REPORT OUTLOOK

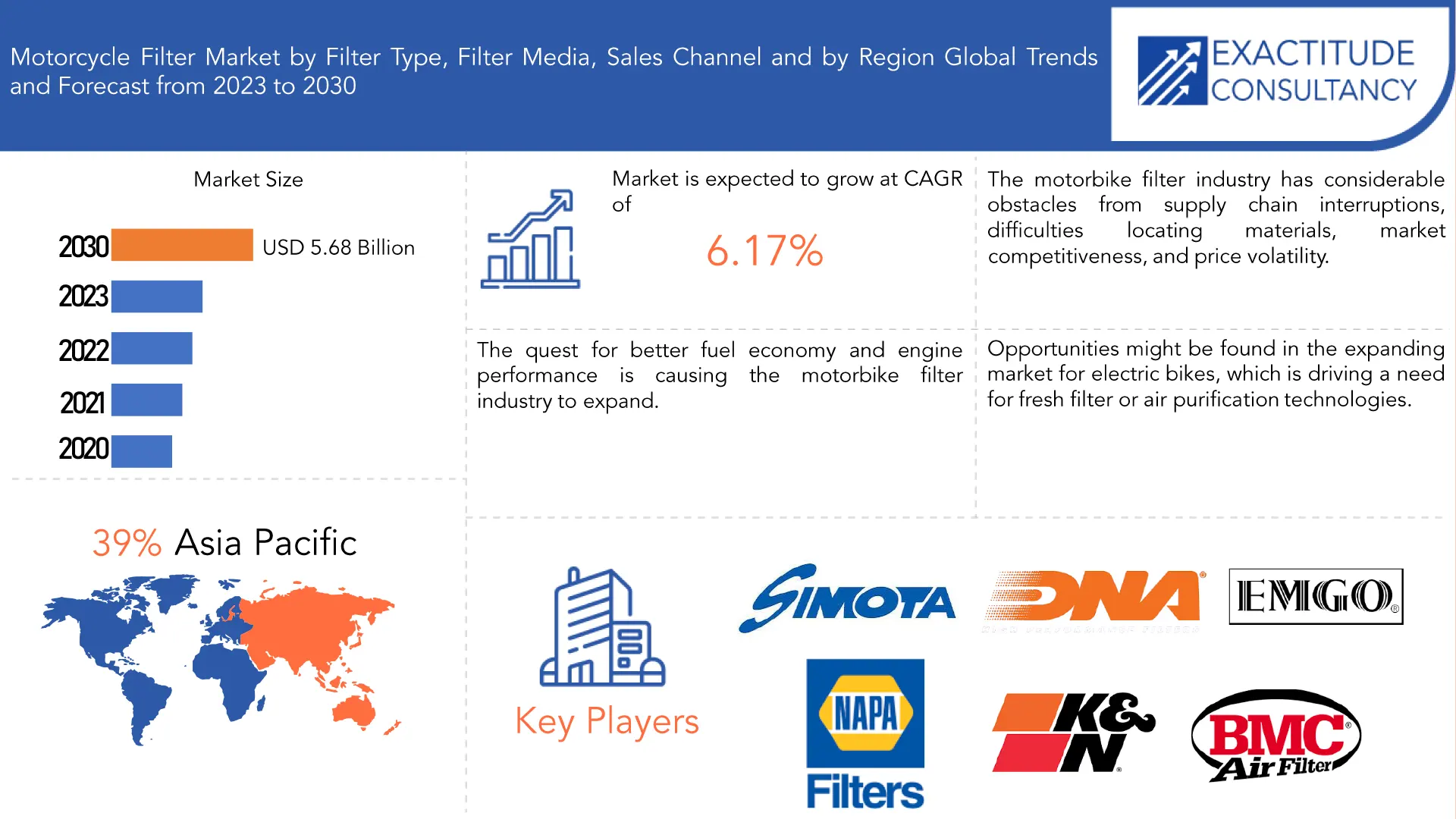

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 5.68 Billion by 2030 | 6.17% | Asia Pacific |

| by Filter Type | by Filter Media | by Sales Channel |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Motorcycle Filter Market Overview

