REPORT OUTLOOK

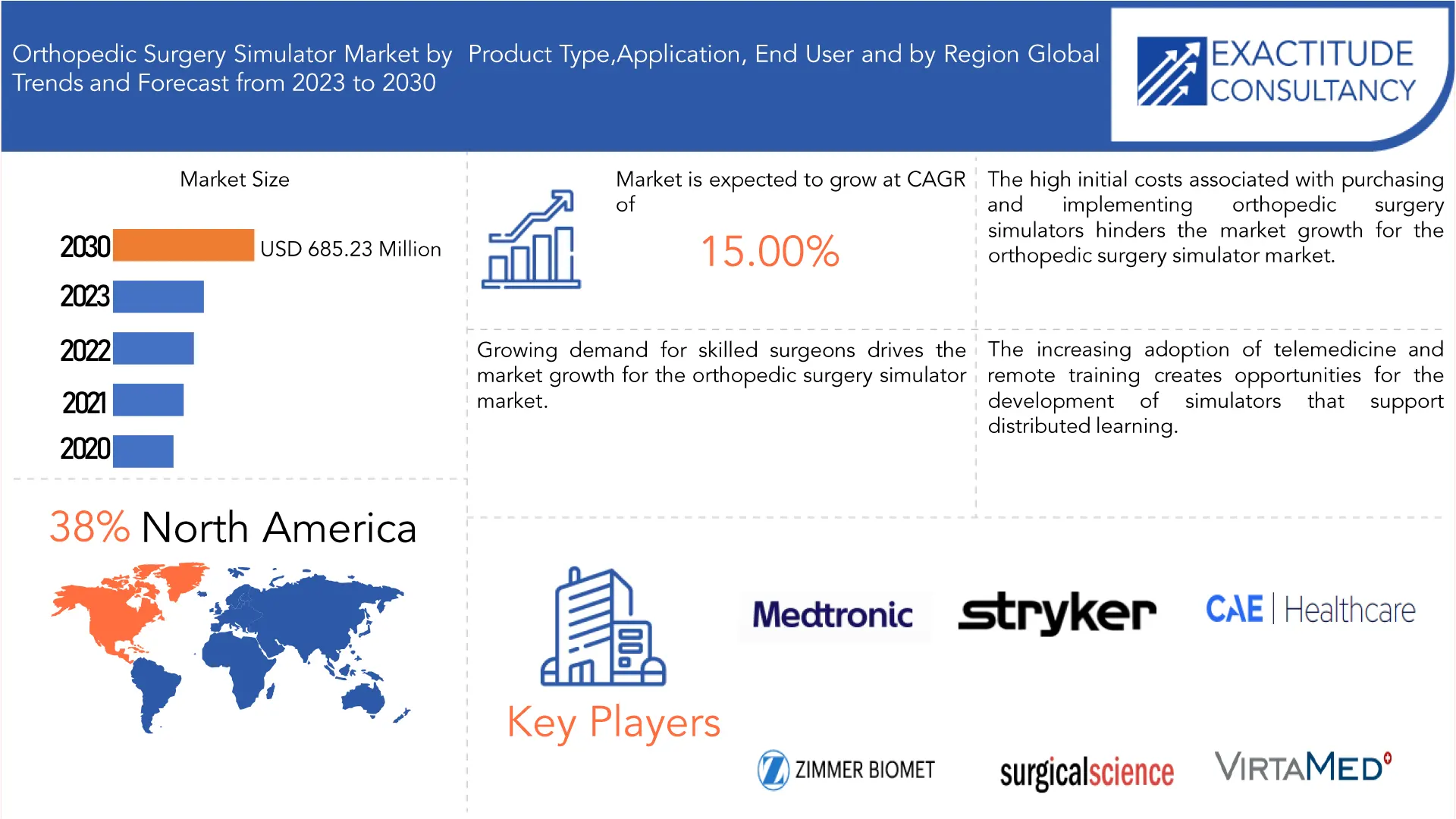

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 685.23 Million by 2030 | 15.00 % | North America |

| Market by Product Type | Market by Application | Market by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Orthopedic Surgery Simulator Market Overview

