Report Outlook

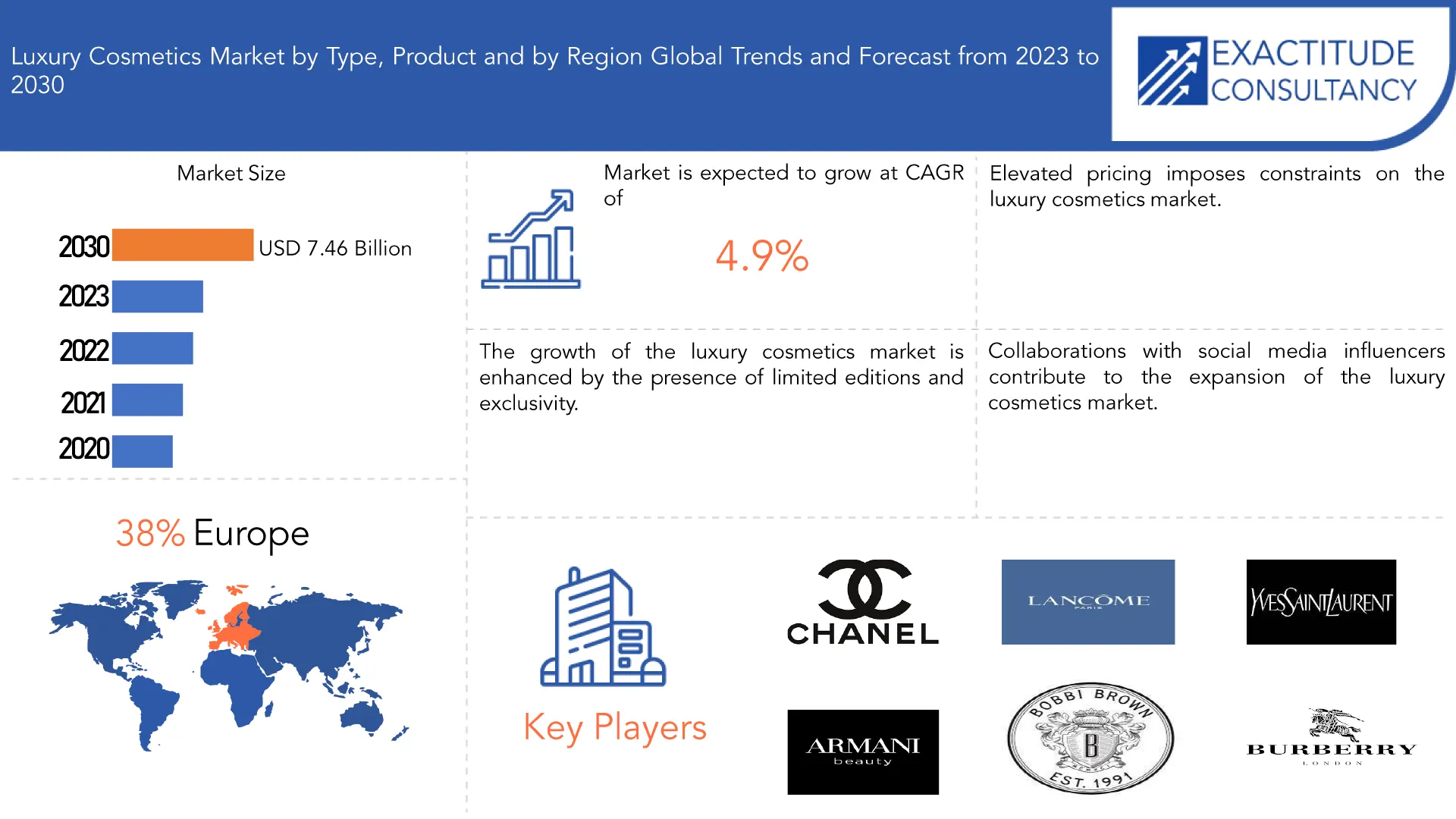

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 73.46 Billion by 2030 | 4.9% | Europe |

| By Type | By Product | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Luxury Cosmetics Market Overview