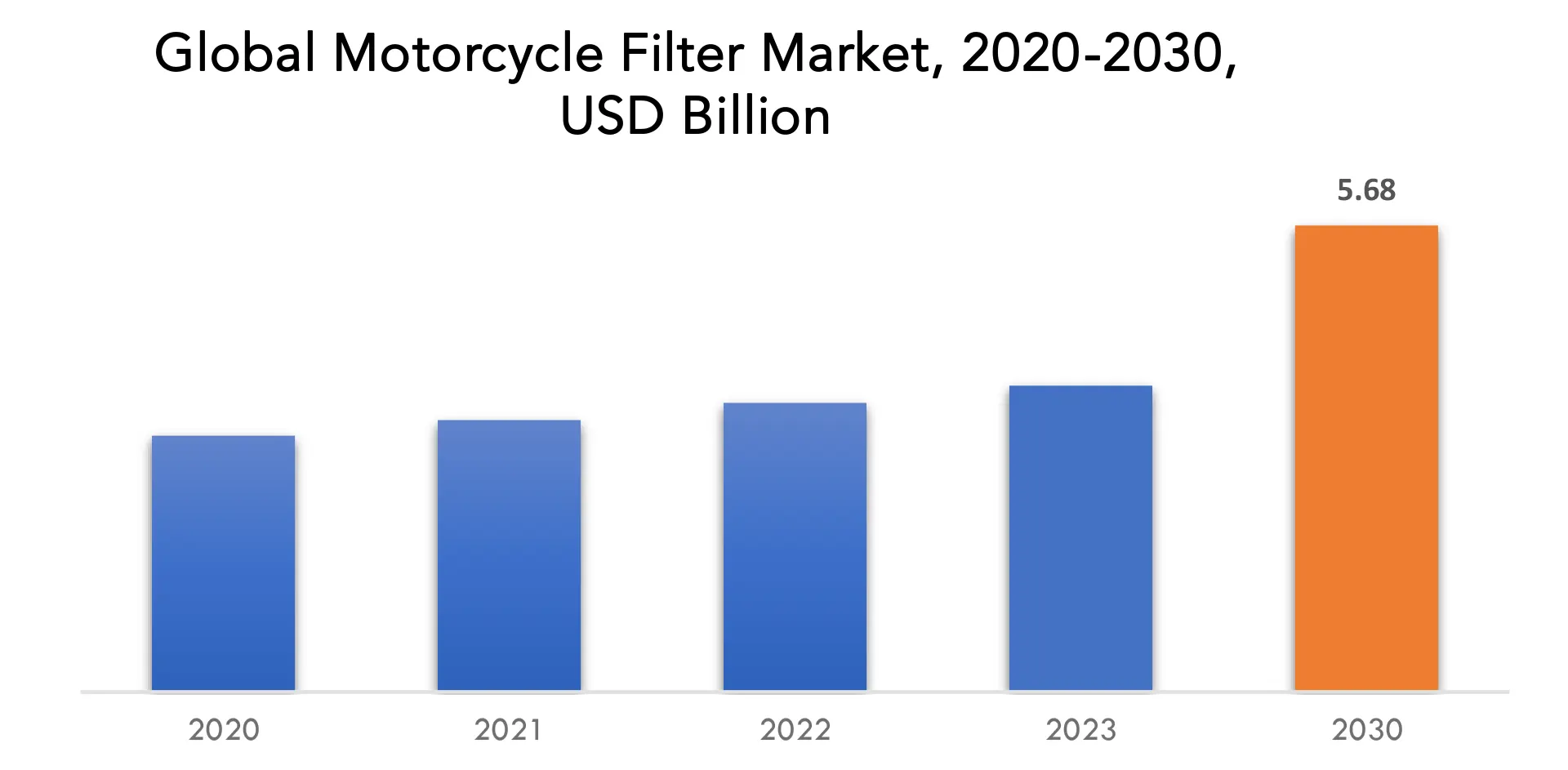

The global motorcycle filter market is anticipated to grow from USD 3.73 Billion in 2023 to USD 5.68 Billion by 2030, at a CAGR of 6.17% during the forecast period.

A motorbike filter is a device that cleans the motorcycle’s engine oil, fuel and air of contaminants. This protects the engine and extends its life. Cotton, foam and paper are popular building materials for motorcycle filters. Depending on the filter type, they can be found in a variety of locations all over the motorbike. For instance, the fuel filter is found in the fuel line, but the air filter is found in the air intake system. According to the manufacturer’s instructions, motorcycle filters frequently need to be updated. By doing this, you can make certain the motorcycle’s engine is operating properly and that the emissions of carbon dioxide are of as little as they may be.

The market for motorcycle-specific filters, including those for air, oil, petrol and other fluids, is referred to as the motorbike filter market. The motorbike filter market has been progressively growing in recent years due to a number of factors. The increasing number of motorbikes on the road, which is a result of urbanization, rising disposable incomes, and changing consumer preferences, is one important factor. Additionally, the popularity of motorbikes as a mode of transportation and recreation has supported market growth. Filters are necessary for motorcycles to run efficiently and endure a long time. Filters help to remove particles and contaminants that might harm the engine, reduce performance, and increase maintenance costs. Periodical filter is used to ensure smooth functioning.

