REPORT OUTLOOK

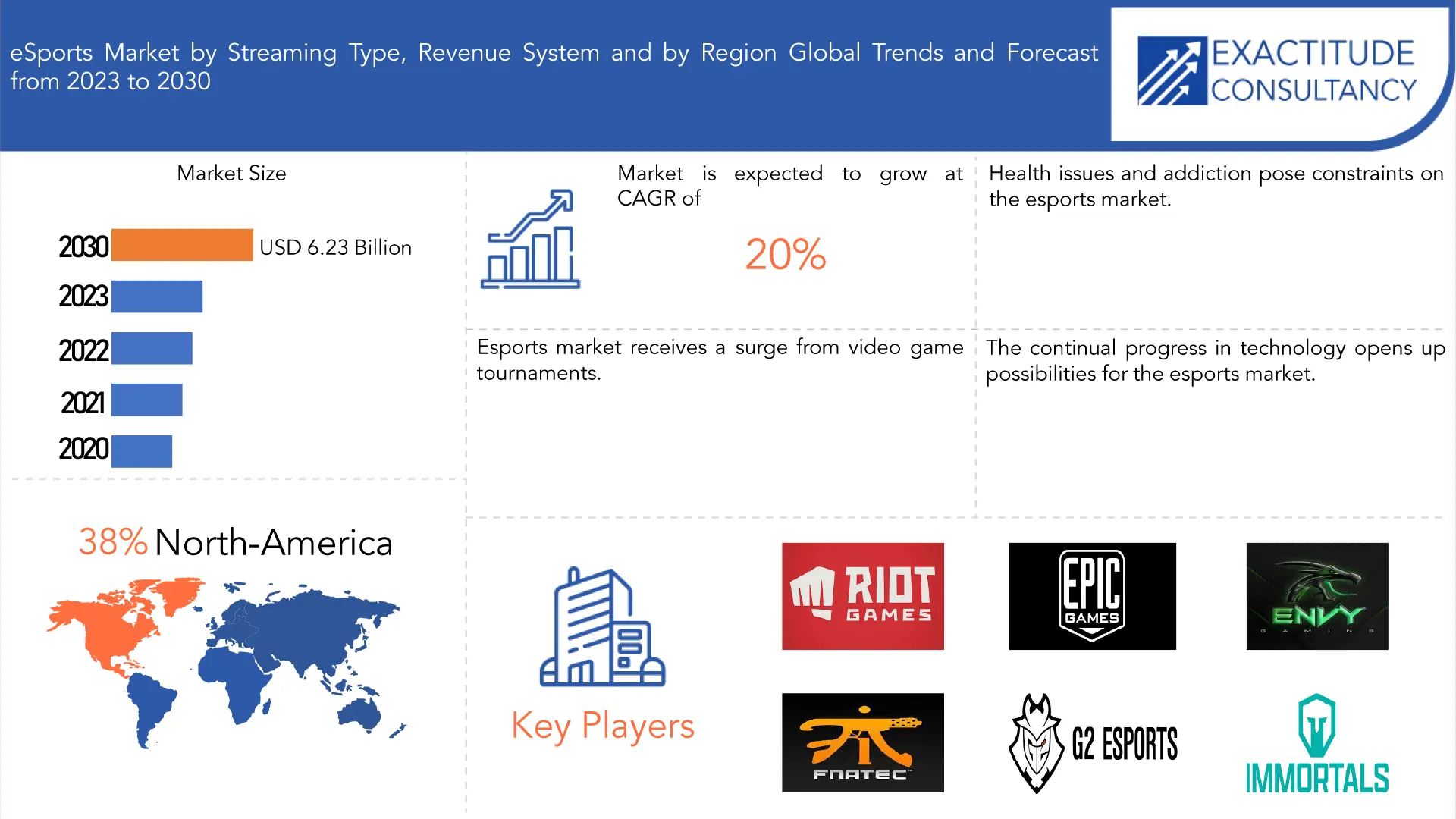

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 6.23 Billion by 2030 | 20% | North America |

| by Streaming Type | by revenue Stream | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Market Overview