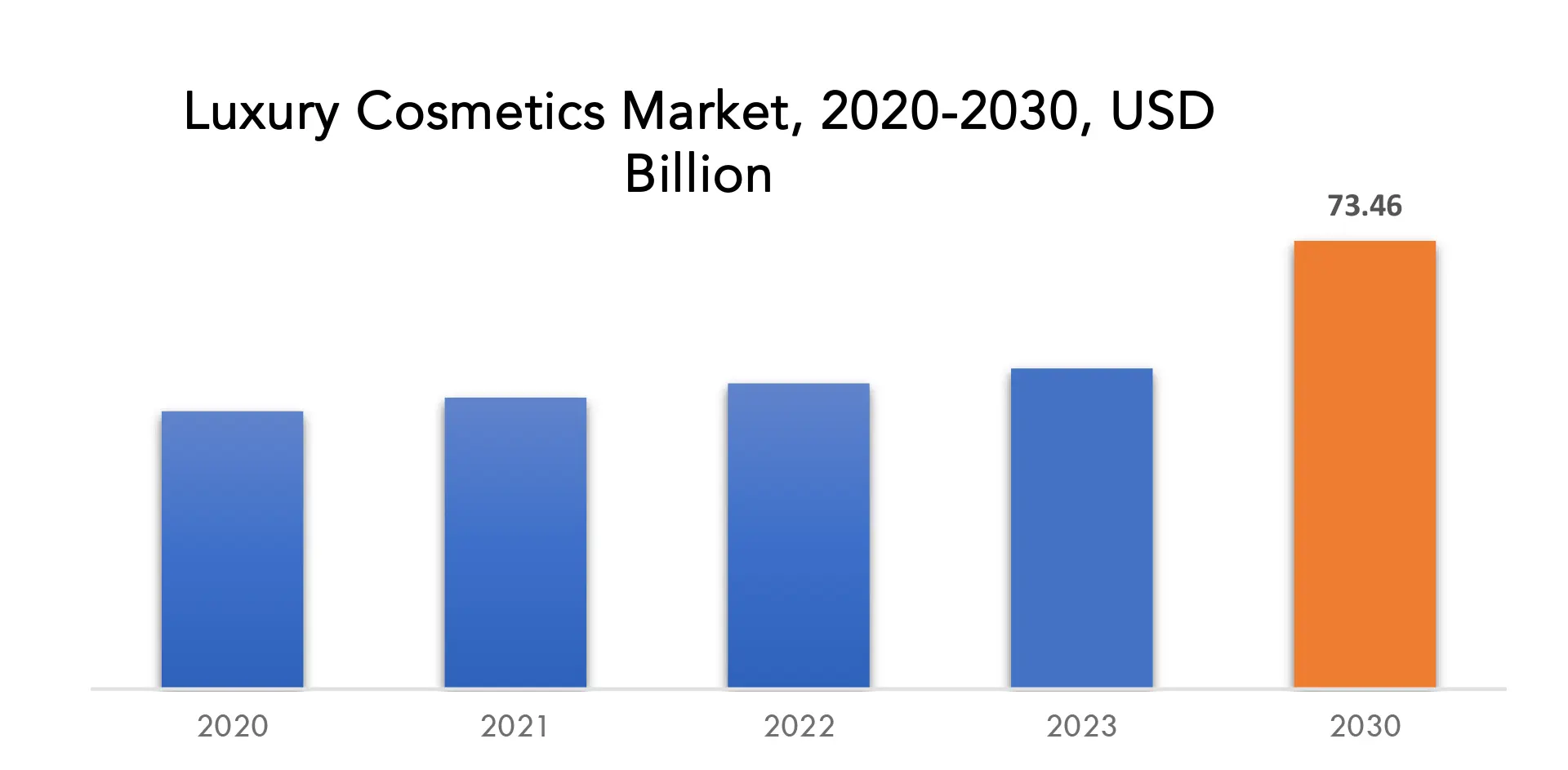

The global luxury cosmetics market is anticipated to grow from USD 50.1 Billion in 2022 to USD 73.46 Billion by 2030, at a CAGR of 4.9% during the forecast period.

Luxury cosmetics epitomize opulence and sophistication in the world of beauty. Renowned for their exquisite formulations, lavish packaging, and unparalleled quality, these prestige beauty products cater to individuals who seek the epitome of indulgence in their skincare and makeup routines. Crafted with precision and using the finest ingredients, luxury cosmetics promise not only flawless results but also a sensorial experience that transcends the ordinary. From sumptuous creams infused with rare botanical extracts to velvety lipsticks with intense pigmentation, each product is a testament to the artistry and innovation of the brand.

The packaging of luxury cosmetics is often a work of art in itself, with attention to detail that reflects the brand’s commitment to elegance. Sleek, embellished containers adorned with logos or intricate designs add a touch of glamour to any vanity. Beyond the allure of aesthetics, these premium beauty brands invest heavily in research and development, incorporating cutting-edge technologies to deliver groundbreaking formulations that address diverse skincare concerns. The purchase of luxury cosmetics goes beyond acquiring a beauty product; it is an investment in self-care, an expression of discerning taste, and an affirmation of the belief that true beauty deserves nothing but the best.

The luxury cosmetics market is a dynamic and thriving sector that has experienced significant growth in recent years. High-end goods, premium ingredients, and exclusive branding define this area of the beauty market and appeal to discriminating customers looking for luxury and excellence. Global economic trends, technology developments, and shifting consumer preferences all have an impact on the market’s future.

Growing consumer spending power, especially in emerging markets, is one of the main factors propelling the luxury cosmetics market. More people are willing to spend their money on high-end beauty products that deliver luxurious experiences and better quality as disposable incomes rise. This trend can also be seen in the Asia-Pacific region, where the growing middle class has increased demand for high-end cosmetics. It is not just seen in the traditional beauty markets of North America and Europe. The landscape of luxury cosmetics is significantly shaped by innovation and technology. Brands are continually investing in research and development to create formulations that deliver visible results and a unique sensorial experience. Cutting-edge ingredients, such as rare botanical extracts and advanced skincare technologies, are often featured in luxury cosmetic products, reinforcing the perception of exclusivity and efficacy.

