REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

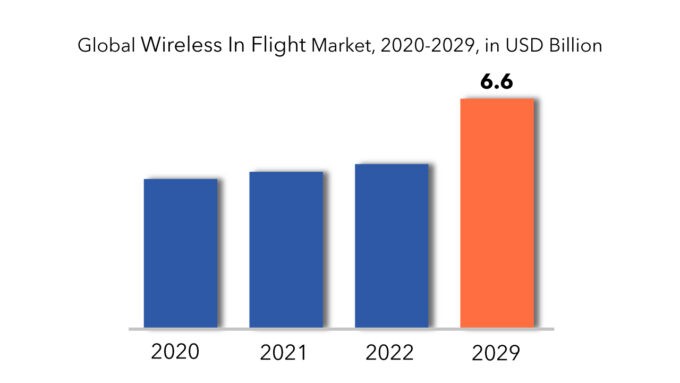

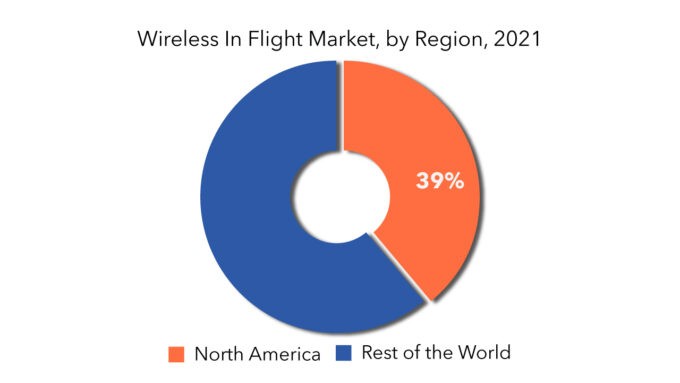

| USD 6.60 Billion | 4.9% | North America |

| By Aircraft | By Fitment | By Technology | By Hardware |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Wireless In Flight Market Overview

The global wireless in flight market is projected to reach USD 6.60 Billion by 2029 from USD 4.29 Billion in 2020, at a CAGR of 4.9% from 2022 to 2029.

The growth of the In-Flight Entertainment and Connectivity (IFEC) Industry is primarily propelled by escalating demand for enhanced in-flight experiences, alongside a surge in aircraft renewals, deliveries, and technological advancements.

The Asia Pacific and other developing regions have witnessed a notable rise in air passenger traffic, reaching approximately 88% of pre-pandemic levels. This surge has significantly bolstered the demand for In-Flight Entertainment (IFE) systems. With the Directorate General of Civil Aviation (DGCA) in India permitting onboard Wi-Fi for commercial flights, passengers increasingly view it as an experiential component rather than mere transportation.

Modern passengers are utilizing an increasing array of personal devices during flights. According to SITA’s Passenger IT Trends survey, 65% of passengers now opt for streaming content on personal devices, surpassing the 44% who prefer seat-back LCD screens for entertainment. Moreover, findings from an Inmarsat survey reveal that 55% of air travelers consider in-flight Wi-Fi indispensable, with 67% expressing willingness to re-book with airlines offering high-quality connectivity.

The aviation industry faced significant disruption due to the COVID-19 pandemic, with global supply chains and logistics severely impacted during widespread lockdowns. Commercial aircraft deliveries dwindled, directly affecting sales of in-flight entertainment and connectivity systems for airline operators.

Despite the initial setbacks, the aviation sector exhibited signs of recovery in 2021, leading to an uptick in aircraft deliveries. This resurgence has prompted airlines and aircraft operators to prioritize upgrading cabin entertainment systems to enhance overall in-flight travel experiences. The resultant rebound in aviation activities and aircraft deliveries has spurred heightened investments. For instance, Air France introduced its new long-haul business seat in May 2022, promising unparalleled comfort with redesigned features, marking a notable advancement in cabin amenities.