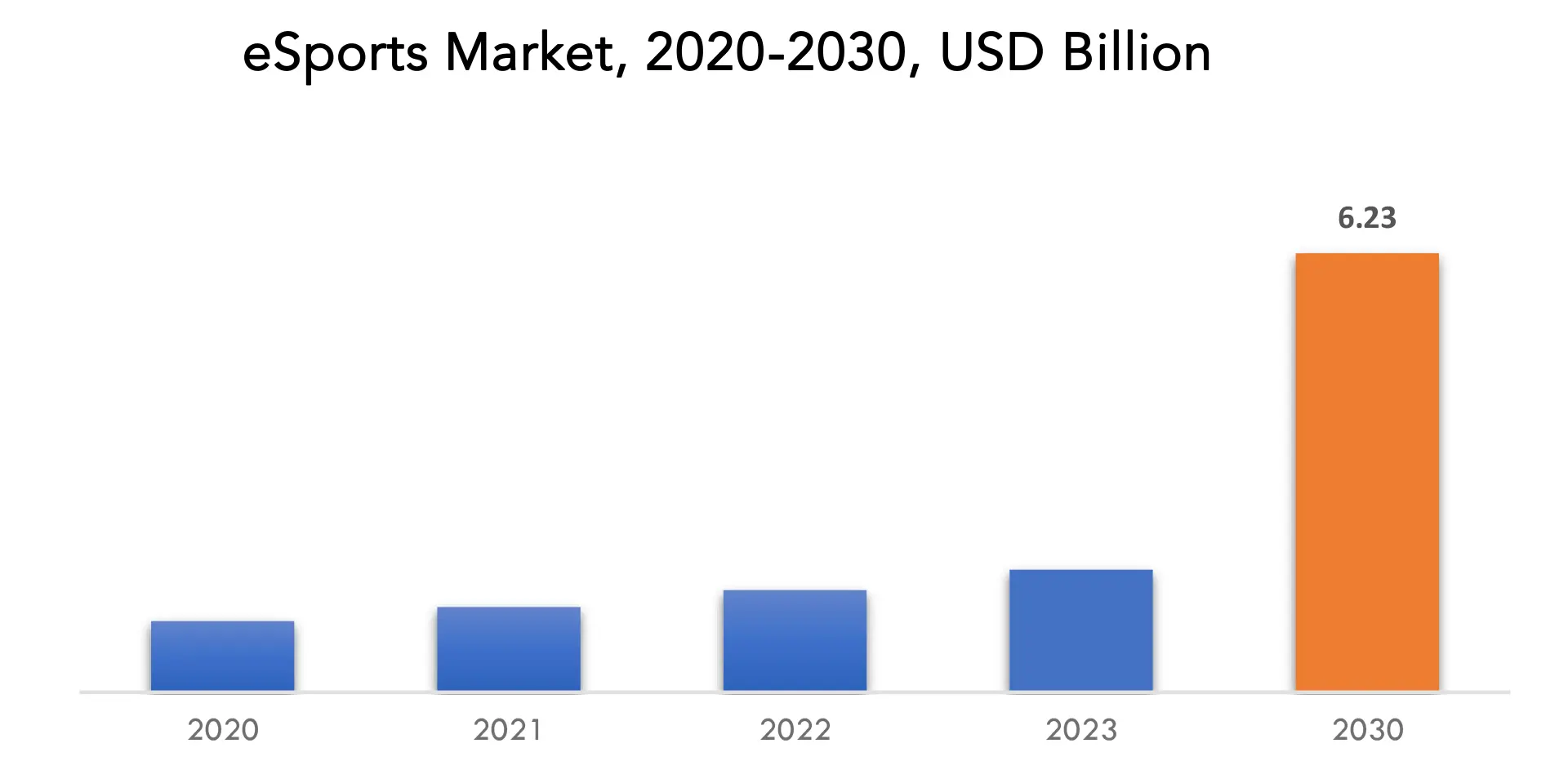

The global esports market is anticipated to grow from USD 1.45 Billion in 2022 to USD 6.23 Billion by 2030, at a CAGR of 20% during the forecast period.

Video gaming has become a highly competitive and organized industry thanks to the rapid global rise of esports, short for electronic sports. Professional players and teams compete in esports in a variety of video game genres, including online multiplayer battle arena games, first-person shooters, and real-time strategy games. Esports’ growing popularity has attracted large crowds to live events and online streaming services. Big prize pools are offered by major esports competitions like The International for Dota 2 and the League of Legends World Championship, which are comparable to traditional sports competitions. Skilled players can now make a good living playing esports thanks to sponsorships, endorsements, and media rights. The industry has also attracted investments from traditional sports teams, celebrities, and corporate sponsors. Esports’ global reach extends to millions of fans who avidly follow their favorite teams and players. Streaming platforms like Twitch and YouTube Gaming have become pivotal in broadcasting live matches, fostering a sense of community and interaction between players and viewers. The esports industry is still developing, with new game titles, infrastructure, and technology paving the way for its continued expansion and global cultural influence.

The esports market has witnessed explosive growth in recent years, transforming from a niche subculture into a mainstream entertainment phenomenon. Defined as competitive video gaming, esports involves professional players, organized competitions, and a dedicated fan base. This industry has become a global powerhouse, attracting massive investments and boasting a viewership that rivals traditional sports. The esports industry has grown significantly, and its worth has surpassed $1 billion globally. It is anticipated that the market will keep expanding quickly and set new records in the upcoming years.

