REPORT OUTLOOK

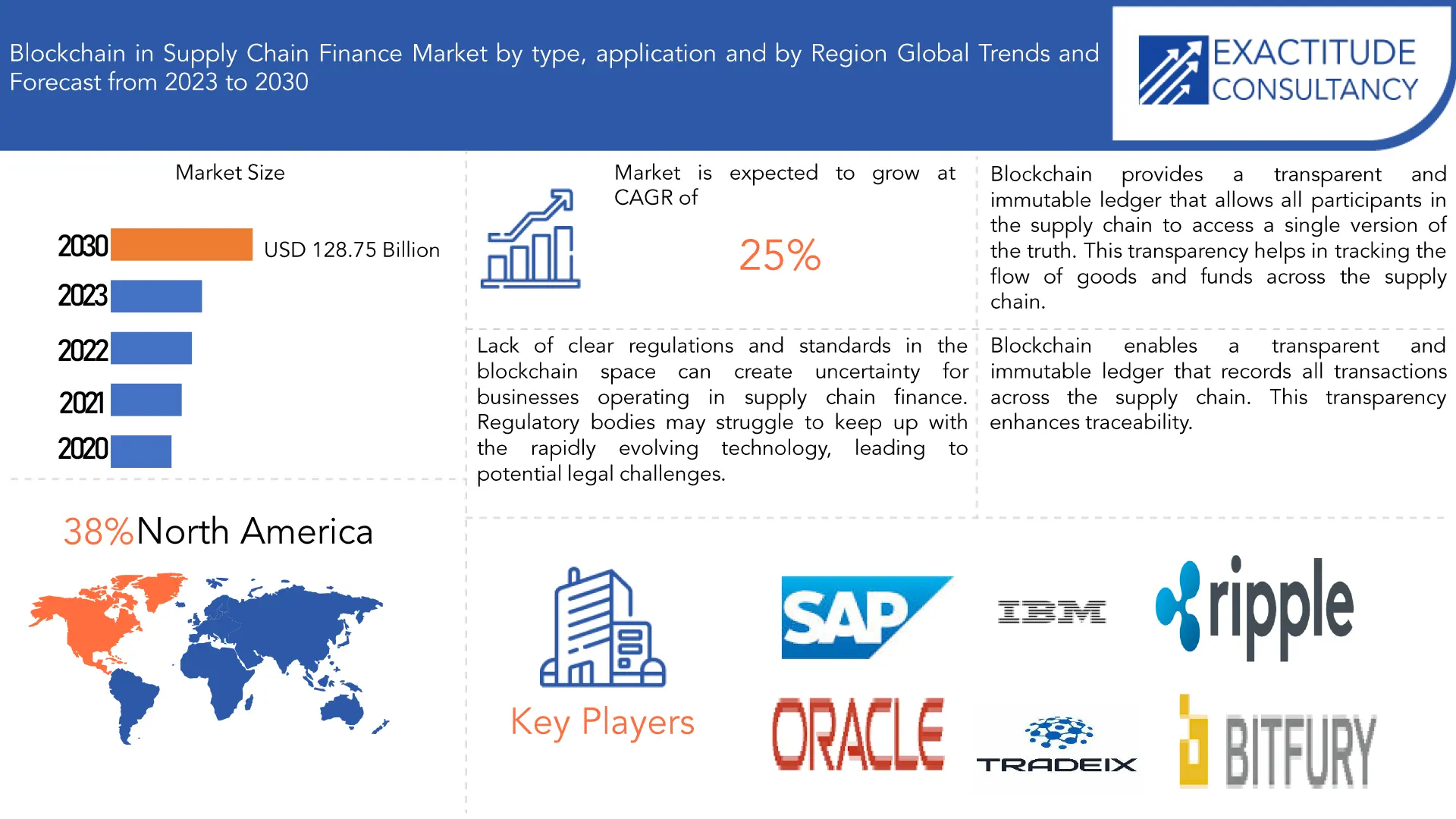

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 128.75 Billion by 2030 | 25 % | North America |

| by Type | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Blockchain in Supply Chain Finance Market Overview