The rise of e-commerce has transformed the way consumers access and purchase luxury cosmetics. Online platforms provide an avenue for brands to reach a global audience, allowing consumers to explore and purchase products from the comfort of their homes. Social media platforms also play a crucial role in marketing luxury cosmetics, with influencers and celebrities often endorsing products and contributing to brand visibility. Sustainability and ethical practices have become increasingly important in the luxury cosmetics market. There is a growing demand for products that are in line with the values of consumers as they become more aware of the environmental and social impact of their purchases. In response, high-end cosmetic companies are showing their dedication to moral principles by introducing cruelty-free procedures, sustainably sourced ingredients, and sustainable packaging. The competitive landscape of the luxury cosmetics market is characterized by established heritage brands as well as emerging players disrupting the industry. Established brands leverage their history and legacy to build trust and credibility, while newer entrants focus on innovation and agility to capture market share. Collaborations between luxury brands and renowned designers or celebrities are also common, creating limited-edition collections that generate excitement and exclusivity.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Type, By Product and By Region |

| By Type |

|

| By Product |

|

| By Region |

|

Luxury Cosmetics Market Segmentation Analysis:

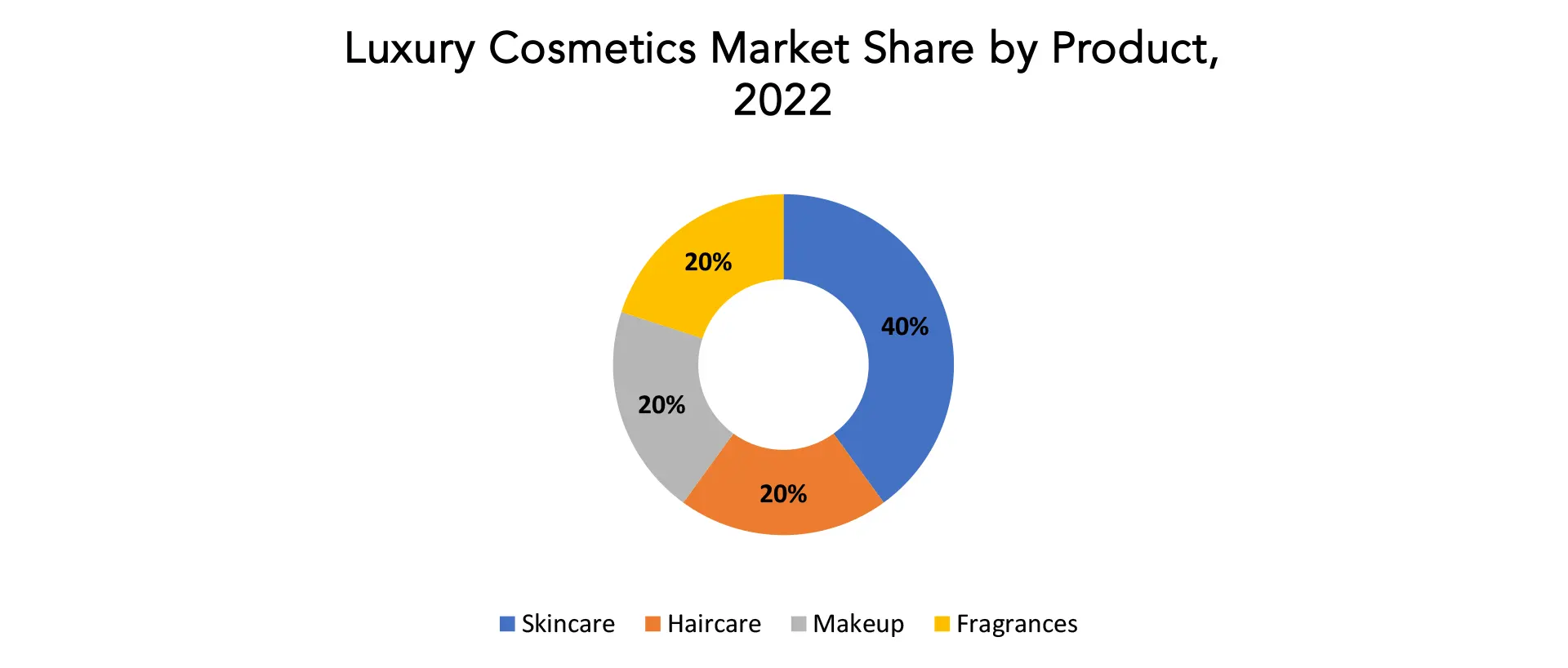

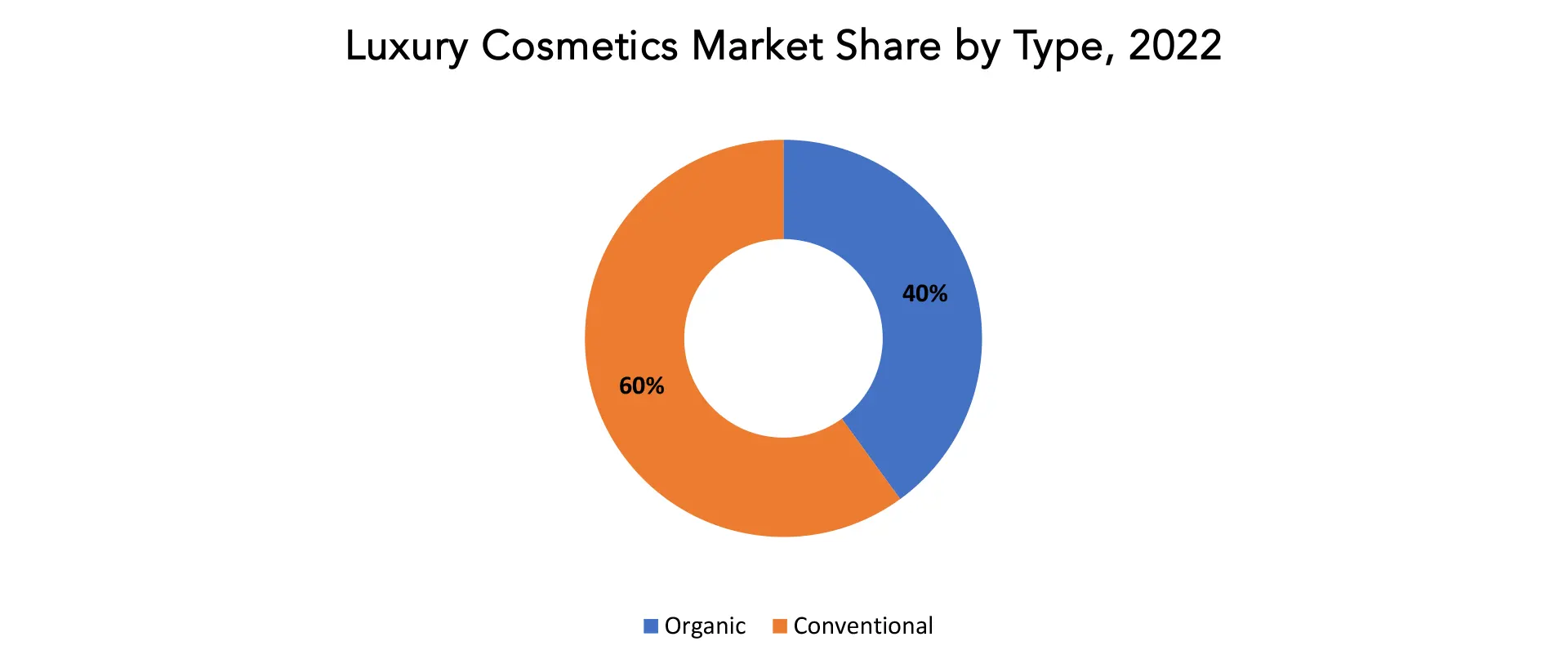

The luxury cosmetics market is divided into 3 segments. By type the market is bifurcated into organic and conventional. By product the market is bifurcated into skincare, haircare, makeup, fragrances. Based on type the conventional luxury cosmetics dominates in the luxury cosmetics market while skincare product dominates the product segment of luxury cosmetics market.

