REPORT OUTLOOK

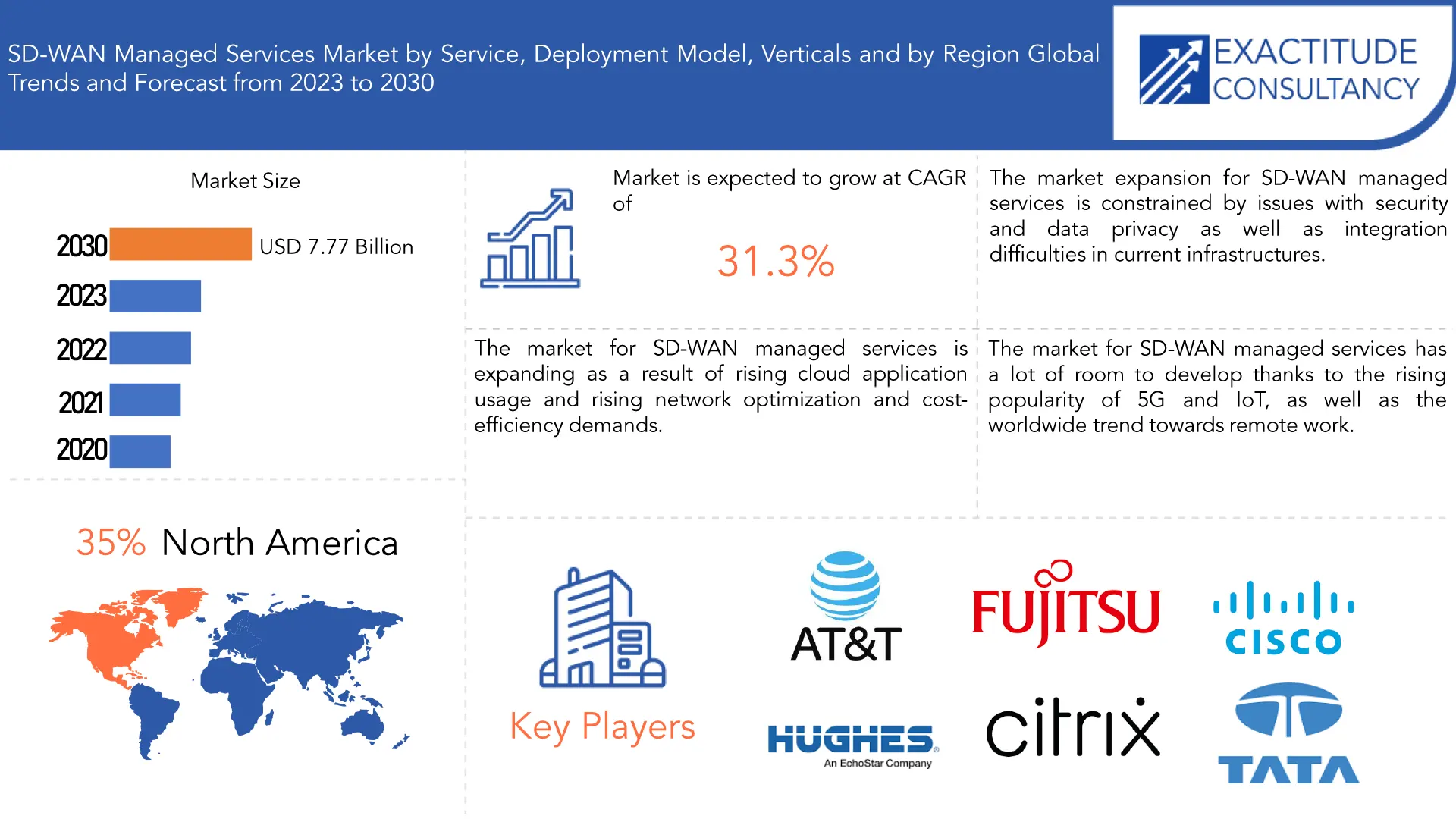

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 7.77 Billion by 2030 | 31.3% | North America |