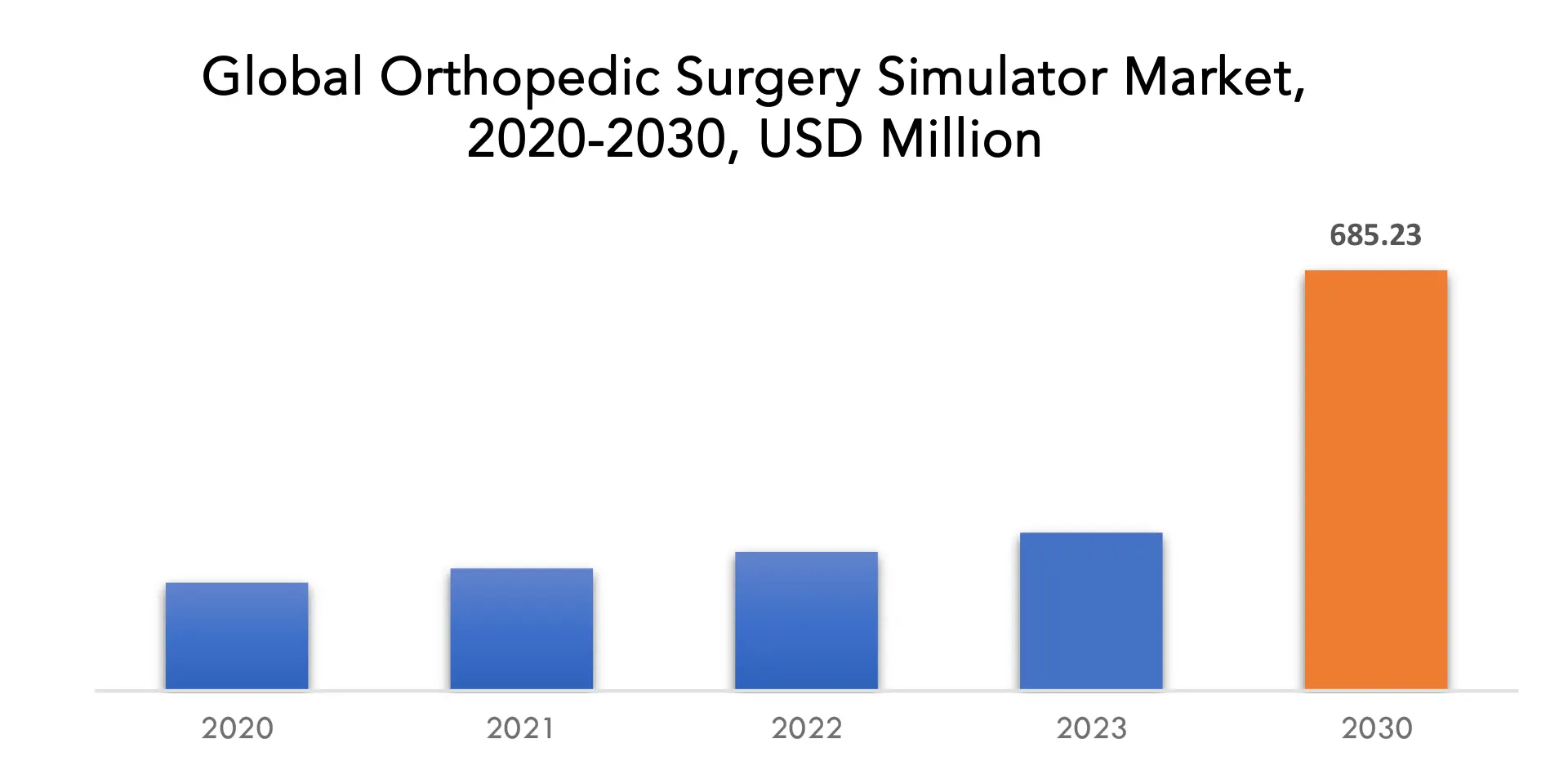

The global Orthopedic Surgery Simulator market is anticipated to grow from USD 257.63 Million in 2023 to USD 685.23 Million by 2030, at a CAGR of 15.00 % during the forecast period.

Orthopedic Surgery Simulators are advanced technological tools designed to provide realistic and immersive training experiences for Orthopedic surgeons. These simulators aim to enhance surgical skills, improve decision-making, and allow practitioners to practice and refine their techniques in a risk-free environment. Simulators provide a controlled and realistic environment for Orthopedic surgeons to develop and refine their surgical skills. Trainees can practice various procedures, such as joint replacements or fracture fixation, in a risk-free setting before performing surgeries on actual patients. Orthopedic procedures can be complex, and the learning curve for surgeons is often steep. Simulators help reduce the learning curve by allowing surgeons to gain proficiency in specific techniques and procedures in a simulated environment. Regular practice on simulators enhances the overall competence of Orthopedic surgeons. It allows them to familiarize themselves with different surgical instruments , techniques, and anatomical variations, improving their ability to handle diverse clinical scenarios. Simulators often include realistic patient scenarios and complications. This helps surgeons develop critical decision-making skills, such as identifying and addressing unexpected challenges during surgery. Simulators contribute to patient safety by ensuring that surgeons are well-trained and competent before performing procedures on real patients. This reduces the risk of errors and complications associated with surgeries conducted by less-experienced practitioners. Simulators can be used for preoperative planning and to test new surgical techniques or devices. Surgeons can explore different approaches and evaluate their effectiveness in a simulated environment before applying them in actual surgeries. Simulators provide an objective means of assessing a surgeon’s performance. Metrics such as accuracy, speed, and precision can be measured, allowing for constructive feedback and continuous improvement.

