REPORT OUTLOOK

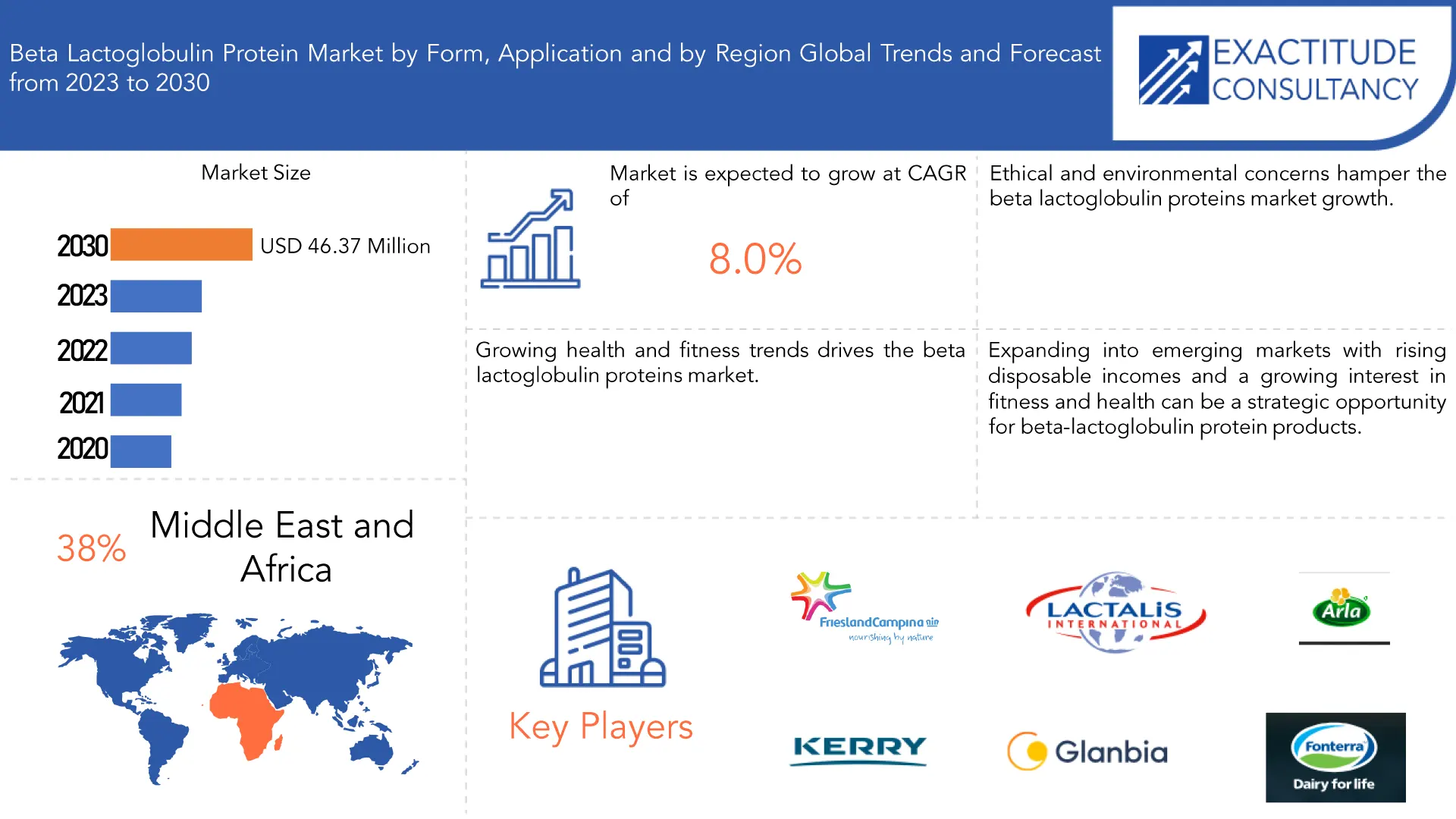

| Market Size | CAGR | Dominating Region |

|---|---|---|

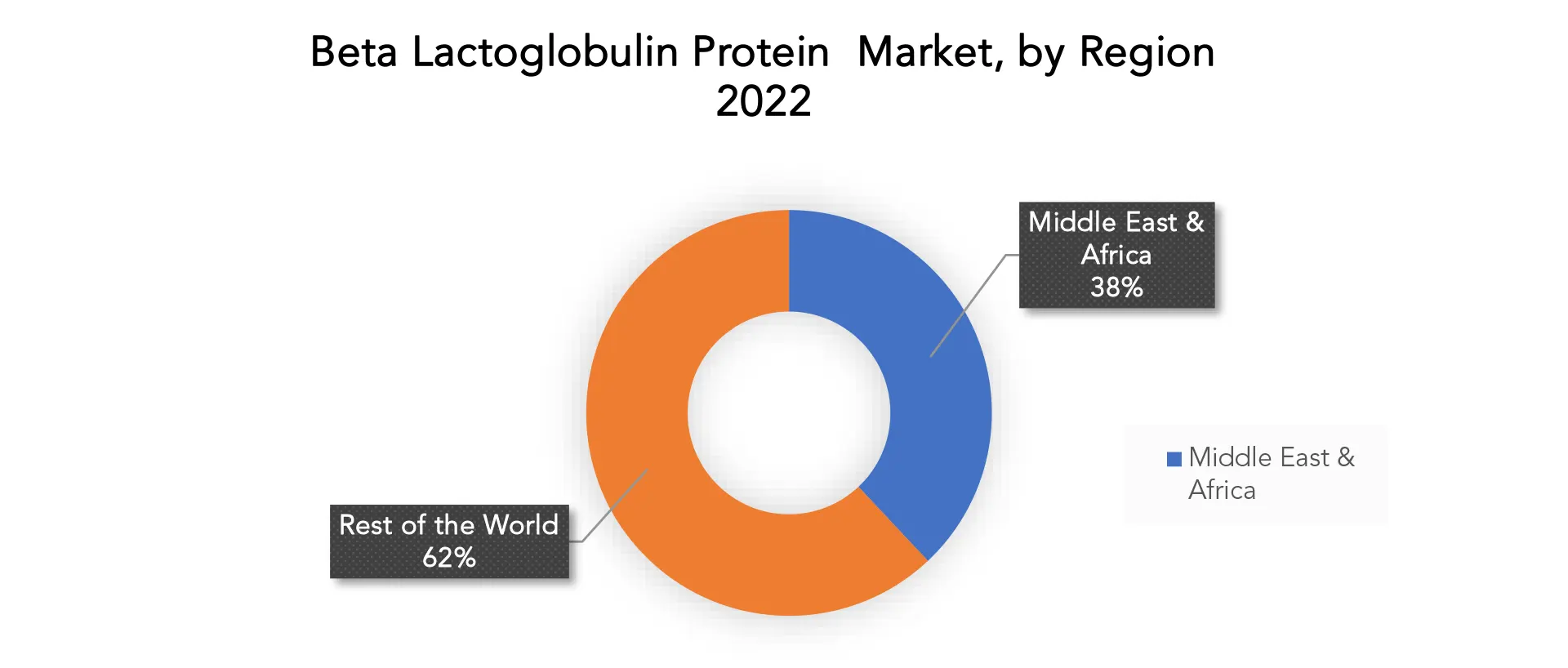

| USD 46.37 Billion by 2030 | 8.0% | Middle East and Africa |

| by Form | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Market Overview

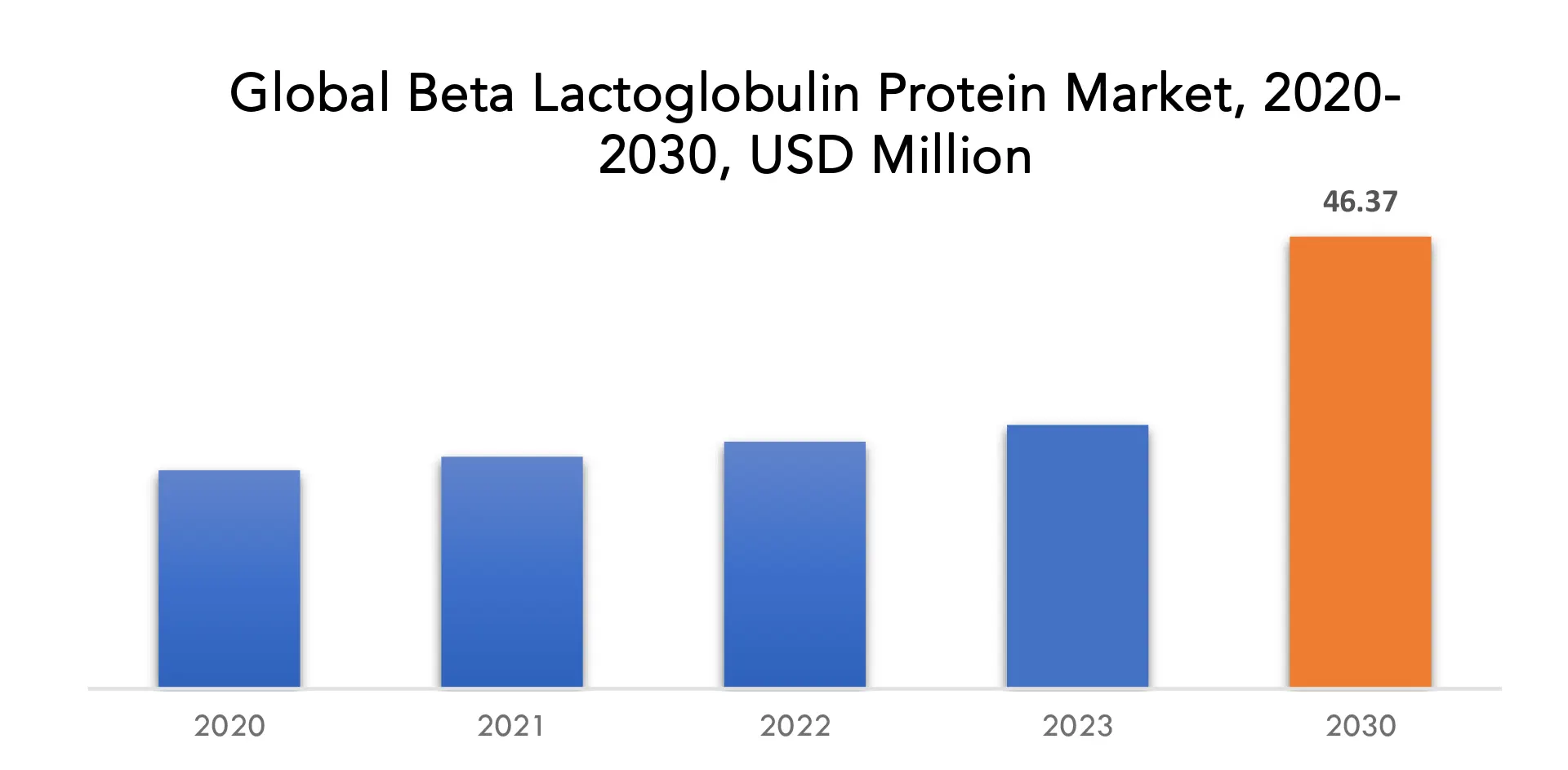

The global beta lactoglobulin protein market is anticipated to grow from USD 27.06 Billion in 2023 to USD 46.37 Billion by 2030, at a CAGR of 8.0% during the forecast period.

Beta-lactoglobulin is a globular protein that belongs to the lipocalin protein family. It is primarily found in the milk of mammals, especially in the milk of cows. Beta-lactoglobulin is of particular interest because it is one of the major Protein found in whey protein, a byproduct of cheese production, and it has important nutritional and functional properties. Beta-lactoglobulin can trap air when whipped, creating stable foams. This property is important in the production of products like whipped cream, meringues, and some desserts, where aeration is desired. Under certain conditions, beta-lactoglobulin can form gels. This property is used in the production of gelled dairy products like yogurt and some cheese varieties. It contributes to the texture and structure of these products. Beta-lactoglobulin is used in nutritional supplements, particularly in protein powders and shakes. It provides a concentrated source of protein, making it easier for people to meet their protein intake goals. It is used in the pharmaceutical industry for drug formulations, especially for protein-based drugs. The protein’s stability and compatibility with drug delivery systems are advantageous in this context.

