REPORT OUTLOOK

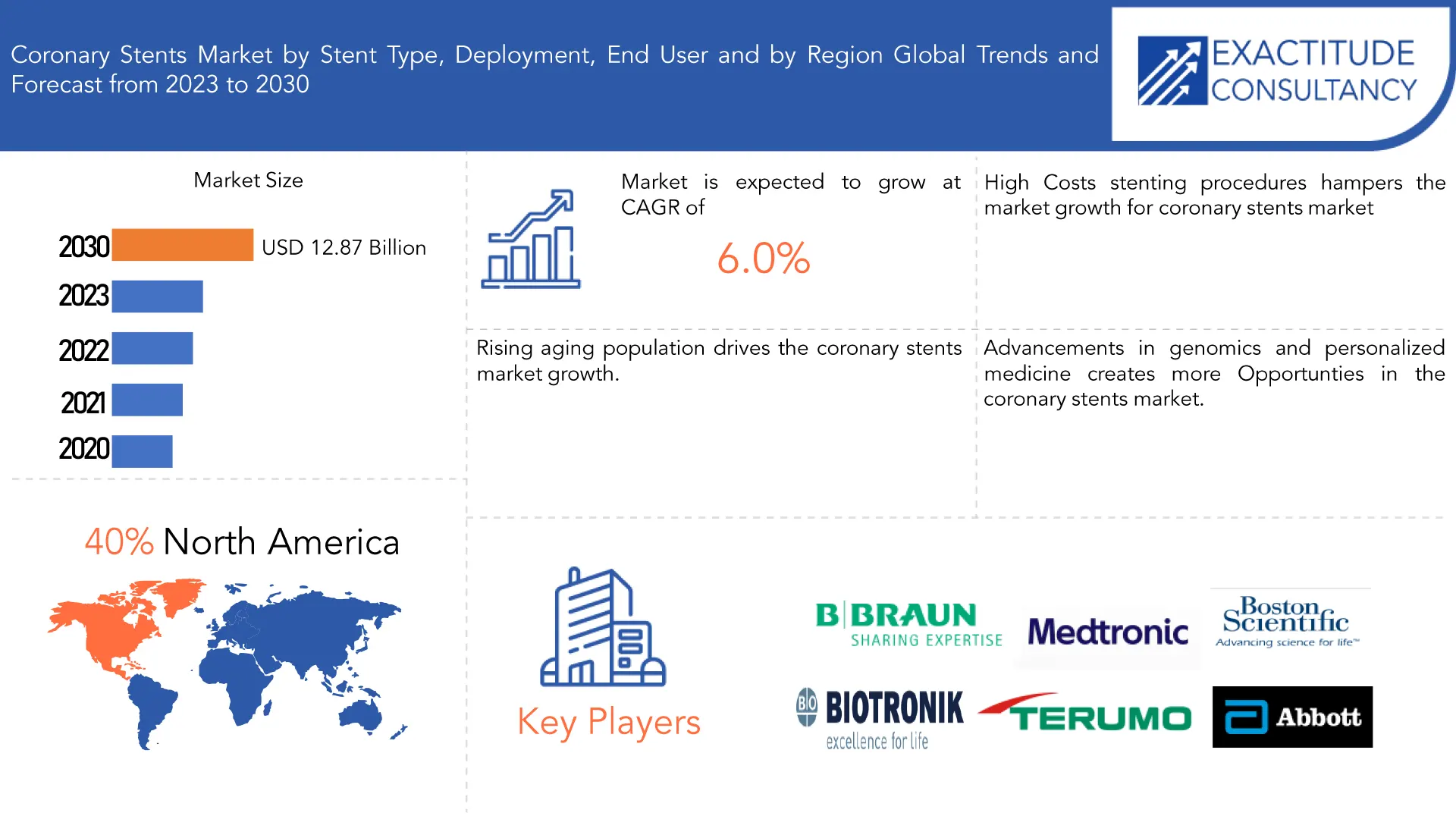

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 12.87 Billion by 2030 | 6.0% | North America |

| by Stent Type | by Deployment | by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Coronary Stents Market Overview