Technological advancements, including improvements in virtual reality (VR) and augmented reality (AR) technologies, have enhanced the realism and effectiveness of Orthopedic surgery simulators. Simulators can provide a realistic and immersive training environment for surgeons, allowing them to practice and refine their skills in a risk-free setting. Orthopedic surgery simulators play a crucial role in training and skill enhancement for both novice and experienced surgeons. Continuous learning and skill development are essential in the field of Orthopedic surgery, and simulators offer a platform for surgeons to practice procedures, improve their techniques, and stay updated on the latest surgical approaches. Simulators contribute to improving patient safety by allowing surgeons to hone their skills before performing actual surgeries. The risk of errors and complications can be reduced through pre-operative practice on simulators, leading to better outcomes for patients. The increasing preference for minimally invasive Orthopedic procedures has created a demand for training tools that simulate these techniques. Simulators can provide a realistic environment for practicing the precision required in minimally invasive surgeries. There is often a limited supply of cadaveric specimens available for surgical training. Orthopedic surgery simulators offer an alternative that is not subject to the constraints of specimen availability, allowing surgeons to practice more frequently and at their convenience. The global prevalence of musculoskeletal conditions and the aging population contribute to an increase in Orthopedic procedures. Surgeons and medical institutions recognize the importance of ongoing training to meet the growing demand for Orthopedic services. Orthopedic surgery simulators are increasingly integrated into medical education programs and residency training. Educational institutions and hospitals recognize the value of incorporating simulation-based training to enhance the skills of future Orthopedic surgeons. Collaboration between healthcare institutions, medical device companies, and simulation technology developers has led to the creation of more advanced and realistic Orthopedic surgery simulators. Increased investment in research and development in this area contributes to the market’s growth. Regulatory bodies and medical associations recognize the importance of simulation training in surgical education. Accreditation programs and guidelines that endorse the use of simulators for training contribute to their increasing adoption. The rise of remote and virtual training platforms, especially in response to global events such as the COVID-19 pandemic, may drive the adoption of Orthopedic surgery simulators that offer flexible and accessible training options.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million), (Thousand Units) |

| Segmentation | By Product Type, Application, End User and By Region |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region

