REPORT OUTLOOK

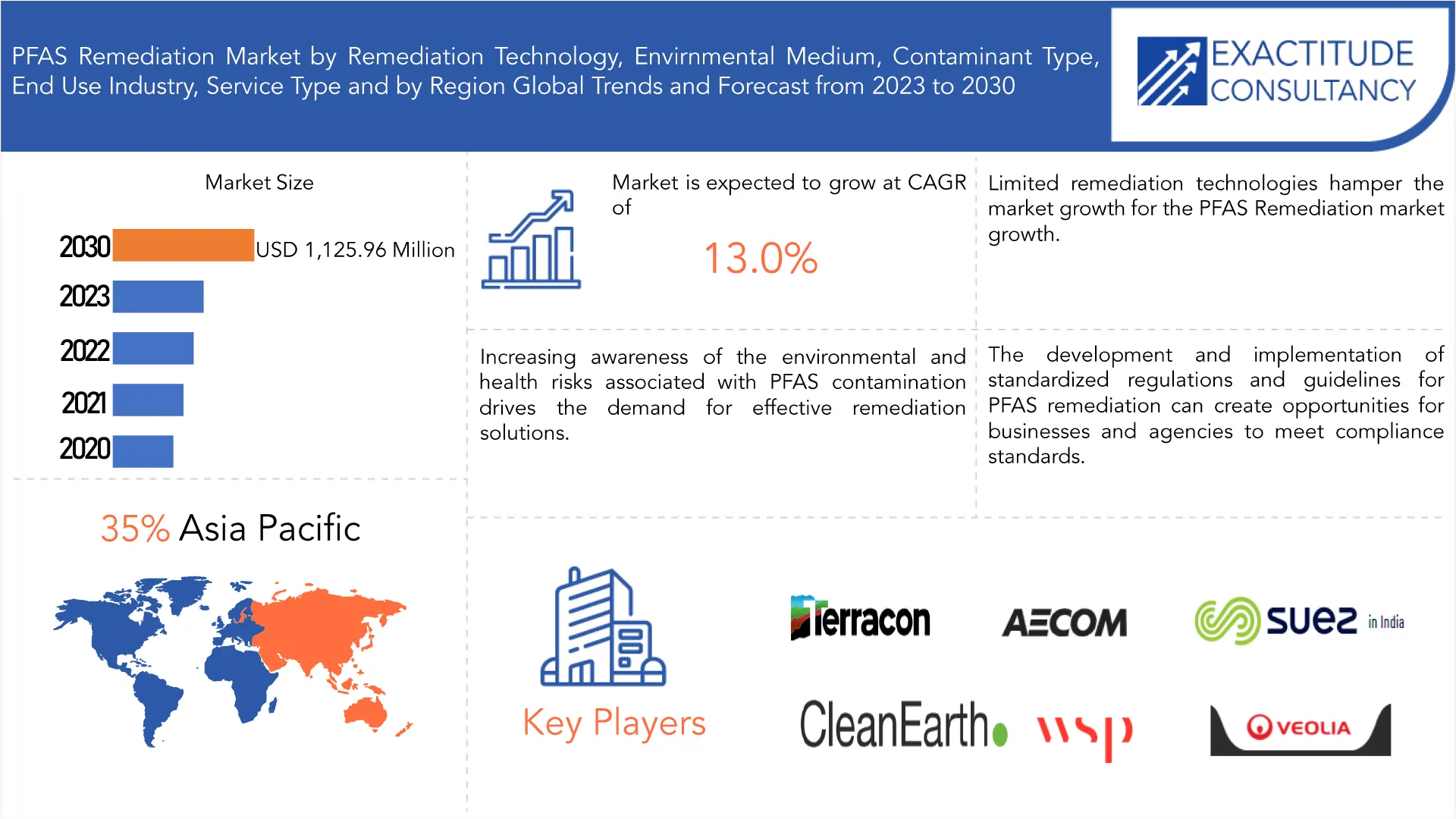

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1,125.96 Million by 2030 | 13% | Asia Pacific |

| by Remediation Technology | by Environmental Medium | by Contaminant Type | End Use Industry | by Region |