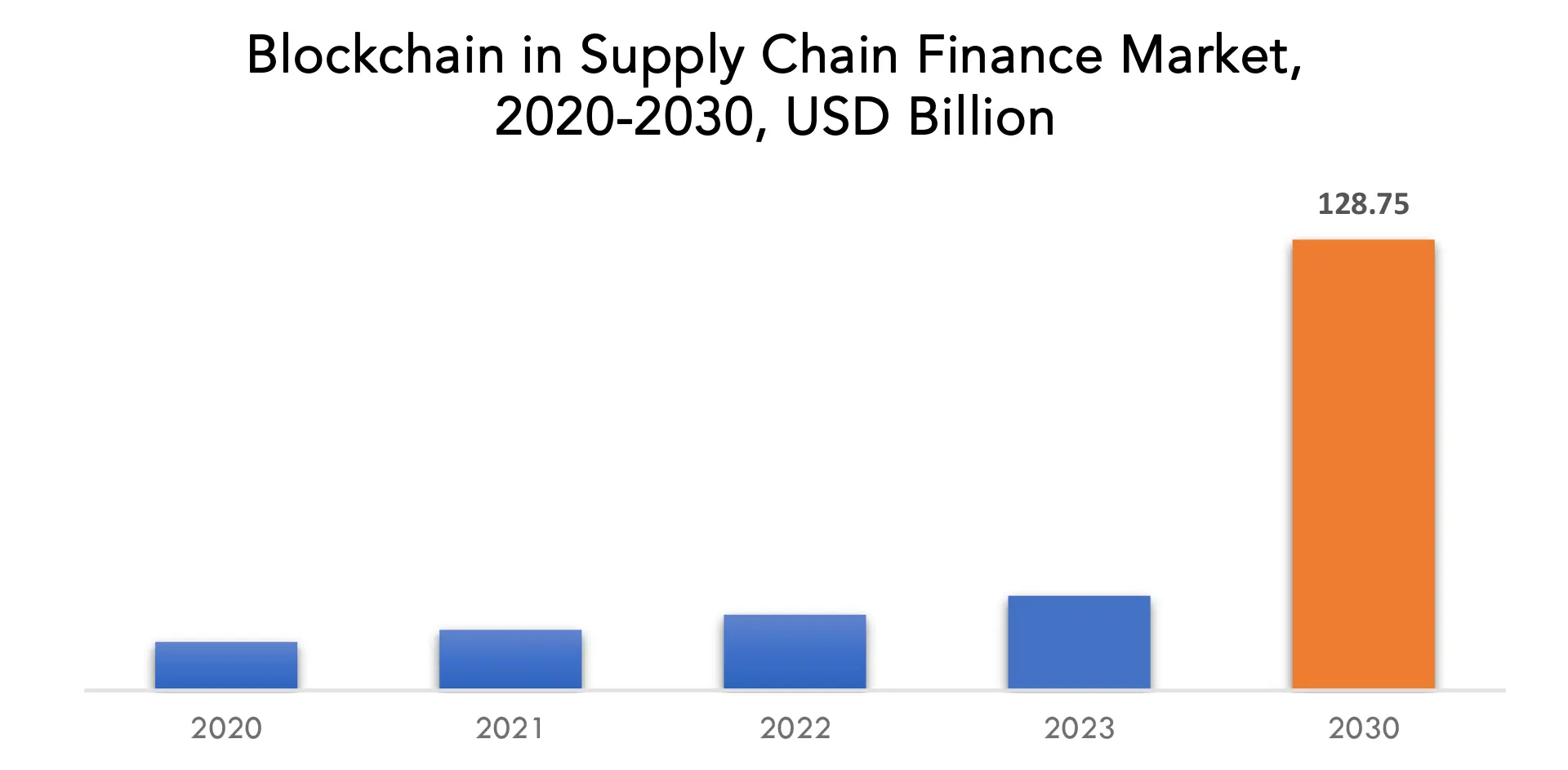

The global Blockchain in Supply Chain Finance market is anticipated to grow from USD 27 Billion in 2023 to USD 128.75 Billion by 2030, at a CAGR of 25 % during the forecast period.

In the field of supply chain finance, blockchain technology has shown to be a revolutionary force, transforming how companies oversee and expedite financial transactions throughout intricate supply networks. Blockchain is a term used to describe a distributed, decentralized ledger system that securely and openly records and validates transactions in the supply chain financing industry. Blockchain, as opposed to conventional centralized databases, allows several participants in a supply chain to keep an immutable, synchronized record of financial transactions, producing an auditable and tamper-proof trail.