There is a rising global demand for protein-rich foods and supplements. Beta-lactoglobulin, as a high-quality protein source, is sought after by consumers looking to meet their protein intake goals. This demand is determined by a increasing awareness of the health benefits of protein consumption. Beta-lactoglobulin has a wide range of applications, counting in the food and beverage industry, pharmaceuticals, cosmetics, and biotechnology. Its versatility and functional properties make it valuable in various sectors, contributing to its market growth. Beta-lactoglobulin can be added to a wide range of food and beverage products for fortification, enhancing their nutritional profiles. It permits manufacturers to create convenient and nutritious options that cater to consumers’ busy lifestyles. Advances in food processing and biotechnology have made it easier to extract and incorporate beta-lactoglobulin into various products, growing its usability and market presence.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Form, by Application and By Region |

| By Form |

|

| By Application |

|

| By Region

|

|

Beta lactoglobulin Protein Market Segmentation Analysis

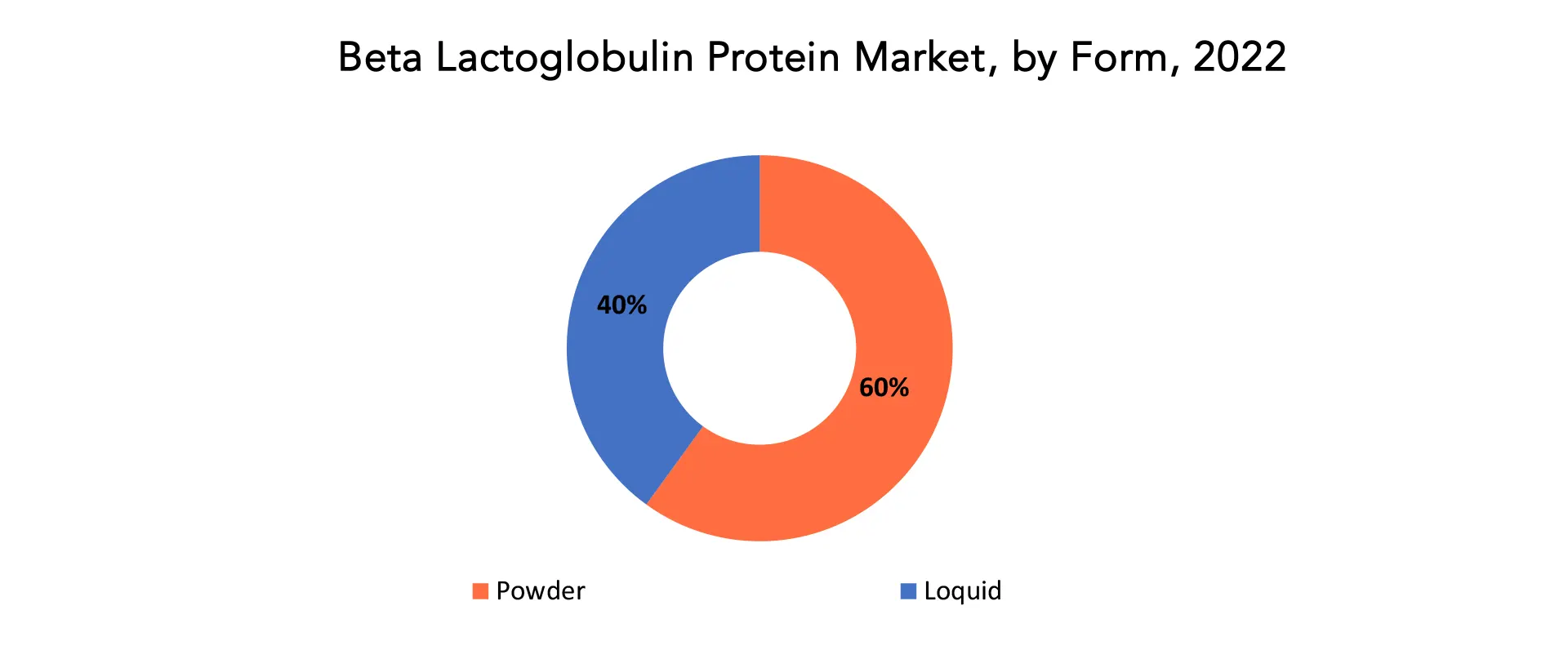