|---|---|---|---|---|

|

|

|

|

|

SCOPE OF THE REPORT

Market Overview

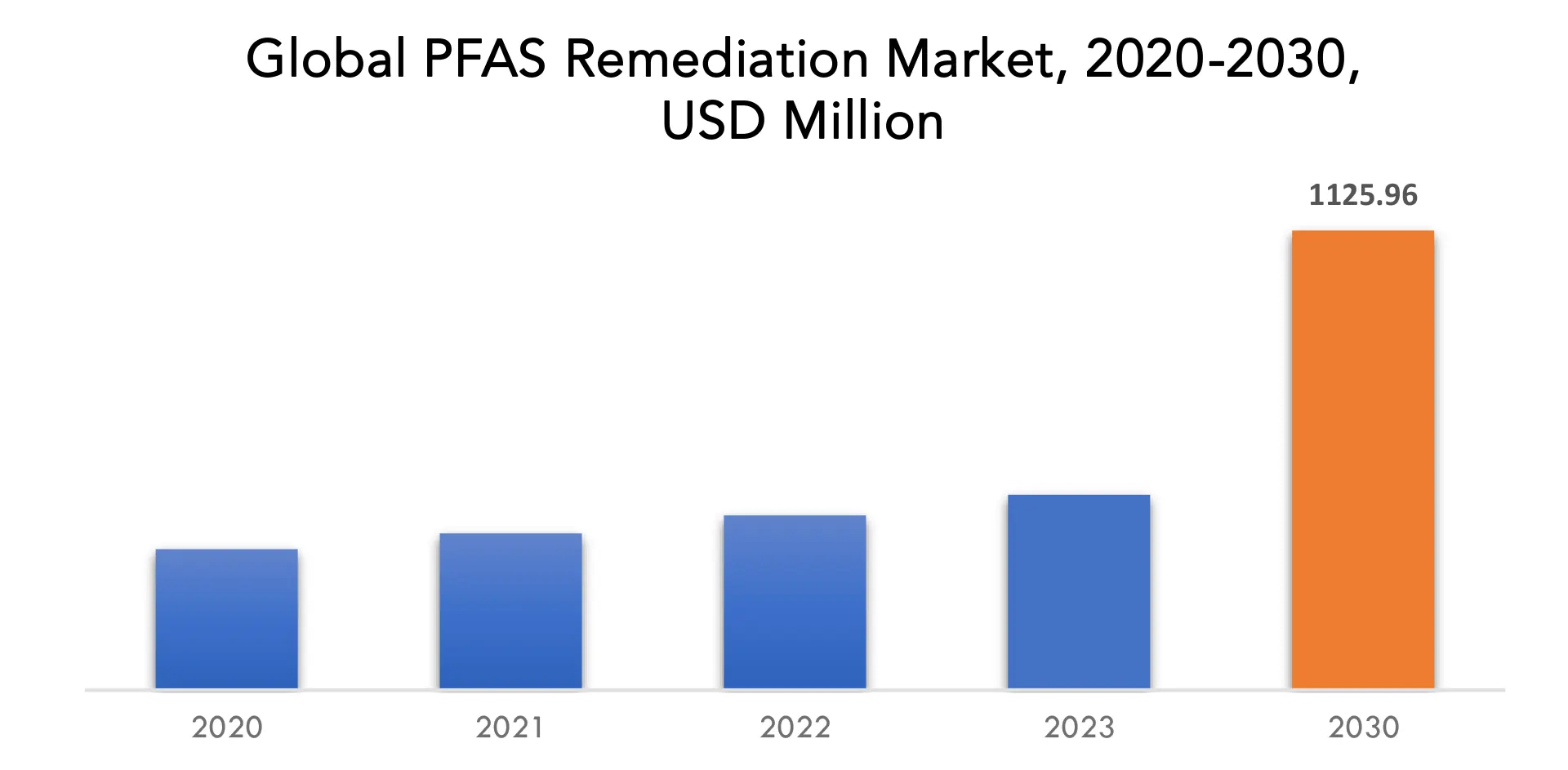

The global PFAS Remediation market is anticipated to grow from USD 478.65 Million in 2023 to USD 1,125.96 Million by 2030, at a CAGR 13.0 % during the forecast period.

PFAS remediation refers to the procedure of mitigating and cleaning up environmental contamination caused by Per- and Polyfluoroalkyl Substances (PFAS), which are a group of synthetic chemicals known for their persistence in the environment and potential health risks. PFAS contamination can occur in soil, groundwater, surface water, and other environmental media due to various sources, including industrial discharges, firefighting foams, and consumer products. PFAS compounds can migrate through soil and groundwater, potentially contaminating larger areas if left unaddressed. Remediation helps contain the spread of contamination and prevent it from affecting new areas. Many countries and regions have enacted or are considering regulations to limit PFAS exposure and contamination. Compliance with these regulations often requires PFAS remediation for affected sites. Groundwater and surface water sources can become contaminated with PFAS, affecting drinking water supplies. Remediation efforts aim to restore clean water sources and protect public drinking water. Many PFAS compounds were used for decades in various industrial and commercial applications, leading to historical contamination. Remediation is necessary to address legacy contamination and rectify past environmental harm. Widespread PFAS contamination can have economic consequences, such as reduced property values, legal liabilities, and the cost of treating contaminated water. Remediation efforts can mitigate these financial burdens. PFAS remediation is part of a broader effort to encourage responsible chemical management practices. It sends a message that persistent and harmful chemicals must be managed and disposed of carefully.

Growing awareness of the health and environmental risks associated with PFAS contamination has prompted governments, communities, and industries to take action. As understanding of PFAS-related issues expands, so does the demand for remediation solutions, fireproof insulation. Governments around the world are enacting regulations and guidelines to address PFAS contamination. These regulations often require responsible parties to remediate contaminated sites. Compliance with these regulations is a driving force behind the growth of the PFAS remediation market. The potential legal liabilities associated with PFAS contamination have led responsible parties to take remedial actions to mitigate legal and financial risks. This includes industries, municipalities, and organizations that may face legal consequences for PFAS contamination. Communities affected by PFAS contamination, as well as advocacy groups and concerned citizens, have exerted pressure on authorities and industries to address the issue. This public pressure contributes to increased efforts in PFAS remediation. Ongoing research and development have led to the advancement of PFAS remediation technologies, making them more effective and cost-efficient. This has encouraged industries to invest in these solutions. The development of innovative treatment methods, such as advanced oxidation processes (AOPs), electrochemical technologies, and bio-based solutions for PFAS removal, has expanded the range of options available for remediation.

