REPORT OUTLOOK

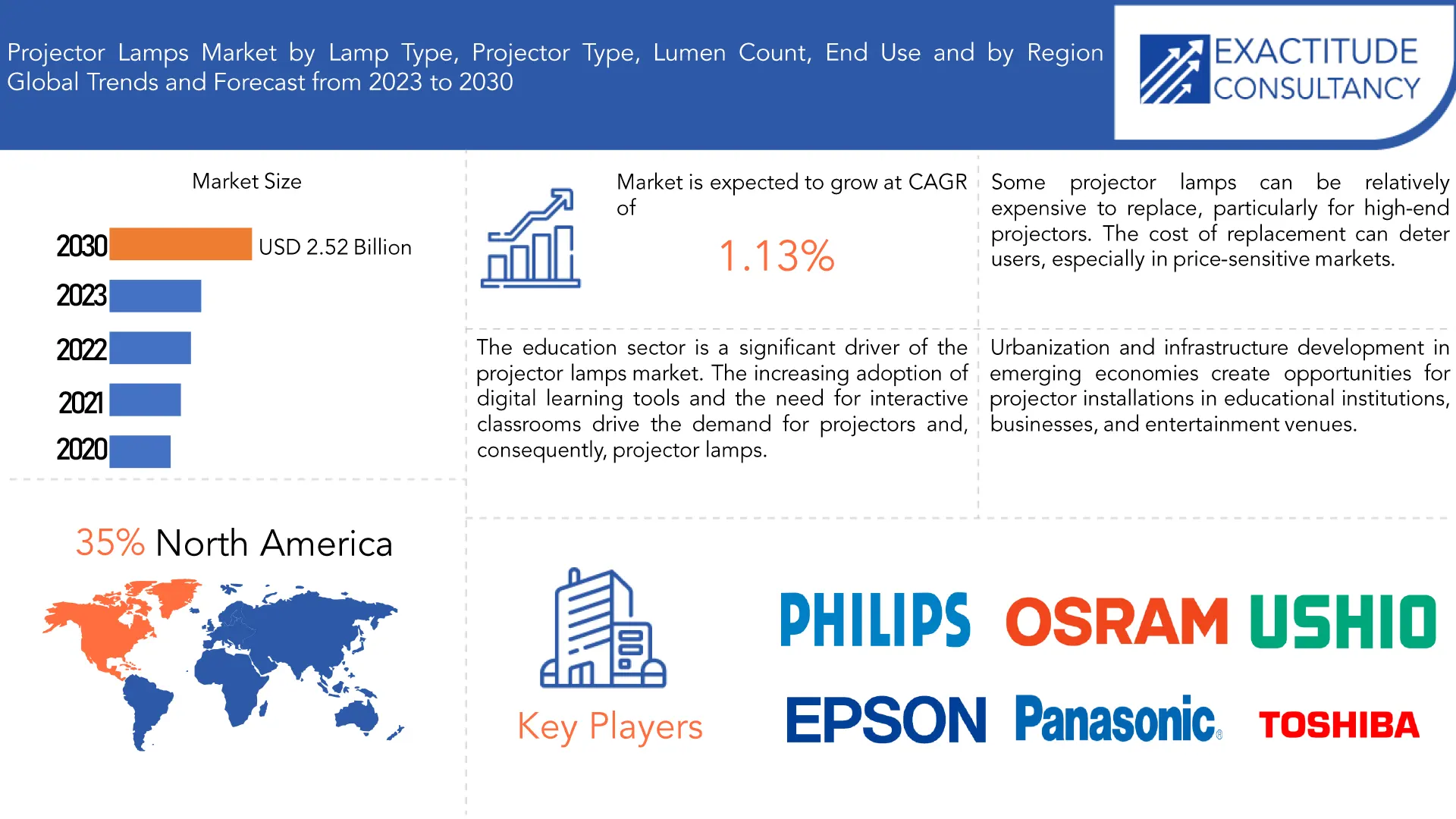

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2.52 Billion by 2030 | 1.13 % | North America |

| by Lamp Type | by Projector Type | by Lumen Count | by End Use |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Projector Lamps Market Overview

