REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 638.88 Billion by 2030 | 39.71 % | North America |

| by Component | by Device Type | by Organization Size |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

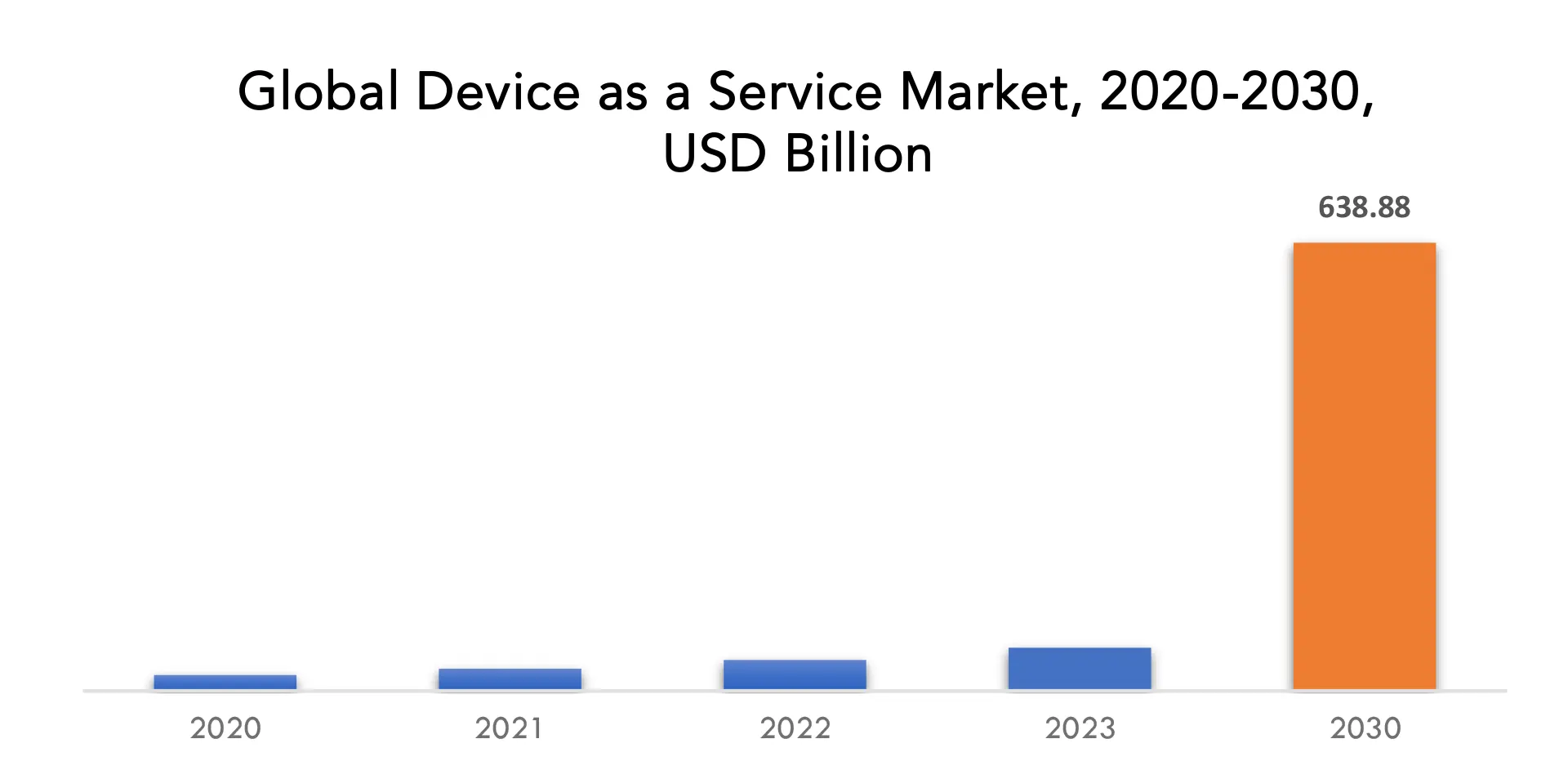

Device as a Service Market Overview

The global device as a service market is anticipated to grow from USD 61.49 Billion in 2023 to USD 638.88 Billion by 2030, at a compound annual growth rate (CAGR) of 39.71 % during the forecast period.

Device as a Service (DaaS) is a revolutionary IT solution that provides businesses with a thorough method of controlling their end-user devices. In contrast to conventional ways of purchasing and managing devices, DaaS offers a subscription-based approach where businesses rent the actual hardware as well as the related software and services from a DaaS provider. This strategy offers organisations a number of significant advantages.

