REPORT OUTLOOK

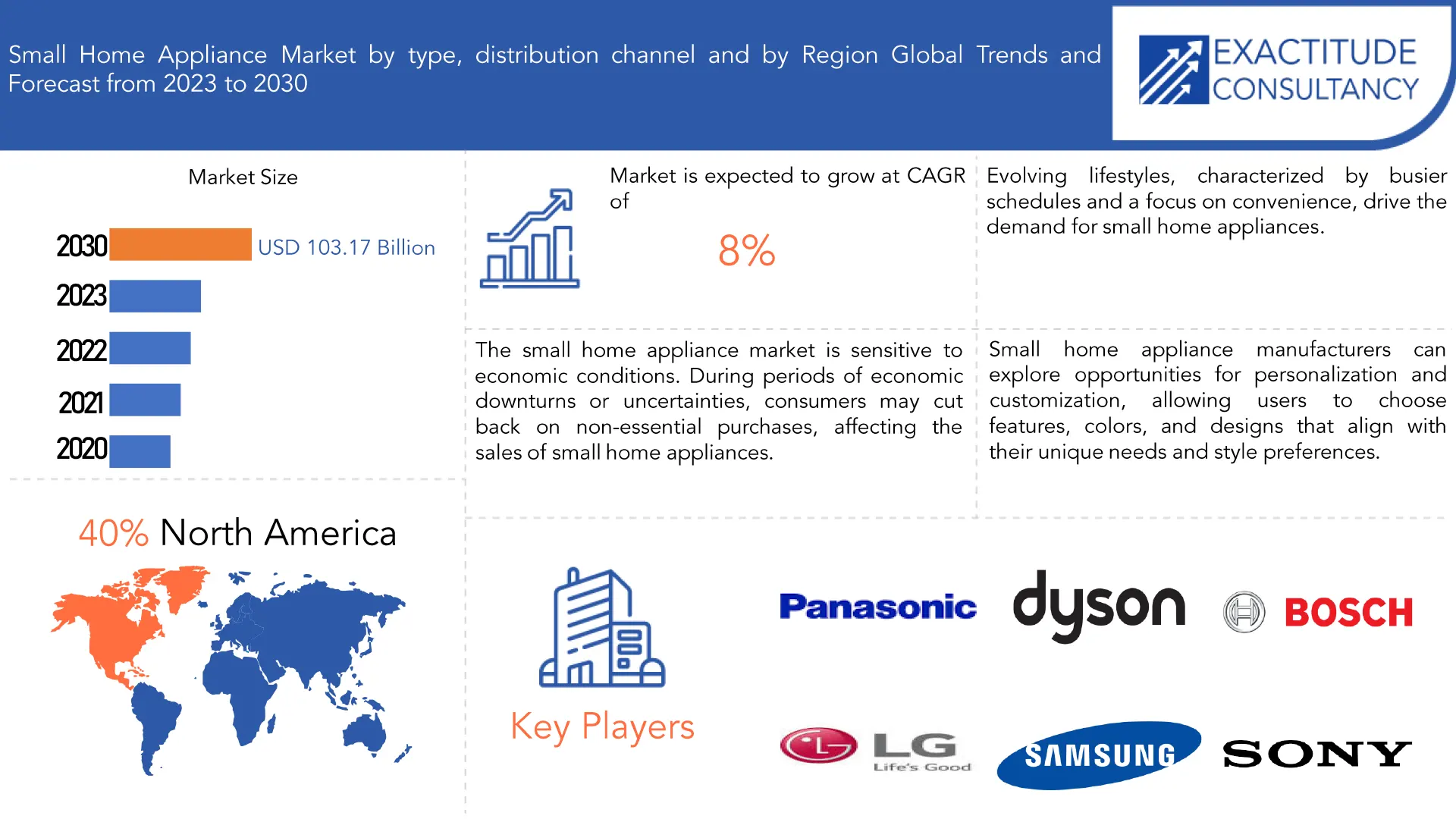

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 103.17 Billion by 2030 | 8 % | Asia Pacific |

| By Product | By Distribution Channel | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Small Home Appliance Market Overview

