REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 103.12 Billion by 2030 | 11.11 % | North America |

| by Deployment Model | by Channel Type | by Organization Size |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Managed Print Services (MPS) Market Overview

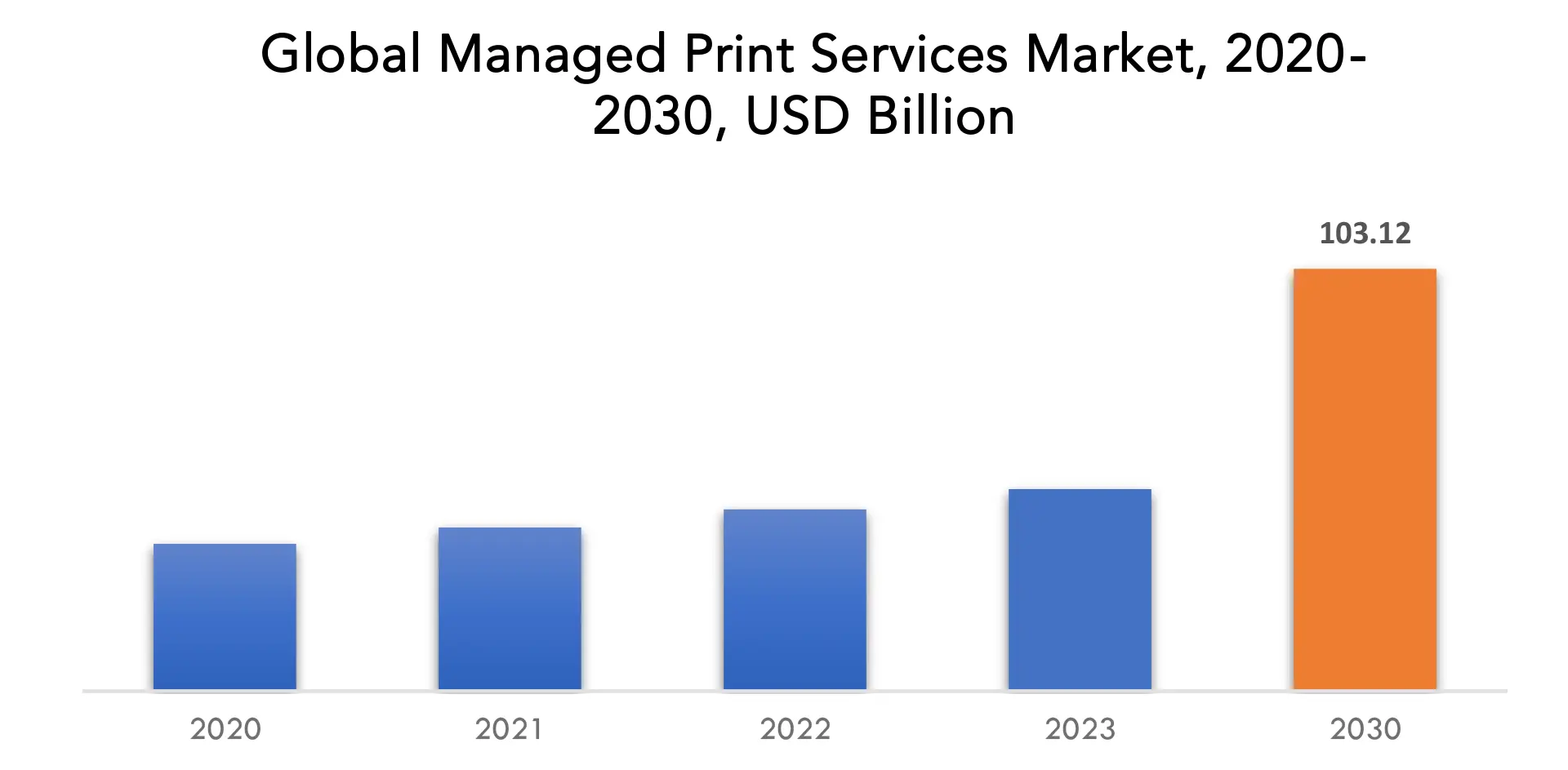

The global managed print services (MPS) market is expected to grow from USD 49.33 Billion in 2023 to USD 103.12 Billion by 2030, at a compound annual growth rate (CAGR) of 11.11 % during the forecast period.

Managed Print Services (MPS) constitutes a comprehensive strategy for overseeing and optimizing an organization’s printing infrastructure and associated document processes. Tailored to enhance efficiency, cut costs, and boost overall productivity in printing tasks, MPS entails the assessment, management, and continual optimization of the complete print environment, encompassing devices like printers, copiers, scanners, and related processes. Typically delivered by third-party providers, MPS covers various services, including print fleet management, proactive maintenance, automated supply replenishment, and workflow optimization.

