Report Outlook

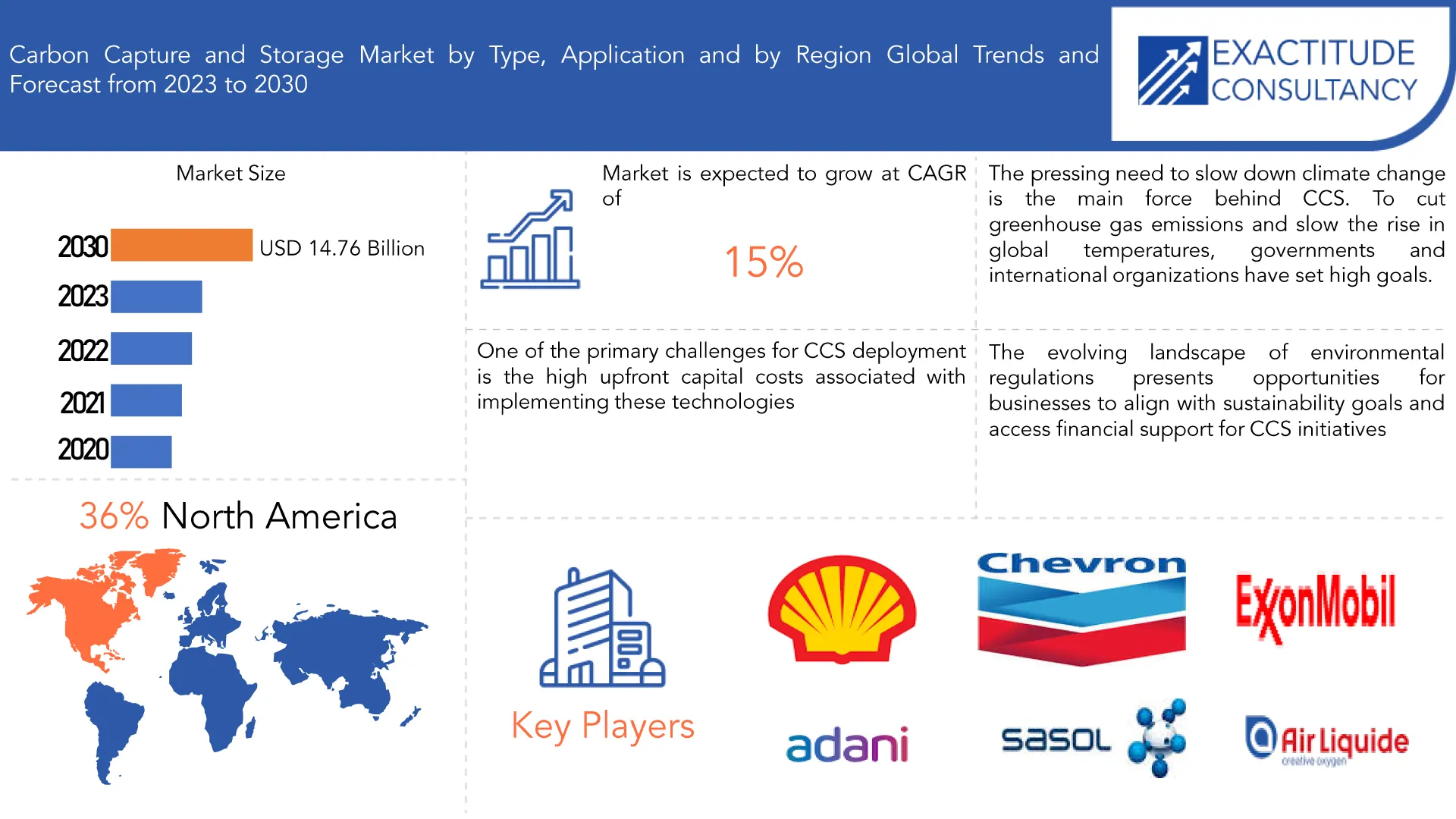

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 14.76 Billion by 2030 | 15% | North America |

| By Type Value | By End Use Industry | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Carbon Capture and Storage Market Overview