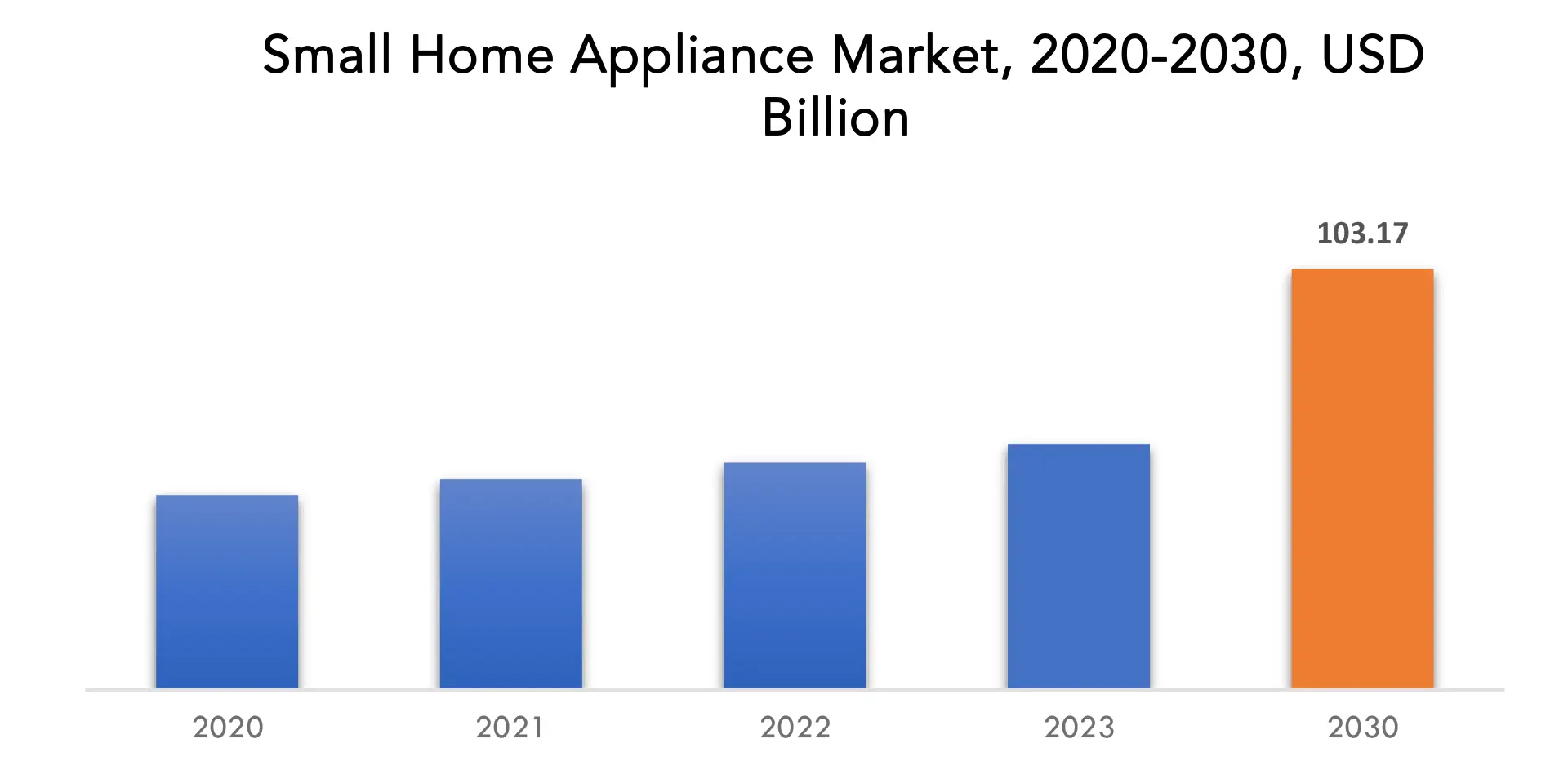

The global Small Home Appliance market is anticipated to grow from USD 60.20 Billion in 2023 to USD 103.17 Billion by 2030, at a CAGR of 8 % during the forecast period.

The market for small home appliances is made up of a wide variety of tiny household appliances that are intended to make a variety of household duties easier, provide convenience, and increase overall efficiency in the home environment. These appliances are usually distinguished by their portability, easy-to-use designs, and adaptability in meeting various demands in various parts of the house. Blenders, toasters, coffee makers, food processors, vacuum cleaners, irons, and electric kettles are a few examples of small home equipment. Small home appliances are a popular choice among consumers looking to simplify daily tasks, save time, and inject some convenience into their routines. These gadgets are made to efficiently carry out specific tasks, like cleaning, cooking, and personal grooming, among other household chores. In order to fulfill the changing needs of contemporary homes, a growing number of small home appliances are incorporating cutting-edge features, smart connection, and energy-efficient solutions.

In order to keep consumers interested, a number of manufacturers are constantly releasing new and better goods in the fiercely competitive small home appliance industry. In this market, design aesthetics, performance capabilities, energy efficiency, and the incorporation of smart technologies are important variables that impact consumer preferences. The small home appliance market is a dynamic and flexible industry that offers a wide range of items aimed to improve consumers’ daily lives, meeting the growing demand for time-saving and convenient solutions.

In the consumer products business, the small home appliance market is quite important since it serves a wide range of household demands and tastes. These appliances have a significant impact on consumers’ daily lives by improving comfort, efficiency, and convenience in homes. The market comprises a diverse range of products, such as electric kettles, toasters, coffee makers, blenders, and vacuum cleaners, among others. The ability of the small home appliance industry to meet the changing needs and lifestyles of contemporary customers is a crucial component of its significance. People are depending more and more on time-saving gadgets that make daily chores easier as their lives get busier. Furthermore, technological developments have stimulated innovation in the small home appliance market. With features like automation and remote control, smart and connected appliances have become more popular, giving consumers more personalization and control. These appliances now perform better thanks to technical advancements, which also bring them into line with the larger trend of smart home integration.