PFAS Remediation Market Report Scope and Segmentation

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million) |

| Segmentation | By Remediation Technology, Environmental Medium, Contaminant Type, End Use Industry, Service Type and Region |

| By Remediation Technology |

|

| By Environmental Medium |

|

| By Contaminant Type |

|

| By End Use Industry |

|

| By Service Type |

|

| By Region

|

|

PFAS Remediation Market Segmentation Analysis

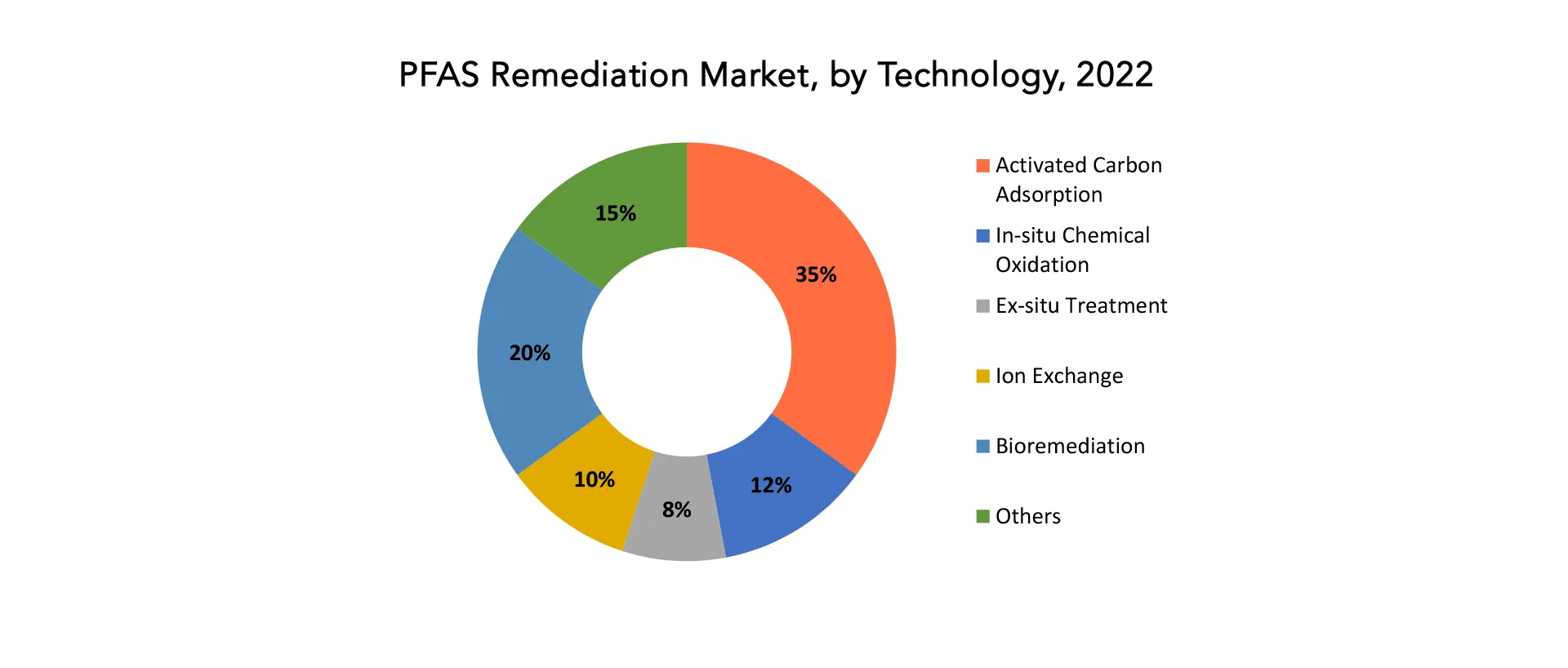

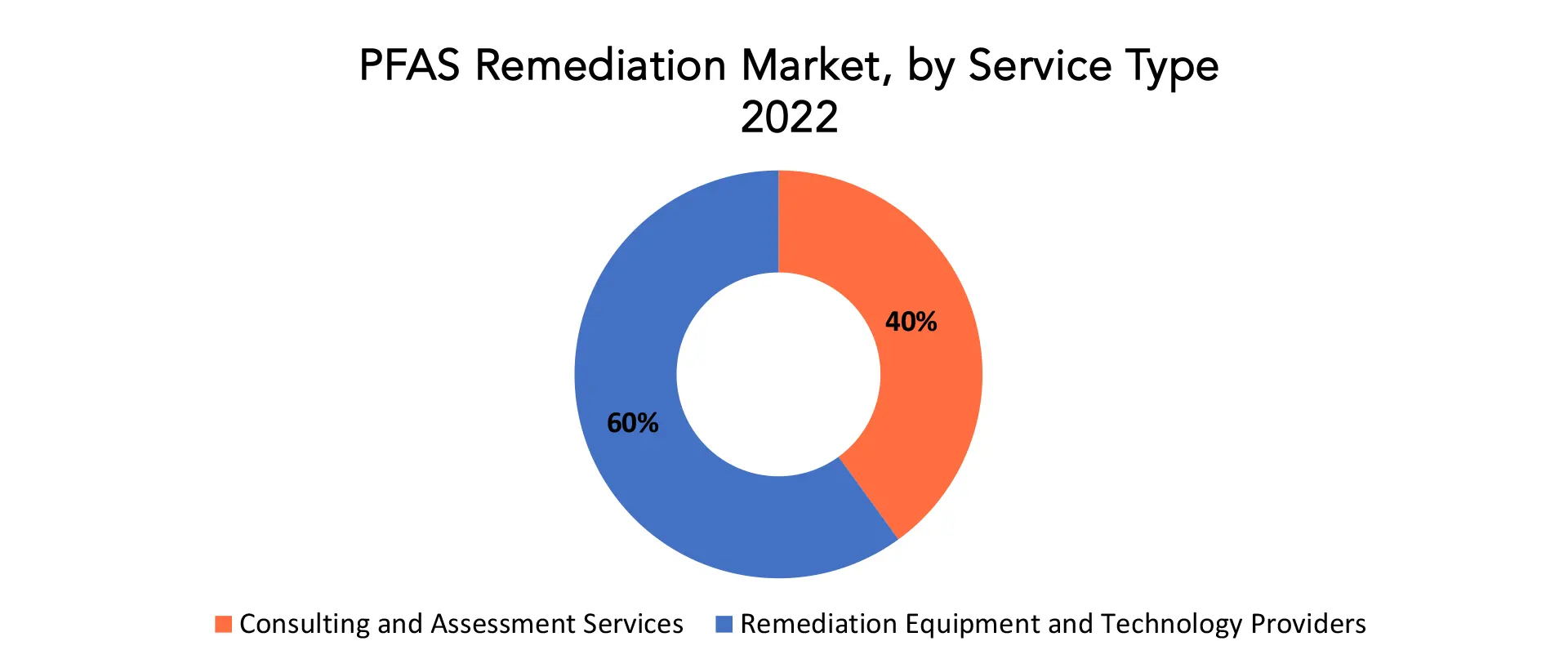

PFAS Remediation market is divided into 6 segments, Remediation Technology, environmental medium, Contaminant Type, End-user Industry, service type and region. By Remediation Technology the market is bifurcated into Activated Carbon Adsorption, In-situ Chemical Oxidation, Ex-situ Treatment, Ion Exchange, Bioremediation, Others. By environmental medium the market is bifurcated into Groundwater Remediation, Soil Remediation, Surface Water and Sediment Remediation. By contaminant type the market is bifurcated into PFOA and PFOS, Multiple PFAS Compounds. By end use industry the market is bifurcated into Manufacturing and Industrial, Municipal and Drinking Water Systems, Military and Defense, Environmental Consulting and Engineering Firms. By service type the market is bifurcated into Consulting and Assessment Services, Remediation Equipment and Remediation Technology Providers.

Based on remediation technology activated carbon adsorption segment dominating in the PFAS Remediation market. Activated carbon is highly effective at adsorbing PFAS compounds from water. Its porous structure provides a large surface area for PFAS molecules to adhere to, allowing for efficient removal. Activated carbon adsorption is a well-established and proven Remediation Technology for PFAS removal. It has been used in various water treatment applications for decades and is trusted for its reliability and effectiveness. Activated carbon can be used in both granular and powdered forms, making it suitable for a wide range of water treatment scenarios, including point-of-entry (POE) and point-of-use (POU) systems, as well as large-scale municipal water treatment plants. Activated carbon adsorption systems are relatively simple to implement. They can be integrated into existing water treatment infrastructure with minimal modifications. Activated carbon adsorption is recognized and accepted by regulatory bodies for PFAS removal. Many water treatment plants and facilities use activated carbon to comply with regulatory standards. Compared to some other PFAS removal technologies, activated carbon is often a cost-effective option, especially for treating low to moderate concentrations of PFAS in water. Spent activated carbon can often be reactivated and reused, reducing the overall cost of PFAS removal. This makes it a sustainable choice. Activated carbon has been successfully used in numerous instances to address PFAS contamination in various settings, including industrial sites and communities. Activated carbon typically does not introduce chemicals or byproducts into the treated water that would negatively affect its quality, taste, or odor. Activated carbon adsorption systems can be started up quickly, which is essential in situations requiring rapid PFAS remediation.