Wireless In Flight Market Segment Analysis

The wireless in flight market is divided into four categories based on aircraft: narrow body, wide body, regional jet. Narrow body segment dominate the wireless in flight market and expected to keep the dominance in coming years. The increased demand for narrow-body aircraft on short-haul flights is credited with the segment’s growth. The increased use of W-IFE systems in single-aisle and twin-aisle aircraft is a growing trend in the industry. Over the projected period, regional jets are expected to be the fastest-growing segment. Wireless In-Flight Connectivity (W-IFEC) and PED entertainment systems are progressively being installed in regional jet fleets throughout the world. In order to improve their systems, airlines are creating strategic relationships with connectivity providers. For example, American Airlines, Inc. recently announced a partnership with Gogo, Inc. to offer in-flight wireless services on its regional jets.

The market is divided into retrofit, line fit based on fitment. Retrofit fitment segment dominate the wireless in flight market. Airlines have begun retrofitting wireless in-flight equipment in order to reduce total weight, improve customer experience, and increase profit margins each flight. Hardware and connectivity companies are progressively creating strategic collaborations with aircraft manufacturers to evaluate their system offerings and deliver standardized W-IFE solutions in their fleets. Global Eagle Entertainment Inc. (GEE) and The Boeing Company recently signed a collaborative collaboration to evaluate its satellite-based in-flight system as a line fit on Boeing 787 Dreamliner and Boeing 737 aircraft.

The market is divided into hardware such as antennas, WAPs, modem. Modem segment dominate the wireless in flight market. As a result of the development of next-generation Airborne Internet (AI) and Airborne Network (AN) systems Via Sat recently unveiled a revolutionary Ka/Ku antenna that is expected to expand uninterrupted coverage beyond Europe and North America around the world. The launch of its ViaSat-2 satellite, as well as joint satellite collaborations, resulted in the development of this revolutionary antenna.

The wireless in flight market is divided into following segments based on technology: ATG, ku-Band, L-band, ka-band. To meet the expanding demand in the aviation and ground industries, airline operators are rapidly investing in next-generation High Throughput Satellite (HTS) technology. These modern satellites are intended to take the place of older satellites that serve traditional Fixed Satellite Service (FSS) markets like broadcast TV and direct-to-home. Over the previous few decades, developing a high-performing worldwide Ka-band spectrum has been a growing trend in military communications, and it is now being achieved for the commercial aviation sector. The pressure on satellite infrastructure and communication is likely to increase as consumer electronic devices continue to utilize frequency capacity. Ka-band communication is expected to assist consumer electronics expansion, allowing for more flexible cabin possibilities.

Wireless In Flight Market Key Players

The major players operating in the global wireless in flight industry include Gogo, Inc., BAE Systems PLC, Panasonic Avionics Corporation, Rockwell Collins, Inc., SITAOnAir, Thales Group SA, Zodiac Aerospace, Lufthansa Systems GmbH, Inflight Dublin, Ltd, Bluebox Avionics Limited. New strategies such as product launches and enhancements, partnerships, collaborations, and strategic acquisitions were adopted by market players to strengthen their product portfolios and maintain a competitive position in the wireless in flight market.

Who Should Buy? Or Key stakeholders

- Airline companies

- Suppliers of wireless in flight devices

- Wireless devices manufacturers

- Others

Key Takeaways:

-

The global wireless in flight market is projected to grow at a CAGR of 4.9% during the forecast period.

-

Narrow body segment dominates the wireless in flight market and expected to keep the dominance in coming years. The increased demand for narrow-body aircraft on short-haul flights is credited with the segment’s growth.

-

Retrofit fitment segment dominate the wireless in flight market. Airlines have begun retrofitting wireless in-flight equipment in order to reduce total weight, improve customer experience, and increase profit margins each flight.

-

Modem segment dominate the wireless in flight market. As a result of the development of next-generation Airborne Internet (AI) and Airborne Network (AN) systems Via Sat recently unveiled a revolutionary Ka/Ku antenna that is expected to expand uninterrupted coverage beyond Europe and North America around the world.

