REPORT OUTLOOK

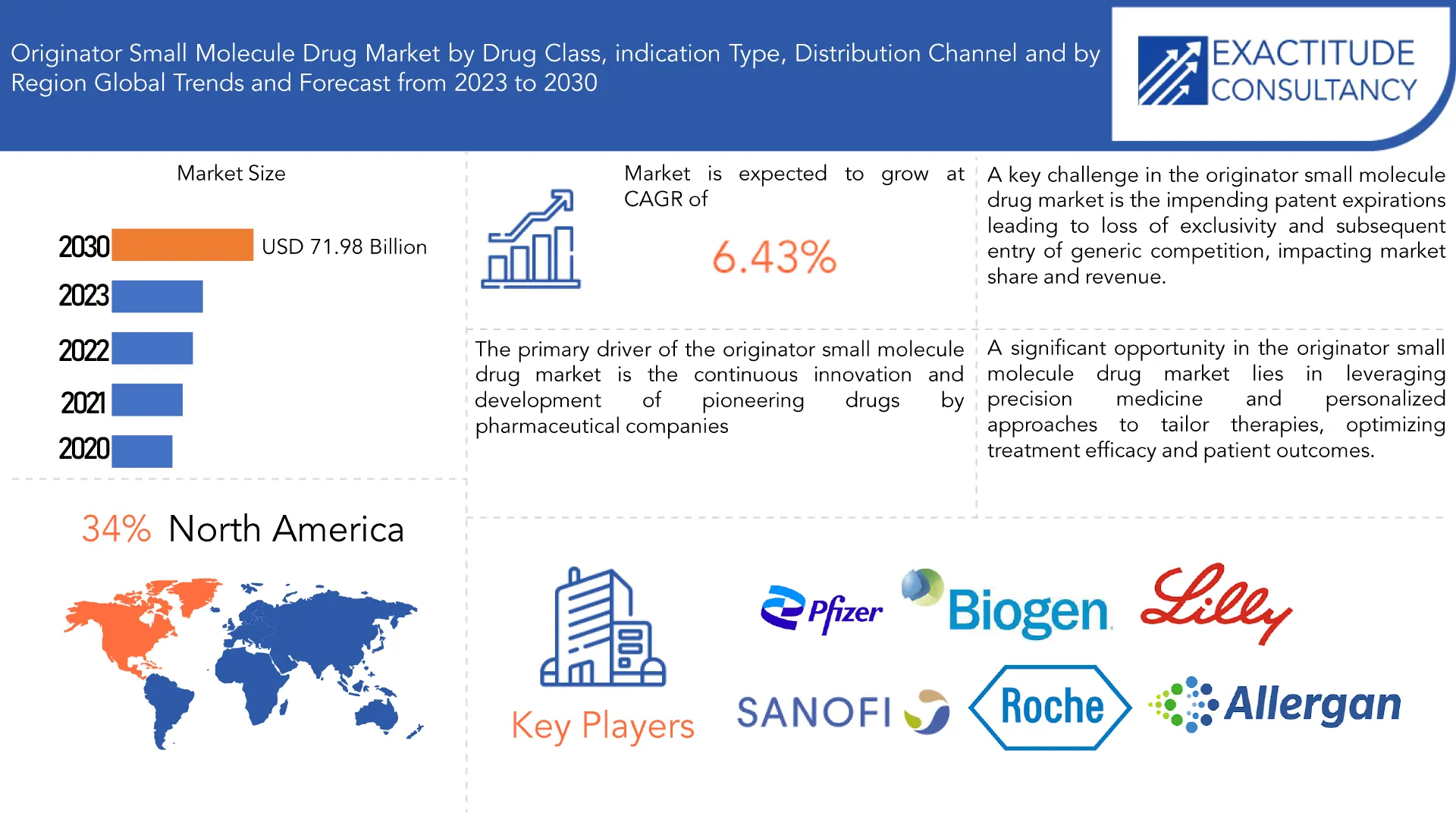

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 71.98 Billion by 2030 | 5.47 % | North America |

| by Drug Class | by Indication Type | by Distribution Channel |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Market Overview