The primary objective is to streamline printing workflows, minimize unnecessary printing, and align the print environment with the organization’s broader business goals. Leveraging technology, software solutions, and analytics, MPS providers monitor usage patterns, implement cost-saving measures, and enhance document security. This comprehensive print management approach aids organizations not only in cost control but also in meeting sustainability objectives by reducing paper waste and encouraging more efficient printing practices. MPS proves particularly beneficial for businesses aiming to regain control over print-related expenses, strengthen document security, and adopt a more sustainable and efficient document management approach.

The Managed Print Services (MPS) market is crucial for modern businesses aiming to enhance operational efficiency, control costs, and align with sustainability goals. Serving as a strategic solution, MPS optimizes printing infrastructure and processes, enabling significant cost reductions through resource efficiency, automated supply management, and proactive device maintenance.

Outsourcing print management enhances workflow efficiency by reducing unnecessary printing and introducing optimizations. Beyond operational benefits, MPS supports environmental sustainability initiatives by minimizing paper waste and promoting greener printing practices, aligning with global trends. Overall, the MPS market is essential for organizations pursuing operational excellence, cost-effectiveness, and sustainability in document management, fostering a more competitive business environment.

The escalating emphasis on cost optimization and operational efficiency within organizations. MPS empowers businesses to take command of their printing infrastructure, resulting in decreased operational costs through efficient resource use, streamlined workflows, and proactive device maintenance. Another pivotal factor is the increasing complexity of IT environments in enterprises, prompting them to opt for specialized MPS providers and allocate internal resources to core competencies.

Sustainability and environmental responsibility are significant drivers, with MPS minimizing paper waste and promoting eco-friendly printing practices. Moreover, the ongoing trend of digital transformation has heightened the demand for streamlined document management, making MPS integral for a seamless transition to digital workflows.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Deployment Model, Channel Type, Organization Size, Application and Region |