From an economic perspective, a sizeable portion of the world economy is made up of the small home appliance sector. The manufacturing, distribution, and retail sectors all benefit from the industry’s significant income generation and job creation. The market is also distinguished by fierce competition and a steady stream of new items, which encourages innovation and pushes producers to continuously enhance their products.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, Distribution channel |

|

By Product |

|

|

By Distribution Channel |

|

|

By Region

|

|

Small Home Appliance Market Segmentation Analysis

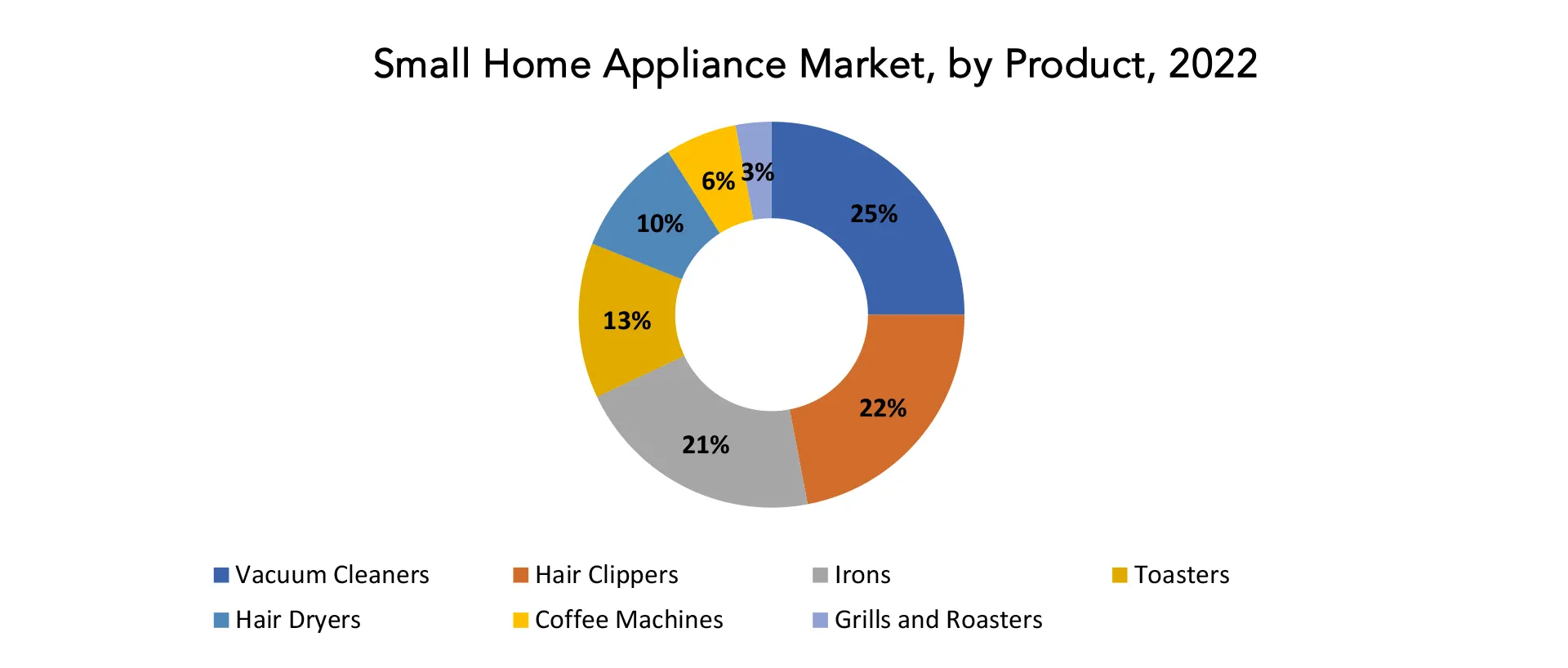

The global Small Home Appliance market is divided into two segments product, distribution channel and region. By product it is divided into Vacuum Cleaners, Hair Clippers, Irons, Toasters, Hair Dryers, Coffee Machines, Grills and Roasters. Vacuum Cleaners holds the largest market share. The segmentation of the small home appliance market into different product categories, like grills, roasters, toasters, hair dryers, vacuum cleaners, hair clippers, irons, and coffee makers, represents the wide range of demands and preferences of customers. Vacuum cleaners come out on top among these categories, with the biggest market share. A vacuum cleaner is an essential tool for keeping homes hygienic and clean. The commercial domination of vacuum cleaners can be ascribed to their extensive usability and crucial function in the daily household activities of consumers. Because homeowners place a great value on cleanliness, there is a constant demand for high-tech, effective vacuum cleaners.