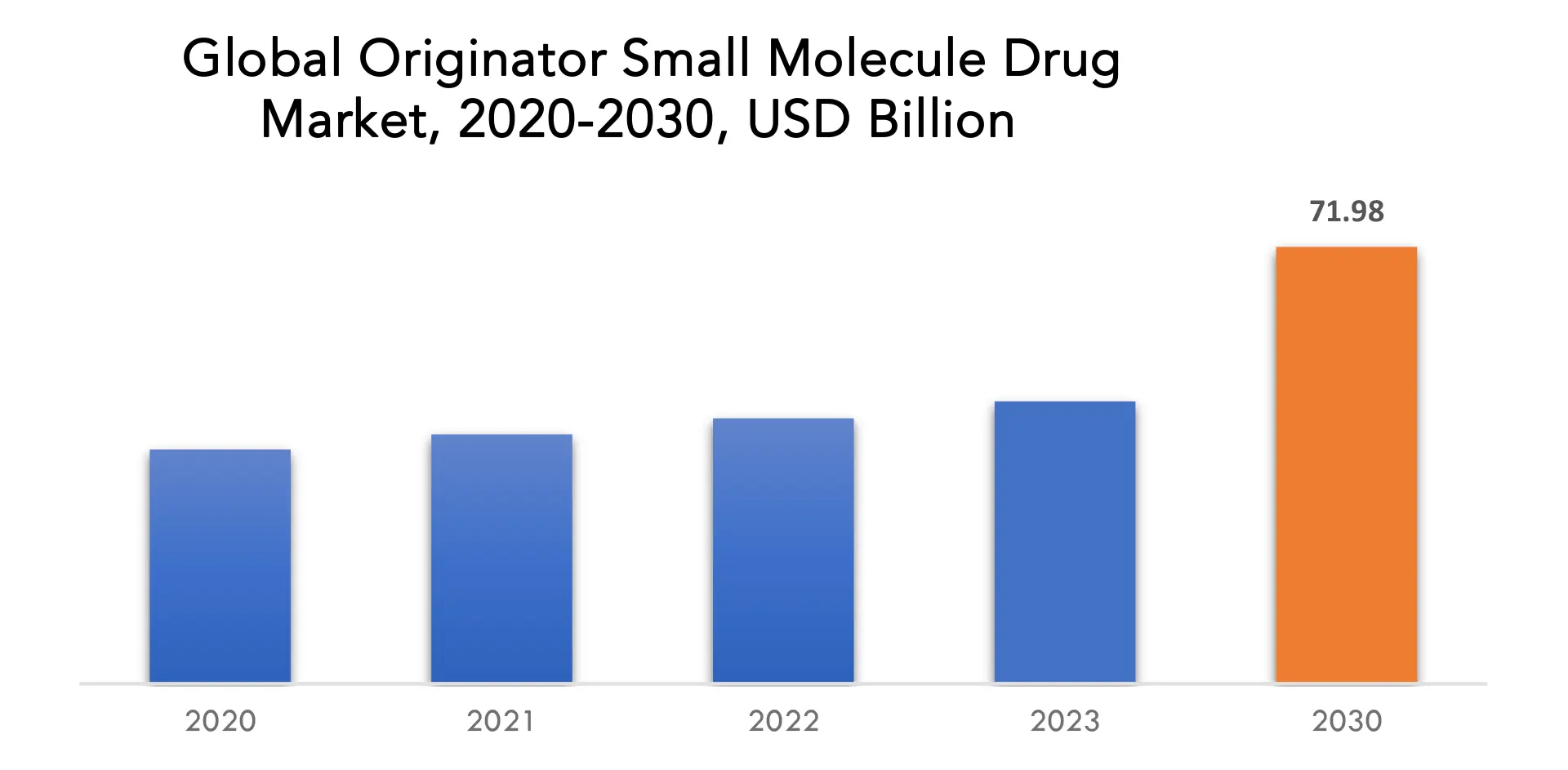

The global originator small molecule drug Market is anticipated to grow from USD 46.53 Billion in 2023 to USD 71.98 Billion by 2030, at a CAGR of 5.47 % during the forecast period.

An innovative small molecule medicine is one that a pharmaceutical company discovers and creates. It is a tiny molecule, which indicates that there aren’t many atoms in it. As opposed to large molecule therapies like biologics, small molecule medications are often simpler to produce and administer. Original small molecule medications are frequently referred to as “prescription drugs” or “branded drugs.” They are often priced higher than generic medicines, which are created in the same factories as brand-name medicines once the intellectual property rights of the original goods have expired. A wide range of ailments, including cancer, diabetes, cardiovascular problems, and infectious diseases, are treated using original small molecule drugs.

The pharmaceutical company and healthcare system place a high importance on the market for unique small molecule medications. These medications are the first, ground-breaking treatments created by pharmaceutical firms to address particular medical diseases. They frequently set the bar higher for existing medicines in terms of efficacy and safety by developing novel therapeutic techniques. Before receiving regulatory clearance, innovator small molecule medications often go through extensive research, development, and clinical studies to guarantee their efficiency and quality. Patent protection for these medications encourages innovation and enables businesses to recuperate their research expenditures. Furthermore, the exclusivity that patents grant promotes competition in the pharmaceutical industry, which leads to breakthroughs in treatment choices and outcomes that ultimately benefit patients.

