REPORT OUTLOOK

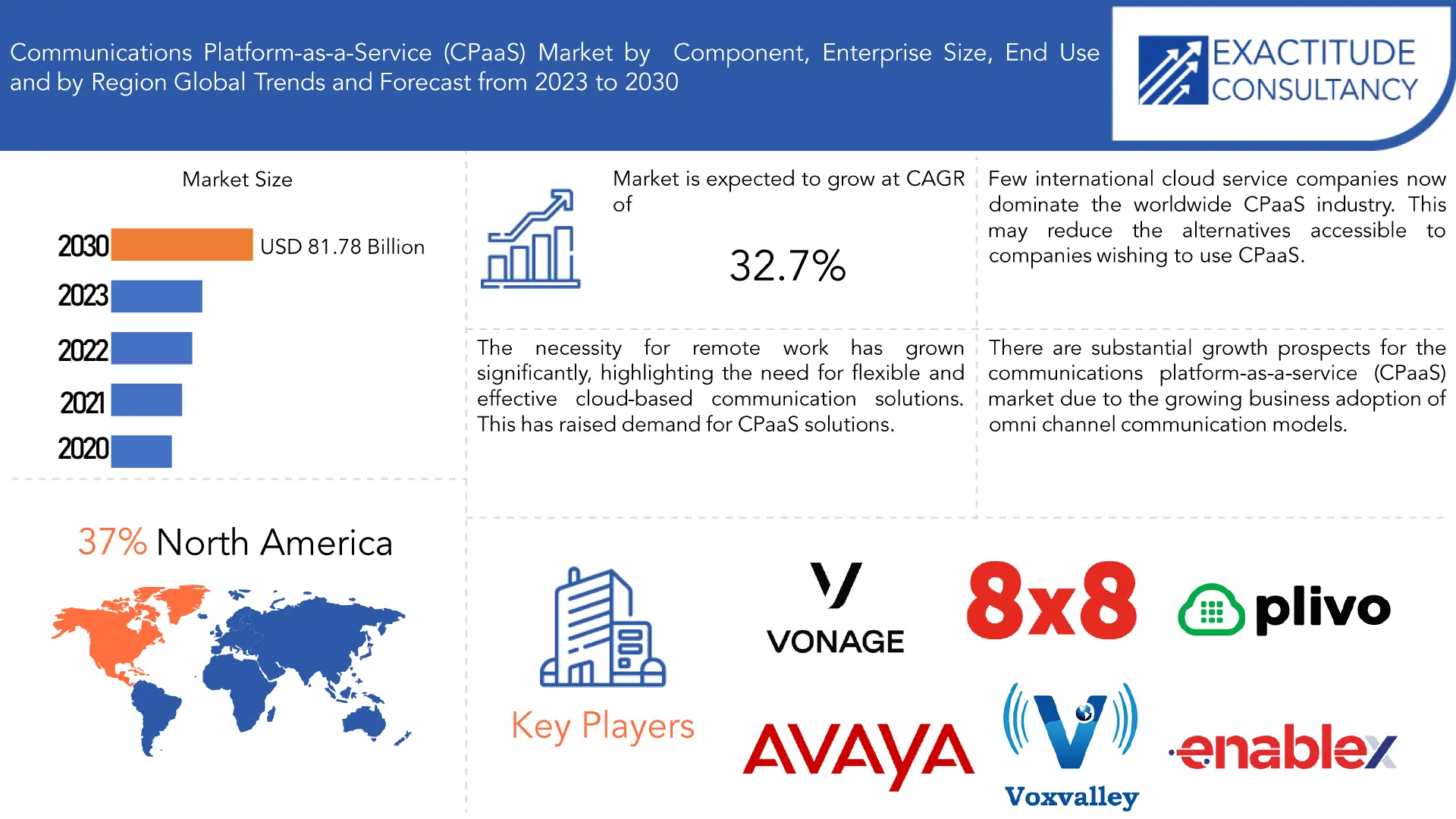

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 81.78 Billion by 2030 | at a CAGR of 32.7% | North America |

| by Component | by Enterprise Size | by End Use |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Communications Platform-as-a-Service (CPaaS) Market Overview