| By Deployment Model |

|

|

By Channel Type |

|

|

By Organization Size |

|

|

By Application |

|

|

By Region

|

|

Managed print services (MPS) Market Segmentation Analysis

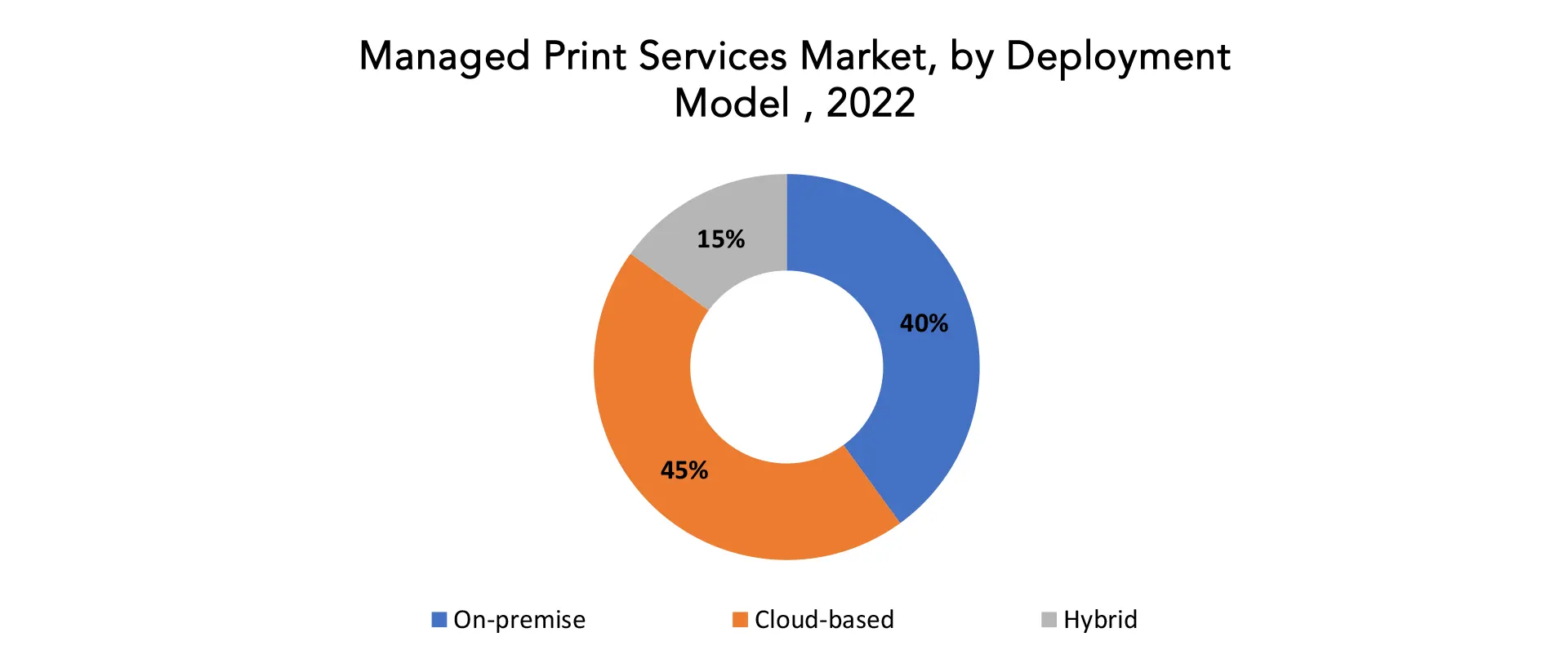

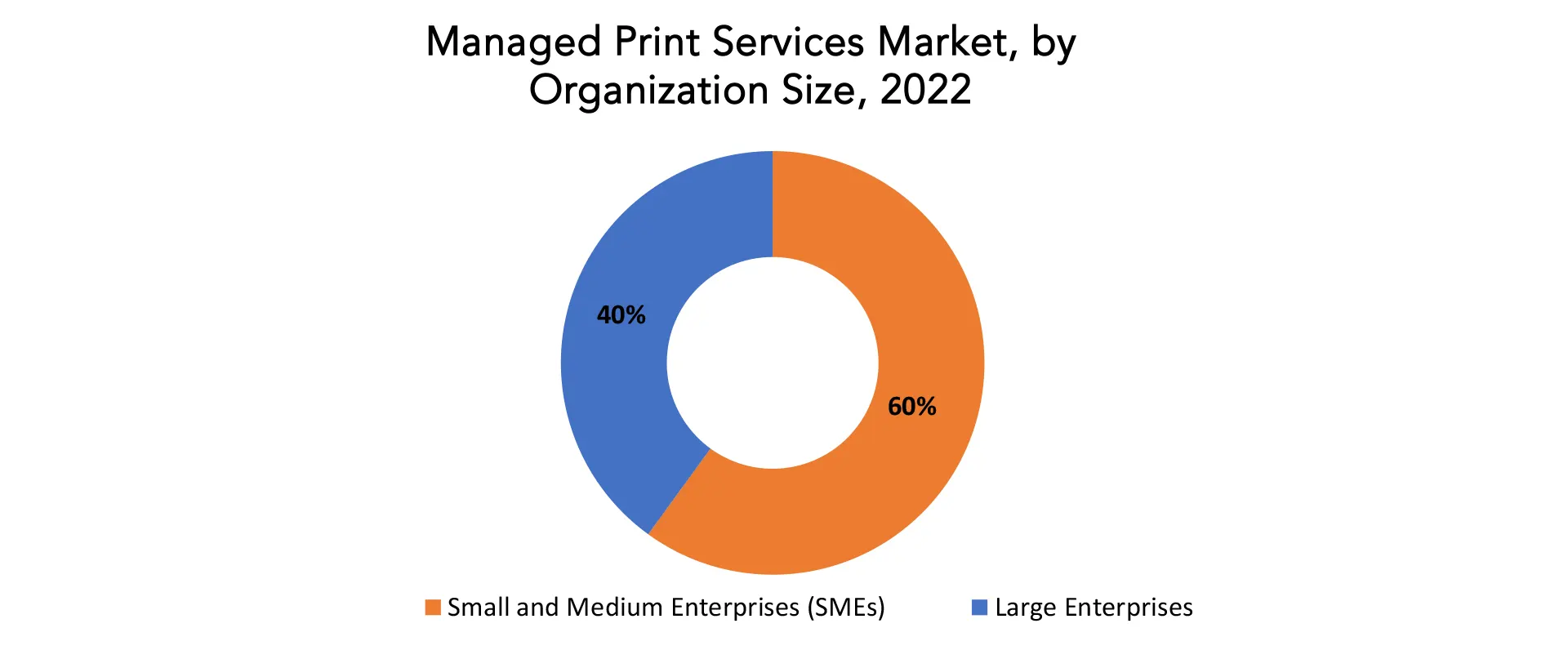

The global managed print services (MPS) market is divided into four segments, component, type, deployment, application and region. By deployment model the market is divided into premise, cloud-based, and hybrid solutions. By channel type, the market is divided into printer/copier manufacturers, system integrators/resellers, and independent software vendors (ISVs). By application the market is classified into BFSI, government, education, healthcare, telecom and IT, manufacturing, legal, and others. By organization size the market is classified into small and medium enterprises (SMEs) and large enterprises.