Vacuum cleaner dominance in terms of market share is impacted by things like smart feature integration, design improvements, and technical innovation. Every year, manufacturers release new versions with enhanced filtering capabilities, suction power, and controllable settings. The popularity and market share of this product category have also been boosted by the emergence of robotic vacuum cleaners that are outfitted with automation and artificial intelligence features. The other product categories add to the overall liveliness and competitiveness of the small home appliance industry, even if vacuum cleaners have the biggest market share. Every category caters to different customer populations by addressing particular needs and interests. For example, toasters and coffee makers take care of breakfast and beverage preparation, while hair clippers and dryers take care of personal grooming needs.

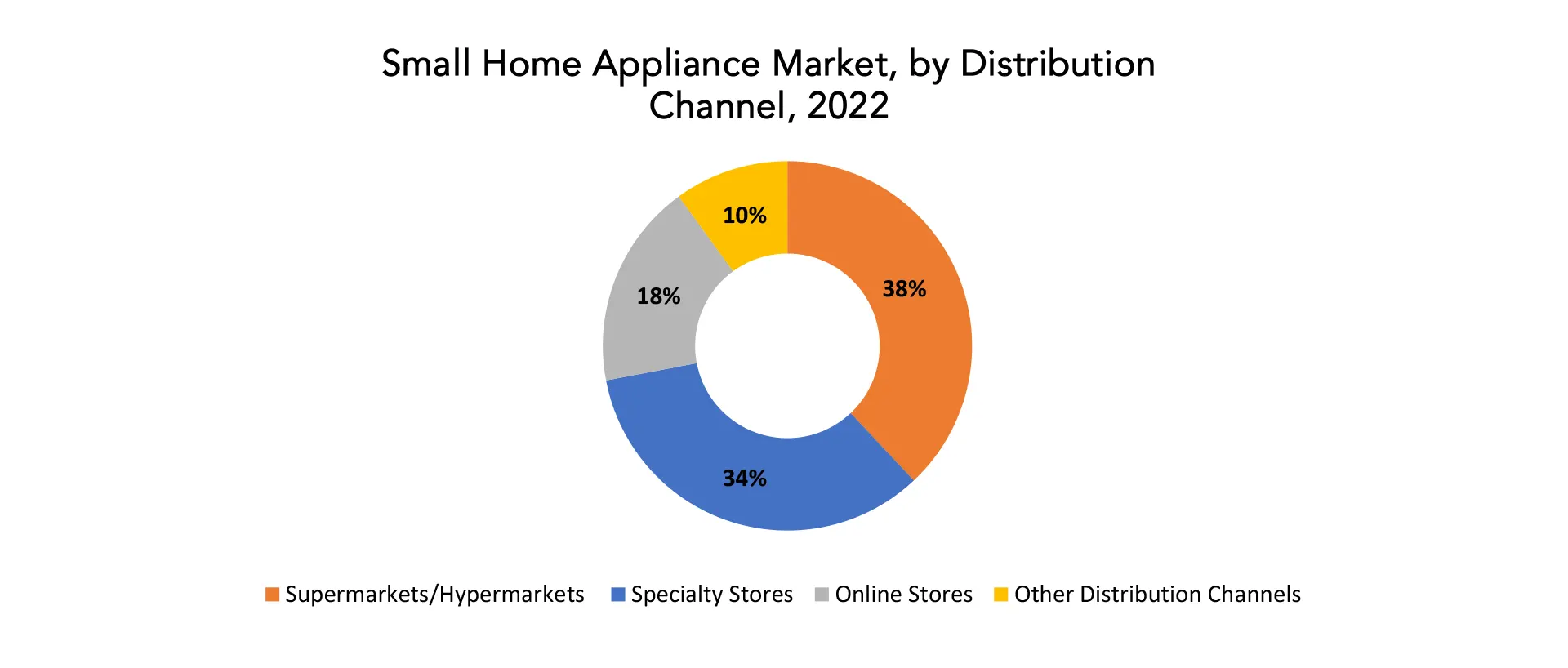

By distribution channel it is divided as Supermarkets/Hypermarkets, Specialty Stores, Online Stores, and Other Distribution Channels. Hyper markets have the highest contribution in Small Home Appliance. Small home appliances are primarily distributed through supermarkets and hypermarkets. These massive retail chains provide customers with a one-stop shopping experience and a large selection of goods, including little household appliances. The ease of physically perusing and contrasting things, making quick purchases, and taking advantage of promos or packaged offers are the main benefits. Supermarkets and hypermarkets are widely dispersed, which increases the awareness of small household appliances and aids in their market penetration.

Another important method of distribution is specialty retailers, which only sell tiny home appliances or particular subsets of this market. These shops cater to customers looking for professional guidance or a more individualized approach by offering a more curated and specialized shopping experience. Specialty stores cater to customers with particular tastes or needs by offering a wide selection of superior products, comprehensive product knowledge, and attentive customer care. Online retailers have become a prominent and quickly expanding distribution channel for small household appliances in recent years. Online retailers are a desirable choice for customers due to the ease of buying from home, the availability of a wide selection of products, and the capacity to compare costs and read reviews.