The market for original small molecule pharmaceuticals is driven by a number of reasons. The continual developments in pharmaceutical research and technology promote the development of novel and cutting-edge medications. The desire to create more effective remedies in response to the expanding global burden of sickness is what drives the market for unique drugs. Pharmaceutical companies are encouraged to engage in the development of innovative medications in particular regions where regulatory conditions are advantageous and the approval procedure is expedited. The market is supported by growing healthcare costs as well as public and private sector R&D expenditures. The demand for and investment in the creation of novel pharmaceuticals is also influenced by variables such as increased understanding and awareness of certain medical conditions. Pharmaceutical businesses are urged to create and bring new treatments to market by the possibility of high returns on investment from successful originator products.

The market for originator small molecule drugs is enormous and constantly expanding. It includes the study, creation, production, marketing, and distribution of new small molecule medications made by pharmaceutical firms. These medications provide a diversified range of therapeutic intervention options since they target a broad range of medical ailments, from common illnesses to uncommon disorders. The pharmaceutical sector is anticipating a dynamic environment for innovation and growth as the market’s focus shifts to precision medicine and customized therapeutics to address the requirements of specific patients.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Drug Class, By Indication Type, By Distribution Channel, and By Region |

| By Drug Class |

|

| By Indication Type |

|

| By Distribution Channel |

|

| By Region

|

|

Originator Small Molecule Drug Market Segmentation Analysis

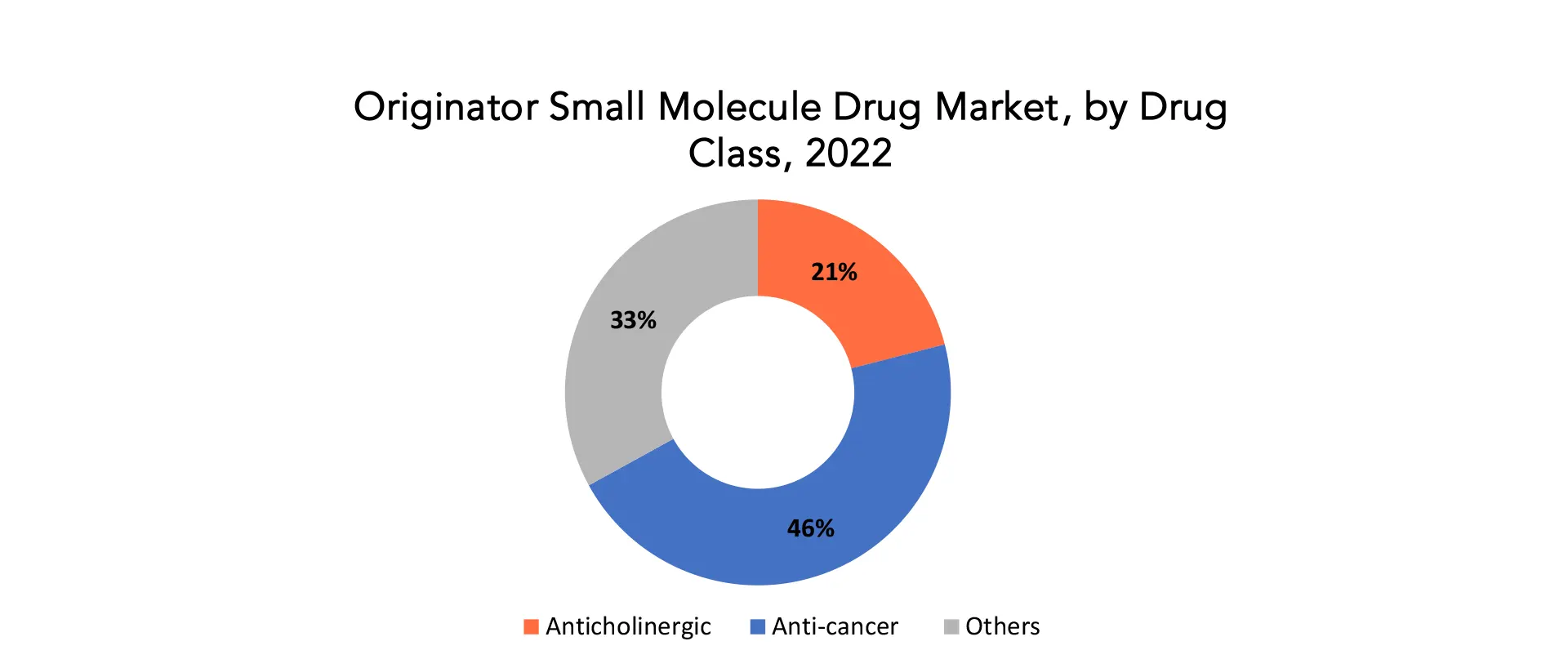

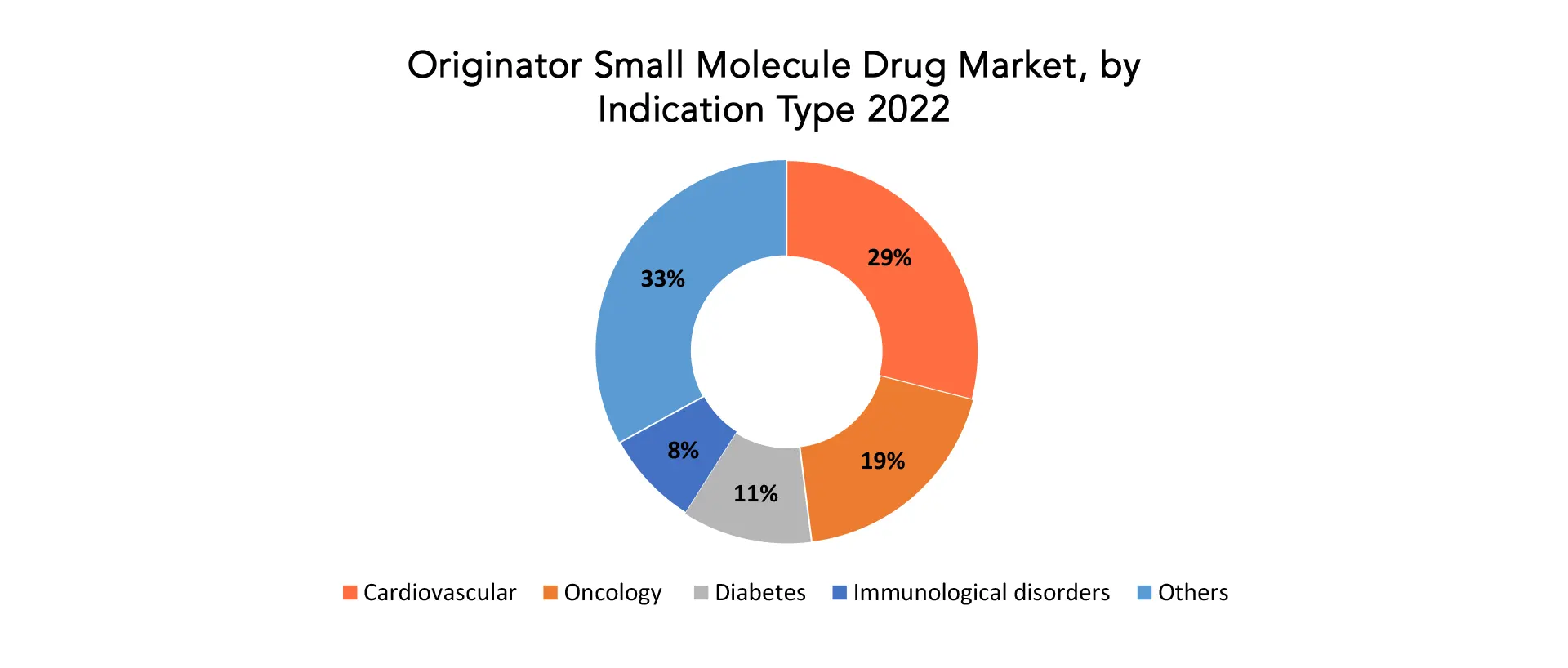

The global originator small molecule drug market is divided into 4 segments drug class, indication type, distribution channel and region. Based on drug class, the originator small molecule drug market is classified into anticholinergic, anti-cancer, others. The originator small molecule drug market is categorized into cardiovascular, oncology, diabetes, immunological disorders, others based on indication type. By distribution channel, the originator small molecule drug market is divided into hospital pharmacies, retail pharmacies, clinics, others.

The market for small molecules with originators is dominated by anti-cancer medications. The increase in cancer diagnoses and the emergence of efficient new treatments are significant contributors to this trend. Anti-cancer drugs, also known as antineoplastic or cytotoxic drugs, are methodically created to specifically target and inhibit the proliferation of cancer cells. They perform a number of tasks, including as stopping cell division, blocking blood vessel formation, or inducing apoptosis, which ultimately leads in the death of cancerous cells. Many disorders, such as malignancies, breast tumours, and lung cancer, require the use of these drugs for treatment and management. The pressing need to enhance treatment efficacy, minimize adverse effects, and extend overall survival rates propels the continuous advancements and refinements witnessed in the development of anti-cancer medications.