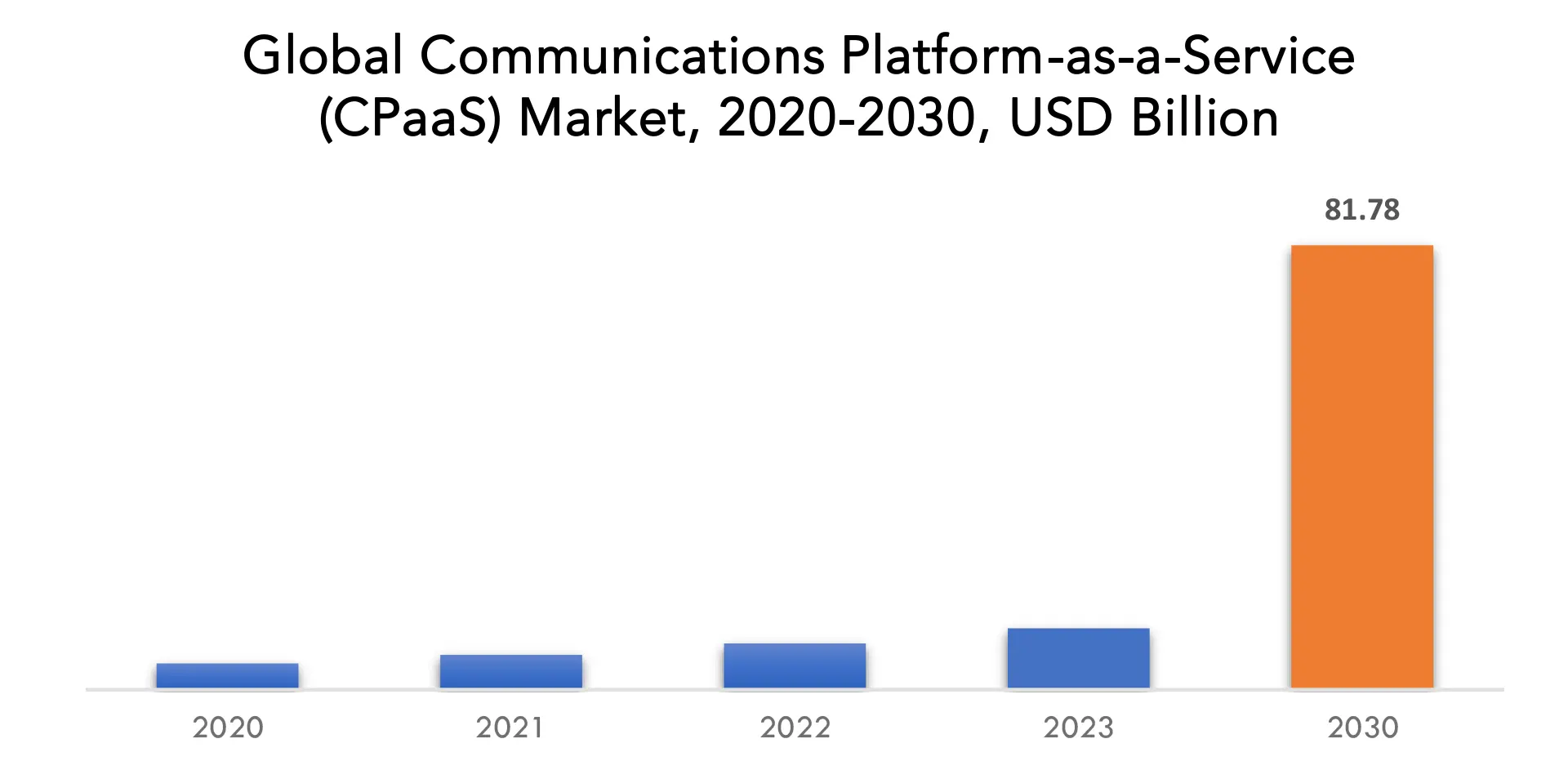

The global Communications Platform-as-a-Service (CPaaS) market is anticipated to grow from USD 11.29 Billion in 2023 to USD 81.78 Billion by 2030, at a CAGR of 32.7% during the forecast period.

Platform for Communications as a Service (CPaaS) is a cloud-based platform that lets companies add collaboration and communication features to their current infrastructure. Basic communication services including texting, audio and video conferencing, and mobile applications are delivered using APIs. Without the need for specialized gear or software, it enables businesses to develop new services and add features or capabilities to already-existing ones.

The Global Communications Platform as a Service (CPaaS) Market is primarily driven by the desire for enhanced customer experience, more consumer engagement, and better customer service. Other key reasons driving the growth of the Global Communications Platform as a Service (CPaaS) Market are the rising popularity of social media platforms, the arrival of 5G technology, and the growing acceptance of cloud-based services. However, a few of the obstacles that can prevent the Global Communications Platform as a Service (CPaaS) Market from expanding include user ignorance, the high implementation costs of CPaaS solutions, and worries about data security.

These days, a lot of industries have changed from having normal work hours to having remote work hours for a variety of reasons. Furthermore, these sectors are planning their operations and embracing digital transformation at a quick pace. Because of this, these sectors greatly rely on CPaaS, incorporating it into their existing workflow. Considering the outdated contact centers, it is evident that there is a growing need for easily maintained network systems that may enable efficient communications across various end-user industries, such as healthcare, retail, and manufacturing.