SCOPE OF THE REPORT

Market Overview

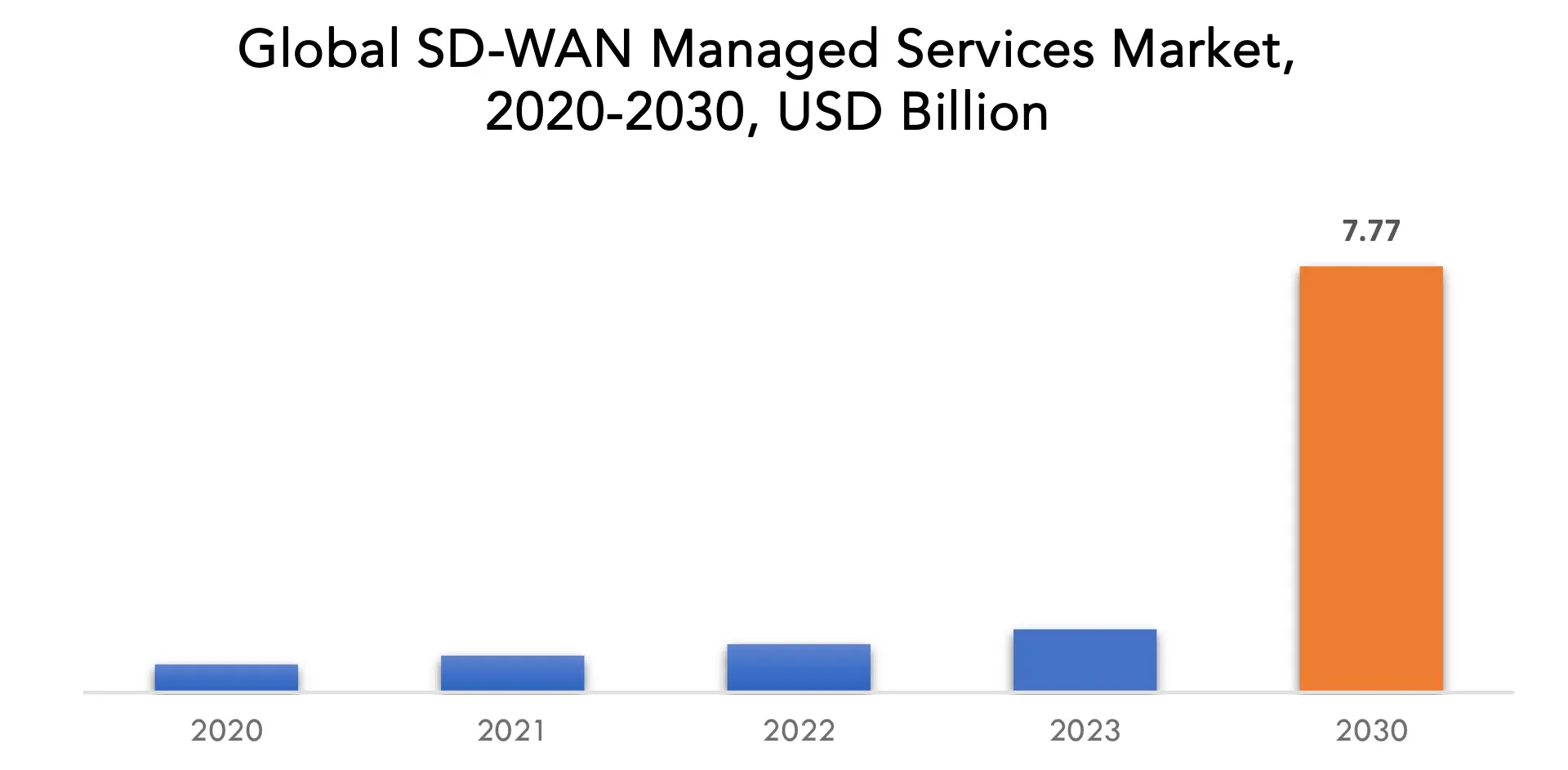

The global SD-WAN managed services market is anticipated to grow from USD 1.15 Billion in 2023 to USD 7.77 Billion by 2030, at a CAGR of 31.3% during the forecast period.

A software-defined WAN (SD-WAN) is a virtual WAN connection that serves as an overlay for all other current network connections. SD-WAN makes network administration easier by employing intelligent routing to transport data packets through the most secure and efficient channels. Instead, then adhering to the rigorously specified paths of traditional WANs, SD-WAN is more outcome-focused. As SD-WAN optimizes routing patterns in accordance with business goals and bandwidth requirements, organizations may manage traffic dynamically to achieve a high degree of security and performance. It enhances visibility and security in addition to speed, uptime, and dependability. Any organization may find it difficult to manage the security of SD-WAN and the setup of these devices.

The requirement to routinely replace hardware is growing along with technological improvements. Many firms’ IT teams are continually battling to stay up with ageing technology, quick innovation cycles, and shifting technological trends. Therefore, more firms are utilizing SD-WAN to provide their IT teams power and flexibility. Nevertheless, setting up SD-WAN architecture may be difficult, which is why businesses are using managed SD-WAN solutions. The key benefit of these services is that the organization’s IT staff may concentrate on its primary goals of creating new services and expanding its clientele. Additionally, it aids in the liberation of resources that are necessary for the IT team to be more productive inside the organizations. Due to all these benefits, a lot of companies have begun using managed SD-WAN services for their setup and administration, which has led to the expansion of managed SD-WAN services. A lot of managed SD-WAN service providers are also developing fresh strategies to acquire a competitive edge in the managed SD-WAN industry.