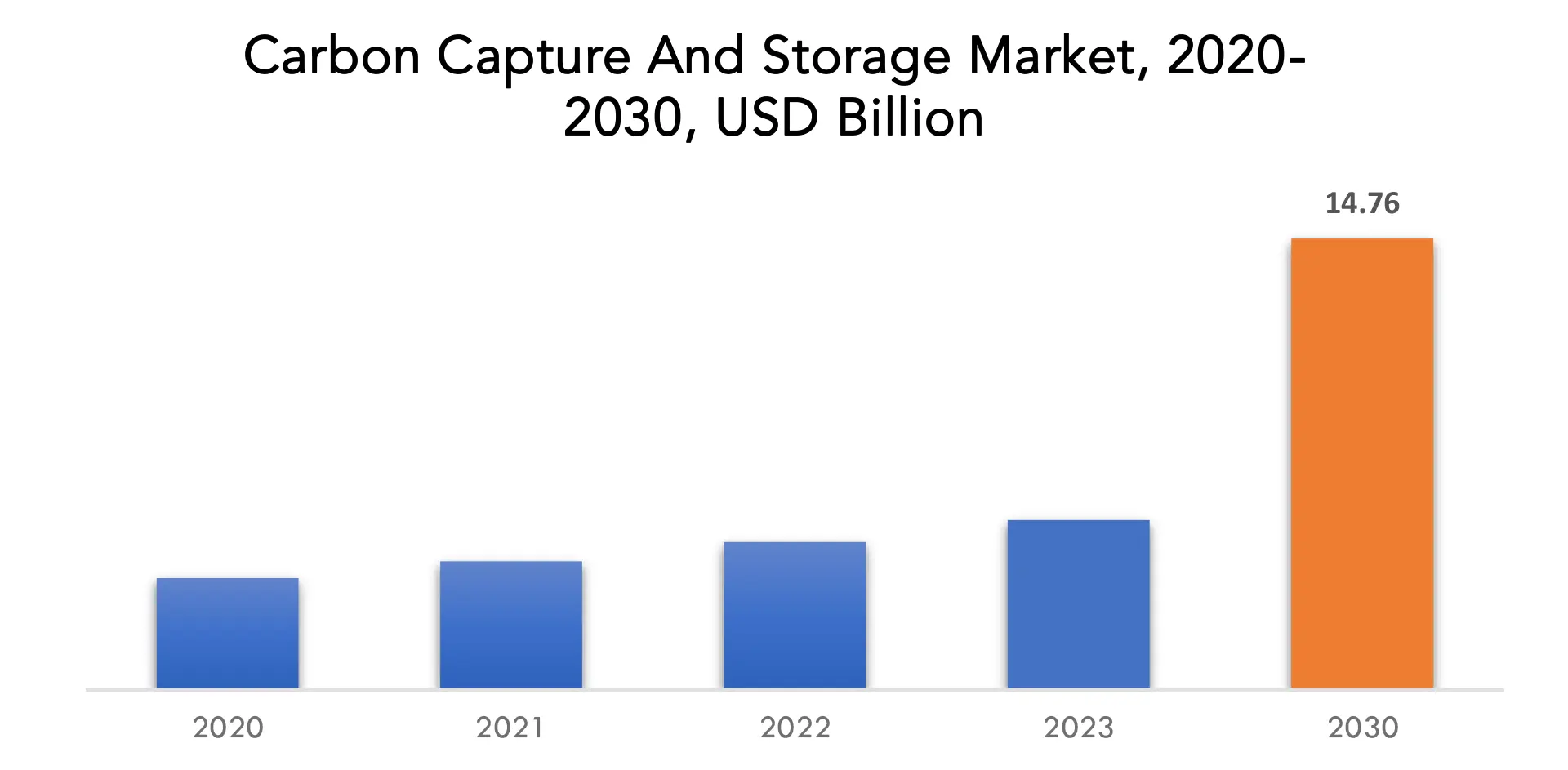

The global Carbon Capture and Storage market is anticipated to grow from USD 5.55 Billion in 2023 to USD 14.76 Billion by 2030, at a CAGR of 15 % during the forecast period.

Within the larger field of environmental technologies, the Carbon Capture and Storage (CCS) market is a vibrant industry that is essential to the global effort to slow down climate change. The term “carbon capture and storage” (CCS) describes a group of technologies intended to absorb carbon dioxide (CO2) emissions from power plants and industrial operations prior to their release into the atmosphere. Preventing significant amounts of CO2, a significant greenhouse gas, from adding to the continuous increase in global temperatures is the main goal of carbon capture and storage (CCS). The market for carbon capture and storage (CCS) essentially includes a variety of technologies and systems that transport and safely store CO2 emissions underground, preventing their release into the atmosphere. Reducing greenhouse gas emissions significantly depends on this process, especially for high-carbon industries like power plants and some manufacturing facilities. The growth and implementation of CCS across different industries and regions is driven by a complex interplay of technology advancements, legal frameworks, and economic incentives.

Globally, governments, businesses, and environmental groups are realizing more and more how important CCS is to meeting climate targets and making the shift to more sustainable energy sources in the future. A variety of legislative initiatives, monetary rewards, and public awareness efforts that support the adoption of CCS technologies have an impact on the market. The market for carbon capture and storage (CCS) is anticipated to grow as the need to combat climate change becomes more pressing. This is because efforts are being made to improve the efficiency and affordability of CCS systems through continuous research and development. Cleaner technology research and innovation are encouraged by the CCS market. Related technologies and processes advance when funds are allocated to the creation and implementation of CCS solutions. This includes advancements in storage methods, transport infrastructure, and capture efficiency, all of which contribute to the development of more scalable and affordable CCS systems. In addition to aiding in the fight against climate change, this promotes job creation and a sustainable culture in the clean energy industry.