Based on deployment model, cloud-based segment dominating in the managed print services (MPS) market. The prevalence of cloud-based solutions in the Managed Print Services (MPS) market reflects a broader industry trend towards adaptable and scalable technologies. Cloud-based MPS stands out as a flexible and accessible approach to print management, consolidating tasks and resources. It eliminates the need for on-premise infrastructure, enabling organizations to harness cloud services for secure and efficient print management. This deployment model facilitates remote monitoring, proactive maintenance, and automated supply replenishment, enhancing overall operational efficiency.

Its alignment with the evolving needs of modern workplaces ensures accessibility from any location with an internet connection, fostering collaboration among geographically dispersed teams. The scalability of cloud-based MPS allows businesses to easily adjust to changing print volumes and requirements, making it an appealing choice for enterprises seeking cost-effective, agile, and technologically advanced print management solutions. As organizations increasingly prioritize digital transformation and remote work capabilities, the cloud-based deployment model emerges as a driving force in the MPS market, offering a strategic and future-ready approach to print services.

Based on organization size, small and medium enterprises (SMEs) segment dominating in the managed print services (MPS) market. The Small and Medium Enterprises (SMEs) segment’s dominance in the Managed Print Services (MPS) market underscores its strategic importance for smaller businesses seeking efficient and cost-effective print management solutions. SMEs, constrained by resources, find substantial benefits in outsourcing non-core functions like print management to specialized service providers.

MPS grants SMEs access to advanced print technologies and expertise without requiring significant upfront investments. These services are tailored to meet the specific needs of smaller enterprises, streamlining printing processes, optimizing resource utilization, and ensuring cost-effective operations. As SMEs embrace digital transformation and modern workflows, MPS becomes a valuable tool for enhancing efficiency and document management.

The scalability and flexibility of MPS align seamlessly with the dynamic nature of SMEs, enabling easy adaptation to changing print requirements and technological advancements. Choosing MPS based on their organizational size allows SMEs to achieve enhanced operational efficiency, reduced printing costs, and improved overall productivity, enhancing their competitiveness in the market.

Managed Print Services (MPS) Market Dynamics

Driver

Growing adoption of cloud-based MPS is driving managed print services (MPS) market.

The increasing adoption of cloud-based Managed Print Services (MPS) is a significant trend shaping the evolution of print management solutions. This approach provides organizations with a dynamic and flexible way to handle print-related tasks and resources by utilizing cloud infrastructure and services. A key driver behind this trend is the scalability and accessibility inherent in cloud-based solutions. By eliminating the need for on-premise infrastructure, organizations can securely centralize print management tasks in the cloud, allowing for remote monitoring, proactive maintenance, and automated supply replenishment, leading to enhanced operational efficiency.

Cloud-based MPS aligns well with the evolving dynamics of modern workplaces, providing accessibility from any location with an internet connection. This adaptability fosters collaboration among geographically dispersed teams, creating a more agile and connected work environment. The scalability of cloud-based MPS makes it an appealing choice for enterprises seeking cost-effective, scalable, and technologically advanced print management solutions that can easily adapt to fluctuating print volumes and changing requirements.

Restraint

Initial cost of implementation can impede the managed print services (MPS) market during the forecast period.

While the managed print services (MPS) market shows promising growth prospects, it faces a notable obstacle in the initial cost of implementation. Organizations contemplating the adoption of MPS often grapple with substantial upfront expenses related to deploying print management solutions. These costs involve various elements such as acquiring hardware, obtaining software licenses, and integrating the MPS with existing IT infrastructure. The demand for specialized printing equipment, multifunctional devices, and advanced software adds to the financial commitment, especially for businesses with limited budgets or smaller enterprises.

The initial investment extends to employee training programs, ensuring the proficient use of the newly implemented MPS. This financial barrier might challenge organizations hesitant about substantial upfront investments, potentially impeding widespread adoption. However, with ongoing technological advancements and market maturation, there’s potential for increased cost efficiencies and scalability, fostering the long-term viability and accessibility of MPS solutions for a broader business spectrum.

Addressing the challenge of the initial cost of implementation will be pivotal for ensuring sustained and inclusive growth in the managed print services market throughout the forecast period.

Opportunities

Growth of the digital economy aids the managed print services (MPS) market growth.

The managed print services (MPS) market is experiencing significant growth fueled by the expansion of the digital economy. With businesses increasingly transitioning to digital processes, there is a heightened demand for efficient document management solutions. MPS serves as a strategic facilitator for organizations navigating this digital shift, offering comprehensive print management services. In the evolving digital landscape, where workflows are progressively becoming digitized, MPS acts as a crucial link between traditional paper-based practices and modern digital workflows.