DaaS makes it easier to acquire devices by providing a variety of options from different manufacturers. Without the upfront capital costs associated with outright hardware purchases, businesses may choose devices that meet their unique needs. This reduces the cost and makes it possible for businesses to use a wide range of devices. DaaS also makes managing and deploying devices more efficient. The setup, configuration, and continuing maintenance of devices are handled by DaaS providers, ensuring that they are ready for use and continue to function at their best throughout their lifespan. This frees up internal IT staff to concentrate on strategic endeavours by offloading the management complexity.

DaaS improves compliance and security. Strong security mechanisms, such as data encryption, remote device tracking, and compliance monitoring, are included by providers into their services. In the present-day data-driven environment, protecting sensitive data and adhering to legal obligations are crucial considerations. DaaS also provides scalability and flexibility, making it simple for organisations to adjust to shifting device demands. DaaS offers the flexibility needed to optimize device resources, whether scaling up during moments of growth or shrinking during economic difficulties.

Companies may really upgrade their pieces of equipment at the conclusion of the leasing time without paying the charges typically connected with the gadget thanks to the subscription of devices without owing any. Many sellers choose to use a contract for software and hardware services that expressly specifies the timeframe, the fee, and the kind of services. Businesses are found to lean towards the DaaS model for their work if they are ready to choose a subscription model and pricing structure that removes the stress of purchasing and managing hardware. PC manufacturers and IT service providers are concentrating on organizing their services, combining their marketing plans, and implementing technologies like artificial intelligence and the internet of things into their device-as-a-service plans as device-as-a-service is anticipated to gain pace. Thus, the high cost of obtaining new technology can be converted by the customers from a capital expense to an operational expense.

Companies can use this technique to free up capital for strategic projects that result in high revenue growth. Another market driver is the reduction in help desk volume, policy compliance, and enhanced end-user productivity that a firm receives by outsourcing services on numerous devices that come with multiple operating systems in the market. Additionally, organisations who utilize devices as a service have access to the most recent technology as well as customised services such as installation, data transfer, device setup, on-site support, technology recycling, and others.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Component, Device Type, Organization Size ,End User and Region |