The market for carbon capture and storage (CCS) is essential for reducing the amount of carbon dioxide (CO2) released into the atmosphere, which is a major worldwide concern. The usage of CCS technology is becoming more and more important in lowering greenhouse gas emissions as long as civilizations continue to rely on fossil fuels for energy. In order to keep CO2 emissions from industrial sources like factories and power plants out of the atmosphere, they must first be captured, transported, and stored underground. The ability for the CCS market to decarbonize many economic sectors is one of its main advantages. Decarbonizing several industries directly is challenging, including the production of cement, electricity, and some manufacturing processes. Furthermore, the market for CCS helps to meet international climate targets, such as those set forth in the Paris Agreement. Nations everywhere are working to lower their carbon emissions and slow down the increase in global temperatures. By giving a way to capture and store vast amounts of CO2, CCS helps achieve these lofty goals by keeping the gas out of the environment and slowing down climate change. Governments and businesses show their dedication to sustainable development and environmental responsibility by working together to execute CCS projects.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, End Use Industry and Region |

| By Type |

|

| By End Use Industry |

|

|

By Region

|

|

Carbon Capture and Storage Market Segmentation Analysis

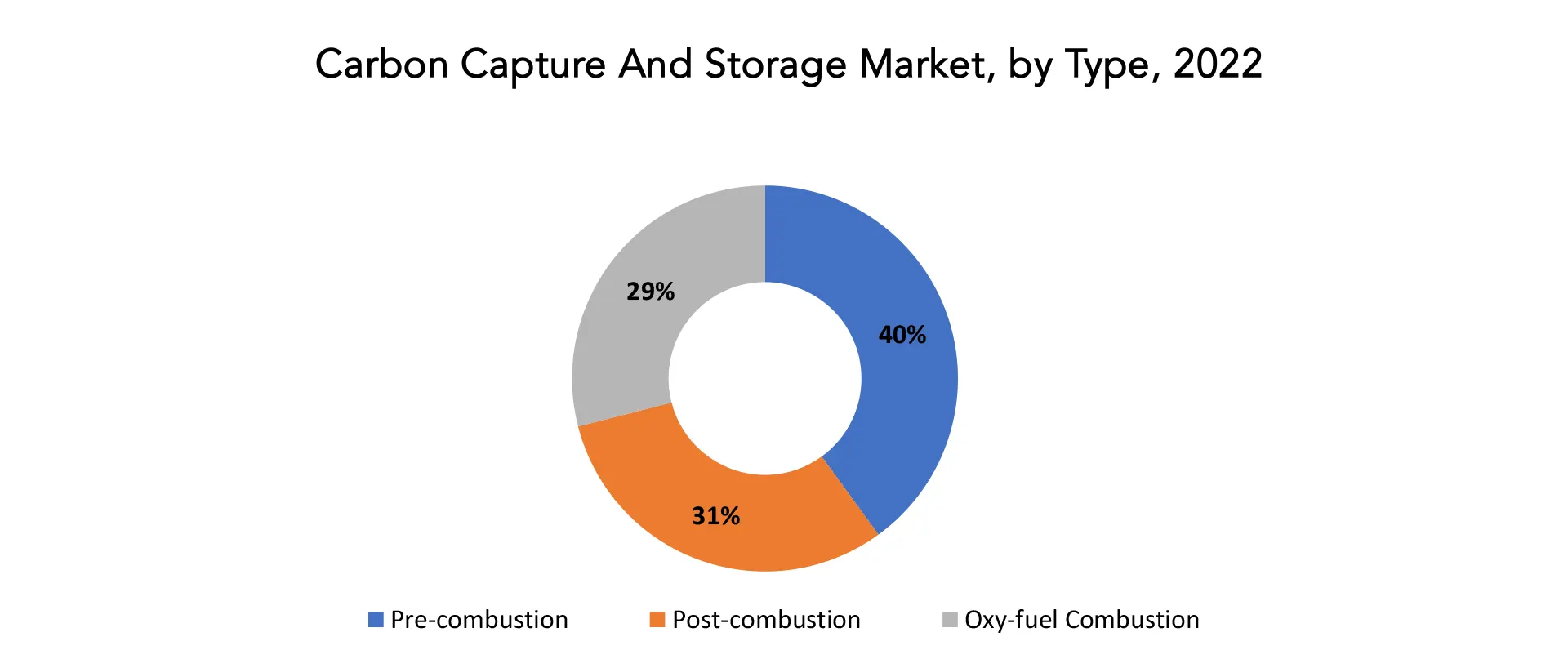

The global Carbon Capture and Storage market is divided into two segments type, application and region. By Type it is sub segmented into Pre-combustion, Post-combustion, Oxy-fuel Combustion. Pre-combustion sector has the largest market share.

Prior to combustion Before fossil fuels are actually burned in power stations or other industrial facilities, CCS technology is used. This method turns fossil fuels into a hydrogen and carbon monoxide mixture prior to burning. After being extracted from this combination, the CO2 is next caught and stored. In situations where the fuel may be gasified, like in integrated gasification combined cycle (IGCC) power plants, pre-combustion CCS is very useful. With the use of this technique, CO2 may be captured at higher concentrations, enabling more effective separation.