-

Over the previous few decades, developing a high-performing worldwide Ka-band spectrum has been a growing trend in military communications, and it is now being achieved for the commercial aviation sector.

-

North America is expected to hold the largest share of the global wireless in flight market and anticipated to retain its dominance over the forecast period.

-

One major trend in the Wireless In-Flight Market is the increasing adoption of advanced satellite-based connectivity solutions to meet the growing demand for high-speed internet access during flights.

Wireless In Flight Market Regional Analysis

Geographically, the wireless in flight market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America is expected to hold the largest share of the global wireless in flight market and anticipated to retain its dominance over the forecast period. Consumers’ desire to spend more on air travel, particularly for their need for constant connectivity, has resulted in increasing spending in North America (particularly the U.S.). As a result, the United States has established itself as an important regional market. Asia Pacific is predicted to develop significantly during the projection period, since it is a lucrative market for the airline industry and has the potential to be a promising market for PEDs that complement the BYOD trend in an aeroplane. In-flight Wi-Fi is becoming more popular among business travellers, notably in China and Japan. Additionally, airlines are considering W-IFE as a new source of additional revenue, as passengers are prepared to pay for Wi-Fi.

Key Market Segments: Wireless In Flight Market

Wireless In Flight Market By Aircraft, 2020-2029, (USD Million) (Thousand Units)

- Narrow Body

- Wide Body

- Regional Jet

Wireless In Flight Market By Fitment, 2020-2029, (USD Million) (Thousand Units)

- Retrofit

- Line Fit Hardware

Wireless In Flight Market By Technology, 2020-2029, (USD Million) (Thousand Units)

- ATG

- KU-BAND

- L-BAND

- KA-BAND

Wireless In Flight Market By Hardware, 2020-2029, (USD Million) (Thousand Units)

- Antennas

- WAPS

- Modem

Wireless In Flight Market By Regions, 2020-2029, (USD Million) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Key Question Answered

- What is the current scenario of the global wireless in flight market?

- What are the emerging technologies for the development of wireless in flight devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Wireless In Flight Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Wireless In Flight Market

- Global Wireless In Flight Market Outlook

- Global Wireless In Flight Market by Aircraft, (USD Million) (Thousand THOUSAND UNITS)

- Narrow Body

- Wide Body

- Regional Jet

- Global Wireless In Flight Market by Fitment, (USD Million) (Thousand THOUSAND UNITS)

- Retrofit

- Line Fit

- Global Wireless In Flight Market by Hardware, (USD Million) (Thousand THOUSAND UNITS)

- Antennas

- WAPs

- Modem

- Global Wireless In Flight Market by Technology, (USD Million) (Thousand THOUSAND UNITS)

- ATG, Ku-Band

- L-Band

- Ka-Band

- Global Wireless In Flight Market by Region, (USD Million) (Thousand THOUSAND UNITS)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Gogo, Inc.

- BAE Systems PLC

- Panasonic Avionics Corporation

- Rockwell Collins, Inc.

- SITAOnAir

- Thales Group SA

- Zodiac Aerospace

- Lufthansa Systems GmbH

- Inflight Dublin, Ltd *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 6 GLOBAL WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 8 GLOBAL WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 9 GLOBAL WIRELESS IN FLIGHT MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 10 GLOBAL WIRELESS IN FLIGHT MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA WIRELESS IN FLIGHT MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 12 NORTH AMERICA WIRELESS IN FLIGHT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 14 US WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 15 US WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 16 US WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 17 US WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 18 US WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 19 US WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 20 US WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 21 CANADA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (CANADA MILLIONS), 2020-2029