|

|

Orthopedic Surgery Simulator Market Segmentation Analysis

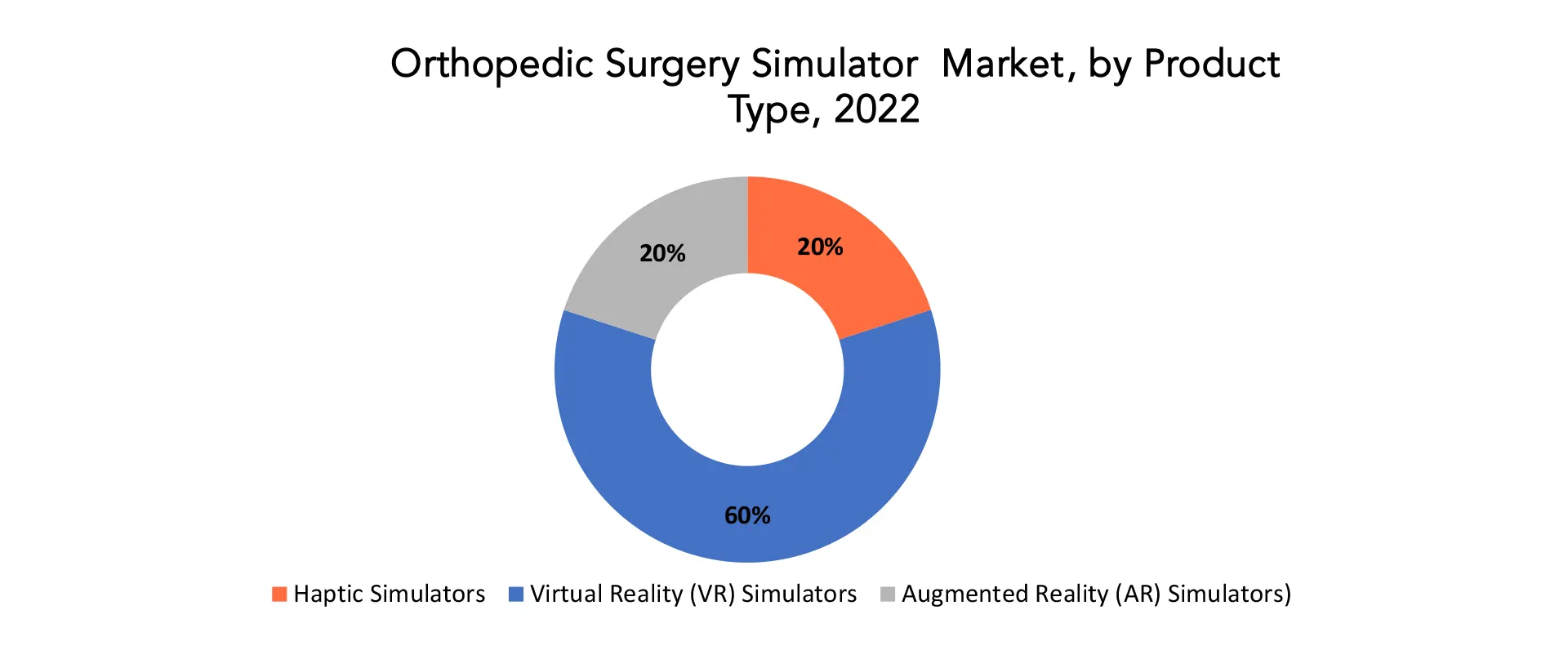

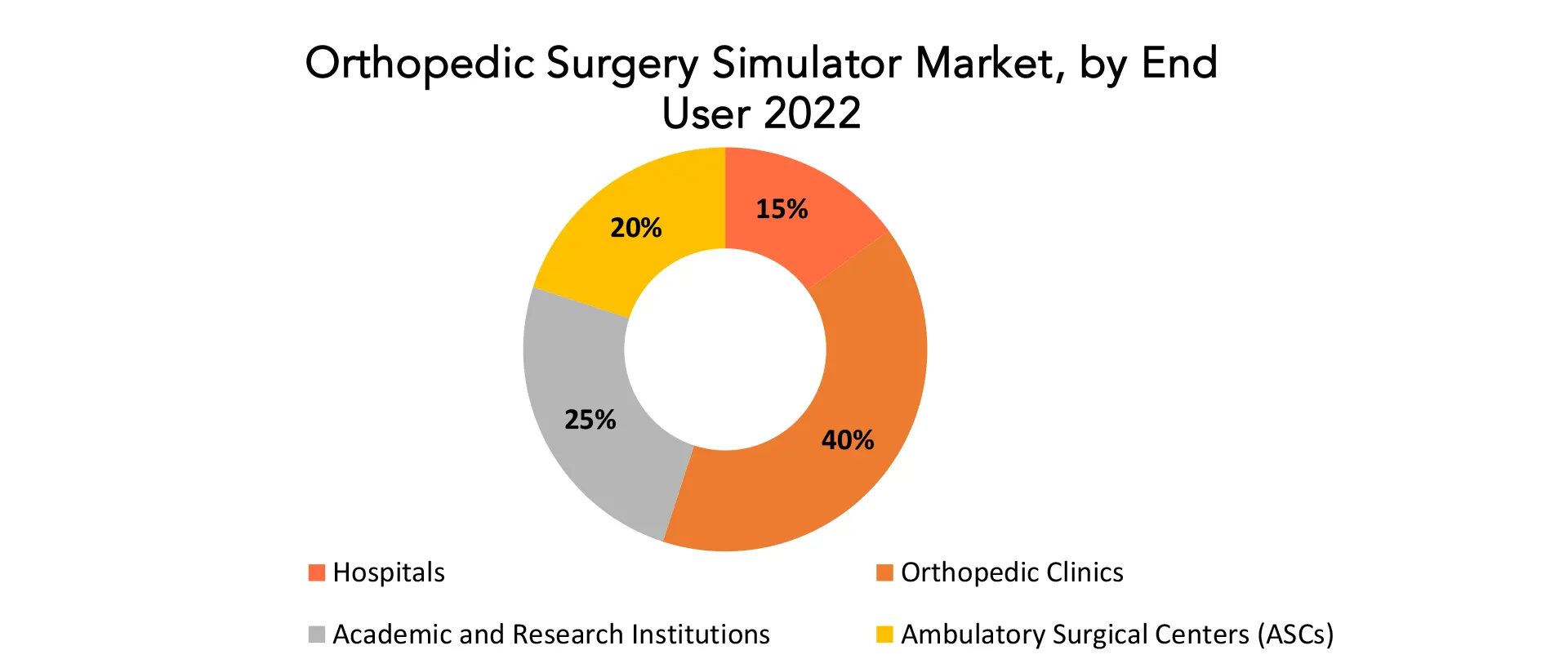

The global Orthopedic Surgery Simulator market is divided into 4 segments Product Type the market is bifurcated into Haptic Simulators, Virtual Reality (VR) Simulators, Augmented Reality (AR) Simulators). By Application the market is bifurcated into Arthroscopy Simulation, Joint Replacement Simulation, Spine Surgery Simulation, Trauma Surgery Simulation. By end user the market is bifurcated into Hospitals, Orthopedic Clinics, Academic and Research Institutions, Ambulatory Surgical Centers (ASCs)

