview

The global Pumps Market size is estimated to be valued at USD 86.46 billion in 2020 and is projected to reach USD 121.99 billion by 2029, recording a CAGR of 3.9%.

Pumps serve dual purposes: augmenting fluid pressure and facilitating fluid transfer at higher discharge rates. Industries such as oil and gas exploration and chemical manufacturing employ pumps for elevating fluid pressure and precisely metering reagents and reactants during chemical synthesis. With the thriving oil and gas exploration sector, the demand for pumps is poised to escalate in the forthcoming years.

The escalating demands for fluid handling across sectors like power generation, construction, and building industries are driving market expansion. Additionally, increased investments in the agricultural domain, coupled with burgeoning urbanization and the imperative for wastewater treatment facilities, are anticipated to further fuel market growth. Technological advancements and the burgeoning array of end-use industries including water and wastewater treatment, chemical processing, power generation, and agriculture are poised to propel market growth.

In the United States, the burgeoning chemical, water and wastewater treatment, and construction sectors are significant contributors to the upsurge in pump demand. The growth of the U.S. oil and gas industry is catalyzing market expansion, given the extensive use of pumps in the refining process for fluid transportation. Furthermore, the chemical processing industry in the U.S. stands as a robust entity, continuously expanding. Anticipated expansions in the operations of the chemical processing industry are poised to drive an increased need for pumps in the U.S.

In January 2023, Grundfos Holding A/S completed the acquisition of Water Works Inc., headquartered in San Diego, US, thereby expanding its water treatment solutions platform within the Industry division. The integration of Water Works into MECO bolsters the Group’s water solutions offerings, particularly in the life science and biopharmaceutical segments.

Pumps Market Segment Analysis

The centrifugal pump category dominates the market, accounting for the vast bulk of global sales. Centrifugal pumps are utilized in the chemical industry because they can handle greater volumes. These are ideal for pumping liquids with viscosities ranging from 0.1 to 200 CP at low pressures and high capacities.

Axial flow, radial flow, and mixed flow centrifugal pumps are the three types of centrifugal pumps. Due to rising demand for high-power pumps in flood dewatering and water & wastewater treatment applications, the market for axial flow pumps is likely to rise significantly over the forecast period. Due to their improved efficiency and reduced pulsation, axial and radial flow pumps are employed for a higher delivery head at a low or medium flow rate.

Because of its efficient operating at lower speeds and steady flow rates, positive displacement pumps are expected to increase at the quickest CAGR of 3.4 percent in terms of revenue during the forecast period. Furthermore, the oil and gas industry’s preference for positive displacement pumps is projected to support segment expansion.

Manufacturers are taking use of technology by creating unique pumping solutions. Electronic sensors and other digital software are used to outfit new items with precision control and efficiency. Furthermore, reciprocating pumps’ suitability for pumping hazardous fluids is expected to raise product demand.

The agriculture application dominated the market with a revenue share of more than 25%. Technological developments in irrigation and farming, particularly in emerging countries, combined with an increase in the use of pumps for a variety of functions in agriculture, such as irrigation, crop dewatering, and reuse, are expected to drive expansion. During the forecast period, the construction industry is expected to increase significantly. The increasing construction of housing complexes and commercial buildings in major cities will necessitate efficient water supply, sewage disposal, and wastewater treatment facilities. Furthermore, significant investments in public infrastructure, such as offices, hospitals, and housing societies, are predicted to raise pump demand in the construction industry.

During the forecast period, demand for pumps in water and wastewater applications is predicted to expand at a CAGR of 3.6 percent. Pump stations are becoming more common in wastewater treatment plants where gravity flow is not possible, and their high flow rate deliverability and transmission velocity are expected to boost market growth. Increased shale gas use in the energy and industrial industries, as well as increased shale gas exploration activities due to technical improvements like horizontal and hydraulic drilling, are expected to raise product demand in the oil and gas sector. Furthermore, the market is predicted to increase due to the increasing use of petrochemical products in modern energy systems such as wind turbine blades, solar panels, batteries, and electric vehicle (EV) parts.