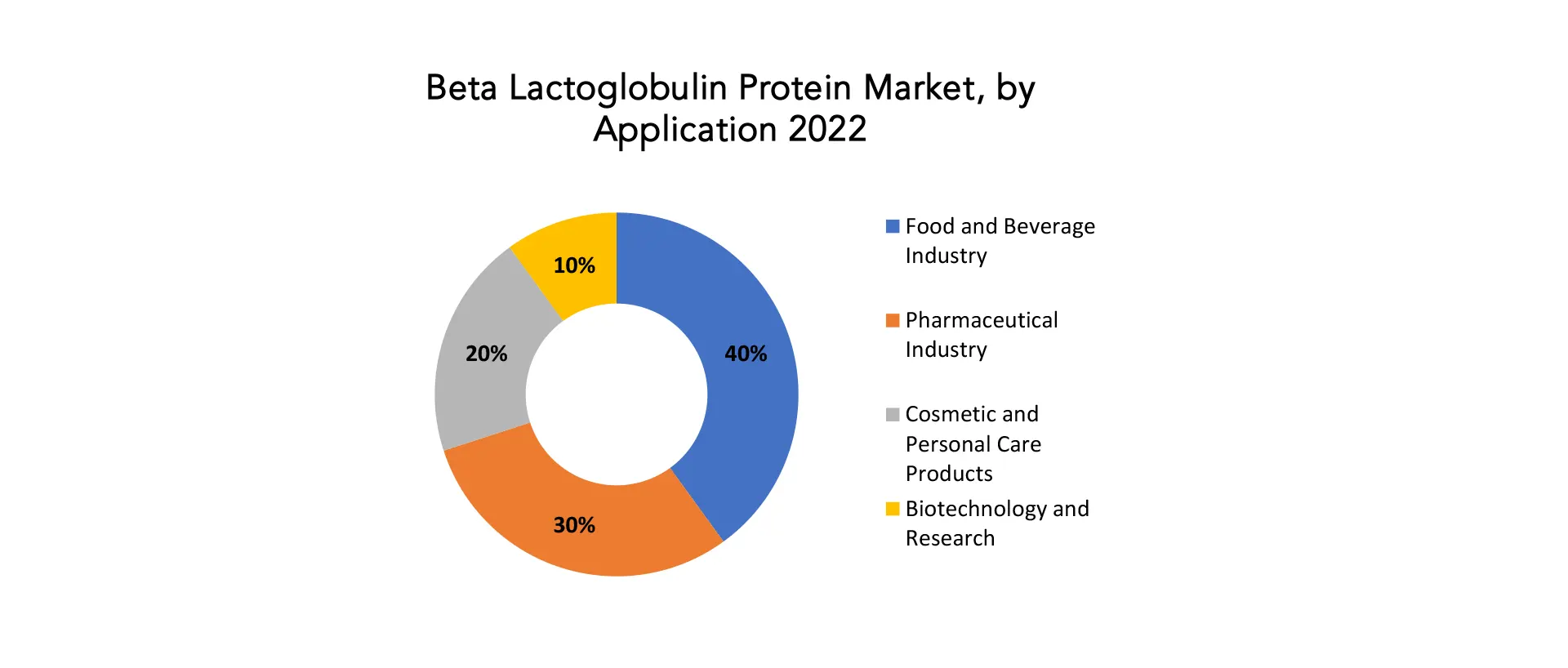

The global Beta lactoglobulin protein market is divided into 3 segments. by form the market is bifurcated into Powder, Liquid. by application the market Food and Beverage Industry, Pharmaceutical Industry, Cosmetic and Personal Care Products, Biotechnology and Research.

Based on form powder segment dominating in the Beta lactoglobulin protein market. Beta-lactoglobulin protein, like many other Protein, is often unbalanced in liquid form due to factors like enzymatic activity, oxidation, and microbial growth. The powder form of beta-lactoglobulin can have an stretched shelf life compared to liquid forms. This extended shelf life is beneficial for manufacturers and suppliers, as it reduces the risk of spoilage or product wastage. Manufacturers can easily customize the concentration and invention of beta-lactoglobulin in powder form to meet specific product requirements. This flexibility in customization allows them to target different market segments and consumer preferences. Powdered beta-lactoglobulin is often more convenient for consumers. They can easily measure and mix the desired amount of protein into their beverages or recipes, providing greater control over protein intake.