Conventional luxury cosmetics have long been synonymous with opulence, indulgence, and a touch of glamour. These high-end beauty products, often adorned with exquisite packaging and boasting formulations enriched with rare and premium ingredients, have carved a niche for themselves in the beauty industry. As consumers seek not just functional solutions but also an elevated and sensorial experience, luxury cosmetics continue to thrive as symbols of sophistication and self-indulgence.

At the heart of conventional luxury cosmetics lies a commitment to quality. These products are meticulously crafted, drawing on extensive research and utilizing cutting-edge technology to deliver superior results. From skincare to makeup, each formulation undergoes rigorous testing and refinement, ensuring that it not only meets but exceeds the expectations of discerning consumers. The emphasis on quality extends beyond the product itself to the entire user experience – from the moment the luxurious packaging is unboxed to the application of the product, creating a ritualistic and indulgent experience. One defining characteristic of luxury cosmetics is the use of premium ingredients. From rare botanical extracts to precious minerals, these formulations often feature elements that are not only effective but also exclusive. This exclusivity contributes to the allure of luxury cosmetics, making them coveted items that go beyond mere beauty products. Ingredients like caviar extract, diamond dust, and gold leaf not only impart a sense of luxury but also claim to offer unique benefits, adding to the overall mystique of these high-end beauty products. Packaging plays a pivotal role in the presentation of luxury cosmetics. Elaborate designs, embossed logos, and sophisticated materials contribute to the overall aesthetic appeal. Luxury cosmetics are not just products; they are an expression of a lifestyle. Brands often cultivate a sense of exclusivity through limited-edition releases, collaboration with renowned artists or designers, and personalized services. This exclusivity not only attracts consumers seeking a premium experience but also fosters a sense of belonging to an elite community of beauty enthusiasts. The purchasing of luxury cosmetics becomes an investment in both self-care and an aspirational identity.