These services not only optimize printing resources but also seamlessly integrate printing tasks into digital processes. Effective management of both physical and digital documents becomes imperative in achieving operational efficiency and compliance. Furthermore, as businesses prioritize sustainability and eco-friendly initiatives, MPS plays a crucial role in reducing paper waste and promoting environmentally conscious printing practices.

The continued growth of the digital economy further underscores the significance of managed print services, positioning them as a vital element in the ongoing digital transformation efforts across diverse industries.

Managed print services (MPS) Market Trends

- Cloud-based MPS solutions are gaining traction as organizations seek to streamline operations, reduce IT overhead, and enhance scalability. Cloud-based MPS offers centralized management, remote access, and real-time data analytics, enabling businesses to effectively monitor and optimize their printing infrastructure.

- MPS providers are leveraging data analytics to gain deeper insights into customer printing behavior, identify cost-saving opportunities, and improve overall efficiency. By analyzing print usage patterns, device performance, and toner consumption, MPS providers can tailor solutions to specific customer needs and optimize print environments.

- Organizations are increasingly concerned about the security of their printed documents and the potential for data breaches. MPS providers are addressing these concerns by offering enhanced security features, such as multi-factor authentication, data encryption, and secure print release protocols.

- The rise of remote work and Bring Your Own Device (BYOD) policies is driving demand for mobile printing solutions and secure access to printing devices from anywhere. MPS providers are developing mobile apps and cloud-based printing platforms to cater to this growing demand.

- Organizations are increasingly prioritizing sustainability initiatives, and MPS providers are responding with eco-friendly solutions that reduce waste, conserve energy, and minimize environmental impact. This includes offering recycled toner cartridges, promoting duplex printing, and implementing energy-efficient devices.

- MPS is moving beyond print management and becoming an integral part of enterprise workflows. MPS providers are integrating their solutions with enterprise resource planning (ERP), customer relationship management (CRM), and document management systems to streamline document processes and enhance productivity.

Competitive Landscape

The competitive landscape of the managed print services (MPS) market was dynamic, with several prominent companies competing to provide innovative and advanced managed print services (MPS) solution.

- HP Inc.

- Dell Technologies Inc.

- Lenovo Group Limited

- Microsoft Corporation

- Apple Inc.

- Cisco Systems, Inc.

- Google LLC

- com, Inc.

- Fujitsu Limited

- Acer Inc.

- Toshiba Corporation

- ASUS Computer International

- Huawei Technologies Co., Ltd.

- Sony Corporation

- LG Electronics Inc.

- Panasonic Corporation

- NEC Corporation

- Sharp Corporation

- Hitachi, Ltd.

- Samsung Electronics Co., Ltd.

- Ricoh

Recent Developments:

SEP 21, 2022: Xerox announced a new strategic partnership with LinkSquares to deliver contract lifecycle management (CLM) capabilities to its customers in the U.S. as part of the company’s Capture & Content Services offerings. The partnership follows Xerox Ventures’ second investment in LinkSquares earlier this year.

October 31, 2023: Ricoh Company, Ltd. announced that Ricoh and Siemens Digital Industries Software, a world-leading provider of product lifecycle management and manufacturing operations management software, have started a collaboration to realize the industrial aluminum Binder Jetting (BJT) solution for mass production.

