REPORT OUTLOOK

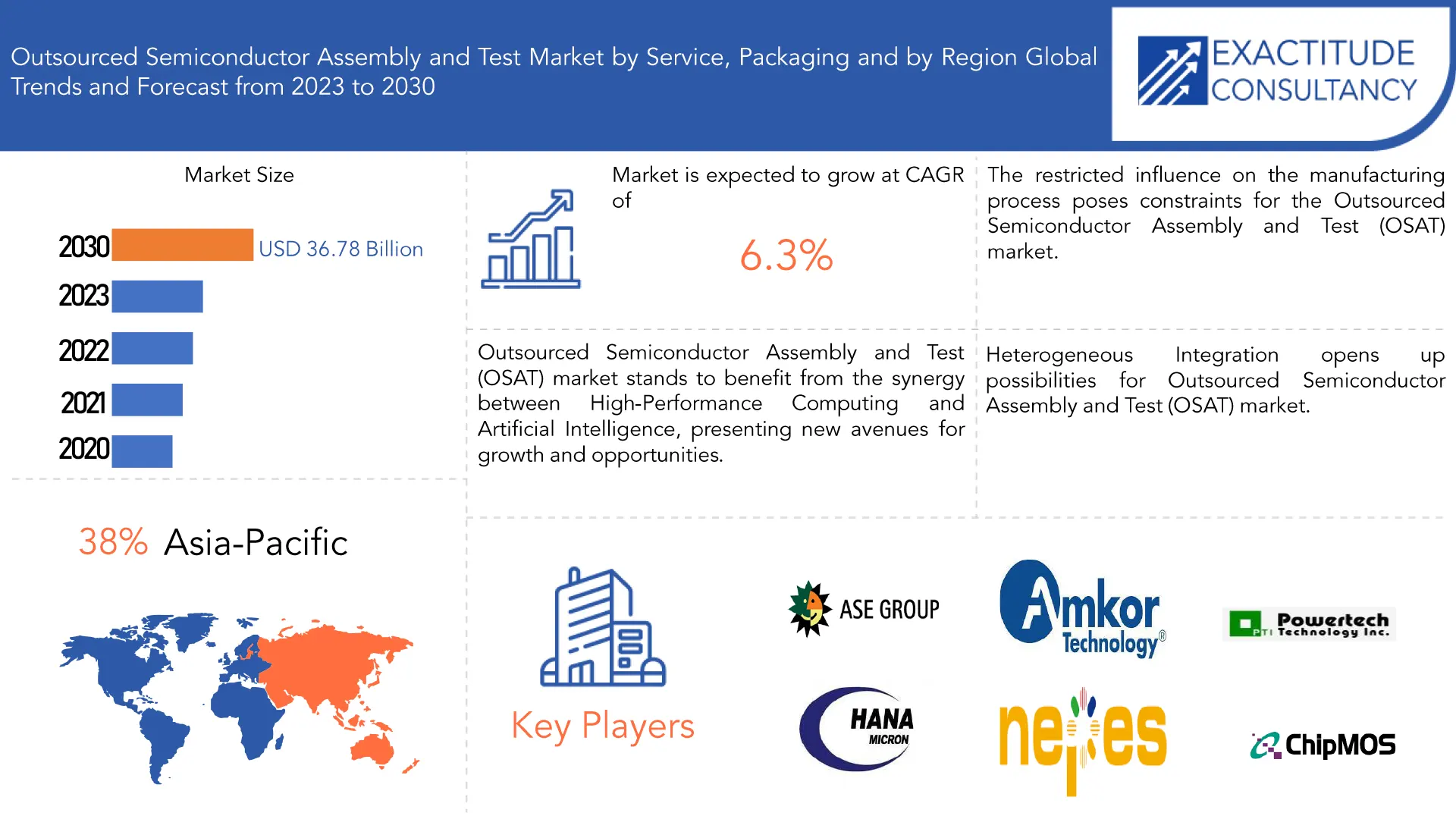

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 59.96 Billion by 2030 | 6.3 % | Asia-Pacific |

| by Service | by Packaging | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Outsourced Semiconductor Assembly and Test (OSAT) Market Overview