The use of blockchain technology in supply chain finance allows for previously unheard-of levels of openness in the frequently complex and multi-tiered financial exchanges between suppliers, manufacturers, distributors, and other stakeholders. By automating and enforcing contractual obligations, players can lower the risk of conflicts and fraud by utilizing smart contracts, self-executing agreements driven by blockchain technology. In addition to improving communication and trust, this decentralized method of maintaining financial records speeds up the settlement of financial transactions and gives supply chain companies access to working cash. Additionally, the problems caused by information asymmetry and inefficiencies in conventional supply chain finance are greatly reduced by blockchain technology.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Type, Application and Region |

| By Type |

|

| By Application |

|

|

By Region

|

|

Blockchain in Supply Chain Finance Market Segmentation Analysis

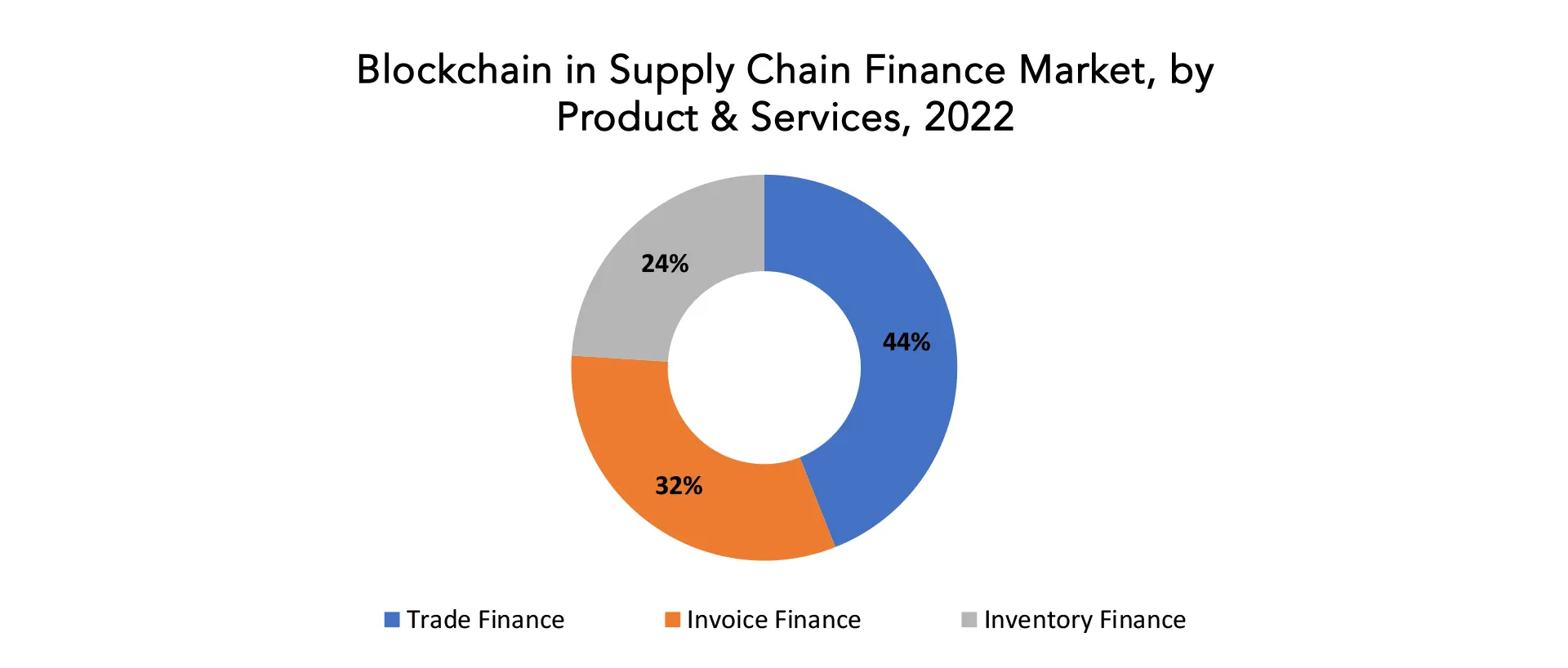

The global Blockchain in Supply Chain Finance market is divided into three segments Type, application and region. By type, it is divided as Trade Finance, Invoice Finance, Inventory Finance. Trade finance holds the largest market share. The innovative use of blockchain in trade finance is revolutionizing the manner in which cross-border transactions are carried out. International trade has historically required a large number of middlemen and intricate paperwork. By offering a decentralized and secure platform to all stakeholders—banks, importers, exporters, and customs authorities—blockchain streamlines and expedites this process. Trade agreements are executed automatically via smart contracts, which guarantee that money is given only once certain requirements are satisfied. This lowers the possibility of fraud and increases the effectiveness and speed of cross-border business transactions.