Based on product type Virtual Reality (VR) Simulators segment dominating in the Orthopedic Surgery Simulator market. VR Simulators provide a highly immersive experience by creating realistic and three-dimensional virtual environments. Surgeons can navigate and interact within these environments, simulating the feel of an actual operating room. VR Simulators offer detailed and accurate virtual models of anatomical structures, allowing surgeons to practice on lifelike patient scenarios. The realism extends to the simulation of Orthopedic surgical procedures, contributing to a more authentic training experience. Many VR Simulators incorporate haptic feedback technology, providing a sense of touch and force feedback during virtual surgery. This tactile feedback enhances the realism of the simulation, allowing surgeons to feel resistance, textures, and the impact of their actions. VR Simulators can simulate a wide range of Orthopedic surgical procedures, from arthroscopy to joint replacement surgeries. The versatility of VR technology allows for a comprehensive training curriculum, accommodating different specialties and skill levels. VR Simulators often offer adaptive learning paths, adjusting the difficulty levels based on the skill and experience of the user. This feature ensures that the training remains challenging and engaging, catering to both novice and experienced surgeons. VR Simulators can collect objective performance metrics, allowing surgeons to track their progress and proficiency in various skills. This data-driven approach to training enables continuous improvement and self-assessment. Virtual reality creates a risk-free environment for surgeons to practice and refine their skills. Mistakes made in the virtual world do not have real-world consequences, providing a safe space for learning and experimentation. The interactive nature of VR Simulators enhances engagement during training sessions. Surgeons can actively participate in the virtual procedures, leading to a more dynamic and effective learning experience.

Based on end user Orthopedic Clinics segment dominating in the Orthopedic Surgery Simulator market. Orthopedic clinics often serve as specialized environments where Orthopedic surgeons receive training and practice specific procedures. Simulators tailored to Orthopedic surgery align well with the focused nature of these clinics. Orthopedic clinics provide a range of services, including diagnostics, treatments, and surgeries. The use of surgery simulators in Orthopedic clinics can offer comprehensive training covering various Orthopedic procedures, from joint replacements to fracture repairs. Orthopedic clinics are often associated with teaching hospitals and surgical residency programs. Surgery simulators are integral to the training curriculum in these programs, providing residents with hands-on experience before entering the operating room. Orthopedic clinics, particularly those focused on surgery, have a patient-centric approach. Utilizing surgery simulators helps ensure that Orthopedic surgeons are well-trained and competent, contributing to improved patient outcomes and safety. The field of Orthopedics continually evolves with advancements in technology and surgical techniques. Orthopedic clinics, as centers of innovation, may be more inclined to invest in the latest simulation technologies to stay at the forefront of their specialty. The emphasis on skill development and continuous training in Orthopedics is high. Orthopedic clinics recognize the value of simulation training in enhancing the surgical skills of their professionals, contributing to better patient care. Simulators provide a controlled environment for Orthopedic surgeons to practice and refine their skills without the risk associated with real surgical procedures. Orthopedic clinics may prioritize the use of simulators as a risk mitigation strategy. Orthopedic clinics often engage in surgical planning and may be more inclined to adopt simulation technologies for preoperative planning and testing of innovative Orthopedic surgical techniques. Orthopedic clinics may collaborate with research institutions and industry partners. The use of simulators in these settings allows for research into new technologies, techniques, and Orthopedic advancements.

Orthopedic Surgery Simulator Market Trends

- The integration of VR and AR technologies continues to be a prominent trend. Simulators that offer immersive virtual environments and augmented overlays for realistic surgical training experiences are gaining traction.

- Ongoing improvements in haptic feedback technology enhance the realism of Orthopedic surgery simulators. Surgeons can experience tactile sensations, providing a more immersive and accurate representation of surgical procedures.

- Advancements in imaging technologies allow for the creation of patient-specific simulations. Surgeons can practice procedures on virtual models based on actual patient scans, contributing to personalized and targeted training.

- The development of mobile and portable Orthopedic surgery simulators allows for flexibility in training. These solutions enable surgeons to practice procedures on the go and facilitate training in various settings, including hospitals and clinics.

- The integration of AI into Orthopedic surgery simulators is a growing trend. AI algorithms can enhance the adaptability of simulations, provide personalized feedback, and simulate dynamic scenarios based on user interactions.

- The trend towards remote training and tele mentoring has gained significance, especially considering global connectivity and the need for distributed learning. Surgeons can engage in virtual training sessions and receive guidance from experts regardless of geographic locations.

- Simulation libraries for Orthopedic surgery continue to expand, covering a broader range of procedures. This includes simulations for various joint replacements, arthroscopic surgeries, trauma procedures, and spine surgeries.

- The incorporation of data analytics tools allows for the comprehensive assessment of surgeons’ performance. Objective metrics are collected during simulations, providing valuable insights for performance improvement and benchmarking.

- Orthopedic surgery simulators increasingly include interactive learning modules. These modules offer step-by-step guidance, tutorials, and interactive assessments, enhancing the educational experience for surgeons at different skill levels.

- Collaborative efforts between industry players and academic institutions are fostering the development of cutting-edge Orthopedic surgery simulators. These partnerships contribute to the creation of high-quality, research-based simulation solutions.

- Simulators are designed with an emphasis on the transferability of surgical skills from the virtual environment to the operating room. Training programs aim to ensure that skills acquired in simulations seamlessly translate to real-world surgical practice.