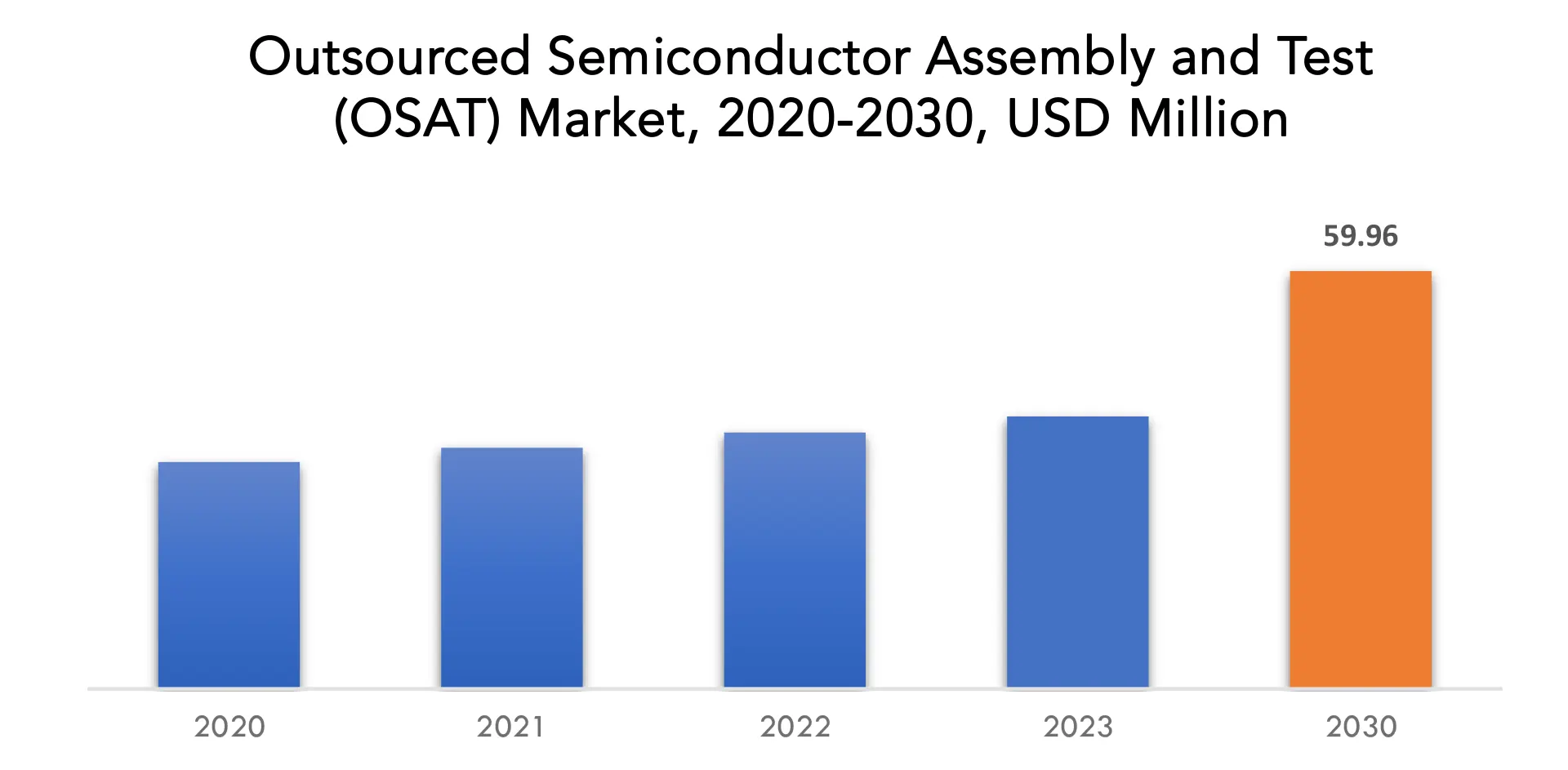

The global Outsourced Semiconductor Assembly and Test (OSAT) market is anticipated to grow from USD 36.78 Billion in 2022 to USD 59.96 Billion by 2030, at a CAGR of 6.3 % during the forecast period.

A vital sector of the semiconductor industry, Outsourced Semiconductor Assembly and Test (OSAT) is responsible for producing and delivering integrated circuits (ICs) that satisfy the ever-increasing demands of electronic devices. OSAT companies are experts in the assembly, packaging, and testing processes that are involved in the last stages of semiconductor manufacturing.In the assembly phase, OSAT firms encapsulate semiconductor dies into packages, providing protection and connectivity for the IC. Packaging is a crucial step that influences the performance, reliability, and form factor of the final product. OSAT companies leverage advanced technologies to ensure precise and efficient assembly. After assembly, the packaged integrated circuits are put through a rigorous testing process to find and fix flaws, guaranteeing the best possible quality and dependability. OSAT facilities conduct functional, electrical, and thermal tests in accordance with industry standards using cutting-edge tools and techniques. OSAT is becoming a crucial component of the global semiconductor supply chain as the industry continues to change quickly. To take advantage of OSAT providers’ specialized knowledge, cut expenses, and shorten the time it takes for new electronic devices to reach the market, semiconductor companies frequently contract out assembly and testing to them.The strategic role of OSAT in delivering high-performance, reliable semiconductor products underscores its significance in the modern electronics ecosystem.

The Outsourced Semiconductor Assembly and Test (OSAT) market play a crucial role in the semiconductor industry by providing essential services in the final stages of semiconductor manufacturing. Due to the growing complexity of semiconductor devices and the need for sophisticated packaging solutions, this market has experienced tremendous growth and change in recent years.