The allure of conventional luxury cosmetics extends beyond tangible benefits, delving into the emotional and psychological realm. The act of using these products becomes a form of self-care, a moment of indulgence in a hectic world. The fragrances, textures, and application rituals contribute to a sensory experience that transcends the utilitarian nature of beauty routines. As consumers increasingly prioritize holistic well-being, luxury cosmetics offer a bridge between self-expression and self-pampering. Conventional luxury cosmetics embody a blend of quality, exclusivity, and a commitment to an elevated beauty experience. As the beauty industry evolves, these high-end products continue to captivate consumers who seek not just effective solutions but a holistic and indulgent approach to self-care. Luxury cosmetics are everlasting representations of exquisite elegance and extravagance in a world where beauty is a means of expression as well as an escape.

The modern definition of luxury skincare is a comprehensive approach to self-care that integrates innovation, science, and indulgence. It is no longer just a beauty regimen. Demand for high-end skincare products has increased dramatically in recent years, driven by consumers looking for products that offer not only efficacy but also a luxurious and sensual experience. Rich ingredients and state-of-the-art technologies combine in luxury skincare products to satisfy people who want more than just glowing skin—they want an indulgent experience that goes above and beyond. At the heart of luxury skincare lies a commitment to using premium and rare ingredients. These formulations often include exotic botanical extracts, precious minerals, and advanced peptides that promise unparalleled results. Brands invest heavily in research and development to identify novel ingredients with potent skincare benefits. For instance, gold-infused serums, caviar-based creams, and diamond dust exfoliants are becoming increasingly popular, promising not only aesthetic enhancements but also therapeutic effects.

Beyond the ingredients, luxury skincare emphasizes the importance of a personalized and indulgent experience. High-end brands often incorporate unique fragrances, elegant textures, and lavish packaging to elevate the user’s routine into a sensory journey. The application of these products becomes a ritual, encouraging users to take the time for self-care and mindfulness, promoting overall well-being. In addition to indulgent formulations, luxury skincare embraces cutting-edge technologies. Scientific advancements such as DNA analysis, stem cell research, and nanotechnology have made it possible to develop ground-breaking products that claim to reverse the effects of aging and restore skin health at the cellular level. High-tech gadgets that provide spa-like experiences in the comfort of one’s own home, like facial sculpting tools, laser treatments, and LED masks, have become essential components of the luxury skincare routine. The allure of luxury skincare extends beyond tangible benefits; it taps into the psychology of self-esteem and confidence. The exquisite packaging, the subtle scent, and the promise of transformative results contribute to a sense of empowerment. Using luxury skincare becomes a symbolic act of self-love, a statement of investing in oneself and embracing the idea that radiant skin is a reflection of inner vitality.

The growing awareness of sustainability and ethical practices is another factor contributing to the global rise in luxury skincare. A lot of luxury brands are implementing cruelty-free testing, environmentally friendly packaging, and ethical ingredient sourcing. Luxury skincare brands are responding to consumers’ growing awareness of the environmental impact of their decisions by matching their values with those of their affluent clientele. Luxury skincare has evolved into a harmonious blend of opulence, efficacy, and mindfulness. It goes beyond the pursuit of flawless skin; it represents a lifestyle choice that emphasizes the importance of self-care and well-being. As the industry continues to innovate and redefine standards, luxury skincare is likely to remain a beacon of sophistication and indulgence, offering consumers a passport to a world where beauty is not just skin deep but a holistic celebration of the self.

Luxury Cosmetics Market Trends

- Consumers in Europe, like in many other regions, were increasingly concerned about the environment. Luxury cosmetic brands were incorporating sustainable and eco-friendly practices, using recycled packaging, reducing waste, and sourcing ingredients responsibly.

- The luxury cosmetics market was adapting to the growing importance of e-commerce. Brands were investing in online platforms, providing a seamless digital shopping experience, and engaging with consumers through social media and influencers.

- Personalized skincare and beauty solutions were gaining popularity. Luxury brands were offering tailor-made products, considering individual preferences, skin types, and concerns. Technology, such as AI and machine learning, played a role in creating customized experiences.

- High-end cosmetic brands were focusing on innovation, introducing new and advanced ingredients in their formulations. This included anti-aging compounds, botanical extracts, and other cutting-edge components to differentiate their products.

- The convergence of beauty and wellness was evident, with luxury cosmetics brands expanding their offerings to include products promoting overall well-being. This included beauty supplements, nutritional products, and holistic beauty approaches.

- Clean beauty, characterized by products with minimalistic and transparent ingredient lists, free from potentially harmful substances, was a growing trend. Consumers were seeking products that aligned with their health-conscious and environmentally friendly values.

- Luxury cosmetics brands were recognizing the importance of catering to a diverse range of skin tones and ethnicities. This involved expanding shade ranges for foundations and other products to be more inclusive.