In the engine of any car, including motorbikes, filters perform a critical role. Any lubricating oil that circulates within an engine picks up dirt particles of all shapes and sizes that are bad for the engine. Filters are employed to remove these pollutants from the engine oil and shield the engine from other forms of contamination. This makes sure the engine runs smoothly, removing dirt from the engine and extending the engine’s life. As the oil filter removes the filth from the engine oil, filters also aid in lowering the air pollution produced by motorbike exhaust. This enables the motorbike to meet and maintain emission standards.

Particularly in the aftermarket area, consumers were displaying an increasing interest in high-quality and high-performance filters. They were looking for filters that would boost motorbike performance all around and increase engine economy while extending engine life. It was anticipated that filter technology will continue to evolve, with an emphasis on improved filtration effectiveness, less environmental impact, and higher durability. To keep up with these changing technical needs, manufacturers were likely to make research and development investments. Challenges included the availability of fake goods on the market, which may have an influence on customer safety and confidence. Market dynamics may also be impacted by economic alterations and interruptions brought on by situations like the COVID-19 pandemic.

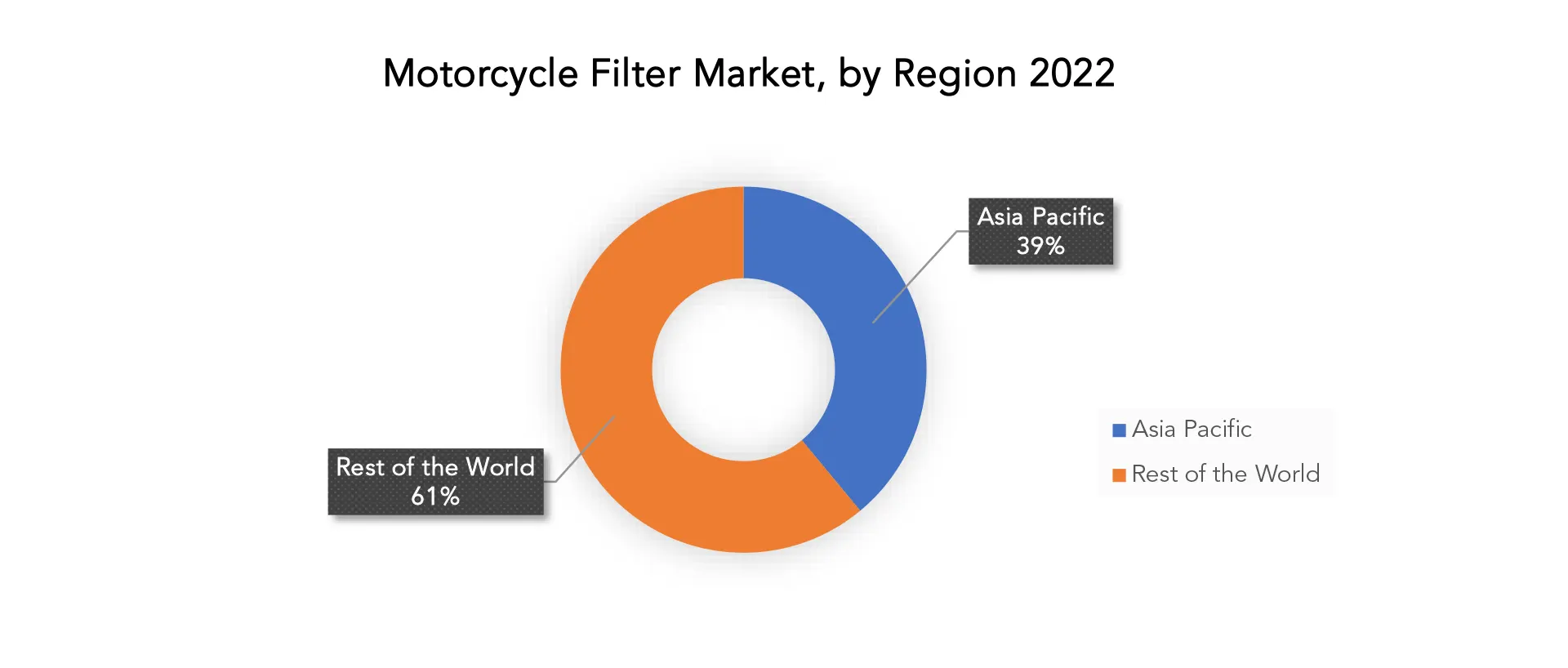

Due to its significant manufacturing and consumption of motorcycles, Asia-Pacific dominates the world’s motorcycle filter industry. Motorcycles are a popular form of transit and leisure vehicle in North America, Europe, and Latin America, which are additional key markets. Due to the rising demand for motorbikes and the significance of filters in preserving their performance, the motorcycle filter market is steadily expanding. Air filters, oil filters, and fuel filters are the three primary product categories in this highly competitive sector. The Asia-Pacific region leads the market, followed by North America, Europe, and Latin America.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Filter Type, By Filter Media, By Sales Channel and By Region |