E-commerce platforms offer a worldwide reach, giving customers access to goods from different producers and brands, frequently with the bonus of home delivery. Different outlets, such as department stores, electronics stores, and smaller local businesses, are examples of other distribution routes. Customers can reach these channels through extra channels, especially if they desire more specialized or regional buying experiences. Small home appliance manufacturers are able to access a wide range of consumers with different preferences and purchasing patterns because to the diversity of distribution channels.

Small Home Appliance Market Dynamics

Driver

With a growing awareness of environmental issues, consumers are increasingly inclined towards energy-efficient and sustainable products.

Small household appliances that are sustainable and energy-efficient are made with the least amount of environmental impact possible throughout their life cycles. This covers factors including where to source raw materials, how much energy is used while using a product, and how to dispose of it after its useful life. Customers are more inclined to select goods that share these values when they are conscious of the limited availability of resources and the effects they have on the environment. Energy-efficient appliances save consumer’s money in addition to being better for the environment. These appliances help lower utility bills by using less energy when in use. Small home appliances that use less energy are becoming more and more popular as people learn more about the long-term financial effects of the products they buy. Customers are becoming more conscious of the environmental policies of the businesses they patronize.

Brands that put sustainability first and integrate eco-friendly practices into their production procedures are likely to win over customers that care about the environment. Consumer trust and loyalty are now greatly influenced by corporate social responsibility. Governmental agencies, advocacy groups, and environmental organizations all have a part to play in informing the public about how different products affect the environment. The significance of making environmentally conscious decisions is emphasized by awareness campaigns and educational programs, which also influence consumer behavior and promote the adoption of sustainable practices. Nowadays, a lot of compact household equipment are accompanied by eco-labels or certificates indicating compliance with particular environmental guidelines. These labels are helpful guides for customers who want to choose products that are less harmful to the environment. Products that fulfill strict energy efficiency standards are directed toward consumers by recognizable certifications like ENERGY STAR.

Restraint

Rapid advancements in technology may result in the obsolescence of existing small home appliances.

New features and functions are introduced in small household appliances due to the rapid speed of technology advancements. Upgrades to older devices frequently include better performance, automation, smarter networking, and expanded capabilities. It’s possible that consumers will be persuaded to replace outdated versions with these technologically sophisticated products. Consumer expectations for performance, convenience, and connectivity are rising along with technology’s evolution. Consumers who seek for newer models that meet their expectations may view older appliances as less capable or antiquated if they do not have the newest features. The use of smart home technology is becoming more and more common. Smart home ecosystems are becoming more and more popular with small home appliances that let consumers operate and monitor equipment from a distance. Appliances without smart features could have trouble keeping up with the changing demands of tech-savvy consumers.

Improves in technology frequently result in appliances that use less energy. Customers are more likely to switch from older, less energy-efficient models to newer ones that help save money and the environment as sustainability becomes more and more of a priority. The obsolescence of current appliances is partly a result of shifting design trends and aesthetics. Modern and elegant devices may attract consumers, leading them to replace older appliances for aesthetic reasons even while the functionality is still there. Newer appliances may not work well with older systems or devices due to technological improvements. Consumers who embrace new technology may find it difficult to incorporate their outdated home surroundings with older appliances, which could result in the replacement of these products.

Opportunities

The integration of smart technology and connectivity in small home appliances presents a significant opportunity.

Voice-activated assistants and smartphone applications allow customers to remotely monitor and operate smart home appliances. With the ability to automate procedures, change settings, and get real-time updates—even while they’re not at home—this degree of control streamlines daily tasks. Numerous smart appliances have sensors and energy-saving technologies built in. By optimizing energy consumption according to usage patterns or user preferences, these gadgets help create a more economical and environmentally friendly home environment. This is consistent with consumers’ growing interest in environmentally friendly items. The smooth connection between devices is facilitated by the incorporation of smart appliances into larger smart home ecosystems. Because of its interconnectedness, users can design complex automation scenarios that include several appliances.

Data generated by smart appliances can be used to get insights into the preferences and behavior of its users. Manufacturers can make tailored advice, increase performance, and improve product design with the use of this data. Product development and marketing plans that are more specifically targeted may result from this data-driven methodology. By incorporating smart technology, users can benefit from enhanced features like voice control, notifications, and remote monitoring. Increased consumer satisfaction and loyalty result from these characteristics, which make using home appliances more pleasant and easy. Improved security features, such remote monitoring and notifications for possible problems, are frequently included with smart home equipment. Smart security cameras that are integrated into appliances, for instance, can give users access to alarms and real-time footage.

Small Home Appliance Market Trends

- One of the most common trends in small household appliances is the integration of smart technologies and connection. Appliances that offer automation, remote control, and seamless integration with smart home ecosystems are in high demand among consumers.

- Small household appliances that are ecological and energy-efficient are becoming more and more important. Because consumers are more concerned about the environment, there is a growing market for items that employ eco-friendly materials, consume less energy, and have a smaller overall environmental impact.