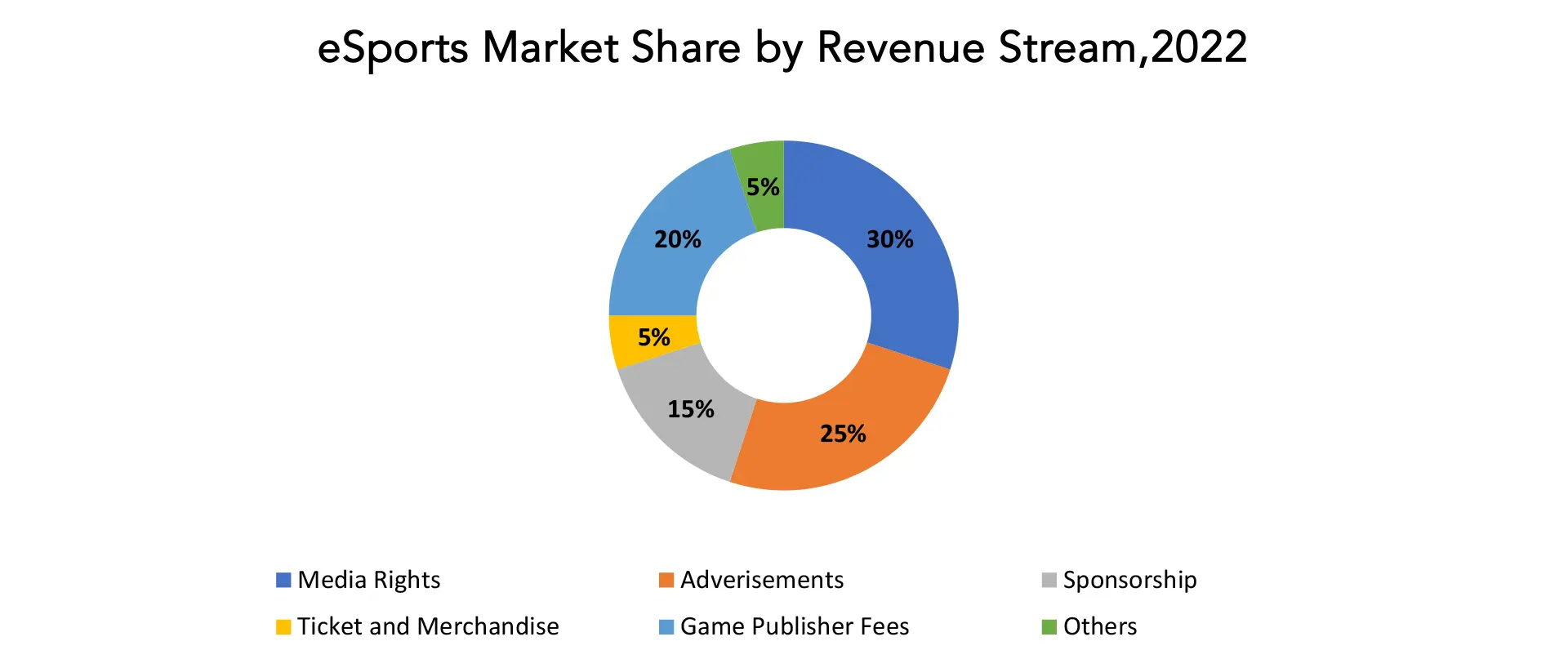

Esports generates revenue through diverse streams, including advertising, sponsorships, media rights, merchandise, and ticket sales. Brand sponsorships are a significant contributor, as companies seek to tap into the lucrative esports audience. Major tournaments and leagues secure broadcasting rights deals, further monetizing the industry. Additionally, in-game purchases, such as virtual items and skins, contribute to the revenue stream for game publishers and developers. Esports’ global appeal is evident in its widespread fan base, transcending geographical boundaries. Asia-Pacific is a hotbed for esports, with countries like South Korea, China, and Japan leading the way. North America and Europe also boast significant esports communities. The diverse player and fan base contribute to a vibrant, cosmopolitan esports culture.

The esports ecosystem has attracted substantial investments from traditional sports teams, celebrities, and venture capitalists. Recognizing the potential for growth, these investors have fueled the development of professional leagues and teams. Furthermore, major brands have entered into partnerships with esports organizations and events, solidifying the industry’s mainstream presence. The future of the esports market appears bright, with consistent expansion anticipated in a number of sectors of the business. Esports is expected to develop and adapt as new games catch people’s attention and technology advances, securing its place as a prominent player in the world of entertainment. Esports offers a vibrant and dynamic environment for spectators and participants alike as it solidifies its position alongside traditional sports.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Streaming Type, by Revenue Stream and By Region |