Based on service type remediation equipment and remediation technology providers segment dominating in the PFAS Remediation market. Innovative Technologies: Remediation equipment and Remediation Technology providers are at the forefront of developing and advancing new PFAS remediation technologies. They continuously innovate to enhance the efficiency and effectiveness of treatment methods. This segment offers a wide range of remediation technologies, allowing site-specific customization to address various PFAS contamination scenarios. Solutions may include activated carbon systems, ion exchange resin technologies, advanced oxidation processes, and more. Many providers offer comprehensive services, including equipment supply, installation, operation, maintenance, and monitoring. They ensure that PFAS remediation systems operate effectively and meet regulatory requirements. Equipment and Remediation Technology providers are knowledgeable about regulatory standards related to PFAS contamination and remediation. They help clients navigate complex compliance issues. Providers employ engineers, scientists, and technical experts who have in-depth knowledge of PFAS chemistry, environmental science, and water treatment. They apply this expertise to design and implement effective solutions. Remediation providers often conduct site assessments to evaluate the extent of PFAS contamination and determine the most appropriate remediation Technology for a given site.

Market Dynamics:

Drivers:

Increasing PFAS Contamination Cases: The rising number of reported PFAS contamination cases globally is a key driver, necessitating the need for effective remediation solutions.

Corporate Environmental Responsibility: Companies are increasingly recognizing the importance of corporate environmental responsibility, leading to the adoption of PFAS remediation measures.

Growing Industrial Applications: The expanding use of PFAS in various industrial processes has contributed to increased contamination, driving the demand for remediation technologies.

Restraints:

High Costs: The cost of PFAS remediation technologies can be significant, acting as a restraint for adoption, especially for smaller companies or municipalities.

Limited Standardization: Lack of standardized regulations and guidelines for PFAS remediation may create uncertainty and hinder the market’s growth.

Opportunities:

Market Expansion: The increasing number of PFAS-affected sites globally presents a significant market expansion opportunity for remediation technologies.

Collaborations and Partnerships: Collaborations between technology providers, research institutions, and government bodies can accelerate the development and adoption of effective PFAS remediation solutions.

Innovation and Product Development: Continued innovation in remediation technologies and the development of cost-effective solutions present opportunities for companies to gain a competitive edge.

PFAS Remediation Market Trends

- Governments at various levels were increasingly enacting and enforcing regulations related to PFAS contamination and remediation. This trend was expected to continue, putting pressure on industries and communities to address PFAS-related challenges.

- Ongoing research and development efforts were focused on improving existing PFAS remediation technologies and developing innovative methods. This included advancements in activated carbon systems, ion exchange resins, and advanced oxidation processes.