- Compact and multipurpose designs are becoming more and more common, particularly in urban areas where living quarters may be scarce. Multifunctional small household appliances that are easy to store are in great demand.

- Customers want features that they can customize and personalize for their little household appliances. This includes customizable colors, sizes, and functionalities to better suit individual preferences and lifestyle needs.

- The market for small home appliances has been impacted by the health and wellness movement, with an emphasis on products that encourage healthy lifestyles. This includes air purifiers, juicers, and blenders with wellness-focused designs.

- Purchasing small household appliances is now primarily done online. Online sales are still increasing because of the ease of online purchasing, the large selection of products available, and the capacity to compare costs and read product reviews.

- Artificial intelligence (AI) integration and voice-activated controls are becoming more common in tiny household appliances. AI algorithms and voice-activated assistants improve user experience by offering more personalized and intuitive ways to engage with the devices.

Competitive Landscape

The competitive landscape of the Small Home Appliance market was dynamic, with several prominent companies competing to provide innovative and advanced Small Home Appliance solutions.

- Whirlpool Corporation

- Electrolux AB

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Bosch Home Appliances

- Haier Group Corporation

- Panasonic Corporation

- Koninklijke Philips N.V.

- Miele & Cie. KG

- Dyson Ltd.

- SharkNinja Operating LLC

- Breville Group Limited

- Groupe SEB

- Newell Brands Inc.

- Hamilton Beach Brands, Inc.

- Cuisinart

- Tefal

- Russell Hobbs

- Sunbeam Products, Inc.

- Black & Decker

Recent Developments:

October 09, 2023: Sony Corporation (“Sony”) today announced the launch of FP7000 spectral cell sorter that supports high-speed, high-parameter sorting with more than 44 colors with simple workflows, leveraging its patented spectral technology-based optics, advanced electronics and fluidics. The new high-parameter spectral cell sorter is configurable with up to 6 lasers and 182 detectors enabling the detection and sorting of cell populations of interest, using complex panels comprised of more than 44 colors. It also supports multiple nozzle sizes for optimized sorting of a wide range of cell types. Its high-speed, real-time spectral unmixing capability, which separates the emission signature of each fluorophore from the composite spectral signal from the multi-color sample analyzed, combined with high sheath pressure and reliable drop-delay calibration, enables up to 6-way sorting of populations at event rates of 25,000 events per second.

July 24, 2030: As the pre-eminent platform for creative freedom, Sony Corporation today announced its new “For The Music” brand platform and campaign for its premier audio products and services. Sony Music Entertainment and Grammy Award-winning artist Miguel will be the first artist “For The Music” will support with a brand spot and campaigns for the WF-1000XM5 headphones and X-Series wireless speakers. Available to watch here, the campaign launch video directed by Liam McRae features Miguel scaling a skyscraper before breaking through the building’s glass walls, a concept fully developed by Miguel and brought to life by Sony’s audio. Symbolic of his next era in music, the video also exemplifies Sony’s intention to support creators like Miguel as they seek to break through creative barriers and connect directly with fans.