| By Filter Type |

|

| By Filter Media |

|

| By Sales Channel |

|

| By Region

|

|

Motorcycle Filters Market Segmentation Analysis

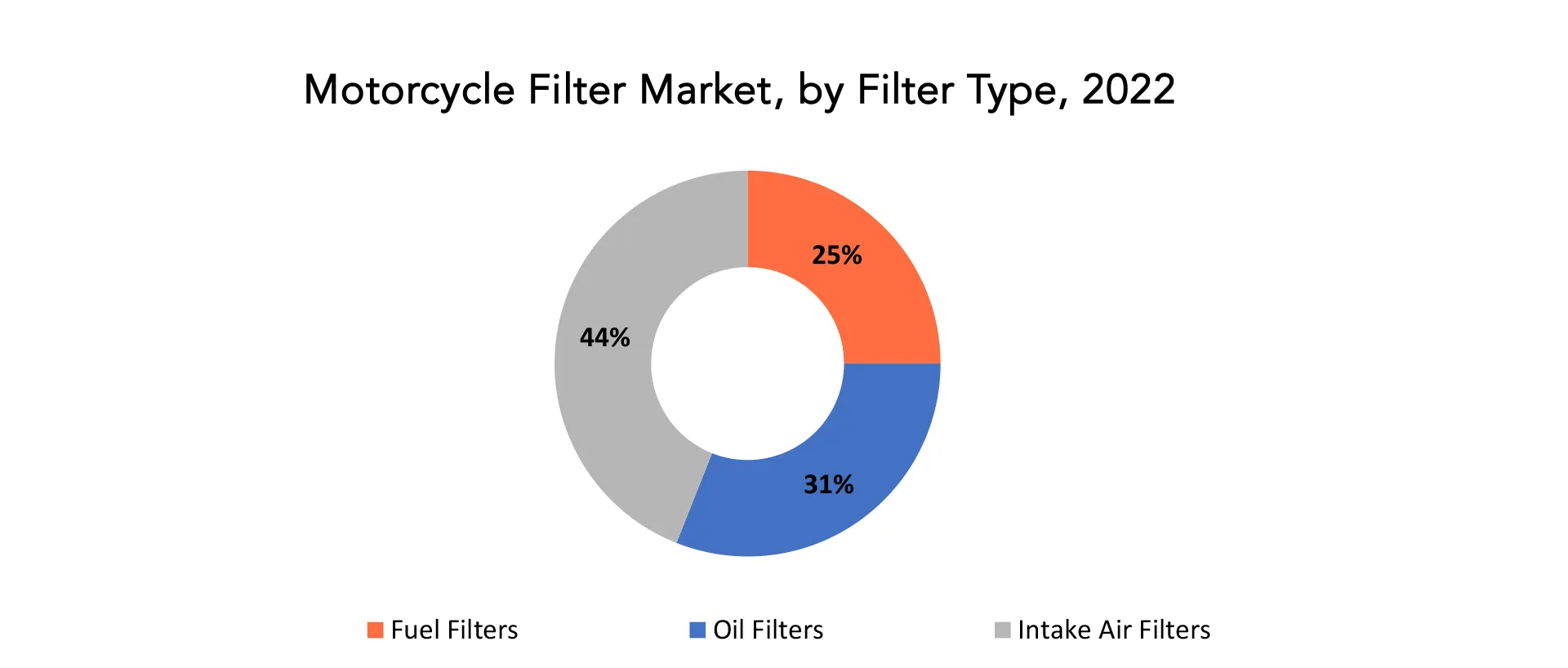

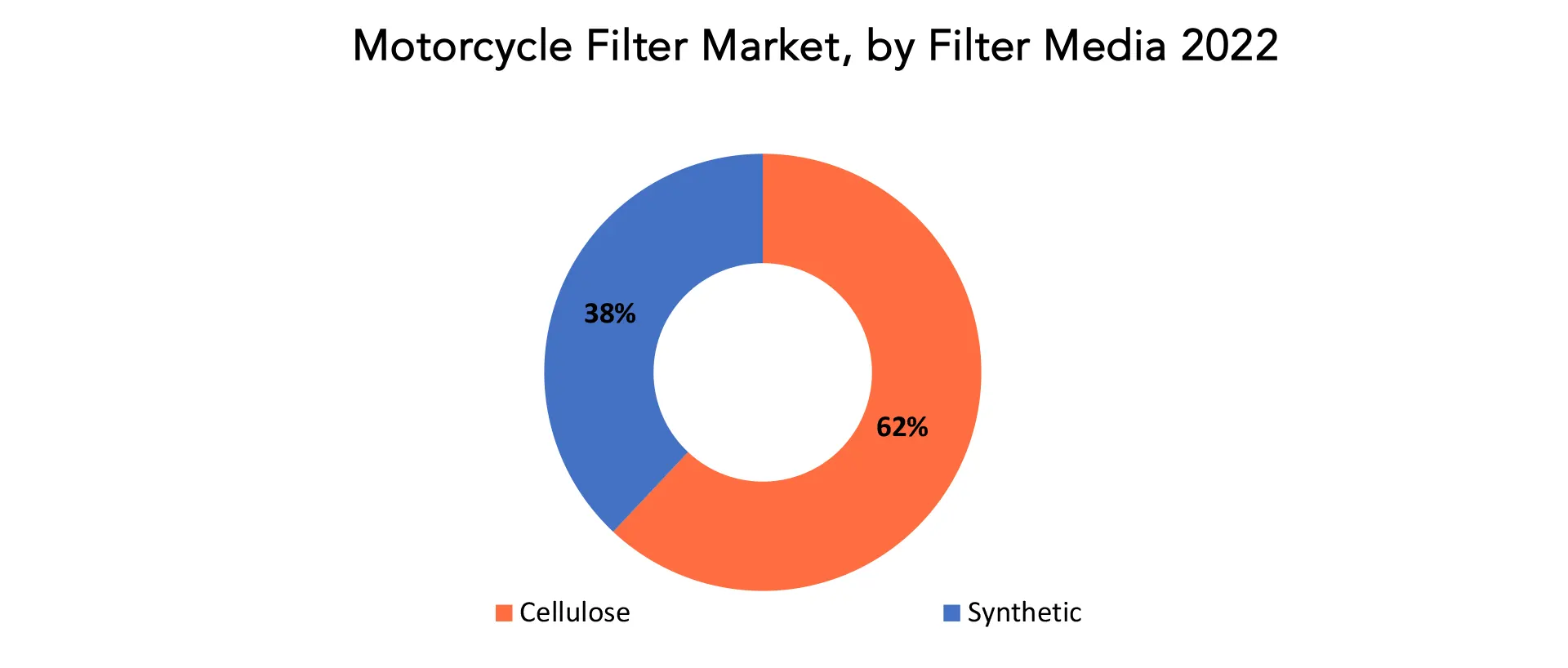

The four segments that make up the worldwide motorcycle filter market are filter type, filter media, sales channel, and geography. The motorcycle filter market is segmented into three categories based on filter type: fuel filters, oil filters, and intake air filters. The market is segmented into cellulose and synthetic filter media. The market is classified into OEMs, OESs, and IAMs based on the sales channel.

The motorcycle filter industry is dominated by intake air filters, with oil filters and fuel filters coming in second and third. The purpose of intake air filters is to filter out impurities like dust, pollen, and debris before they reach the motorcycle’s engine. Intake air filters are essential for preserving engine performance, improving fuel combustion, and extending engine life because they provide clean and filtered air intake. To fulfil strict performance requirements and adhere to pollution rules, manufacturers concentrate on filtration efficiency improvement and airflow optimization, enabling a healthier and more effective motorcycle engine operating. To meet the changing needs of motorbike enthusiasts and take into account environmental concerns, this market sector sees constant innovation and technical developments.

Oil filters purge the engine oil of debris, metal, and dirt. This aids in preventing wear and tear on the engine’s parts. The manufacturer’s instructions should be followed on how frequently oil filters need to be replaced. Before the gasoline reaches the engine, fuel filters remove impurities like water and dirt. By doing this, the fuel injectors and other engine parts are better shielded from harm. Continually change fuel filters in accordance with the manufacturer’s instructions.

Historically, one of the most popular and economical solutions utilized in motorcycle filters has been cellulose filter material. Cellulose filters frequently made up a sizeable share of the market, typically between 60% and 70% or more. For many motorcycle applications, this medium works well at trapping bigger particles and providing appropriate filtration. The most popular kind of filter material for motorcycles is cellulose. They are reasonably priced and made of cotton or paper. Although cellulose filters are efficient at collecting impurities from engine oil, air, and gasoline, they require more frequent replacement than synthetic filters.