- Many remediation projects employed a combination of technologies to effectively treat PFAS contamination. Hybrid systems that integrate different remediation methods were gaining popularity to address the diversity of PFAS compounds and site-specific conditions.

- Affected communities and advocacy groups were increasingly vocal about the need for PFAS remediation and stringent regulatory standards. Public pressure was a driving force behind remediation efforts.

- Companies were taking proactive steps to address PFAS contamination as part of corporate social responsibility and sustainability initiatives. This trend was expected to continue as responsible chemical management practices gained prominence.

- Continued scientific research on PFAS, including their behavior in the environment and their health effects, was informing remediation strategies and regulatory decisions.

- Remediation efforts were increasingly focused on addressing legacy PFAS contamination from historical industrial activities. These efforts aimed to rectify past environmental harm.

- Given that PFAS contamination is a global issue, international collaboration and information sharing among countries and organizations were increasing to address the problem comprehensively.

- Cost-effective PFAS remediation solutions were in high demand. Companies and communities sought to address contamination without incurring excessive financial burdens.

- Tailoring remediation approaches to the specific conditions of each site was a growing trend. Site assessments and detailed analysis were used to determine the most effective treatment methods.

- Continuous monitoring and reporting of PFAS remediation efforts were considered essential to track the progress and effectiveness of treatment systems.

- Some remediation projects incorporated environmentally friendly and sustainable approaches to minimize the ecological footprint of remediation efforts.

Competitive Landscape

The competitive landscape of the PFAS (Per- and Polyfluoroalkyl Substances) remediation market includes a mix of established environmental remediation companies, equipment and Remediation Technology providers, research institutions, and consulting firms.

- Veolia Environments

- SUEZ

- Jacobs Engineering Group

- AECOM

- Golder Associates

- Terracon

- Clean Earth

- Wood Group

- PerkinElmer

- Battelle Memorial Institute

- ExxonMobil

- Peroxy Chem

- Xylem Inc.

- GZA Geo Environmental, Inc.

- TRC Companies, Inc.

- CycloPure, Inc.

- American Water

- Charah Solutions, Inc.

- QED Environmental Systems

- Cytec Solvay Group

Regional Analysis

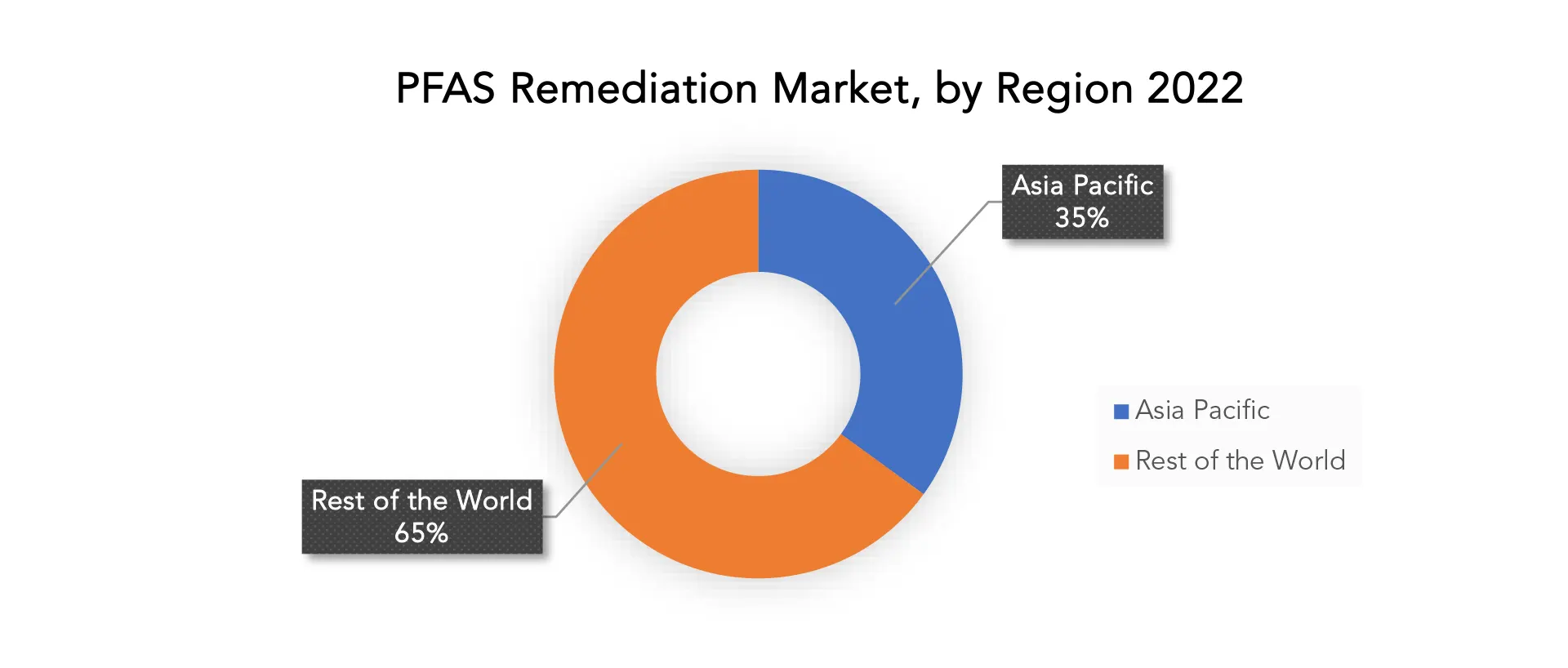

Asia Pacific accounted for the largest market in the PFAS Remediation market. Asia Pacific accounted for the 35 % market share across the globe. The Asia-Pacific region has faced extensive PFAS contamination due to various factors, including industrial activities, military bases, and the use of firefighting foams. This contamination has led to a pressing need for PFAS remediation. The Asia-Pacific region, particularly China, has become a global manufacturing hub. Many industries in the region have historically used PFAS-containing materials, resulting in contamination. This has driven the demand for remediation services. Some countries in the Asia-Pacific region have taken proactive steps to address PFAS contamination. Governments have introduced regulations and guidelines, creating a conducive environment for PFAS remediation projects.