The OSAT market is a crucial link in the larger semiconductor supply chain, helping to produce semiconductor devices more effectively and economically. It covers a broad range of services, such as semiconductor testing, assembly, and packaging. Prior to semiconductor devices being used by end users, these services are essential for guaranteeing their performance, dependability, and functionality.The quick development of semiconductor technology is one of the main forces behind the OSAT market. The need for advanced packaging and testing solutions has increased as semiconductor devices get smaller, more powerful, and more complex. OSAT firms are experts at tackling these problems, providing cutting-edge packaging solutions like wafer-level packaging, system-in-package (SiP), and 3D packaging to satisfy the sector’s changing needs. The OSAT market has expanded due in part to the increased demand for high-tech devices such as automotive electronics and consumer electronics on a global scale. Because these sectors demand semiconductors that are smaller, more dependable, and efficient, OSAT companies are essential to making advanced electronic devices possible. The demand for advanced packaging and testing solutions has increased due to the growth of the Internet of Things (IoT) and the proliferation of smart devices. The OSAT industry is dominated by a small number of powerful players, and the market has grown extremely competitive. These businesses provide a broad range of services, ranging from conventional packaging and testing to more sophisticated options made for particular uses. Innovation and efficiency in the industry have been spurred by competition, resulting in the creation of new testing procedures and packaging technologies.

The Outsourced Semiconductor Assembly and Test market is a vital component of the semiconductor industry, providing essential services in packaging, assembly, and testing. The market has experienced significant growth driven by technological advancements, increasing demand for advanced packaging solutions, and the proliferation of electronic devices. As the semiconductor landscape continues to evolve, the OSAT market is poised to play a pivotal role in shaping the future of semiconductor manufacturing.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million) (Thousand Units) |