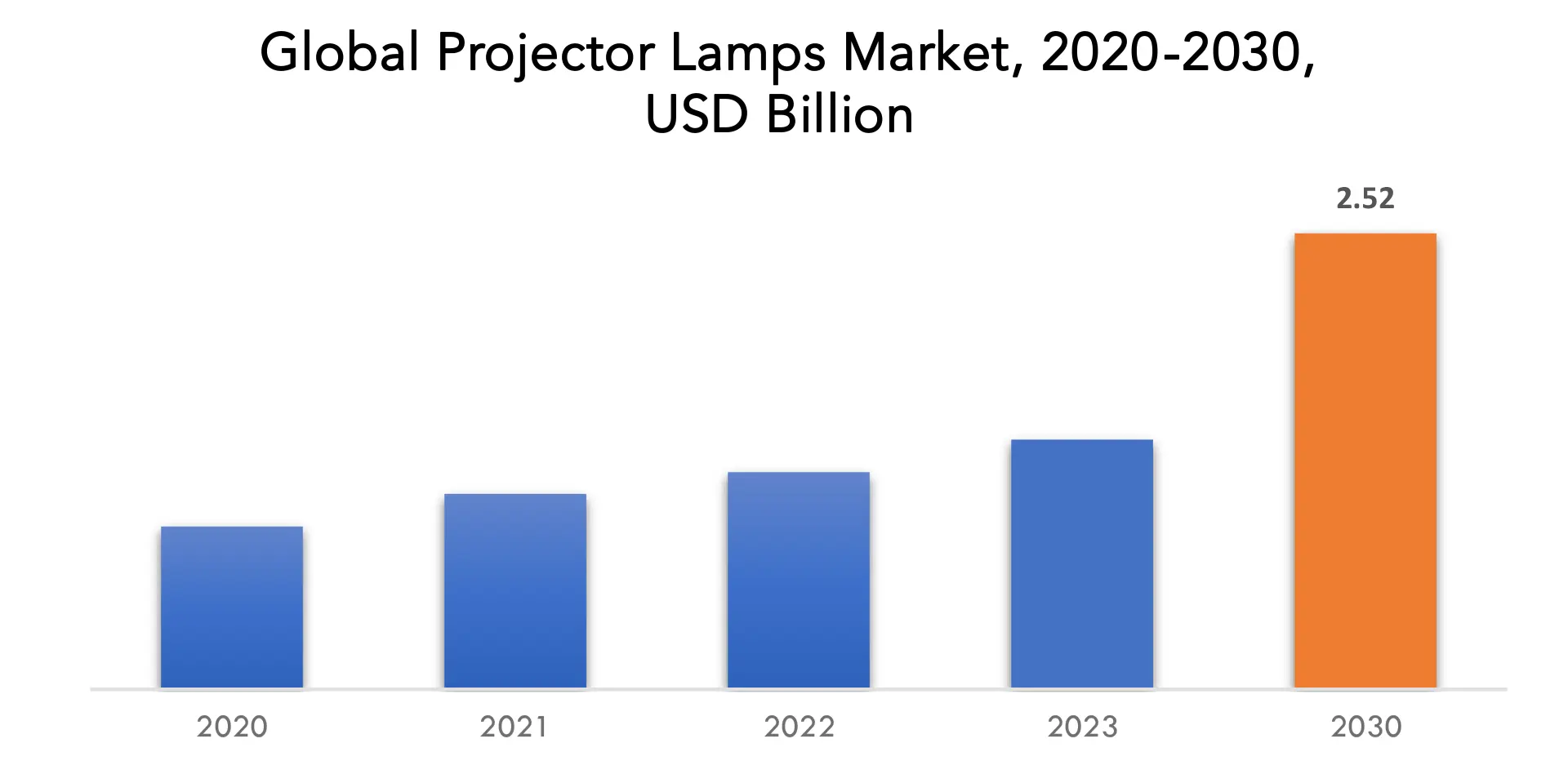

The global projector lamps market is anticipated to grow from USD 2.30 Billion in 2023 to USD 2.52 Billion by 2030, at a CAGR of 1.13 % during the forecast period.

Projector lamps, commonly referred to as projector bulbs or projector light sources, are critical components of projection technology. These lamps supply the light required for projectors to display pictures, films, presentations, and other visual material on a screen or projection surface. The level of brightness and quality of the projected picture are determined by projector lights, which are essential components of the projection process. Metal halide lamps, mercury vapour lamps, and, more recently, LED lamps are all forms of projector lights. Each variety has unique qualities and benefits. Metal halide lamps, for example, are recognized for their extreme brightness and colour precision, which makes them ideal for applications demanding colorful images. LED lighting, on the other hand, use less energy and last longer, lowering maintenance expenses.

Projector lamps, also known as projector bulbs, are essential in allowing projectors to show pictures, movies, presentations, and other visual material on screens or surfaces. The market includes a wide range of bulb types, including classic alternatives such as metal halide and mercury vapour lamps, as well as emerging technologies such as LED lights.

The continuing need for projection technology across many industries, including education, business, entertainment, and home theatre applications, is one of the key drivers driving the projector lights market. Projectors are used in educational institutions for interactive learning and presentations, while corporations use them for meetings and conferences. For realistic viewing experiences, the entertainment sector, including theatres and live events, relies on projectors. Furthermore, the popularity of home theatres and gaming systems has increased demand for high-quality projector bulbs.

The market additionally reflects current technology improvements, such as the shift to LED bulbs, which are more energy efficient and have a longer lifespan. Furthermore, the incorporation of smart and interactive capabilities into projectors is spawning inventive uses and raising the need for suitable bulbs.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Lamp Type, Projector Type, Lumen Count ,End Use and Region |