Since synthetic filter media outperforms cellulose in terms of filtering effectiveness and performance, it has been gaining popularity. Synthetic filter media’s market share was rising gradually, frequently hovering between 30% and 40% or more. Better airflow, durability, and filtration are all features of synthetic filters, which increase engine efficiency. Foam or polyester are examples of materials used to make synthetic filters. They last longer than cellulose filters and require less replacement time. Additionally, synthetic filters outperform cellulose filters in terms of performance and filtering. However, they also cost more money.

Motorcycle Filters Market Dynamics

Driver

Motorcycle filters need to be effective due to rising environmental concerns and government rules requiring fewer emissions.

Motorcycle filters are extremely important in view of the growing environmental concerns and the stricter government rules meant to reduce emissions. When it comes to removing and reducing dangerous particles from the air that enters the motorbike engine, these filters must be quite effective. They so provide a major contribution to lowering emissions and assuring adherence to emission requirements. An effective motorbike filter contributes to maintaining ideal engine combustion, which improves performance and reduces the number of pollutants released into the environment. Filter technologies are always being improved by manufacturers in order to increase filtration effectiveness and keep these filters at the forefront of emission control techniques. Effective motorcycle filters are essential for reducing the environmental impact of motorbikes and promoting a cleaner environment, as motorcycles are recognized as important contributors of air pollution.

Restraint

It is difficult for producers to keep up with the quick speed of technical breakthroughs and incorporate this technology into motorbike filters.

Motorcycle filter manufacturers have a substantial problem as a result of the quick speed of technical progress. It takes significant expenditures in research and development to keep up with the quickly developing technology, such as improvements in filtration materials, design, and effectiveness. To include these advancements while maintaining cost effectiveness and competitive pricing, manufacturers must continually change their manufacturing methods. Additionally, this effort is made more difficult by the requirement to maintain compliance with evolving regulatory standards. Innovation, quality, and pricing must all be balanced to meet client expectations. Small and medium-sized businesses usually struggle to integrate cutting-edge technologies rapidly due to resource limitations. Collaboration and partnerships with research organizations and technology firms are essential if one wants to stay on the cutting edge of advancements. having a long-term outlook, a strategic approach, and a dedication to making investments in both sophisticated technology skills and human resources.

Opportunities

Customer desire for specialized, high-performance filters opens doors for filter makers.

The growing customer demand for specialized, high-performance motorbike filters offers filter makers a substantial potential. In order to maximize the performance of their motorbike, riders nowadays look for higher engine efficiency, more airflow, and superior filtration. In order to satisfy these needs and serve a wide range of customers, customized filters are created for certain motorbike kinds, riding styles, and climatic circumstances. In order to address these particular expectations, this trend enables filter manufacturers to innovate and create cutting-edge filter technologies, which promotes consumer happiness and brand loyalty. High-performance filters also frequently improve fuel economy and minimize emissions, which is in line with environmental concerns and legal requirements. Manufacturers may take advantage of this need to distinguish their goods from the competition, forge competitive advantages, and build a robust market presence. Building a product range that prioritizes innovation, performance, and durability to thrive in a competitive marketplace driven by evolving customer preferences.

Motorcycle Filters Market Trends

- Growing need for synthetic filters: Compared to conventional paper filters, synthetic filters are more dependable and perform better. As a result, the market for motorcycle filters is experiencing an increase in demand for synthetic filters.

- The creation of “smart filters”: These filters have sensors built in to check their condition and notify riders when they need to change them. In the upcoming years, this is anticipated to substantially increase the need for motorbike filters.

- Sustainability is becoming more of a focus: Motorcycle filter producers are putting more and more effort into creating sustainable filters. For instance, some producers are creating filters that are compostable or produced from recycled materials. In the upcoming years, this is anticipated to be a major development in the motorbike filter industry.

- Global demand for motorbikes is rising as a result of its accessibility, affordability, and efficiency in terms of fuel use. The need for motorbike filters is also being driven by this.

- The necessity of motorcycle maintenance, particularly the frequent replacement of filters, is becoming more and more recognized by consumers. This is also assisting in the market for motorbike filters expanding.

- Governments from all around the world have started enforcing strict emission standards for motorbikes. This is encouraging the creation of more sophisticated motorbike filters that can aid in the reduction of emissions.

Competitive Landscape

The competitive landscape of the motorcycle filter market was dynamic, with several prominent companies competing to provide innovative and advanced motorcycle filter solutions.

- NAPA Filters

- SIMOTA

- Mann+Hummel

- Pipercross Performance Filters

- K & N Engineering Inc.

- BMC Srl

- Uni Filter Inc.

- Roki Co. Ltd.

- Solat International Trading Co. Ltd.