Additionally, the advent of affordable cloud-based solutions has increased uptake from healthcare providers, many of whom have limited IT resources. Now that United Communication services are available on a subscription basis, healthcare contact centers are implementing PBX systems and seamlessly meeting a variety of consumer needs from several sites.

Growing trend of mobility and BYOD as well as demand for personalized and streamlined customer interaction to achieve high customer satisfaction is boosting the growth of the communication platform-as-a-service market. In addition, increase in use of chat bot sales in communication platform as a service positively impacts the communication platform-as-a-service market growth. However, internet bandwidth & technical glitch issues and increasing security concerns are hampering the communication platform as a service market growth. On the contrary, increase in use of technological advancement is expected to offer remunerative opportunities for expansion of the communication platform as a service market during the forecast period.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Component, By Enterprise Size, By End Use, and By Region |

| By Component |

|

| By Enterprise Size |

|

| By End Use |

|

| By Region

|

|

Communications Platform-as-a-Service (CPaaS) Market Segmentation Analysis

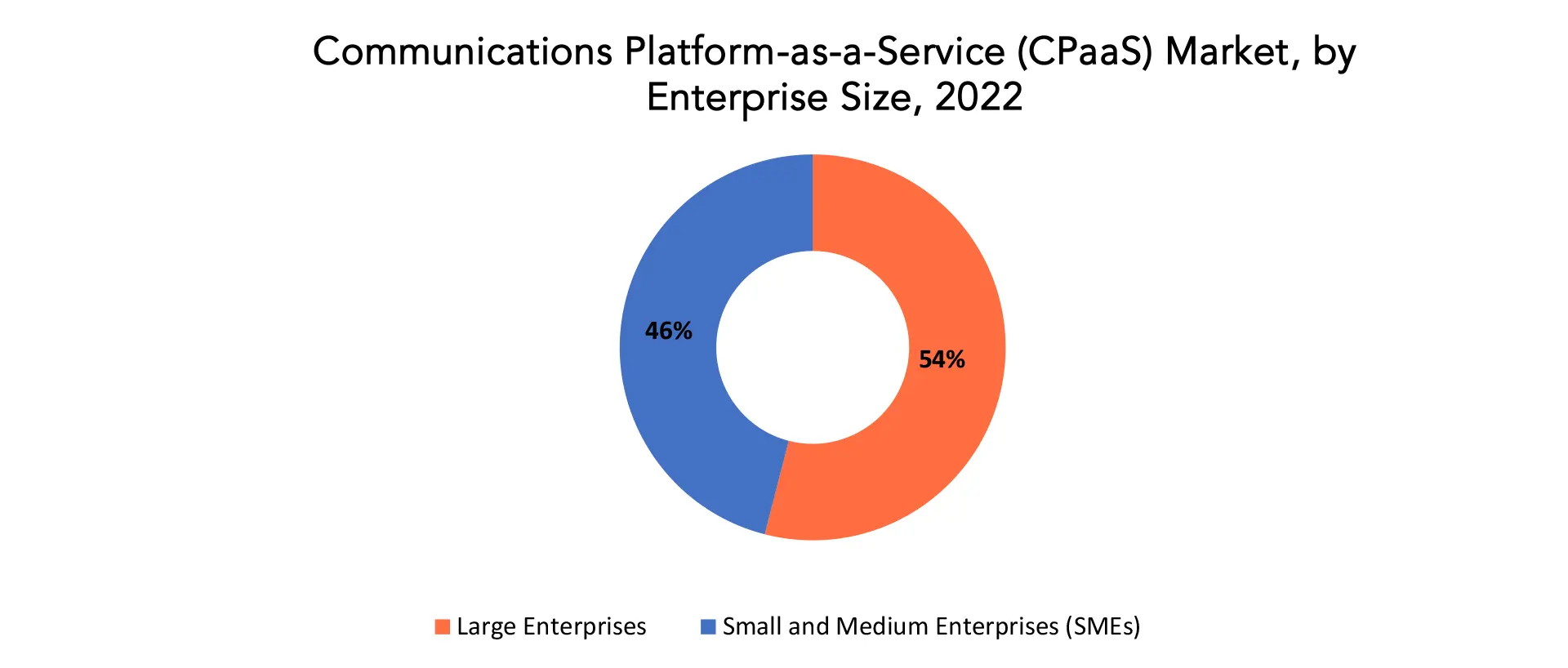

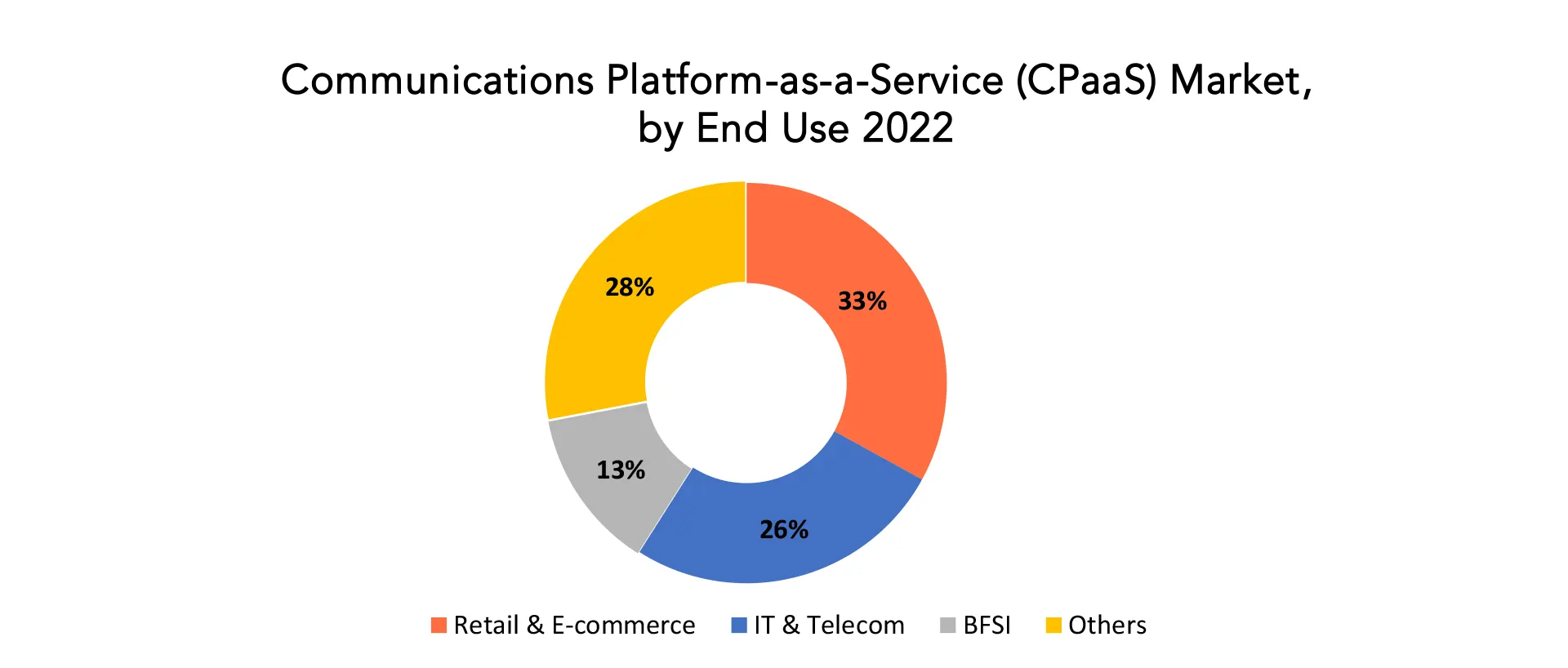

The component, enterprise size, end use, and region segments make up the global communications platform-as-a-service (CPaaS) market.

The Communications Platform-as-a-Service (CPaaS) market is characterized by a diverse range of components, including both solutions and services. It caters to enterprises of varying sizes, encompassing both large enterprises and small & medium enterprises. Across different industries, the adoption of CPaaS is witnessed, with notable applications in BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Transportation & Logistics, Travel & Hospitality, and other sectors.