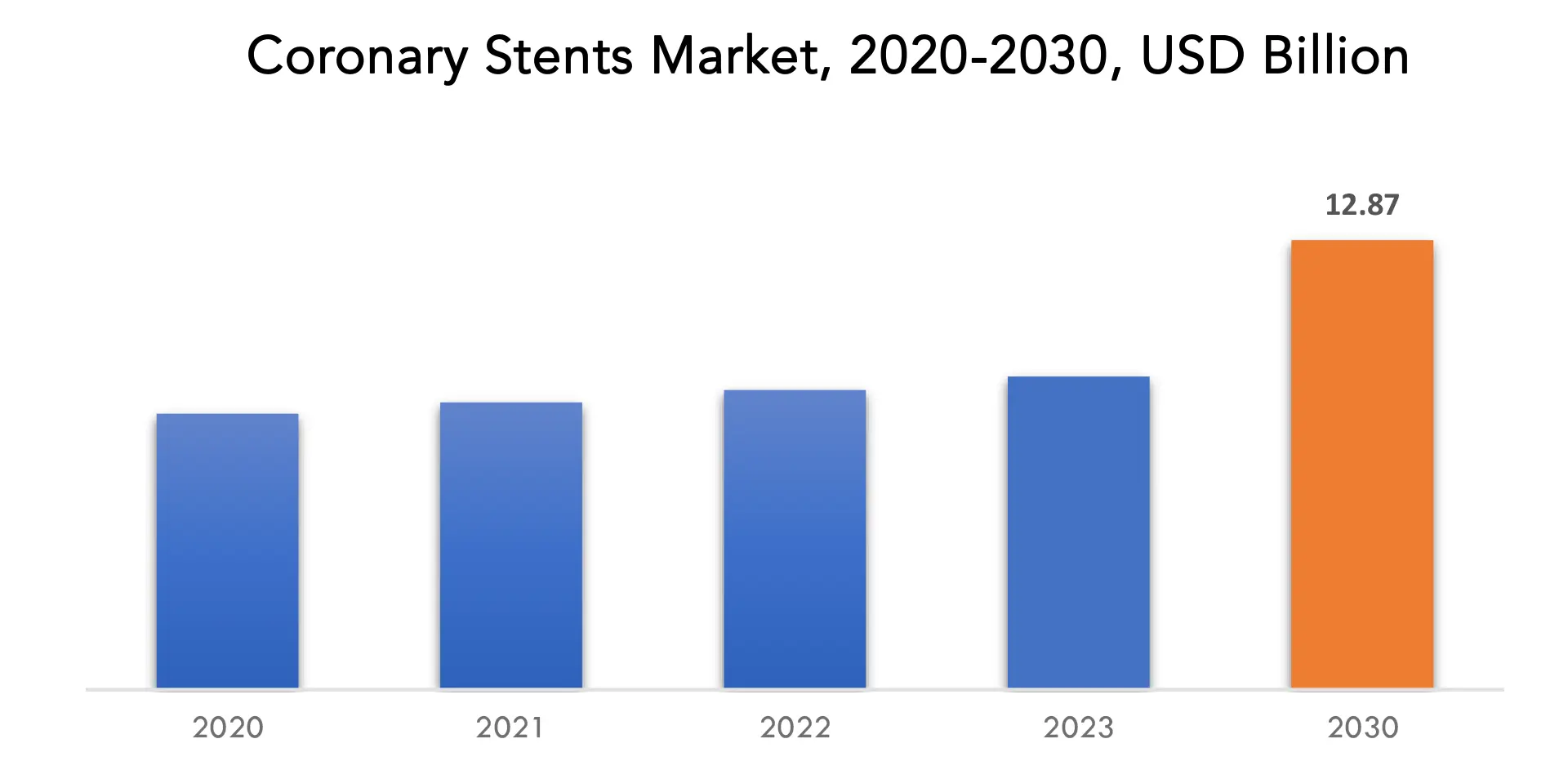

The Global Coronary Stents market is anticipated to grow from USD 9.0 Billion in 2023 to USD 12.87 Billion by 2030, at a CAGR of 6.0 % during the forecast period.

Coronary stents are medical devices used in the treatment of coronary artery disease (CAD), which is a condition where the blood vessels that supply the heart muscle with oxygen and nutrients become narrowed or blocked due to the buildup of fatty deposits and plaque. Stents are specifically designed to help open up and keep these arteries clear, allowing for improved blood flow to the heart muscle. Stents can provide rapid relief from angina symptoms. Patients with chest pain and other symptoms of CAD often experience improved quality of life shortly after the placement of stents.

The advent of drug-eluting stents, which release medications to inhibit the growth of scar tissue inside the stent, has significantly improved long-term outcomes. These stents have reduced the rate of restenosis (re-narrowing of the treated artery) compared to earlier bare-metal stents, leading to better results for patients. Coronary stents offer healthcare providers a range of treatment options. They can be used in various clinical scenarios, such as single-vessel disease or multivessel disease, and can be deployed in specific locations within the coronary arteries, depending on the patient’s condition. Stenting is often considered a less invasive option compared to coronary artery bypass surgery. While bypass surgery remains a valuable treatment for certain patients, it involves open-chest surgery and a longer recovery period. By maintaining blood flow to the heart muscle, stents can prevent or minimize damage to the heart muscle tissue. This is particularly important during a heart attack when timely intervention with stents can salvage heart muscle and improve the patient’s prognosis.

The global population is aging, and older individuals are more susceptible to CAD. This demographic shift has contributed to the increased demand for coronary stents. Stent procedures typically involve shorter hospital stays and recovery periods compared to open-heart surgery. This attracts both patients and healthcare providers looking for quicker and less disruptive treatment options. Advances in stent technology, including drug-eluting stents, have led to improved long-term outcomes and reduced rates of restenosis. This has bolstered the confidence of healthcare providers in using stents for CAD treatment. Improved access to healthcare services in developing countries, coupled with medical tourism, has expanded the patient pool for coronary stent procedures.