| By Streaming Type |

|

| By Revenue Stream |

|

| By Region |

|

eSports Market Segmentation Analysis

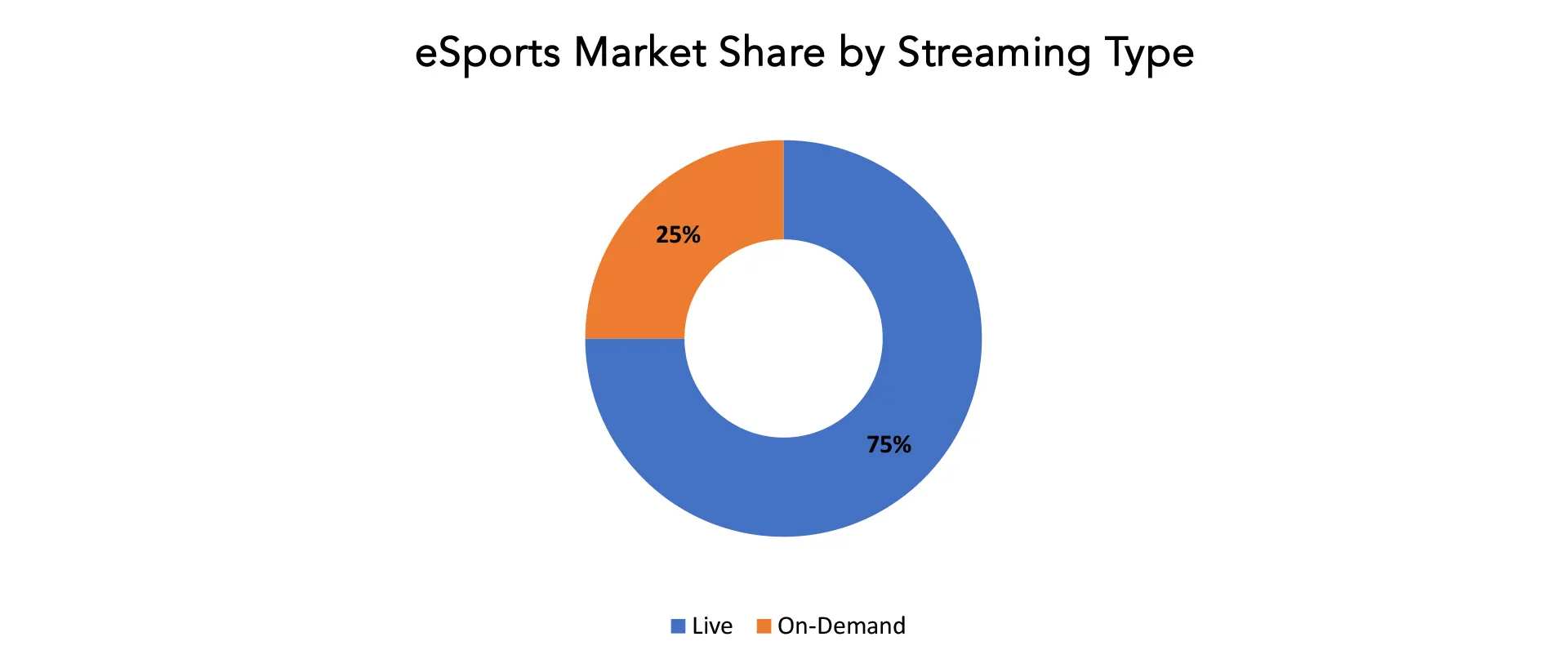

The esports system market is divided into 3 segments. By streaming type the market is bifurcated into live and on-demand. By revenue stream the market is bifurcated into media rights, advertisements, sponsorship, ticket and merchandise, game publisher fees, others.

On-demand streaming dominates the streaming type segment which has revolutionized the way we consume content, and the realm of esports is no exception. Electronic sports, or esports, have become incredibly popular worldwide, drawing millions of fans. On-demand streaming services have become essential in providing competitive gaming excitement to viewers whenever and wherever they choose, as the demand for esports content continues to soar.

The flexibility that on-demand streaming in esports provides to viewers is one of its main benefits. On-demand services, in contrast to traditional broadcasting, let fans view their preferred esports content whenever it’s convenient for them. This flexibility is crucial given the diverse global audience of esports, spanning different time zones. Viewers can now catch up on matches, tournaments, and highlights whenever they have free time, so they are no longer concerned about missing a live broadcast. An improved viewing experience is also offered by on-demand streaming. Viewers have control over their viewing experience thanks to functions like fast-forward, pause, and rewind. In the fast-paced world of esports, where pivotal moments and amazing plays happen in the blink of an eye, this is especially advantageous. Intense team battles can be replayed, gameplay analysis can be done, and viewers can learn more about the tactics used by pros. Online gaming portals such as YouTube Gaming, Twitch, and specialized esports streaming services have been essential in the development of on-demand esports content. With its extensive library of live and on-demand esports content, Twitch in particular has emerged as a major player in the streaming market. The worlds of their favorite video games are accessible to fans thanks to specialized channels for different games and esports leagues.