|

By Lamp Type |

|

|

By Projector Type |

|

|

By Lumen Count |

|

| By End Use |

|

| By Region |

|

Projector Lamps Market Segmentation Analysis

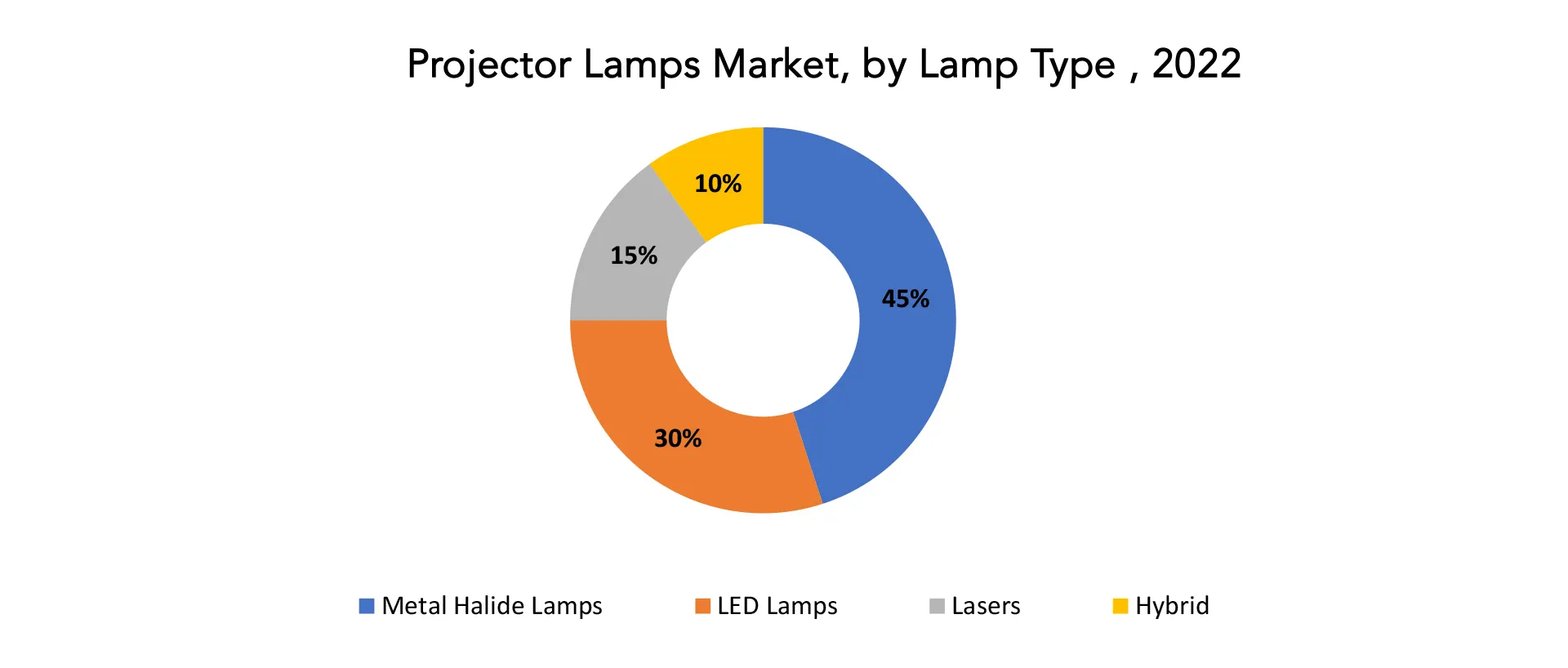

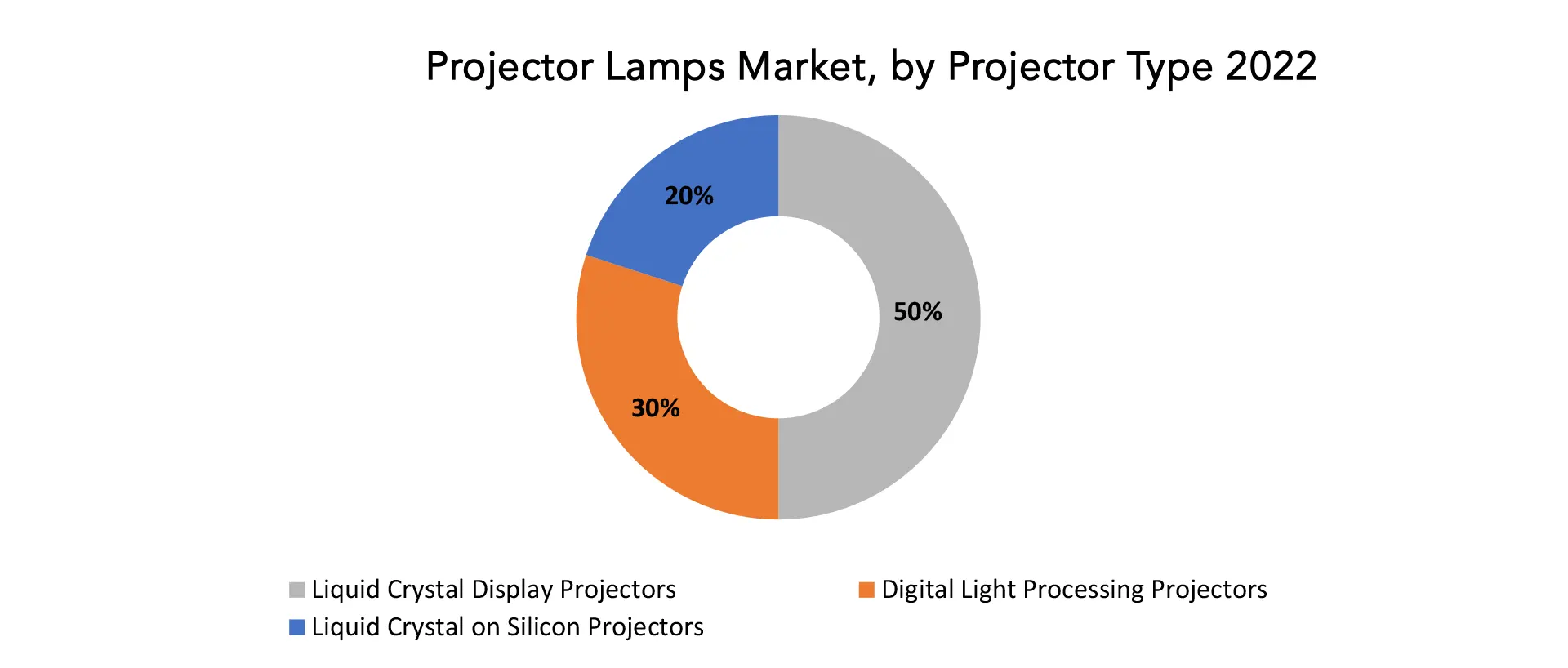

The global projector lamps market is divided into four segments, lamp type, projector type, lumen count, end use and region. By lamp type the market is divided into metal halide lamps, led lamps, lasers, hybrid. By projector type the market is divided into liquid crystal display projectors, digital light processing projectors, liquid crystal on silicon projectors. By lumen count the market is classified into below 3,500 lumens, 3,501 to 6,500 lumens, 6,501 to 9,000 lumens, above 9,000 lumens. By end use the market is classified into residential, commercial.

Based on lamp type metal halide lamps segment dominating in the projector lamps market. Metal halide lamps have become popular for projection uses due to their great brightness, extended lifespan, and superb colour rendering capabilities. Metal halide lamps are a form of high-intensity discharge (HID) lamp that produces light from a combination of metal halide salts. As an electric arc is sent across the metal halide salts, it produces a dazzling, white light. Metal halide lamps are available in a number of power ratings and brightness levels, making them appropriate for a wide range of projector applications. They have several benefits above different kinds of projector lights, such as halogen and LED bulbs. Metal halide lights are brighter and last longer than halogen bulbs. Metal halide lamps additionally have greater colour rendering than LED lights, making them excellent for applications requiring precise colour reproduction.

Metal halide lamps are the most powerful projector lights available. This is significant for projector applications since it enables for picture projection in big, well-lit environments. Metal halide lamps generally have a lifetime of 2,000 to 3,000 hours. This lowers the need for regular light changes, which saves money and time. Metal halide lamps have also been frequently employed in large-venue projectors, such as those seen in cinemas, theatres, and stadiums. Their capacity to produce high levels of brightness over long periods of time makes them useful for situations where a big audience need clear and vivid pictures on a large screen or projection surface.

Based on projector type, liquid crystal display projectors segment dominating in the Projector Lamps market. LCD projectors have gained popularity due to its versatility, picture quality, and flexibility to a wide range of projection requirements. One of the key reasons for LCD projector domination is their capacity to offer high-quality, crisp, and vivid pictures. LCD technology enables exact manipulation of individual pixels, leading in high colour accuracy and visual clarity. This skill is critical in a variety of industries, including education, corporate presentations, home theatres, and digital signs, wherever visual impact and clarity are critical.