Many countries have invested in upgrading their healthcare infrastructure, including cardiac care facilities. This has increased the availability of stenting procedures in various regions. Widespread health insurance coverage in many countries makes it more feasible for patients to afford coronary stent procedures, further increasing demand. Integration of stent placement procedures with advanced imaging techniques and tools like angiography and intravascular ultrasound allows for more precise and effective stent deployment, enhancing patient outcomes. Growing economies and increased healthcare spending in emerging markets have led to greater adoption of advanced medical treatments, including coronary stenting.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion), (Thousand Units) |

| Segmentation | By Type, Application, Industry Vertical, By Region |

| By Stent Type |

|

| By Deployment |

|

| By End User |

|

| By Region

|

|

Coronary Stents Market Segmentation Analysis

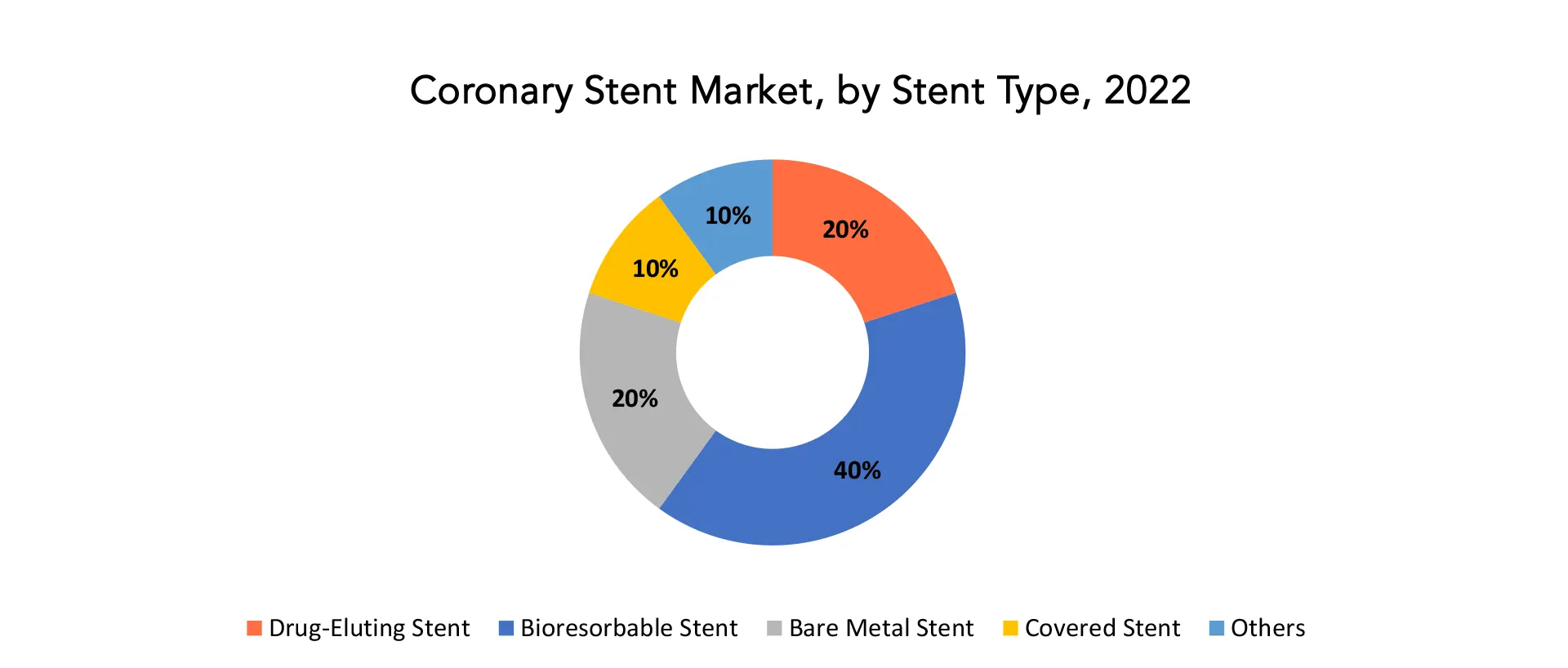

The global Coronary Stents market is divided into 4 segments stent type, deployment, end user and region. by stent type the market is bifurcated into Drug-Eluting Stent Bioresorbable Stent Bare Metal Stent Covered Stent Others.

Based on stent type Bioresorbable Stent segment dominating in the coronary Stents market. The safety and efficacy of bioresorbable stents are critical factors in their adoption. Clinical trials and real-world studies play a significant role in establishing their performance compared to traditional drug-eluting metallic stents. Positive clinical outcomes can drive greater adoption. Approval by regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) is necessary for market entry. Regulatory decisions can influence the adoption of bioresorbable stents. The preferences of interventional cardiologists and healthcare providers play a crucial role in selecting stent types. Their confidence in the safety and effectiveness of bioresorbable stents can impact adoption. Patient outcomes and experiences with bioresorbable stents, including reduced complications and better long-term results, can influence their adoption Ongoing advancements in bioresorbable stent technology, including improvements in design and materials, can enhance their performance and safety.