Pumps Market Players

Market players focus on growth strategies, such as new product launches, collaborations, partnerships, operational expansion, mergers & acquisitions, and awareness campaigns. Companies operating the target market can focus on partnerships and collaborations, in order to develop advanced products which in turn create lucrative growth opportunities. Few of the important market players Schlumberger Ltd, Ingersoll Rand, Weir Group PLC, Vaughan Company Inc, KSB SE & Co. KGaA, Pentair, Grundfos Holding A/S, Xylem, Flowserve Corporation and ITT Inc.

Companies are mainly in the developing and they are competing closely with each other. Innovation is one of the most important and key strategy as it has to be for any market. However, companies in the market have also opted and successfully driven inorganic growth strategies like mergers & acquisition and so on.

- In June 2021, the Verder Group, a Dutch company involved in the manufacturing and distributing pumps and laboratory equipment, announced the acquisition of the Jabsco rotary lobe pump product line from Xylem. The acquisition is expected to strengthen Verder’s group offering in the pharmaceutical and food & beverage market.

- In April 2021, IDEX Corporation signed a definitive agreement to acquire Airtech Group Inc., US Valve Corporation and related entities from investment funds managed by EagleTree Capital for a cash consideration of USD 470 million. Airtech manufactures and designs a wide range of engineered pressure technology, including positive displacement vacuum pumps, regenerative blowers, compressor systems, and valves.

Who Should Buy? Or Key Stakeholders

- Pumps Companies

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Key Takeaways:

-

The global Pumps Market size is estimated to be recording a CAGR of 3.9% during the forecast period.

-

The centrifugal pump category dominates the market, accounting for the vast bulk of global sales. Centrifugal pumps are utilized in the chemical industry because they can handle greater volumes.

-

Due to rising demand for high-power pumps in flood dewatering and water & wastewater treatment applications, the market for axial flow pumps is likely to rise significantly over the forecast period.

-

The agriculture application dominated the market with a revenue share of more than 25%.

-

The major share is expected to be occupied by North America for global pumps market during the forecast period.

-

One major trend in the pumps market is the increasing adoption of smart pumping systems incorporating IoT technology for enhanced monitoring and control.

Pumps Market Regional Analysis

The Pumps Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes US, Canada and Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The major share is expected to be occupied by North America for global pumps market during the forecast period. Rapid industrialization in Asia Pacific’s developing countries, as well as increased investments in manufacturing, commercial, and industrial projects, have all contributed to the region’s overall prosperity. Increased product penetration in a variety of end-use industries, such as agriculture, petrochemicals, and HVAC, is also expected to contribute to market growth.

Key Market Segments: Pumps Market

Pumps Market by Product Type, 2020-2029, (In USD Million)

- Centrifugal Pump

- Positive Displacement Pump

Pumps Market by Application, 2020-2029, (In USD Million)

- Agriculture

- Building & Construction

- Waste & Wastewater

- Power Generation

- Oil & Gas

- Chemical

Pumps Market by Regions, 2020-2029, (In USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current market size of this high growth market?

- What is the overall growth rate?

- What are the key growth areas, applications, end uses and types?

- Key reasons for growth

- Challenges for growth

- Who are the important market players in this market?

- What are the key strategies of these players?

- What technological developments are happening in this area?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Pumps Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Pumps Market

- Global Pumps Market Outlook

- Global Pumps Market by Product Type, (USD Million) (Thousand Units)

- Centrifugal Pump

- Positive Displacement Pump

- Global Pumps Market by Application, (USD Million) (Thousand Units)

- Agriculture

- Building & Construction

- Waste & Wastewater

- Power Generation

- Oil & Gas

- Chemical

- Global Pumps Market by Region, (USD Million) (Thousand Units)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Product Types Offered, Recent Developments)