The difficulties in processing and financing invoices are resolved by the integration of blockchain technology into invoice finance. Blockchain technology makes it possible to digitize invoices and store them on an immutable ledger, giving a visible and auditable history of transactions. Transparency reduces the possibility of invoice fraud and expedites the approval and settlement procedures. Blockchain also makes it easier to create smart contracts, which streamline the invoice financing process by automatically releasing cash when invoice requirements are satisfied. This invention lessens the administrative load related to invoice administration, which helps firms with their cash flow. The potential of blockchain technology to improve the visibility and traceability of commodities throughout the supply chain will have an influence on inventory finance. The whole inventory lifecycle—from manufacturing to distribution—can be tracked in a safe, decentralized ledger by implementing blockchain technology. By giving real-time information on stock levels and lowering the possibility of stockouts or overstock scenarios, this visibility aids in the optimization of inventory management. Furthermore, the transparency that blockchain provides reduces the possibility of fraud and mistakes in inventory data. As a result, companies are better equipped to decide how best to finance inventories, guaranteeing that working capital is distributed effectively to satisfy operational demands.

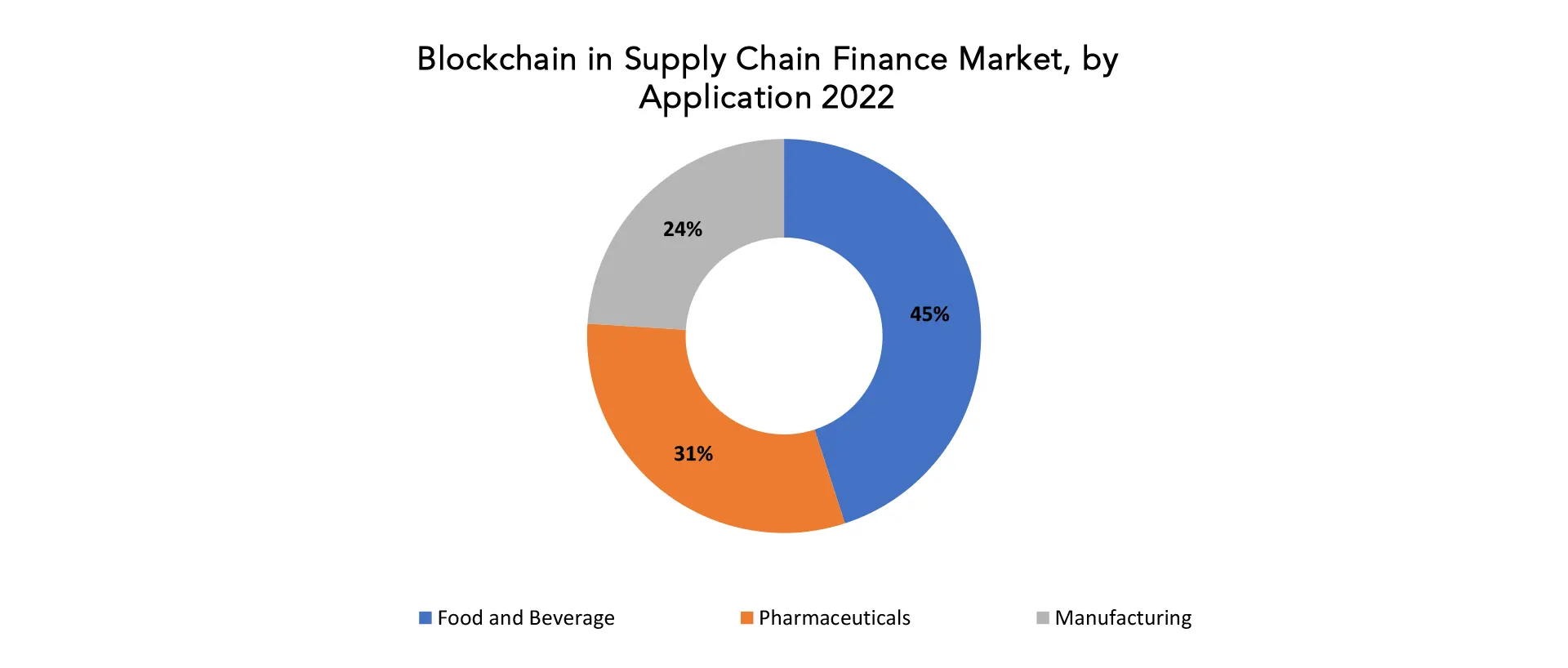

By Application it is divided into Food and Beverage, Pharmaceuticals, Manufacturing. In this Food and Beverage holds the largest market share. Blockchain technology is transforming the food and beverage sector by giving the supply chain previously unheard-of transparency and traceability. Within this industry, the use of blockchain technology for supply chain financing allows players to safely document and validate transactions pertaining to the manufacturing, preparing, and distributing of food items.