The coronary stents market is highly competitive, with various types of stents available, including traditional metallic stents, drug-eluting stents, and bioresorbable stents. The dominance of one segment over the others can depend on factors like pricing, performance, and clinical data. Reimbursement policies and coverage by healthcare payers can affect the adoption of bioresorbable stents. Favorable reimbursement can incentivize healthcare providers to offer these stents. The training and expertise of healthcare providers in using bioresorbable stents may influence their adoption. Proper training ensures that stents are deployed correctly, reducing the risk of complications.

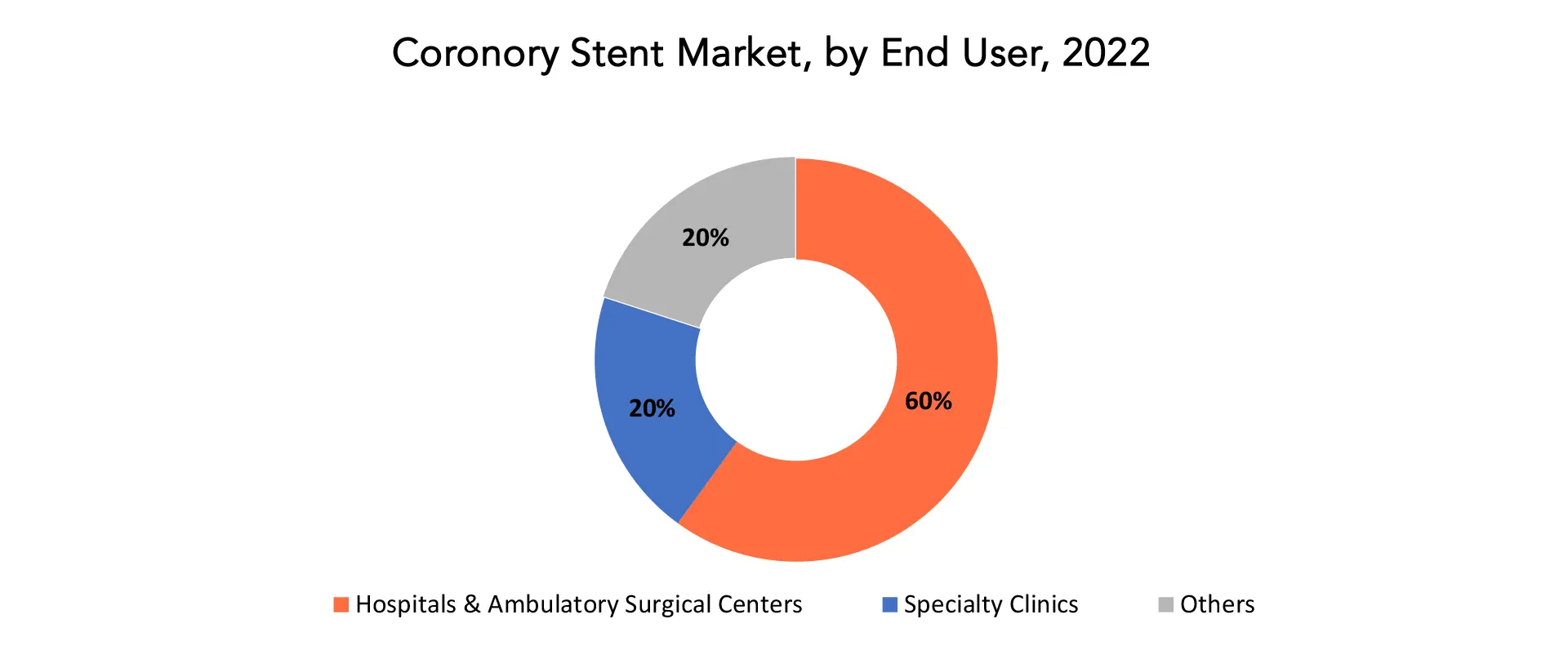

Based on end user hospital & Ambulatory Surgical Centers segment dominating in the coronary stent market. Hospitals, particularly those with cardiac catheterization labs and specialized interventional cardiology departments, have traditionally been the primary settings for coronary stent procedures. Hospitals generally handle a wide range of cardiac cases, including complex cases requiring advanced surgical facilities and expertise. Patients with acute coronary syndromes, severe blockages, or multiple vessel diseases often receive coronary stents in hospital settings. ASCs have gained popularity for certain coronary stent procedures, especially for elective cases and lower-risk patients. ASCs offer a more convenient and cost-effective alternative to traditional hospital settings for some patients. For straightforward coronary stent placements, such as those in single-vessel disease or for uncomplicated elective procedures, ASCs can be a suitable and efficient option. The complexity of the coronary stent procedure often determines the choice of setting. More complex cases, such as those requiring additional cardiac interventions or treatment of multiple blockages, are more likely to occur in hospital settings.

Coronary Stents Market Dynamics

Driver

Rising aging population drives the coronary stents market growth.