- Increasing emphasis on customization and personalization of simulator experiences to cater to individual learning needs and skill levels. This trend supports a more adaptive and learner-centric approach to Orthopedic surgery training.

Competitive Landscape

The competitive landscape can change over time due to factors such as mergers, acquisitions, new product launches, and shifts in market dynamics.

- Touch Surgery

- VirtaMed AG

- Precision OS

- CAE Healthcare

- OSSimTech

- Surgical Science

- 3D Systems Corporation

- Virtamed

- Simulab Corporation

- Stryker Corporation

- Medtronic

- Zimmer Biomet

- ArthoSim

- Axial3D

- VirtaMed AG

- Mimic Technologies

- Ossim

- Voxel-Man

- InSimo

- OSSimTech

Recent Developments:

July 28, 2021: Surgical Science entered into a conditional contract to acquire all outstanding shares of Simbionix USA Corp., which practices simulation to train surgeons and other medical specialists in a variety of areas, including robotic surgery. The deal was carried out in cash and debt-free consideration of USD 305 million.

Regional Analysis

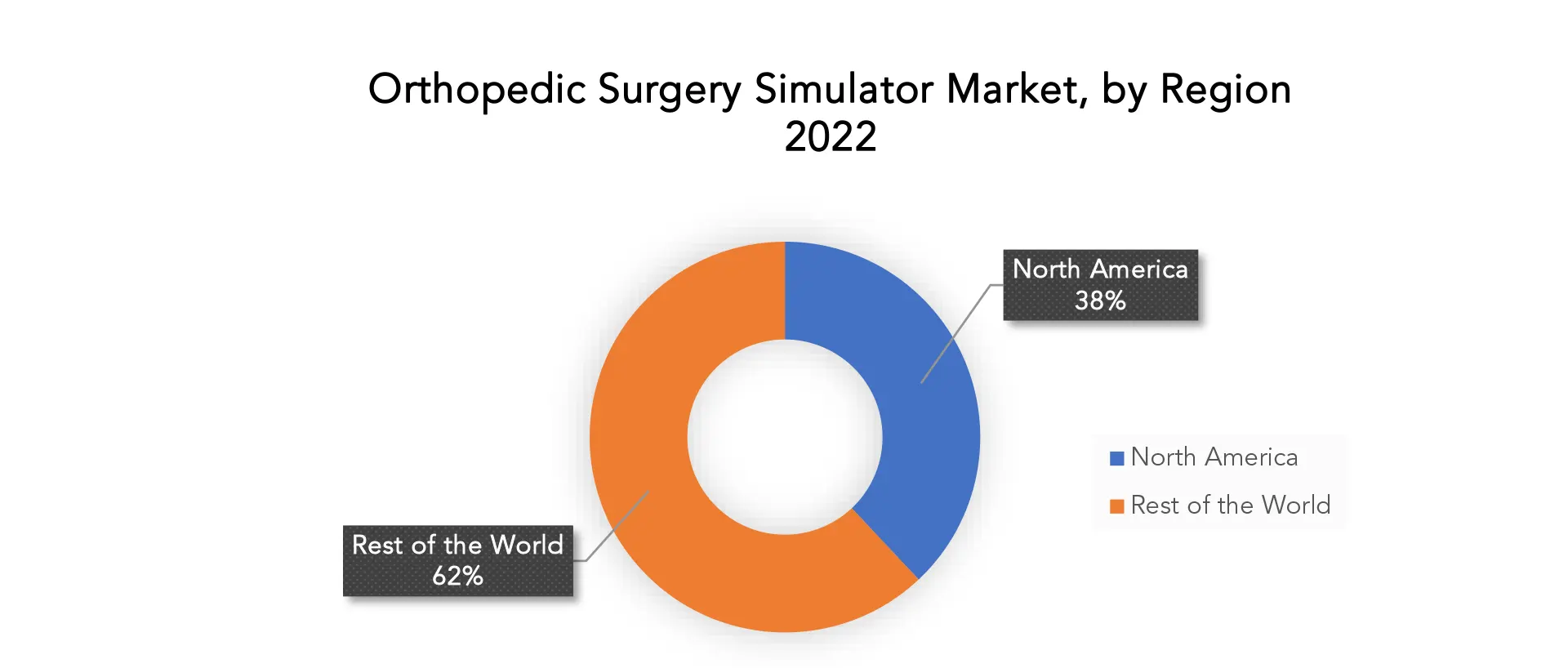

North America accounted for the largest market in the Orthopedic surgery simulator market. North America accounted for the 38 % market share of the global market value. North America, particularly the United States and Canada, possesses highly advanced and sophisticated healthcare infrastructure. The presence of well-established medical institutions and hospitals with a focus on technological advancements contributes to the adoption of Orthopedic surgery simulators. The region is at the forefront of technological advancements and innovation in healthcare. The continuous development of cutting-edge simulation technologies, including virtual reality (VR) and haptic feedback systems, is driving the adoption of Orthopedic surgery simulators. North America is known for its robust research and development activities in the healthcare sector. Ongoing collaborations between research institutions, medical schools, and industry players contribute to the creation of advanced Orthopedic surgery simulation solutions. The United States, in particular, has one of the highest healthcare expenditures globally. The willingness to invest in state-of-the-art medical technologies and training tools, including Orthopedic surgery simulators, is a significant driver of market growth the increasing demand for skilled Orthopedic surgeons, driven by factors such as an aging population and a growing number of Orthopedic procedures, has led to a greater emphasis on advanced training tools. Orthopedic surgery simulators address this need for high-quality, realistic training experiences. North American medical institutions and teaching hospitals have been early adopters of simulation-based training programs. The recognition of the effectiveness of simulation in improving surgical skills and reducing errors has fueled the demand for Orthopedic surgery simulators.

Many major players in the Orthopedic surgery simulator market are headquartered or have a significant presence in North America. The proximity of these companies to key markets and their ability to collaborate with local healthcare institutions contribute to market dominance. The emphasis on continuing medical education and professional development for healthcare practitioners, including surgeons, drives the adoption of advanced training tools. Orthopedic surgery simulators align with the goals of providing ongoing education and skill enhancement.

Target Audience for Orthopedic Surgery Simulator Market

- Dental Implant Manufacturers

- Dental Professionals (Dentists, Oral Surgeons, Periodontists)

- Dental Laboratories

- Dental Clinics and Hospitals

- Dental Associations and Societies