Regional Analysis

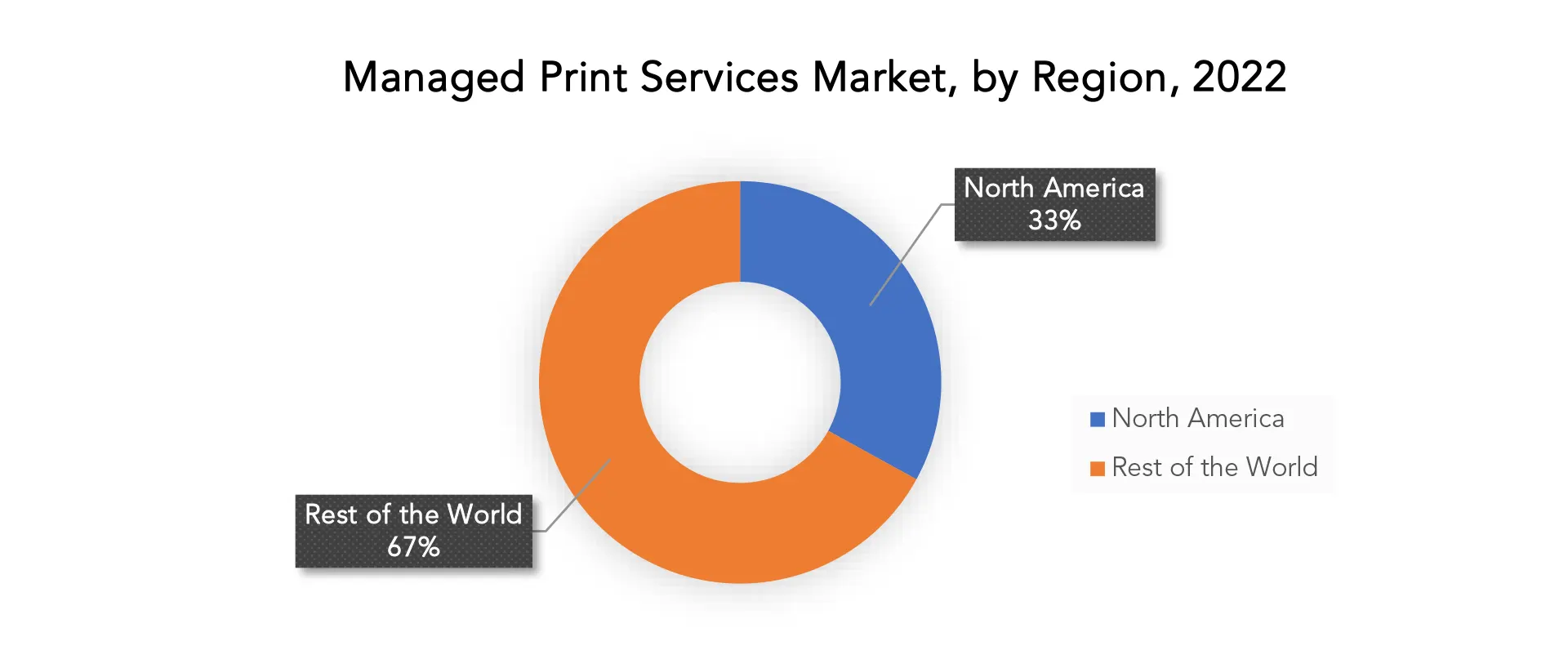

North America accounted for the largest market in the managed print services (MPS) market. North America accounted for the 33% market share of the global market value. North America emerges as the dominant force in the managed print services (MPS) sector, propelled by several factors that underline its leadership. The region’s technologically advanced landscape, combined with a high level of awareness and widespread adoption of managed print services among enterprises, serves as a primary catalyst. Businesses in North America are known for their swift embrace of innovative solutions to enhance operational efficiency and curtail costs, and MPS fits seamlessly into this ethos. The market’s growth is further supported by the presence of numerous established MPS providers and a robust IT infrastructure. Additionally, the region’s emphasis on sustainability and environmental responsibility contributes to the growing demand for MPS solutions, prized for their ability to minimize paper waste and promote eco-friendly printing practices.

In the mature European market, characterized by a robust technological infrastructure, the adoption of Managed Print Services (MPS) is driven by a strong emphasis on optimizing operational efficiency and reducing costs. Much like their counterparts in North America, European enterprises prioritize innovative solutions to streamline document management workflows. The continent’s stringent regulatory environment, particularly concerning data privacy and compliance, further amplifies the demand for MPS, with businesses actively seeking secure and compliant print management solutions.

In the dynamic and rapidly evolving Asia-Pacific region, MPS is positioned as a strategic tool for businesses looking to enhance efficiency. The expanding economies, coupled with a growing wave of digital transformation, contribute significantly to the rising adoption of MPS. As businesses across Asia-Pacific embrace modern technologies, MPS becomes instrumental in bridging traditional and digital document management practices. The diverse market, encompassing both established economies and emerging markets, creates a varied landscape for MPS providers, who tailor their services to meet the specific needs of businesses at different stages of technological maturity.

Target Audience for Managed print services (MPS) Market

- Managed print services providers

- IT service providers

- Cloud service providers

- Printer suppliers

- Original equipment manufacturers (OEMs)

- System integrators and third-party vendors

- Software solution providers

- Government bodies

- Technology investors

- Enterprise data center professionals

- Research institutes and organizations

Market research and consulting firms

Import & Export Data for Managed Print Services (MPS) Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Managed Print Services (MPS) market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Managed Print Services (MPS) Market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the Managed Print Services (MPS) Market Report

Managed Print Services (MPS) Market by Deployment Model

- On-premise

- Cloud-based

- Hybrid

Managed Print Services (MPS) Market by Channel Type

- Printer/Copier Manufacturers

- System Integrators/Resellers

- Independent Software Vendors (ISVs)

Managed Print Services (MPS) Market by Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Managed Print Services (MPS) Market by Application

- BFSI

- Government

- Education

- Healthcare

- Telecom and IT

- Manufacturing

- Legal

- Others

Managed Print Services (MPS) Market by Region

- North America

- Europe

- Asia Pacific

- South America

Middle East and Africa

Key Question Answered

- What is the expected growth rate of the managed print services (MPS) market over the next 7 years?