LCD projectors are noted for their adaptability, with a wide range of resolutions to meet a variety of needs, ranging from standard resolution to higher definition (HD) and 4K ultra-high definition (UHD). This versatility guarantees that LCD projectors can satisfy the changing needs of consumers seeking varied degrees of picture detail and clarity, making them appropriate both for basic presentations and immersive home entertainment installations. LCD projectors excel in colour reproduction as well, providing precise and consistent colour rendering across a wide range. This is especially useful in applications requiring high colour integrity, like design work, medical imaging, and artistic presentations.

Projector Lamps Market Dynamics

Driver

Growing demand for high-resolution and 4K projection is driving projector lamps market.

High-resolution and 4K projectors produce clearer pictures with greater specifics, leading to them becoming increasingly popular in a wide range of applications such as business, education, home theatre, and gaming. High-resolution and 4K projector bulbs are critical components. They generate the light utilised to display the graphic onto the screen. The quality and efficiency of the projector light have a considerable influence on the projector’s image quality. excellent-resolution and 4K projectors need projector bulbs with excellent brightness and contrast. It is due to the fact that high-resolution and 4K photos contain more pixels than normal quality images, requiring more light to generate a clear image.

Additionally, high-resolution and 4K projector panels are frequently bigger than normal definition projector screens. This implies that the projector bulb must provide a larger beam of light in order to illuminate the entire screen equally. The increasing need for high-resolution and 4K projectors drives the demand for projector lights that can suit these projectors’ unique specifications. As a result, new projector light technologies with improved brightness, contrast, and colour accuracy are being developed.

Restraint

Increasing popularity of LED projectors can impede the projector lamps market during the forecast period.

LED projectors are a form of projector that generates light using light-emitting diodes (LEDs) rather than typical projector lamps. LED projectors provide multiple benefits over classic projectors, such a longer lifespan, decreased energy use, and improved image quality.

LED projectors are well-known for their exceptional energy efficiency. They use far less power than lamp-based projectors, resulting in decreased operational costs and energy usage. This is consistent with the rising worldwide emphasis on sustainability and energy saving, making LED projectors appealing to both environmentally conscientious customers and cost-sensitive enterprises.

Moreover, LED projectors produce less heat when in use, resulting in a more pleasant and cooler environment. This function is especially useful in tight rooms or venues with restricted airflow, where heat from standard bulbs might be an issue.