The on-demand nature of esports streaming also benefits the industry by extending the shelf life of content. Unlike traditional sports broadcasts that may lose relevance shortly after airing, esports content remains accessible and engaging long after the live event concludes. This extended lifespan contributes to the sustained growth and popularity of esports titles, as fans continue to discover and enjoy content from past tournaments. Content producers and esports organizations now have more ways to monetarily support their offerings thanks to on-demand streaming. In order to create a sustainable ecosystem that benefits both the streaming platforms and the content creators, platforms frequently give creators the means to monetize their work through donations, subscriptions, and advertisements. As a result, many skilled players and content creators now see esports as a potential career path. The esports ecosystem has come to rely heavily on on-demand streaming because it gives viewers unmatched flexibility and control over their viewing experience. The esports industry has reached unprecedented heights thanks to improved features, monetization opportunities, and the capacity to watch content at any time. On-demand streaming services will probably become more and more important in determining the direction of competitive gaming entertainment in the future as the demand for esports grows.

Electronic sports, or esports, have grown from a specialized subculture to a worldwide phenomenon that captivates viewers and attracts a lot of attention from media companies looking to profit from its increasing appeal. The broadcast, consumption, and financial aspects of leagues and tournaments are all shaped by the media rights landscape in esports, which has grown to be a crucial part of the business.

The unprecedented viewership figures for esports are a major factor contributing to the recent increase in media rights sales. Esports competitions draw millions of spectators from all over the globe, both virtually and physically, which appeals to broadcasters and streaming services. Big names in traditional media as well as online retailers like Twitch and YouTube have negotiated high-paying contracts to be the exclusive broadcasters of important esports competitions. These complex media rights agreements cover a wide range of platforms, including on-demand services, live streaming, and television broadcasting. Esports leagues negotiate deals that not only bring substantial revenue but also provide exposure to a broader audience. The exclusivity aspect is crucial, as it creates a competitive environment among media companies vying for the rights to broadcast prestigious tournaments, mirroring traditional sports broadcasting rights. The format of esports competitions also plays a role in shaping media rights deals. Unlike traditional sports with fixed seasons, esports tournaments are often more flexible, allowing for frequent and diverse events throughout the year. This flexibility enables media companies to offer a steady stream of content, catering to the preferences of different audiences and maintaining engagement year-round. The global nature of esports has made it a diverse and inclusive form of entertainment. Media rights agreements often involve considerations for regional broadcasting, ensuring that fans around the world can access content in their preferred languages and time zones. This approach not only broadens the reach of esports but also facilitates localized marketing and sponsorship opportunities.

Esports organizations and tournament organizers have also embraced innovative production techniques to enhance the viewing experience. Virtual reality, augmented reality, and interactive elements are integrated into broadcasts, providing a more immersive and engaging experience for the audience. Media rights agreements encompass these technological advancements, allowing broadcasters to explore and implement cutting-edge features that set esports apart from traditional sports.The monetization of esports media rights extends beyond broadcasting deals. Sponsors and advertisers recognize the potential of reaching a younger, tech-savvy demographic through esports, leading to additional revenue streams. Product placements, in-game advertising, and brand partnerships are integral components of media rights agreements, creating a symbiotic relationship between the gaming industry and corporate entities. The landscape of media rights in esports is dynamic and integral to the industry’s sustained growth. The future of the esports industry will be significantly shaped by media companies as the sport continues to draw attention from a global audience. The dynamic and flexible nature of the gaming industry is reflected in the evolution of media rights in esports, which has generated a thriving and profitable market for all parties involved.

eSports Market Trends

- Esports has attracted substantial investments from traditional sports teams, celebrities, and major corporations. Sponsorship deals have become more prevalent, with companies recognizing the potential of reaching the esports audience.

- Esports has become a global phenomenon, with a growing audience not only in traditional gaming strongholds like Asia but also in North America, Europe, and other regions. International competitions and leagues have gained popularity, contributing to the globalization of esports.

- Major broadcasters and streaming platforms have entered the esports arena, securing broadcasting rights for popular tournaments and leagues. This has led to increased visibility and accessibility of esports content to a broader audience.

- Similar to traditional sports, esports has seen the rise of franchised leagues where teams represent specific cities or regions. This model aims to create a more stable and sustainable ecosystem for both players and investors.

- The popularity of mobile esports has grown significantly, with games like PUBG Mobile, Free Fire, and Mobile Legends becoming major players in the competitive gaming scene. Mobile esports have a massive user base, making them attractive for sponsors and advertisers.

- Traditional non-endemic brands outside the gaming industry have shown increased interest in sponsoring esports events and teams. This includes partnerships with companies from sectors such as automotive, food and beverage, and fashion.

