REPORT OUTLOOK

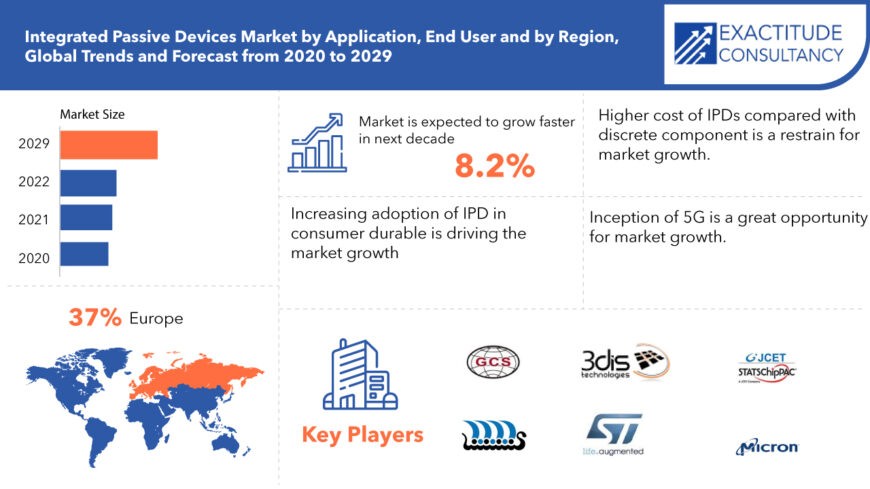

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2477.48 Million | 8.2% | Europe |

| by Application | by End Use |

|---|---|

|

|

SCOPE OF THE REPORT

Integrated Passive Devices Market Overview

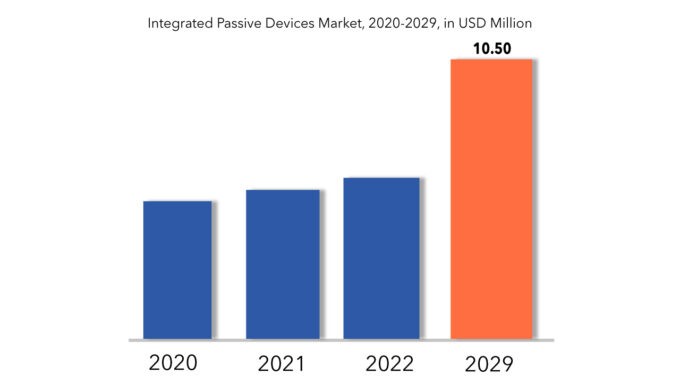

The global Integrated Passive Devices Market is projected to reach USD 2477.48 Million by 2029 from USD 1218.89 Million in 2020, at a CAGR of 8.2% from 2022 to 2029.

The expansion of the integrated passive devices (IPD) market is propelled by various factors, including the rising adoption of IPDs in consumer durables, their integration into RF applications, and the growing demand for compact, high-performance electronic devices. Furthermore, the incorporation of infotainment and navigation features, such as GPS, in automobiles is bolstering market growth.

Among the primary applications of IPD technology are white goods, which exhibit significant penetration in the consumer electronics sector encompassing smartphones, tablets, portable media players, set-top boxes, digital TVs, and others. The soaring demand for smartphones in recent years, driven by the necessity for multiple features in compact designs, has fueled the utilization of integrated passive devices.

Smartphones incorporate various features like Wi-Fi, Bluetooth, GPS, and NFC. As the evolution of communication technologies, particularly 4G LTE, demands support for higher frequency bands, there is a heightened need for miniaturized components, consequently driving the adoption of IPDs in consumer electronics for cost-effective miniaturization solutions.

With the anticipated commercialization of 5G by the end of 2018, the development of products compatible with this technology, such as baluns, filters, and diplexers, will necessitate the integration of IPDs. This integration promises to reduce the size and power consumption of telecom infrastructure products, thereby propelling the IPD market’s growth, particularly in the telecom sector. The projected 89 million subscriptions to 5G by 2022 present a significant opportunity for the expansion of the IPD market. Notably, 3D Glass Solutions has pioneered high-efficiency 5G IPD RF filters.