Based on application Food and Beverage Industry segment dominating in the Beta lactoglobulin protein market. Due to expanding consumer interest in health and wellbeing, the food and beverage industry has experienced an increase in the demand for products with added protein. A high-quality protein source known as beta-lactoglobulin is regularly used to fortify a variety of goods, including dairy, baked goods, snacks, and beverages. It helps consumers who want to eat more protein satisfy their nutritional demands. Beta-lactoglobulin has versatile functional properties, including emulsification, foaming, and gelling. These properties make it valued in a variety of food and beverage applications, such as improving texture, mouthfeel, and stability. It is commonly used in the production of products like protein bars, protein-enriched drinks, and dairy items. The food and beverage industry are a global market with a wide range of products that can advantage from the inclusion of beta-lactoglobulin. Its presence in various food and beverage categories allows it to have a significant impact on the overall market.

Beta lactoglobulin Protein Market Trends

- Consumers were showing a preference for clean label products with natural and transparent ingredients. Companies were responding by promoting beta-lactoglobulin as a naturally derived protein source.

- Ongoing research into the functional and nutritional properties of beta-lactoglobulin was driving innovation in product development. Researchers were exploring new applications and benefits of this protein, contributing to its market growth.

- Given that beta-lactoglobulin is an allergenic protein, there was a growing demand for allergen-free protein sources. Companies were developing and marketing alternative protein options for individuals with food allergies.

- As disposable incomes rose in emerging markets, there was an opportunity for beta-lactoglobulin protein products to expand internationally. The demand for health and wellness products was on the rise in many developing regions.

- The development of clean meat and cell-based Protein was emerging as a potential disruptive technology. This trend had the potential to impact traditional protein markets, including those involving beta-lactoglobulin.

Competitive Landscape

The competitive landscape of the beta-lactoglobulin Protein market featured several key players, including both established companies and newer entrants. This landscape may have evolved since then, but here is an overview of some prominent companies involved in the production and distribution of beta-lactoglobulin Protein:

- Fonterra Co-operative Group Limited

- Arla Foods

- Lactalis Group

- Glanbia Plc

- Saputo Inc.

- Kerry Group

- FrieslandCampina

- Hilmar Ingredients

- Agropur

- Firmus Group

- Davisco Foods International, Inc.

- Sachsenmilch Leppersdorf GmbH

- Hoogwegt Group

- Carbery Group

- Leprino Foods

- DMK Group

- Wheyco GmbH

- Milk Specialties Global

- Armor Proteines

- Molkerei MEGGLE Wasserburg GmbH & Co. KG

Regional Analysis

Middle east and africa accounted for the largest market in the Beta lactoglobulin protein market. Middle east and africa accounted for the 38 % market share of the global market value. Like many other regions, the Middle East and Africa have witnessed an upsurge in the significance of health and wellness. This trend has increased consumer interest in protein supplements and functional foods, creating new market opportunities for protein subunits like beta-lactoglobulin. Rapid population growth and urbanization have increased the demand for convenient and nutritious food products. Beta-lactoglobulin can be used in various applications to meet this demand. The Middle East has seen an increasing interest in fitness and sports nutrition, with a demand for protein supplements. Beta-lactoglobulin is a key ingredient in protein supplements used by athletes and fitness enthusiasts.

Some countries in the Middle East and Africa have been capitalizing in their dairy industries, which could lead to an increase in the production and use of dairy Protein like beta-lactoglobulin. The food and beverage industry in the Middle East and Africa has been growing to meet the diverse preferences of consumers. Beta-lactoglobulin can be used in various products, including dairy-based and non-dairy-based options.