Financial agreements are automated via smart contracts on the blockchain, enabling faster and more secure transactions. Furthermore, the transparency and immutability of blockchain technology guarantee easy access to vital information on the provenance, caliber, and safety of food goods, boosting customer confidence and regulatory compliance. Blockchain supply chain financing in the pharmaceutical industry solves important issues with the legitimacy and integrity of medicinal products. Substandard and counterfeit medications present serious health dangers to the population. Blockchain technology offers a decentralized ledger that allows for the recording and verification of the whole pharmaceutical product lifecycle, from production to distribution. This uses smart contracts to automate payment operations, ensuring the integrity of the supply chain while also streamlining financial transactions. The pharmaceutical business may increase transparency, lower the risk of fake medications, and boost the effectiveness of financial transactions along the supply chain by utilizing blockchain.

Blockchain technology in supply chain finance helps the manufacturing industry by streamlining financial procedures and raising overall production cycle efficiency. Manufacturers can record and verify transactions pertaining to the acquisition of raw materials, production procedures, and the delivery of completed items using blockchain’s decentralized ledger. By automating payment terms and streamlining the settlement procedure, smart contracts improve cash flow and cut down on delays. Furthermore, the openness of blockchain reduces the possibility of fraud and mistakes in financial transactions, which promotes increased confidence amongst supply chain actors in the manufacturing industry.

Blockchain in Supply Chain Finance Market Dynamics

Driver

The immutability of blockchain records makes it difficult for unauthorized parties to manipulate data or engage in fraudulent activities.

A block of data in a blockchain is nearly impossible to remove or change once it is introduced to the chain and validated by the network via consensus procedures. Based on the content of the block and the hash of the one before it, each block has a unique identifier (hash). This implies that a tamper-resistant and auditable record is produced by preserving and connecting all of the data and transaction history on the blockchain into a chain of blocks. Because blockchain networks are distributed and decentralized, modifications must be approved by participants by consensus. Since gaining control over most of the network would be necessary for unauthorized attempts to alter data, it is extremely secure against manipulation.

The blockchain’s general trustworthiness is enhanced by immutability. Participants can rely on the accuracy, integrity, and truthfulness of the transaction history reflected in the data stored on the blockchain. This increased trust is especially crucial in situations involving multiple parties in the supply chain. The immutability of blockchain records fosters trust among participants in a variety of applications, including tracking the provenance of goods, confirming financial transactions, and confirming the authenticity of documents. Adherence to industry standards and regulatory compliance depends on the audit and verification capabilities of historical data. Regulators and auditors can depend on the accuracy of the data stored on the blockchain because of immutability. By offering an unalterable and transparent record of transactions, blockchain technology streamlines the auditing procedure.

Restraint

Integrating blockchain technology with existing legacy systems can be complex and costly.

There are many different platforms in the blockchain ecosystem, including Ethereum, Hyperledger, Corda, and others. Every platform has distinct features, smart contract languages, and consensus techniques and is made for particular use cases. The various blockchain platforms don’t adhere to the same standards. It can be difficult for different platforms to interact and exchange data easily since each one may adhere to its own set of norms and protocols. It’s possible that smart contracts—self-executing agreements with the terms of the deal directly encoded in code—won’t work on all platforms. The interoperability of smart contract languages and execution environments is limited. The validation process for transactions is influenced by the consensus mechanism (proof-of-work, proof-of-stake) that a blockchain platform employs. Platforms with disparate consensus techniques might have trouble coming to an agreement.

Sharing sensitive data across networks can be made more difficult by differences in privacy standards and data storage across blockchain platforms. It is very difficult to maintain interoperability while protecting data privacy and consistency. Cross-chain communication, which is the process of facilitating transactions and communication between various blockchains, is a challenging issue. There is currently work being done on ways to exchange information between chains safely and effectively. The degree to which various blockchain platforms comply with regulations may vary. For cross-platform transactions, maintaining interoperability while adhering to various regulatory frameworks presents an additional challenge.

Opportunities

The decentralized and secure nature of blockchain helps in reducing the risk of fraud and errors in supply chain finance transactions.

Information is almost impossible to change once it is stored on the blockchain. A chain of blocks connected and secured by cryptographic hashes is created by each block in the blockchain having a reference to the one before it. The data’s integrity is guaranteed by its immutability. The inability to modify a transaction after it has been recorded lowers the possibility of fraudulent changes being made to financial records. Because blockchain relies on a decentralized network of nodes, the entire system is not under the control of a single entity. Every member of the network possesses a duplicate of the complete blockchain. A single point of failure or manipulation is less likely when there is decentralization.