- The popularity of specific game titles can significantly impact the esports landscape. New game releases or updates to existing titles can lead to shifts in player preferences and viewership patterns.

- The production quality of esports events is always rising, and to improve the spectator experience, cutting-edge technologies like augmented reality and virtual reality are being used.

- The value of inclusion and diversity in esports is becoming increasingly recognized. Initiatives to promote greater inclusivity in the industry are in the works, as are efforts to address issues pertaining to gender diversity.

- Educational institutions are increasingly recognizing esports as a legitimate field of study. Grassroots initiatives, including local tournaments and community-building efforts, play a crucial role in nurturing talent and growing the esports ecosystem.

Competitive Landscape

The competitive landscape of the esports market is diverse and includes various players, from multinational corporations to artisanal and specialty brands.

- Riot Games

- Activision Blizzard

- Twitch

- Electronic Arts (EA)

- Tencent

- Epic Games

- Intel

- Team SoloMid

- Fnatic

- Cloud9

- Envy Gaming

- G2 Esports

- Immortals Gaming Club

- Natus Vincere

- OG (OG Esports)

- Astralis Group

- HyperX

- FACEIT

- Electronic Sports League

- DreamHack

Recent Development

- On 26th October 2022, Nike, an International sport apparel company, released its first commercial on an esport platform.

- On 2nd April 2021, Gameloft partnered with ESL Gaming, a German electronic sports production and organizer company.

- In July 2022, Twitch announced for the largest market share in 2022. The region has significant number of online gamers that is expected to drive the market growth.

Regional Analysis

Esports, or electronic sports, has emerged as a cultural phenomenon, captivating millions of enthusiasts around the world. In North America, the esports industry has experienced unprecedented growth, transforming competitive gaming into a mainstream entertainment spectacle. This rapid ascent can be attributed to various factors, including technological advancements, a burgeoning fan base, and strategic investments from both traditional sports organizations and corporate entities.

One of the key drivers behind the success of esports in North America is the region’s robust technological infrastructure. With high-speed internet connectivity and widespread access to cutting-edge gaming hardware, players and fans alike can seamlessly participate in and enjoy esports competitions. This has paved the way for the development of professional leagues and tournaments, providing a platform for skilled gamers to showcase their talent. Major cities across North America have become hubs for esports events, with arenas and venues dedicated to hosting tournaments. Iconic locations like the Staples Center in Los Angeles and the Barclays Center in Brooklyn have witnessed esports events that rival the scale and energy of traditional sports competitions. The integration of esports into these mainstream venues underscores the industry’s growing influence and appeal. North America boasts a diverse and passionate esports community. Gamers from different backgrounds and cultures come together to compete and celebrate their shared love for gaming. This inclusivity has contributed to the rise of esports as a global phenomenon, transcending geographical boundaries and fostering a sense of unity among players and fans. Traditional sports organizations in North America have recognized the potential of esports and have made strategic investments to capitalize on its popularity. Major franchises in the National Basketball Association (NBA), National Football League (NFL), and other leagues have established esports teams to compete in popular titles like League of Legends, Overwatch, and Call of Duty. This crossover between traditional sports and esports has led to increased visibility and legitimacy for competitive gaming.

Corporate sponsorship and partnerships have played a pivotal role in fueling the growth of esports in North America. Recognizing the demographic reach and engagement of esports audiences, major brands have entered into partnerships with esports teams and events. This influx of sponsorship deals has injected significant financial resources into the industry, enabling the development of professional leagues, player salaries, and high-production-value tournaments. The esports ecosystem in North America continues to evolve, with colleges and universities recognizing esports as a legitimate and competitive activity. Many educational institutions offer scholarships for talented gamers, further legitimizing esports as a viable career path. Collegiate esports leagues and tournaments have become breeding grounds for emerging talent, creating a pipeline for the professional ranks. The landscape of esports in North America is thriving, marked by technological advancements, a diverse and passionate community, strategic investments from traditional sports organizations, and corporate sponsorships. The region has become a global epicenter for competitive gaming, and the trajectory suggests continued growth and innovation in the years to come. Esports is no longer a niche subculture but a mainstream phenomenon that has firmly established itself in the fabric of North American entertainment.

Target Audience for eSports Market

- Age Range

- Tech-Savvy Individuals

- Gamer Community

- Spectators and Fans

- Global Audience

- Male and Female Participants

- Urban and Online Presence

- Social Media Users

- Crossover with Traditional Sports Fans

- Advertisers and Sponsors

Import & Export Data for esports Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the esports market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global esports market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the eSports Market Report

eSports Market by Streaming Type, 2020-2030, USD Billion

- Live

- On-Demand

eSports Market by revenue Stream, 2020-2030, USD Billion

- Media Rights

- Advertisements

- Sponsorships

- Ticket and Merchandise

- Game Publisher Fees

- Others

eSports Market by Region 2020-2030, USD Billion

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the esports market over the next 7 years?