Contrarily, post-combustion CCS collects CO2 emissions following the burning of fossil fuels. This technology is a flexible retrofitting solution that may be used to existing industrial buildings and power plants. The majority of post-combustion capture techniques use chemical solvents or other absorbents to specifically extract CO2 from flue gases. After being caught, the CO2 is moved, compressed, and stored in appropriate geological formations.

An innovative method known as “oxy-fuel combustion” involves burning fossil fuels without the use of air, but rather in a setting high in oxygen. This leads to a flue gas that is primarily made up of CO2 and water vapor, which makes the separation process easier. From this concentrated stream, the CO2 may be easily extracted, and the leftover water vapor can be condensed and eliminated.

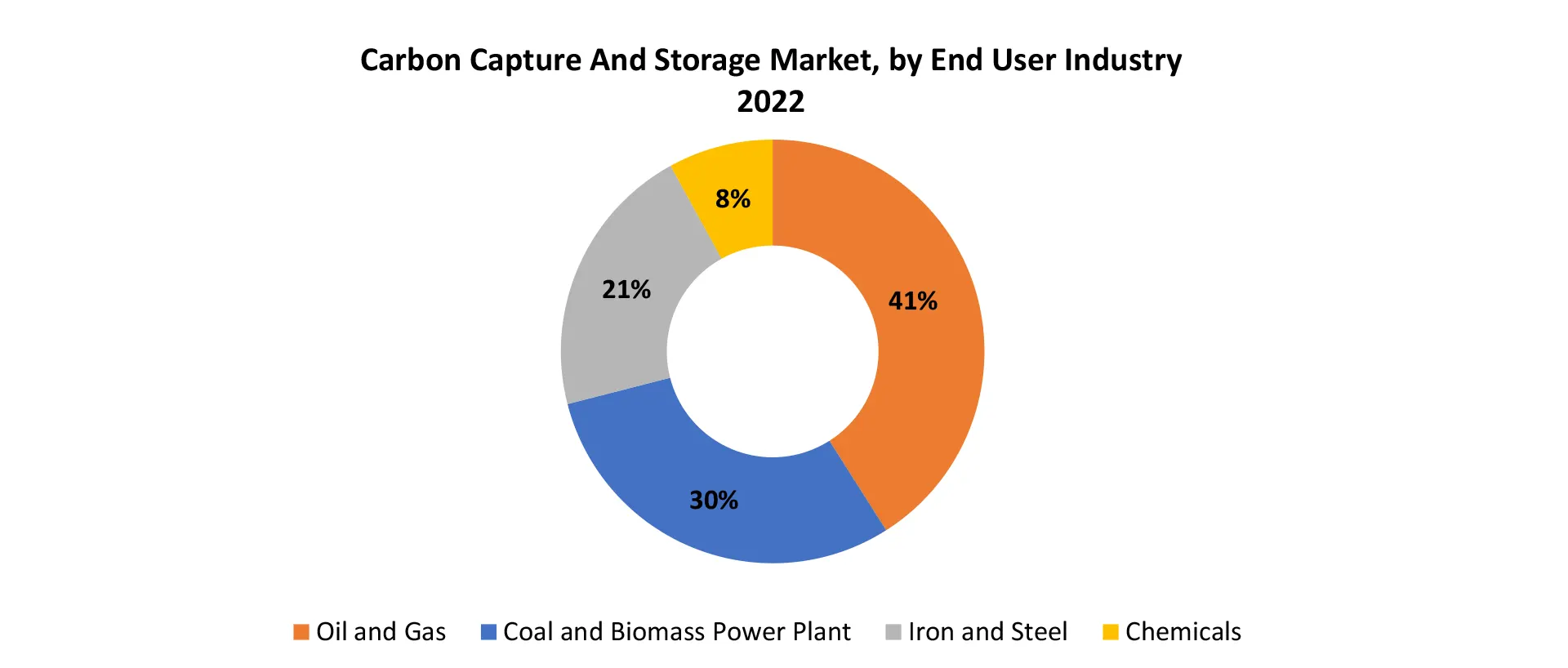

By End Use Industry it is again divided into Indoor Oil and Gas, Coal and Biomass Power Plant, Iron and Steel, Chemicals, Others. Oil and Gas cultivation sector holds the largest market share.

Hydrocarbons are extracted, processed, and refined in the indoor oil and gas industry. CO2 emissions from these operations are captured and stored using CCS systems. This application is essential for reducing the negative environmental effects of the extraction and refinement of fossil fuels, supporting international efforts to switch to greener forms of energy. CCS is especially important for power generation using biomass and coal. Carbon dioxide emissions from coal-fired power plants are well-known, and CCS provides a way to absorb and store CO2 before it is discharged into the atmosphere. Similarly, biomass power plants can use CCS to address combustion emissions and reach carbon neutrality, even if they are regarded as renewable energy sources.