TABLE 22 CANADA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 24 CANADA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 26 CANADA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 27 CANADA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 28 CANADA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 30 MEXICO WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 32 MEXICO WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 34 MEXICO WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 35 MEXICO WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 36 MEXICO WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 38 SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 39 BRAZIL WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 40 BRAZIL WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 41 BRAZIL WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 42 BRAZIL WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 44 BRAZIL WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 45 BRAZIL WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 46 BRAZIL WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 47 ARGENTINA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 48 ARGENTINA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 50 ARGENTINA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 51 ARGENTINA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 52 ARGENTINA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 53 ARGENTINA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 54 ARGENTINA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 56 COLOMBIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 57 COLOMBIA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 58 COLOMBIA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 59 COLOMBIA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 60 COLOMBIA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 61 COLOMBIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 62 COLOMBIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 64 REST OF SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 66 REST OF SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 67 REST OF SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 68 REST OF SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 69 REST OF SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 70 REST OF SOUTH AMERICA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 71 ASIA-PACIFIC WIRELESS IN FLIGHT MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 72 ASIA-PACIFIC WIRELESS IN FLIGHT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 73 INDIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 74 INDIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 75 INDIA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 76 INDIA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 77 INDIA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 78 INDIA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 79 INDIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 80 INDIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 81 CHINA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 82 CHINA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 83 CHINA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 84 CHINA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 85 CHINA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 86 CHINA DECISION SUPPORT SYSTEMS MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 87 CHINA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 88 CHINA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 89 JAPAN WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 90 JAPAN WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 91 JAPAN WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 92 JAPAN WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 93 JAPAN WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 94 JAPAN WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 95 JAPAN WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 96 JAPAN WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 97 SOUTH KOREA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 98 SOUTH KOREA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 99 SOUTH KOREA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 100 SOUTH KOREA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 101 SOUTH KOREA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 102 SOUTH KOREA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 103 SOUTH KOREA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 104 SOUTH KOREA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 105 AUSTRALIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 106 AUSTRALIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 107 AUSTRALIA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 108 AUSTRALIA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 109 AUSTRALIA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 110 AUSTRALIA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 111 AUSTRALIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 112 AUSTRALIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 113 SOUTH EAST ASIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 114 SOUTH EAST ASIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 115 SOUTH EAST ASIA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 116 SOUTH EAST ASIA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 117 SOUTH EAST ASIA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 118 SOUTH EAST ASIA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 119 SOUTH EAST ASIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 120 SOUTH EAST ASIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 121 REST OF ASIA PACIFIC WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 122 REST OF ASIA PACIFIC WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 123 REST OF ASIA PACIFIC WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 124 REST OF ASIA PACIFIC WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 125 REST OF ASIA PACIFIC WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 126 REST OF ASIA PACIFIC WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 127 REST OF ASIA PACIFIC WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 128 REST OF ASIA PACIFIC WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 129 EUROPE WIRELESS IN FLIGHT MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 130 EUROPE WIRELESS IN FLIGHT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 131 GERMANY WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 132 GERMANY WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 133 GERMANY WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 134 GERMANY WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 135 GERMANY WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 136 GERMANY WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 137 GERMANY WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 138 GERMANY WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 139 UK WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 140 UK WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 141 UK WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 142 UK WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 143 UK WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 144 UK WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 145 UK WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 146 UK WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 147 FRANCE WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 148 FRANCE WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 149 FRANCE WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 150 FRANCE WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 151 FRANCE WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 152 FRANCE WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 153 FRANCE WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 154 FRANCE WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 155 ITALY WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 156 ITALY WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 157 ITALY WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 158 ITALY WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 159 ITALY WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 160 ITALY WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 161 ITALY WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 162 ITALY WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 163 SPAIN WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 164 SPAIN WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 165 SPAIN WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 166 SPAIN WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 167 SPAIN WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 168 SPAIN WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 169 SPAIN WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 170 SPAIN WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 171 RUSSIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 172 RUSSIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 173 RUSSIA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 174 RUSSIA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 175 RUSSIA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 176 RUSSIA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 177 RUSSIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 178 RUSSIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 179 REST OF EUROPE WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 180 REST OF EUROPE WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 181 REST OF EUROPE WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 182 REST OF EUROPE WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 183 REST OF EUROPE WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 184 REST OF EUROPE WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 185 REST OF EUROPE WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 186 REST OF EUROPE WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 187 MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 188 MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 189 UAE WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 190 UAE WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 191 UAE WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 192 UAE WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 193 UAE WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 194 UAE WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 195 UAE WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 196 UAE WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 197 SAUDI ARABIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 198 SAUDI ARABIA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 199 SAUDI ARABIA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 200 SAUDI ARABIA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 201 SAUDI ARABIA WIRELESS IN FLIGHT MARKET BY HARDWARE(USD MILLIONS), 2020-2029