- Who are the major players in the esports market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the esports market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the esports system market?

- What is the current and forecasted size and growth rate of the esports market?

- What are the key drivers of growth in the esports market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the esports market?

- What are the technological advancements and innovations in the esports market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the esports market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the esports market?

- What are the products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ESPORTS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ESPORTS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ESPORTS MARKET OUTLOOK

- GLOBAL ESPORTS MARKET BY STREAMING TYPE, 2020-2030, (USD BILLION)

- LIVE

- ON-DEMAND

- GLOBAL ESPORTS MARKET BY REVENUE STREAM, 2020-2030, (USD BILLION)

- MEDIA RIGHTS

- ADVERTISEMENTS

- SPONSORSHIP

- TICKET AND MERCHANDISE

- GAME PUBLISHER FEES

- OTHERS

- GLOBAL ESPORTS MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, STREAMING TYPES OFFERED, RECENT DEVELOPMENTS)

- RIOT GAMES

- ACTIVISION BLIZZARD

- TWITCH

- ELECTRONIC ARTS (EA)

- TENCENT

- EPIC GAMES

- INTEL

- TEAM SOLOMID

- FNATIC

- CLOUD9

- ENVY GAMING

- G2 ESPORTS

- IMMORTALS GAMING CLUB

- NATUS VINCERE

- OG (OG ESPORTS)

- ASTRALIS GROUP

- HYPERX

- FACEIT

- ELECTRONIC SPORTS LEAGUE

- DREAMHACK

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 2 GLOBAL ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL ESPORTS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA ESPORTS MARKET BY COUNTRY (USD BILLION)

2020-2030

TABLE 5 NORTH AMERICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 7 US ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 8 US ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 9 CANADA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 10 CANADA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 11 MEXICO ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 12 MEXICO ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA ESPORTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA ESPORTSMARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 16 BRAZIL ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 17 BRAZIL ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 18 ARGENTINA ESPORTSMARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 19 ARGENTINA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 20 COLOMBIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 21 COLOMBIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC ESPORTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 27 INDIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 28 INDIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 29 CHINA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 30 CHINA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 31 JAPAN ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 32 JAPAN ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA ESPORTSMARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 41 EUROPE ESPORTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 43 EUROPE ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 44 GERMANY ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 45 GERMANY ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 46 UK ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 47 UK ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 48 FRANCE ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 49 FRANCE ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 50 ITALY ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 51 ITALY ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 52 SPAIN ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 53 SPAIN ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 54 RUSSIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 55 RUSSIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA ESPORTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 61 UAE ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 62 UAE ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA ESPORTS MARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA ESPORTSMARKET BY REVENUE STREAM (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA ESPORTS MARKET BY STREAMING TYPE (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ESPORTS MARKET BY REVENUE STREAM USD BILLION, 2020-2030

FIGURE 9 GLOBAL ESPORTS MARKET BY STREAMING TYPE, USD BILLION, 2020-2030

FIGURE 10 GLOBAL ESPORTS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ESPORTS MARKET BY REVENUE STREAM, USD BILLION 2022

FIGURE 13 GLOBAL ESPORTS MARKET BY STREAMING TYPE, USD BILLION 2022

FIGURE 14 GLOBAL ESPORTS MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 RIOT GAMES: COMPANY SNAPSHOT

FIGURE 17 ACTIVISION BLIZZARD: COMPANY SNAPSHOT

FIGURE 18 TWITCH: COMPANY SNAPSHOT

FIGURE 19 ELECTRONIC ARTS (EA): COMPANY SNAPSHOT

FIGURE 20 TENCENT: COMPANY SNAPSHOT

FIGURE 21 EPIC GAMES: COMPANY SNAPSHOT

FIGURE 22 INTEL: COMPANY SNAPSHOT

FIGURE 23 TEAM SOLOMID: COMPANY SNAPSHOT

FIGURE 24 FNATIC: COMPANY SNAPSHOT

FIGURE 25 CLOUD9: COMPANY SNAPSHOT

FIGURE 26 ENVY GAMING: COMPANY SNAPSHOT

FIGURE 27 G2 ESPORTS: COMPANY SNAPSHOT

FIGURE 28 IMMORTALS GAMING CLUB: COMPANY SNAPSHOT

FIGURE 29 NATUS VINCERE: COMPANY SNAPSHOT

FIGURE 30 OG (OG ESPORTS): COMPANY SNAPSHOT

FIGURE 31 ASTRALIS GROUP: COMPANY SNAPSHOT

FIGURE 32 HYPERX: COMPANY SNAPSHOT

FIGURE 33 FACEIT: COMPANY SNAPSHOT

FIGURE 34 ELECTRONIC SPORTS LEAGUE: COMPANY SNAPSHOT

FIGURE 35 DREAMHACK: COMPANY SNAPSHOT

FAQ

The global esports market is anticipated to grow from USD 1.45 Billion in 2022 to USD 6.23 Billion by 2030, at a CAGR of 20% during the forecast period.