The Originator Small Molecule Drug Market’s anticholinergic drug sector comprises a sizable class of pharmaceuticals that work by obstructing the neurotransmitter acetylcholine. Asthma, chronic obstructive pulmonary disease (COPD), overactive bladder, and gastrointestinal issues are just a few of the many conditions that require the use of these drugs. Anticholinergic medications assist in symptom relief by obstructing acetylcholine’s actions on both muscle and nerve tissue. They are crucial when it comes to the treatment of a number of chronic and acute illnesses because of their well-known bronchodilator actions and capacity to relax the adaptable muscles in the prostate cancer and airways.

The pharmaceutical market predominantly revolves around drugs catering to cardiovascular ailments. These drugs are mostly used to treat heart problems such arrhythmias, a high blood pressure and heart failure. Their goals are to increase overall cardiovascular wellness, improve heart health, and lower blood pressure and cholesterol. The significance of the pharmaceutical market in addressing heart diseases remains paramount in mitigating the escalating global burden of cardiovascular disorders. This market is known for its continuous research and development initiatives, which have the goal of introducing cutting-edge therapies that improve patient outcomes and raise quality of life. These medications frequently concentrate on preserving cardiovascular health, controlling blood pressure, improving cardiac performance, avoiding blood clotting, and controlling cholesterol levels.

The oncology drug offerings within this market segment are formulated to prevent, treat, and effectively manage specific types of cancers. This category encompasses a broad spectrum of drugs, including chemotherapy drugs, targeted therapies, and immunotherapies, all working to impede the growth and spread of cancer cells, often through precise biological pathways. On the flip side, the hyperglycemia sector primarily revolves around medications designed to regulate blood sugar levels and associated complications in individuals with diabetes. This includes insulin, oral hypoglycemic agents, an array of small molecule drugs, and drugs that enhance insulin sensitivity or stimulate insulin production.

Originator Small Molecule Drug Market Dynamics

Driver

The market is fueled by the usage of various tiny molecule medications that treat various humane illnesses including the common cold, cough, and fever.

The small molecule medications make up a significant component of the medicines available for managing symptomatic relief. They are distinguished by their relatively low molecular weight and clearly defined chemical structures. They effectively target certain biological processes, reducing the symptoms of many widespread disorders. They are a popular option for those looking for therapy for mild symptoms because they are readily available over the counter and simple to use. To treat the symptoms of a common cold, coughing, and raised temperatures, including nasal congestion, sore throats, body pains, and rising body temperatures, these tiny molecule medications must be highly effective. Due to advancements in development and study, these medications are also often updated and modified, ensuring superior outcomes and greater satisfaction for patients. The demand for these small molecule medications is still strong overall, demonstrating their significance in symptomatic alleviation and improving general quality of life during bouts of mild diseases.

Restraint

The market has a significant challenge in addressing safety worries and potential adverse effects related to small molecule medications.

Patients’ health and safety ought to consistently come first, and any unfavorable side effects can greatly affect how these drugs are perceived and utilized in the market. If small molecule drugs mistakenly interfere with undesired cells or biological processes, they run the danger of having unanticipated side effects. Thorough molecular and clinical research, as well as knowledge of pharmacodynamics and pharmacokinetics of the medication, are necessary to strike a balance between the efficacy of medical therapy and the possible hazards. Additionally, it could be challenging to predict and reduce side effects since each person’s reaction to small molecule medications may differ due to variances in genetics, the metabolism, or other factors. To reduce side effects while maximizing therapeutic advantages, the pharmaceutical business must make significant investments in research, creative medication design, and cutting-edge technology. In order to continually monitor and resolve any safety issues that may surface once the medicine is used by a larger population, thorough post-market monitoring and real-world evidence analysis are essential. Transparency, continual monitoring, and efficient risk management strategies are essential to establishing and maintaining consumer trust in the safety and effectiveness of small-molecule pharmaceuticals available on the market.

Opportunities

The need for targeted therapies to treat cancer, diabetes, seizure disorders, and other terrible illnesses is anticipated to increase demand for small-molecule medications.

Due to their low molecular masses and clearly defined chemical structures, small molecules are advantageous in the discovery, creation, and administration of medications. Small-molecule anticancer medications are crucial in oncology for accurately identifying cancer cells, preventing their development, and causing the least amount of harm to healthy cells. Similar to this, tiny molecules play a key role in treating disorders like epilepsy and diabetes by altering biological pathways and relieving symptoms. The creation of very targeted and effective small-molecule medications is being made possible by developments in drug discovery, molecular biology, and pharmacology, which are further fueling the increase in demand. Their broad range of therapeutic uses and capacity to enhance therapeutic results while reducing adverse effects highlight their relevance in the healthcare environment. Small-molecule drug development and use are anticipated to flourish as research continues to identify new therapeutic targets, improving patient lives and revolutionizing the treatment of several incapacitating illnesses.