| Segmentation | By Type, by Application and By Region |

| By Service |

|

| By Application |

|

| By Region

|

|

Outsourced Semiconductor Assembly and Test (OSAT) Market Segmentation Analysis

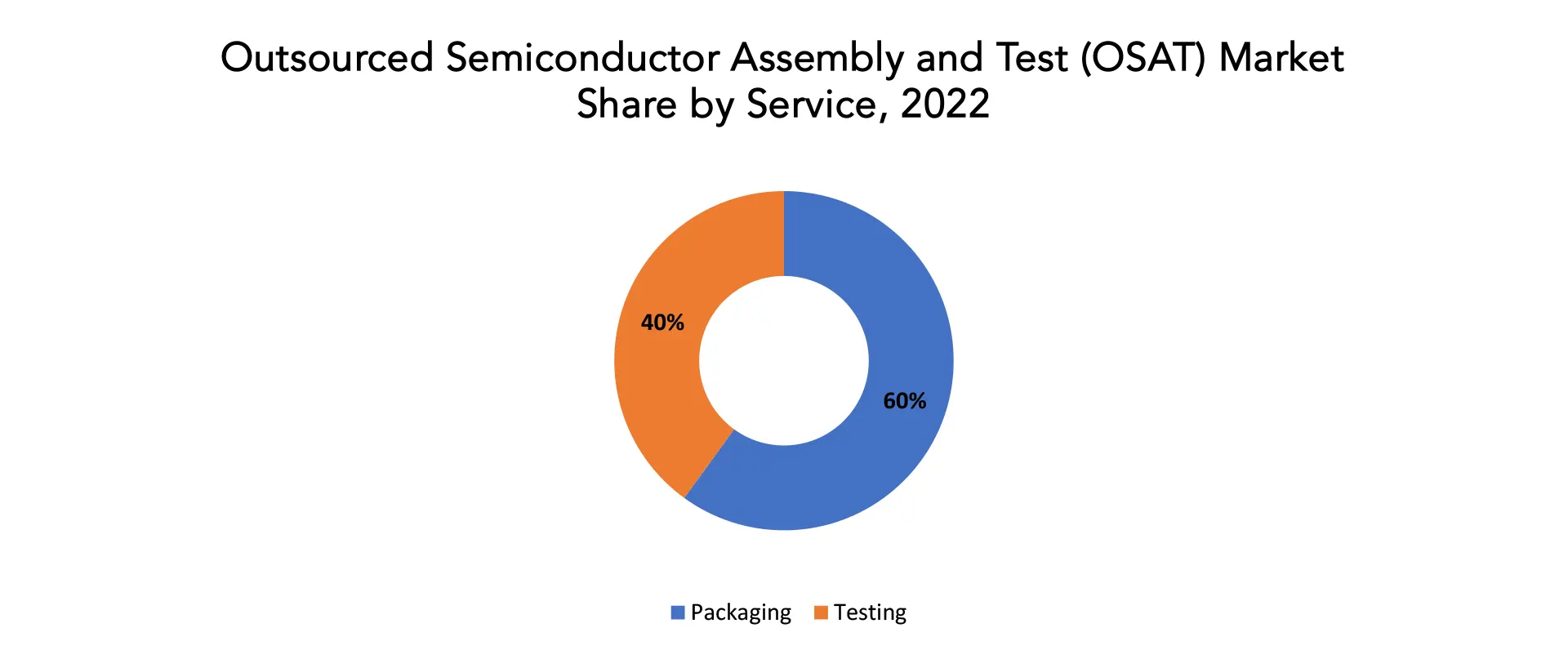

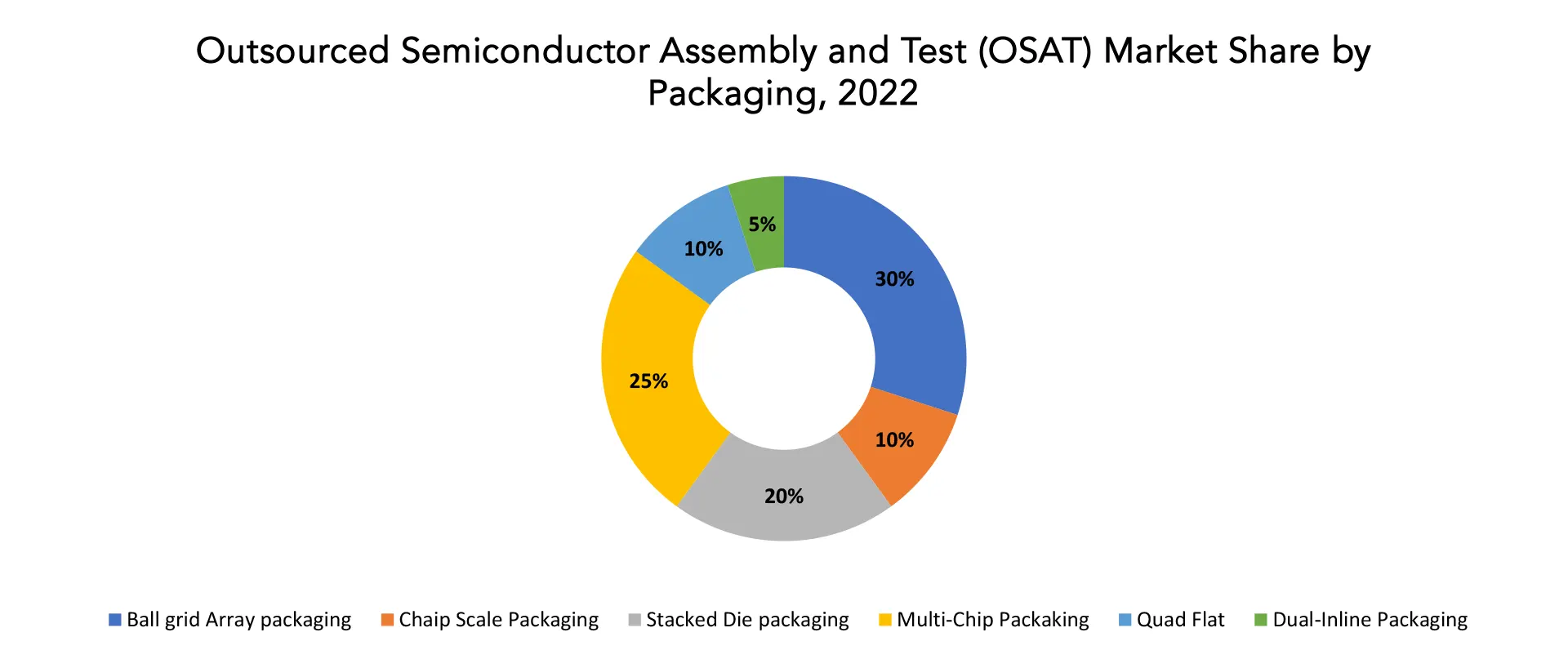

The outsourced semiconductor assembly and test (OSAT) market is divided into 3 segments. By service the market is bifurcated into packaging and testing. By packaging the market is bifurcated into ball grid array packaging, chip scale packaging, stacked die packaging, multi-chip packaging, quad flat and dual-incline packaging.

Based on service, packaging dominates the outstanding semiconductor assembly and test market. as it offers vital services during the last phases of semiconductor manufacturing, Outsourced Semiconductor Assembly and Test, or OSAT, is a key player in the semiconductor industry. Enclosing the semiconductor die in a functional and protective package during packaging is an essential step in the production process that guarantees dependability, performance, and simplicity of integration into electronic devices. It is impossible to overstate the significance of effective and dependable packaging given that semiconductor manufacturers are depending more and more on OSAT suppliers for packaging services.

One of the primary functions of OSAT in packaging is to encapsulate the semiconductor die to protect it from environmental factors, mechanical stress, and to provide a platform for electrical connections. The packaging process involves various steps, including die attach, wire bonding, encapsulation, and final testing. OSAT companies leverage their expertise and specialized equipment to perform these tasks with precision, meeting the stringent requirements of the semiconductor industry. Die attach is a crucial step where the semiconductor die is bonded to the package substrate. OSAT companies utilize advanced techniques such as flip-chip bonding or wire bonding to establish electrical connections between the die and the package. This step requires precision and attention to detail to ensure proper alignment and minimal thermal resistance. Wire bonding, another integral aspect of packaging, involves connecting the semiconductor die to the package leads using fine wires. OSAT providers employ automated wire bonding equipment capable of handling the miniaturized dimensions of modern semiconductor devices. The choice of wire material and bonding techniques is critical in determining the electrical and thermal performance of the packaged semiconductor. Encapsulation, or molding, is the process of covering the semiconductor die and wire bonds with a protective material. This material provides mechanical strength, environmental protection, and thermal dissipation. OSAT companies employ various encapsulation materials, such as epoxy or mold compounds, and use precision molding techniques to ensure a secure and uniform encapsulation. Final testing is the last stage in the packaging process, where OSAT providers assess the functionality and reliability of the packaged semiconductor. This involves electrical testing to verify proper connections, functionality testing to ensure the semiconductor operates as intended, and reliability testing to assess long-term performance under various conditions.