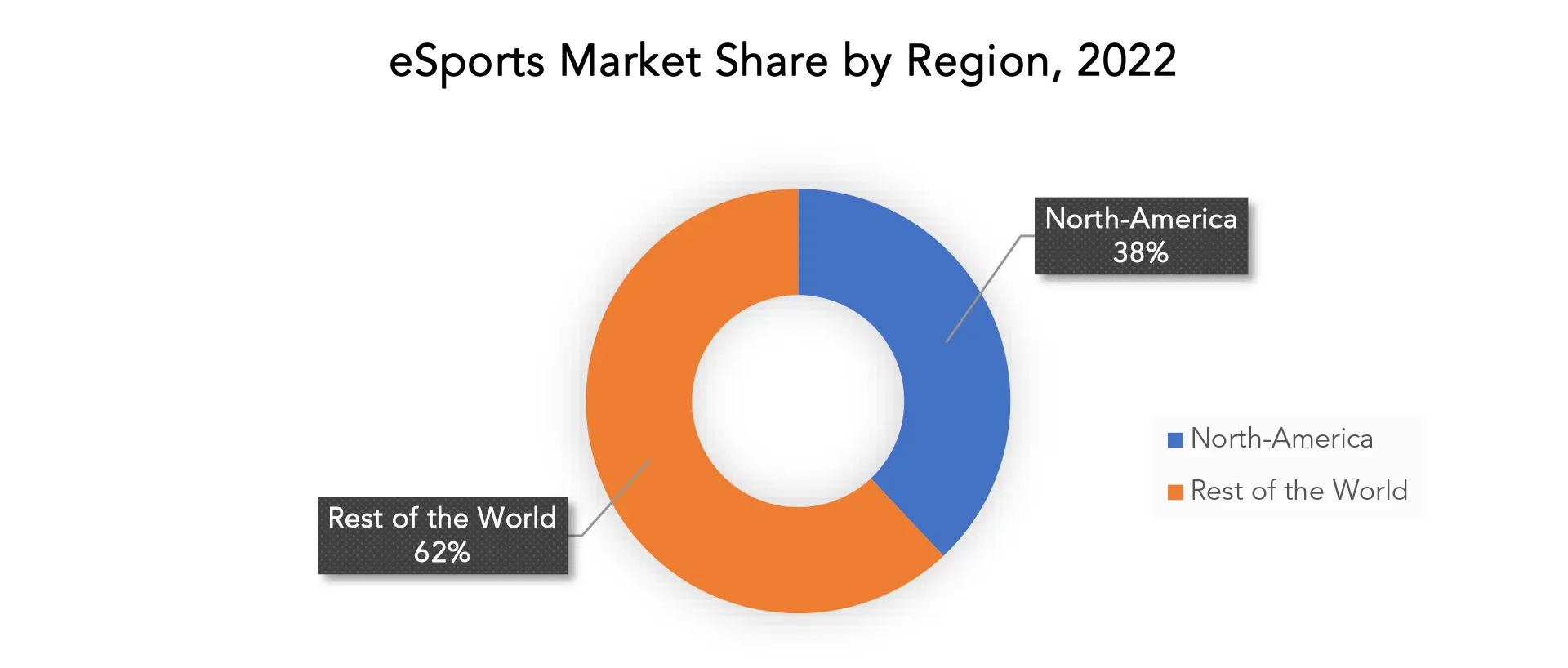

North-America accounted for the largest market in the esports market. North-America accounted for the 38% percent market share of the global market value.

Riot Games, Activision Blizzard, Twitch, Electronic Arts (EA), Tencent, Epic Games, Intel, Team SoloMid, Fnatic, Cloud9, Envy Gaming, G2 Esports, Immortals Gaming Club, Natus Vincere, OG (OG Esports), Astralis Group, HyperX, FACEIT, Electronic Sports League, DreamHack are some of the major key players in the esports market.

The esports market presents immense opportunities driven by a global surge in online gaming. With a growing fan base, sponsorship deals, and media rights, the market offers diverse revenue streams. Brands are capitalizing on the demographic diversity of esports audiences, targeting tech-savvy youth. Furthermore, the rise of mobile gaming and virtual reality opens new avenues for engagement. Esports betting is gaining traction, creating a lucrative industry within the ecosystem. As traditional sports teams invest in esports franchises, the convergence of sports and gaming amplifies market potential. In essence, the esports market is a dynamic landscape ripe for innovation, investment, and strategic partnerships.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.