| By Component |

|

|

By Device Type |

|

|

By Organization Size |

|

|

By End User |

|

|

By Region

|

|

Device as a Service Market Segmentation Analysis

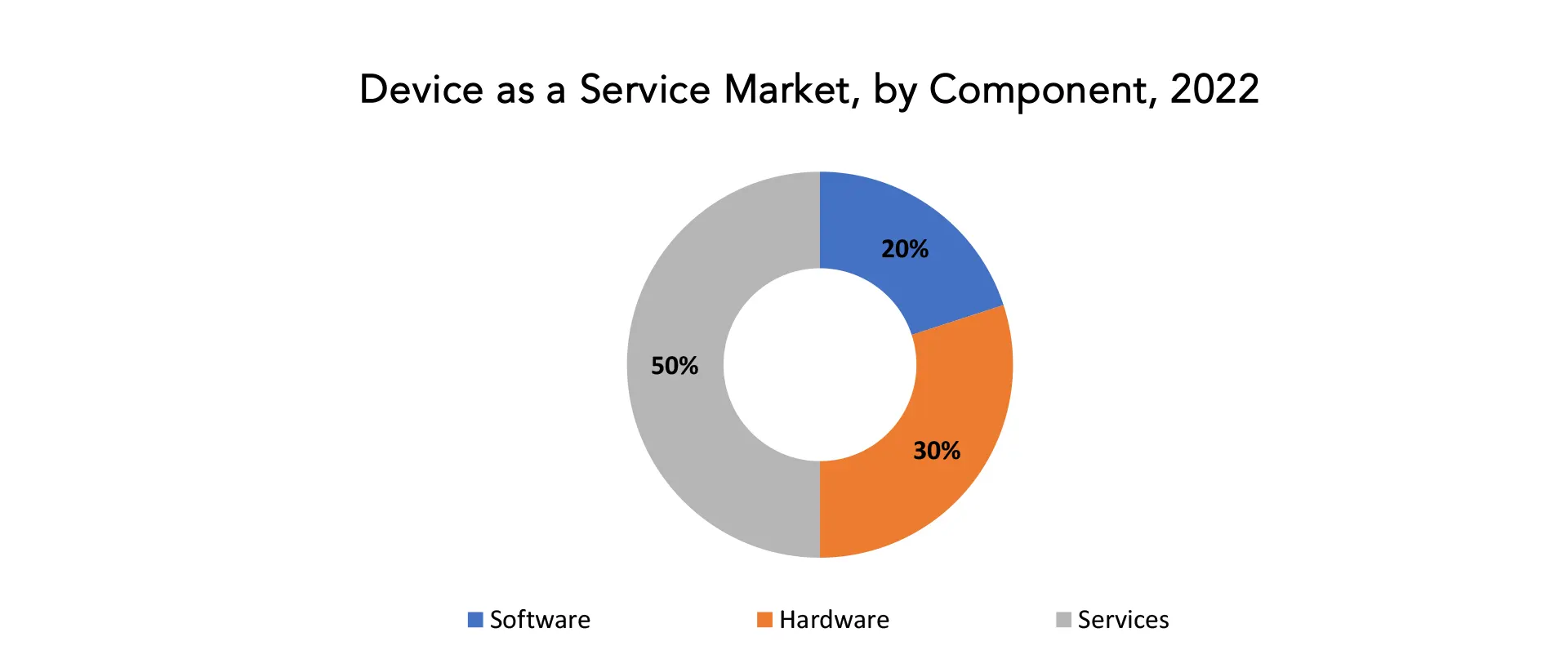

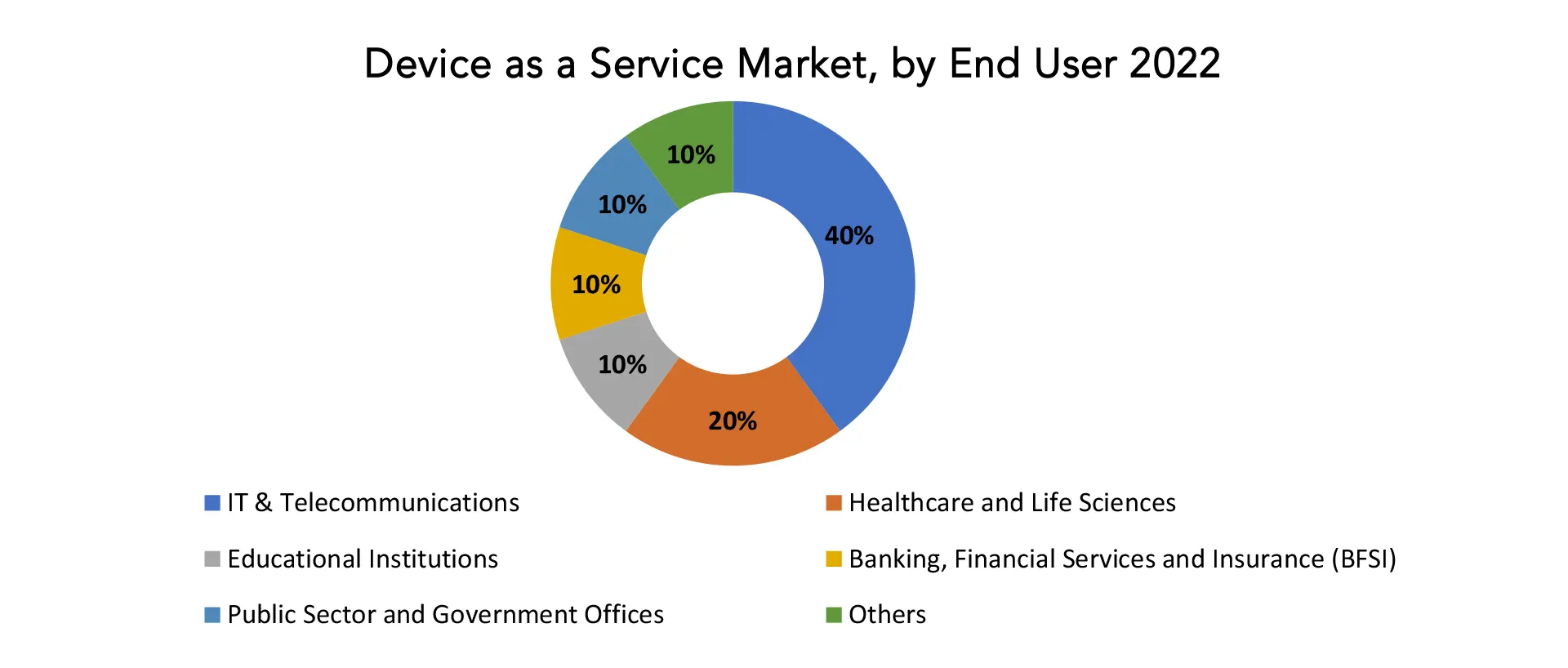

The global device as a service market is divided into four segments, component, device type, organization size, end user and region. By component the market is divided into software, services hardware. By device type, the market is divided into up to desktops, laptops, notebooks and tablets, smartphones and peripherals. By organization size the market is classified into small & medium enterprise, large enterprise. By end user the market is classified into it & telecommunications, healthcare and life sciences, educational institutions, banking, financial services and insurance (BFSI), public sector and government offices, others

Based on component service segment dominating in the device as a service market. The DaaS services component is a complete product that addresses many elements of the device lifecycle. It comprises procurement services, in which DaaS providers source and provide devices to businesses depending on their requirements. Deployment services include the setup and configuration of equipment for users to provide a seamless onboarding experience. Management services include capabilities such as remote troubleshooting and security management, as well as continuing device monitoring, maintenance, and support. End-of-life device services, in which DaaS providers safely retire and replace devices at the end of their lives, are also available. The services component, taken together, enables organisations to outsource the difficulties of device management, ensuring that devices are constantly functioning, secure, and up to date.