- Who are the major players in the managed print services (MPS) market and what is their market share?

- What are the Application industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the managed print services (MPS) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the managed print services (MPS) market?

- What is the current and forecasted size and growth rate of the global managed print services (MPS) market?

- What are the key drivers of growth in the managed print services (MPS) market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the managed print services (MPS) market?

- What are the technological advancements and innovations in the managed print services (MPS) market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the managed print services (MPS) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the managed print services (MPS) market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL MANAGED PRINT SERVICES (MPS) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON MANAGED PRINT SERVICES (MPS) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- APPLICATION VALUE CHAIN ANALYSIS

- GLOBAL MANAGED PRINT SERVICES (MPS) MARKET OUTLOOK

- GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE, 2020-2030, (USD BILLION)

- HARDWARE

- SOFTWARE

- SERVICES

- GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE, 2020-2030, (USD BILLION)

- COMMON RESPONSE SYSTEM

- PERSONAL RESPONSE SYSTEMS

- GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE, 2020-2030, (USD BILLION)

- CLOUD

- ON-PREMISES

- GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- EDUCATIONAL INSTITUTES

- INTERNATIONAL CONFERENCES

- COACHING CLASSES

- WORKSHOPS

- OTHERS

- GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- XEROX CORPORATION

- HP DEVELOPMENT COMPANY, L.P.

- RICOH COMPANY, LTD.

- KONICA MINOLTA, INC.

- CANON, INC.

- LEXMARK INTERNATIONAL, INC.

- KYOCERA CORPORATION

- SHARP CORPORATION

- TOSHIBA CORPORATION

- SAMSUNG ELECTRONICS CO., LTD.

- ARC DOCUMENT SOLUTIONS, INC.

- BROTHER INDUSTRIES, LTD.

- FUJIFILM BUSINESS INNOVATION CORP.

- CDW LLC

- KONICA MINOLTA BUSINESS SOLUTIONS U.S.A., INC.

- SHARP ELECTRONICS CORPORATION

- KYOCERA DOCUMENT SOLUTIONS AMERICA, INC.

- LEXMARK INTERNATIONAL

- RICOH USA, INC.

- HP INC.*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 2 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 4 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 5 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 9 NORTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 US MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 12 US MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 13 US MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 14 US MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 15 CANADA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 16 CANADA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 17 CANADA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 18 CANADA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 19 MEXICO MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 20 MEXICO MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 21 MEXICO MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 22 MEXICO MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 23 SOUTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 24 SOUTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 25 SOUTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 27 SOUTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 28 BRAZIL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 29 BRAZIL MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 30 BRAZIL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 31 BRAZIL MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 32 ARGENTINA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 33 ARGENTINA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 34 ARGENTINA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 35 ARGENTINA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 36 COLOMBIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 37 COLOMBIA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 38 COLOMBIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 39 COLOMBIA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 40 REST OF SOUTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 41 REST OF SOUTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 42 REST OF SOUTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 43 REST OF SOUTH AMERICA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 ASIA-PACIFIC MANAGED PRINT SERVICES (MPS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 45 ASIA-PACIFIC MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 46 ASIA-PACIFIC MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 47 ASIA-PACIFIC MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 49 INDIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 50 INDIA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 51 INDIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 52 INDIA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 53 CHINA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 54 CHINA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 55 CHINA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 56 CHINA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 57 JAPAN MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 58 JAPAN MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 59 JAPAN MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 60 JAPAN MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 61 SOUTH KOREA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 62 SOUTH KOREA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 63 SOUTH KOREA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 64 SOUTH KOREA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 AUSTRALIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 66 AUSTRALIA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 67 AUSTRALIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 68 AUSTRALIA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 69 SOUTH-EAST ASIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 70 SOUTH-EAST ASIA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 71 SOUTH-EAST ASIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 72 SOUTH-EAST ASIA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 73 REST OF ASIA PACIFIC MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 74 REST OF ASIA PACIFIC MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 75 REST OF ASIA PACIFIC MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 76 REST OF ASIA PACIFIC MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 77 EUROPE MANAGED PRINT SERVICES (MPS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 78 EUROPE MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 79 EUROPE MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 80 EUROPE MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 81 EUROPE MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 82 GERMANY MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 83 GERMANY MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 84 GERMANY MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 85 GERMANY MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 UK MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 87 UK MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 88 UK MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 89 UK MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 FRANCE MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 91 FRANCE MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 92 FRANCE MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 93 FRANCE MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 94 ITALY MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 95 ITALY MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 96 ITALY MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 97 ITALY MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 SPAIN MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 99 SPAIN MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 100 SPAIN MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 101 SPAIN MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 102 RUSSIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 103 RUSSIA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 104 RUSSIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 105 RUSSIA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 106 REST OF EUROPE MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 107 REST OF EUROPE MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 108 REST OF EUROPE MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 109 REST OF EUROPE MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 MIDDLE EAST AND AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 111 MIDDLE EAST AND AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 112 MIDDLE EAST AND AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 113 MIDDLE EAST AND AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 114 MIDDLE EAST AND AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 115 UAE MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 116 UAE MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 117 UAE MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 118 UAE MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 119 SAUDI ARABIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 120 SAUDI ARABIA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 121 SAUDI ARABIA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 122 SAUDI ARABIA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 123 SOUTH AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 124 SOUTH AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 125 SOUTH AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 126 SOUTH AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 127 REST OF MIDDLE EAST AND AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