- MAHLE GmbH

- BMC

- Champion

- DNA Filter

- EBC Brakes

- Emgo

- Feuling

- Kuryakyn

- MRA

- Rizoma

Recent Developments:

September 5, 2023 – In order to successfully protect individuals from these minute contaminants, MANN+HUMMEL has created HEPA filtration systems. HEPA, which stands for High Efficiency Particulate Air, is the acronym. Since it is not a protected term, more caution needs to be taken.

August 16 2023 – With the benefits of its benchmark SCT and MCT electric motors combined, MAHLE has created a new technology kit for electric motors. The “perfect motor” combines constant high peak power, wear-free, contactless power gearbox, no rare earths, and maximum efficiency.

Regional Analysis

With more than 39% of the worldwide motorbike filter market, Asia Pacific is the region with the largest market. This is a result of the substantial manufacture and sales of motorbikes in nations like Indonesia, Japan, China, and India. The majority of Asian nations have sizable middle-class populations, and motorbike use is primarily restricted to this group of people. Among the nations in the Asia Pacific area with sizable motorcycle fleets are China, Indonesia, and India. It is anticipated that the substantial increase in motorcycle production and rising demand for aftermarket motorcycle filter kits would be the key factors directing market expansion in China and India in the future. Over the next 10 years, it is predicted that rapid urbanization, population growth, and increased disposable income would all drive motorbike filter sales in Asian nations. In addition, as emerging nations struggle to optimize their road infrastructure, more and more individuals are choosing motorbikes to avoid traffic congestion, which is turning into a significant problem.

The second-largest market for motorbike filters is in North America. The increased demand for high-performance bikes and the expanding acceptance of aftermarket filters in North America are the main factors driving the market for motorcycle filters. Due to the rising popularity of adventure bikes and the rising number of motorcycle riders, the North American market for motorcycle filters is predicted to expand further in the upcoming years.

Target Audience for Motorcycle Filters

- Motorcycle riders and enthusiasts

- Motorcycle repair and maintenance shops

- Motorcycle dealerships

- Motorcycle manufacturers (OEMs)

- Automotive parts distributors

- E-commerce platforms and online retailers

- Mechanics and service technicians

- Motorcycle accessory stores

- Environmental agencies and organizations

- Automotive trade shows and exhibitions attendees

Import & Export Data for Motorcycle Filters Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the motorcycle filters market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Area Scan Camera Market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Motorcycle Filters Market Report

Motorcycle Filters Market by Filter Type

- Fuel Filters

- Oil Filters

- Intake Air Filters

Motorcycle Filters Market by Filter Media

- Cellulose

- Synthetic

Motorcycle Filters Market by Sales Channel

- OEMs

- OESs

- IAMs

Motorcycle Filters Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the motorcycle filters market over the next 7 years?

- Who are the major players in the motorcycle filters market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the motorcycle filters market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the motorcycle filters market?

- What is the current and forecasted size and growth rate of the motorcycle filters market?

- What are the key drivers of growth in the motorcycle filters market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the motorcycle filters market?

- What are the technological advancements and innovations in the motorcycle filters market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the motorcycle filters market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the motorcycle filters market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- MOTORCYCLE FILTER MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON MOTORCYCLE FILTER MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- MOTORCYCLE FILTER MARKET OUTLOOK

- GLOBAL MOTORCYCLE FILTER MARKET BY FILTER TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- FUEL FILTERS

- OIL FILTERS

- INTAKE AIR FILTERS

- GLOBAL MOTORCYCLE FILTER MARKET BY FILTER MEDIA, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- CELLULOSE

- SYNTHETIC

- GLOBAL MOTORCYCLE FILTER MARKET BY SALES CHANNEL, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- OEMs

- OESs

- IAMs

- GLOBAL MOTORCYCLE FILTER MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- NAPA FILTERS

- SIMOTA

- MANN+HUMMEL

- PIPERCROSS PERFORMANCE FILTERS

- K & N ENGINEERING INC.

- BMC SRL

- UNI FILTER INC.

- ROKI CO. LTD.

- SOLAT INTERNATIONAL TRADING CO. LTD.