Local companies in the Asia-Pacific region have developed expertise in PFAS remediation. They understand the specific challenges and requirements of the region, making them well-suited to address local contamination issues. The Asia-Pacific region has actively involved in international collaborations and information sharing related to PFAS remediation, benefitting from global expertise and best practices.

Target Audience for PFAS Remediation Market

- Government Agencies and Regulators

- Industries and Corporations

- Environmental Consulting Firms

- Remediation Equipment and Remediation Technology Providers

- Environmental Engineering Firms

- Water Treatment Companies

- Research Institutions and Laboratories

- Community Advocacy Groups

- Law Firms and Legal Professionals

- Non-Governmental Organizations (NGOs)

- Healthcare and Medical Professionals

- Governmental and Industry Associations

- Financiers and Investors

- International Collaboration and Information Sharing Forums

Segments Covered in the PFAS Remediation Market Report

PFAS Remediation Market by Remediation Technology, 2020-2030, USD Million

- Activated Carbon Adsorption

- In-situ Chemical Oxidation

- Ex-situ Treatment

- Ion Exchange

- Bioremediation

- Others

PFAS Remediation Market by Environmental Medium 2020-2030, USD Million

- Groundwater Remediation

- Soil Remediation

- Surface Water and Sediment Remediation

PFAS Remediation Market by Contaminant Type 2020-2030, USD Million

- PFOA and PFOS

- Multiple PFAS Compounds

PFAS Remediation Market by End Use Industry, 2020-2030, USD Million

- Manufacturing and Industrial

- Municipal and Drinking Water Systems

- Military and Defense

- Environmental Consulting and Engineering Firms

PFAS Remediation Market by Service Type, 2020-2030, USD Million

- Consulting and Assessment Services

- Remediation Equipment and Technology Providers

PFAS Remediation Market by Region, 2020-2030, USD Million

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the PFAS Remediation market over the next 7 years?

- Who are the major players in the PFAS Remediation market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and africa?

- How is the economic environment affecting the 3-d projector market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the 3-d projector market?

- What is the current and forecasted size and growth rate of the PFAS Remediation market?

- What are the key drivers of growth in the PFAS Remediation market?

- Who are the major players in the market and what is their market share?

- What are the End Use Industry’s and supply chain dynamics in the projector market?

- What are the technological advancements and innovations in the PFAS Remediation market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the PFAS Remediation market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the PFAS Remediation market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- PFAS REMEDIATION MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON PFAS REMEDIATION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- PFAS REMEDIATION MARKET OUTLOOK

- GLOBAL PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY, 2020-2030, (USD BILLION)

- TRAFFIC SIGNALS

- BARRICADES AND CONES

- BARRIER SYSTEMS

- PARKING CONTROL PRODUCTS

- TRAFFIC CONTROL BEACONS

- ROAD MARKINGS

- TRAFFIC MANAGEMENT SYSTEMS

- GLOBAL PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM, 2020-2030, (USD BILLION)

- TRADITIONAL PFAS REMEDIATION

- CONNECTED VEHICLE INFRASTRUCTURE

- SMART PFAS REMEDIATION

- GLOBAL PFAS REMEDIATION MARKET BY CONTAMINANT TYPE, 2020-2030, (USD BILLION)

- URBAN TRAFFIC CONTROL

- PEDESTRIAN AND SCHOOL ZONE SAFETY

- PARKING FACILITY CONTROL

- METAL PFAS REMEDIATION

- PLASTIC PFAS REMEDIATION

- GLOBAL PFAS REMEDIATION MARKET BY END USE INDUSTRY, 2020-2030, (USD BILLION)

- METAL PFAS REMEDIATION

- PLASTIC PFAS REMEDIATION

- GLOBAL PFAS REMEDIATION MARKET BY SERVICE TYPE, 2020-2030, (USD BILLION)

- CONSULTING AND ASSESSMENT SERVICES

- REMEDIATION EQUIPMENT AND TECHNOLOGY PROVIDERS

- GLOBAL PFAS REMEDIATION MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, TYPES OFFERED, RECENT DEVELOPMENTS)

- VEOLIA ENVIRONMENTS

- SUEZ

- JACOBS ENGINEERING GROUP

- AECOM

- GOLDER ASSOCIATES

- TERRACON

- CLEAN EARTH

- WOOD GROUP

- PERKINELMER

- BATTELLE MEMORIAL INSTITUTE

- EXXONMOBIL

- PEROXYCHEM

- XYLEM INC.

- GZA GEOENVIRONMENTAL, INC.

- TRC COMPANIES, INC.

- CYCLOPURE, INC.

- AMERICAN WATER

- CHARAH SOLUTIONS, INC.