During the projection period, large firms are anticipated to receive the largest revenue share. Large industries should see an increase in demand for communication platform-as-a-service due to the fast-expanding digital client involvement. In order to improve consumer services on digital platforms, these businesses are investing more in IT, which is projected to increase the market share of communication platforms as services. CPaaS is used by large organizations across several sectors for various enterprise communication channels. The following industries, among others, are the most frequent users of communication platform as a service (CPaaS) solution: retail, insurance, healthcare, education, accounting, travel & hospitality, and transportation & logistics. Large businesses are anticipated to use CPaaS extensively for improved connection, customer engagement, and streamlined communication processes because of their broad operations and varied communication demands. This will position them as significant contributors.

Due to the increased government funding and additional private investments, small and medium-sized businesses will see strong compound annual growth. Offering real-time consumer involvement is the main goal of these SMEs in order to grow their businesses. Thus, SMEs are integrating communication platform-as-a-service throughout their organization to enhance customer connection and pleasure.

With the biggest market share, the retail and e-commerce sector is anticipated to expand at a compound annual growth rate (CAGR) of 35.2% over the course of the projection period. Marketing automation programme, customer relationship management software, and other customer databases can be integrated with CPaaS. The gadget then shapes messages and recommendations that are further offered by chatbots or human representatives, as well as the user search results that are dispersed throughout algorithms. Additionally, merchants that integrate CPaaS with e-commerce platforms enable chatbots to perform tasks like order taking, question answering, item suggestion, and even transaction completion.