To send data packets through the most dependable and secure networks SD-WAN’s intelligent routing facilitates better network administration. SD-WAN is more outcome-focused than conventional WANs, which follow strictly specified paths. Organizations may manage traffic dynamically to achieve a high level of security and efficiency because SD-WAN optimizes routing paths based on business objectives and bandwidth needs. Along with speed, uptime, and dependability, it also improves accessibility and security. Despite all these benefits, setting up and managing an SD-WAN is rather difficult. An organization’s unique SD-WAN architecture must incorporate the main office, several branches, data hubs, and other cloud computing services.

Any organization can find it challenging to control SD-WAN security and set up of these devices. A managed SD-WAN service provider is used by many enterprises to set up and operate SD-WAN infrastructure more rapidly and effectively. A managed SD-WAN vendor can handle it and deploy the SD-WAN with the least amount of disruption. The market for managed SD-WAN services has been expanding globally due to the advantages of these managed services.

Additionally, it helps free up the resources needed for the technical people to work within organizations more productively. Because of all these advantages, many businesses have started adopting managed SD-WAN services for their setup and management, which has sparked the growth of managed SD-WAN services. Many managed SD-WAN suppliers are also coming up with novel ways to get an advantage in the managed SD-WAN market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Services, By Deployment Model, By Verticals, and By Region |