The significance of OSAT in packaging lies in its ability to streamline the semiconductor manufacturing process. By outsourcing packaging to specialized providers, semiconductor manufacturers can focus on core competencies such as design and fabrication. OSAT companies help the semiconductor industry achieve better overall efficiency, lower costs, and faster time-to-market thanks to their specialized knowledge and cutting-edge facilities. Electronic device performance and dependability are greatly impacted by the crucial process of semiconductor packaging. Outsourced Semiconductor Assembly and Test (OSAT) providers play a vital role in this process, offering specialized services to semiconductor manufacturers. Through precise die attach, wire bonding, encapsulation, and final testing, OSAT companies contribute to the success of the semiconductor industry by ensuring the timely delivery of reliable and high-performance packaged semiconductor devices.

Ball Grid Array (BGA) packaging plays a pivotal role in the field of semiconductor assembly and testing, and Outsourced Semiconductor Assembly and Test (OSAT) companies are crucial players in this process. BGA packaging has become increasingly popular due to its numerous advantages, such as improved electrical performance, higher pin counts, and enhanced thermal characteristics. OSAT companies specialize in providing semiconductor packaging and testing services, offering a range of solutions to meet the demanding requirements of modern electronic devices.

In BGA packaging, solder balls are arranged in a grid pattern on the bottom of the package, a type of surface-mount technology. The printed circuit board (PCB) and integrated circuit (IC) are connected by means of these solder balls. BGA packages are perfect for applications with limited space and high performance requirements, like consumer electronics, telecommunications, and automotive systems, because of their compact design, which enables a higher density of interconnects. OSAT businesses are essential to the semiconductor supply chain because they offer specialized packaging and testing services. As the complexity of semiconductor devices continues to increase, semiconductor manufacturers often choose to outsource these critical stages of the production process to OSAT providers. Outsourcing enables semiconductor companies to focus on core competencies like design and fabrication while relying on the expertise of OSAT firms for packaging and testing.

One of the key advantages of outsourcing BGA packaging to OSAT companies is cost-effectiveness. OSAT suppliers use advanced equipment, advanced manufacturing processes, and economies of scale to achieve cost efficiencies that may be difficult for individual semiconductor companies to match internally. This enables producers of semiconductors to lower their overall production costs while upholding strict testing and packaging guidelines. OSAT providers provide a large selection of packaging choices to meet the various needs of their clients.They can handle various package types, including BGA, chip-on-board (COB), quad flat package (QFP), and more. Due to this flexibility, semiconductor makers can select the packaging option that best suits their particular applications, guaranteeing optimum performance and dependability. In order to meet the high standards required by the semiconductor industry, OSAT companies heavily invest in cutting-edge testing and inspection technologies. They perform rigorous tests to identify and eliminate defects, ensuring that the packaged semiconductor devices meet the specified performance criteria. This commitment to quality is crucial in meeting the stringent requirements of industries such as aerospace, medical devices, and automotive electronics.

Outsourced Semiconductor Assembly and Test (OSAT) Market Trends

- The growing need for semiconductor devices across a range of industries, including consumer electronics, automotive, healthcare, and industrial applications, has led to growth in the OSAT market.

- There has been a shift towards advanced packaging technologies, including 2.5D and 3D packaging. These technologies enable higher performance, better power efficiency, and smaller form factors, meeting the requirements of modern electronic devices.

- The rollout and expansion of 5G networks worldwide have driven demand for semiconductors, contributing to the growth of the OSAT market. The increased complexity of 5G devices often requires advanced packaging solutions.

- The proliferation of AI and edge computing applications has led to an increased demand for specialized semiconductor solutions. OSAT providers are adapting to the requirements of these emerging technologies.

- Heterogeneous integration, which involves combining different types of semiconductor devices on a single package, has gained traction. This trend aims to address the performance and efficiency requirements of diverse applications.

- There is an increasing focus on sustainability and environmental considerations in semiconductor manufacturing. OSAT companies are exploring ways to reduce the environmental impact of their processes and packaging materials.

- The semiconductor industry, including OSAT providers, has faced challenges related to supply chain disruptions, particularly in the context of geopolitical tensions, natural disasters, and the global chip shortage.

- Some companies have been reevaluating their supply chain strategies, considering reshoring or regionalizing certain aspects of semiconductor manufacturing and testing to reduce risks associated with global supply chain disruptions.

- To meet the growing demand for semiconductor devices, many OSAT companies have invested in expanding their production capacity and upgrading their facilities.

Competitive Landscape

The competitive landscape of the Outsourced Semiconductor Assembly and Test (OSAT) Market is diverse and includes various players, from multinational corporations to artisanal and specialty brands.

- ASE Group

- Amkor Technology

- Powertech Technology Inc. (PTI)

- STATS ChipPAC

- ChipMOS Technologies

- UTAC (United Test and Assembly Center)

- Siliconware Precision Industries Co., Ltd.

- Jiangsu Changjiang Electronics Technology Co., Ltd. (JCET)

- Chipbond Technology Corporation

- Lingsen Precision Industries Ltd.

- King Yuan Electronics (KYEC)

- Hana Micron

- Walton Advanced Engineering Inc.