The second-largest category is IT and telecommunication. The use of traditional phone services, such as voice and SMS, has significantly decreased. The main cause of this is the emergence of new real-time communication channels, such as over-the-top (OTT) platforms. Organizations are being pushed over the edge by focused demand to collaborate with CPaaS providers and implement solutions on their own networks, impacting their current infrastructures and data centers and launching new income streams.

Communications Platform-as-a-Service (CPaaS) Market Competitive Landscape

The competitive landscape of the communications platform-as-a-service (CPaaS) market was dynamic, with several prominent companies competing to provide innovative and advanced communications platform-as-a-service (CPaaS) solutions.

- Twilio Inc

- Vonage Holdings Corp

- MessageBird BV

- Plivo Inc.

- Snitch AB

- Voximplant (Zingaya Inc.)

- 8×8 Inc

- Voxvalley Technologies

- Bandwidth Inc.

- IntelePeer Cloud Communications

- Wazo Communication Inc

- Avaya Inc.

- AT&T Inc.

- Mitel Networks Corporation

- Telestax

- Voxbone SA

- Iotum Inc

- M800 Limited

- Infobip Ltd

- EnableX

Recent Developments:

26 June 2023 – Amazon Web Services (AWS) and Twilio (NYSE: TWLO), the customer engagement platform that drives real-time, personalized experiences for today’s leading brands, announced an extension of their longstanding strategic work together that will place powerful artificial intelligence (AI) capabilities at the fingertips of Twilio customers.

5 September 2023 – 8×8, Inc. (NASDAQ: EGHT), a leading integrated cloud contact center, unified communications and Communications Platform as a Service (CPaaS) platform provider, announced the 8×8 Omni Shield solution, allowing enterprises to proactively safeguard their customers from fraudulent SMS activity. The new SMS fraud prevention communication API is part of the 8×8 CPaaS portfolio, which helps enterprises drive business growth by integrating various communication channels, including SMS, voice, chat apps, and video interaction, to enhance customer experience.

Communications Platform-as-a-Service (CPaaS) Market Dynamics

Driver

Introduction of chatbots to increase revenue in the market for communications platform-as-a-service (CPaaS).

Businesses may improve customer interaction, expedite communication procedures, and provide more individualized and effective services by incorporating chatbots into CPaaS platforms. Chatbots allow for real-time communication by automating repetitive operations and responding instantly to client inquiries. This maximizes operational efficiency for businesses while also enhancing overall consumer happiness. Demand for CPaaS with integrated chatbot capabilities is predicted to soar, propelling revenue growth, as companies come to understand the importance of instantaneous and seamless communication. This trend is especially relevant to a variety of industries, including travel and hospitality, BFSI, IT & Telecom, Retail & E-commerce, Healthcare, and Transportation & Logistics, where effective communication is essential to succeed in a highly competitive market. The ability to integrate chatbots and increase income makes CPaaS a wise investment for businesses looking to stay in business.

Restraint

One of the reasons for the CPaaS market’s sluggish development is the security and regulatory worries around user data.

The increased stringency of government rules on data usage and privacy poses a major problem to many industries as these communication technologies are deployed more often. For many applications, cloud-based solutions are the best choice since they provide cloud users inexpensive storage and processing. Despite the recent fast expansion in the implementation of cloud-based solutions, there are currently insufficient security safeguards in place to safeguard data and apps for cloud customers who switch providers. Calyptix Security claims that following their use of the cloud, businesses are vulnerable to dangers including unauthorized access to client data and sensitive information. The development of the industry is being hampered by the server- and cloud-based services’ lack of security and privacy concerns. The e-commerce and retail sectors are major drivers of the expansion of CPaaS solutions. The global operations of retailers and e-tailers have made compliance management even more difficult. For example, laws such as the General Data Protection Regulation (GDPR) of the European Union are impeding market expansion.

Opportunities

Growth in the CPaaS market is anticipated to be driven by the growing enterprise Bring Your Own Device (BYOD) trend.

Enterprise Bring Your Own Device (BYOD) is a growing trend that is closely related to the Communications Platform-as-a-Service (CPaaS) market’s predicted expansion. Employees are using their personal devices for business-related tasks as more organizations adopt flexible work arrangements, which calls for effective communication solutions. CPaaS provides a cloud-based platform that enables communication across various devices and operating systems, therefore it fits in well with the BYOD trend. Through this convergence, businesses may build an accessible and coherent communication environment that improves productivity and teamwork. CPaaS solves the issues raised by the BYOD model by guaranteeing safe and effective communication routes in addition to supporting a wide variety of devices. The complementary nature of CPaaS and BYOD makes the former a strategic enabler for contemporary workplaces, propelling its uptake and significantly bolstering the projected expansion of the CPaaS industry. The symbiotic link between CPaaS and BYOD becomes a crucial accelerator for the growth of the communication technology environment as organizations prioritize mobility and flexibility in their operations.