Aging is a major risk factor for CAD, and as the population ages, the incidence of CAD tends to rise. CAD is a condition in which the coronary arteries become narrowed or blocked, leading to reduced blood flow to the heart muscle. This condition often necessitates the use of coronary stents to restore blood flow and alleviate symptoms. Older individuals may have more complex cases of CAD due to the cumulative effects of aging, including atherosclerosis and other comorbidities. These complex cases often require more extensive interventions, including the use of multiple stents or specialized techniques. Aging individuals with CAD may require revascularization procedures to alleviate chest pain (angina) and prevent heart attacks. Coronary stents are commonly used in these procedures. Advances in healthcare have led to longer lifespans, resulting in a larger elderly population. This demographic trend means that there is a growing number of people at higher risk for CAD and other cardiovascular conditions. Coronary stents can significantly improve the quality of life for older adults by relieving symptoms and reducing the risk of major cardiac events, such as heart attacks. The development of newer and more advanced stent technologies, including drug-eluting stents and bioresorbable stents, has made stenting procedures safer and more effective, making them a viable option for elderly patients. Coronary stenting is a minimally invasive procedure compared to open-heart surgery, making it a more suitable option for older individuals who may have additional health concerns or are at a higher risk for complications. Improved access to healthcare services, including cardiac care, has made it easier for older individuals to receive timely diagnosis and treatment for CAD, including stenting procedures.

Restraint:

High Costs stenting procedures hampers the market growth for coronary stents market

High costs can strain healthcare systems, insurers, and government healthcare programs. The financial burden of providing coronary stenting procedures may lead to limitations on reimbursement rates, which can affect the willingness of healthcare providers to offer these procedures. In regions or healthcare systems with limited resources, the high cost of stenting procedures can result in restricted access to these treatments for certain patient populations. This can lead to disparities in healthcare access and outcomes. Stent manufacturers may face pressure to reduce prices, especially in competitive markets. This can impact their profitability and innovation efforts. The extent to which healthcare systems or insurance providers cover the cost of stenting procedures can vary widely. In some regions, comprehensive insurance coverage may alleviate the financial burden on patients. these are some factors that hampers the market growth for coronary stents market.

Opportunities:

Advancements in genomics and personalized medicine creates more Opportunties in the coronary stents market.

Genomic and genetic testing can assistance identify individuals who are at a higher risk of developing coronary artery disease (CAD) or experiencing complications after coronary stent placement. This information enables healthcare providers to tailor their treatment plans and select the most appropriate stent types for each patient. Genomic data can be used to create modified treatment plans that take into account a patient’s genetic profile, lifestyle factors, and underlying cardiovascular conditions. This can lead to more effective interventions and improved patient outcomes. Personalized medicine allows for the selection of stents that are specifically suited to an individual’s unique characteristics. For example, genetic information can influence the choice between drug-eluting stents and bare-metal stents, or help determine the optimal drug therapies to accompany stent placement. Ultimately, the use of genomics and personalized medicine in coronary stent procedures can lead to improved patient outcomes, reduced complications, and a more tailored approach to care.

Coronary Stents Market Trends

- The development of advanced stent technologies, including drug-eluting stents (DES) and bioresorbable stents, was a prominent trend. These innovations aimed to improve stent performance, reduce the risk of restenosis, and enhance patient outcomes.

- The trend toward personalized medicine, including the use of genomics and patient-specific data, was influencing treatment decisions. Genetic profiling and individualized treatment plans were becoming more common, allowing for tailored stent selection and medication regimens.

- The preference for minimally invasive procedures continued to grow. Patients and healthcare providers favored percutaneous coronary intervention (PCI) over traditional open-heart surgery when feasible, resulting in increased demand for coronary stent procedures.

- While not yet dominant, bioresorbable stents gained attention as a promising technology. These stents are designed to be absorbed by the body over time, potentially reducing long-term complications associated with permanent metallic stents.

- The COVID-19 pandemic accelerated the adoption of telemedicine and remote monitoring in healthcare. These technologies were increasingly used for post-stenting follow-up and patient care.

- The shift towards value-based healthcare models encouraged healthcare providers and payers to focus on patient outcomes and cost-effectiveness, potentially influencing treatment decisions and stent selection.

- Emerging markets, particularly in Asia and Latin America, were witnessing increased demand for coronary stents due to expanding healthcare infrastructure, rising incomes, and a growing awareness of cardiovascular health.

- Evolving regulatory environments and approvals for new stent technologies played a role in shaping the market. Regulatory agencies like the FDA and EMA continued to assess the safety and efficacy of stent products.

- Competition among stent manufacturers remained fierce, driving innovation and pricing strategies. Companies focused on developing differentiated products and expanding their market reach.

- Environmental sustainability became a concern in the stent industry, leading to research and development efforts aimed at creating more environmentally friendly stent materials and manufacturing processes.

- There was a growing emphasis on patient education and shared decision-making in the selection of stent types and post-procedure care.

Competitive Landscape

The competitive landscape of the coronary stents market is dynamic and characterized by several major players as well as numerous smaller companies that specialize in the development and manufacturing of coronary stents.