Because the iron and steel sector uses carbon-intensive processes, such reducing iron ore, it contributes significantly to industrial carbon emissions. In order to lessen their negative effects on the environment and support the industry’s sustainable transformation, CCS applications in this sector concentrate on capturing CO2 emissions from a variety of activities, including as blast furnaces and steel manufacture. Numerous procedures used in the chemical industry have the potential to emit significant volumes of CO2. The goal of CCS technology used in the chemical industry is to collect emissions from production activities like petrochemical and chemical synthesis. For the chemical sector to achieve emission reductions and promote a more environmentally friendly and sustainable production method, CCS implementation is essential. A variety of applications and sectors that are not on the list but for which carbon emissions are a major problem are included in the “Others” category. Cement manufacturing, trash incineration, and other industrial operations with significant CO2 emissions may fall under this category. Applications for CCS technology are numerous and versatile, providing a flexible alternative for businesses looking to lower their carbon footprint.

Carbon Capture and Storage Market Dynamics

Driver

Advances in dehumidification technology, such as energy-efficient models and smart control systems, make these devices more attractive to cultivators.

Conventional dehumidifiers may use a lot of energy. On the other hand, more recent versions frequently feature energy-saving features including heat exchangers, improved refrigeration cycles, and variable speed compressors. Over time, farmers will find dehumidification to be more cost-effective due to these advancements in energy consumption reduction. Smart technology integration is now a major trend. Mobile apps or web interfaces can be used to remotely monitor and control smart dehumidifiers. This makes managing production conditions more practical and effective by enabling farmers to change settings, keep an eye on humidity levels, and get warnings or messages. A few sophisticated dehumidifiers come with sensors and data analytics built in. These devices have the ability to analyze environmental data, such as humidity and temperature, and automatically modify settings to create the ideal environment. Cultivators can save time with this level of automation, which also guarantees that the growth environment stays within the specified parameters. Modern dehumidifiers frequently include expandable, modular designs that make it simple for growers to expand or modify their growing spaces. For growers who may need to adjust to shifting production demands or space limits, this flexibility is essential.

Certain dehumidifiers come with sophisticated sensors that provide input on the ambient conditions in real time. The dehumidifier can react dynamically to variations in humidity thanks to this feedback loop, which gives it fine control and guarantees the best growing conditions for cannabis plants.

Restraint

The growing focus on renewable energy sources, such as solar and wind, has led to increased competition for investment and attention.

Government incentives and policies are crucial in determining how the energy landscape is shaped. Strong regulations, including as feed-in tariffs, tax incentives, and renewable portfolio standards, are in place in many areas to encourage the use of renewable energy. These regulations may increase the financial appeal of renewable energy projects, so drawing money away from other technologies such as CCS.

Over the years, there have been major technology improvements and cost reductions in the renewable energy sector. As a result, the cost and efficiency of solar and wind technologies are becoming more and more competitive. The rivalry for investment is fueled by market dynamics, which are impacted by things like falling costs for renewable energy and growing demand for clean energy. Many nations have made commitments to challenging climate objectives, with the intention of lowering carbon emissions and shifting to renewable energy sources. In order to satisfy renewable energy targets, these promises frequently lead to substantial investments in wind and solar installations. Although CCS is acknowledged as an essential technology for reducing emissions, in some situations its relative lower priority may be due to the pressing need to meet immediate renewable energy targets.

The adoption of renewable energy technologies, especially solar and wind, has accelerated due to their maturity and readiness. These technologies now have established markets and readily available solutions, making them extensively deployable on a worldwide scale. On the other hand, CCS technologies might still have to contend with market uncertainty and technological difficulties that affect their ability to compete.

Opportunities

The CCS market offers attractive investment opportunities for venture capitalists, private equity firms, and institutional investors.

Sustainable ways to reduce carbon emissions are becoming more and more in demand as the world becomes more aware of climate change. By absorbing and storing carbon dioxide, CCS technologies are essential in reducing the effects of climate change. As a result, investments in this field are in line with the worldwide movement towards environmental sustainability. Globally, numerous countries are actively promoting CCS efforts with grants, financial incentives, and legal frameworks. These encouraging policies, which foster an atmosphere that is favorable to the development and implementation of CCS projects, might be advantageous to investors. Investments in CCS are more profitable and feasible when supported by the government. The market for CCS is expected to expand significantly as businesses look to lower their carbon footprint and abide by stricter environmental laws. Investing in carbon capture and storage (CCS) projects puts investors in a position to profit from the growing industry and the increasing demand for technology that help businesses become carbon neutral. Investment opportunities to support and profit from technology developments are presented by ongoing research and development initiatives in CCS technologies. Advances in collection, transport, and storage techniques can boost the effectiveness and economics of CCS systems, giving businesses that invest in or create cutting-edge technology a competitive edge.