- In physical retail spaces, luxury cosmetic brands were focusing on creating immersive and experiential environments. This included interactive displays, in-store events, and personalized consultations to enhance the overall shopping experience.

- The men’s grooming market was expanding in Europe, with luxury brands introducing specialized products for men. This included skincare, grooming, and fragrance products tailored to meet the specific needs and preferences of male consumers.

Competitive Landscape

The competitive landscape of the Luxury Cosmetics Market is diverse and includes various players, from multinational corporations to artisanal and specialty brands.

- L’Oréal

- Estée Lauder Companies

- Shiseido

- Christian Dior

- Chanel

- Giorgio Armani Beauty

- Lancôme

- Yves Saint Laurent Beauty

- Tom Ford Beauty

- Guerlain

- Givenchy Beauty

- Clarins

- Dolce & Gabbana Beauty

- Burberry Beauty

- La Mer

- NARS Cosmetics

- Clé de Peau Beauté

- Kérastase (L’Oréal Group)

- Anastasia Beverly Hills

Recent Development

On may 2021, Endress+Hauser AG has launched Memosens 2.0 technology for simple, safe and liquid analysis. Liquid analysis has been transformed thanks to the Memosens technology. Moreover, it has the capacity to convert the measured value to a digital signal and send it inductively to the transmitter, guaranteeing that the measuring point is always available and that processes run smoothly. In addition, the new technology is accessible for pH/ORP, conductivity and dissolved oxygen sensors.

Regional Analysis

Europe has long been synonymous with sophistication, elegance, and a rich cultural heritage, and its luxury cosmetics industry is no exception. Renowned for its commitment to quality, innovation, and timeless beauty, Europe stands at the forefront of the global luxury cosmetics market. The continent’s cosmetic brands not only cater to the aesthetic needs of their consumers but also embody a legacy of craftsmanship and excellence. One of the hallmarks of European luxury cosmetics is the emphasis on premium ingredients. European brands are known for their meticulous selection of the finest raw materials, often sourced from the lush landscapes that dot the continent. This commitment to quality extends beyond marketing rhetoric, as brands prioritize the use of natural, organic, and sustainable ingredients. The result is a range of products that not only enhance beauty but also reflect a dedication to environmental responsibility. Innovation is another driving force behind Europe’s luxury cosmetics industry. European brands continuously push the boundaries of beauty technology, introducing cutting-edge formulations and state-of-the-art packaging. This commitment to innovation is not only reflected in the efficacy of the products but also in the overall consumer experience. From luxurious textures to groundbreaking application techniques, European luxury cosmetics offer a sensory journey that transcends the ordinary.

Iconic European cities such as Paris, Milan, and London serve as epicenters for fashion and beauty, providing inspiration for luxury cosmetic brands. The convergence of art, fashion, and beauty in these cultural hubs fuels creativity, resulting in products that are not just cosmetics but also wearable works of art. The packaging, design, and presentation of these products often reflect the rich cultural tapestry of their places of origin, adding an extra layer of allure for consumers. European luxury cosmetics also embody a commitment to craftsmanship and heritage. Many brands boast a storied history, with formulations and beauty rituals passed down through generations. This sense of heritage not only lends credibility to the products but also connects consumers to a legacy of timeless beauty. From century-old apothecaries to family-owned brands, the European luxury cosmetics industry celebrates the artistry and tradition that defines its products.

The allure of European luxury cosmetics extends beyond the products themselves; it encompasses the entire experience. The chic boutiques, flagship stores, and exclusive counters in high-end department stores offer a personalized shopping experience that befits the premium nature of the products. Knowledgeable beauty consultants and aesthetically pleasing environments contribute to a sense of luxury that goes beyond the cosmetic application. Europe’s luxury cosmetics industry is a testament to the continent’s commitment to beauty, innovation, and tradition. From the lush landscapes that provide premium ingredients to the bustling cities that inspire creativity, every element contributes to the allure of European luxury cosmetics. With a focus on quality, innovation, and a rich cultural heritage, these cosmetics embody the essence of European elegance, offering consumers a journey into the world of timeless beauty.

Target Audience for Luxury Cosmetics Market

- High Disposable Income

- Discerning Taste and Appreciation for Quality

- Brand Consciousness

- Desire for Prestige and Exclusivity

- Fashion and Trends Awareness

- Personalization and Customization

- Experience-Oriented

- Social Media Presence

Import & Export Data for Luxury Cosmetics Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the luxury cosmetics market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global luxury cosmetics Market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the Luxury Cosmetics Market Report

Luxury Cosmetics Market by Type 2020-2030, USD Billion, (Thousand Units)

- Organic

- Conventional

Luxury Cosmetics Market by Product, 2020-2030, USD Billion, (Thousand Units)

- Skincare

- Haircare

- Makeup

- Fragrances

Luxury Cosmetics Market by Region 2020-2030, USD Billion, (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the luxury cosmetics market over the next 7 years?

- Who are the major players in the luxury cosmetics market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the luxury cosmetics market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the luxury cosmetics market?

- What is the current and forecasted size and growth rate of the luxury cosmetics market?