Blockchain relies on consensus techniques to verify and reach a consensus regarding the ledger’s current state, such as proof-of-work or proof-of-stake. Before a transaction is added to the blockchain, it needs to be approved by the majority of nodes. Consensus mechanisms make sure that only legitimate transactions are added to the ledger, which improves network security. Because of this, it is more difficult for dishonest people to introduce fraudulent transactions. Blockchain secures transactions with cutting-edge cryptographic methods. Sensitive information can only be accessed and decrypted by the intended recipients thanks to public-key cryptography. By limiting the possibility of unauthorized access, this cryptographic security makes sure that only parties with permission can conduct secure transactions. Self-executing contracts with programmable conditions are known as smart contracts. When particular conditions are met, they automatically carry out predefined actions.

Blockchain in Supply Chain Finance Market Trends

- Businesses and financial organizations are investigating and implementing blockchain systems made especially for supply chain financing more frequently. The end-to-end visibility, effectiveness, and security in financial transactions throughout the supply chain are the goals of these platforms.

- The problem of interoperability between different blockchain platforms is being worked on. Working on standards that enable smooth communication and data exchange between various systems within the supply chain finance ecosystem are industry consortia and collaborations.

- Blockchain technology is being combined with other cutting-edge innovations like machine learning (ML), artificial intelligence (AI), and the Internet of Things (IoT). Real-time data and predictive analytics for improved decision-making are provided by this integration, which expands the capabilities of supply chain finance solutions.

- In order to address issues with sustainability and responsible sourcing, blockchain technology is being used to establish transparent and traceable supply chains. This trend is especially important for businesses where customers are becoming more concerned about the ethical standards and country of origin of the goods they buy.

- Within the supply chain, the tokenization of monetary and physical assets is becoming more popular. On the blockchain, assets like shipping documents, inventory, and invoices are represented as digital tokens that facilitate trading and increase liquidity.

- Supply chain finance is utilizing the ideas of decentralized finance, or DeFi. The goal of blockchain-based DeFi solutions is to give small and medium-sized businesses (SMEs) more access to capital by offering alternative financing options that lessen dependency on conventional banking systems.

Competitive Landscape

The competitive landscape of the Blockchain in Supply Chain Finance market was dynamic, with several prominent companies competing to provide innovative and advanced Blockchain in Supply Chain Finance solutions.

- IBM

- Accenture

- Ripple

- SAP

- Oracle

- Chainalysis

- TradeIX

- Everledger

- Provenance

- CargoX

- B3i

- Bitfury

- R3

- TradeLens (jointly developed by Maersk and IBM)

- VeChain

- Digital Asset Holdings

- Blockstream

- ConsenSys

- Hashed Health

Recent Developments:

October 26, 2023: IBM’s new modernization solution, watsonx Code Assistant for IBM Z, lets developers selectively translate COBOL applications to high-quality Java code optimized for IBM Z and the hybrid cloud.

July 26, 2023: At the helm of boAt’s success lies a passionate duo of Aman Gupta and Sameer Mehta, driven by their mission to bring forth a sound revolution. Like many other startups investing in better IT infrastructure to support their growth plans, boAt has invested in cloud technology to transform its operations and is now reaping remarkable results. During the fiscal year 2022-2023, the brand achieved an impressive total sale of Rs 4,000 crore, displaying robust growth in a cluttered marketplace.