Communications Platform-as-a-Service (CPaaS) Market Trends

- Rising demand for omnichannel communication: Businesses are increasingly recognizing the need to engage with customers on their preferred channels, whether it’s SMS, email, voice, or social media. CPaaS provides a single platform to manage all these communications, streamlining operations and improving customer experience.

- Embracing the power of APIs: CPaaS leverages APIs to integrate seamlessly with existing business applications, such as CRM or marketing automation platforms. This enables businesses to automate communication workflows and personalize outreach based on customer data.

- The rise of programmable communications: Businesses are no longer satisfied with one-way communication. They want to interact with customers in real-time, gather feedback, and personalize experiences. Programmable communications APIs enable two-way interactions, like chatbots, interactive voice menus, and video calls.

- AI and machine learning (ML) for smarter communications: CPaaS platforms are increasingly incorporating AI and ML to analyze customer data and predict preferences. This allows businesses to send targeted messages, optimize campaigns, and deliver more relevant experiences.

- Growing popularity of emerging channels: CPaaS is expanding beyond traditional channels to include new, innovative options like Rich Communication Services (RCS) and messaging platforms like WhatsApp and WeChat. This opens up new avenues for customer engagement and brand building.

Communications Platform-as-a-Service (CPaaS) Market Regional Analysis

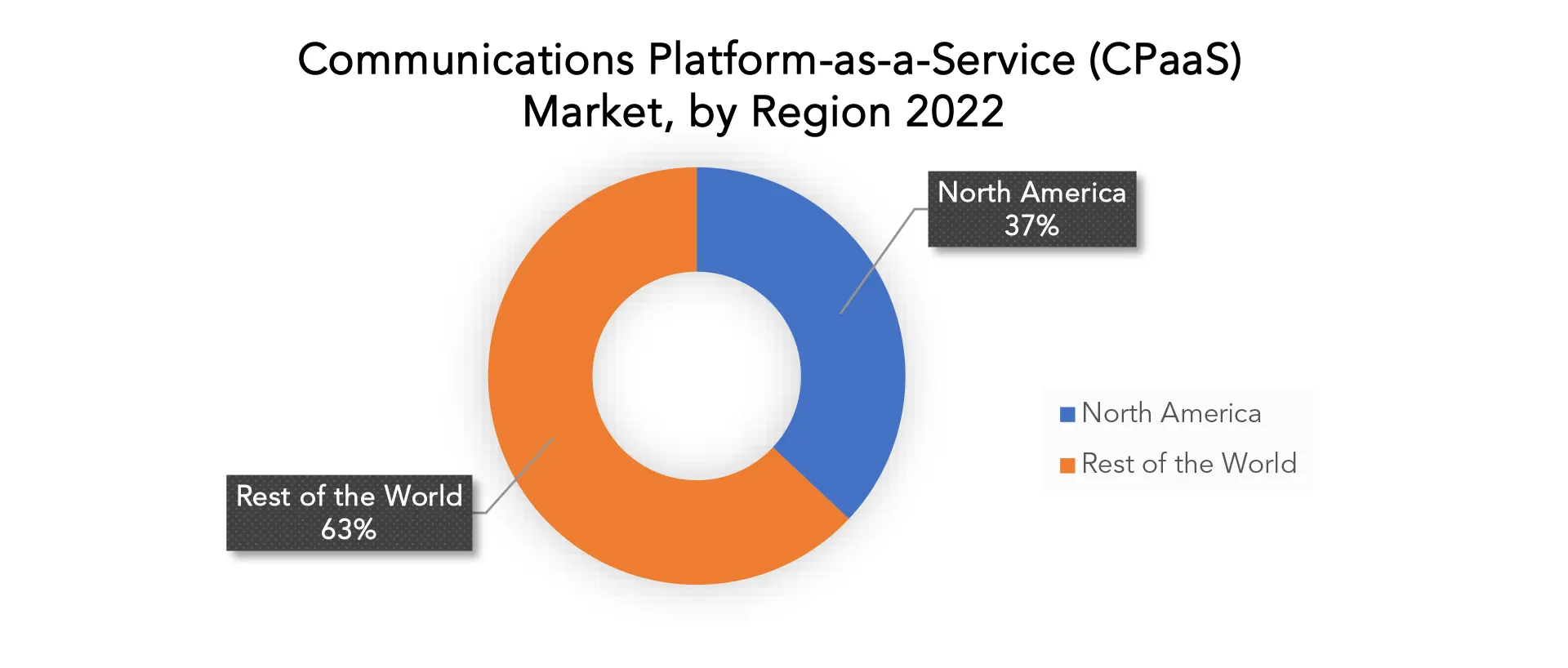

North America is predicted to increase at a CAGR of 33.1% over the course of the projection period, maintaining its largest market share of 37%. Due to the present increase in mobility and the enormous advancement in the saturation of smart mobile devices owing to IT’s consumerization, North America leads the CPaaS industry. Additionally, leading market players are planning to familiarize themselves with integrated and cohesive CPaaS solutions in this area due to the rising need for affordable and user-friendly browser-based communication solutions, which would propel market expansion. Because of its high deployment investment rate for 5G, the US is one of the top inventors and investors in the 5G industry. The increased use of CPaaS may potentially encourage dishonest and unlawful behaviors, which has resulted in the adoption of secure methods to increase the demand for CPaaS in the region and maintain compliance with regional regulations.

With a fantastic CAGR of 35.1%, Europe, which now owns the second highest market share, is expected to reach USD 26.3 billion by 2030. Since many European nations are making major investments in their private and digital infrastructures, it is anticipated that the area would embrace CPaaS at a significant rate. In an effort to close the skills gap and quicken the pace of cloud adoption, public initiatives have been started. The governments of Bulgaria, Poland, and Romania, for example, have pledged to improve their digital infrastructures, while the government of Ukraine has quadrupled its expenditure on ICT R&D in 2021—well ahead of schedule. The regional government is concentrating on supporting these companies by pressuring telecom companies, such as EE or Vodafone, to accelerate their 5G infrastructure deployment efforts.