Carbon Capture and Storage Market Trends

- Governments and international organizations are increasingly recognizing the importance of CCS in achieving climate goals. Supportive policies, such as financial incentives, subsidies, and regulatory frameworks, continue to emerge, encouraging investments in CCS projects

- Global development and execution of CCS projects is the direction of the trend. To show the viability and efficacy of CCS systems in many industrial sectors, numerous nations are investing in large-scale initiatives and pilot programs.

- A large number of businesses in many industries have committed to achieving net-zero carbon emissions. These businesses are investigating and investing in CCS technologies as part of their sustainability initiatives in order to satisfy their environmental goals and offset inevitable emissions.

- Capture technologies are evolving as a result of ongoing research and development. The goal of innovations is to make CCS systems more flexible and relevant to a wider range of industries by improving capture efficiency, cutting costs, and adapting them to diverse industrial processes.

- A technique called “Direct Air Capture” is becoming more and more popular. It includes taking CO2 straight out of the environment. Even though DAC is still in its infancy, it has the potential to be extremely important in tackling hard-to-abate industries and reaching zero emissions.

- The technologies used to produce hydrogen are progressively integrating CCS. In the interim, blue hydrogen—hydrogen produced from fossil fuels with carbon capture and storage—serves as a low-carbon substitute while renewable hydrogen technologies are developed.

- The financial sustainability of CCS projects is being impacted by the growth and development of carbon markets and pricing structures. The capacity to make money from the sale of carbon credits is increasingly being taken into account when funding projects.

- Governments, business leaders, and academic institutions are working together more and more. Through the sharing of best practices, resources, and information, partnerships hope to accelerate the development and broader implementation of CCS technology.

Competitive Landscape

The competitive landscape of the Carbon Capture and Storage market was dynamic, with several prominent companies competing to provide innovative and advanced Carbon Capture and Storage solutions.

- Shell

- Chevron

- ExxonMobil

- Occidental Petroleum

- BP

- Equinor

- Sasol

- Adani Group

- Norsk Hydro

- Southern Company

- Air Liquide

- TotalEnergies

- Cenovus Energy

- Petra Nova

- NRG Energy

- Mitsubishi Heavy Industries

- Aker Solutions

- BHP Billiton

- ENI

- Linde plc

Recent Developments:

August 01, 2023: Energy lies at the heart of India’s development aspirations, from ensuring a better life for its 1.4 billion people to realising a USD 5 trillion climate economy. At the same time India confronts an energy trilemma: Balancing energy security, energy equity, and environmental sustainability while pursuing decarbonisation. To successfully navigate this trilemma, concerted efforts and partnerships are essential among the government, businesses, and civil society. Decisions made in this decisive decade will determine India’s ability to decarbonise while ensuring continued economic growth and development.

The report launched on August 1 by The Energy and Resources Institute (TERI) and Shell, INDIA TRANSFORMING TO A NET-ZERO EMISSIONS ENERGY SYSTEM outlines what India needs to do this decade (from now until 2030) to help meet its net-zero emissions target while also delivering energy security and energy equity.

October 30, 2023: Cabinda Gulf Oil Company Limited (CABGOC), a Chevron’s subsidiary in Angola, hosted in Luanda a signature of a Memorandum of Understanding (MOU) between Chevron New Energies, a Chevron U.S.A. Inc. division, and the Angola Government to explore potential lower carbon business opportunities in Angola. Chevron and the Angola Government plan to evaluate various projects related to nature-based and technological carbon offsets, lower-carbon intensity biofuels and products such as hydrogen, carbon capture and storage, and the creation of a regional centre of excellence to incentivize and attract lower carbon investments.