LED projectors have grown more popular in a range of applications, such home theatre, business, and education, as a result of these benefits. As more people transition to LED projectors, demand for projector bulbs is projected to fall.

Opportunities

The development of new projector technologies is creating new opportunities for the projector lamps market.

The switch to laser light source projectors is an interesting development in projector technology. Compared to typical lamp-based projectors, laser projectors have various benefits. They have excellent image clarity, tremendous brightness, and a much longer lifespan. Because of the transition towards laser projectors, there is an increased need for specialised laser-compatible projector bulbs. These bulbs are created to meet the specific needs of laser projection systems, assuring maximum performance and lifespan. The need for these specialised lights is projected to rise as more sectors and venues embrace laser projection for its dependability and quality.

An additional technical breakthrough is the introduction of 4K and even 8K resolution projectors. The need for projector lights capable of supporting high-resolution projectors is rising as consumers and professionals seek improved picture quality and clarity. To fully harness the potential of 4K and 8K content, these bulbs must provide the requisite brightness and colour accuracy. This advancement is especially significant in the home entertainment industry, as viewers are establishing immersive home theatres with ultra-high-definition projection.

In addition, the incorporation of smart and interactive capabilities into projectors is spawning new applications and industries. Smart projectors with operating systems and networking possibilities are becoming more common in educational and business environments. These projectors necessitate bulbs with enhanced functionality, which adds to the demand for suitable lamps.

Projector Lamps Market Trends

- LED projector bulbs are becoming more popular as a result of their energy efficiency, longer lifespan, and lower maintenance costs. More consumers are transitioning from traditional lamp-based projectors to LED ones as LED technology progresses.

- The 4K content is more widely available, there is a growing need for 4K-compatible projectors. Consumers and companies alike want more resolution and crisper image quality, which is pushing the use of 4K projector bulbs.

- Short-throw and ultra-short-throw projectors are popular in small-space applications. These projectors are perfect for schools, boardrooms, and home theatres since they can display enormous pictures from a short distance.

- Wireless projection technology is becoming more popular, allowing users to connect their devices to projectors without the usage of cords. This trend simplifies presentation setup and increases versatility for home entertainment.

- Energy-efficient projectors with recyclable components are growing popular among ecologically aware consumers and businesses.

- Artificial intelligence is being integrated into projectors to increase image quality, automatically modify settings, and improve user experiences.

- Smart projector lights include sensors and other technology that give consumers real-time input on the status of their projector bulbs.

- New projector technologies, such as laser projectors, are constantly being developed. These new projector technologies have several advantages over older projector technologies, including longer light life and better image quality.

Competitive Landscape

The competitive landscape of the projector lamps market was dynamic, with several prominent companies competing to provide innovative and advanced projector lamps solutions.

- Philips

- Osram

- Ushio

- Epson

- Panasonic

- Toshiba

- Hitachi

- Sony

- BenQ

- NEC

- Optoma

- ViewSonic

- Christie Digital

- Barco

- Dell

- InFocus

- LG Electronics

- Acer

- Mitsubishi Electric

- EIKI International

Recent Developments:

June 9, 2023: Panasonic Connect introduced the REQ15 1-Chip DLP™ 4K Projector and REZ15 1-Chip DLP™ Projector models. These products are set to make their debut at Infocomm 2023, taking place in Orlando, Florida

May 17, 2023: Sony Electronics Inc. announced three new Native 4K HDR Home Cinema laser projectors, featuring the world’s smallest1 Native 4K SXRD 0.61″ panel (3840 x 2160) enabling a compact chassis design. New wide dynamic range optics in combination with TRILUMINOUS PRO™ deliver an unmatched 4K HDR experience on the large screen.