| By Services |

|

| By Deployment Model |

|

|

By Verticals |

|

|

By Region

|

|

SD-WAN Managed Services Market Segmentation Analysis

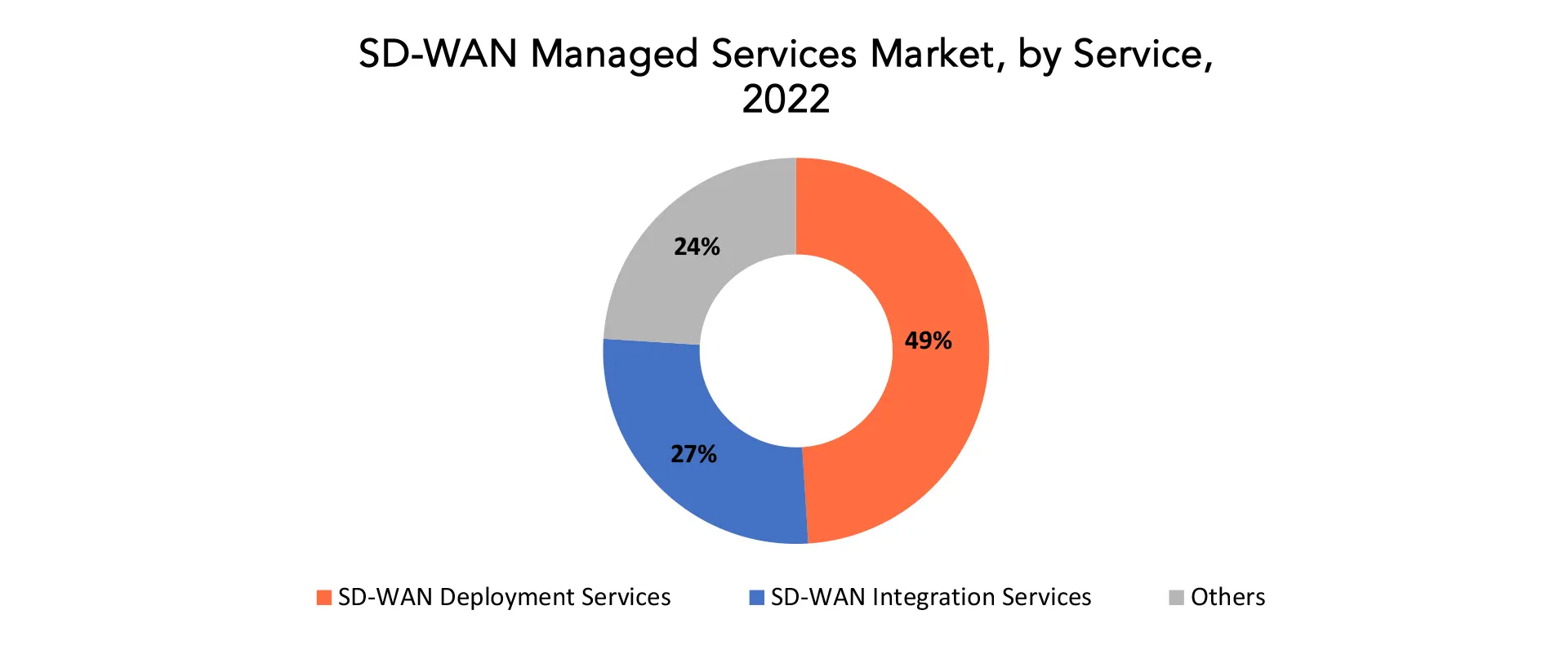

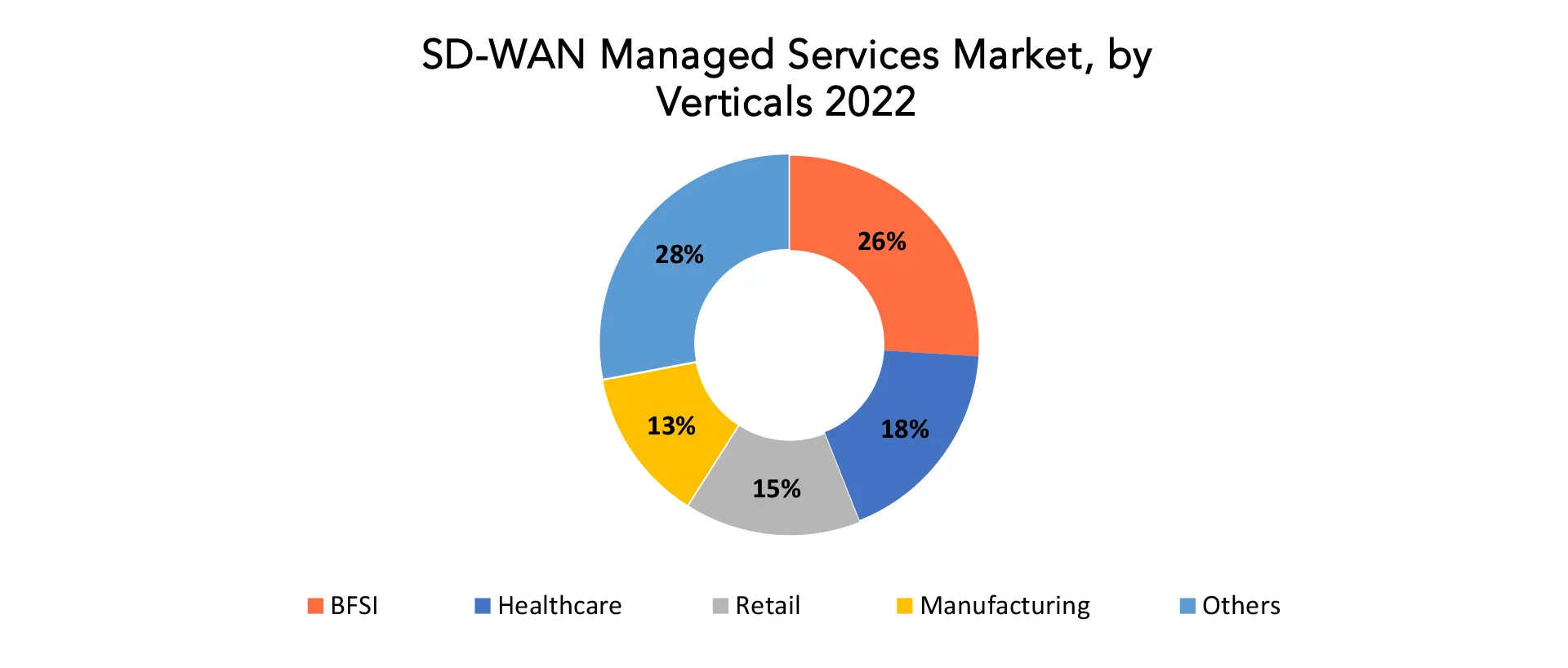

The global SD-WAN Managed Services market is divided into 4 segments services, deployment model, verticals and region. Based on services, the SD-WAN managed services market is classified into SD-WAN deployment services, SD-WAN integration services, Others. The SD-WAN managed services market is categorized into on-premise, cloud based, hybrid based on components. By end user, the market is divided into BFSI, healthcare, retail, IT & telecommunication, manufacturing, government, others.

The market for SD-WAN Managed Services in 2022 was dominated by the SD-WAN deployment services segment with 49% market share. The most common kind of SD-WAN managed service, SD-WAN deployment services comprise designing, deploying, and configuring the SD-WAN network. This include creating the network architecture, deploying the SD-WAN devices, and choosing the appropriate SD-WAN hardware and software. This service includes a comprehensive analysis of the current network infrastructure, comprehension of the organization’s needs, and development of a custom deployment plan. To enable a seamless deployment, it covers tasks like network analysis, application classification, bandwidth evaluation, policy definition, and device configuration. The goal is to enhance network efficiency, guarantee a smooth migration, and match the SD-WAN solution to the particular requirements and objectives of the client organization.

As they include connecting the SD-WAN network with current IT systems and applications, SD-WAN Integration Services are very well-liked. The present WAN infrastructure, security protocols, and application performance management (APM) platforms may then be linked with the SD-WAN network. Managed SD-WAN services are also available. These services include SD-WAN security services, SD-WAN APM services, SD-WAN network monitoring and management services, and SD-WAN technical support services.