- Abbott Laboratories

- Boston Scientific

- Medtronic

- Terumo Corporation

- Braun Melsungen AG

- Cook Medical

- Biotronik

- MicroPort Scientific Corporation

- Cordis Corporation

- Biosensors International Group

- Meril Life Science

- Vascular Concepts

- Translumina GmbH

- Cardinal Health

- Hexacath

- OrbusNeich Medical

- Alvimedica

- Endocor GmbH

- Stentys

- Lepu Medical Technolog

Recent developments:

April 2021: Abbott declared the launch of coronary imaging platform Ultreon 1.0 Software powered by AI in Europe. The software has been launched with an purpose to improve detection of calcium-based blockages and measure vessel diameter during coronary stenting procedures.

March 2022 : A partnership between Cardiovascular Systems Inc. and Chansu Vascular Technologies, LLC has been announced with the goal of creating peripheral and coronary drug-coated balloons for use in drug-eluting stents.

Regional Analysis

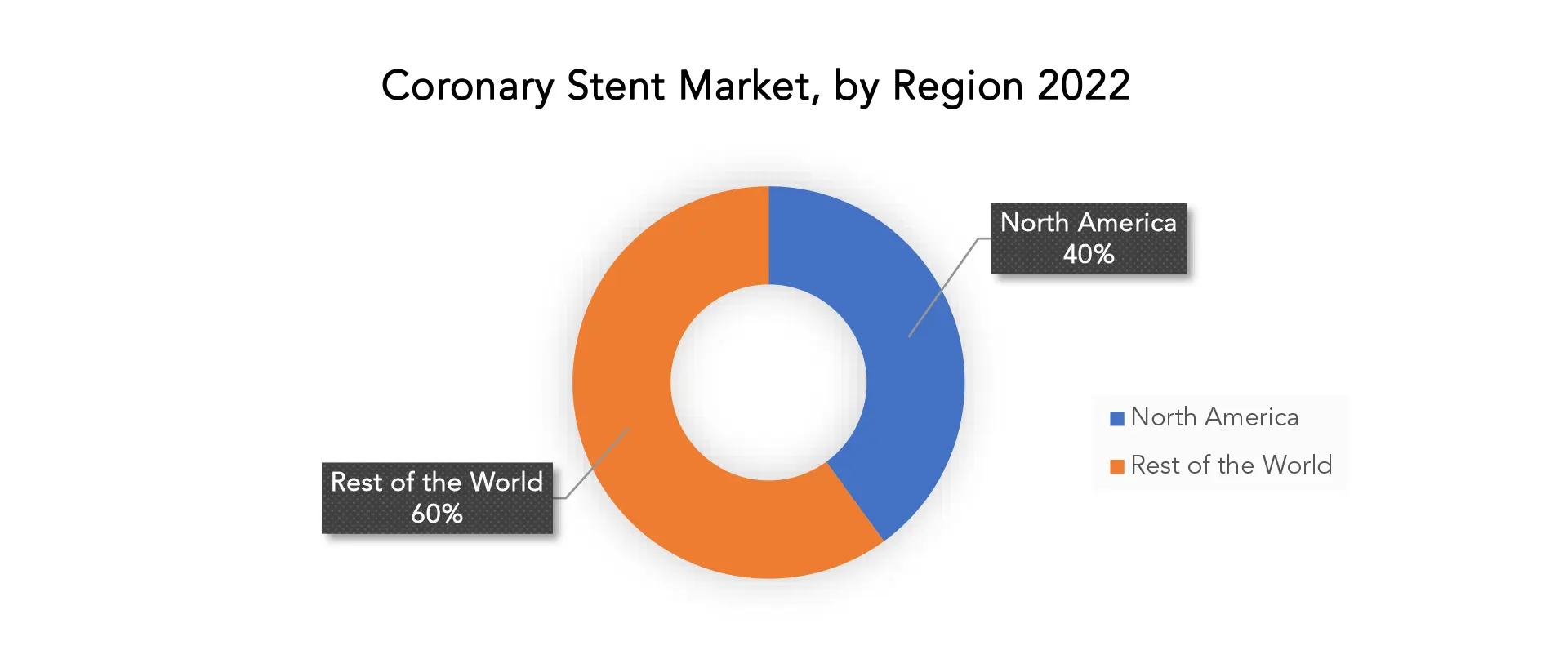

North America accounted for the largest market in the Coronary Stents market North America accounted for the 40 % market share of the global market value. North America, particularly the United States, has a comparatively high prevalence of CAD. This is often attributed to lifestyle factors, such as poor diet, sedentary lifestyles, and a high prevalence of risk factors like obesity and diabetes. The greater incidence of CAD leads to a higher demand for coronary stent actions. North America has a highly advanced and technologically advanced healthcare system. The region is home to numerous hospitals, cardiac care centers, and healthcare institutions that are outfitted with the newest medical technology, including interventional cardiology equipment for stenting procedures. The region is home to numerous research institutions and academic medical centers that conduct clinical trials related to cardiovascular diseases and stent technologies. These trials help in advancing the understanding of stent efficacy and safety.

North America, particularly the United States, has one of the highest healthcare expenditure levels in the world. This substantial healthcare spending supports the adoption of advanced medical treatments and technologies, including coronary stents. The coronary stents market in North America is highly competitive, with several major players vying for market share. This competition can drive innovation and potentially lead to improved patient outcomes. These are some factors that drives the market growth in the north America region.