TABLE 128 REST OF MIDDLE EAST AND AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

TABLE 129 REST OF MIDDLE EAST AND AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 130 REST OF MIDDLE EAST AND AFRICA MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

FIGURE 11 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 12 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE MODE (USD BILLION) 2022

FIGURE 15 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY CHANNEL TYPE (USD BILLION) 2022

FIGURE 16 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY ORGANIZATION SIZE (USD BILLION) 2022

FIGURE 17 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 18 GLOBAL MANAGED PRINT SERVICES (MPS) MARKET BY REGION (USD BILLION) 2022

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 XEROX CORPORATION: COMPANY SNAPSHOT

FIGURE 21 HP DEVELOPMENT COMPANY, L.P.: COMPANY SNAPSHOT

FIGURE 22 RICOH COMPANY, LTD.: COMPANY SNAPSHOT

FIGURE 23 KONICA MINOLTA, INC.: COMPANY SNAPSHOT

FIGURE 24 CANON, INC.: COMPANY SNAPSHOT

FIGURE 25 LEXMARK INTERNATIONAL, INC.: COMPANY SNAPSHOT

FIGURE 26 KYOCERA CORPORATION: COMPANY SNAPSHOT

FIGURE 27 SHARP CORPORATION: COMPANY SNAPSHOT

FIGURE 28 TOSHIBA CORPORATION: COMPANY SNAPSHOT

FIGURE 29 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

FIGURE 30 ARC DOCUMENT SOLUTIONS, INC.: COMPANY SNAPSHOT

FIGURE 31 BROTHER INDUSTRIES, LTD.: COMPANY SNAPSHOT

FIGURE 32 FUJIFILM BUSINESS INNOVATION CORP.: COMPANY SNAPSHOT

FIGURE 33 CDW LLC: COMPANY SNAPSHOT

FIGURE 34 KONICA MINOLTA BUSINESS SOLUTIONS U.S.A., INC.: COMPANY SNAPSHOT

FIGURE 35 SHARP ELECTRONICS CORPORATION: COMPANY SNAPSHOT

FIGURE 36 KYOCERA DOCUMENT SOLUTIONS AMERICA, INC.: COMPANY SNAPSHOT

FIGURE 37 LEXMARK INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 38 RICOH USA, INC.: COMPANY SNAPSHOT

FIGURE 39 HP INC.: COMPANY SNAPSHOT

FAQ

The global managed print services (MPS) market is expected to grow from USD 49.33 Billion in 2023 to USD 103.12 Billion by 2030, at a compound annual growth rate (CAGR) of 11.11 % during the forecast period.

North America accounted for the largest market in the managed print services (MPS) market. North America accounted for 33 % market share of the global market value.

Xerox Corporation, HP Development Company, L.P., Ricoh Company, Ltd., Konica Minolta, Inc., Canon, Inc., Lexmark International, Inc., Kyocera Corporation, Sharp Corporation, Toshiba Corporation, Samsung Electronics Co., Ltd., ARC Document Solutions, Inc., Brother Industries, Ltd., Fujifilm Business Innovation Corp., CDW LLC, Konica Minolta Business Solutions U.S.A., Inc., Sharp Electronics Corporation, Kyocera Document Solutions America, Inc., Lexmark International, Ricoh USA, Inc., HP Inc.

The managed print services (MPS) market presents significant opportunities for providers to offer advanced solutions that integrate artificial intelligence and machine learning, enabling predictive maintenance, automated issue resolution, and further optimization of print-related processes. Additionally, the increasing demand for cloud-based MPS solutions provides a fertile ground for service providers to deliver scalable, flexible, and cost-effective print management services to a diverse range of organizations.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.