The SD-WAN managed services market’s largest vertical is the BFSI industry, followed by the healthcare industry. Additionally significant verticals for the SD-WAN managed services industry are the retail and industrial industries. Due to its heavy reliance on reliable and secure network connectivity, the Banking, Financial Services, and Insurance (BFSI) sector dominates the market for SD-WAN managed services. The BFSI sector’s strict regulatory requirements and demand for smooth operations are perfectly matched by the SD-WAN’s increased security, agility, and cost-effective solutions. The technology makes it an appealing option for the BFSI sector to modernize and optimize their network infrastructure since it enables secure transactions, inter-branch connection, and real-time data exchange while guaranteeing compliance with industry-specific standards.

The market for SD-WAN managed services is expanding, especially in the healthcare sector. To support their crucial business activities, such as patient care, medical research, and administrative duties, healthcare organizations need a dependable and secure network. Healthcare organizations may benefit from SD-WAN managed services to enhance the speed, security, and dependability of their networks. Electronic health records (EHRs), patient portals, and telemedicine systems are just a few examples of healthcare applications that might benefit from SD-WAN’s performance enhancements. This may result in better patient treatment and higher client satisfaction.

SD-WAN Managed Services Market Dynamics

Driver

The need for SD-WAN is being driven by the increase in remote work and the requirement for secure network connectivity.

The demand for SD-WAN has increased as a result of the rise in distant work, which has been exacerbated by world events like the COVID-19 epidemic. Businesses need secure, dependable, and high-performing network connectivity to enable smooth operations with a scattered workforce. This need is met by SD-WAN, which makes it possible for remote sites to securely connect to the corporate network while protecting critical information and increasing productivity. Its capacity to priorities and optimize traffic guarantees that distant workers may easily access vital applications. Additionally, the centralized administration and monitoring features of SD-WAN provide effective network control, enabling businesses to respond swiftly to shifting needs. The technology’s security capabilities, such as threat detection and encryption, comfort organizations about data safety, which is essential in a time of increased cyber threats. Overall, SD-WAN is a crucial tool in the contemporary workplace since it not only supports a strong remote working environment but also future-proofs enterprises.

Restraint

It might be difficult to maintain security in an SD-WAN setup.

Due to the inherent complexity of connecting numerous locations and devices through the internet using an SD-WAN configuration, security must be maintained. Since SD-WAN uses open networks, there is a risk of data interception and unauthorized access. Due to its increased vulnerability as a result of traffic decentralization and the variety of access points it offers, SD-WAN is a popular target for cyberattacks. Data in transit is protected by encryption, but protecting endpoints and access points is still difficult. Securing connections from diverse remote locations becomes increasingly important as businesses employ cloud-based technologies. Strong security rules and training are required since any configuration problems and human error might unintentionally expose the network. One ongoing problem is ensuring uniform security throughout the network while integrating various security solutions with SD-WAN effectively. In order to successfully minimize security risks and guarantee a safe SD-WAN environment, continuous monitoring, threat detection, and quick incident response are essential.

Opportunities

An important possibility is the integration of SD-WAN with cutting-edge technologies like 5G and the Internet of Things (IoT).

An important networking potential is the integration of SD-WAN with 5G and IoT. When combined with SD-WAN, 5G’s high-speed, low-latency capabilities may optimize traffic and improve application performance. By allowing seamless operation of real-time apps and IoT devices, this integration has the potential to revolutionize a number of sectors. IoT device traffic may be intelligently managed by SD-WAN, resulting in effective data transmission and enhanced operational results. Through 5G-enabled SD-WAN, the enormous amounts of data produced by IoT may be analyzed and transferred in an effective manner, improving data analytics and decision-making procedures. Additionally, the expansive 5G coverage and adaptability of SD-WAN make communication possible even in distant or difficult situations. These technologies operate together to provide dynamic network modifications, assuring the best utilization of resources and bandwidth. Businesses may use this connection to create networks that are nimble, adaptable, and responsive, enabling them to introduce novel ideas and promote digital transformation. But with the growing complexity, preserving security and privacy is a crucial factor in this technological convergence.

SD-WAN Managed Services Market Trends

- Change to cloud-based SD-WAN: As opposed to on-premises SD-WAN, cloud-based SD-WAN has a number of benefits, including scalability, flexibility, and ease of implementation.

- Small and medium-sized organizations (SMBs) are using SD-WAN more and more because it may help them increase the performance, dependability, and security of their networks without having to spend money on pricy hardware and software.

- Growing demand for SD-WAN managed services in emerging markets: As organizations in emerging economies explore for methods to increase the performance and dependability of their networks, SD-WAN adoption is exploding in these regions.