Target Audience for Communications Platform-as-a-Service (CPaaS)

- Enterprise IT Decision-Makers

- Communication Service Providers

- Developers and Programmers

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- System Integrators

- IT Consultants

- Investors and Venture Capital Firms

- Government and Public Sector Organizations

Import & Export Data for Communications Platform-as-a-Service (CPaaS) Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Communications Platform-as-a-Service (CPaaS) Market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Communications Platform-as-a-Service (CPaaS) Market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Communications Platform-as-a-Service (CPaaS) trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Communications Platform-as-a-Service (CPaaS) types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Communications Platform-as-a-Service (CPaaS) Market Report

Communications Platform-as-a-Service (CPaaS) Market by Component

- Solution

- API Platform

- Messaging API

- Voice API

- Video API

- Others

- SDK Platform

- Service

- Managed Services

- Professional Services

Communications Platform-as-a-Service (CPaaS) Market by Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Communications Platform-as-a-Service (CPaaS) Market by End Use

- BFSI

- IT & Telecom

- Retail & E-commerce

- Healthcare

- Transportation & Logistic

- Travel & Hospitality

- Others

Communications Platform-as-a-Service (CPaaS) Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the communications platform-as-a-service (CPaaS) market over the next 7 years?

- Who are the major players in the communications platform-as-a-service (CPaaS) market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the communications platform-as-a-service (CPaaS) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the communications platform-as-a-service (CPaaS) market?

- What is the current and forecasted size and growth rate of the global communications platform-as-a-service (CPaaS) market?

- What are the key drivers of growth in the communications platform-as-a-service (CPaaS) market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the communications platform-as-a-service (CPaaS) market?

- What are the technological advancements and innovations in the communications platform-as-a-service (CPaaS) market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the communications platform-as-a-service (CPaaS) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the communications platform-as-a-service (CPaaS) market?

- What are the services offered and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET OUTLOOK

- GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT, 2020-2030, (USD BILLION)

- SOLUTION

- API PLATFORM

- MESSAGING API

- VOICE API

- VIDEO API

- OTHERS

- SDK PLATFORM

- API PLATFORM

- SERVICE

- MANAGED SERVICES

- PROFESSIONAL SERVICES

- SOLUTION

- GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE, 2020-2030, (USD BILLION)

- LARGE ENTERPRISES

- SMALL AND MEDIUM ENTERPRISES (SMES)

- GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE, 2020-2030, (USD BILLION)