Regional Analysis

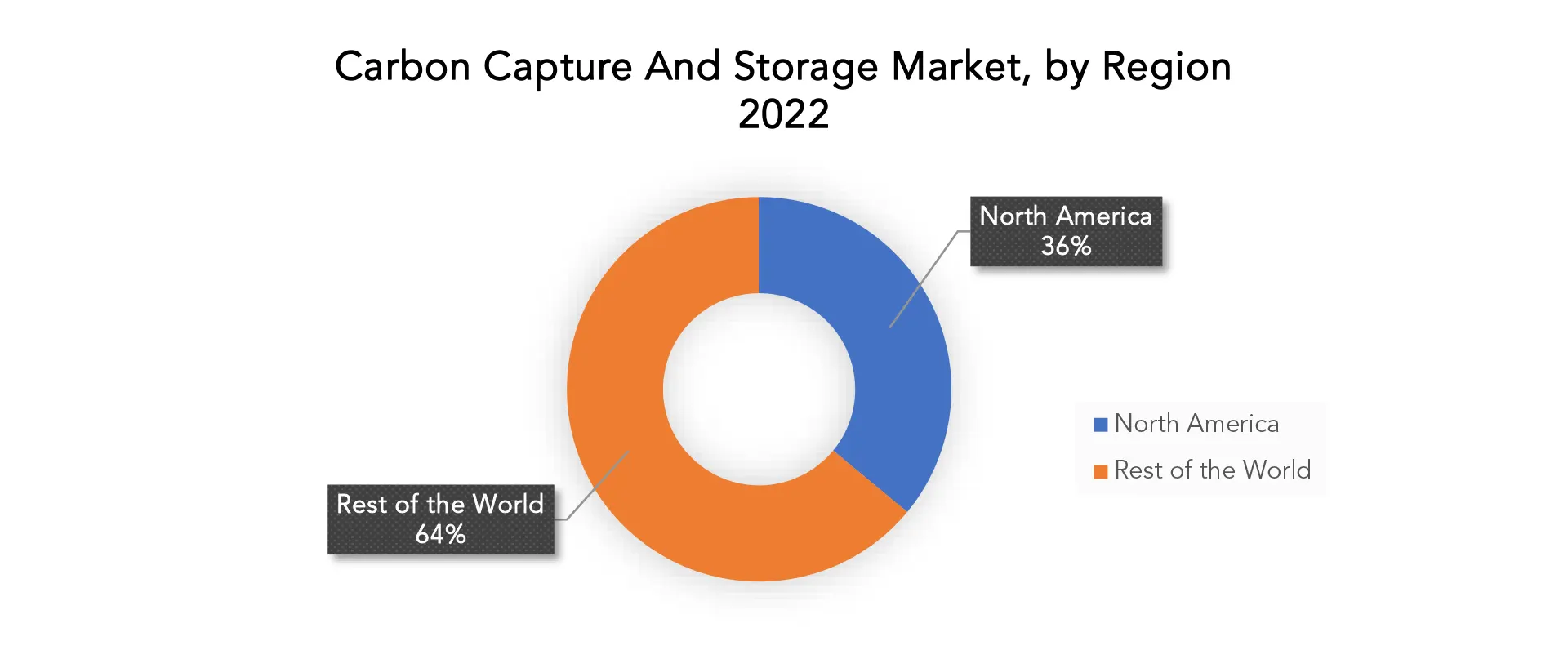

North America accounted for the largest market in the Carbon Capture and Storage market. North America accounted for 36 % of the worldwide market value. With numerous programs aiming at lowering emissions from power stations and industrial facilities, the United States has been actively participating in CCS initiatives. CCS deployment is encouraged by funding schemes like the 45Q tax credit. Research and development in CCS technologies is supported by the US Department of Energy (DOE). Both new and old facilities are included in the focus, particularly those in the power generation industry. When it comes to lowering emissions from its oil sands sector and other industrial operations, Canada is a big fan of CCS. CCS projects have primarily been centered in Alberta. Infrastructure and research in CCS have received funding commitments from the Canadian government. In Canada, there is growing interest in combining CCS with hydrogen generation. There has been an emphasis on creating laws that will encourage CCS projects in both the US and Canada. Regulations, financial initiatives, and tax breaks are all very important in promoting investment in carbon capture systems. The energy and gas industry has been a major target of CCS projects, especially in the US and Canada. Reducing the carbon intensity of oil extraction and processing operations is the aim. In North America, CCS projects frequently target power plants, particularly those that use fossil fuels. One noteworthy development is the installation of CCS technology in already-existing power facilities.

Investments have been made in R&D projects to advance CCS technologies by both the US and Canada. Collaborations between national laboratories and academic institutions are common. Due to the interdependence of North America’s energy system, cross-border cooperation on CCS projects is possible. The creation of best practices is aided by knowledge sharing and shared infrastructure. It is imperative that the public and private sectors participate. While private businesses, such as those in the energy and technology sectors, drive innovation and project implementation, governments give financing and regulatory assistance.

Target Audience for Carbon Capture and Storage Market

- Energy Companies

- Industrial Manufacturers

- Government Agencies

- Environmental NGOs

- Research and Development Institutions

- Financial Investors (Venture Capital, Private Equity)

- Technology Providers

- Regulatory Bodies

- Carbon Market Participants

- Consulting and Advisory Firms

Import & Export Data for Carbon Capture and Storage Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Carbon Capture and Storage market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Carbon Capture and Storage market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Carbon Capture and Storage trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Carbon Capture and Storage types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Carbon Capture and Storage Market Report

Carbon Capture and Storage Market by Type Value (USD Billion) (Thousand Units)

- Pre-combustion

- Post-combustion

- Oxy-fuel Combustion

Carbon Capture and Storage Market by End Use Industry (USD Billion) (Thousand Units)

- Oil and Gas

- Coal and Biomass Power Plant

- Iron and Steel

- Chemicals

OthersCarbon Capture and Storage Market by Region (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Carbon Capture and Storage market over the next 7 years?

- Who are the major players in the Carbon Capture and Storage market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Carbon Capture and Storage market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Carbon Capture and Storage market?

- What is the current and forecasted size and growth rate of the global Carbon Capture and Storage market?

- What are the key drivers of growth in the Carbon Capture and Storage market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Carbon Capture and Storage market?