- MAHLE GMBH

- BMC

- CHAMPION

- DNA FILTER

- EBC BRAKES

- EMGO

- FEULING

- KURYAKYN

- MRA

- RIZOMA *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 4 GLOBAL MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 6 GLOBAL MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL MOTORCYCLE FILTER MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL MOTORCYCLE FILTER MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA MOTORCYCLE FILTER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA MOTORCYCLE FILTER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 17 US MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 18 US MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 US MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 20 US MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 21 US MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 22 US MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 24 CANADA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 26 CANADA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 28 CANADA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 30 MEXICO MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 32 MEXICO MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 34 MEXICO MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA MOTORCYCLE FILTER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA MOTORCYCLE FILTER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 44 BRAZIL MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 46 BRAZIL MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 48 BRAZIL MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 50 ARGENTINA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 52 ARGENTINA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 54 ARGENTINA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 56 COLOMBIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 58 COLOMBIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 60 COLOMBIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC MOTORCYCLE FILTER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC MOTORCYCLE FILTER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 76 INDIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 78 INDIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 80 INDIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 82 CHINA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 84 CHINA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 86 CHINA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 88 JAPAN MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 90 JAPAN MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 92 JAPAN MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE MOTORCYCLE FILTER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE MOTORCYCLE FILTER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 120 EUROPE MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 122 EUROPE MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 124 EUROPE MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 126 GERMANY MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 128 GERMANY MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 130 GERMANY MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 131 UK MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 132 UK MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 UK MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 134 UK MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 135 UK MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 136 UK MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 138 FRANCE MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 140 FRANCE MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 142 FRANCE MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 144 ITALY MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 146 ITALY MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 148 ITALY MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 150 SPAIN MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 152 SPAIN MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 154 SPAIN MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 156 RUSSIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 158 RUSSIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 160 RUSSIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 175 UAE MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 176 UAE MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 177 UAE MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 178 UAE MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 179 UAE MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 180 UAE MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY FILTER TYPE (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY FILTER MEDIA (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA MOTORCYCLE FILTER MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL MOTORCYCLE FILTER MARKET BY FILTER TYPE USD BILLION, 2020-2030

FIGURE 9 GLOBAL MOTORCYCLE FILTER MARKET BY FILTER MEDIA USD BILLION, 2020-2030

FIGURE 10 GLOBAL MOTORCYCLE FILTER MARKET BY SALES CHANNEL, USD BILLION, 2020-2030

FIGURE 11 GLOBAL MOTORCYCLE FILTER MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL MOTORCYCLE FILTER MARKET BY FILTER TYPE USD BILLION, 2022

FIGURE 14 GLOBAL MOTORCYCLE FILTER MARKET BY FILTER MEDIA, USD BILLION, 2022

FIGURE 15 GLOBAL MOTORCYCLE FILTER MARKET BY SALES CHANNEL, USD BILLION, 2022

FIGURE 16 GLOBAL MOTORCYCLE FILTER MARKET BY REGION, USD BILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 NAPA FILTERS: COMPANY SNAPSHOT

FIGURE 19 SIMOTA: COMPANY SNAPSHOT

FIGURE 20 MANN+HUMMEL: COMPANY SNAPSHOT

FIGURE 21 PIPERCROSS PERFORMANCE FILTERS: COMPANY SNAPSHOT

FIGURE 22 K & N ENGINEERING INC.: COMPANY SNAPSHOT

FIGURE 23 BMC SRL: COMPANY SNAPSHOT

FIGURE 24 UNI FILTER INC.: COMPANY SNAPSHOT

FIGURE 25 ROKI CO. LTD.: COMPANY SNAPSHOT

FIGURE 26 SOLAT INTERNATIONAL TRADING CO. LTD.: COMPANY SNAPSHOT

FIGURE 27 MAHLE GMBH: COMPANY SNAPSHOT

FIGURE 28 BMC: COMPANY SNAPSHOT

FIGURE 29 CHAMPION: COMPANY SNAPSHOT

FIGURE 30 DNA FILTER: COMPANY SNAPSHOT

FIGURE 31 EBC BRAKES: COMPANY SNAPSHOT

FIGURE 32 EMGO: COMPANY SNAPSHOT

FIGURE 33 FEULING: COMPANY SNAPSHOT

FIGURE 34 KURYAKYN: COMPANY SNAPSHOT

FIGURE 35 MRA: COMPANY SNAPSHOT

FIGURE 36 RIZOMA: COMPANY SNAPSHOT

FAQ

The global motorcycle filter market is anticipated to grow from USD 3.73 Billion in 2023 to USD 5.68 Billion by 2030, at a CAGR of 6.17% during the forecast period.

Asia Pacific accounted for the largest market in the Motorcycle Filters Market. Asia pacific accounted for 39% market share of the global market value.

NAPA Filters, SIMOTA, Mann+Hummel, Pipercross Performance Filters, K & N Engineering Inc., BMC Srl, Uni Filter Inc., Roki Co. Ltd., Solat International Trading Co. Ltd., MAHLE GmbH, BMC, Champion, DNA Filter, EBC Brakes, Emgo, Feuling, Kuryakyn, MRA, Rizoma

Growing need for synthetic filters: Compared to conventional paper filters, synthetic filters are more dependable and perform better. As a result, the market for motorcycle filters is experiencing an increase in demand for synthetic filters.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.