Regional Analysis

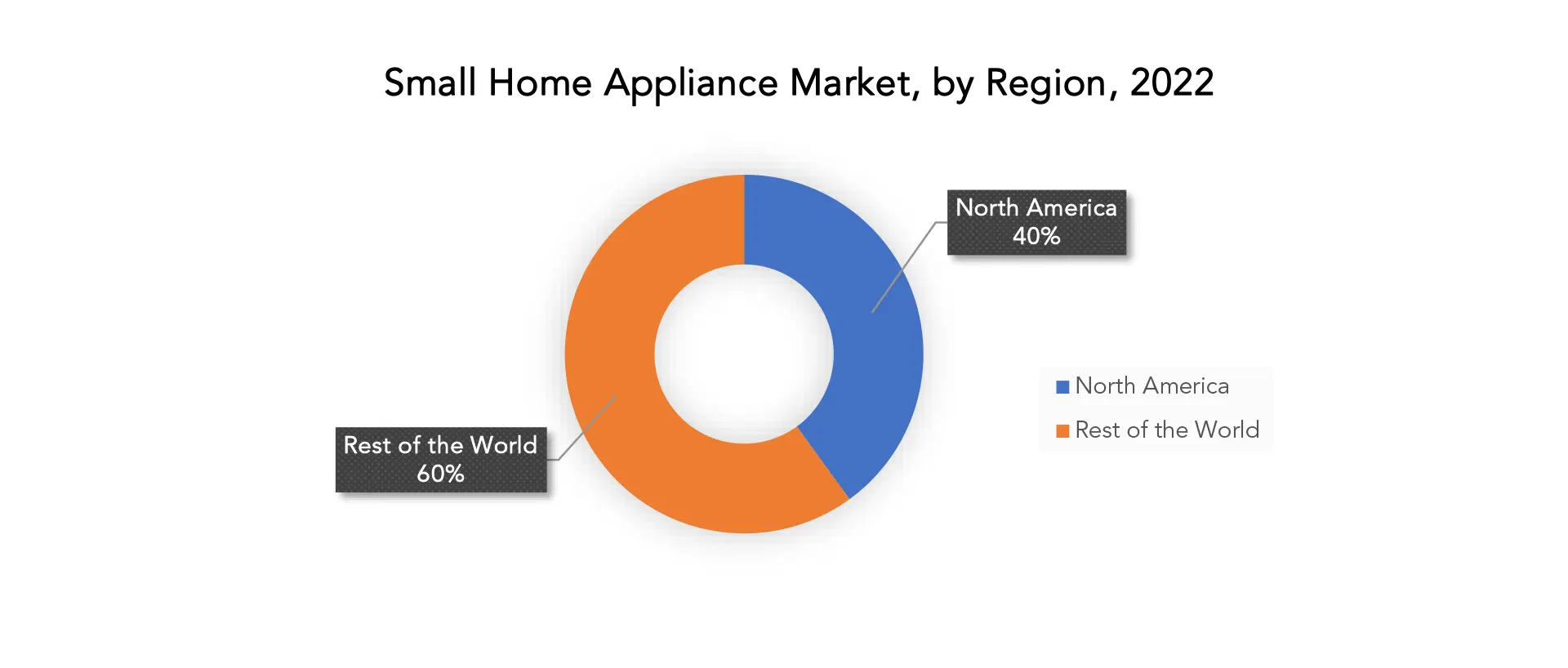

North America accounted for the largest market in the Small Home Appliance market. North America accounted for 40 % of the worldwide market value. An important development in the North American small-home appliance industry is the growing popularity of connected and intelligent gadgets. Manufacturers have responded to the rapid adoption of new technologies by consumers in the region by launching small home appliances that are integrated with smart home ecosystems. Products that improve the user experience overall fall under this category, such as linked kitchen appliances, smart coffee makers, and home automation systems. The market for small home appliances in North America is seeing a rise in sustainability in addition to technological developments. As a result of growing consumer concern over the effects of their purchases on the environment, manufacturers are implementing eco-friendly design, production, and packaging techniques. The focus on sustainability is in line with the larger North American consumer trend of looking for products that are both effective and sustainable.

The North American market for small home appliances is greatly influenced by retail dynamics. Large appliance merchants, department stores, specialist cookware stores, and an increasing number of internet retailers are all part of the region’s well-established retail scene. Because internet purchasing is so convenient, more and more people are using e-commerce sites to research and buy small home appliances, which is changing the dynamics of the market. A large variety of small household appliances that meet different demands are available in the North American market, which also reflects the diversity of consumer tastes. Manufacturers provide a wide range of items to suit the various lives and tastes of North American consumers, from energy-efficient kitchen appliances and tiny vacuum cleaners to sophisticated coffee makers and smart freezers.

Target Audience for Small Home Appliance Market

- Consumers

- Retailers

- E-commerce Platforms

- Appliance Manufacturers

- Distributors and Wholesalers

- Investors and Financial Institutions

- Research and Development Teams

- Marketing and Advertising Agencies

- Regulatory Authorities

- Home Improvement Stores

- Online Marketplaces

- Smart Home Technology Companies

- Interior Designers

- Hospitality Industry

Import & Export Data for Small Home Appliance Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Small Home Appliance market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Small Home Appliance market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Small Home Appliance trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Small Home Appliance types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Small Home Appliance Market Report

Small Home Appliance Market by Product (USD Billion) (Thousand Units)

- Vacuum Cleaners

- Hair Clippers

- Irons

- Toasters

- Hair Dryer

- Coffee Machines

- Grills and Roasters

Small Home Appliance Market by Distribution Channel (USD Billion) (Thousand Units)

- Hypermarkets/Supermarkets

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Stores

- Other Distribution Channels

Small Home Appliance Market by Region (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Small Home Appliance market over the next 7 years?

- Who are the major players in the Small Home Appliance market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Small Home Appliance market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Small Home Appliance market?

- What is the current and forecasted size and growth rate of the global Small Home Appliance market?

- What are the key drivers of growth in the Small Home Appliance market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Small Home Appliance market?

- What are the technological advancements and innovations in the Small Home Appliance market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Small Home Appliance market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Small Home Appliance market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- SMALL HOME APPLIANCE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SMALL HOME APPLIANCE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- SMALL HOME APPLIANCE MARKET OUTLOOK

- GLOBAL SMALL HOME APPLIANCE MARKET BY PRODUCT, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- VACUUM CLEANERS

- HAIR CLIPPERS

- IRONS

- TOASTERS

- HAIR DRYERS

- COFFEE MACHINES

- GRILLS AND ROASTERS

- GLOBAL SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- SUPERMARKETS/HYPERMARKETS

- SPECIALTY STORES

- ONLINE STORES

- OTHER DISTRIBUTION CHANNELS

- GLOBAL SMALL HOME APPLIANCE MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BLACK & DECKER

- WHIRLPOOL CORPORATION

- ELECTROLUX AB

- SAMSUNG ELECTRONICS CO., LTD.