Regional Analysis

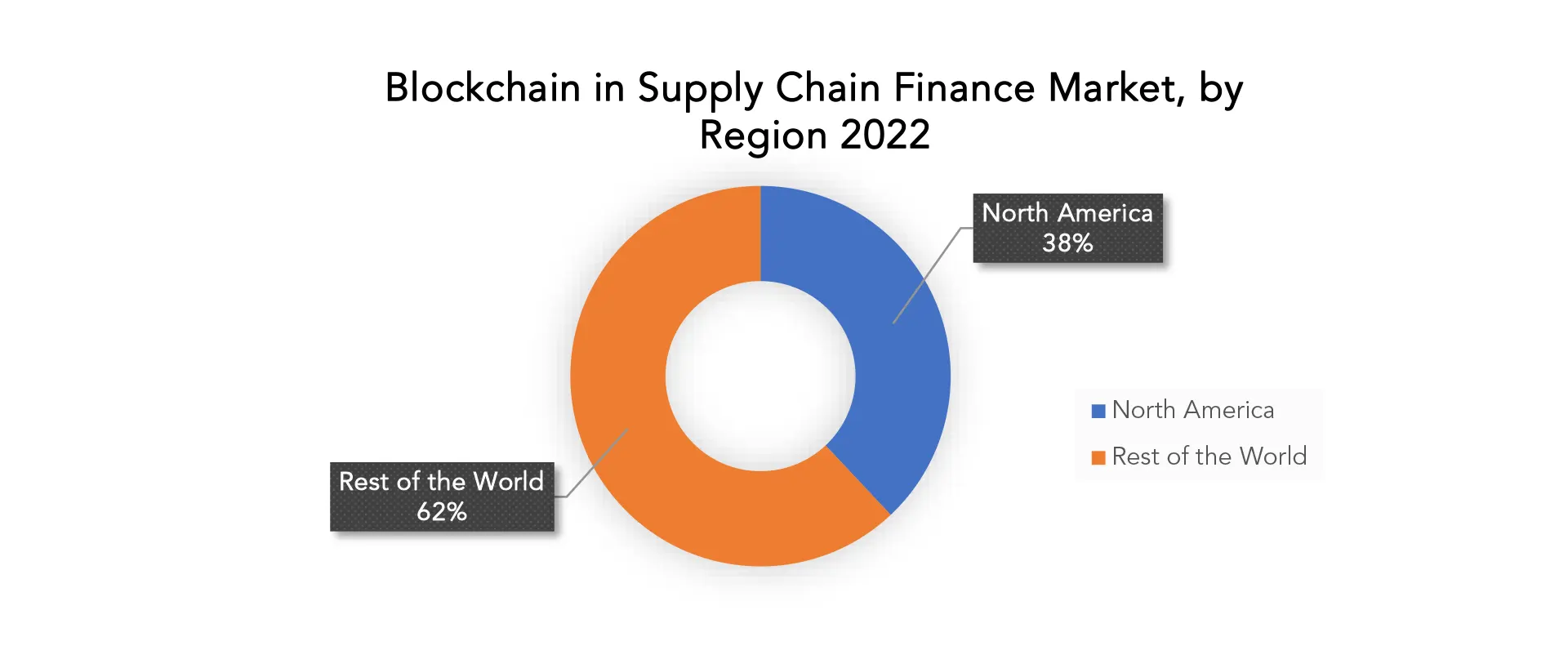

North America accounted for the largest market in the Blockchain in Supply Chain Finance market. North America accounted for 38% of the worldwide market value. The emphasis on innovation and technological advancements in the North American supply chain finance market is one of the main factors driving blockchain adoption in the region. Particularly American businesses have been at the forefront of testing blockchain applications in an effort to expedite international trade, lower fraud, and increase supply chain visibility. North American financial institutions have also been heavily involved in supply chain finance-related blockchain projects. Banks, technology companies, and industry participants are working together to develop blockchain-based platforms that can automate different financial processes in the supply chain and offer end-to-end visibility.

Furthermore, the focus on risk management and regulatory compliance in North America has prompted businesses to investigate blockchain solutions as a way to guarantee accountability and transparency in their supply chains. Blockchain records’ immutability and auditability comply with legal requirements and contribute to the establishment of a trustworthy and secure financial transaction environment. To address shared issues and create standardized blockchain solutions, major industry players in North America are forming partnerships and consortiums. Through the establishment of interoperability standards, various supply chain ecosystem participants will be able to exchange data and transactions on the blockchain with ease.

Target Audience for Blockchain in Supply Chain Finance Market

- Financial Institutions

- Supply Chain Management Companies

- Manufacturing Companies

- Logistics and Transportation Companies

- Retailers and Distributors

- Technology Providers

- Government and Regulatory Bodies

- Trade Finance Organizations

- Blockchain Solution Providers

- Consulting and Advisory Firms

- Research and Development Institutions

- Importers and Exporters

- Customs and Border Protection Agencies

- Small and Medium-sized Enterprises (SMEs)

- Cryptocurrency and Blockchain Enthusiasts

Import & Export Data for Blockchain in Supply Chain Finance Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Blockchain in Supply Chain Finance market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

- Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Blockchain in Supply Chain Finance market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

- Market players: gain insights into the leading players driving the Blockchain in Supply Chain Finance trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

- Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

- Product breakdown: by segmenting data based on Blockchain in Supply Chain Finance types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Blockchain in Supply Chain Finance Market Report

Blockchain in Supply Chain Finance Market by Type, 2020-2030, (USD Billion)

- Trade Finance

- Invoice Finance

- Inventory Finance

Blockchain in Supply Chain Finance Market by Application, 2020-2030, (USD Billion)

- Food and Beverage

- Pharmaceuticals

- Manufacturing

Blockchain in Supply Chain Finance Market by Region, 2020-2030, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Blockchain in Supply Chain Finance market over the next 7 years?

- Who are the major players in the Blockchain in Supply Chain Finance market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Blockchain in Supply Chain Finance market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Blockchain in Supply Chain Finance market?

- What is the current and forecasted size and growth rate of the global Blockchain in Supply Chain Finance market?

- What are the key drivers of growth in the Blockchain in Supply Chain Finance market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Blockchain in Supply Chain Finance market?