Regional Analysis

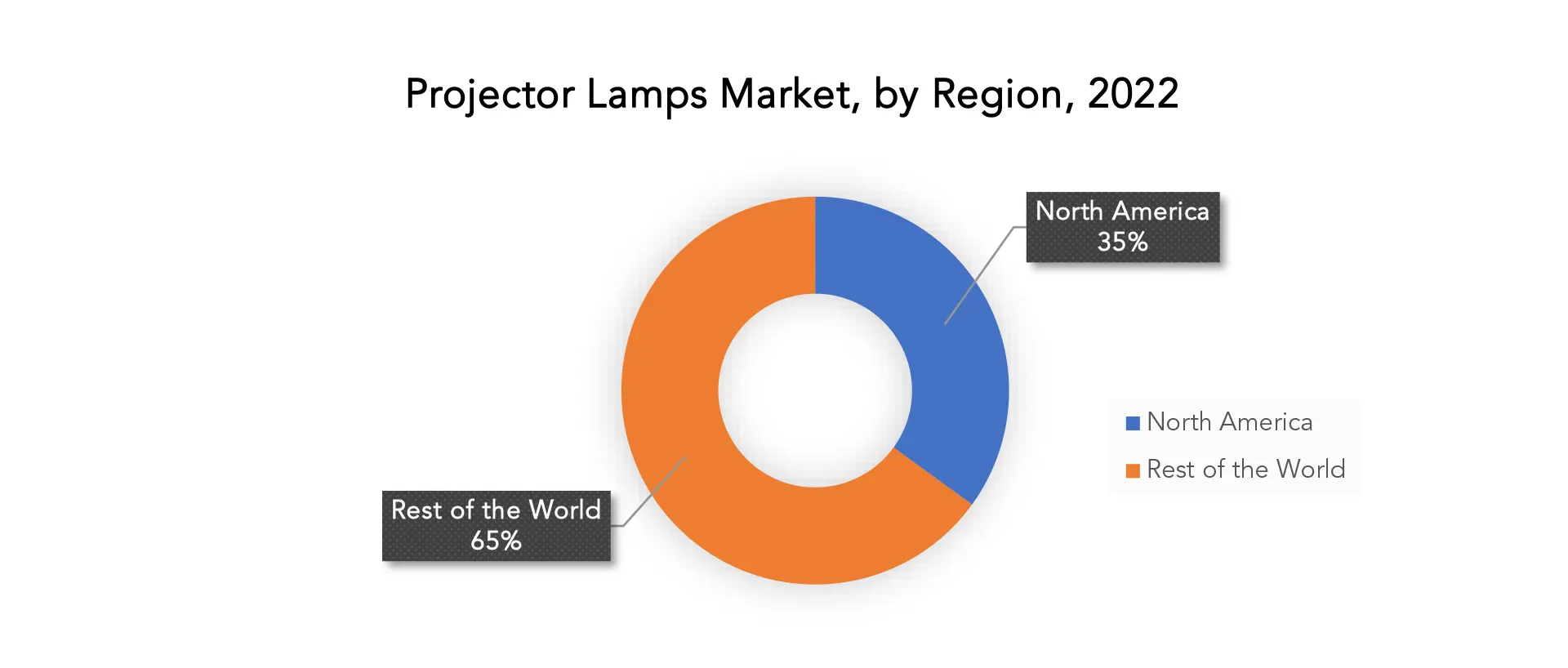

North America accounted for the largest market in the projector lamps market. North America accounted for the 35 % market share of the global market value. The dynamic and diversified economy of North America produces significant interest across a wide range of industries, such education, business, entertainment, and technology, where projectors are frequently utilised. In North America, educational institutions such as schools and colleges actively employ projectors for interactive learning, presentations, and digital classrooms, resulting in a constant need for projector lights. In addition, in North America, the corporate sector is a significant driver of the projector lamp industry. Numerous global firms call the region home, and they rely extensively on projectors for conferences, meetings, training sessions, and demonstrations. The business culture in North America places a premium on cutting-edge presenting technology, producing a sizable market for projector bulbs.

A further driver is the existence of premier technology and manufacturing businesses in North America. These firms are always investing in R&D, which drives development in projector technology. As a result, high-quality projector bulbs are in high demand for use with these cutting-edge projection systems. The market in North America additionally gains from a well-established manufacturing and retail network, making projector bulbs more accessible to consumers and companies. Furthermore, the region’s propensity to adopt the most recent advances in technology, such as home theatres and smart schools, helps to the market’s long-term growth.

The need for projectors in business and education applications is being driven by the vast and ageing populations in the United States and Canada. Furthermore, the region’s expanding construction industry is driving up demand for projectors.

Target Audience for Projector Lamps Market

- Rental companies

- Staging companies

- Audio/visual companies

- Projector manufacturers and distributors

- Projector repair and maintenance companies

- Event and Entertainment Industry

- Educational Institutions

- Businesses and Corporations

- Government and Public Sector

- AV Rental Companies

- Manufacturers and Suppliers

Import & Export Data for Projector Lamps Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the projector lamps market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global projector lamps market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the projector lamps trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on projector lamps types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Projector Lamps Market Report

Projector Lamps Market by Lamp Type

- Metal Halide Lamps

- LED Lamps

- Lasers

- Hybrid

Projector Lamps Market by Projector Type

- Liquid Crystal Display Projectors

- Digital Light Processing Projectors

- Liquid Crystal on Silicon Projectors

Projector Lamps Market by Lumen Count

- Below 3,500 Lumens

- 3,501 to 6,500 Lumens

- 6,501 to 9,000 Lumens

- Above 9,000 Lumens

Projector Lamps Market by End Use

- Residential

- Commercial

Projector Lamps Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the projector lamps market over the next 7 years?

- Who are the major players in the projector lamps market and what is their market share?

- What are the end use industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the projector lamps market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the projector lamps market?

- What is the current and forecasted size and growth rate of the global projector lamps market?

- What are the key drivers of growth in the projector lamps market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the projector lamps market?

- What are the technological advancements and innovations in the projector lamps market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the projector lamps market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the projector lamps market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL PROJECTOR LAMPS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON PROJECTOR LAMPS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL PROJECTOR LAMPS MARKET OUTLOOK

- GLOBAL PROJECTOR LAMPS MARKET BY LAMP TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- WEARABLE

- NON-WEARABLE

- GLOBAL PROJECTOR LAMPS MARKET BY PROJECTOR TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- ELECTROCHEMICAL

- OPTICAL

- PIEZOELECTRIC

- THERMAL

- NANOMECHANICAL

- GLOBAL PROJECTOR LAMPS MARKET BY LUMEN COUNT, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- HEALTHCARE

- AGRICULTURE

- BIOREACTOR

- FOOD TOXICITY

- OTHERS

- GLOBAL PROJECTOR LAMPS MARKET BY END-USE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- POINT OF CARE (POC)