Target Audience for Beta lactoglobulin Protein Market

- Food and Beverage Manufacturers

- Nutritional Supplement Manufacturers

- Pharmaceutical Companies

- Dairy and Dairy Processing Companies

- Ingredient Suppliers and Distributors

- Research and Development (R&D) Professionals

- Regulatory Authorities

- Nutritionists and Dietitians

- Health and Fitness Industry Professionals

- Retailers and Distributors

- Consumers

- Startups and Entrepreneurs

- Academic and Educational Institutions

- This list represents the key stakeholders and pr

Import & Export Data for Beta lactoglobulin Protein Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Beta lactoglobulin Protein market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Area Scan Camera Market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the Beta Lactoglobulin Protein Market Report

Beta Lactoglobulin Protein Market by Form 2020-2030, USD Million, (Kilotons)

- Powder

- Liquid

Beta Lactoglobulin Protein Market by Application 2020-2030, USD Million, (Kilotons)

- Food and Beverage Industry

- Pharmaceutical Industry

- Cosmetic and Personal Care Products

- Biotechnology and Research

Beta lactoglobulin Protein Market by Region 2020-2030, USD Million, (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the beta lactoglobulin protein market over the next 7 years?

- Who are the major players in the beta lactoglobulin protein market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, the middle east, and africa?

- How is the economic environment affecting the beta lactoglobulin protein market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the beta lactoglobulin protein market?

- What is the current and forecasted size and growth rate of the beta lactoglobulin protein market?

- What are the key drivers of growth in the beta lactoglobulin protein market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the beta lactoglobulin protein market?

- What are the technological advancements and innovations in the beta lactoglobulin protein market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the beta lactoglobulin protein market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the beta lactoglobulin protein market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- BETA LACTOGLOBULIN PROTEIN MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BETA LACTOGLOBULIN PROTEIN MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- BETA LACTOGLOBULIN PROTEIN MARKET OUTLOOK

- GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY FORM, 2020-2030, (USD MILLION) (THOUSAND UNITS)

- POWDER

- LIQUID

- GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION, 2020-2030, (USD MILLION) (THOUSAND UNITS)

- FOOD AND BEVERAGE INDUSTRY

- PHARMACEUTICAL INDUSTRY

- COSMETIC AND PERSONAL CARE PRODUCTS

- BIOTECHNOLOGY AND RESEARCH

- GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY REGION, 2020-2030, (USD MILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, FORMS OFFERED, RECENT DEVELOPMENTS)

- FONTERRA CO-OPERATIVE GROUP LIMITED

- ARLA FOODS

- LACTALIS GROUP

- GLANBIA PLC

- SAPUTO INC.

- KERRY GROUP

- FRIESLANDCAMPINA

- HILMAR INGREDIENTS

- AGROPUR

- FIRMUS GROUP

- DAVISCO FOODS INTERNATIONAL, INC.

- SACHSENMILCH LEPPERSDORF GMBH

- HOOGWEGT GROUP

- CARBERY GROUP

- LEPRINO FOODS

- DMK GROUP

- WHEYCO GMBH

- MILK SPECIALTIES GLOBAL

- ARMOR PROTEINES

- MOLKEREI MEGGLE WASSERBURG GMBH & CO. KG

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 2 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 3 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 4 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 5 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY REGION (USD MILLION) 2020-2030

TABLE 6 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY REGION (KILOTONS) 2020-2030

TABLE 7 NORTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (USD MILLION)

2020-2030

TABLE 8 NORTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (KILOTONS)