- BFSI

- IT & TELECOM

- RETAIL & E-COMMERCE

- HEALTHCARE

- TRANSPORTATION & LOGISTIC

- TRAVEL & HOSPITALITY

- OTHERS

- GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

9.1 TWILIO INC

9.2 VONAGE HOLDINGS CORP

9.3 MESSAGEBIRD BV

9.4 PLIVO INC.

9.5 SNITCH AB

9.6 VOXIMPLANT (ZINGAYA INC.)

9.7 8X8 INC

9.8 VOXVALLEY TECHNOLOGIES

9.9 BANDWIDTH INC.

9.10 INTELEPEER CLOUD COMMUNICATIONS

9.11 WAZO COMMUNICATION INC

9.12 AVAYA INC.

9.13 AT&T INC.

9.14 MITEL NETWORKS CORPORATION

9.15 TELESTAX

9.16 VOXBONE SA

9.17 IOTUM INC

9.18 M800 LIMITED

9.19 INFOBIP LTD

9.20 ENABLEX

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 2 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 3 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 4 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY REGIONS (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 10 US COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 11 US COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 12 CANADA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 13 CANADA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 14 CANADA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 15 MEXICO COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 16 MEXICO COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 17 MEXICO COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 23 BRAZIL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 24 BRAZIL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 25 ARGENTINA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 26 ARGENTINA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 28 COLOMBIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 29 COLOMBIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 39 INDIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 40 INDIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 41 CHINA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 42 CHINA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 43 CHINA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 44 JAPAN COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 45 JAPAN COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 46 JAPAN COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 59 EUROPE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 60 EUROPE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 61 EUROPE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 62 EUROPE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 64 GERMANY COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 65 GERMANY COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 66 UK COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 67 UK COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 68 UK COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 69 FRANCE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 70 FRANCE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 71 FRANCE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 72 ITALY COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 73 ITALY COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 74 ITALY COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 75 SPAIN COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 76 SPAIN COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 77 SPAIN COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 78 RUSSIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 79 RUSSIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 80 RUSSIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 89 UAE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 90 UAE COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT USD BILLION, 2020-2030

FIGURE 9 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE USD BILLION, 2020-2030

FIGURE 10 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE USD BILLION, 2020-2030

FIGURE 11 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY REGION USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY COMPONENT USD BILLION, 2022

FIGURE 14 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY ENTERPRISE SIZE USD BILLION, 2022

FIGURE 15 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY END USE USD BILLION, 2022

FIGURE 16 GLOBAL COMMUNICATIONS PLATFORM-AS-A-SERVICE (CPAAS) MARKET BY REGION USD BILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 TWILIO INC: COMPANY SNAPSHOT

FIGURE 19 VONAGE HOLDINGS CORP: COMPANY SNAPSHOT

FIGURE 20 MESSAGEBIRD BV: COMPANY SNAPSHOT

FIGURE 21 PLIVO INC.: COMPANY SNAPSHOT

FIGURE 22 SNITCH AB: COMPANY SNAPSHOT

FIGURE 23 VOXIMPLANT (ZINGAYA INC.): COMPANY SNAPSHOT

FIGURE 24 8X8 INC: COMPANY SNAPSHOT

FIGURE 25 VOXVALLEY TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 26 BANDWIDTH INC.: COMPANY SNAPSHOT

FIGURE 27 INTELEPEER CLOUD COMMUNICATIONS: COMPANY SNAPSHOT

FIGURE 28 WAZO COMMUNICATION INC: COMPANY SNAPSHOT

FIGURE 29 AVAYA INC.: COMPANY SNAPSHOT

FIGURE 30 AT&T INC.: COMPANY SNAPSHOT

FIGURE 31 MITEL NETWORKS CORPORATION: COMPANY SNAPSHOT

FIGURE 32 TELESTAX: COMPANY SNAPSHOT

FIGURE 33 VOXBONE SA: COMPANY SNAPSHOT

FIGURE 34 IOTUM INC: COMPANY SNAPSHOT

FIGURE 35 M800 LIMITED: COMPANY SNAPSHOT

FIGURE 36 INFOBIP LTD: COMPANY SNAPSHOT

FIGURE 37 ENABLEX: COMPANY SNAPSHOT

FAQ

The global Communications Platform-as-a-Service (CPaaS) market is anticipated to grow from USD 11.29 Billion in 2023 to USD 81.78 Billion by 2030, at a CAGR of 32.7% during the forecast period.

North America accounted for the largest market in the communications platform-as-a-service (CPaaS) market. North America accounted for 37 % market share of the global market value.

Twilio Inc, Vonage Holdings Corp, MessageBird BV, Plivo Inc., Snitch AB, Voximplant (Zingaya Inc.), 8×8 Inc, Voxvalley Technologies, Bandwidth Inc., IntelePeer Cloud Communications, Wazo Communication Inc, Avaya Inc., AT&T Inc., Mitel Networks Corporation, Telestax, Voxbone SA,Iotum Inc, M800 Limited, Infobip Ltd, EnableX

Growing popularity of emerging channels: CPaaS is expanding beyond traditional channels to include new, innovative options like Rich Communication Services (RCS) and messaging platforms like WhatsApp and WeChat. This opens up new avenues for customer engagement and brand building.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.