- Security is becoming a key concern for businesses, and SD-WAN managed service providers are responding by providing a range of security capabilities including encryption, intrusion detection, and intrusion prevention.

- Integration of SD-WAN with other network technologies: 5G and artificial intelligence (AI) are only a couple of the other network technologies that SD-WAN is becoming more and more integrated with. SD-WAN networks’ performance, security, and dependability are all being boosted by this integration.

Competitive Landscape

The competitive landscape in the SD-WAN Managed Services Market is dynamic and evolving. Key players in this market include established manufacturers, emerging companies, and niche players, each striving to gain a competitive edge.

- Fujitsu

- Silver Peak

- Telstra

- Versa Networks

- Masergy

- Verizon

- VMware Inc.

- Citrix

- Cisco

- AT&T

- Hughes Network Systems,

- LLC,

- Tata Communications,

- ARYAKA NETWORKS,INC.,

- Masergy Communications, Inc.,

- Turnium Technology Group Inc.,

- ZeroOutages,

- Open Systems,

- Blue Wireless Pte. Ltd.,

- Cato Networks

Recent Developments:

26 September 2023: To increase the dependability of the replies from conversational AI models, Fujitsu has announced the release of two new AI trust technologies. The recently created technologies include a method for detecting hallucinations in conversational AI models and a method for detecting phishing site URLs implanted in the responses of the AI through poisoning attacks that inject false information, both jointly developed at its small research lab (1) at Ben Gurion University.

21 September 2023: In a binding deal, Cisco and Splunk, the market leader in cybersecurity and observability, stated that Cisco will buy Splunk for USD 157 per share in cash, or over USD 28 billion in equity. Gary Steele, president and chief executive officer of Splunk, will join Cisco’s Executive Leadership Team upon acquisition’s completion and will report to chair and CEO Chuck Robbins.