- What are the key drivers of growth in the luxury cosmetics market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the luxury cosmetics market?

- What are the technological advancements and innovations in the luxury cosmetics market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the luxury cosmetics market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the luxury cosmetics market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- LUXURY COSMETICS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON LUXURY COSMETICS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- LUXURY COSMETICS MARKET OUTLOOK

- GLOBAL LUXURY COSMETICS MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- ORGANIC

- CONVENTIONAL

- GLOBAL LUXURY COSMETICS MARKET BY PRODUCT, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- SKINCARE

- HAIRCARE

- MAKEUP

- FRAGRANCES

- GLOBAL LUXURY COSMETICS MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- L’ORÉAL

- ESTÉE LAUDER COMPANIES

- SHISEIDO

- CHRISTIAN DIOR

- CHANEL

- GIORGIO ARMANI BEAUTY

- LANCÔME

- YVES SAINT LAURENT BEAUTY

- TOM FORD BEAUTY

- GUERLAIN

- GIVENCHY BEAUTY

- CLARINS

- DOLCE & GABBANA BEAUTY

- BURBERRY BEAUTY

- LA MER

- NARS COSMETICS

- BOBBI BROWN

- CLÉ DE PEAU BEAUTÉ

- KÉRASTASE

- ANASTASIA BEVERLY HILLS

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 2 GLOBAL LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 4 GLOBAL LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL LUXURY COSMETICS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL LUXURY COSMETICS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA LUXURY COSMETICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA LUXURY COSMETICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 13 US LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 14 US LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 15 US LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 16 US LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 18 CANADA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 20 CANADA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 22 MEXICO LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 24 MEXICO LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA LUXURY COSMETICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA LUXURY COSMETICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA LUXURY COSMETICSMARKET BY TYPE (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 32 BRAZIL LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 34 BRAZIL LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA LUXURY COSMETICSMARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 36 ARGENTINA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 38 ARGENTINA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 40 COLOMBIA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 42 COLOMBIA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC LUXURY COSMETICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC LUXURY COSMETICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 54 INDIA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 56 INDIA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 58 CHINA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 CHINA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 62 JAPAN LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 JAPAN LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA LUXURY COSMETICSMARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA LUXURY COSMETICSMARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE LUXURY COSMETICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE LUXURY COSMETICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 84 EUROPE LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 86 EUROPE LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 88 GERMANY LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 90 GERMANY LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 91 UK LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 92 UK LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 93 UK LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 94 UK LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 96 FRANCE LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 98 FRANCE LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 100 ITALY LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 102 ITALY LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 104 SPAIN LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 106 SPAIN LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 108 RUSSIA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 110 RUSSIA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA LUXURY COSMETICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA LUXURY COSMETICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 121 UAE LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 122 UAE LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 123 UAE LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 124 UAE LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA LUXURY COSMETICS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA LUXURY COSMETICSMARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA LUXURY COSMETICS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA LUXURY COSMETICS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA LUXURY COSMETICS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LUXURY COSMETICS MARKET BY PRODUCT USD BILLION, 2020-2030

FIGURE 9 GLOBAL LUXURY COSMETICS MARKET BY TYPE, USD BILLION, 2020-2030

FIGURE 10 GLOBAL LUXURY COSMETICS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL LUXURY COSMETICS MARKET BY PRODUCT, USD BILLION, 2022

FIGURE 13 GLOBAL LUXURY COSMETICS MARKET BY TYPE, USD BILLION, 2022

FIGURE 14 GLOBAL LUXURY COSMETICS MARKET BY REGION, USD BILLION, 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 L’ORÉAL: COMPANY SNAPSHOT

FIGURE 17 ESTÉE LAUDER COMPANIES: COMPANY SNAPSHOT

FIGURE 18 SHISEIDO: COMPANY SNAPSHOT

FIGURE 19 CHRISTIAN DIOR: COMPANY SNAPSHOT

FIGURE 20 CHANEL: COMPANY SNAPSHOT

FIGURE 21 GIORGIO ARMANI BEAUTY: COMPANY SNAPSHOT

FIGURE 22 LANCÔME: COMPANY SNAPSHOT

FIGURE 23 YVES SAINT LAURENT BEAUTY: COMPANY SNAPSHOT

FIGURE 24 TOM FORD BEAUTY: COMPANY SNAPSHOT

FIGURE 25 GUERLAIN: COMPANY SNAPSHOT

FIGURE 26 GIVENCHY BEAUTY: COMPANY SNAPSHOT

FIGURE 27 CLARINS: COMPANY SNAPSHOT

FIGURE 28 DOLCE & GABBANA BEAUTY: COMPANY SNAPSHOT

FIGURE 29 BURBERRY BEAUTY: COMPANY SNAPSHOT

FIGURE 30 LA MER: COMPANY SNAPSHOT

FIGURE 31 NARS COSMETICS: COMPANY SNAPSHOT

FIGURE 32 BOBBI BROWN: COMPANY SNAPSHOT

FIGURE 33 CLÉ DE PEAU BEAUTÉ: COMPANY SNAPSHOT

FIGURE 34 KÉRASTASE: COMPANY SNAPSHOT

FIGURE 35 ANASTASIA BEVERLY HILLS: COMPANY SNAPSHOT

FAQ

The global luxury cosmetics market is anticipated to grow from USD 50.1 Billion in 2022 to USD 73.46 Billion by 2030, at a CAGR of 4.9% during the forecast period.