- HOME DIAGNOSTICS

- RESEARCH LABS

- ENVIRONMENTAL MONITORING

- FOOD & BEVERAGES

- BIODEFENSE

- OTHERS

- GLOBAL PROJECTOR LAMPS MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- PHILIPS

- OSRAM

- USHIO

- EPSON

- PANASONIC

- TOSHIBA

- HITACHI

- SONY

- BENQ

- NEC

- OPTOMA

- VIEWSONIC

- CHRISTIE DIGITAL

- BARCO

- DELL

- INFOCUS

- LG ELECTRONICS

- ACER

- MITSUBISHI ELECTRIC

- EIKI INTERNATIONAL

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 4 GLOBAL PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 6 GLOBAL PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 8 GLOBAL PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 9 GLOBAL PROJECTOR LAMPS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 10 GLOBAL PROJECTOR LAMPS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA PROJECTOR LAMPS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA PROJECTOR LAMPS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 17 NORTH AMERICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 18 NORTH AMERICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 19 NORTH AMERICA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 20 NORTH AMERICA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 21 US PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 22 US PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 US PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 24 US PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 US PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 26 US PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 27 US PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 28 US PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 29 CANADA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 30 CANADA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 CANADA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 32 CANADA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 CANADA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 34 CANADA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 35 CANADA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 36 CANADA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 37 MEXICO PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 38 MEXICO PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 MEXICO PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 40 MEXICO PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 MEXICO PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 42 MEXICO PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 43 MEXICO PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 44 MEXICO PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 45 SOUTH AMERICA PROJECTOR LAMPS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 46 SOUTH AMERICA PROJECTOR LAMPS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 47 SOUTH AMERICA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 48 SOUTH AMERICA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 49 SOUTH AMERICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 50 SOUTH AMERICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 SOUTH AMERICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 52 SOUTH AMERICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 53 SOUTH AMERICA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 54 SOUTH AMERICA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 55 BRAZIL PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 56 BRAZIL PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 BRAZIL PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 58 BRAZIL PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 BRAZIL PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 60 BRAZIL PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 61 BRAZIL PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 62 BRAZIL PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 63 ARGENTINA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 64 ARGENTINA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 65 ARGENTINA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 66 ARGENTINA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 ARGENTINA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 68 ARGENTINA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 69 ARGENTINA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 70 ARGENTINA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 71 COLOMBIA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 72 COLOMBIA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 73 COLOMBIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 74 COLOMBIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 COLOMBIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 76 COLOMBIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 77 COLOMBIA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 78 COLOMBIA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF SOUTH AMERICA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 80 REST OF SOUTH AMERICA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 81 REST OF SOUTH AMERICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 82 REST OF SOUTH AMERICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 83 REST OF SOUTH AMERICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 84 REST OF SOUTH AMERICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 85 REST OF SOUTH AMERICA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 86 REST OF SOUTH AMERICA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 87 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 89 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 90 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 91 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 92 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 94 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 95 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 96 ASIA-PACIFIC PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 97 INDIA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 98 INDIA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 99 INDIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 100 INDIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 INDIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 102 INDIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 103 INDIA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 104 INDIA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 105 CHINA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 106 CHINA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 CHINA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 108 CHINA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 CHINA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 110 CHINA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 111 CHINA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 112 CHINA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 113 JAPAN PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 114 JAPAN PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 115 JAPAN PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 116 JAPAN PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 117 JAPAN PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 118 JAPAN PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 119 JAPAN PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 120 JAPAN PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 121 SOUTH KOREA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 122 SOUTH KOREA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 SOUTH KOREA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 124 SOUTH KOREA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 125 SOUTH KOREA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 126 SOUTH KOREA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 127 SOUTH KOREA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 128 SOUTH KOREA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 129 AUSTRALIA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 130 AUSTRALIA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 AUSTRALIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 132 AUSTRALIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 AUSTRALIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 134 AUSTRALIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 135 AUSTRALIA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 136 AUSTRALIA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 137 SOUTH-EAST ASIA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 138 SOUTH-EAST ASIA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 139 SOUTH-EAST ASIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 140 SOUTH-EAST ASIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 141 SOUTH-EAST ASIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 142 SOUTH-EAST ASIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 143 SOUTH-EAST ASIA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 144 SOUTH-EAST ASIA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 145 REST OF ASIA PACIFIC PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 146 REST OF ASIA PACIFIC PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 147 REST OF ASIA PACIFIC PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 148 REST OF ASIA PACIFIC PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 149 REST OF ASIA PACIFIC PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 150 REST OF ASIA PACIFIC PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 151 REST OF ASIA PACIFIC PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 152 REST OF ASIA PACIFIC PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 153 EUROPE PROJECTOR LAMPS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 154 EUROPE PROJECTOR LAMPS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 155 EUROPE PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 156 EUROPE PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 157 EUROPE PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 158 EUROPE PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 159 EUROPE PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 160 EUROPE PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 161 EUROPE PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 162 EUROPE PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 163 GERMANY PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 164 GERMANY PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 165 GERMANY PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 166 GERMANY PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 167 GERMANY PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 168 GERMANY PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 169 GERMANY PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 170 GERMANY PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 171 UK PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 172 UK PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 173 UK PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 174 UK PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 175 UK PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 176 UK PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 177 UK PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 178 UK PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 179 FRANCE PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 180 FRANCE PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 181 FRANCE PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 182 FRANCE PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 183 FRANCE PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 184 FRANCE PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 185 FRANCE PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 186 FRANCE PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 187 ITALY PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 188 ITALY PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 189 ITALY PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 190 ITALY PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 191 ITALY PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 192 ITALY PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 193 ITALY PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 194 ITALY PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 195 SPAIN PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 196 SPAIN PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 197 SPAIN PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 198 SPAIN PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 199 SPAIN PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 200 SPAIN PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 201 SPAIN PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 202 SPAIN PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 203 RUSSIA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 204 RUSSIA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 205 RUSSIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 206 RUSSIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 207 RUSSIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 208 RUSSIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 209 RUSSIA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 210 RUSSIA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 211 REST OF EUROPE PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 212 REST OF EUROPE PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 213 REST OF EUROPE PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 214 REST OF EUROPE PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 215 REST OF EUROPE PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 216 REST OF EUROPE PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 217 REST OF EUROPE PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 218 REST OF EUROPE PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 219 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 220 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 221 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 222 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 223 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 224 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 225 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 226 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 227 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 228 MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 229 UAE PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 230 UAE PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 231 UAE PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 232 UAE PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 233 UAE PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 234 UAE PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 235 UAE PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 236 UAE PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 237 SAUDI ARABIA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 238 SAUDI ARABIA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 239 SAUDI ARABIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 240 SAUDI ARABIA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 241 SAUDI ARABIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 242 SAUDI ARABIA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 243 SAUDI ARABIA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 244 SAUDI ARABIA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 245 SOUTH AFRICA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 246 SOUTH AFRICA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 247 SOUTH AFRICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 248 SOUTH AFRICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 249 SOUTH AFRICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 250 SOUTH AFRICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 251 SOUTH AFRICA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 252 SOUTH AFRICA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