2020-2030

TABLE 9 NORTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 10 NORTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 11 NORTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 12 NORTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 13 US BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 14 US BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 15 US BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 16 US BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 17 CANADA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 18 CANADA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 19 CANADA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 20 CANADA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 21 MEXICO BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 22 MEXICO BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 23 MEXICO BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 24 MEXICO BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 25 SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 26 SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 27 SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 28 SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 29 SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 30 SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 31 BRAZIL BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 32 BRAZIL BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 33 BRAZIL BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 34 BRAZIL BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 35 ARGENTINA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 36 ARGENTINA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 37 ARGENTINA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 38 ARGENTINA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 39 COLOMBIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 40 COLOMBIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 41 COLOMBIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 42 COLOMBIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 47 ASIA-PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 48 ASIA-PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 49 ASIA-PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 50 ASIA-PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 51 ASIA-PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 52 ASIA-PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 53 INDIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 54 INDIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 55 INDIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 56 INDIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 57 CHINA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 58 CHINA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 59 CHINA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 60 CHINA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 61 JAPAN BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 62 JAPAN BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 63 JAPAN BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 64 JAPAN BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 65 SOUTH KOREA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 66 SOUTH KOREA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 67 SOUTH KOREA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 68 SOUTH KOREA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 69 AUSTRALIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 70 AUSTRALIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 71 AUSTRALIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 72 AUSTRALIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 73 SOUTH-EAST ASIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 75 SOUTH-EAST ASIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 81 EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 82 EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 83 EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 84 EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 85 EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 86 EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 87 GERMANY BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 88 GERMANY BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 89 GERMANY BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 90 GERMANY BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 91 UK BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 92 UK BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 93 UK BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 94 UK BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 95 FRANCE BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 96 FRANCE BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 97 FRANCE BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 98 FRANCE BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 99 ITALY BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 100 ITALY BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 101 ITALY BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 102 ITALY BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 103 SPAIN BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 104 SPAIN BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 105 SPAIN BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 106 SPAIN BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 107 RUSSIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 108 RUSSIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 109 RUSSIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 110 RUSSIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 111 REST OF EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 112 REST OF EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 113 REST OF EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 114 REST OF EUROPE BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 121 UAE BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 122 UAE BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 123 UAE BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 124 UAE BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 125 SAUDI ARABIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 126 SAUDI ARABIA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 127 SAUDI ARABIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 128 SAUDI ARABIA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 129 SOUTH AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 130 SOUTH AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 131 SOUTH AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 132 SOUTH AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (USD MILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA BETA LACTOGLOBULIN PROTEIN MARKET BY FORM (KILOTONS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION USD MILLION, 2020-2030

FIGURE 9 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY FORM, USD MILLION, 2020-2030

FIGURE 10 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY REGION, USD MILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY APPLICATION, USD MILLION 2022

FIGURE 13 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY FORM, USD MILLION 2022

FIGURE 14 GLOBAL BETA LACTOGLOBULIN PROTEIN MARKET BY REGION, USD MILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 FONTERRA CO-OPERATIVE GROUP LIMITED: COMPANY SNAPSHOT

FIGURE 17 ARLA FOODS: COMPANY SNAPSHOT

FIGURE 18 LACTALIS GROUP: COMPANY SNAPSHOT

FIGURE 19 GLANBIA PLC: COMPANY SNAPSHOT

FIGURE 20 KERRY GROUP: COMPANY SNAPSHOT

FIGURE 21 FRIESLANDCAMPINA: COMPANY SNAPSHOT

FIGURE 22 HILMAR INGREDIENTS: COMPANY SNAPSHOT

FIGURE 23 AGROPUR: ‘COMPANY SNAPSHOT

FIGURE 24 FIRMUS GROUP: COMPANY SNAPSHOT

FIGURE 25 DAVISCO FOODS INTERNATIONAL, INC.: COMPANY SNAPSHOT

FIGURE 26 SACHSENMILCH LEPPERSDORF GMBH: COMPANY SNAPSHOT

FIGURE 27 HOOGWEGT GROUP: COMPANY SNAPSHOT

FIGURE 28 CARBERY GROUP: COMPANY SNAPSHOT

FIGURE 29 LEPRINO FOODS: COMPANY SNAPSHOT

FIGURE 30 DMK GROUP: COMPANY SNAPSHOT

FIGURE 31 WHEYCO GMBH: COMPANY SNAPSHOT

FIGURE 32 MILK SPECIALTIES GLOBAL: COMPANY SNAPSHOT

FIGURE 33 ARMOR PROTEINES: COMPANY SNAPSHOT

FAQ

The global Beta lactoglobulin protein market is anticipated to grow from USD 27.06 Billion in 2023 to USD 46.37 Billion by 2030, at a CAGR of 8.0% during the forecast period.

Middle East and Africa accounted for the largest market in the Beta lactoglobulin protein market. Middle east and africa accounted for the 38 % percent market share of the global market value.

Fonterra Co-operative Group Limited, Arla Foods, Lactalis Group, Glanbia Plc, Saputo Inc., Kerry Group, FrieslandCampina, Hilmar Ingredients, Agropur, Firms Group

Growing Health and Wellness Trends, Plant-Based Alternatives, Customized and Personalized Nutrition, International Expansion this factor will creates kore Opportunties in the Beta lactoglobulin Protein market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.