- Dental Distributors and Suppliers

- Academic and Research Institutions

- Regulatory Bodies and Health Authorities

- Patients and the General Public

- Insurance Companies

Import & Export Data for Orthopedic Surgery Simulator Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Orthopedic Surgery Simulator market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Area Scan Camera Market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Surgical Drill Product Types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the Orthopedic Surgery Simulator Market Report

Orthopedic Surgery Simulator Market by Product Type, 2020-2030, (USD Million), (Thousand Units)

- Haptic Simulators

- Virtual Reality (VR) Simulators

- Augmented Reality (AR) Simulators

Orthopedic Surgery Simulator Market by Application, 2020-2030, (USD Million), (Thousand Units)

- Arthroscopy Simulation

- Joint Replacement Simulation

- Spine Surgery Simulation

- Trauma Surgery Simulation

Orthopedic Surgery Simulator Market by End User, 2020-2030, (USD Million), (Thousand Units)

- Hospitals

- Orthopedic Clinics

- Academic and Research Institutions

- Ambulatory Surgical Centers (ASCs)

Orthopedic Surgery Simulator Market by Region, 2020-2030, (USD Million), (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Orthopedic surgery simulator market over the next 7 years?

- Who are the major players in the Orthopedic surgery simulator market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, the middle east, and africa?

- How is the economic environment affecting the Orthopedic surgery simulator market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Orthopedic surgery simulator market?

- What is the current and forecasted size and growth rate of the Orthopedic surgery simulator market?

- What are the key drivers of growth in the Orthopedic surgery simulator market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Orthopedic surgery simulator market?

- What are the technological advancements and innovations in the Orthopedic surgery simulator market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Orthopedic surgery simulator market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Orthopedic surgery simulator market?

- What are the products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ORTHOPEDIC SURGERY SIMULATOR MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ORTHOPEDIC SURGERY SIMULATOR MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ORTHOPEDIC SURGERY SIMULATOR MARKET OUTLOOK

- GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE, 2020-2030, (USD MILLION), (THOUSAND UNITS)

- HAPTIC SIMULATORS

- VIRTUAL REALITY (VR) SIMULATORS

- AUGMENTED REALITY (AR) SIMULATORS)

- GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION, 2020-2030, (USD MILLION), (THOUSAND UNITS)

- ARTHROSCOPY SIMULATION

- JOINT REPLACEMENT SIMULATION

- SPINE SURGERY SIMULATION

- TRAUMA SURGERY SIMULATION

- GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER, 2020-2030, (USD MILLION), (THOUSAND UNITS)

- HOSPITALS

- ORTHOPEDIC CLINICS

- ACADEMIC AND RESEARCH INSTITUTIONS AMBULATORY SURGICAL CENTERS (ASCS)

- GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY REGION, 2020-2030, (USD MILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- TOUCH SURGERY

- VIRTAMED AG

- PRECISION OS

- CAE HEALTHCARE

- OSSIMTECH

- SURGICAL SCIENCE

- 3D SYSTEMS CORPORATION

- VIRTAMED

- SIMULAB CORPORATION

- STRYKER CORPORATION

- MEDTRONIC

- ZIMMER BIOMET

- ARTHOSIM

- AXIAL3D

- VIRTAMED AG

- MIMIC TECHNOLOGIES

- OSSIM

- VOXEL-MAN

- INSIMO

- OSSIMTECH*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 2 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 4 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS)