Integrated Passive Devices Market Segment Analysis

The integrated passive devices market is divided into two categories based on application: EMS and EMI protection IPD, RF IPD, LED lighting, digital and mixes single IPD. LED lighting segment dominate the integrated passive devices market and is expected to keep its dominance in coming years. LEDs’ low power consumption and long-lasting performance are attributed to their silicon incorporated IPD, which eliminates the disadvantages of traditional lighting systems. Effective heat dissipation and great reliability are among the benefits. EMS and EMI protection IPD, which was valued at USD 439.6 million, is likely to dominate the market. The utilisation of these integrated passive components in mobile phones is a major factor in the segment’s growth. The EMS and EMI protection segments are expected to increase significantly during the next nine years, preventing transmission loss and improving signal reception.

The market is divided into automotive, consumer electronics, healthcare based on end user. Automotive segment dominate the integrated passive devices market. This segment’s growth is likely to be aided by the widespread usage of integrated passive devices in in-car electronics for wireless communication. Over the projection period, demand in the consumer electronics application category is expected to invigorate the industry’s growth potential. The segment is expected to increase at a CAGR of more than 13%. The growing popularity of smartphones and other IoT devices is driving the growth of the integrated passive devices market. Furthermore, technological improvements such as smaller chip sizes have allowed electronic devices to shrink in size, contributing to the growing popularity of consumer electronics such as mobile phones, LED televisions, tablets, and laptops.

Integrated Passive Devices Market Players

The major players operating in the global integrated passive devices industry include 3DiS Technologies, On Semiconductor, Johanson Technology, Inc., STATS ChipPAC Ltd, STMicroelectronics, Global Communication Semiconductors, Inc., Micron Technology, Inc., Infineon Technologies AG. The presence of established industry players and is characterized by mergers and acquisitions, joint ventures, capacity expansions, substantial distribution, and branding decisions to improve market share and regional presence. Also, they are involved in continuous R&D activities to develop new products as well as are focused on expanding the product portfolio. This is expected to intensify competition and pose a potential threat to the new players entering the market.

Who Should Buy? Or Key Stakeholders

- Automotive sector

- Consumer Electronics industries

- Healthcare sector

- Others

Key Takeaways:

- The global Integrated Passive Devices Market is projected to grow at a CAGR of 8.2%

- Based on application, LED lighting segment dominate the integrated passive devices market and is expected to keep its dominance in coming years.

- Based on end user, automotive segment dominates the integrated passive devices market.

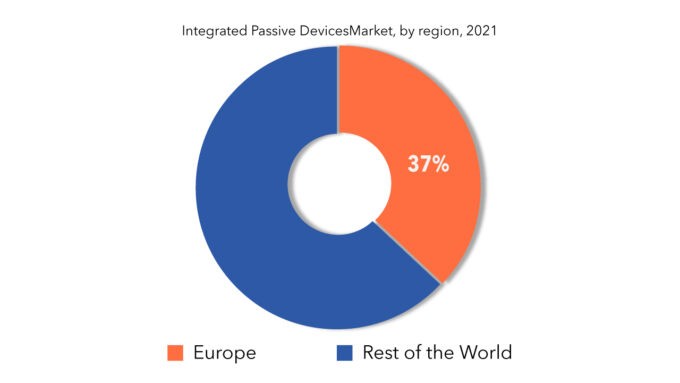

- Europe is expected to hold the largest share of the global integrated passive devices market.

- A prominent trend in Integrated Passive Devices (IPD) is their increasing integration into various electronic applications, driven by demands for miniaturization, enhanced performance, and expanded functionality.

Integrated Passive Devices Market Regional Analysis

Geographically, the integrated passive devices market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Europe is expected to hold the largest share of the global integrated passive devices market. The market for integrated passive devices in this region is fueled by significant technical advancements. Germany, France, and the United Kingdom are the leading contributors to market growth. In addition, the Integrated Passive Devices Industry Size in North America is the second-largest in the world. Canada and the United States have a stronger presence in the market for integrated passive devices. The growing semiconductor industries are important market drivers in North America. The market for integrated passive devices is booming in Asia Pacific. The three key regional players are responsible for the tremendous increase during the projection period. In the coming years, the production process in these sectors will become more intense. In addition, market expansions potential abound in these areas.