- What are the technological advancements and innovations in the Blockchain in Supply Chain Finance market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Blockchain in Supply Chain Finance market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Blockchain in Supply Chain Finance market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET OUTLOOK

- GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE, 2020-2030, (USD BILLION)

- TRADE FINANCE

- INVOICE FINANCE

- INVENTORY FINANCE

- GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- FOOD AND BEVERAGE

- PHARMACEUTICALS

- MANUFACTURING

- GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- DUPONT

- IBM

- ACCENTURE

- RIPPLE

- SAP

- ORACLE

- CHAINALYSIS

- TRADEIX

- EVERLEDGER

- PROVENANCE

- CARGOX

- B3I

- BITFURY

- R3

- TRADELENS

- VECHAIN

- DIGITAL ASSET HOLDINGS

- BLOCKSTREAM

- CONSENSYS

- HASHED HEALTH

- MODUM

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 7 US BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 8 US BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 9 CANADA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 CANADA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 MEXICO BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 12 MEXICO BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 BRAZIL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 17 BRAZIL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 ARGENTINA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 19 ARGENTINA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 COLOMBIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 21 COLOMBIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 27 INDIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 28 INDIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 29 CHINA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 30 CHINA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 31 JAPAN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 JAPAN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 41 EUROPE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 43 EUROPE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 GERMANY BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 45 GERMANY BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 UK BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 47 UK BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 FRANCE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 49 FRANCE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 ITALY BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 51 ITALY BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 SPAIN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 53 SPAIN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 RUSSIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 55 RUSSIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 61 UAE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 UAE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE, USD BILLION, 2022-2030

FIGURE 9 GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION, USD BILLION, 2022-2030

FIGURE 10 GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY REGION, USD BILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY TYPE, USD BILLION,2022

FIGURE 13 GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY APPLICATION, USD BILLION,2022

FIGURE 14 GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET BY REGION, USD BILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 IBM: COMPANY SNAPSHOT

FIGURE 17 ACCENTURE: COMPANY SNAPSHOT

FIGURE 18 RIPPLE: COMPANY SNAPSHOT

FIGURE 19 SAP: COMPANY SNAPSHOT

FIGURE 20 ORACLE: COMPANY SNAPSHOT

FIGURE 21 CHAINALYSIS: COMPANY SNAPSHOT

FIGURE 22 TRADEIX: COMPANY SNAPSHOT

FIGURE 23 EVERLEDGER: COMPANY SNAPSHOT

FIGURE 24 PROVENANCE: COMPANY SNAPSHOT

FIGURE 25 CARGOX: COMPANY SNAPSHOT

FIGURE 26 B3I: COMPANY SNAPSHOT

FIGURE 27 BITFURY: COMPANY SNAPSHOT

FIGURE 28 R3: COMPANY SNAPSHOT

FIGURE 29 TRADELENS (JOINTLY DEVELOPED BY MAERSK AND IBM): COMPANY SNAPSHOT

FIGURE 30 VECHAIN: COMPANY SNAPSHOT

FIGURE 31 DIGITAL ASSET HOLDINGS: COMPANY SNAPSHOT

FIGURE 32 BLOCKSTREAM: COMPANY SNAPSHOT

FIGURE 33 CONSENSYS: COMPANY SNAPSHOT

FIGURE 34 HASHED HEALTH: COMPANY SNAPSHOT

FIGURE 35 MODUM.: COMPANY SNAPSHOT

FAQ

The global Blockchain in Supply Chain Finance market is anticipated to grow from USD 27 Billion in 2023 to USD 128.75 Billion by 2030, at a CAGR of 25 % during the forecast period.

North America accounted for the largest market in the Blockchain in Supply Chain Finance market. North America accounted for 38 % market share of the global market value.

IBM,Accenture,Ripple,SAP,Oracle,Chainalysis,TradeIX,Everledger,Provenance,CargoX,B3i,Bitfury,R3,TradeLens

In order to address issues with sustainability and responsible sourcing, blockchain technology is being used to establish transparent and traceable supply chains. This trend is especially important for businesses where customers are becoming more concerned about the ethical standards and country of origin of the goods they buy. Within the supply chain, the tokenization of monetary and physical assets is becoming more popular. On the blockchain, assets like shipping documents, inventory, and invoices are represented as digital tokens that facilitate trading and increase liquidity. Supply chain finance is utilizing the ideas of decentralized finance, or DeFi. The goal of blockchain-based DeFi solutions is to give small and medium-sized businesses (SMEs) more access to capital by offering alternative financing options that lessen dependency on conventional banking systems.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.