- Tianshui Huatian Technology Co., Ltd.

- Shanghai Huali Microelectronics Corporation (HLMC)

- Pulse Electronics

- Nepes Corporation

- Signetics

- FormFactor, Inc.

- China Wafer Level CSP Co., Ltd. (CWLCSP)

- SpaceX

Recent Development

- On 19th January 2023, SpaceX launched two satellites for the U.S. Space Force on their Falcon Heavy rocket and 51 Starlink broadband satellites into low-Earth orbit. This achievement is contributing significantly to the growth of OSAT companies, as it addresses the escalating need for high-speed internet, reliable communication and various satellite-dependent services.

- In November 2022, Advanced Semiconductor Engineering Inc. expanded its operations in Malaysia by building a new semiconductor assembly and testing plant in Penang. This strategic expansion helped expand ASE’s production capacity, enabling them to meet the growing demands of the semiconductor industry.

Regional Analysis

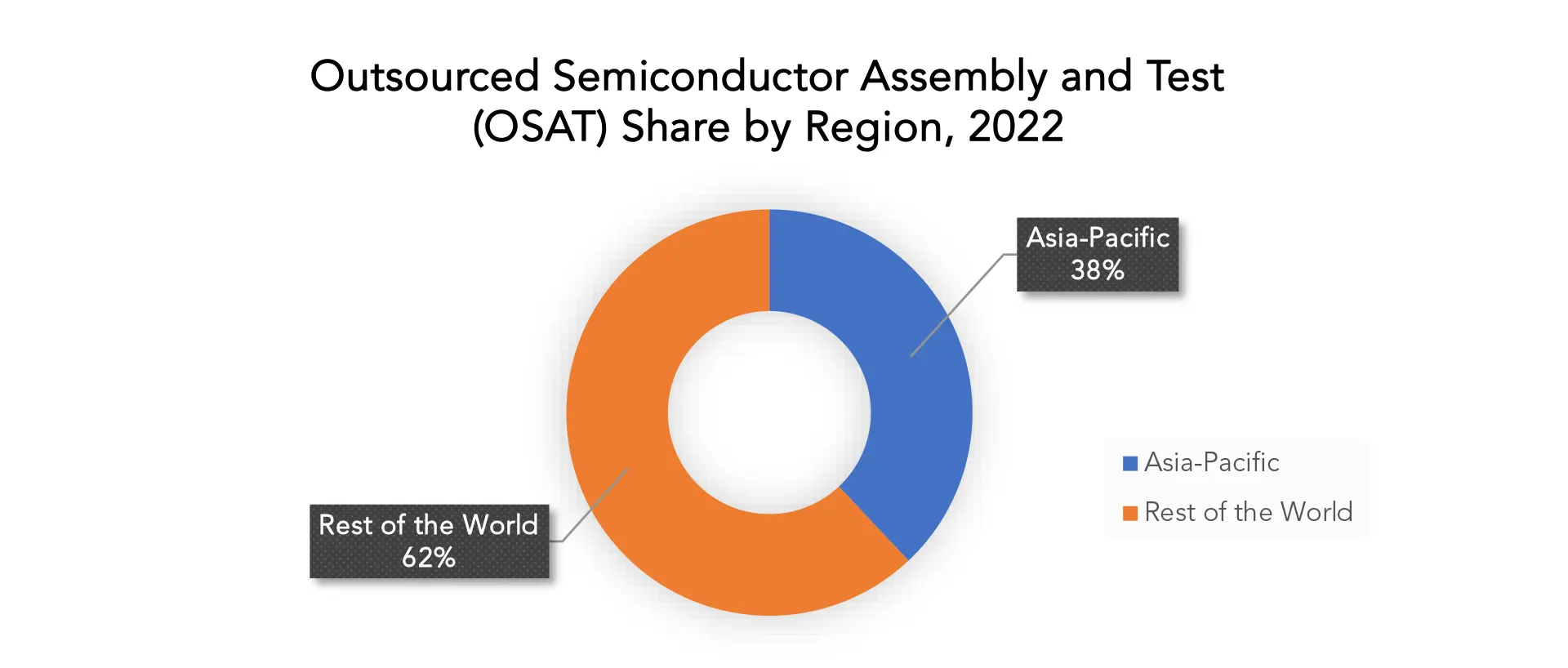

The Asia-Pacific region has emerged as a global hub for Outsourced Semiconductor Assembly and Test (OSAT) services, playing a pivotal role in the semiconductor industry’s value chain. OSAT providers in the region offer crucial services in packaging and testing, enabling semiconductor companies to focus on design and fabrication while outsourcing the assembly and testing phases.