Regional Analysis

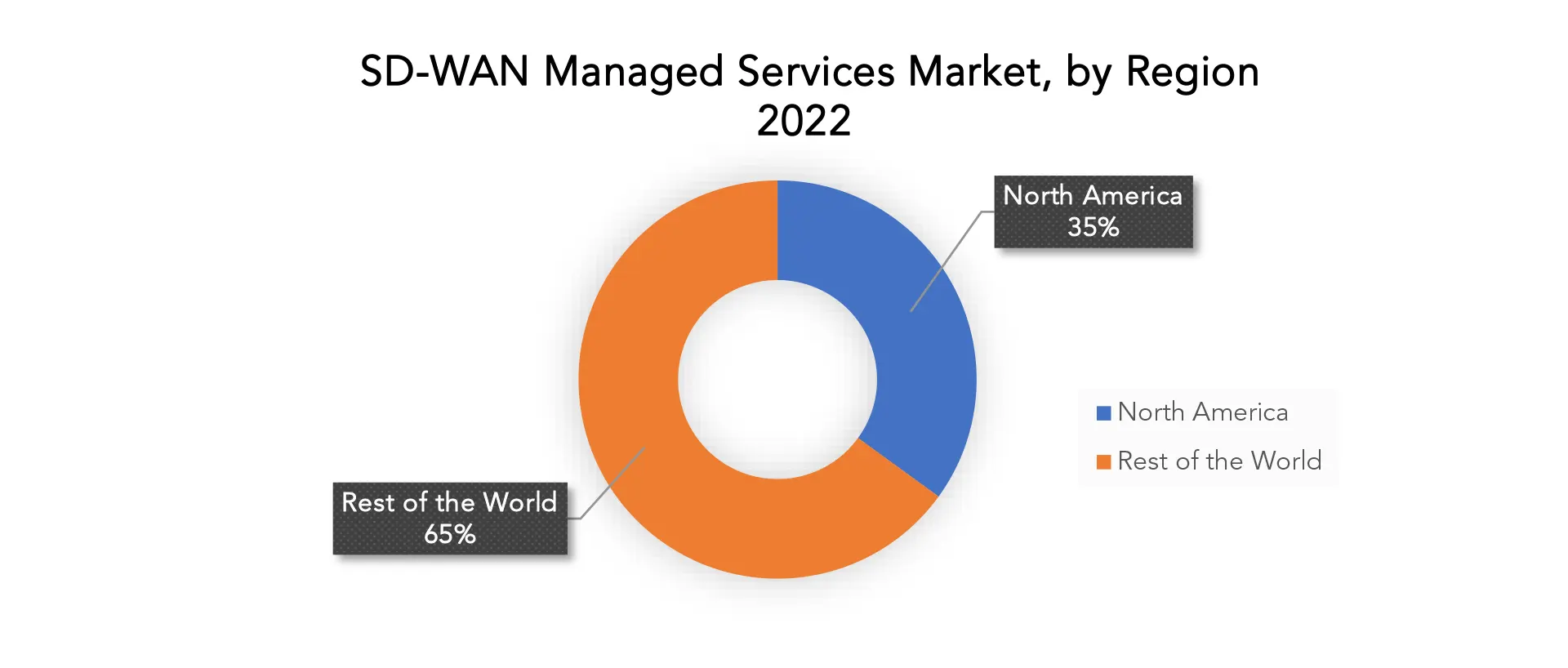

North America accounted for the largest market in the SD-WAN managed services market. North America accounted for the 35% market share of the global market value. It is projected that increasing mobile usage, a quick uptake of cloud computing services, and major improvements in broadband networks would all contribute to demand growth in North America. The growing trend of employee mobility is also boosting demand for a centralized network management solution that allows businesses complete control over their networks. As policymakers clear the way for quickly expanding next-generation services, the USA is anticipated to be among the first nations to roll out large-volume 5G wireless apps and networks. Businesses including AT&T Inc. and Verizon Communication Inc. are collaborating in North America to deploy fifth-generation wireless technology. Additionally, the federal commission of the United States has agreed to make a high-frequency spectrum, around 11GHz, available for mobile, fixed, and flexible wireless broadband. Businesses in the USA are increasingly utilising SD-WAN services, which will enhance demand for them.

In the market for managed SD-WAN services globally, Europe comes in second place, just behind North America. The use of managed SD-WAN services has expanded in Europe over the last two to three years as businesses want to streamline their network design and boost network flexibility. The regional market will expand as a result of service providers delivering secure access service edge (SASE) solutions and customer desire for increased security through SD-WAN solutions. Due to the region’s emphasis on digital transformation and the need for effective, affordable network solutions, SD-WAN technology has seen substantial adoption across Europe.

Target Audience for SD-WAN Managed Services

- Enterprises and Corporations

- Small and Medium-sized Businesses (SMBs)

- Multinational Corporations (MNCs)

- Telecommunication Companies

- Cloud Service Providers (CSPs)

- Managed Service Providers (MSPs)

- Data Centers and Hosting Providers

- Government and Public Sector Organizations

- Healthcare Institutions

- Financial Institutions (Banks, Insurance, etc.)

- Educational Institutions (Schools, Universities)

- Retail and E-commerce Businesses

Segments Covered in the SD-WAN Managed Services Market Report

SD-WAN Managed Services Market by Services

- SD-WAN Deployment Services

- SD-WAN Integration Services

- Others

SD-WAN Managed Services Market by Deployment Model

- On-premise

- Cloud Based

- Hybrid

SD-WAN Managed Services Market by verticals

- BFSI

- Healthcare

- Retail

- IT & Telecommunication

- Manufacturing

- Government

- Others

SD-WAN Managed Services Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the SD-WAN managed services market over the next 7 years?

- Who are the major players in the SD-WAN managed services market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the SD-WAN managed services market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the SD-WAN managed services market?

- What is the current and forecasted size and growth rate of the global SD-WAN managed services market?

- What are the key drivers of growth in the SD-WAN managed services market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the SD-WAN managed services market?

- What are the technological advancements and innovations in the SD-WAN managed services market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the SD-WAN managed services market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the SD-WAN managed services market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- SD-WAN MANAGED SERVICES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SD-WAN MANAGED SERVICES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- SD-WAN MANAGED SERVICES MARKET OUTLOOK

- GLOBAL SD-WAN MANAGED SERVICES MARKET BY SERVICES, 2020-2030, (USD BILLION)

- SD-WAN DEPLOYMENT SERVICES

- SD-WAN INTEGRATION SERVICES

- OTHERS

- GLOBAL SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL, 2020-2030, (USD BILLION)

- ON-PREMISE

- CLOUD BASED

- HYBRID

- GLOBAL SD-WAN MANAGED SERVICES MARKET BY VERTICALS, 2020-2030, (USD BILLION)

- BFSI

- HEALTHCARE

- RETAIL

- IT & TELECOMMUNICATION

- MANUFACTURING

- GOVERNMENT

- OTHERS

- GLOBAL SD-WAN MANAGED SERVICES MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- FUJITSU

- SILVER PEAK

- TELSTRA

- VERSA NETWORKS

- MASERGY

- VERIZON

- VMWARE INC.