- What are the technological advancements and innovations in the Carbon Capture and Storage market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Carbon Capture and Storage market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Carbon Capture and Storage market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GARDEN SEEDS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CARBON CAPTURE AND STORAGE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GARDEN SEEDS MARKET OUTLOOK

- GLOBAL CARBON CAPTURE AND STORAGE MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- PRE-COMBUSTION

- POST-COMBUSTION

- OXY-FUEL COMBUSTION

- GLOBAL CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- OIL AND GAS

- COAL AND BIOMASS POWER PLANT

- IRON AND STEEL

- CHEMICALS

- OTHERS

- GLOBAL CARBON CAPTURE AND STORAGE MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

8.1 SHELL

8.2 CHEVRON

8.3 EXXONMOBIL

8.4 OCCIDENTAL PETROLEUM

8.5 BP

8.6 EQUINOR

8.7 SASOL

8.8 ADANI GROUP

8.9 NORSK HYDRO

8.10 THERMO-STOR LLC

8.11 SOUTHERN COMPANY

8.12 AIR LIQUIDE

8.13 TOTALENERGIES

8.14 CENOVUS ENERGY

8.15 PETRA NOVA

8.16 NRG ENERGY

8.17 MITSUBISHI HEAVY INDUSTRIES

8.18 AKER SOLUTIONS

8.19 BHP BILLITON

8.20 ENI

LIST OF TABLES

TABLE 1 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 4 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 13 US CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 14 US CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 16 US CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 18 CANADA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 20 CANADA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 22 MEXICO CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 24 MEXICO CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 BRAZIL CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 34 BRAZIL CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 ARGENTINA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 38 ARGENTINA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 COLOMBIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 42 COLOMBIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 INDIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 56 INDIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 58 CHINA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 60 CHINA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 JAPAN CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 64 JAPAN CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 84 EUROPE CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 86 EUROPE CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 88 GERMANY CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 90 GERMANY CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 91 UK CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 UK CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 94 UK CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 96 FRANCE CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 98 FRANCE CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 100 ITALY CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 102 ITALY CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 104 SPAIN CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 106 SPAIN CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 108 RUSSIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 110 RUSSIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 121 UAE CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 122 UAE CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 124 UAE CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY TYPE USD BILLION, 2020-2030

FIGURE 9 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY, USD BILLION, 2020-2030

FIGURE 10 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY TYPE, USD BILLION 2022

FIGURE 13 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY END USE INDUSTRY, USD BILLION 2022

FIGURE 14 GLOBAL CARBON CAPTURE AND STORAGE MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 SHELL: COMPANY SNAPSHOT

FIGURE 17 CHEVRON: COMPANY SNAPSHOT

FIGURE 18 EXXONMOBIL: COMPANY SNAPSHOT

FIGURE 19 OCCIDENTAL PETROLEUM: COMPANY SNAPSHOT

FIGURE 20 BP: COMPANY SNAPSHOT

FIGURE 21 EQUINOR: COMPANY SNAPSHOT

FIGURE 22 SASOL: COMPANY SNAPSHOT

FIGURE 23 ADANI GROUP: COMPANY SNAPSHOT

FIGURE 24 NORSK HYDRO: COMPANY SNAPSHOT

FIGURE 25 SOUTHERN COMPANY: COMPANY SNAPSHOT

FIGURE 26 AIR LIQUIDE: COMPANY SNAPSHOT

FIGURE 27 TOTALENERGIES: COMPANY SNAPSHOT

FIGURE 28 CENOVUS ENERGY: COMPANY SNAPSHOT

FIGURE 29 PETRA NOVA: COMPANY SNAPSHOT

FIGURE 30 NRG ENERGY: COMPANY SNAPSHOT

FIGURE 31 MITSUBISHI HEAVY INDUSTRIES: COMPANY SNAPSHOT

FIGURE 32 AKER SOLUTIONS: COMPANY SNAPSHOT

FIGURE 33 BHP BILLITON: COMPANY SNAPSHOT

FIGURE 34 ENI: COMPANY SNAPSHOT

FIGURE 35 LINDE PLC: COMPANY SNAPSHOT

FAQ

The global Carbon Capture and Storage market is anticipated to grow from USD 5.55 Billion in 2023 to USD 14.76 Billion by 2030, at a CAGR of 15 % during the forecast period.

North America accounted for the largest market in the Carbon Capture and Storage market. North America accounted for 36 % market share of the global market value.

Exxonmobil Corporation, Schlumberger, Huaneng, Linde AG, Sulzer, Equinor, NRG, AkerSolutions, Shell, Skyonic Corp., Mitsubishi Hitachi, Fluor, Sinopec.

A large number of businesses in many industries have committed to achieving net-zero carbon emissions. These businesses are investigating and investing in CCS technologies as part of their sustainability initiatives in order to satisfy their environmental goals and offset inevitable emissions. Capture technologies are evolving as a result of ongoing research and development. The goal of innovations is to make CCS systems more flexible and relevant to a wider range of industries by improving capture efficiency, cutting costs, and adapting them to diverse industrial processes.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.