- LG ELECTRONICS INC.

- BOSCH HOME APPLIANCES

- HAIER GROUP CORPORATION

- PANASONIC CORPORATION

- KONINKLIJKE PHILIPS N.V.

- MIELE & CIE. KG

- DYSON LTD.

- SHARKNINJA OPERATING LLC

- BREVILLE GROUP LIMITED

- GROUPE SEB

- NEWELL BRANDS INC.

- HAMILTON BEACH BRANDS, INC.

- CUISINART

- TEFAL

- RUSSELL HOBBS

- SUNBEAM PRODUCTS, INC.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 2 GLOBAL SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 4 GLOBAL SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL SMALL HOME APPLIANCE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL SMALL HOME APPLIANCE MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA SMALL HOME APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA SMALL HOME APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 13 US SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 14 US SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 15 US SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 16 US SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 18 CANADA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 20 CANADA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 22 MEXICO SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 24 MEXICO SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 32 BRAZIL SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 34 BRAZIL SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 36 ARGENTINA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 38 ARGENTINA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 40 COLOMBIA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 42 COLOMBIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC SMALL HOME APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC SMALL HOME APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 54 INDIA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 56 INDIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 58 CHINA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 60 CHINA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 62 JAPAN SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 64 JAPAN SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE SMALL HOME APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE SMALL HOME APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 84 EUROPE SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 86 EUROPE SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 88 GERMANY SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 90 GERMANY SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 91 UK SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 92 UK SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 93 UK SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 94 UK SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 96 FRANCE SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 98 FRANCE SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 100 ITALY SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 102 ITALY SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 104 SPAIN SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 106 SPAIN SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 108 RUSSIA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 110 RUSSIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 121 UAE SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 122 UAE SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 123 UAE SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 124 UAE SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SMALL HOME APPLIANCE MARKET BY PRODUCT USD BILLION, 2020-2030

FIGURE 9 GLOBAL SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL, USD BILLION, 2020-2030

FIGURE 10 GLOBAL SMALL HOME APPLIANCE MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL SMALL HOME APPLIANCE MARKET BY PRODUCT, USD BILLION 2022

FIGURE 13 GLOBAL SMALL HOME APPLIANCE MARKET BY DISTRIBUTION CHANNEL, USD BILLION 2022

FIGURE 14 GLOBAL SMALL HOME APPLIANCE MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 WHIRLPOOL CORPORATION: COMPANY SNAPSHOT

FIGURE 17 ELECTROLUX AB: COMPANY SNAPSHOT

FIGURE 18 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

FIGURE 19 LG ELECTRONICS INC.: COMPANY SNAPSHOT

FIGURE 20 BOSCH HOME APPLIANCES: COMPANY SNAPSHOT

FIGURE 21 HAIER GROUP CORPORATION: COMPANY SNAPSHOT

FIGURE 22 PANASONIC CORPORATION: COMPANY SNAPSHOT

FIGURE 23 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

FIGURE 24 MIELE & CIE. KG: COMPANY SNAPSHOT

FIGURE 25 DYSON LTD.: COMPANY SNAPSHOT

FIGURE 26 SHARKNINJA OPERATING LLC: COMPANY SNAPSHOT

FIGURE 27 BREVILLE GROUP LIMITED: COMPANY SNAPSHOT

FIGURE 28 GROUPE SEB: COMPANY SNAPSHOT

FIGURE 29 NEWELL BRANDS INC.: COMPANY SNAPSHOT

FIGURE 30 HAMILTON BEACH BRANDS, INC.: COMPANY SNAPSHOT

FIGURE 31 CUISINART: COMPANY SNAPSHOT

FIGURE 32 TEFAL: COMPANY SNAPSHOT

FIGURE 33 RUSSELL HOBBS: COMPANY SNAPSHOT

FIGURE 34 SUNBEAM PRODUCTS, INC.: COMPANY SNAPSHOT

FIGURE 35 BLACK & DECKER: COMPANY SNAPSHOT

FAQ

The global Small Home Appliance market is anticipated to grow from USD 60.20 Billion in 2023 to USD 103.17 Billion by 2030, at a CAGR of 8% during the forecast period.

North America accounted for the largest market in the Small Home Appliance market. North America accounted for 40 % market share of the global market value.

Whirlpool Corporation, Electrolux AB, Samsung Electronics, LG Electronics, Bosch Home Appliances, Haier Group Corporation, Panasonic Corporation, Koninklijke Philips N.V., Miele & Cie. KG, Dyson Ltd., SharkNinja Operating, Breville Group Limited.

The market for small home appliances has been impacted by the health and wellness movement, with an emphasis on products that encourage healthy lifestyles. This includes air purifiers, juicers, and blenders with wellness-focused designs. Purchasing small household appliances is now primarily done online. Online sales are still increasing because of the ease of online purchasing, the large selection of products available, and the capacity to compare costs and read product reviews.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.