The DaaS software component includes the administration, orchestration, and automation capabilities required for the smooth running of device fleets. DaaS software provides a centralized platform that allows organisations to remotely monitor, control, and optimize their devices. Device provisioning, configuration management, software upgrades, and security management are all included in this package. It also offers insights via analytics and reporting tools, assisting organisations in making data-driven choices regarding their device fleets.

The actual devices themselves, such as laptops, desktops, tablets, cellphones, and other endpoints, represent the hardware component of DaaS. To meet the varying demands of organisations, DaaS providers provide a variety of device solutions from various manufacturers. The selection of hardware is an important part of DaaS since it determines device performance, capabilities, and compatibility with certain use cases. As part of a subscription-based offering, DaaS hardware is sometimes packaged with software and services, making it more accessible to enterprises.

Based on end-user, IT & Telecommunications segment dominating in the device as a service market. The IT and telecommunications industries are a significant end-user group in the DaaS industry. This industry’s activities are significantly reliant on technology and gadgets, which include data centres, networking equipment, cellphones, and other endpoints. DaaS solutions address the demand for effective device management in the IT and telecommunications sectors, allowing organisations to routinely update and protect their enormous device fleets. DaaS is an excellent solution for this industry due to the quick rate of technological development, high security requirements, and dynamic labour needs.

The rapid pace of technical development in the IT and telecommunications sectors is astounding. Maintaining competitiveness demands remaining current with the newest hardware and software. DaaS allows organisations in this market to routinely refresh their device fleets with the most up-to-date technology, allowing them to capitalise on cutting-edge advancements without the hassle of managing device procurement and updates internally.

The Healthcare and Life Sciences industry is distinguished by its distinct device needs, which include medical equipment, electronic health records (EHR) systems, and mobile healthcare devices. In this industry, DaaS solves the requirements for compliance, data protection, and device standardisation. It enables healthcare organisations to streamline the administration of key medical equipment, ensuring that they are up to date and in compliance with healthcare laws while concentrating on patient care.

Device as a Service Market Dynamics

Driver

The increasing adoption of cloud-based solutions is driving device as a service market.

Cloud-based DaaS solutions provide businesses a scalable and flexible approach to device management. They let enterprises to access and deploy devices and related services directly from the cloud, removing the need for complex on-premises infrastructure. This scalability is critical for organisations with changing device requirements, allowing them to simply add or remove devices as their needs change. Second, cloud-based DaaS is less expensive. Organisations may sign up to DaaS services on a pay-as-you-go or monthly subscription basis rather of acquiring and maintaining expensive hardware and software licences upfront. This reduces the capital costs involved with device acquisition, making it more affordable for organisations of all sizes, particularly small and medium-sized enterprises (SMEs).

Cloud-based DaaS solutions improve device security and data protection. Data is kept and processed in secure data centres, which reduces the risk of data breaches and loss as a result of physical device theft or damage. DaaS suppliers frequently incorporate security features like remote device control, data encryption, and regular software upgrades, which help organisations comply with data protection rules. Furthermore, the cloud-based DaaS paradigm streamlines device administration and support. Organisations may use a centralized platform to remotely monitor and manage their device fleets, solve faults, and push upgrades, enhancing operational efficiency and decreasing downtime. This is particularly beneficial for supporting remote workforces and keeping devices up to date and secure.

Restraint

Security concerns can impede the device as a service market during the forecast period.

Data privacy is a major security problem. Organisations use DaaS to commit sensitive data, apps, and, in some cases, whole IT infrastructure to third-party service providers. This comprises device information, user credentials, and operational data. Any security breach, data leak, or unauthorised access to sensitive information might have serious effects, including financial losses, legal ramifications, and reputational harm to an organisations. To overcome these problems, DaaS providers must incorporate strong data encryption, access restrictions, and compliance mechanisms.

A further crucial aspect is device security. DaaS entails the deployment and administration of several devices, such as laptops, smartphones, and tablets. As these devices are used to access mission-critical apps and data, they are prime targets for hackers. They may become entry points for malware, ransomware, and other dangers that can spread through an organization’s network if not adequately secured. To address these threats, DaaS providers must adopt severe security measures such as device monitoring, frequent security upgrades, and remote device management. Furthermore, the adoption of cloud-based DaaS systems raises new security concerns. While cloud services provide scalability and versatility, they also present distinct issues in terms of data sovereignty, regulatory compliance, and cloud-specific risks.