- CITRIX

- CISCO

- AT&T

- HUGHES NETWORK SYSTEMS,

- LLC,

- TATA COMMUNICATIONS,

- ARYAKA NETWORKS, INC.,

- MASERGY COMMUNICATIONS, INC.,

- TURNIUM TECHNOLOGY GROUP INC.,

- ZEROOUTAGES,

- OPEN SYSTEMS,

- BLUE WIRELESS PTE. LTD.,

- CATO NETWORKS

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 2 GLOBAL SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 3 GLOBAL SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 4 GLOBAL SD-WAN MANAGED SERVICES MARKET BY REGIONS (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA SD-WAN MANAGED SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 10 US SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 11 US SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 12 CANADA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 13 CANADA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 14 CANADA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 15 MEXICO SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 16 MEXICO SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 17 MEXICO SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA SD-WAN MANAGED SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 23 BRAZIL SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 24 BRAZIL SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 25 ARGENTINA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 26 ARGENTINA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 27 ARGENTINA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 28 COLOMBIA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 29 COLOMBIA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 30 COLOMBIA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC SD-WAN MANAGED SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 39 INDIA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 40 INDIA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 41 CHINA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 42 CHINA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 43 CHINA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 44 JAPAN SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 45 JAPAN SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 46 JAPAN SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 59 EUROPE SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 60 EUROPE SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 61 EUROPE SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 62 EUROPE SD-WAN MANAGED SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 64 GERMANY SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 65 GERMANY SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 66 UK SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 67 UK SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 68 UK SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 69 FRANCE SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 70 FRANCE SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 71 FRANCE SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 72 ITALY SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 73 ITALY SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 74 ITALY SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 75 SPAIN SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 76 SPAIN SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 77 SPAIN SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 78 RUSSIA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 79 RUSSIA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 80 RUSSIA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA SD-WAN MANAGED SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 89 UAE SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 90 UAE SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA SD-WAN MANAGED SERVICES MARKET BY SERVICES (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA SD-WAN MANAGED SERVICES MARKET BY VERTICALS (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SD-WAN MANAGED SERVICES MARKET BY SERVICES USD BILLION, 2020-2030

FIGURE 9 GLOBAL SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL USD BILLION, 2020-2030

FIGURE 10 GLOBAL SD-WAN MANAGED SERVICES MARKET BY VERTICALS USD BILLION, 2020-2030

FIGURE 11 GLOBAL SD-WAN MANAGED SERVICES MARKET BY REGION USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL SD-WAN MANAGED SERVICES MARKET BY SERVICES USD BILLION, 2022

FIGURE 14 GLOBAL SD-WAN MANAGED SERVICES MARKET BY DEPLOYMENT MODEL USD BILLION, 2022

FIGURE 15 GLOBAL SD-WAN MANAGED SERVICES MARKET BY VERTICALS USD BILLION, 2022

FIGURE 16 GLOBAL SD-WAN MANAGED SERVICES MARKET BY REGION USD BILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 FUJITSU: COMPANY SNAPSHOT

FIGURE 19 SILVER PEAK: COMPANY SNAPSHOT

FIGURE 20 TELSTRA: COMPANY SNAPSHOT

FIGURE 21 VERSA NETWORKS: COMPANY SNAPSHOT

FIGURE 22 MASERGY: COMPANY SNAPSHOT

FIGURE 23 VERIZON: COMPANY SNAPSHOT

FIGURE 24 VMWARE INC.: COMPANY SNAPSHOT

FIGURE 25 CITRIX: COMPANY SNAPSHOT

FIGURE 26 CISCO: COMPANY SNAPSHOT

FIGURE 27 AT&T: COMPANY SNAPSHOT

FIGURE 28 HUGHES NETWORK SYSTEMS: COMPANY SNAPSHOT

FIGURE 29 LLC: COMPANY SNAPSHOT

FIGURE 30 TATA COMMUNICATIONS: COMPANY SNAPSHOT

FIGURE 31 ARYAKA NETWORKS, INC: COMPANY SNAPSHOT

FIGURE 32 MASERGY COMMUNICATIONS, INC: COMPANY SNAPSHOT

FIGURE 33 TURNIUM TECHNOLOGY GROUP INC: COMPANY SNAPSHOT

FIGURE 34 ZEROOUTAGES: COMPANY SNAPSHOT

FIGURE 35 OPEN SYSTEMS: COMPANY SNAPSHOT

FIGURE 36 BLUE WIRELESS PTE. LTD: COMPANY SNAPSHOT

FIGURE 37 CATO NETWORKS: COMPANY SNAPSHOT

FAQ

The global SD-WAN managed services market is anticipated to grow from USD 1.15 Billion in 2023 to USD 7.77 Billion by 2030, at a CAGR of 31.3% during the forecast period.

North America accounted for the largest market in the SD-WAN managed services market. North America accounted for 35% market share of the global market value.

Fujitsu, Silver Peak, Telstra, Versa Networks, Masergy, Verizon, VMware Inc., Citrix, Cisco, AT&T, Hughes Network Systems, LLC, Tata Communications, ARYAKA NETWORKS,INC., Masergy Communications, Inc., Turnium Technology Group Inc., ZeroOutages, Open Systems, Blue Wireless Pte. Ltd., Cato Networks

Security is becoming a key concern for businesses, and SD-WAN managed service providers are responding by providing a range of security capabilities including encryption, intrusion detection, and intrusion prevention.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.