- QED ENVIRONMENTAL SYSTEMS

- CYTEC SOLVAY GROUP

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1GLOBAL PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 2 GLOBAL PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS)

2020-2030

TABLE 3 GLOBAL PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 4 GLOBAL PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 6 GLOBAL PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 8 GLOBAL PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS)

2020-2030

TABLE 9 GLOBAL PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 10 GLOBAL PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 GLOBAL PFAS REMEDIATION MARKET BY REGION (USD BILLION) 2020-2030

TABLE 12 GLOBAL PFAS REMEDIATION MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA PFAS REMEDIATION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA PFAS REMEDIATION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 17 NORTH AMERICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 18 NORTH AMERICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 NORTH AMERICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 20 NORTH AMERICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 21 NORTH AMERICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 22 NORTH AMERICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 23 NORTH AMERICA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 24 NORTH AMERICA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 US PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 26 US PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 27 US PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 28 US PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 US PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 30 US PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 31 US PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 32 US PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 33 US PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 34 US PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 35 CANADA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 36 CANADA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 37 CANADA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 38 CANADA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 CANADA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 40 CANADA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 41 CANADA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 42 CANADA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 43 CANADA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 44 CANADA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 MEXICO PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 46 MEXICO PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 47 MEXICO PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 48 MEXICO PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 49 MEXICO PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 50 MEXICO PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 51 MEXICO PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 52 MEXICO PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 53 MEXICO PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 54 MEXICO PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 SOUTH AMERICA PFAS REMEDIATION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 56 SOUTH AMERICA PFAS REMEDIATION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 57 SOUTH AMERICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 58 SOUTH AMERICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 59 SOUTH AMERICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 60 SOUTH AMERICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 61 SOUTH AMERICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 62 SOUTH AMERICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 63 SOUTH AMERICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 64 SOUTH AMERICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH AMERICA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH AMERICA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 BRAZIL PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 68 BRAZIL PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 69 BRAZIL PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 70 BRAZIL PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 BRAZIL PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 72 BRAZIL PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 73 BRAZIL PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 74 BRAZIL PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 75 BRAZIL PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 76 BRAZIL PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 77 ARGENTINA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 78 ARGENTINA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 79 ARGENTINA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 80 ARGENTINA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 81 ARGENTINA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 82 ARGENTINA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 83 ARGENTINA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 84 ARGENTINA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 85 ARGENTINA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 86 ARGENTINA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 87 COLOMBIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 88 COLOMBIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 89 COLOMBIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 90 COLOMBIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 91 COLOMBIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 92 COLOMBIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 93 COLOMBIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 94 COLOMBIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 95 COLOMBIA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 96 COLOMBIA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 98 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 99 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 100 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 102 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 103 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 104 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 105 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 106 REST OF SOUTH AMERICA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 ASIA-PACIFIC PFAS REMEDIATION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 108 ASIA-PACIFIC PFAS REMEDIATION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 109 ASIA-PACIFIC PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 110 ASIA-PACIFIC PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 111 ASIA-PACIFIC PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 112 ASIA-PACIFIC PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 ASIA-PACIFIC PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 114 ASIA-PACIFIC PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 115 ASIA-PACIFIC PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 116 ASIA-PACIFIC PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 117 ASIA-PACIFIC PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 118 ASIA-PACIFIC PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 INDIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 120 INDIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 121 INDIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 122 INDIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 INDIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 124 INDIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 125 INDIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 126 INDIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 127 INDIA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 128 INDIA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 129 CHINA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 130 CHINA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 131 CHINA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 132 CHINA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 CHINA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 134 CHINA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 135 CHINA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 136 CHINA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 137 CHINA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 138 CHINA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 139 JAPAN PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 140 JAPAN PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 141 JAPAN PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 142 JAPAN PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 143 JAPAN PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 144 JAPAN PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 145 JAPAN PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 146 JAPAN PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 147 JAPAN PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 148 JAPAN PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 149 SOUTH KOREA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 150 SOUTH KOREA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 151 SOUTH KOREA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 152 SOUTH KOREA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 153 SOUTH KOREA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 154 SOUTH KOREA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 155 SOUTH KOREA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 156 SOUTH KOREA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 157 SOUTH KOREA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 158 SOUTH KOREA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 159 AUSTRALIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 160 AUSTRALIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 161 AUSTRALIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 162 AUSTRALIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 163 AUSTRALIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 164 AUSTRALIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 165 AUSTRALIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 166 AUSTRALIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 167 AUSTRALIA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 168 AUSTRALIA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 169 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 170 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 171 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 172 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 173 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 174 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 175 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 176 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 177 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 178 SOUTH-EAST ASIA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 179 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 180 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 181 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 182 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 183 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 184 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 185 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 186 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 187 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 188 REST OF ASIA PACIFIC PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 189 EUROPE PFAS REMEDIATION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 190 EUROPE PFAS REMEDIATION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 191 EUROPE PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 192 EUROPE PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 193 EUROPE PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 194 EUROPE PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 195 EUROPE PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 196 EUROPE PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 197 EUROPE PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 198 EUROPE PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 199 EUROPE PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 200 EUROPE PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 201 GERMANY PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 202 GERMANY PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 203 GERMANY PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 204 GERMANY PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 205 GERMANY PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 206 GERMANY PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 207 GERMANY PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 208 GERMANY PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 209 GERMANY PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 210 GERMANY PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 211 UK PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 212 UK PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 213 UK PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 214 UK PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 215 UK PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 216 UK PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 217 UK PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 218 UK PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 219 UK PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 220 UK PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 221 FRANCE PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 222 FRANCE PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 223 FRANCE PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 224 FRANCE PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 225 FRANCE PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 226 FRANCE PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 227 FRANCE PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 228 FRANCE PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 229 FRANCE PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 230 FRANCE PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 231 ITALY PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 232 ITALY PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 233 ITALY PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 234 ITALY PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 235 ITALY PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 236 ITALY PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 237 ITALY PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 238 ITALY PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 239 ITALY PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 240 ITALY PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 241 SPAIN PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 242 SPAIN PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 243 SPAIN PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 244 SPAIN PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 245 SPAIN PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 246 SPAIN PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 247 SPAIN PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 248 SPAIN PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 249 SPAIN PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 250 SPAIN PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 251 RUSSIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 252 RUSSIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 253 RUSSIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 254 RUSSIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 255 RUSSIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 256 RUSSIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 257 RUSSIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 258 RUSSIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 259 RUSSIA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 260 RUSSIA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 261 REST OF EUROPE PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 262 REST OF EUROPE PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 263 REST OF EUROPE PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 264 REST OF EUROPE PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 265 REST OF EUROPE PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 266 REST OF EUROPE PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 267 REST OF EUROPE PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 268 REST OF EUROPE PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 269 REST OF EUROPE PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 270 REST OF EUROPE PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 271 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 272 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 273 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 274 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 275 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 276 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 277 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 278 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 279 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 280 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 281 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 282 MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 283 UAE PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 284 UAE PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 285 UAE PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 286 UAE PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 287 UAE PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 288 UAE PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 289 UAE PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 290 UAE PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 291 UAE PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 292 UAE PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 293 SAUDI ARABIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 294 SAUDI ARABIA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 295 SAUDI ARABIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 296 SAUDI ARABIA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 297 SAUDI ARABIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 298 SAUDI ARABIA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 299 SAUDI ARABIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 300 SAUDI ARABIA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 301 SAUDI ARABIA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 302 SAUDI ARABIA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 303 SOUTH AFRICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 304 SOUTH AFRICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 305 SOUTH AFRICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 306 SOUTH AFRICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 307 SOUTH AFRICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 308 SOUTH AFRICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 309 SOUTH AFRICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 310 SOUTH AFRICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 311 SOUTH AFRICA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 312 SOUTH AFRICA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