TABLE 202 SAUDI ARABIA WIRELESS IN FLIGHT MARKET BY HARDWARE(THOUSAND UNITS), 2020-2029

TABLE 203 SAUDI ARABIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(USD MILLIONS), 2020-2029

TABLE 204 SAUDI ARABIA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY(THOUSAND UNITS), 2020-2029

TABLE 205 SOUTH AFRICA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 206 SOUTH AFRICA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 207 SOUTH AFRICA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 208 SOUTH AFRICA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 209 SOUTH AFRICA WIRELESS IN FLIGHT MARKET BY HARDWARE (USD MILLIONS), 2020-2029

TABLE 210 SOUTH AFRICA WIRELESS IN FLIGHT MARKET BY HARDWARE (THOUSAND UNITS), 2020-2029

TABLE 211 SOUTH AFRICA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 212 SOUTH AFRICA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 213 REST OF MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (USD MILLIONS), 2020-2029

TABLE 214 REST OF MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY AIRCRAFT (THOUSAND UNITS), 2020-2029

TABLE 215 REST OF MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY FITMENT (USD MILLIONS), 2020-2029

TABLE 216 REST OF MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY FITMENT (THOUSAND UNITS), 2020-2029

TABLE 217 REST OF MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY HARDWARE (USD MILLIONS), 2020-2029

TABLE 218 REST OF MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY HARDWARE (THOUSAND UNITS), 2020-2029

TABLE 219 REST OF MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 220 REST OF MIDDLE EAST AND AFRICA WIRELESS IN FLIGHT MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL WIRELESS IN FLIGHT S MARKET BY AIRCRAFT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL WIRELESS IN FLIGHT S MARKET BY FITMENT, USD MILLION, 2020-2029

FIGURE 10 GLOBAL WIRELESS IN FLIGHT S MARKET BY HAEDWARE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL WIRELESS IN FLIGHT S MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 12 GLOBAL WIRELESS IN FLIGHT S MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL WIRELESS IN FLIGHT S MARKET BY AIRCRAFT, USD MILLION, 2020-2029

FIGURE 15 GLOBAL WIRELESS IN FLIGHT S MARKET BY FITMENT, USD MILLION, 2020-2029

FIGURE 16 GLOBAL WIRELESS IN FLIGHT S MARKET BY HARDWARE, USD MILLION, 2020-2029

FIGURE 17 GLOBAL WIRELESS IN FLIGHT S MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 18 GLOBAL WIRELESS IN FLIGHT S MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 19 WIRELESS IN FLIGHT S MARKET BY REGION 2020

FIGURE 20 MARKET SHARE ANALYSIS

FIGURE 21 GOGO, INC.: COMPANY SNAPSHOT

FIGURE 22 BAE SYSTEMS PLC: COMPANY SNAPSHOT

FIGURE 23 PANASONIC AVIONICS CORPORATION: COMPANY SNAPSHOT

FIGURE 24 ROCKWELL COLLINS, INC.: COMPANY SNAPSHOT

FIGURE 25 SITAONAIR: COMPANY SNAPSHOT

FIGURE 26 THALES GROUP SA: COMPANY SNAPSHOT

FIGURE 27 ZODIAC AEROSPACE: COMPANY SNAPSHOT

FIGURE 28 LUFTHANSA SYSTEMS GMBH: COMPANY SNAPSHOT

FIGURE 29 INFLIGHT DUBLIN, LTD: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.