Opportunities

The growth of the small and medium-sized business (SMB) market aids the device as a service market growth.

Small and medium-sized businesses (SMBs) frequently suffer resource limits, both in terms of capital spending and IT skills. DaaS addresses these limits nicely by providing a cost-effective, subscription-based solution for device management. It enables SMBs to have access to cutting-edge technology and devices without incurring the significant upfront expenditures involved with acquiring and maintaining gear and software licences. DaaS is an appealing alternative for SMBs wishing to modernize their IT infrastructure due to its affordability and predictable monthly expenditure structure.

SMBs usually have small in-house IT departments. DaaS companies provide full device management services such as purchase, deployment, maintenance, and support, effectively functioning as an extension of a small business’s IT staff. This relieves SMBs of the load, allowing them to focus on their core company activities while specialists maintain their device fleets smoothly.

SMBs frequently want scalable solutions that are able to adjust to their changing requirements. As SMBs expand or see changes in device requirements, DaaS allows them to simply add and remove devices from their fleet. This scalability means that SMBs may manage their IT resources efficiently without overinvesting or underinvesting in device infrastructure.

Device as a Service Market Trends

- The move to remote work, fueled by global events, has hastened DaaS acceptance. Organisations want DaaS solutions to provide devices to distant employees, manage device security, and ensure business continuity.

- The emergence of hybrid work patterns, in which people work both in the office and remotely, has raised demand for flexible DaaS products that can accommodate a variety of work environments.

- DaaS providers offer comprehensive device lifecycle management services such as purchase, deployment, maintenance, and disposal, to assist organisations in successfully managing their device fleets.

- Sustainability is a rising concern, and DaaS providers are responding by providing environmentally friendly device alternatives as well as responsible device disposal and recycling services.

- AI and data analytics integration is improving DaaS solutions by providing predictive maintenance, better device performance monitoring, and data-driven insights.

- DaaS providers are broadening their device offerings outside traditional PCs and laptops to encompass smartphones, tablets, and IoT devices, representing the changing technological world.

Competitive Landscape

The competitive landscape of the device as a service market was dynamic, with several prominent companies competing to provide innovative and advanced device as a service solution.

- HP Inc.

- Dell Technologies Inc.

- Lenovo Group Limited

- Microsoft Corporation

- Apple Inc.

- Cisco Systems, Inc.

- Google LLC

- com, Inc.

- Fujitsu Limited

- Acer Inc.

- Toshiba Corporation

- ASUS Computer International

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Sony Corporation

- LG Electronics Inc.

- Panasonic Corporation

- NEC Corporation

- Sharp Corporation

- Hitachi, Ltd.

Recent Developments:

September 12, 2023: Toshiba Global Commerce Solutions launched the ELERA™ Security Suite, a solution to help retailers reduce losses due to shrinkage and enhance customer checkout experiences. In 2021, U.S. retailers incurred $94.5 billion in losses from shrinkage, making it a significant challenge. The ELERA™ Security Suite, available later this year, addresses various forms of shrink, offering retailers a comprehensive solution to protect their profits.

September 13, 2023: NEC Corporation introduced a “Management and Business Optimization Consulting Service.” This service aims to assess a company’s supply chain, identify its strengths and weaknesses, and devise optimal strategies and implementation plans. It primarily serves manufacturing and distribution industry clients, covering management, business processes, and IT perspectives.