Key Market Segments: Integrated Passive Devices Market

Integrated Passive Devices Market by Application, 2020-2029, (USD Million) (Thousand Units)

- Ems and Emi Protection IPD

- RF IPD

- Led Lighting

- Digital and Mixes Single IPD

Integrated Passive Devices Market by End Use, 2020-2029, (USD Million) (Thousand Units)

- Automotive

- Consumer Electronics

- Healthcare

Integrated Passive Devices Market by Regions, 2020-2029, (USD Million) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Key Question Answered

- What is the current scenario of the global integrated passive devices market?

- What are the emerging technologies for the development of integrated passive devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Integrated Passive Devices Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Integrated Passive Devices Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Integrated Passive Devices Market Outlook

- Global Integrated Passive Devices Market by Application (USD Millions) (Thousand Units)

- EMS and EMI Protection IPD

- RF IPD

- LED Lighting

- Digital and Mixes Single IPD

- Global Integrated Passive Devices Market by End Use (USD Millions) (Thousand Units)

- Automotive

- Consumer Electronics

- Healthcare

- Global Integrated Passive Devices Market by Region (USD Millions) (Thousand Units)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- 3DiS Technologies

- On Semiconductor

- Johanson Technology, Inc.

- STATS ChipPAC Ltd

- STMicroelectronics

- Global Communication Semiconductors, Inc.

- Micron Technology, Inc.

- Infineon Technologies AG *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 7 US INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 8 US INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 9 US INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 10 US INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 11 CANADA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 12 CANADA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 13 CANADA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 14 CANADA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 15 MEXICO INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 16 MEXICO INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 17 MEXICO INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 18 MEXICO INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 19 BRAZIL INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 21 BRAZIL INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 23 ARGENTINA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 25 ARGENTINA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 27 COLOMBIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 29 COLOMBIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 35 INDIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 36 INDIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 37 INDIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 38 INDIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 39 CHINA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 40 CHINA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 41 CHINA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 42 CHINA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 43 JAPAN INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 44 JAPAN INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 45 JAPAN INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 46 JAPAN INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH KOREA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH KOREA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 51 AUSTRALIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 53 AUSTRALIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 55 SOUTH-EAST ASIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 57 SOUTH-EAST ASIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 63 GERMANY INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 64 GERMANY INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 65 GERMANY INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 66 GERMANY INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 67 UK INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 68 UK INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 69 UK INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 70 UK INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 71 FRANCE INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 72 FRANCE INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 73 FRANCE INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 74 FRANCE INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 75 ITALY INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 76 ITALY INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 77 ITALY INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 78 ITALY INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 79 SPAIN INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 80 SPAIN INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 81 SPAIN INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 82 SPAIN INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 83 RUSSIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 85 RUSSIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 87 REST OF EUROPE INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 89 REST OF EUROPE INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 91 UAE INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 92 UAE INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 93 UAE INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 94 UAE INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 95 SAUDI ARABIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 97 SAUDI ARABIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 99 SOUTH AFRICA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 101 SOUTH AFRICA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA INTEGRATED PASSIVE DEVICES MARKET BY END USE (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA INTEGRATED PASSIVE DEVICES MARKET BY END USE (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 9 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY END USE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY END USE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL INTEGRATED PASSIVE DEVICES MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA INTEGRATED PASSIVE DEVICES MARKET SNAPSHOT

FIGURE 14 EUROPE INTEGRATED PASSIVE DEVICES MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC INTEGRATED PASSIVE DEVICES MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA INTEGRATED PASSIVE DEVICES MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA INTEGRATED PASSIVE DEVICES MARKET SNAPSHOT

FIGURE 18 3DIS TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 19 JOHANSON TECHNOLOGY, INC.: COMPANY SNAPSHOT

FIGURE 20 STATS CHIPPAC LTD: COMPANY SNAPSHOT

FIGURE 21 STMICROELECTRONICS: COMPANY SNAPSHOT

FIGURE 22 GLOBAL COMMUNICATION SEMICONDUCTORS, INC.: COMPANY SNAPSHOT

FIGURE 23 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

FIGURE 24 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.