- Schlumberger Ltd

- Ingersoll Rand

- Weir Group PLC

- Vaughan Company Inc

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT Inc *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL PUMPS MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL PUMPS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA PUMPS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA PUMPS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 9 US PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 10 US PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 US PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 12 US PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 13 CANADA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 14 CANADA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 CANADA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 16 CANADA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 17 MEXICO PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 18 MEXICO PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 MEXICO PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 20 MEXICO PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 21 SOUTH AMERICA PUMPS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 22 SOUTH AMERICA PUMPS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 23 BRAZIL PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 24 BRAZIL PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 BRAZIL PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 26 BRAZIL PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 27 ARGENTINA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 28 ARGENTINA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 29 ARGENTINA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 30 ARGENTINA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 31 COLOMBIA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 32 COLOMBIA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 COLOMBIA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 34 COLOMBIA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 REST OF SOUTH AMERICA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 36 REST OF SOUTH AMERICA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 REST OF SOUTH AMERICA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 38 REST OF SOUTH AMERICA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 39 ASIA-PACIFIC PUMPS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 40 ASIA-PACIFIC PUMPS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 41 INDIA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 42 INDIA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 43 INDIA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 44 INDIA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 45 CHINA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 46 CHINA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 CHINA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 48 CHINA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 49 JAPAN PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 50 JAPAN PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 JAPAN PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 52 JAPAN PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 53 SOUTH KOREA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 54 SOUTH KOREA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 SOUTH KOREA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 56 SOUTH KOREA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 57 AUSTRALIA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 58 AUSTRALIA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 AUSTRALIA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 60 AUSTRALIA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 SOUTH-EAST ASIA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 62 SOUTH-EAST ASIA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 SOUTH-EAST ASIA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 64 SOUTH-EAST ASIA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 65 REST OF ASIA PACIFIC PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 66 REST OF ASIA PACIFIC PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 REST OF ASIA PACIFIC PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 68 REST OF ASIA PACIFIC PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 69 EUROPE PUMPS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 70 EUROPE PUMPS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 71 GERMANY PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 72 GERMANY PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 73 GERMANY PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 74 GERMANY PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 75 UK PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 76 UK PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 UK PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 78 UK PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 79 FRANCE PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 80 FRANCE PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 81 FRANCE PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 82 FRANCE PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 83 ITALY PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 84 ITALY PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 ITALY PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 86 ITALY PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 87 SPAIN PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 88 SPAIN PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 SPAIN PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 90 SPAIN PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 91 RUSSIA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 92 RUSSIA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 RUSSIA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 94 RUSSIA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 95 REST OF EUROPE PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 96 REST OF EUROPE PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 REST OF EUROPE PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 98 REST OF EUROPE PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 99 MIDDLE EAST AND AFRICA PUMPS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 100 MIDDLE EAST AND AFRICA PUMPS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 101 UAE PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 102 UAE PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 103 UAE PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 104 UAE PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 105 SAUDI ARABIA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 106 SAUDI ARABIA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 107 SAUDI ARABIA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 108 SAUDI ARABIA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 109 SOUTH AFRICA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 110 SOUTH AFRICA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 111 SOUTH AFRICA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 112 SOUTH AFRICA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF MIDDLE EAST AND AFRICA PUMPS MARKET BY PRODUCT TYPE (USD MILLIONS), 2020-2029

TABLE 114 REST OF MIDDLE EAST AND AFRICA PUMPS MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 115 REST OF MIDDLE EAST AND AFRICA PUMPS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 116 REST OF MIDDLE EAST AND AFRICA PUMPS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PUMPS MARKET BY PRODUCT TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL PUMPS MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL PUMPS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL PUMPS MARKET BY PRODUCT TYPE, USD MILLION, 2020-2029

FIGURE 13 GLOBAL PUMPS MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 14 GLOBAL PUMPS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 15 PUMPS MARKET BY REGION 2020

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 SCHLUMBERGER LTD: COMPANY SNAPSHOT

FIGURE 18 INGERSOLL RAND: COMPANY SNAPSHOT

FIGURE 19 WEIR GROUP PLC: COMPANY SNAPSHOT

FIGURE 20 VAUGHAN COMPANY INC: COMPANY SNAPSHOT

FIGURE 21 KSB SE & CO. KGAA: COMPANY SNAPSHOT

FIGURE 22 PENTAIR: COMPANY SNAPSHOT

FIGURE 23 GRUNDFOS HOLDING A/S: COMPANY SNAPSHOT

FIGURE 24 XYLEM: COMPANY SNAPSHOT

FIGURE 25 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

FIGURE 26 ITT INC: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.