Originator Small Molecule Drug Market Trends

-

Gene editing: CRISPR-Cas9 and other gene editing technologies are being used to create new treatments that target specific genes or genetic mutations. For instance, CRISPR-Cas9 can change the genes of cancer cells to increase their receptivity to therapy.

-

Utilizing nanotechnology, new drug delivery systems are being created that can deliver medications to the target area more effectively and accurately. For instance, medicine delivery to tumours directly using nanoparticles can eliminate the requirement for systemic administration.

-

3D printing: This technology is being utilized to produce specialized inhalers and implants for the delivery of medications. This might enhance the effectiveness and security of medicinal therapies.

-

Big data and analytics: From target identification to clinical trial design, big data and analytics are being used to advance many facets of drug discovery and development.

-

Artificial intelligence (AI) and machine learning (ML) are being used to speed up the discovery and development of new drugs as well as to increase the precision of clinical trials. For instance, AI may be used to screen enormous chemical compound libraries in search of promising novel medication candidates.

Competitive Landscape

The competitive landscape of the originator small molecule drug market was dynamic, with several prominent companies competing to provide innovative and advanced originator small molecule drug solutions.

- Pfizer

- Roche

- Johnson & Johnson

- Novartis

- Merck & Co.

- GlaxoSmithKline

- Eli Lilly

- AbbVie

- Bristol-Myers Squibb

- Sanofi

- Celgene

- Amgen

- Biogen

- Gilead Sciences

- Allergan

- Alexion Pharmaceuticals

- Vertex Pharmaceuticals

- Regeneron Pharmaceuticals

- Novo Nordisk

- Boehringer Ingelheim

Recent Developments:

04 October 2023 – In order to treat Crohn’s disease and ulcerative colitis, two forms of inflammatory bowel disease, Sanofi and Teva Pharmaceuticals, a U.S. division of Teva Pharmaceutical Industries Ltd., have announced a partnership to co-develop and co-commercialize the drug TEV’574.

20 September 2023 – Merck has unveiled two new strategic drug discovery partnerships that would help the company’s research efforts by using AI’s (artificial intelligence) potent design and discovery capabilities. In the important therapeutic areas of cancer, neurology, and immunology, the partnerships with BenevolentAI, London, U.K., and Exscientia, Oxford, U.K., are anticipated to provide a number of unique clinical development drug candidates with best-in-class and first-in-class potential.