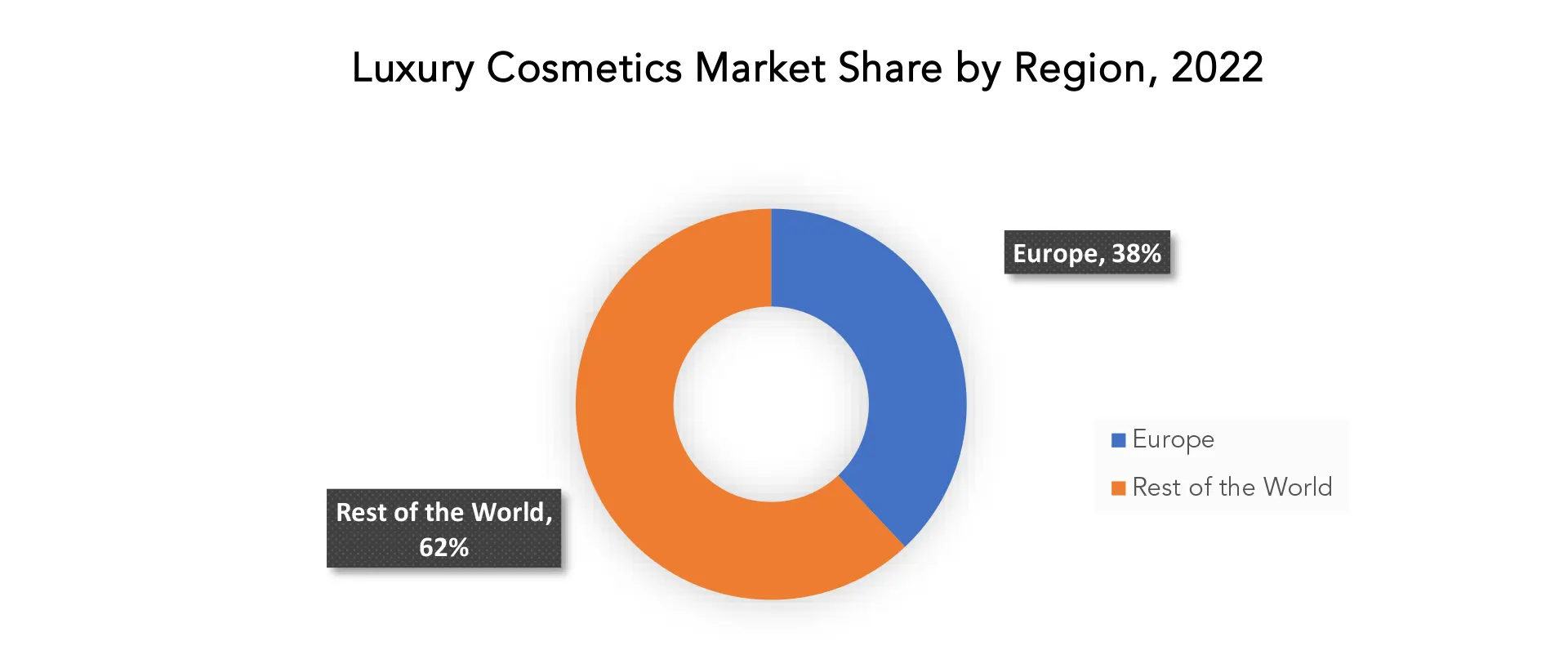

Europe accounted for the largest market in the luxury cosmetics market. Europe accounted for the 38 % percent market share of the global market value.

L’Oréal, Estée Lauder Companies, Shiseido, Christian Dior, Chanel, Giorgio Armani Beauty, Lancôme, Yves Saint Laurent Beauty, Tom Ford Beauty, Guerlain, Givenchy Beauty, Clarins, Dolce & Gabbana Beauty, Burberry Beauty, La Mer, NARS Cosmetics, Bobbi Brown, Clé de Peau Beauté, Kérastase, Anastasia Beverly Hills are some of the major key players in the luxury cosmetics market.

The luxury cosmetics market presents vast opportunities for growth, driven by evolving consumer preferences and rising disposable incomes. Demand for high-end skincare, premium fragrances, and exclusive makeup is on the rise, fueled by a growing emphasis on self-care and personal indulgence. E-commerce platforms offer a global reach, enabling brands to tap into new markets. Innovation in formulations, sustainable practices, and personalized experiences are key differentiators. Collaborations with influencers and celebrities enhance brand visibility. Emerging markets, particularly in Asia, exhibit untapped potential. Strategic digital marketing and leveraging social media trends further position luxury cosmetics for substantial market expansion and increased profitability.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.