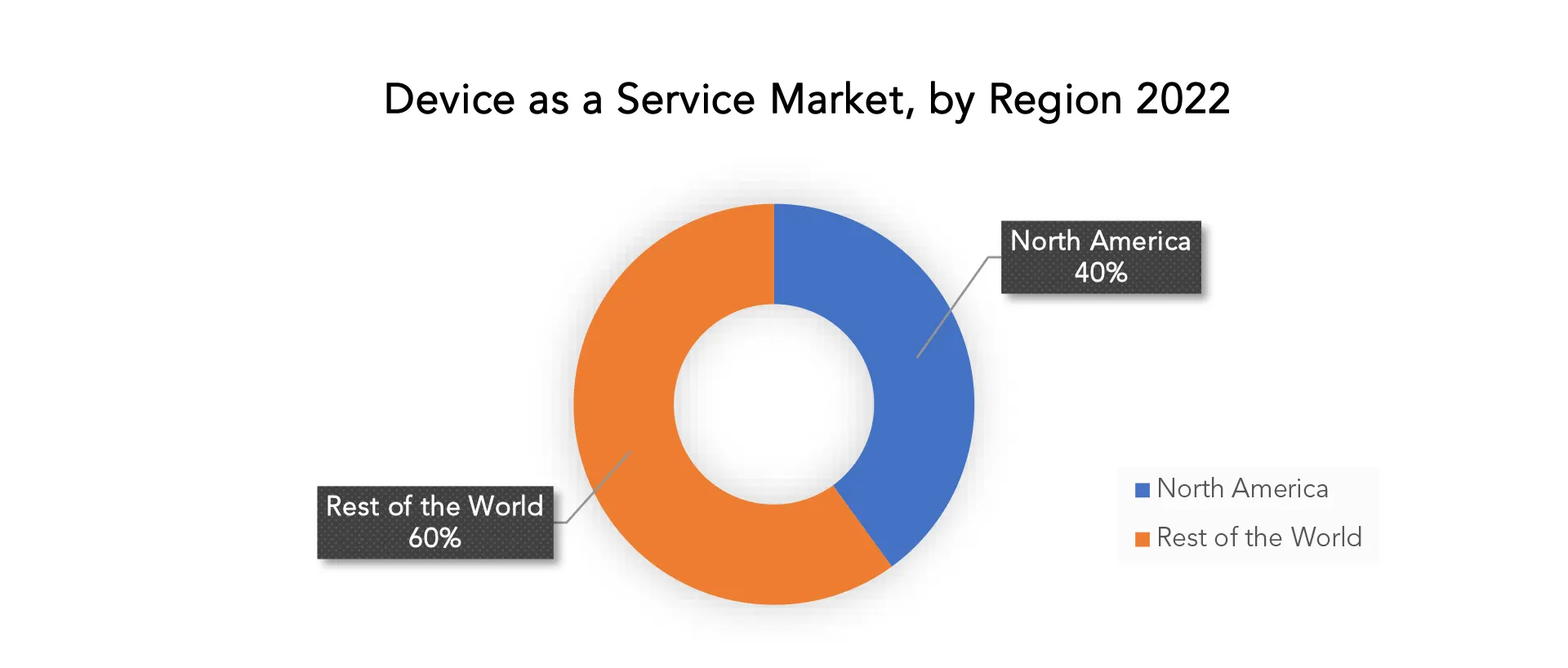

Regional Analysis

North America accounted for the largest market in the device as a service market. North America accounted for the 40% market share of the global market value. The region has established itself as the largest and most significant market in the Device as a Service (DaaS) category, due to a number of compelling considerations. The need for DaaS solutions has been fuelled by North America’s solid and highly developed IT infrastructure, as well as a considerable number of tech-savvy organisations. The region has a flourishing business scene, with everyone from startups to international enterprises turning to DaaS to optimise their IT processes.

The region’s early and widespread embrace of cloud computing and associated technologies laid a solid platform for the expansion of DaaS. DaaS, which provides scalable, cloud-based device management solutions, ideally integrates with organisations cloud-centric goals. The concentration on innovation and technological leadership in North America has fueled the creation of cutting-edge DaaS products. Leading IT businesses and service providers in the region engage continuously in R&D, providing high-quality and diversified DaaS alternatives adapted to a variety of business needs.

The region’s emphasis on security and data privacy matches with DaaS companies’ ability to deliver effective data protection measures. This is especially important in light of the increased scrutiny and legal constraints around data privacy. Furthermore, the rise in remote work arrangements, spurred by global events, has increased demand for DaaS solutions in North America. Businesses and organisations have turned to DaaS to manage distant devices and assist their workers, making it a critical component in the current work period of time.

Device as a Service (DaaS) is seeing a dynamic and quick growth in the Asia-Pacific area, due to a number of strong drivers. There is a substantial need for DaaS solutions due to the region’s strong economic growth, thriving startup culture, and expanding initiatives to digitalize numerous industries. DaaS is a tempting choice for businesses, from small and medium-sized organisations (SMEs) to major corporations, that are looking for affordable and scalable methods to manage their IT devices. There is a sizable market for consumer electronics in the Asia-Pacific region as its large and diversified population. The demand for DaaS among people and families is being driven by the prevalence of smartphones, laptops, and other personal devices. This trend also affects educational institutions and remote learning programmes, as DaaS provides a practical means of equipping students and teachers with the tools they need.

Target Audience for Device as a Service Market

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Managed Services Providers (MSPs)

- IT Departments and Managers

- Educational Institutions

- Healthcare Organizations

- Government Agencies

- Retailers

- Financial Institutions

- Telecommunication Companies

- Manufacturers

- Technology Enthusiasts

- Non-profit Organizations

Segments Covered in the Device as a Service Market Report

Device as a Service Market by Component

- Hardware

- Software

- Services

Device as a Service Market by Device Type

- Desktops

- Laptops, Notebooks and Tablets

- Smartphones and Peripherals

Device as a Service Market by Organization Size

- Small & Medium Enterprise

- Large Enterprise

Device as a Service Market by End User

- IT & Telecommunications

- Healthcare and Life Sciences

- Educational Institutions

- Banking, Financial Services and Insurance (BFSI)

- Public Sector and Government Offices

- Others

Device as a Service Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the device as a service market over the next 7 years?