Regional Analysis

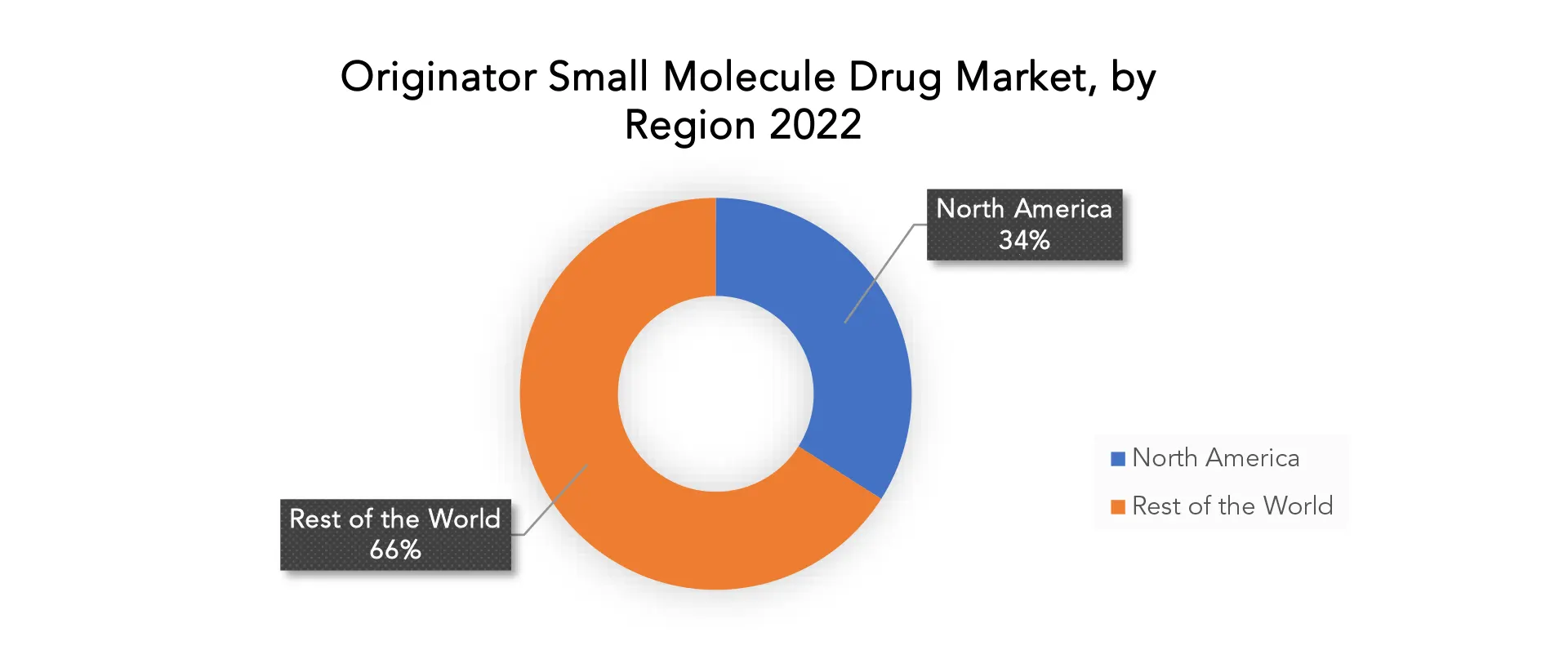

North America accounted for the largest market in the originator small molecule drug market. North America accounted for the 34% market share of the global market value. The original small molecule medication market’s largest regional sector is North America. This is a result of the high frequency of chronic illnesses, the presence of several sizable pharmaceutical and biotechnology firms, as well as the willingness of patients to pay for cutting-edge medications. In the US, the total cost of healthcare is expected to reach the amount of USD 4.7 billion in 2023. The US is expected to have spent USD 6.7 trillion on healthcare by 2030. The United States is one of the world’s biggest markets. Between 2023 and 2033, there will likely be a major increase in the US market. In the upcoming years, the market is anticipated to see tremendous expansion due to the rapidly rising need for medications to treat various ailments. Due to the tendency of governmental bodies to allocate significant amounts of money to the healthcare system and to encourage the development of numerous pharmaceuticals to cure various ailments, Canada also anticipates significant spending on the development of small molecule medicines. North America is an area with very good compensations to continue to be the most dominant worldwide.

The original small molecule medication market’s second-largest geographic sector is located in Europe. Given the difficulties brought on by the new coronavirus, the majority of European nations have kept their healthcare spending strong in 2020. France, which spends a lot on healthcare, has set aside a sizable amount of money to invest in the creation of small molecules, which will help the local economy grow and present chances for suppliers and product makers. For producers and suppliers, the positive expectations for healthcare spending in Europe might be countered by the overall weakness of poor effectiveness in compared to biologics. Clinical studies and other development initiatives continue to be important driving forces for long-term demand, nevertheless.

Target Audience For Originator Small Molecule Drug

- Drug Manufacturing Companies

- Pharmacologists

- Biotechnology Companies

- Academic Institutions

- Investors and Financial Institutions

- Contract Research Organizations (CROs)

- Government Health Departments

- Drug Quality Control and Assurance Teams

- Clinical Trial Organizations

- Medical and Pharmaceutical Associations

- Drug Distributors and Retailers

- Healthcare Policy Makers

- Healthcare Advisory and Consulting Firms

Segments Covered in the Originator Small Molecule Drug Market Report

Originator small molecule drug Market by Drug Class

-

- Anticholinergic

- Anti-cancer

- Others

Originator small molecule drug Market by Indication Type

-

- Cardiovascular

- Oncology

- Diabetes

- Immunological disorders

- Others

Originator small molecule drug Market by Distribution Channel

-

- Hospital Pharmacies

- Retail Pharmacies

- Clinics

- Others

Originator small molecule drug Market by Region

-

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the originator small molecule drug market over the next 7 years?

- Who are the major players in the originator small molecule drug market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the originator small molecule drug market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the originator small molecule drug market?

- What is the current and forecasted size and growth rate of the global originator small molecule drug market?

- What are the key drivers of growth in the originator small molecule drug market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the originator small molecule drug market?

- What are the technological advancements and innovations in the originator small molecule drug Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the originator small molecule drug market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the originator small molecule drug market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ORIGINATOR SMALL MOLECULE DRUG MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ORIGINATOR SMALL MOLECULE DRUG MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ORIGINATOR SMALL MOLECULE DRUG MARKET OUTLOOK

- GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS, 2020-2030, (USD BILLION)

- ANTICHOLINERGIC

- ANTI-CANCER

- OTHERS

- GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE, 2020-2030, (USD BILLION)

- CARDIOVASCULAR

- ONCOLOGY

- DIABETES

- IMMUNOLOGICAL DISORDERS

- OTHERS

- GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL, 2020-2030, (USD BILLION)

- HOSPITAL PHARMACIES

- RETAIL PHARMACIES

- CLINICS

- OTHERS

- GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- PFIZER

- ROCHE

- JOHNSON & JOHNSON

- NOVARTIS

- MERCK & CO.