Target Audience for Coronary Stents Market

- Healthcare Providers and Practitioners

- Hospitals and Healthcare Facilities

- Medical Device Manufacturers and Suppliers

- Pharmaceutical Companies

- Regulatory Authorities and Agencies

- Clinical Researchers and Scientists

- Healthcare Insurers and Payers

- Patients and Caregivers

- Academic and Research Institutions

- Healthcare Associations and Societies

- Investors and Financial Institutions

- Government and Health Policy Makers

- Medical Training and Education Providers

- Patient Advocacy Groups

- Ethical and Regulatory Review Boards

Import & Export Data for Coronary Stents Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Coronary Stents market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Coronary Stents Market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Coronary Stents trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Coronary Stents types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Coronary Stents Market Report

Coronary Stent Market by Stent Type, 2020-2030, (USD Billion), (Thousand Units)

- Drug-Eluting Stent

- Bioresorbable Stent

- Bare Metal Stent

- Covered Stent

- Others

Coronary Stent Market by Deployment, (USD Billion), (Thousand Units)

- Self-expandable

- Balloon-expandable

Coronary Stent Market by End User, (USD Billion), (Thousand Units)

- Hospitals & Ambulatory Surgical Centers

- Specialty Clinics

- Others

Coronary Stent Market by Region, 2020-2030, (USD Billion), (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Coronary Stents market over the next 7 years?

- Who are the major players in the Coronary Stents market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and africa?

- How is the economic environment affecting the Coronary Stents market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Coronary Stents market?

- What is the current and forecasted size and growth rate of the global cleanroom wipes market?

- What are the key drivers of growth in the Coronary Stents market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Coronary Stents market?

- What are the technological advancements and innovations in the Coronary Stents market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Coronary Stents market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Coronary Stents market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- CORONARY STENTS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CORONARY STENTS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- CORONARY STENTS MARKET OUTLOOK

- GLOBAL CORONARY STENTS MARKET BY STENT TYPE, 2020-2030, (USD BILLION), (THOUSAND UNITS)

- DRUG-ELUTING STENT

- BIORESORBABLE STENT

- BARE METAL STENT

- COVERED STENT

- OTHERS

- GLOBAL CORONARY STENTS MARKET BY DEPLOYMENT, 2020-2030, (USD BILLION), (THOUSAND UNITS)

- SELF-EXPANDABLE

- BALLOON-EXPANDABLE

- GLOBAL CORONARY STENTS MARKET BY END USER, 2020-2030, (USD BILLION), (THOUSAND UNITS)

- HOSPITALS & AMBULATORY SURGICAL CENTERS

- SPECIALTY CLINICS

- OTHERS

- GLOBAL CORONARY STENTS MARKET BY REGION, 2020-2030, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, STENT TYPES OFFERED, RECENT DEVELOPMENTS)