TABLE 313 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (USD BILLION) 2020-2030

TABLE 314 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 315 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (USD BILLION) 2020-2030

TABLE 316 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY CONTAMINANT TYPE (THOUSAND UNITS) 2020-2030

TABLE 317 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 318 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 319 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (USD BILLION) 2020-2030

TABLE 320 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM (THOUSAND UNITS) 2020-2030

TABLE 321 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 322 REST OF MIDDLE EAST AND AFRICA PFAS REMEDIATION MARKET BY SERVICE TYPE (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY USD BILLION, 2020-2030

FIGURE 9 GLOBAL PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM USD BILLION, 2020-2030

FIGURE 10 GLOBAL PFAS REMEDIATION MARKET BY CONTAMINANT TYPE, USD BILLION, 2020- 2030

FIGURE 11 GLOBAL PFAS REMEDIATION MARKET BY END USE INDUSTRY, USD BILLION, 2020-2030

FIGURE 12 GLOBAL PFAS REMEDIATION MARKET BY SERVICE TYPE, USD BILLION, 2020-2030

FIGURE 13 GLOBAL PFAS REMEDIATION MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 14 PORTER’S FIVE FORCES MODEL

FIGURE 15 GLOBAL PFAS REMEDIATION MARKET BY REMEDIATION TECHNOLOGY USD BILLION, 2022

FIGURE 16 GLOBAL PFAS REMEDIATION MARKET BY ENVIRONMENTAL MEDIUM, USD BILLION, 2022

FIGURE 17 GLOBAL PFAS REMEDIATION MARKET BY CONTAMINANT TYPE, USD BILLION, 2022

FIGURE 18 GLOBAL PFAS REMEDIATION MARKET BY END USE INDUSTRY, USD BILLION, 2022

FIGURE 19 GLOBAL PFAS REMEDIATION MARKET BY SERVICE TYPE, USD BILLION, 2022

FIGURE 20 GLOBAL PFAS REMEDIATION MARKET BY REGION, USD BILLION, 2022

FIGURE 21 MARKET SHARE ANALYSIS

FIGURE 22 VEOLIA ENVIRONMENTS: COMPANY SNAPSHOT

FIGURE 23 SUEZ: COMPANY SNAPSHOT

FIGURE 24 JACOBS ENGINEERING GROUP: COMPANY SNAPSHOT

FIGURE 25 AECOM: COMPANY SNAPSHOT

FIGURE 26 GOLDER ASSOCIATES: COMPANY SNAPSHOT

FIGURE 27 TERRACON: COMPANY SNAPSHOT

FIGURE 29 CLEAN EARTH: COMPANY SNAPSHOT

FIGURE 30 WOOD GROUP: COMPANY SNAPSHOT

FIGURE 31 PERKINELMER: COMPANY SNAPSHOT

FIGURE 32 BATTELLE MEMORIAL INSTITUTE: COMPANY SNAPSHOT

FIGURE 33 XYLEM INC.: COMPANY SNAPSHOT

FIGURE 34 TRC COMPANIES, INC.: COMPANY SNAPSHOT

FIGURE 35 CYCLOPURE, INC.: COMPANY SNAPSHOT

FIGURE 36 AMERICAN WATER: COMPANY SNAPSHOT

FAQ

The global PFAS Remediation market is anticipated to grow from USD 478.65 Million in 2023 to USD 1,125.96 Million by 2030, at a CAGR 13.0 % during the forecast period.

Asia pacific accounted for the largest market in the PFAS Remediation market. Asia pacific accounted for the 35 % market share across the globe.

Veolia Environments, SUEZ, Jacobs Engineering Group, AECOM, Golder Associates, Terraco, Clean Earth, Wood Group, PerkinElmer.

Governments at various levels were increasingly enacting and enforcing regulations related to PFAS contamination and remediation. This trend was expected to continue, putting pressure on industries and communities to address PFAS-related challenges. Ongoing research and development efforts were focused on improving existing PFAS remediation technologies and developing innovative methods. This included advancements in activated carbon systems, ion exchange resins, and advanced oxidation processes.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.