- Who are the major players in the device as a service market and what is their market share?

- What are the Application industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the device as a service market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the device as a service market?

- What is the current and forecasted size and growth rate of the global device as a service market?

- What are the key drivers of growth in the device as a service market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the device as a service market?

- What are the technological advancements and innovations in the device as a service market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the device as a service market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the device as a service market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL DEVICE AS A SERVICE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON DEVICE AS A SERVICE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- END USER VALUE CHAIN ANALYSIS

- GLOBAL DEVICE AS A SERVICE MARKET OUTLOOK

- GLOBAL DEVICE AS A SERVICE MARKET BY COMPONENT, 2020-2030, (USD BILLION)

- HARDWARE

- SOFTWARE

- SERVICES

- GLOBAL DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE, 2020-2030, (USD BILLION)

- SMALL AND MEDIUM-SIZED ENTERPRISES

- LARGE ENTERPRISES

- GLOBAL DEVICE AS A SERVICE MARKET BY DEVICE TYPE, 2020-2030, (USD BILLION)

- DESKTOPS

- LAPTOPS, NOTEBOOKS AND TABLETS

- SMARTPHONES AND PERIPHERALS

- GLOBAL DEVICE AS A SERVICE MARKET BY END USER, 2020-2030, (USD BILLION)

- IT & TELECOMMUNICATIONS

- HEALTHCARE AND LIFE SCIENCES

- EDUCATIONAL INSTITUTIONS

- BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

- PUBLIC SECTOR AND GOVERNMENT OFFICES

- OTHERS

- GLOBAL DEVICE AS A SERVICE MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)HP INC.

- DELL TECHNOLOGIES INC.

- LENOVO GROUP LIMITED

- MICROSOFT CORPORATION

- APPLE INC.

- CISCO SYSTEMS, INC.

- GOOGLE LLC

- AMAZON.COM, INC.

- FUJITSU LIMITED

- ACER INC.

- TOSHIBA CORPORATION

- ASUS COMPUTER INTERNATIONAL

- SAMSUNG ELECTRONICS CO., LTD.

- HUAWEI TECHNOLOGIES CO., LTD.

- SONY CORPORATION

- LG ELECTRONICS INC.

- PANASONIC CORPORATION

- NEC CORPORATION

- SHARP CORPORATION

- HITACHI, LTD.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 2 GLOBAL DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 3 GLOBAL DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 4 GLOBAL DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 5 GLOBAL DEVICE AS A SERVICE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA DEVICE AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 9 NORTH AMERICA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 11 US DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 12 US DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 13 US DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 14 US DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 15 CANADA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 16 CANADA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 17 CANADA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 18 CANADA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 19 MEXICO DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 20 MEXICO DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 21 MEXICO DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 22 MEXICO DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 23 SOUTH AMERICA DEVICE AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 24 SOUTH AMERICA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 25 SOUTH AMERICA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 27 SOUTH AMERICA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 28 BRAZIL DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 29 BRAZIL DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 30 BRAZIL DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 31 BRAZIL DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 32 ARGENTINA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 33 ARGENTINA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 34 ARGENTINA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 35 ARGENTINA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 36 COLOMBIA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 37 COLOMBIA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 38 COLOMBIA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 39 COLOMBIA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 40 REST OF SOUTH AMERICA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 41 REST OF SOUTH AMERICA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 42 REST OF SOUTH AMERICA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 43 REST OF SOUTH AMERICA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 44 ASIA-PACIFIC DEVICE AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 45 ASIA-PACIFIC DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 46 ASIA-PACIFIC DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 47 ASIA-PACIFIC DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 49 INDIA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 50 INDIA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 51 INDIA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 52 INDIA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 53 CHINA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 54 CHINA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 55 CHINA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 56 CHINA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 57 JAPAN DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 58 JAPAN DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 59 JAPAN DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 60 JAPAN DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 61 SOUTH KOREA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 62 SOUTH KOREA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 63 SOUTH KOREA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 64 SOUTH KOREA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 65 AUSTRALIA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 66 AUSTRALIA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 67 AUSTRALIA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 68 AUSTRALIA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 69 SOUTH-EAST ASIA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 70 SOUTH-EAST ASIA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 71 SOUTH-EAST ASIA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 72 SOUTH-EAST ASIA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 73 REST OF ASIA PACIFIC DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 74 REST OF ASIA PACIFIC DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 75 REST OF ASIA PACIFIC DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 76 REST OF ASIA PACIFIC DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 77 EUROPE DEVICE AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 78 EUROPE DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 79 EUROPE DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 80 EUROPE DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 81 EUROPE DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 82 GERMANY DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 83 GERMANY DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 84 GERMANY DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 85 GERMANY DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 86 UK DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 87 UK DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 88 UK DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 89 UK DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 90 FRANCE DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 91 FRANCE DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 92 FRANCE DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 93 FRANCE DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 94 ITALY DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 95 ITALY DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 96 ITALY DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 97 ITALY DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 98 SPAIN DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 99 SPAIN DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 100 SPAIN DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 101 SPAIN DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 102 RUSSIA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 103 RUSSIA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 104 RUSSIA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 105 RUSSIA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 106 REST OF EUROPE DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 107 REST OF EUROPE DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 108 REST OF EUROPE DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 109 REST OF EUROPE DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 110 MIDDLE EAST AND AFRICA DEVICE AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 111 MIDDLE EAST AND AFRICA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 112 MIDDLE EAST AND AFRICA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 113 MIDDLE EAST AND AFRICA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 114 MIDDLE EAST AND AFRICA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 115 UAE DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 116 UAE DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 117 UAE DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 118 UAE DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 119 SAUDI ARABIA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 120 SAUDI ARABIA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 121 SAUDI ARABIA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 122 SAUDI ARABIA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 123 SOUTH AFRICA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 124 SOUTH AFRICA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 125 SOUTH AFRICA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 126 SOUTH AFRICA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 127 REST OF MIDDLE EAST AND AFRICA DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 128 REST OF MIDDLE EAST AND AFRICA DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 129 REST OF MIDDLE EAST AND AFRICA DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