- ABBOTT LABORATORIES: A

- BOSTON SCIENTIFIC

- MEDTRONIC

- TERUMO CORPORATION

- BRAUN MELSUNGEN AG

- COOK MEDICAL

- BIOTRONIK

- MICROPORT SCIENTIFIC CORPORATION

- CORDIS CORPORATION

- BIOSENSORS INTERNATIONAL GROUP

- MERIL LIFE SCIENCE

- VASCULAR CONCEPTS

- TRANSLUMINA GMBH

- CARDINAL HEALTH

- HEXACATH

- ORBUSNEICH MEDICAL

- ALVIMEDICA

- ENDOCOR GMBH

- STENTYS

- LEPU MEDICAL TECHNOLOG*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 4 GLOBAL CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 6 GLOBAL CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 13 US CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 14 US CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 16 US CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 17 US CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 18 US CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 20 CANADA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 21 CANADA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 22 CANADA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 24 CANADA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 25 MEXICO CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 26 MEXICO CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 27 MEXICO CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 28 MEXICO CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 30 MEXICO CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 31 SOUTH AMERICA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 32 SOUTH AMERICA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 SOUTH AMERICA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 34 SOUTH AMERICA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 37 BRAZIL CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 38 BRAZIL CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 BRAZIL CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 40 BRAZIL CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 41 BRAZIL CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 42 BRAZIL CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 43 ARGENTINA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 44 ARGENTINA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 ARGENTINA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 46 ARGENTINA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 47 ARGENTINA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 48 ARGENTINA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 49 COLOMBIA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 50 COLOMBIA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 COLOMBIA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 52 COLOMBIA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 53 COLOMBIA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 54 COLOMBIA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 55 REST OF SOUTH AMERICA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 56 REST OF SOUTH AMERICA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 REST OF SOUTH AMERICA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 58 REST OF SOUTH AMERICA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 59 REST OF SOUTH AMERICA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 60 REST OF SOUTH AMERICA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 61 ASIA-PACIFIC CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 62 ASIA-PACIFIC CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 ASIA-PACIFIC CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 64 ASIA-PACIFIC CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 65 ASIA-PACIFIC CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 66 ASIA-PACIFIC CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 67 INDIA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 68 INDIA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 69 INDIA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 70 INDIA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 71 INDIA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 72 INDIA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 73 CHINA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 74 CHINA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 CHINA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 76 CHINA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 77 CHINA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 78 CHINA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 79 JAPAN CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 80 JAPAN CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 81 JAPAN CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 82 JAPAN CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 83 JAPAN CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 84 JAPAN CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 85 SOUTH KOREA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 86 SOUTH KOREA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 87 SOUTH KOREA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 88 SOUTH KOREA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 89 SOUTH KOREA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 90 SOUTH KOREA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 91 AUSTRALIA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 92 AUSTRALIA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 AUSTRALIA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 94 AUSTRALIA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 95 AUSTRALIA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 96 AUSTRALIA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH-EAST ASIA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 98 SOUTH-EAST ASIA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 99 SOUTH-EAST ASIA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 100 SOUTH-EAST ASIA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 101 SOUTH-EAST ASIA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 102 SOUTH-EAST ASIA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 103 REST OF ASIA PACIFIC CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 104 REST OF ASIA PACIFIC CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 REST OF ASIA PACIFIC CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 106 REST OF ASIA PACIFIC CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 107 REST OF ASIA PACIFIC CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 108 REST OF ASIA PACIFIC CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 109 EUROPE CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 110 EUROPE CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 111 EUROPE CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 112 EUROPE CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 113 EUROPE CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 114 EUROPE CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 115 GERMANY CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 116 GERMANY CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 117 GERMANY CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 118 GERMANY CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 119 GERMANY CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 120 GERMANY CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 121 UK CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 122 UK CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UK CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 124 UK CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 125 UK CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 126 UK CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 127 FRANCE CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 128 FRANCE CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 129 FRANCE CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 130 FRANCE CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 131 FRANCE CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 132 FRANCE CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 133 ITALY CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 134 ITALY CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 ITALY CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 136 ITALY CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 137 ITALY CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 138 ITALY CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 139 SPAIN CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 140 SPAIN CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 141 SPAIN CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 142 SPAIN CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 143 SPAIN CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 144 SPAIN CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 145 RUSSIA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 146 RUSSIA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 147 RUSSIA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 148 RUSSIA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 149 RUSSIA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 150 RUSSIA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 151 REST OF EUROPE CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 152 REST OF EUROPE CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 153 REST OF EUROPE CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 154 REST OF EUROPE CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 155 REST OF EUROPE CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 156 REST OF EUROPE CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 157 MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 158 MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 159 MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 160 MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 161 MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 162 MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 163 UAE CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 164 UAE CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 165 UAE CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 166 UAE CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 167 UAE CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 168 UAE CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 169 SAUDI ARABIA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 170 SAUDI ARABIA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 171 SAUDI ARABIA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 172 SAUDI ARABIA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 173 SAUDI ARABIA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 174 SAUDI ARABIA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 175 SOUTH AFRICA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 176 SOUTH AFRICA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 177 SOUTH AFRICA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 178 SOUTH AFRICA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 179 SOUTH AFRICA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 180 SOUTH AFRICA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 181 REST OF MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY STENT TYPE (USD BILLION) 2020-2030

TABLE 182 REST OF MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY STENT TYPE (THOUSAND UNITS) 2020-2030

TABLE 183 REST OF MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY DEPLOYMENT (USD BILLION) 2020-2030

TABLE 184 REST OF MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY DEPLOYMENT (THOUSAND UNITS) 2020-2030

TABLE 185 REST OF MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 186 REST OF MIDDLE EAST AND AFRICA CORONARY STENTS MARKET BY END USER (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CORONARY STENTS MARKET BY STENT TYPE, USD BILLION, 2020-2030

FIGURE 9 GLOBAL CORONARY STENTS MARKET BY DEPLOYMENT, USD BILLION, 2020-2030

FIGURE 10 GLOBAL CORONARY STENTS MARKET BY END USER, USD BILLION, 2020-2030

FIGURE 11 GLOBAL CORONARY STENTS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CORONARY STENTS MARKET BY STENT TYPE, USD BILLION, 2022

FIGURE 14 GLOBAL CORONARY STENTS MARKET BY DEPLOYMENT, USD BILLION, 2022

FIGURE 15 GLOBAL CORONARY STENTS MARKET BY END USER, USD BILLION, 2022

FIGURE 16 GLOBAL CORONARY STENTS MARKET BY REGION, USD BILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ABBOTT LABORATORIES: COMPANY SNAPSHOT

FIGURE 19 BOSTON SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 20 MEDTRONIC: COMPANY SNAPSHOT

FIGURE 21 TERUMO CORPORATION: COMPANY SNAPSHOT

FIGURE 22 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

FIGURE 23 BIOTRONIK: COMPANY SNAPSHOT

FIGURE 24 MICROPORT SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

FIGURE 25 CORDIS CORPORATION: COMPANY SNAPSHOT

FIGURE 26 BIOSENSORS INTERNATIONAL GROUP: COMPANY SNAPSHOT

FIGURE 27 MERIL LIFE SCIENCE: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.