2020-2030

TABLE 5 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 6 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY REGION (USD MILLION) 2020-2030

TABLE 8 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 10 NORTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 12 NORTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 14 NORTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 16 NORTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 17 US ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 18 US ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 US ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 20 US ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 US ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 22 US ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 24 CANADA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 26 CANADA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 28 CANADA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 30 MEXICO ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 32 MEXICO ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 34 MEXICO ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 36 SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 38 SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 40 SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 42 SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 44 BRAZIL ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 46 BRAZIL ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 48 BRAZIL ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 50 ARGENTINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 52 ARGENTINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 54 ARGENTINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 56 COLOMBIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 58 COLOMBIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 60 COLOMBIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 68 ASIA-PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 70 ASIA-PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 72 ASIA-PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 74 ASIA-PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 76 INDIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 78 INDIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 80 INDIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 82 CHINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 84 CHINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 86 CHINA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 88 JAPAN ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 90 JAPAN ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 92 JAPAN ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 94 SOUTH KOREA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 96 SOUTH KOREA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 98 SOUTH KOREA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 100 AUSTRALIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 102 AUSTRALIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 104 AUSTRALIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 118 EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 120 EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 122 EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 124 EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 126 GERMANY ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 128 GERMANY ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 130 GERMANY ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 131 UK ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 132 UK ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 UK ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 134 UK ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 135 UK ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 136 UK ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 138 FRANCE ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 140 FRANCE ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 142 FRANCE ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 144 ITALY ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 146 ITALY ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 148 ITALY ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 150 SPAIN ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 152 SPAIN ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 154 SPAIN ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 156 RUSSIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 158 RUSSIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 160 RUSSIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 162 REST OF EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 164 REST OF EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 166 REST OF EUROPE ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 175 UAE ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 176 UAE ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 177 UAE ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 178 UAE ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 179 UAE ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 180 UAE ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 182 SAUDI ARABIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 184 SAUDI ARABIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 186 SAUDI ARABIA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 188 SOUTH AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 190 SOUTH AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 192 SOUTH AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (USD MILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (USD MILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE USD

MILLION, 2020-2030

FIGURE 9 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION, USD

MILLION, 2020-2030

FIGURE 10 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER, USD MILLION,

2020-2030

FIGURE 11 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY REGION, USD MILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY PRODUCT TYPE, USD

MILLION 2022

FIGURE 14 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY APPLICATION, USD

MILLION 2022

FIGURE 15 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY END-USER, USD MILLION 2022

FIGURE 16 GLOBAL ORTHOPEDIC SURGERY SIMULATOR MARKET BY REGION, USD MILLION 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 TOUCH SURGERY: COMPANY SNAPSHOT

FIGURE 19 VIRTAMED AG: COMPANY SNAPSHOT

FIGURE 20 PRECISION OS: COMPANY SNAPSHOT

FIGURE 21 CAE HEALTHCARE: COMPANY SNAPSHOT

FIGURE 22 OSSIMTECH: COMPANY SNAPSHOT

FIGURE 23 SURGICAL SCIENCE: COMPANY SNAPSHOT

FIGURE 24 3D SYSTEMS CORPORATION: COMPANY SNAPSHOT

FIGURE 25 VIRTAMED: COMPANY SNAPSHOT

FIGURE 26 SIMULAB CORPORATION: COMPANY SNAPSHOT

FIGURE 27 STRYKER CORPORATION: COMPANY SNAPSHOT

FIGURE 28 MEDTRONIC: COMPANY SNAPSHOT

FIGURE 29 ZIMMER BIOMET: COMPANY SNAPSHOT

FIGURE 30 AXIAL3D: COMPANY SNAPSHOT

FIGURE 31 VIRTAMED AG: COMPANY SNAPSHOT

FIGURE 32 MIMIC TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 33 OSSIM: COMPANY SNAPSHOT

FIGURE 34 VOXEL-MAN: COMPANY SNAPSHOT

FIGURE 35 INSIMO: COMPANY SNAPSHOT

FAQ

The global Orthopedic Surgery Simulator market is anticipated to grow from USD 257.63 Million in 2023 to USD 685.23 Million by 2030, at a CAGR of 15.00 % during the forecast period.

North America accounted for the largest market in the Orthopedic Surgery Simulator market. North america accounted for the 38 % percent market share of the global market value.

Touch Surgery, VirtaMed AG, Precision OS, CAE Healthcare, OSSimTech, Surgical Science, 3D Systems Corporation, Virtamed, Simulab Corporation.

The integration of VR and AR technologies continues to be a prominent trend. Simulators that offer immersive virtual environments and augmented overlays for realistic surgical training experiences are gaining traction. Ongoing improvements in haptic feedback technology enhance the realism of Orthopedic surgery simulators. Surgeons can experience tactile sensations, providing a more immersive and accurate representation of surgical procedures.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.