- GLAXOSMITHKLINE

- ELI LILLY

- ABBVIE

- BRISTOL-MYERS SQUIBB

- SANOFI

- CELGENE

- AMGEN

- BIOGEN

- GILEAD SCIENCES

- ALLERGAN

- ALEXION PHARMACEUTICALS

- VERTEX PHARMACEUTICALS

- REGENERON PHARMACEUTICALS

- NOVO NORDISK

- BOEHRINGER INGELHEIM *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 2 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 4 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY REGIONS (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 10 US ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 11 US ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 12 CANADA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 13 CANADA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 14 CANADA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 15 MEXICO ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 16 MEXICO ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 17 MEXICO ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 23 BRAZIL ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 24 BRAZIL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 25 ARGENTINA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 26 ARGENTINA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 28 COLOMBIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 29 COLOMBIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC ORIGINATOR SMALL MOLECULE DRUG MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 39 INDIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 40 INDIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 41 CHINA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 42 CHINA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 43 CHINA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 44 JAPAN ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 45 JAPAN ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 46 JAPAN ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 59 EUROPE ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 60 EUROPE ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 61 EUROPE ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 62 EUROPE ORIGINATOR SMALL MOLECULE DRUG MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 64 GERMANY ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 65 GERMANY ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 66 UK ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 67 UK ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 68 UK ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 69 FRANCE ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 70 FRANCE ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 71 FRANCE ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 72 ITALY ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 73 ITALY ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 74 ITALY ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 75 SPAIN ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 76 SPAIN ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 77 SPAIN ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 78 RUSSIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 79 RUSSIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 80 RUSSIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 89 UAE ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 90 UAE ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS USD BILLION, 2020-2030

FIGURE 9 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE USD BILLION, 2020-2030

FIGURE 10 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL USD BILLION, 2020-2030

FIGURE 11 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY REGION USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DRUG CLASS USD BILLION, 2022

FIGURE 14 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY INDICATION TYPE USD BILLION, 2022

FIGURE 15 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY DISTRIBUTION CHANNEL USD BILLION, 2022

FIGURE 16 GLOBAL ORIGINATOR SMALL MOLECULE DRUG MARKET BY REGION USD BILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 PFIZER: COMPANY SNAPSHOT

FIGURE 19 ROCHE: COMPANY SNAPSHOT

FIGURE 20 JOHNSON & JOHNSON: COMPANY SNAPSHOT

FIGURE 21 NOVARTIS: COMPANY SNAPSHOT

FIGURE 22 MERCK & CO.: COMPANY SNAPSHOT

FIGURE 23 GLAXOSMITHKLINE: COMPANY SNAPSHOT

FIGURE 24 ELI LILLY: COMPANY SNAPSHOT

FIGURE 25 ABBVIE: COMPANY SNAPSHOT

FIGURE 26 BRISTOL-MYERS SQUIBB: COMPANY SNAPSHOT

FIGURE 27 SANOFI: COMPANY SNAPSHOT

FIGURE 28 CELGENE: COMPANY SNAPSHOT

FIGURE 29 AMGEN: COMPANY SNAPSHOT

FIGURE 30 BIOGEN: COMPANY SNAPSHOT

FIGURE 31 GILEAD SCIENCES: COMPANY SNAPSHOT

FIGURE 32 ALLERGAN: COMPANY SNAPSHOT

FIGURE 33 ALEXION PHARMACEUTICALS: COMPANY SNAPSHOT

FIGURE 34 VERTEX PHARMACEUTICALS: COMPANY SNAPSHOT

FIGURE 35 REGENERON PHARMACEUTICALS: COMPANY SNAPSHOT

FIGURE 36 NOVO NORDISK: COMPANY SNAPSHOT

FIGURE 37 BOEHRINGER INGELHEIM: COMPANY SNAPSHOT

FAQ

The global originator small molecule drug Market is anticipated to grow from USD 46.53 Billion in 2023 to USD 71.98 Billion by 2030, at a CAGR of 5.47 % during the forecast period.

North America accounted for the largest market in the originator small molecule drug market. North America accounted for 34% market share of the global market value.

Pfizer, Roche, Johnson & Johnson, Novartis, Merck & Co., GlaxoSmithKline, Eli Lilly, AbbVie, Bristol-Myers Squibb, Sanofi, Celgene, Amgen, Biogen, Gilead Sciences, Allergan, Alexion Pharmaceuticals, Vertex Pharmaceuticals, Regeneron Pharmaceuticals, Novo Nordisk, Boehringer Ingelheim

3D printing: This technology is being utilized to produce specialized inhalers and implants for the delivery of medications. This might enhance the effectiveness and security of medicinal therapies.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.