One of the key factors driving the growth of OSAT in the Asia-Pacific region is the presence of major semiconductor manufacturing hubs, particularly in countries like Taiwan, China, South Korea, and Singapore. These countries have become integral to the global semiconductor supply chain, with a significant concentration of semiconductor companies and facilities. Taiwan, in particular, has established itself as a prominent player in the OSAT sector. The island nation is home to several leading OSAT companies that provide a wide range of packaging and testing services. The close proximity of these OSAT facilities to major semiconductor foundries allows for efficient and timely collaboration between different stages of the semiconductor manufacturing process. China has also made substantial strides in the OSAT industry, leveraging its position as a major consumer of semiconductors and striving to enhance its capabilities in semiconductor manufacturing. The Chinese government has actively supported the development of a robust semiconductor ecosystem, encouraging investments in OSAT facilities and technology development. South Korea, with its strong focus on technology and innovation, hosts several key OSAT players that contribute significantly to the region’s semiconductor landscape. Korean OSAT companies are known for their advanced packaging and testing solutions, catering to the diverse needs of semiconductor manufacturers. Singapore, a hub for high-tech industries, has also become a key player in the Asia-Pacific OSAT market. The country’s strategic location, well-developed infrastructure, and supportive business environment have attracted OSAT companies looking to establish a strong presence in the region.

The region’s OSAT industry plays a crucial role in addressing the growing complexities and challenges in semiconductor manufacturing. As semiconductor devices become more sophisticated, the demand for specialized packaging and testing solutions continues to rise. Asia-Pacific OSAT providers are well-positioned to meet these demands, providing semiconductor companies with the expertise and resources needed to bring cutting-edge products to market. The Asia-Pacific region has solidified its position as a powerhouse in the Outsourced Semiconductor Assembly and Test sector. With a concentration of leading OSAT companies and a commitment to innovation, the region continues to drive the growth and advancement of the global semiconductor industry. The collaborative ecosystem, strong infrastructure, and technological expertise make the Asia-Pacific OSAT market a vital component of the broader semiconductor supply chain. The Asia-Pacific OSAT industry is characterized by its adaptability and agility, allowing it to meet the evolving demands of the semiconductor market. OSAT providers in the region continuously invest in research and development to stay at the forefront of technological advancements in packaging and testing. This commitment to innovation has enabled them to offer a diverse array of services, from traditional packaging methods to advanced technologies like fan-out wafer-level packaging (FOWLP) and system-in-package (SiP).

Target Audience for Outsourced Semiconductor Assembly and Test (OSAT) Market

- Semiconductor Companies

- Original Equipment Manufacturers (OEMs)

- Electronics Manufacturing Services (EMS) Providers

- Investors and Financial Institutions

- Technology Analysts and Researchers

- Government Agencies and Regulators

- Academic and Research Institutions

- Supply Chain and Logistics Professionals

- Consumers

Import & Export Data for Outsourced Semiconductor Assembly and Test (OSAT) Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the outsourced semiconductor assembly and test (OSAT) market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global outsourced semiconductor assembly and test (OSAT) This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the Outsourced Semiconductor Assembly and Test (OSAT) Market Report

Outsourced Semiconductor Assembly and Test (OSAT) Market by Service 2020-2030, USD Million, (Thousand Units)

- Packaging

- Testing

Outsourced Semiconductor Assembly and Test (OSAT) Market by Packaging, 2020-2030, USD Million, (Thousand Units)

- Ball grid Array Packaging

- Chip Scale Packaging

- Stacked Die Packaging

- Multi-Chip Packaging

- Quad Flat

- Dual-incline Packaging

Outsourced Semiconductor Assembly and Test (OSAT) Market by Region 2020-2030, USD Million, (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the outsourced semiconductor assembly and test (OSAT) market over the next 7 years?

- Who are the major players in the outsourced semiconductor assembly and test (OSAT) market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the outsourced semiconductor assembly and test (OSAT) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the outsourced semiconductor assembly and test (OSAT) market?

- What is the current and forecasted size and growth rate of the outsourced semiconductor assembly and test (OSAT) market?

- What are the key drivers of growth in the outsourced semiconductor assembly and test (OSAT) market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the outsourced semiconductor assembly and test (OSAT) market?

- What are the technological advancements and innovations in the outsourced semiconductor assembly and test (OSAT) market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the outsourced semiconductor assembly and test (OSAT) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the outsourced semiconductor assembly and test (OSAT) market?

- What are the product products and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET OUTLOOK

- GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- PACKAGING

- TESTING

- GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- BALL GRID ARRAY PACKAGING

- CHIP SCALE PACKAGING

- STACK DIE PACKAGING

- MULTI-CHIP PACKAGING

- QUAD FLAT

- DUAL-INCLINE PACKAGING

- GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, SERVICES OFFERED, RECENT DEVELOPMENTS)

- ASE GROUP

- AMKOR TECHNOLOGY

- POWERTECH TECHNOLOGY INC. (PTI)

- STATS CHIPPAC

- CHIPMOS TECHNOLOGIES

- UTAC (UNITED TEST AND ASSEMBLY CENTER)

- SILICONWARE PRECISION INDUSTRIES CO., LTD

- JIANGSU CHANGJIANG ELECTRONICS TECHNOLOGY CO., LTD. (JCET)

- CHIPBOND TECHNOLOGY CORPORATION

- LINGSEN PRECISION INDUSTRIES LTD.

- KING YUAN ELECTRONICS (KYEC)

- HANA MICRON

- WALTON ADVANCED ENGINEERING INC

- TIANSHUI HUATIAN TECHNOLOGY CO., LTD.

- SHANGHAI HUALI MICROELECTRONICS CORPORATION (HLMC)

- PULSE ELECTRONICS

- NEPES CORPORATION

- SIGNETICS

- FORMFACTOR, INC.