TABLE 130 REST OF MIDDLE EAST AND AFRICA DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2020-2030

FIGURE 9 GLOBAL DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2020-2030

FIGURE 11 GLOBAL DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2020-2030

FIGURE 12 GLOBAL DEVICE AS A SERVICE MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL DEVICE AS A SERVICE MARKET BY COMPONENT (USD BILLION) 2022

FIGURE 15 GLOBAL DEVICE AS A SERVICE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022

FIGURE 16 GLOBAL DEVICE AS A SERVICE MARKET BY DEVICE TYPE (USD BILLION) 2022

FIGURE 17 GLOBAL DEVICE AS A SERVICE MARKET BY END USER (USD BILLION) 2022

FIGURE 18 GLOBAL DEVICE AS A SERVICE MARKET BY REGION (USD BILLION) 2022

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 HP INC.: COMPANY SNAPSHOT

FIGURE 21 DELL TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 22 LENOVO GROUP LIMITED: COMPANY SNAPSHOT

FIGURE 23 MICROSOFT CORPORATION: COMPANY SNAPSHOT

FIGURE 24 APPLE INC.: COMPANY SNAPSHOT

FIGURE 25 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 26 GOOGLE LLC: COMPANY SNAPSHOT

FIGURE 27 AMAZON.COM, INC.: COMPANY SNAPSHOT

FIGURE 28 FUJITSU LIMITED: COMPANY SNAPSHOT

FIGURE 29 ACER INC.: COMPANY SNAPSHOT

FIGURE 30 TOSHIBA CORPORATION: COMPANY SNAPSHOT

FIGURE 31 ASUS COMPUTER INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 32 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

FIGURE 33 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

FIGURE 34 SONY CORPORATION: COMPANY SNAPSHOT

FIGURE 35 LG ELECTRONICS INC.: COMPANY SNAPSHOT

FIGURE 36 PANASONIC CORPORATION: COMPANY SNAPSHOT

FIGURE 37 NEC CORPORATION: COMPANY SNAPSHOT

FIGURE 38 SHARP CORPORATION: COMPANY SNAPSHOT

FIGURE 39 HITACHI, LTD.: COMPANY SNAPSHOT

FAQ

The global device as a service market is expected to grow from USD 61.49 Billion in 2023 to USD 638.88 Billion by 2030, at a CAGR of 39.71 % during the forecast period.

North America accounted for the largest market in the device as a service market. North America accounted for 40 % market share of the global market value.

Acer Inc., Lenovo Group Limited, Panasonic Corporation, Huawei Technologies Co., Ltd., Fujitsu Limited, Google LLC, Dell Technologies Inc., Toshiba Corporation, Hitachi, Ltd., LG Electronics Inc., Sharp Corporation, Amazon.com, Inc., Microsoft Corporation, Samsung Electronics Co., Ltd., HP Inc., NEC Corporation, Apple Inc., ASUS Computer International, Sony Corporation, Cisco Systems, Inc.

The Device as a Service (DaaS) market include catering to small and medium-sized enterprises (SMEs) seeking cost-effective device solutions and expanding globally to tap into new markets and meet the growing demand for device outsourcing.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.