TABLE 253 REST OF MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

TABLE 254 REST OF MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY LAMP TYPE (THOUSAND UNITS) 2020-2030

TABLE 255 REST OF MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

TABLE 256 REST OF MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (THOUSAND UNITS) 2020-2030

TABLE 257 REST OF MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

TABLE 258 REST OF MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY LUMEN COUNT (THOUSAND UNITS) 2020-2030

TABLE 259 REST OF MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

TABLE 260 REST OF MIDDLE EAST AND AFRICA PROJECTOR LAMPS MARKET BY END-USE (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2020-2030

FIGURE 11 GLOBAL PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2020-2030

FIGURE 12 GLOBAL PROJECTOR LAMPS MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL PROJECTOR LAMPS MARKET BY LAMP TYPE (USD BILLION) 2022

FIGURE 15 GLOBAL PROJECTOR LAMPS MARKET BY PROJECTOR TYPE (USD BILLION) 2022

FIGURE 16 GLOBAL PROJECTOR LAMPS MARKET BY LUMEN COUNT (USD BILLION) 2022

FIGURE 17 GLOBAL PROJECTOR LAMPS MARKET BY END-USE (USD BILLION) 2022

FIGURE 18 GLOBAL PROJECTOR LAMPS MARKET BY REGION (USD BILLION) 2022

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 PHILIPS: COMPANY SNAPSHOT

FIGURE 21 OSRAM: COMPANY SNAPSHOT

FIGURE 22 USHIO: COMPANY SNAPSHOT

FIGURE 23 EPSON: COMPANY SNAPSHOT

FIGURE 24 PANASONIC: COMPANY SNAPSHOT

FIGURE 25 TOSHIBA: COMPANY SNAPSHOT

FIGURE 26 HITACHI: COMPANY SNAPSHOT

FIGURE 27 SONY: COMPANY SNAPSHOT

FIGURE 28 BENQ: COMPANY SNAPSHOT

FIGURE 29 NEC: COMPANY SNAPSHOT

FIGURE 30 OPTOMA: COMPANY SNAPSHOT

FIGURE 31 VIEWSONIC: COMPANY SNAPSHOT

FIGURE 32 CHRISTIE DIGITAL: COMPANY SNAPSHOT

FIGURE 33 BARCO: COMPANY SNAPSHOT

FIGURE 34 DELL: COMPANY SNAPSHOT

FIGURE 35 INFOCUS: COMPANY SNAPSHOT

FIGURE 36 LG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 37 ACER: COMPANY SNAPSHOT

FIGURE 38 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

FIGURE 39 EIKI INTERNATIONAL: COMPANY SNAPSHOT

FAQ

The global projector lamps market is expected to grow from USD 2.30 Billion in 2023 to USD 2.52 Billion by 2030, at a CAGR of 1.13 % during the forecast period.

North America accounted for the largest market in the Projector Lamps market. North America accounted for 35 % market share of the global market value.

Philips, Osram, Ushio, Epson, Panasonic, Toshiba, Hitachi, Sony, BenQ, NEC, Optoma, ViewSonic, Christie Digital, Barco, Dell, InFocus, LG Electronics, Acer, Mitsubishi Electric, EIKI International

A shift towards energy-efficient and longer-lasting LED lamp technology, reducing the need for frequent lamp replacements and lowering operational costs. Additionally, there is a growing demand for ultra-short-throw projectors, which can project large images from a very short distance, making them ideal for smaller spaces and interactive applications.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.