- CHINA WAFER LEVEL CSP CO., LTD. (CWLCSP)*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 2 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 4 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (USD BILLION)

2020-2030

TABLE 8 NORTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (THOUSAND UNITS)

2020-2030

TABLE 9 NORTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 13 US OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 14 US OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 15 US OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 16 US OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 18 CANADA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 20 CANADA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 22 MEXICO OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 24 MEXICO OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 32 BRAZIL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 34 BRAZIL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 36 ARGENTINA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 38 ARGENTINA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 40 COLOMBIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 42 COLOMBIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 54 INDIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 56 INDIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 58 CHINA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 60 CHINA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 62 JAPAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 64 JAPAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 84 EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 86 EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 88 GERMANY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 90 GERMANY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 91 UK OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 92 UK OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 93 UK OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 94 UK OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 96 FRANCE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 98 FRANCE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 100 ITALY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 102 ITALY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 104 SPAIN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 106 SPAIN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 108 RUSSIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 110 RUSSIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 121 UAE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 122 UAE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 123 UAE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 124 UAE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TESTMARKET BY PACKAGING (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING USD BILLION, 2020-2030

FIGURE 9 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE, USD BILLION, 2020-2030

FIGURE 10 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY PACKAGING, USD BILLION 2022

FIGURE 13 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY SERVICE, USD BILLION 2022

FIGURE 14 GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 ASE GROUP: COMPANY SNAPSHOT

FIGURE 17 AMKOR TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 18 POWERTECH TECHNOLOGY INC. (PTI): COMPANY SNAPSHOT

FIGURE 19 STATS CHIPPAC (NOW PART OF JCET): COMPANY SNAPSHOT

FIGURE 20 CHIPMOS TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 21 UTAC (UNITED TEST AND ASSEMBLY CENTER: COMPANY SNAPSHOT

FIGURE 22 SILICONWARE PRECISION INDUSTRIES CO., LTD: COMPANY SNAPSHOT

FIGURE 23 JIANGSU CHANGJIANG ELECTRONICS TECHNOLOGY CO., LTD. (JCET): COMPANY SNAPSHOT

FIGURE 24 CHIPBOND TECHNOLOGY CORPORATION: COMPANY SNAPSHOT

FIGURE 25 LINGSEN PRECISION INDUSTRIES LTD.: COMPANY SNAPSHOT

FIGURE 26 KING YUAN ELECTRONICS (KYEC): COMPANY SNAPSHOT

FIGURE 27 HANA MICRON: COMPANY SNAPSHOT

FIGURE 28 WALTON ADVANCED ENGINEERING INC.: COMPANY SNAPSHOT

FIGURE 29 TIANSHUI HUATIAN TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

FIGURE 30 SHANGHAI HUALI MICROELECTRONICS CORPORATION (HLMC): COMPANY SNAPSHOT

FIGURE 31 PULSE ELECTRONICS: COMPANY SNAPSHOT

FIGURE 32 NEPES CORPORATION: COMPANY SNAPSHOT

FIGURE 33 SIGNETICS: COMPANY SNAPSHOT

FIGURE 34 FORMFACTOR, INC.: COMPANY SNAPSHOT

FIGURE 35 CHINA WAFER LEVEL CSP CO., LTD. (CWLCSP): COMPANY SNAPSHOT

FAQ

The global outsourced semiconductor assembly and test (OSAT) market is anticipated to grow from USD 36.78 Billion in 2022 to USD 59.96 Billion by 2030, at a CAGR of 6.3 % during the forecast period.

Asia-Pacific accounted for the largest market in the outsourced semiconductor assembly and test (OSAT) market. Asia-Pacific accounted for the 38 % percent market share of the global market value.

ASE Group, Amkor Technology, Powertech Technology Inc. (PTI), STATS ChipPAC (now part of JCET), ChipMOS Technologies, UTAC (United Test and Assembly Center), Siliconware Precision Industries Co., Ltd., Jiangsu Changjiang Electronics Technology Co., Ltd. (JCET), Chipbond Technology Corporation, Lingsen Precision Industries Ltd., King Yuan Electronics (KYEC), Hana Micron, Walton Advanced Engineering Inc., Tianshui Huatian Technology Co., Ltd., Shanghai Huali Microelectronics Corporation (HLMC), Pulse Electronics, Nepes Corporation, Signetics, FormFactor, Inc., China Wafer Level CSP Co., Ltd. (CWLCSP) are some of the major key players of the Outsourced Semiconductor Assembly and Test (OSAT) market.

The Outsourced Semiconductor Assembly and Test (OSAT) market presents compelling opportunities driven by the escalating demand for advanced electronics. As the semiconductor industry evolves, OSAT providers play a crucial role in offering cost-effective packaging and testing solutions. The growing complexity of integrated circuits, coupled with the rise of 5G technology and the Internet of Things (IoT), fosters a robust OSAT market. Additionally, increased outsourcing by semiconductor manufacturers seeking specialized expertise and agility further propels the OSAT sector. With an expanding market for smartphones, automotive electronics, and emerging technologies, OSAT providers are poised to capitalize on a dynamic landscape, ensuring sustained growth.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.